Last edit by: Global Adventurer

*Equinox $25 Credit will not be issued for ANY products you buy online at their merchandise Shop which is coded as "Equinox The Shop". However, it appears that you can purchase Gift Cards straight off the site, but lowest denomination is $100. Gift cards can be used for merchandise and memberships.

USA personal Platinum annual fee increase to $695, July 2021.

#736

#737

I get more cards to call AmEx, a couple Gold cards. Business Gold just closed.

#738

Join Date: Jan 2019

Location: SAN, BOS

Programs: AS MVPG100K, BAEC Gold, Hilton Diamond, Bonvoy Plat,

Posts: 2,281

Just be honest with you. I did call AmEx this afternoon. They gave me a nice retention. So I get AF pretty much free. Happy to keep it without doing all the hard work to "optimize" the "benefits". I'm not going to learn the new tricks of dancing with Equinox, or watch Peacock TV....

I get more cards to call AmEx, a couple Gold cards. Business Gold just closed.

I get more cards to call AmEx, a couple Gold cards. Business Gold just closed.

Good on you for getting a retention offer, but perhaps a premium credit card is simply not for you.

#739

It is so bad that Chase no longer give out the heavy metal Ritz card. The metal card is even more impressive than the white AmEx Platinum card.

#740

Join Date: Dec 2016

Location: Plainfield, IN

Programs: IHG Platinum / HHonors Diamond / Hyatt Globalist / AA EX Platinum

Posts: 200

I don't often agree with RedSun, but in this case I have to. The Platinum has that "Faux" Premium feel, kinda like Hilton Diamond staus. When everyone is special, no one is, LOL.

#741

I'm shifting to Citi and Cap1. Earning is straightforward. Still a lot of good ways to earn a lot of points. They still get good transfer partners.

It gets harder to keep track of the small $$. I ordered some diner plates with the Saks $50 credit. Two separate orders on two cards. One order was out of stock and Saks put the order on hold. So the charge was posted late. No credit from AmEx since the posting date was past the cut-off date. So the order was on my own.

I do use spreadsheets to keep track of all the AmEx monthly credit. $5 here, $10 there. I get about 20 of such credits. Restaurants are not happy with split credit card payments since each time they pay a CC fee. AmEx charges a higher swipe fee. So sometimes I let some of the $5 or $10 expire. Not worth the efforts to use them.

I often ask myself, why am I doing all this? What are the purposes of AmEx doing all this? Cardholder appreciation? Guess not....

Anyhow. I had fun. AmEx outgrows me. I just can't catch it up....

It gets harder to keep track of the small $$. I ordered some diner plates with the Saks $50 credit. Two separate orders on two cards. One order was out of stock and Saks put the order on hold. So the charge was posted late. No credit from AmEx since the posting date was past the cut-off date. So the order was on my own.

I do use spreadsheets to keep track of all the AmEx monthly credit. $5 here, $10 there. I get about 20 of such credits. Restaurants are not happy with split credit card payments since each time they pay a CC fee. AmEx charges a higher swipe fee. So sometimes I let some of the $5 or $10 expire. Not worth the efforts to use them.

I often ask myself, why am I doing all this? What are the purposes of AmEx doing all this? Cardholder appreciation? Guess not....

Anyhow. I had fun. AmEx outgrows me. I just can't catch it up....

#742

#743

Join Date: Nov 2013

Location: PHX, SEA

Programs: Avis President's Club, Global Entry, Hilton/Marriott Gold. No more DL/AA status.

Posts: 4,422

But if I travel 4 round trips a year domestically (I fly international J and get lounges with that), after the price hike and an AU card it's roughly $215/trip or $108/departure for lounge access if I don't want to be bothered with the piddly, annoying credits.

But I think what bugs me is how inflexible the entertainment one is, after the 2020 "no holds barred" version that would have benefitted members, but I guess "too well" for the earnings per share metric.

#744

FlyerTalk Evangelist

Join Date: Oct 2006

Location: SFO/SJC

Programs: UA Silver, Marriott Gold, Hilton Gold

Posts: 14,891

Most of these topics are covered in separate threads:

1. Purchases of merchant gift cards typically earn points and count toward bonuses. Purchases of Amex, Discover, MasterCard, VISA cards are more problematic. The key thing to understand is that American Express audits accounts, and transactions that are not flagged by the automated system may still be disallowed later.

2. Airline tickets purchased with miles are not covered by the Travel Delay, Interruption or Cancelation benefits. Tickets purchased with Membership Rewards points are covered. Partial payment with airline credit does not invalidate Travel Delay, Interruption or Cancellation benefits, but it does invalidate lost baggage benefit.

3. The Round Trip requirement applies to the full itinerary. Individual tickets can be one-way.

4. The Uber benefit applies only to the primary card. The card can be linked to any Uber account.

6. American Express does not use the term "Authorized User" in the same way as bankcard issuers. Additional Platinum cardholders receive nearly all of the benefits provided to the Basic cardholder, but in cases where the benefit has a capped monetary value the cap usually applies per account, not per card. You can also add free Gold or Green cards to a Platinum account. These cards earn rewards for spending at the same rate as the Platinum card (not at the rate of separate Gold or Green accounts).

7. Every American Express card has its own number. Additional cardholder can create separate online accounts, but this is not required. The Basic cardmember can see all activity on all cards. Membership Rewards points from all cards are credited to the Basic cardmember. Initially, transfers can only be made to airline or hotel accounts in the Basic member's name. After the Additional cards have been open for awhile (90 days?) transfers can also be made to their airline and hotel accounts. Membership Rewards points cannot be transferred to any other Membership Rewards account, nor to anyone else's airline or hotel accounts.

1. Purchases of merchant gift cards typically earn points and count toward bonuses. Purchases of Amex, Discover, MasterCard, VISA cards are more problematic. The key thing to understand is that American Express audits accounts, and transactions that are not flagged by the automated system may still be disallowed later.

2. Airline tickets purchased with miles are not covered by the Travel Delay, Interruption or Cancelation benefits. Tickets purchased with Membership Rewards points are covered. Partial payment with airline credit does not invalidate Travel Delay, Interruption or Cancellation benefits, but it does invalidate lost baggage benefit.

3. The Round Trip requirement applies to the full itinerary. Individual tickets can be one-way.

4. The Uber benefit applies only to the primary card. The card can be linked to any Uber account.

6. American Express does not use the term "Authorized User" in the same way as bankcard issuers. Additional Platinum cardholders receive nearly all of the benefits provided to the Basic cardholder, but in cases where the benefit has a capped monetary value the cap usually applies per account, not per card. You can also add free Gold or Green cards to a Platinum account. These cards earn rewards for spending at the same rate as the Platinum card (not at the rate of separate Gold or Green accounts).

7. Every American Express card has its own number. Additional cardholder can create separate online accounts, but this is not required. The Basic cardmember can see all activity on all cards. Membership Rewards points from all cards are credited to the Basic cardmember. Initially, transfers can only be made to airline or hotel accounts in the Basic member's name. After the Additional cards have been open for awhile (90 days?) transfers can also be made to their airline and hotel accounts. Membership Rewards points cannot be transferred to any other Membership Rewards account, nor to anyone else's airline or hotel accounts.

I re-read the terms for trip cancelation/inturruption/delay, and it seems like I misread previously, and doesn't outwardly say that using ff miles in combo with the card counts - which is odd since it does allow you to use frequent flyer 'or similar' vouchers, coupons, etc. in combo with the card. but is what it is.

#745

Join Date: Aug 2017

Programs: Hilton Diamond, IHG Spire Ambassador, Global Entry

Posts: 2,869

When the card was introduced, it was about service, it was about prestige. It was about things that it was difficult to put a price on. Now that identity is lost. Are we targeting 75k+ spenders or someone who wants a $5 NYT credit? Those are not the same two people. A past price of anything is irrelevant if it doesn't make sense for you today.

#746

Join Date: Sep 2008

Location: AUS

Programs: BAEC Gold, AA PPro, Hyatt Globalist, Amex Plat

Posts: 7,043

If wife and I both have the platinum <two seperate accounts) could we book a $400 hotel night using the fine hotels and resorts program split on $200 on each card and get the $200 statement credit for both bookings? Anyone with actual experience making a similar booking?

My wife and I both have Platinum card as well, so I'd thought about this too, but just don't see how to trigger the credit on the second card. Certainly would be interested if anyone figures this out though.

Regards

#747

Original Member

Join Date: May 1998

Location: Tampa, FL

Programs: AAMM & PLT; UA Gold, DL Silver, Marriott LT Titanium Elite, Hilton Diamond, Hertz #1 Gold Club

Posts: 1,591

#748

Original Member

Join Date: May 1998

Location: Tampa, FL

Programs: AAMM & PLT; UA Gold, DL Silver, Marriott LT Titanium Elite, Hilton Diamond, Hertz #1 Gold Club

Posts: 1,591

7. Every American Express card has its own number. Additional cardholder can create separate online accounts, but this is not required. The Basic cardmember can see all activity on all cards. Membership Rewards points from all cards are credited to the Basic cardmember. Initially, transfers can only be made to airline or hotel accounts in the Basic member's name. After the Additional cards have been open for awhile (90 days?) transfers can also be made to their airline and hotel accounts. Membership Rewards points cannot be transferred to any other Membership Rewards account, nor to anyone else's airline or hotel accounts.

#749

How much do you pay each MONTH? And we get $25 to offset it? How many are available? What are the alternatives, like LA Fitness and a lot more?

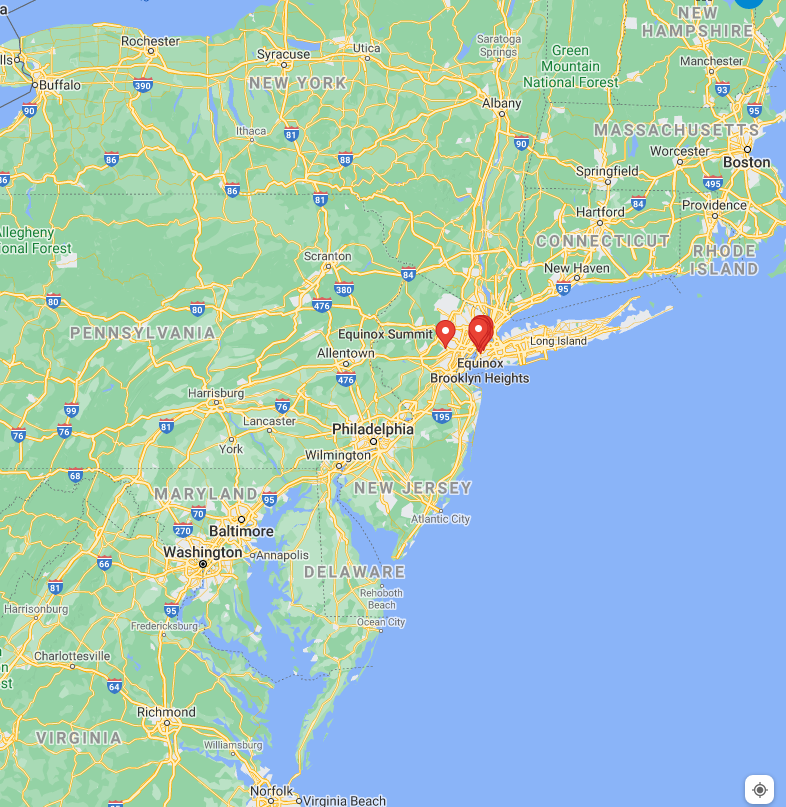

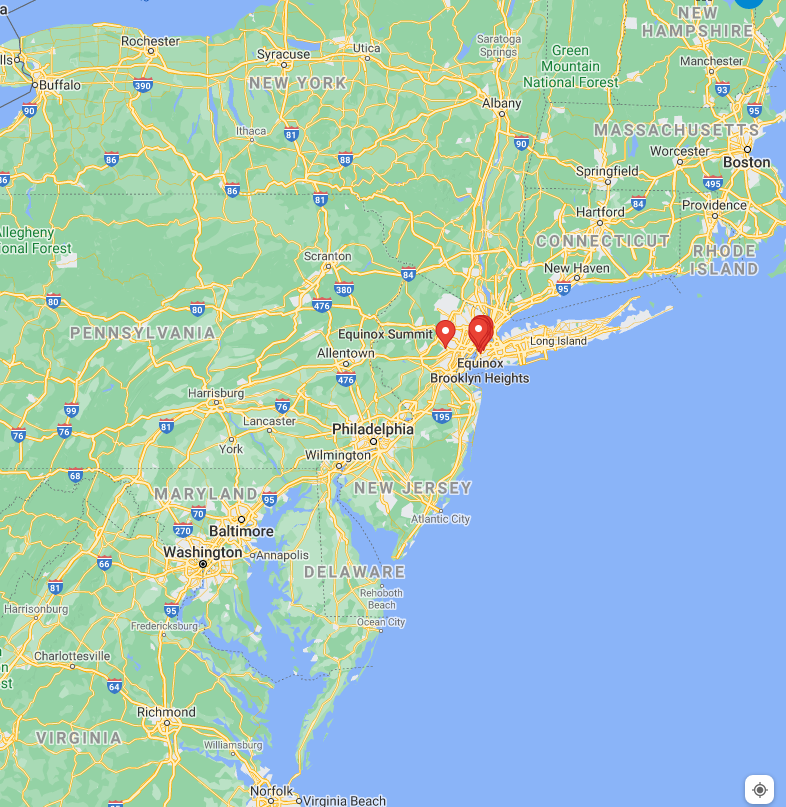

Here is the geographic locations. The locator has been working for 30 minutes and still can't find a location. Google does a much better job:

This is what I found:

Base memberships that only grant you access to one club still cost at least $2,200 a year, plus a $500 initiation fee. If you want to go to multiple Equinox locations in the US, an "all access" membership runs $3,120 a year.

So the base membership costs like $200/month and AmEx only covers $25/month? Even if I want to join the "club" and pay the fee, I still can't find any location. This is very entertaining....

Here is the geographic locations. The locator has been working for 30 minutes and still can't find a location. Google does a much better job:

This is what I found:

Base memberships that only grant you access to one club still cost at least $2,200 a year, plus a $500 initiation fee. If you want to go to multiple Equinox locations in the US, an "all access" membership runs $3,120 a year.

So the base membership costs like $200/month and AmEx only covers $25/month? Even if I want to join the "club" and pay the fee, I still can't find any location. This is very entertaining....

Last edited by RedSun; Jul 17, 2021 at 9:00 am

#750

Tempted is not the same as dictated. American Express was marketing products to cardholders decades before any of these features were added to the Platinum Card. In one year American Express spent more on postage for direct mail ads than the annual fee that I paid them. Advertising subsidizes the cost of countless consumer products. Removing the Saks, Uber, Clear and Equinox features would simply make the Platinum Card more expensive. Evaluating marketing claims and choosing only the goods and services you need is a core adult skill in a mass market economy.

If "Removing the Saks, Uber, Clear and Equinox features would simply make the Platinum Card more expensive" is true, then would the new AF be cheaper since the old card without all the new "benefits" would be more expensive? Or say the other way around, "Adding (removing) the Saks, Uber, Clear and Equinox features would simply make the Platinum Card less (more) expensive"?

Last edited by RedSun; Jul 17, 2021 at 8:34 am