Last edit by: Global Adventurer

*Equinox $25 Credit will not be issued for ANY products you buy online at their merchandise Shop which is coded as "Equinox The Shop". However, it appears that you can purchase Gift Cards straight off the site, but lowest denomination is $100. Gift cards can be used for merchandise and memberships.

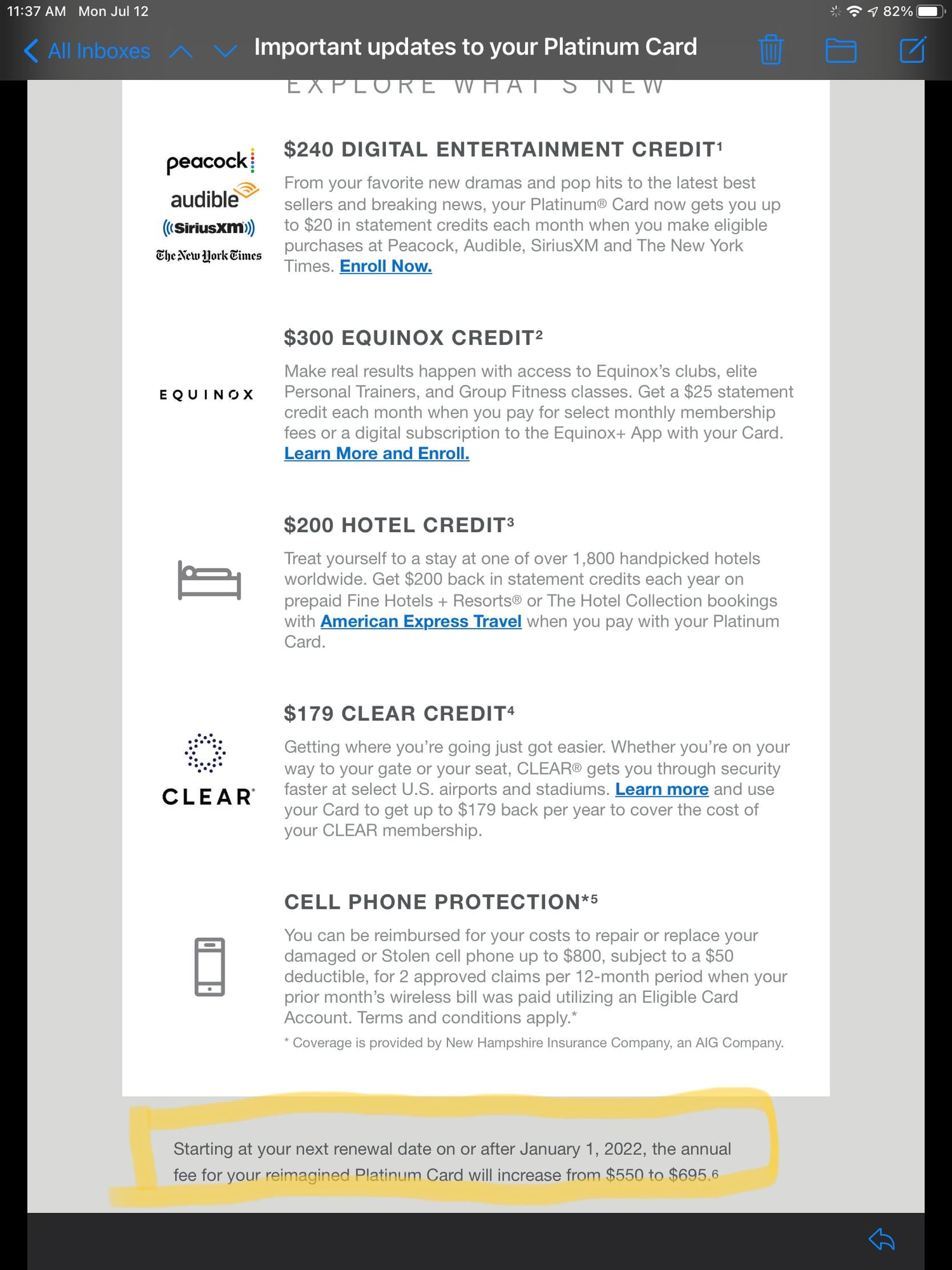

USA personal Platinum annual fee increase to $695, July 2021.

#631

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,857

I think 2% or 2.625% cash back cards are great for saving a baseline amount without any further work. Those of us in this thread probably consider looking for good new signup bonuses and tracking/redeeming Amex/Chase offers to be part of the travel optimization hobby. Others don’t want another part time job.

#632

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

...but it may not beat it by enough to justify the $695 fee. Here's my idiosyncrasy. I don't care what conclusions others reach, but I am very interested in the reasoning and evidence they use to get there. When I ask this type of question it doesn't mean I disagree, it means there was a gap in the explanation that I'd like to understand.

#633

Join Date: Dec 2008

Location: NYC

Programs: BA Gold, HH Diamond, Marriott Gold

Posts: 1,261

Did any existing cardmember with renewal dates Jan or later get notice of higher fee in their July statement? My account anniversary is in Dec but the annual fee bills on Jan statement. I'm assuming I'll be hit with $695 fee.

July statement closed with notices about CS Invest with rewards, new benefits, centurion access changes but no mention of fee increase.

July statement closed with notices about CS Invest with rewards, new benefits, centurion access changes but no mention of fee increase.

#634

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,857

Did any existing cardmember with renewal dates Jan or later get notice of higher fee in their July statement? My account anniversary is in Dec but the annual fee bills on Jan statement. I'm assuming I'll be hit with $695 fee.

July statement closed with notices about CS Invest with rewards, new benefits, centurion access changes but no mention of fee increase.

July statement closed with notices about CS Invest with rewards, new benefits, centurion access changes but no mention of fee increase.

my AF posts in late January.

#635

Join Date: Sep 2014

Location: TPA/DFW/K15

Programs: AA EXP, Mar AMB, HH LT DIA

Posts: 1,653

#636

Join Date: May 2002

Location: EWR/JFK/LGA

Programs: DL Silver, AA, UA Silver, Hilton Diamond, Marriott Gold

Posts: 389

(sorry for the size, I had to edit and remove many of the images to get the file size small enough for FT requirements)

#637

Join Date: Aug 2017

Programs: Hilton Diamond, IHG Spire Ambassador, Global Entry

Posts: 2,862

I mean CSR vs Platinum, of course. But I disagree looking at the portfolio overall. Most folks have 1 or 2 cards they use regularly. AMEX Gold is 4x on restaurants and groceries. I would say “regular people” are spending way more on groceries and dining and earning 4x vs. 3x on travel and dining.

1.5cpp with PYB is great…but if that’s what you regularly use your points for, I think the the Altitude Reserve is superior to what Chase offers. Yes, you are losing 5x opportunities…but “regular people” aren’t heavily shopping 5x categories with an ink cash card and “regular people” aren’t keeping up with or maximizing the 5x Freedom categories.

1.5cpp with PYB is great…but if that’s what you regularly use your points for, I think the the Altitude Reserve is superior to what Chase offers. Yes, you are losing 5x opportunities…but “regular people” aren’t heavily shopping 5x categories with an ink cash card and “regular people” aren’t keeping up with or maximizing the 5x Freedom categories.

It's tough to group all of the spending habits of "regular people." Everyone spends their money differently. Some people would be legitimately better with a free card. Some people don't even know where they spend their money. Some are missing out on big rewards for multiple reasons. As much as people hate to hear this, the 4 and 5x points are largely for theater. Your average person isn't cleaning up nearly as much as they think they are.

#638

Join Date: Dec 2008

Location: NYC

Programs: BA Gold, HH Diamond, Marriott Gold

Posts: 1,261

I got the email, but prior rumors were that July statement will include the official notice of fee increase. Cardmember agreement also mentions $550 still. So does a December anniversary but Jan statement AF post date mean we are still considered as Dec 'renewal'?

#639

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,857

I haven’t received my July statement yet, so unfortunately I can’t answer your actual question.

Last edited by notquiteaff; Jul 12, 2021 at 5:45 pm Reason: Correction: anniversary date -> renewal date

#640

Join Date: Dec 2008

Location: NYC

Programs: BA Gold, HH Diamond, Marriott Gold

Posts: 1,261

Hmm, that’s an interesting point. The screenshot of my email talks about anniversary date. What’s the definition of that - the date on which the annual fee posts, or the actual anniversary of the opening date of the account? My AF posts apparently at the end of the January billing cycle near the end of Jan, but that statement always has some trx from December, so I presumably opened my account in December.

I haven’t received my July statement yet, so unfortunately I can’t answer your actual question.

I haven’t received my July statement yet, so unfortunately I can’t answer your actual question.

Wondering if anyone with Feb-June AF bill date has their cardmember agreement reflecting $695 fee

#643

Moderator: Hyatt; FlyerTalk Evangelist

Join Date: Jun 2015

Location: WAS

Programs: :rolleyes:, DL DM, Mlife Plat, Caesars Diam, Marriott Tit, UA Gold, Hyatt Glob, invol FT beta tester

Posts: 18,942

See the T&C:

https://www.americanexpress.com/us/c...num/terms.html

the credit is "$200 per calendar year", so Jan 1-Dec 31. Supposedly the date of the transaction is the one that "counts" (not when it posts) but at least one person reported otherwise in the DL-specific thread (I don't closely follow the others), so best not to cut it close if you want to be sure.

EDIT: sorry, I had the airline fee credit in my mind by default, but it seems like you were asking about the new-ish $200 travel credit.

https://www.americanexpress.com/us/c...num/terms.html

the credit is "$200 per calendar year", so Jan 1-Dec 31. Supposedly the date of the transaction is the one that "counts" (not when it posts) but at least one person reported otherwise in the DL-specific thread (I don't closely follow the others), so best not to cut it close if you want to be sure.

EDIT: sorry, I had the airline fee credit in my mind by default, but it seems like you were asking about the new-ish $200 travel credit.

#645

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,194