Last edit by: Dr Jabadski

Bilt Rewards Mastercard WikiPost

(10/7/23 Original author (Dr Jabadski) note: As I posted here on 9/9/23 �Considering I�ve been salivating about simple no-cost points-etizing (like monetizing) my condo payments for about 25 years, I see Bilt as a game changer.� I should have added �almost a Holy Grail� (a thing that is eagerly pursued or sought after). I successfully applied for a Bilt Mastercard 1 month ago thus I�m far from an expert. Both before and after approval I posted multiple questions many times on this thread and several other FTers were highly gracious and informative. Thought a WikiPost might save some others a good deal of time, effort and aggravation, at least in not repeating my questions and searching for the answers. I certainly hope the experts will edit and update this WikiPost as necessary. I�m also exercising Writer's Prerogative to officially coin the term �pointsetize�, like monetize �convert into or express in the form of currency�, to earn points from payments which otherwise would not earn points.)

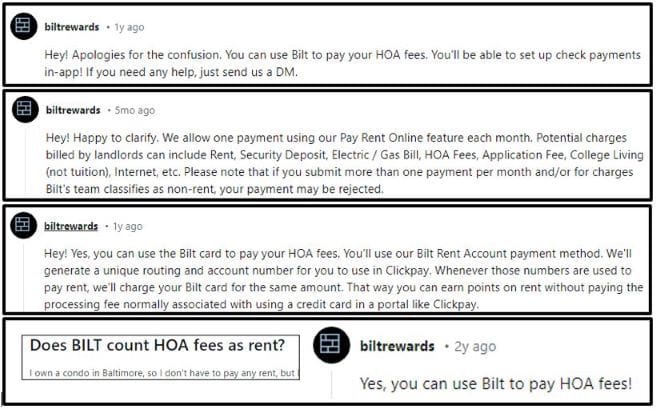

Bilt Rewards Mastercard (Bilt MC) was first launched in mid-2021, in good part as a no fee way to charge and pointsetize rent payments. (Perhaps the only no fee way to pointsetize rent payments.) There are multiple reports of earning Bilt points for paying condominium monthly maintenance/common charges, sometimes even when the word �condo� or �condominium� is in the transaction description.

Bilt MC is a personal credit card, WF reports credit card information to the various credit bureaus and Bilt MC will count toward Chase 5/24.

This post and this post (both from 9/7/23) describe shutdown reports perhaps related to �micro transactions�, fluctuating rent payment amounts or multiple rent payments. This 10/11/23 post includes several references to Reddit user quotes about shutdowns and several Reddit Bilt quotes in response.

Links to Bilt Rewards Terms of Use and Evolve Bank & Trust (Bilt Technologies) Customer Account Agreement. The Terms state �Bilt may make available to you a Bilt Rent Account (�Account�), which is a transaction bank account that can be used by you solely to make rent payments.� The Agreement states: �For the avoidance of doubt, the Account is a transaction bank account that can be used by you solely to make rent payments. For the avoidance of doubt, this is not an account that you may use to deposit or withdraw funds for any other purposes outside of rent payments.�

Bilt MC is a metal card weighing ~16 grams (comparisons: AmEx biz plat 18.5 gm, AmEx Gold 15 gm, Chase Sapphire Reserve 13 gm, traditional plastic card 5 gm).

Bilt Mastercard is issued and managed by Wells Fargo. Bilt Rewards is a separate website and app (which contains some credit card information but not as much as WF website).

Most reports are of instant approvals, Wells Fargo reconsideration phone number and experiences are not well documented. Reported initial Credit Limits vary $4,000 - $30,000 with higher limits more commonly reported. This post (9/1/23) describes one instance of a �Something went wrong� message upon application and the steps toward approval several days later.

Rent payments can be made in multiple different ways. Bilt will provide a (bank) routing number and account number. ACH rent payments can be sent (deposited) by Bilt or withdrawn by a managing company.

Bilt MC is shipped via trackable no-signature-required First Class mail in a small (4.5� x 6.5�) white box with unique packaging inside as pictured at the bottom of this post. As of Feb 2024 no reports of expedited shipping.

Reports on this thread starting in late November 2023 indicate this "quasi-SUB" may be offered randomly and/or only to some people, selection criteria unknown. This post may be the only report of being offered the quasi-SUB prior to Bilt Mastercard application, based on existing Bilt Rewards account. Bilt's �quasi-SUB" is offered via an email and a text message notification the same day as card receipt informing of 5x/5 days/max 50K (email quoted verbatim in this post). (Quasi* due to very short duration in contrast to many traditional SUBs of 3 month duration.) Please note this quasi-SUB maxs out at $12,500 (not $10,000) and tax payments will count. No reports yet of returns and their effect on quasi-SUB. (* �quasi-� a combining form meaning �resembling,� �having some, but not all of the features of,� used in the formation of compound words: quasi-definition; quasi-monopoly; quasi-official; quasi-scientific.)

Newly earned Bilt points will display as �pending� until 5 transactions per statement cycle. After 5 transactions, points will post and become available shortly after a transaction, before statement date. The Bilt Rewards website has a �transaction counter� which disappears upon reaching 5.

Bilt points for linking partner programs (100 points each) and for adding a credit card to Bilt Wallet (100 points each for first 3) post immediately. Original author received 500 point bonus for first rent payment.

Bilt Rewards points are transferable at 1:1 usually within a few minutes to multiple different airline and hotel programs.

There�s discussion of the long term viability of Bilt with some of those posts linked at the bottom of this post after �BREAK�.

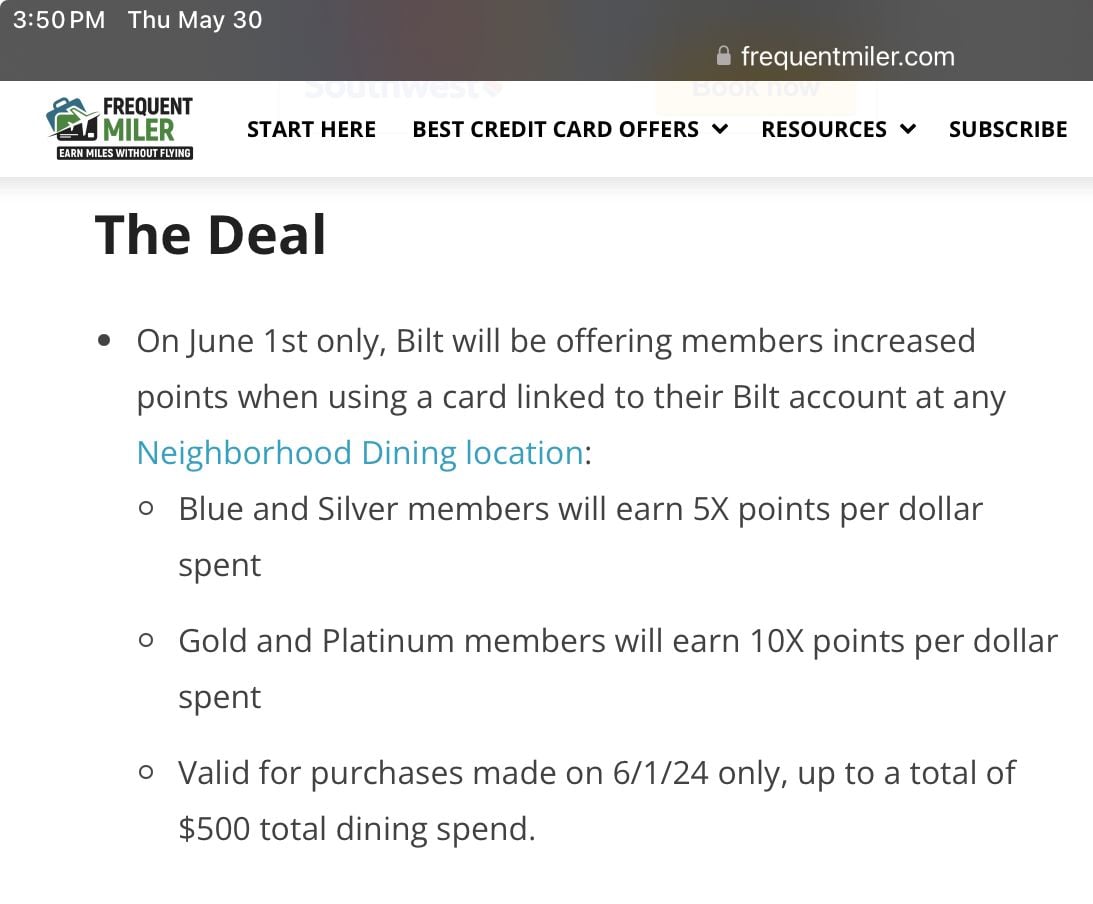

Bilt Status Tiers: Blue - anyone enrolled in Bilt Rewards with under 25,000 points, Silver - 25,000 points earned, Gold - 50,000 points earned, Platinum - 100,000 points earned. �Tier status earned at any point in a year remains active through the end of the following year.� �Earn Interest on Points� (Silver, Gold, Platinum Tiers) is minimal, discussed on this post and this post.

Bilt Points Quest Trivia on the first of each month offers up to 250 points for correctly answering, within 10 seconds, 6 (out of 15-20) questions. Must get first 5 questions (10, 20, 30, 40, 50 points) correct to see the 6th �bonus� 100 point question. There�s often a Reddit thread with the Q & A. (Point Quest - October 2023 Answers) The lower half of this post has comments from a highly experienced �test taker� regarding memory, recall and �studying� for Points Quest Trivia.

Bilt also has various �RentFree� games, available a few days prior to and/or on the 1st of the month, different people get different games. Could be a Family Feud style question with enough time to Google answers or a �Where's Wally?� (Bilt Brick) type of game or something else. Successful completion enters to be one of 3 people for whom Bilt pays their monthly rent (up to $2500).

List of Bilt�s Rent Day promotions going back to October 2022 at the bottom of the page here: DEALSPOINTS.

June 2024: Bottom of this post describes one person�s experience paying a significant assessment (and earning points) with Bilt MC, at this time (only 3 weeks later) no report of clawback or shutdown (based on using Bilt to pay rent more than once a month and/or for something other than rent/condo fees).

June 2024: Bottom of this post contains Bilt quotes regarding Bilt BiltProtect.

June 2024: Important post (and link) stating that WF is losing money every month on Bilt.

(10/7/23 Original author (Dr Jabadski) note: As I posted here on 9/9/23 �Considering I�ve been salivating about simple no-cost points-etizing (like monetizing) my condo payments for about 25 years, I see Bilt as a game changer.� I should have added �almost a Holy Grail� (a thing that is eagerly pursued or sought after). I successfully applied for a Bilt Mastercard 1 month ago thus I�m far from an expert. Both before and after approval I posted multiple questions many times on this thread and several other FTers were highly gracious and informative. Thought a WikiPost might save some others a good deal of time, effort and aggravation, at least in not repeating my questions and searching for the answers. I certainly hope the experts will edit and update this WikiPost as necessary. I�m also exercising Writer's Prerogative to officially coin the term �pointsetize�, like monetize �convert into or express in the form of currency�, to earn points from payments which otherwise would not earn points.)

Bilt Rewards Mastercard (Bilt MC) was first launched in mid-2021, in good part as a no fee way to charge and pointsetize rent payments. (Perhaps the only no fee way to pointsetize rent payments.) There are multiple reports of earning Bilt points for paying condominium monthly maintenance/common charges, sometimes even when the word �condo� or �condominium� is in the transaction description.

Bilt MC is a personal credit card, WF reports credit card information to the various credit bureaus and Bilt MC will count toward Chase 5/24.

This post and this post (both from 9/7/23) describe shutdown reports perhaps related to �micro transactions�, fluctuating rent payment amounts or multiple rent payments. This 10/11/23 post includes several references to Reddit user quotes about shutdowns and several Reddit Bilt quotes in response.

Links to Bilt Rewards Terms of Use and Evolve Bank & Trust (Bilt Technologies) Customer Account Agreement. The Terms state �Bilt may make available to you a Bilt Rent Account (�Account�), which is a transaction bank account that can be used by you solely to make rent payments.� The Agreement states: �For the avoidance of doubt, the Account is a transaction bank account that can be used by you solely to make rent payments. For the avoidance of doubt, this is not an account that you may use to deposit or withdraw funds for any other purposes outside of rent payments.�

Bilt MC is a metal card weighing ~16 grams (comparisons: AmEx biz plat 18.5 gm, AmEx Gold 15 gm, Chase Sapphire Reserve 13 gm, traditional plastic card 5 gm).

Bilt Mastercard is issued and managed by Wells Fargo. Bilt Rewards is a separate website and app (which contains some credit card information but not as much as WF website).

Most reports are of instant approvals, Wells Fargo reconsideration phone number and experiences are not well documented. Reported initial Credit Limits vary $4,000 - $30,000 with higher limits more commonly reported. This post (9/1/23) describes one instance of a �Something went wrong� message upon application and the steps toward approval several days later.

Rent payments can be made in multiple different ways. Bilt will provide a (bank) routing number and account number. ACH rent payments can be sent (deposited) by Bilt or withdrawn by a managing company.

Bilt MC is shipped via trackable no-signature-required First Class mail in a small (4.5� x 6.5�) white box with unique packaging inside as pictured at the bottom of this post. As of Feb 2024 no reports of expedited shipping.

Reports on this thread starting in late November 2023 indicate this "quasi-SUB" may be offered randomly and/or only to some people, selection criteria unknown. This post may be the only report of being offered the quasi-SUB prior to Bilt Mastercard application, based on existing Bilt Rewards account. Bilt's �quasi-SUB" is offered via an email and a text message notification the same day as card receipt informing of 5x/5 days/max 50K (email quoted verbatim in this post). (Quasi* due to very short duration in contrast to many traditional SUBs of 3 month duration.) Please note this quasi-SUB maxs out at $12,500 (not $10,000) and tax payments will count. No reports yet of returns and their effect on quasi-SUB. (* �quasi-� a combining form meaning �resembling,� �having some, but not all of the features of,� used in the formation of compound words: quasi-definition; quasi-monopoly; quasi-official; quasi-scientific.)

Newly earned Bilt points will display as �pending� until 5 transactions per statement cycle. After 5 transactions, points will post and become available shortly after a transaction, before statement date. The Bilt Rewards website has a �transaction counter� which disappears upon reaching 5.

Bilt points for linking partner programs (100 points each) and for adding a credit card to Bilt Wallet (100 points each for first 3) post immediately. Original author received 500 point bonus for first rent payment.

Bilt Rewards points are transferable at 1:1 usually within a few minutes to multiple different airline and hotel programs.

There�s discussion of the long term viability of Bilt with some of those posts linked at the bottom of this post after �BREAK�.

Bilt Status Tiers: Blue - anyone enrolled in Bilt Rewards with under 25,000 points, Silver - 25,000 points earned, Gold - 50,000 points earned, Platinum - 100,000 points earned. �Tier status earned at any point in a year remains active through the end of the following year.� �Earn Interest on Points� (Silver, Gold, Platinum Tiers) is minimal, discussed on this post and this post.

Bilt Points Quest Trivia on the first of each month offers up to 250 points for correctly answering, within 10 seconds, 6 (out of 15-20) questions. Must get first 5 questions (10, 20, 30, 40, 50 points) correct to see the 6th �bonus� 100 point question. There�s often a Reddit thread with the Q & A. (Point Quest - October 2023 Answers) The lower half of this post has comments from a highly experienced �test taker� regarding memory, recall and �studying� for Points Quest Trivia.

Bilt also has various �RentFree� games, available a few days prior to and/or on the 1st of the month, different people get different games. Could be a Family Feud style question with enough time to Google answers or a �Where's Wally?� (Bilt Brick) type of game or something else. Successful completion enters to be one of 3 people for whom Bilt pays their monthly rent (up to $2500).

List of Bilt�s Rent Day promotions going back to October 2022 at the bottom of the page here: DEALSPOINTS.

June 2024: Bottom of this post describes one person�s experience paying a significant assessment (and earning points) with Bilt MC, at this time (only 3 weeks later) no report of clawback or shutdown (based on using Bilt to pay rent more than once a month and/or for something other than rent/condo fees).

June 2024: Bottom of this post contains Bilt quotes regarding Bilt BiltProtect.

June 2024: Important post (and link) stating that WF is losing money every month on Bilt.

Bilt Mastercard

#781

Flyertalk Posting Legend Moderator: Credit Card Programs, American Express, Capital One, Chase, Citi, Diners Club, Signatures.

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 49,063

#782

Join Date: May 2011

Posts: 91

A bit of clarification, please

Last month I posted a question about paying HOA frees on these forums and Dr Jabadski kindly directed me to this thread. I have now read through all this (a bit bleary eyed...). I have not yet applied for the Bilt MC since my husband might be getting new hearing aids (~$5K) so would like to time it with that JIC I get the quasi-SUB offer.

I tried doing a multi-quote but not sure if it will show up when I post this. So I am referencing the relevant posts here:

In post #492, Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment.

In post #409, there is a link to an article explaining how to use eCheck from a portal.

Post #761 is a reddit post from Bilt Rewards regarding HOA payments.

Our HOA fee is $800 and our new assessment is an additional $600 for total $1400. Our management company allows payment in a variety of ways:

1. Pay by mailing check with coupons. 2 coupons - one for each part of the payment. Checks addressed to " <Condo Name> HOA"

2. Bank Bill Pay with one payment totaling $1400. Currently I pay my HOA fee from my Chase checking account's bill pay, where it is sent as "1 business day electronic" payment. New assessment hit May 1, so I paid this way this month.

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company.

4. NEW option - by credit card and eCheck via a portal for our management company from cincwebaxis.com. The CC payment carries a 3.25% fee and the eCheck fee is $1.99.. Can set this up online.

So options 3 or 4 via eCheck would be best. My concern is that these payments are listed as <Condo Name> HOA, which I suppose mgt company might use in option 3. Just don't want any problems, or want to waste a 5/24 slot, have another hard pull, etc.

Valid or unwarranted concern? Would option 4 be better ("safer") than option 3, despite the fee? TIA

I tried doing a multi-quote but not sure if it will show up when I post this. So I am referencing the relevant posts here:

In post #492, Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment.

In post #409, there is a link to an article explaining how to use eCheck from a portal.

Post #761 is a reddit post from Bilt Rewards regarding HOA payments.

Our HOA fee is $800 and our new assessment is an additional $600 for total $1400. Our management company allows payment in a variety of ways:

1. Pay by mailing check with coupons. 2 coupons - one for each part of the payment. Checks addressed to " <Condo Name> HOA"

2. Bank Bill Pay with one payment totaling $1400. Currently I pay my HOA fee from my Chase checking account's bill pay, where it is sent as "1 business day electronic" payment. New assessment hit May 1, so I paid this way this month.

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company.

4. NEW option - by credit card and eCheck via a portal for our management company from cincwebaxis.com. The CC payment carries a 3.25% fee and the eCheck fee is $1.99.. Can set this up online.

So options 3 or 4 via eCheck would be best. My concern is that these payments are listed as <Condo Name> HOA, which I suppose mgt company might use in option 3. Just don't want any problems, or want to waste a 5/24 slot, have another hard pull, etc.

Valid or unwarranted concern? Would option 4 be better ("safer") than option 3, despite the fee? TIA

#783

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,128

Last month I posted a question about paying HOA frees on these forums and Dr Jabadski kindly directed me to this thread. I have now read through all this (a bit bleary eyed...). I have not yet applied for the Bilt MC since my husband might be getting new hearing aids (~$5K) so would like to time it with that JIC I get the quasi-SUB offer.

I tried doing a multi-quote but not sure if it will show up when I post this. So I am referencing the relevant posts here:

In post #492, Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment.

In post #409, there is a link to an article explaining how to use eCheck from a portal.

Post #761 is a reddit post from Bilt Rewards regarding HOA payments.

Our HOA fee is $800 and our new assessment is an additional $600 for total $1400. Our management company allows payment in a variety of ways:

1. Pay by mailing check with coupons. 2 coupons - one for each part of the payment. Checks addressed to " <Condo Name> HOA"

2. Bank Bill Pay with one payment totaling $1400. Currently I pay my HOA fee from my Chase checking account's bill pay, where it is sent as "1 business day electronic" payment. New assessment hit May 1, so I paid this way this month.

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company.

4. NEW option - by credit card and eCheck via a portal for our management company from cincwebaxis.com. The CC payment carries a 3.25% fee and the eCheck fee is $1.99.. Can set this up online.

So options 3 or 4 via eCheck would be best. My concern is that these payments are listed as <Condo Name> HOA, which I suppose mgt company might use in option 3. Just don't want any problems, or want to waste a 5/24 slot, have another hard pull, etc.

Valid or unwarranted concern? Would option 4 be better ("safer") than option 3, despite the fee? TIA

I tried doing a multi-quote but not sure if it will show up when I post this. So I am referencing the relevant posts here:

In post #492, Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment.

In post #409, there is a link to an article explaining how to use eCheck from a portal.

Post #761 is a reddit post from Bilt Rewards regarding HOA payments.

Our HOA fee is $800 and our new assessment is an additional $600 for total $1400. Our management company allows payment in a variety of ways:

1. Pay by mailing check with coupons. 2 coupons - one for each part of the payment. Checks addressed to " <Condo Name> HOA"

2. Bank Bill Pay with one payment totaling $1400. Currently I pay my HOA fee from my Chase checking account's bill pay, where it is sent as "1 business day electronic" payment. New assessment hit May 1, so I paid this way this month.

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company.

4. NEW option - by credit card and eCheck via a portal for our management company from cincwebaxis.com. The CC payment carries a 3.25% fee and the eCheck fee is $1.99.. Can set this up online.

So options 3 or 4 via eCheck would be best. My concern is that these payments are listed as <Condo Name> HOA, which I suppose mgt company might use in option 3. Just don't want any problems, or want to waste a 5/24 slot, have another hard pull, etc.

Valid or unwarranted concern? Would option 4 be better ("safer") than option 3, despite the fee? TIA

I wouldn't have Bilt send the payment since we've read about issues there where the landlord doesn't receive the check. That is to say, I wouldn't do option 2 if it were Bilt instead of Chase.

#784

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,377

… and Dr Jabadski kindly directed me to this thread. ...

… I am referencing the relevant posts here: …

… Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment ...

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company. …

… unwarranted concern? …

… I am referencing the relevant posts here: …

… Dr J indicates he provided the Bilt account # and routing # to his managing agent and they pulled the ACH payment ...

3. ACH/Direct Debit - which would be for the full $1400. Just need to provide info to management company. …

… unwarranted concern? …

? Regardless, thank you for the compliment

? Regardless, thank you for the compliment  .

.Reads as though you’ve done more than your due diligence, good on you.

If I’m understanding correctly, I do #3, as do the majority of people who post about Bilt. Many of us had “HOA” and/or “condo” in the line item description of the charge when using previous payments methods, Bilt simply lists it as (on Wells Fargo credit card activity) “05/01/24 BPS*BILT REWARDS B NEW YORK NY #12345678ABCDEFGH $1,XXX.XX Billing location: NEW YORK, NY Phone: 1234567899 Purchase Mode: MANUALLY ENTERED” and (on Bilt Rewards website) “BPS*BILT REWARDS B NEW YORK NY 05/01/24 $1,XXX.XX Transaction date May 01, 2024 Posting date May 01, 2024”.

There are many Reddit posts from “biltrewards” in this regard, I’ve copied some below. (Although on those Reddit threads "biltrewards" is essentially accepted as "official", I cannot confirm nor verify that “biltrewards” is an official representative of the company.)

Your concern, which is identical to mine until I received and transferred my first Bilt points, is indeed unwarranted. As with Majuki, I agree with option #3.

Last edited by Dr Jabadski; May 15, 2024 at 6:28 pm Reason: appropriate image size. why? because it's not too big and not too small :-)

#786

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,128

I wouldn't worry about the name either. For all Bilt knows, the HOA has some units in the building available for rent. This was the case at an apartment complex where I lived 15 years ago. They were built as condos yet had been rented out like they were apartments.

#787

FlyerTalk Evangelist

Join Date: Mar 2009

Location: NYC

Programs: AS MVPG, DL KM, Bee Six, Bonvoy Plat, Avis PC, Natl Exec, Greyhound Road Rewards Z"L

Posts: 16,946

Hello! I am very new to Bilt and just had a quick question. I can now use the Bilt platform to pay my building's monthly maintenance. Is there a benefit to using the Bilt CC over another credit card via the platform? I would likely transfer any points earned to Alaska Airlines or Marriott.

-J.

-J.

#788

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,128

1) Initial bonus points for linking some cards

2) Lyft bonus on a linked card (which gets bonus Bilt points)

1) Bilt Dining (if you use an Amex Gold which would get 4x MR vs 3x Bilt points)

#789

FlyerTalk Evangelist

Join Date: Mar 2009

Location: NYC

Programs: AS MVPG, DL KM, Bee Six, Bonvoy Plat, Avis PC, Natl Exec, Greyhound Road Rewards Z"L

Posts: 16,946

If you use another linked card for rent or "rent", there will be a fee. The other use cases I can think of for linking cards are:

1) Initial bonus points for linking some cards

2) Lyft bonus on a linked card (which gets bonus Bilt points)

1) Bilt Dining (if you use an Amex Gold which would get 4x MR vs 3x Bilt points)

1) Initial bonus points for linking some cards

2) Lyft bonus on a linked card (which gets bonus Bilt points)

1) Bilt Dining (if you use an Amex Gold which would get 4x MR vs 3x Bilt points)

-J.

#790

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,377

(5/15/24) … Just notified of a new assessment, $15,717 one-time (affordable) check only payment OR $308.22 added to monthly Bilt ACH payment for 60 months (total $18,493, ~18%). I’ll do all I can to have them do one-time payment by Bilt ACH but don’t expect success…..

Asked the management company if they could add the assessment to June 1st ACH, they said no, they need payment by the date the loan starts (May 20). On Friday morning May 17, I told them it might not be processed but please the to do the full assessment as a one-time ACH pull and to let me know of any problems. Later that day I saw a pending charge for $15,717.XX on my WF Bilt MC activity, did not hear back from management company.

Previous Bilt balance ~1,600, charge was pending all weekend, this (Monday) morning, charge indicated posted. Bilt Rewards balance ~17,XXX, immediately initiated 17k transfer to partner, confirmed on partner website 5 minutes later, partner website balance 17k higher, Bilt Rewards balance = XXX. (I remain skeptical of Bilt's long term viability in general and after this experience specifically for me personally, still maintaining a minimal Bilt balance via monthly partner transfers as soon as HOA Bilt points post.)

I’ll post again if/when the transfer is clawed back and/or if/when I receive notification of Bilt shutdown.

Perfect example of what I was thinking about all along this process: "It's easier to ask forgiveness than it is to get permission." (retired Rear Adm. Grace M. Hopper)

Go big or go home. If you can’t stand the heat, get out of the kitchen. No guts, no glory. Luck is often on the side of those who take risks. Successful people are often willing to take risks. Etc., etc., etc.

Last edited by Dr Jabadski; May 20, 2024 at 10:57 pm Reason: typo correction

#791

Join Date: Jul 2012

Location: ATL

Programs: All of Them

Posts: 512

Paying rent/HOA monthly charges without fees is far and away the #1 benefit and attraction of Bilt.

Other than the initial bonus for linking, I�ve not earned any Bilt points or seen any other benefit of linking a credit card.

Datapoint: My monthly Bilt HOA fee ACH is invariably processed and posts on the 1st of the month. Of course, Bilt has zero telephone customer service. I did �Chat� with Bilt, likely robo customer service, asking about ramifications and trying to get �one-time exception approval� of a second payment in the same month, kept being told only 1 payment allowed per month.

Asked the management company if they could add the assessment to June 1st ACH, they said no, they need payment by the date the loan starts (May 20). On Friday morning May 17, I told them it might not be processed but please the to do the full assessment as a one-time ACH pull and to let me know of any problems. Later that day I saw a pending charge for $15,717.XX on my WF Bilt MC activity, did not hear back from management company.

Previous Bilt balance ~1,600, charge was pending all weekend, this (Monday) morning, charge indicated posted. Bilt Rewards balance ~17,XXX, immediately initiated 17k transfer to partner, confirmed on partner website 5 minutes later, partner website balance 17k higher, Bilt Rewards balance = XXX. (I remain skeptical of Bilt's long term viability in general and after this experience specifically for me personally, still maintaining a minimal Bilt balance via monthly partner transfers as soon as HOA Bilt points post.)

I�ll post again if/when the transfer is clawed back and/or if/when I receive notification of Bilt shutdown.

Perfect example of what I was thinking about all along this process: "It's easier to ask forgiveness than it is to get permission." (retired Rear Adm. Grace M. Hopper)

Go big or go home. If you can�t stand the heat, get out of the kitchen. No guts, no glory. Luck is often on the side of those who take risks. Successful people are often willing to take risks. Etc., etc., etc.

Other than the initial bonus for linking, I�ve not earned any Bilt points or seen any other benefit of linking a credit card.

Datapoint: My monthly Bilt HOA fee ACH is invariably processed and posts on the 1st of the month. Of course, Bilt has zero telephone customer service. I did �Chat� with Bilt, likely robo customer service, asking about ramifications and trying to get �one-time exception approval� of a second payment in the same month, kept being told only 1 payment allowed per month.

Asked the management company if they could add the assessment to June 1st ACH, they said no, they need payment by the date the loan starts (May 20). On Friday morning May 17, I told them it might not be processed but please the to do the full assessment as a one-time ACH pull and to let me know of any problems. Later that day I saw a pending charge for $15,717.XX on my WF Bilt MC activity, did not hear back from management company.

Previous Bilt balance ~1,600, charge was pending all weekend, this (Monday) morning, charge indicated posted. Bilt Rewards balance ~17,XXX, immediately initiated 17k transfer to partner, confirmed on partner website 5 minutes later, partner website balance 17k higher, Bilt Rewards balance = XXX. (I remain skeptical of Bilt's long term viability in general and after this experience specifically for me personally, still maintaining a minimal Bilt balance via monthly partner transfers as soon as HOA Bilt points post.)

I�ll post again if/when the transfer is clawed back and/or if/when I receive notification of Bilt shutdown.

Perfect example of what I was thinking about all along this process: "It's easier to ask forgiveness than it is to get permission." (retired Rear Adm. Grace M. Hopper)

Go big or go home. If you can�t stand the heat, get out of the kitchen. No guts, no glory. Luck is often on the side of those who take risks. Successful people are often willing to take risks. Etc., etc., etc.

#792

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,118

Referred someone recently who definitely used my link, and I didn't get referral credit.

All previous referrals credited instantly. This has now been two weeks.

Anyone get a referral credit recently?

All previous referrals credited instantly. This has now been two weeks.

Anyone get a referral credit recently?

#793

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA ExPlat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 17,150