Last edit by: Zorak

As summarized in this Citi/AA press release, the benefits associated with this card changed on July 23, 2023. The new terms and conditions (T&Cs) can be found here.

10k Loyalty Point Bonuses

Reports on this thread to date suggest this benefit is being implemented in the following manner:

10k Loyalty Point Bonuses

Reports on this thread to date suggest this benefit is being implemented in the following manner:

- You are entitled to a 10k bonus if you surpass the 50k and/or 90k LP threshold by any means -- i.e. this is not limited to LPs earned by spend on your credit card. (For the current status year, it is still possible to earn a 10k bonus based on credit card spend -- see T&Cs for details.)

- You must meet, or have met, these thresholds sometime during the current status year. It does not matter if you were a cardholder at the time you crossed the threshold.

- Citi has not published any official information about when such 10k bonuses will post to your AA account

- Experience to date suggests that once cardholders have crossed the 50k or 90k LP threshold, posting of the bonus is triggered by either (a) the closing of your current statement, or (b) a flight or other LP-earning activity (e.g. shopping portal).

- In the case of (b) above, some bonuses are not posting correctly, and others have posted as being earned, but the points have not been added to people's balances.

- UPDATE: Many 10k bonuses posted beginning 7/31/23 without flight or other activity, and multiple users have reported corrections to their LP balances

- these typically post to your account when your statement closes

- per the T&C, "An ďEligible RideĒ is any Lyft ride type, excluding business rides and bicycle and scooter rental rides."

- credits are applied to your Lyft account, not your Citi account

Citi AAdvantage Executive Card questions

#976

Join Date: Nov 2017

Location: CLT

Programs: AA EXP, 2 Million Miler

Posts: 836

So bit the bullet and PC'd my MileUp card to the Exec. Honestly I feel a bit guilty seeing how much overlap there is with my Amex plat and Chase Sapphire Reserve cards, and I don't think I value the Admiral lounge membership too much. Mostly I'm just trying to make hitting plat status, and maybe plat pro a bit easier, and can use the Avis and grubhub pretty easily.

I noticed Citi stated that I had several weeks to cancel the PC, thought not sure if that can still be done after receiving and activating the new card.

Anyone else still able to justify this card if they don't value the lounge access?

I noticed Citi stated that I had several weeks to cancel the PC, thought not sure if that can still be done after receiving and activating the new card.

Anyone else still able to justify this card if they don't value the lounge access?

#977

Join Date: Jul 2011

Posts: 2,387

Additionally if you just did a PC to this product from an existing card, does that mean you didn't get any kind of sign-on bonus?

#978

Join Date: Nov 2017

Location: CLT

Programs: AA EXP, 2 Million Miler

Posts: 836

I believe that is correct, at least that is the way it ways several years ago. That's what I did years ago, and didn't receive the sign-up bonus. I realized the error of my ways back then.

#979

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA ExPlat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 17,399

So bit the bullet and PC'd my MileUp card to the Exec. Honestly I feel a bit guilty seeing how much overlap there is with my Amex plat and Chase Sapphire Reserve cards, and I don't think I value the Admiral lounge membership too much. Mostly I'm just trying to make hitting plat status, and maybe plat pro a bit easier, and can use the Avis and grubhub pretty easily.

well I do use the aspire sometimes though mostly working on Hyatt status at the moment so that really discourages portal bookings. That said it seems like you only need a few nights here and there to make good LPs and I do a reasonable amount of shopping portal and dining already so maybe that’ll be enough

I certainly assign some value to the lounge benefit. Many of my trips are on AS, flying through one of their hubs, so I actually expect to use AS lounges more often than AA lounges. And I am considering whether to cancel my Amex Plat next year now that I can get my wife for free into the AS lounges with this card, instead of paying for an AU Plat card.

#980

Join Date: Sep 2018

Posts: 170

Yes, I have the EXEC and would not give it up. We usually bring 6 into AC's and reap the benefits of MCE seating so the benefits work and brings good value too. The financials in the AA program are really useful because the card helps boost in so many areas. 10X loyalty is really nice on AAhotels because we usually score cheap rooms with 15K base points. Combined with spend, three bookings usually put us beyond Platinum status (Plat Pro this year). But you also get 10X additional bonus miles on the price of these hotel stays as well. This brings the price of those booking to peanuts. Many people think the two 10K loyalty bonus is based on spend but it is based on your loyalty point balance at AA. So for Plat, you get a 10K loyalty boost along the way to earning that 75K.

#981

Join Date: Jan 2023

Programs: AA EP, Delta G, Marriott lt P, Hyatt, Radisson, etc etc etc

Posts: 47

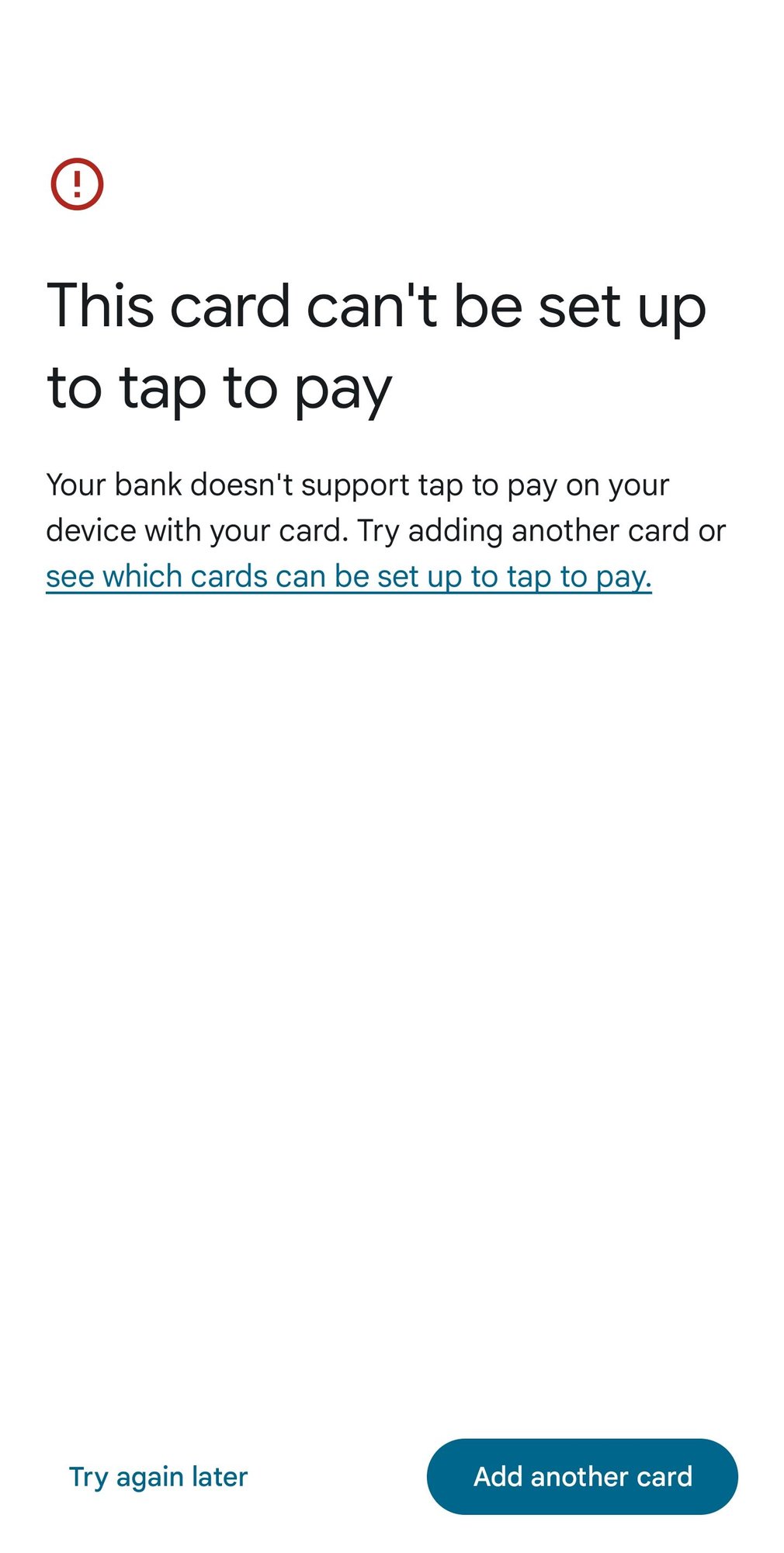

Has anyone had recent success adding this card to Google Pay (now Google Wallet) for tap to pay? There are posts about this going back years in here, and I've reached out to American to complain about it multiple times (since Citi keeps telling me it's an American policy). Well, I finally got a call from someone at American who seems legitimately interested in trying to track this down, but she says multiple of her colleagues have been able to add this exact card to Google Pay. I find that hard to believe since I still can't add mine (tried again today) and the Citi website still explicitly says that none of the Aadvantage cards are eligible for Google Pay.

Would be nice to verify that this is still not just a "me" problem - maybe a chorus of "me toos" would help finally get this sorted. I'm really appreciative that this woman is trying to hunt it down.

Would be nice to verify that this is still not just a "me" problem - maybe a chorus of "me toos" would help finally get this sorted. I'm really appreciative that this woman is trying to hunt it down.

#982

Join Date: Feb 2003

Location: Washington, DC

Programs: AA Executive Platinum/Million Miler, Marriott Titanium Elite-Lifetime, Hilton Gold

Posts: 3,378

Has anyone had recent success adding this card to Google Pay (now Google Wallet) for tap to pay? There are posts about this going back years in here, and I've reached out to American to complain about it multiple times (since Citi keeps telling me it's an American policy). Well, I finally got a call from someone at American who seems legitimately interested in trying to track this down, but she says multiple of her colleagues have been able to add this exact card to Google Pay. I find that hard to believe since I still can't add mine (tried again today) and the Citi website still explicitly says that none of the Aadvantage cards are eligible for Google Pay.

Would be nice to verify that this is still not just a "me" problem - maybe a chorus of "me toos" would help finally get this sorted. I'm really appreciative that this woman is trying to hunt it down.

Would be nice to verify that this is still not just a "me" problem - maybe a chorus of "me toos" would help finally get this sorted. I'm really appreciative that this woman is trying to hunt it down.

#983

Join Date: Jan 2023

Programs: AA EP, Delta G, Marriott lt P, Hyatt, Radisson, etc etc etc

Posts: 47

I'm not just talking about having it in your Google Pay profile for payments online. I'm specifically talking about being able to use it to tap with your phone to pay.

#984

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 21,196

#985

Join Date: Jan 2023

Programs: AA EP, Delta G, Marriott lt P, Hyatt, Radisson, etc etc etc

Posts: 47

THANK YOU. Jeez, I was starting to feel like I was going insane. Even the Citi rep I first spoke to when I ran into this started with "You should absolutely be able to do it" and spent five minutes on technical stuff before realizing there's a policy limitation on Aadvantage cards. Although Citi still says it's an American policy and American is still claiming it's Citi's decision.

#986

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 21,196

#987

Join Date: Jan 2023

Programs: AA EP, Delta G, Marriott lt P, Hyatt, Radisson, etc etc etc

Posts: 47

#988

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA ExPlat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 17,399

Has anyone had recent success adding this card to Google Pay (now Google Wallet) for tap to pay? There are posts about this going back years in here, and I've reached out to American to complain about it multiple times (since Citi keeps telling me it's an American policy).

Google Payments is different. I donít think you have it in your wallet for mobile payments with your phone.

#989

Join Date: Jan 2023

Programs: AA EP, Delta G, Marriott lt P, Hyatt, Radisson, etc etc etc

Posts: 47

Yep. The fine print is still there on Citi's sites (though confusingly, since they haven't updated it since Google switched from Pay to Wallet for tap to pay, it still says you can't add Aadvantage cards to Google Pay. But you can add the Aadvantage cards to Apple Pay or Samsung Pay; and as you pointed out, AA's Barclay cards work fine. Nobody can explain what this ridiculous limitation is about and it's really, really maddening.

#990

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA ExPlat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 17,399

The “workaround”, if you want or need to put mobile spend on your Exec MC (say, for the signup bonus) is to buy eGift Visa giftcards via the AA shopping portal on giftcards.com and add those to your Android wallet. The extra benefit is that you also earn more miles and LP for everyday spend.