Last edit by: yugi

US Bank Altitude Reserve card

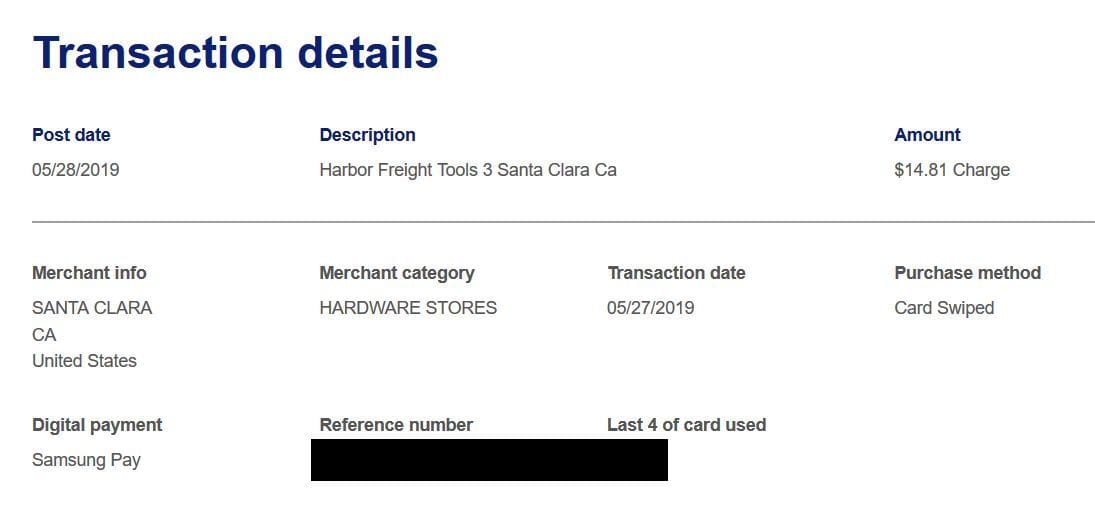

Mobile wallet category is defined as follows: the method of paying for a transaction by use of a mobile device (in-store, in-app or online) and includes ApplePay®, Samsung Pay,Android Google Pay™, Microsoft Wallet, LG Pay®

Card provides primary CDW coverage in the US for cars up to $75k in value up to 15 days. In other countries coverage is up to 31 days. Excluded countries: Israel, Jamaica, Ireland and Northern Ireland.

Card provides 8 Priority Pass lounge visits per PP membership year.

Direct link to application:

http://mycard.usbank.com/credit/team...e_reserve.html

Point Redemptions

Reconsideration Line: 1-800-947-1444

- 50,000 bonus points after $4,500 spend within first 90 days

- Up to $325 annually (cardmember year NOT calendar year) in statement credits for eligible travel and dining/takeout purchases

- $400 annual fee

- Free authorized users

- 3x on travel and mobile wallet purchases

- 5x on hotel and car rental purchases made via US Bank portal

Mobile wallet category is defined as follows: the method of paying for a transaction by use of a mobile device (in-store, in-app or online) and includes ApplePay®, Samsung Pay,

Card provides primary CDW coverage in the US for cars up to $75k in value up to 15 days. In other countries coverage is up to 31 days. Excluded countries: Israel, Jamaica, Ireland and Northern Ireland.

Card provides 8 Priority Pass lounge visits per PP membership year.

Direct link to application:

http://mycard.usbank.com/credit/team...e_reserve.html

Point Redemptions

- Redeem at 1.5c per point value for travel purchases made directly at the US Bank travel site

- Redeem at 1.5c per point for travel purchases made at other sites when using the Realtime Rewards feature. Must enroll first.

- Otherwise redeem at 1c per point.

- With Realtime Rewards it's possible to redeem for fees such as Delta award charges for example.

- To redeem for lodging the minimum purchase must be

$500$150 and you must have enough points to cover the whole purchase. For car rentals, the minimum is$250$150. $10 minimum for the rest of the categories. - Some non-US travel charges work with Realtime Rewards even though they shouldn't.

Reconsideration Line: 1-800-947-1444

US Bank Altitude Reserve Card (2017 - 2023)

#781

Join Date: May 2006

Location: Melbourne, Florida, USA

Posts: 2,983

Does this credit card provide rental car insurance in New Zealand?

#782

Join Date: Jul 2016

Location: ORD

Programs: Hyatt Globalist, IHG Platinum, Bonvoy Platinum, Hilton Gold - cheapass economy flyer!

Posts: 241

just another dp that they gave me 10k to keep the card for another year. They gave me 10k last year too, so they're not unwilling to do repeat business.

I like the card benefits, even if I often can't find ways to use up my gogo credits, and the PP is duplicative of other cards I carry. And I like the 3x using my phone together with 1.5 cents per point. So they might not need to give me a great reason to keep. With 10k it's a money maker and a no-brainer.

I like the card benefits, even if I often can't find ways to use up my gogo credits, and the PP is duplicative of other cards I carry. And I like the 3x using my phone together with 1.5 cents per point. So they might not need to give me a great reason to keep. With 10k it's a money maker and a no-brainer.

Last edited by UsernameChuck; Jun 9, 2019 at 12:44 am

#783

Join Date: Jan 2014

Location: TYS/BNA/ATL

Programs: UR, TYP, MR, C1, AA, UA, WN, BA, AS, AV, AC, Choice, Hyatt, IHG, Hilton, Wyndham, Marriott

Posts: 1,978

#784

Join Date: Dec 2007

Location: Virginia City Highlands

Programs: Nothing anymore after 20 years

Posts: 6,900

Question about points - are they shown immediately once transaction is posted/cleared or are they awarded once statement for the month is generated?

#785

Join Date: Jan 2018

Location: BGI | MIA

Programs: AA Platinum Pro | Hyatt Globalist | HH Diamond | SPG Gold

Posts: 316

once monthly and there’s no view by transaction for points either. It only lists how many points you earned in each category

#786

Join Date: Apr 2014

Posts: 540

#787

Join Date: Dec 2007

Location: Virginia City Highlands

Programs: Nothing anymore after 20 years

Posts: 6,900

Guess, I have to wait then.

And do I understand correctly that car rental goes under travel category earning 3 points per $?

And do I understand correctly that car rental goes under travel category earning 3 points per $?

#788

Join Date: Apr 2014

Posts: 540

Travel:

- Earn 3X points per $1 for eligible net travel purchases made directly with airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise line companies.

#789

Join Date: Jan 2014

Location: TYS/BNA/ATL

Programs: UR, TYP, MR, C1, AA, UA, WN, BA, AS, AV, AC, Choice, Hyatt, IHG, Hilton, Wyndham, Marriott

Posts: 1,978

Last edited by yugi; Jun 11, 2019 at 12:32 pm

#790

Join Date: Jan 2018

Location: BGI | MIA

Programs: AA Platinum Pro | Hyatt Globalist | HH Diamond | SPG Gold

Posts: 316

yes I knew that, but that doesn’t list the amount of points you earned for each transaction which is what I was referring to.

with other card issuers you can see exactly how many points each transaction earned

#791

Join Date: Jan 2014

Location: TYS/BNA/ATL

Programs: UR, TYP, MR, C1, AA, UA, WN, BA, AS, AV, AC, Choice, Hyatt, IHG, Hilton, Wyndham, Marriott

Posts: 1,978

You can tell - if it's mobile wallet, then it's 3x, if it's travel category (airline, hotel, etc), then it's 3x too.

#792

Join Date: Mar 2017

Location: USA

Programs: AA Gold, Hyatt Globalist, Hilton Diamond

Posts: 310

Took a long time to track that down while it was mixed in with a month's worth of spending (some of which was 1x).

#793

Join Date: Dec 2007

Location: Virginia City Highlands

Programs: Nothing anymore after 20 years

Posts: 6,900

#794

Join Date: Jul 2014

Location: Western US

Programs: Costco Executive Member, Amazon Optimus Prime

Posts: 1,251

USB AR has a narrower definition of 'travel' than others, which I've found out using lots of small comparisons.

I thought somewhere they had a list of MCC or actual categories....but it doesn't matter if the vendor doesn't code stuff up the way we expect.

If it's a big expense, and I would really care about losing the pts, I sometimes book through a travel agency with Prestige to get 5x. or use Premier directly with 3x on a big spectrum of travel MCC's.

For things like real estate agencies which usually don't count as travel (I thought there was one card maybe BOA or Pathfinder? that did) try to use a card you're doing MSR on.....

I thought somewhere they had a list of MCC or actual categories....but it doesn't matter if the vendor doesn't code stuff up the way we expect.

If it's a big expense, and I would really care about losing the pts, I sometimes book through a travel agency with Prestige to get 5x. or use Premier directly with 3x on a big spectrum of travel MCC's.

For things like real estate agencies which usually don't count as travel (I thought there was one card maybe BOA or Pathfinder? that did) try to use a card you're doing MSR on.....

#795

Join Date: Mar 2017

Location: USA

Programs: AA Gold, Hyatt Globalist, Hilton Diamond

Posts: 310

They did not, nor did I receive travel credit for that purchase. Luckily most of the rest of my foreign travel purchases did count, so I'm not worried.

It was just annoying manually tracking down which purchases did/didn't count for 3x and why. Would be much better if they showed earning per transaction.

Once I hit MSR, I plan to use this card exclusively for mobile wallet purchases and not worry about the travel coding. Though I do want to use it for RTR, so I guess I will have to worry which US merchants I'm using it at to redeem points.

It was just annoying manually tracking down which purchases did/didn't count for 3x and why. Would be much better if they showed earning per transaction.

USB AR has a narrower definition of 'travel' than others, which I've found out using lots of small comparisons.

I thought somewhere they had a list of MCC or actual categories....but it doesn't matter if the vendor doesn't code stuff up the way we expect.

If it's a big expense, and I would really care about losing the pts, I sometimes book through a travel agency with Prestige to get 5x. or use Premier directly with 3x on a big spectrum of travel MCC's.

For things like real estate agencies which usually don't count as travel (I thought there was one card maybe BOA or Pathfinder? that did) try to use a card you're doing MSR on.....

I thought somewhere they had a list of MCC or actual categories....but it doesn't matter if the vendor doesn't code stuff up the way we expect.

If it's a big expense, and I would really care about losing the pts, I sometimes book through a travel agency with Prestige to get 5x. or use Premier directly with 3x on a big spectrum of travel MCC's.

For things like real estate agencies which usually don't count as travel (I thought there was one card maybe BOA or Pathfinder? that did) try to use a card you're doing MSR on.....

Last edited by milesforhire; Jun 13, 2019 at 9:37 am Reason: Avoiding double post