Last edit by: NoonRadar

Nov 24, 2015

Dear XXXXXXXXX,

We want to let you know that we are making a change to your Target Prepaid REDcard® by American Express, and you will no longer be able to add money from your debit card at Target stores. As always, you can continue to add money to your Prepaid REDcard by using:

• Your debit card online through your Account

• Cash at a Target Store

• Direct Deposit (You can automatically add all or part of your paycheck, government benefits and federal tax refunds to your Prepaid REDcard)

DEAD FOR DEBIT CARD LOADS EFFECTIVE 10/12/2015 - MEMO: http://frequentmiler.boardingarea.co...uests-can-use/

DEAD FOR CREDIT CARD LOADS. (Amex GCs Included)

Effective May 6, 2015 registers are hard-coded to not allow credit card reload. PIN-based debit cards are working, however YMMV. PIN-based debit cards may be refused by cashiers.

WHAT IS TARGET PREPAID REDCARD?

Prepaid Redcard is a reloadable American Express card. It is only available to purchase at select Target stores.

WEBSITE:

This site may error when in Firefox, especially with adding payees / bill pay. Customer service says to use Chrome or Internet Explorer.

https://amex.serve.com/prepaidredcard

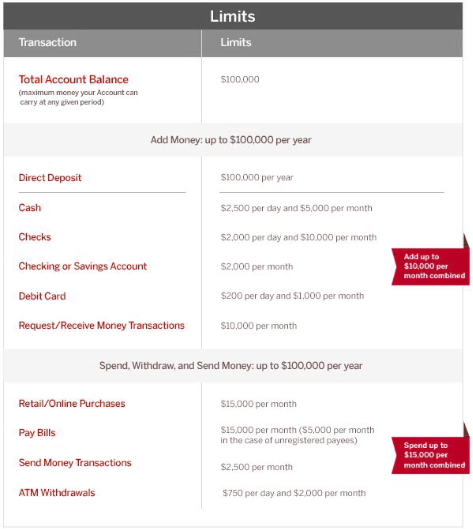

PREPAID REDCARD LOAD LIMITS

Cash (or debit card) loading at Target: ** - $1,000/transaction, $2,500/day and $5,000/month

Online Debit Card Load * - $200/day and $1,000/month

Checking/Savings Account - $2,000/month

Checks - $2,000/day and $10,000/month

ATM Withdrawals - $750/day and $2,000/month

All "Monthly" limits are per calendar month and reset on the 1st of each month.

Daily limits reset at midnight Eastern time, 9 PM Pacific time.

*For online debit load, only use of bank-issued cards is allowed. The use of pre-paid debit cards (Netspend, Paypower, Univision, Paypal, etc.) and VGC/MGC/AGCs is not allowed. Your account will be flagged upon first/second attempt.

ATM Withdrawals:

No-fee ATM usage at US Target stores* and U.S. Allpoint network ATMs. (ATM usage not available at any other ATMs.) Find an Allpoint ATM at: www.allpointnetwork.com Note that some ATMs only allow $400/transaction. There is a $750/day and $2,000/month limit to ATM withdrawals.

RedCard is only available in specific Target stores and is not available in all states. Go to this site to find a list of available locations:https://amex.serve.com/prepaidredcard

FREQUENTLY ASKED QUESTIONS

Q: Can I reload a RB at a Target that doesn't sell RB?

Yes. However, the cashier may not know how to do it. You may be able to coach them through it by saying "It's like reloading a Starbucks (or Gift) card". For step-by-step instructions on one method of 'coaching' new cashiers see Post#1904

Q: Can I buy or reload a RB in North Carolina?

See post here: http://www.flyertalk.com/forum/manuf...a-63.html#2520

There is currently a software issue preventing any reload of any kind in NC. It is a known issue but there is no ETA on a fix.

Q: Can I reload the RB at any register, or just at the Customer Service desk?

It can be done at any register, however some cashiers are not trained on how to do this and you may have to go to Customer Service.

Q: What is the most efficient way to drain a RedCard?

Use BillPay to pay bills. For example, pay the credit card you used to load RedCard with. You can also withdraw money at ATMs.

Q: I cant access the BillPay feature through the RB website!

Verify that your account information correctly reflects a 10-digit phone number (including area code). Numerous people have reported that their account only had a 7-digit phone number (no area code) and that, after updating to a 10-digit phone number, BillPay miraculously started working.

Q: Can we buy a temporary Redbird card while we still have a Bluebird or Serve account?

Yes.

Q: How many Redbird cards can you purchase at once?

You can only purchase one Redbird card a day per SSN. If you plan to purchase more than one, be sure to use a different SSN for each purchase to avoid activation issues.

Q: Can we register our temporary Redbird online while we still have a Bluebird or Serve account?

No. You will have to cancel your Bluebird or Serve account first before registering.

Q: How do I cancel my BlueBird or Serve Account online? Do I need to call them?

Frequent Miler posted a useful trick that will help you cancel online How to cancel Bluebird online This works for both BlueBird and Serve.

Q: Cancelled Bluebird, why does registering Redbird error out saying Bluebird is still active?

If you have open transactions that have not been settled, like BillPay checks that have not yet been cashed, the account cannot settle and will not be truly closed. Thus Target will reject it until it's permanently closed.

Q: Can we get Redbird online?

No. The only way to get Redbird is to find a participating Target store and buy a temporary card there. Some people have purchased RB on Ebay, Amazon, or through private deals. Be aware that doing so may violate the TOS of one or more of these services. Also be aware that buying an un-activated RB, you are potentially buying "stolen" merchandise; the seller *may* have simply taken the un-activated RB cards from a target store without permission. At best they got permission from a low-level employee; they certainly are not getting permission from someone authorized to allow sale of RB outside of the current Target-authorized roll out markets. It is highly recommended to only buy already activated Redbirds because many Targets which do not offer Redbirds also will not be able to activate them and you will spend a month with the Customer Service line trying to get a new one.

Q: Does the initial load you put in when purchasing the Redbird count against the monthly limit?

No. After registering the Redbird online, any loads done will count against your monthly limit, even on your temp card.

Q: Can we load Redbird with Target gift cards at Target?NO.

When loading, the register displays a large message saying that gift cards cannot be used to pay for this transaction.

Q: What are the card’s load limits per transaction at Target?

[B]As of 2/2/2015 there is a maximum $1,000 load per transaction. You can no longer load the same RB multiple times (multiple swipes) in 1 transaction. Likewise, you can no longer load multiple RBs (say your's and your spouse's) in 1 transaction. Maximum of 1 load, for $1,000 per debit card payment. End of story.

Q: What credit cards can I use to reload RedCard in Target stores?

NONE. As of May 6, 2015, credit cards cannot be used to reload.

Q: Can I reload with a debit card?

Yes, but only if the debit card can be authenticated with PIN-number. Signature-based debit that processes on the Visa/MasterCard/AmEx networks will NOT work.

Q: Can I reload with a prepaid debit card or Vanilla Visa?

Yes, but only if you have a PIN for that card.

Q: How can I load 2 debit cards in one transaction? Example 2x$500.

1. Swipe debit card on my terminal after total comes up $1000.

2. PIN pad comes up. Enter 4 digit PIN.

3. Do you want cash back? press NO

4. Do you want full amount on this card? press NO <<<Note: I pressed YES and did not have a step 5. - PHLisa

5. Cashier reads something on register, asks how much on this card. $500. They push something to continue.

6. Swipe card #2. Enter PIN

7. Repeat 3 to 5. Total: 0.00

8. Receipt prints. Thank cashier. The end.

(thanks to Mamibear)

Q: Can someone else buy a Redbird card for you?

Yes. When you buy a temp Redbird card at Target, you have to give them your drivers license info, your SSN (can be any set of numbers, does not need to be real), birthdate, and more. Then, you have to register the card online in order to get a permanent card. In the process of registering online, they ask for the birthday of the original buyer on the first screen, but you can put your own and it will still work. Either way, you can still change the details on the following screens. I did this for my wife. I bought the card at Target and used my own driver’s license, SSN, etc. But, when I got home, I registered the card to my wife. I can’t promise this will work for everyone, but it worked for me.

Q: Can you reload Serve/Bluebird at Target?

No.

Q: How do I contact Target's support team to resolve an issue with my RedCard?

Call Target's Prepaid Resolution Team, their direct telephone number is 800 438 6468 (open from 8AM to 430PM MST).

Q: Can you have both Redbird and AFT cards?

Yes.

You can have both Redbird and AFT since they are independent products.

Q: I got a "Pending" notice that the registration is being reviewed, what now?

Add [email protected] to your address book, and check your spam folder for an email about it. You can also call in. They will need images or faxes of:

• Social Security Documentation (must clearly show full 9 digit Social Security Number). Choose 1 of the following options:

◦ Social Security Card, OR

◦ A Medicare insurance card

Plus...

• Picture ID

◦ A valid driver's license card OR

◦ A valid state issued ID OR

◦ A valid United States Government ID Card (e.g. Green Card) OR

◦ A valid United States Passport (photo page only)

◦ Social Security Card, OR

◦ A Medicare insurance card

Plus...

• Picture ID

◦ A valid driver's license card OR

◦ A valid state issued ID OR

◦ A valid United States Government ID Card (e.g. Green Card) OR

◦ A valid United States Passport (photo page only)

Secure Document Upload

Here's the link to upload secure documents to REDcard: https://secure.prepaidredcard.com/User/SecureFileUpload

Prepaid REDcard (Target) 2015-2016

#901

Suspended

Join Date: Dec 2014

Posts: 8,460

#902

Suspended

Join Date: Dec 2014

Posts: 8,460

Are you doing back-to-back loads? Same amounts repeatedly in a short timespan, looks a lot like duplication in the transaction stream. This may also be labelled "fraud" by the software that looks for irregularities. I have multiple cards I am loading from, and just don't duplicate any of them per trip.

#903

Join Date: Feb 2004

Location: Just off the Main Line

Programs: AA Lifetime PLT 2MM, DL Lifetime GM 2MM, Bonvoy Lifetime Titanium Elite, HH Diamond, IHG Amb Diamond

Posts: 881

#904

Join Date: Jan 2012

Programs: Marriott/SPG Plat, Hilton Gold

Posts: 887

I wouldn't do this monthly. Redbird is too good of a product to risk getting shut out of.

#906

Join Date: Jul 2013

Location: DFW,OVB (Russia)

Programs: AA HH Gold SPG Gold BA

Posts: 1,823

Citi is a f'ing pain in the behind to load up on a RB, fraud alerts left and right. After the third time, I called them and told them if they do it again, I'm going to close their card.

Another annoying thing with Citi is I always get a young asian girl, it's like I'm calling into Bangkok or something. They don't seem to get it so I hung up a few times and redialed and each time got a young asian girl.

Another annoying thing with Citi is I always get a young asian girl, it's like I'm calling into Bangkok or something. They don't seem to get it so I hung up a few times and redialed and each time got a young asian girl.

Anyway, are you new with Citi, or new to MS with Citi?

I've said this before, but Citi is VERY pattern based

2 years ago, when I first started MSing on my card , I too would get fraud alerts on every other transaction (ap) after some time though,after cleaning a few fraud alerts, I saw them less and less .

Eventually, I stopped having that problem. Moreover, thanks to me sticking with them , I now exclusively get US based customer service and can push almost ANYTHING through my card will almost zero fraud alerts (and if I do get them, I can now just clear them via text) Trust me, give it time, stick with them, read flyertalk and you will have a rewarding experience with Citi (in more ways than one) better than Chase for sure, don't even get me started on them, and how outsourced and unhelpful their back end customer service is, and their frontline on CSP isn't much better, even though it's US based

#907

Suspended

Join Date: Dec 2014

Posts: 8,460

Call center is likely in the Philippines.

Anyway, are you new with Citi, or new to MS with Citi?

I've said this before, but Citi is VERY pattern based

2 years ago, when I first started MSing on my card , I too would get fraud alerts on every other transaction (ap) after some time though,after cleaning a few fraud alerts, I saw them less and less .

Eventually, I stopped having that problem. Moreover, thanks to me sticking with them , I now exclusively get US based customer service and can push almost ANYTHING through my card will almost zero fraud alerts (and if I do get them, I can now just clear them via text) Trust me, give it time, stick with them, read flyertalk and you will have a rewarding experience with Citi (in more ways than one) better than Chase for sure, don't even get me started on them, and how outsourced and unhelpful their back end customer service is, and their frontline on CSP isn't much better, even though it's US based

Anyway, are you new with Citi, or new to MS with Citi?

I've said this before, but Citi is VERY pattern based

2 years ago, when I first started MSing on my card , I too would get fraud alerts on every other transaction (ap) after some time though,after cleaning a few fraud alerts, I saw them less and less .

Eventually, I stopped having that problem. Moreover, thanks to me sticking with them , I now exclusively get US based customer service and can push almost ANYTHING through my card will almost zero fraud alerts (and if I do get them, I can now just clear them via text) Trust me, give it time, stick with them, read flyertalk and you will have a rewarding experience with Citi (in more ways than one) better than Chase for sure, don't even get me started on them, and how outsourced and unhelpful their back end customer service is, and their frontline on CSP isn't much better, even though it's US based

#908

Join Date: Mar 2012

Location: Boulder

Programs: AA Plat, CX Silver

Posts: 2,361

Call center is likely in the Philippines.

Anyway, are you new with Citi, or new to MS with Citi?

I've said this before, but Citi is VERY pattern based

2 years ago, when I first started MSing on my card , I too would get fraud alerts on every other transaction (ap) after some time though,after cleaning a few fraud alerts, I saw them less and less .

Eventually, I stopped having that problem. Moreover, thanks to me sticking with them , I now exclusively get US based customer service and can push almost ANYTHING through my card will almost zero fraud alerts (and if I do get them, I can now just clear them via text) Trust me, give it time, stick with them, read flyertalk and you will have a rewarding experience with Citi (in more ways than one) better than Chase for sure, don't even get me started on them, and how outsourced and unhelpful their back end customer service is, and their frontline on CSP isn't much better, even though it's US based

Anyway, are you new with Citi, or new to MS with Citi?

I've said this before, but Citi is VERY pattern based

2 years ago, when I first started MSing on my card , I too would get fraud alerts on every other transaction (ap) after some time though,after cleaning a few fraud alerts, I saw them less and less .

Eventually, I stopped having that problem. Moreover, thanks to me sticking with them , I now exclusively get US based customer service and can push almost ANYTHING through my card will almost zero fraud alerts (and if I do get them, I can now just clear them via text) Trust me, give it time, stick with them, read flyertalk and you will have a rewarding experience with Citi (in more ways than one) better than Chase for sure, don't even get me started on them, and how outsourced and unhelpful their back end customer service is, and their frontline on CSP isn't much better, even though it's US based

That said, it's been a while since I did any major spending on Citi.

#909

Join Date: Dec 2014

Posts: 13

They are learning..

just loaded at my local Target (mckinney TX). For the first time, the customer service girl knew exactly what to do. I have loaded here before, but don't remember if she ever helped me before? Out of curiosity,does anyone on here use this location for loading,besides me?

just loaded at my local Target (mckinney TX). For the first time, the customer service girl knew exactly what to do. I have loaded here before, but don't remember if she ever helped me before? Out of curiosity,does anyone on here use this location for loading,besides me?

#910

Join Date: Jun 2013

Location: VA

Programs: AA EXP, A3 Gold, Marriott Silver, Choice Privileges Gold, National Exec

Posts: 192

#911

Suspended

Join Date: Dec 2014

Posts: 8,460

You're pretty new to Citi and upset that you're getting fraud alerts for purchases of $500 or more?? So upset in fact, that you called in and threatened to cancel when they are simply trying to protect you?? Target did have a data breach not too long ago after all...and by your own admission you're a relatively new customer. Give them a chance at least...

#912

Join Date: Jun 2013

Location: VA

Programs: AA EXP, A3 Gold, Marriott Silver, Choice Privileges Gold, National Exec

Posts: 192

From your response, I feel like we would have a pretty good conversation about "nanny state interference" (as in, agreement on the topic) but, I'll stick to talking about the REDcard ^

#913

Join Date: Apr 2014

Location: UES/MWC

Programs: Braniff, TWA, Eastern, Midwest, AA Exec, Club Carlson Gold

Posts: 270

Citi is particularly paranoid about large purchases at Target due to the "Target data breach". That seems like it was a long time ago to me, but Citi, like an elephant, never forgets. They're much less likely to decline due to fraud concerns if the transaction is somewhere other than Target. Le sigh.

#914

Join Date: Dec 2014

Location: DFW

Programs: SPG Gold, SW Companion Pass, Hilton Gold

Posts: 128

This is great. I live in the Dallas area and I'm waiting to receive my permanent card but I will let you know how it goes closer to downtown.

#915

Join Date: Aug 2013

Posts: 1,207

Citi is a f'ing pain in the behind to load up on a RB, fraud alerts left and right. After the third time, I called them and told them if they do it again, I'm going to close their card.

Another annoying thing with Citi is I always get a young asian girl, it's like I'm calling into Bangkok or something. They don't seem to get it so I hung up a few times and redialed and each time got a young asian girl.

Another annoying thing with Citi is I always get a young asian girl, it's like I'm calling into Bangkok or something. They don't seem to get it so I hung up a few times and redialed and each time got a young asian girl.