Last edit by: storewanderer

Older (archived) threads: 2014-16

- - - - - -

- What is EMV contactless?

EMV contactless is a form of contactless/NFC that uses the same security and encryption that is used when inserting a chip card into an EMV-enabled terminal. Other than not having to sign/enter a PIN for smaller transactions, the security is effectively the same as chip and PIN/chip and signature.

In contrast, MSD contactless is an older version that is designed just and only for the United States. This effectively uses much the same flow as a swiped card transaction with the same rules.

- What is CDCVM?

CDCVM stands for Consumer Device Cardholder Verification Method. It's a method of telling the terminal that the customer verified their identity using their mobile device. Terminals that support it will waive the signature/PIN requirement typically in place for larger transactions, potentially saving time at checkout.

More info: https://support.apple.com/en-us/HT202527

- Does EMV contactless need to be supported to support CDCVM?

Typically, yes. (However, there are some exceptions below.)

- Why can't I tap my foreign-issued contactless card at most places in the US?

This is likely because the store does not support EMV contactless. Foreign issued contactless cards typically do not support MSD contactless since other markets have had EMV for quite some time. In contrast, most stores in the US have yet to get the necessary certifications/software for EMV contactless so they are typically MSD-only--if contactless is enabled at all. (See below for a list of stores where your card will likely work.)

- I paid for a purchase with Apple/Android/Samsung Pay and still had to sign for it.

Most likely, the store in question does not have EMV contactless enabled (see above question). However, there are instances where CDCVM does not work even with EMV contactless enabled. Restaurants that allow tip adjust, for example--where the tip amount is written on a paper receipt and entered by the staff later--cannot support CDCVM. It may simply be a matter of the merchant's processor or the POS software in use not supporting it too.

Another common reason is if you used a US-issued AmEx card with a mobile wallet. AmEx currently does not allow EMV contactless support in mobile wallets for these cards, so they always run as MSD contactless. Because of this, CDCVM is not supported (with very few exceptions, as noted below).

Note: if you used Samsung Pay, you may have paid with MST instead of NFC. Since MST emulates the magnetic pulses that the terminal receives when swiping a regular card, the normal magstripe rules apply.

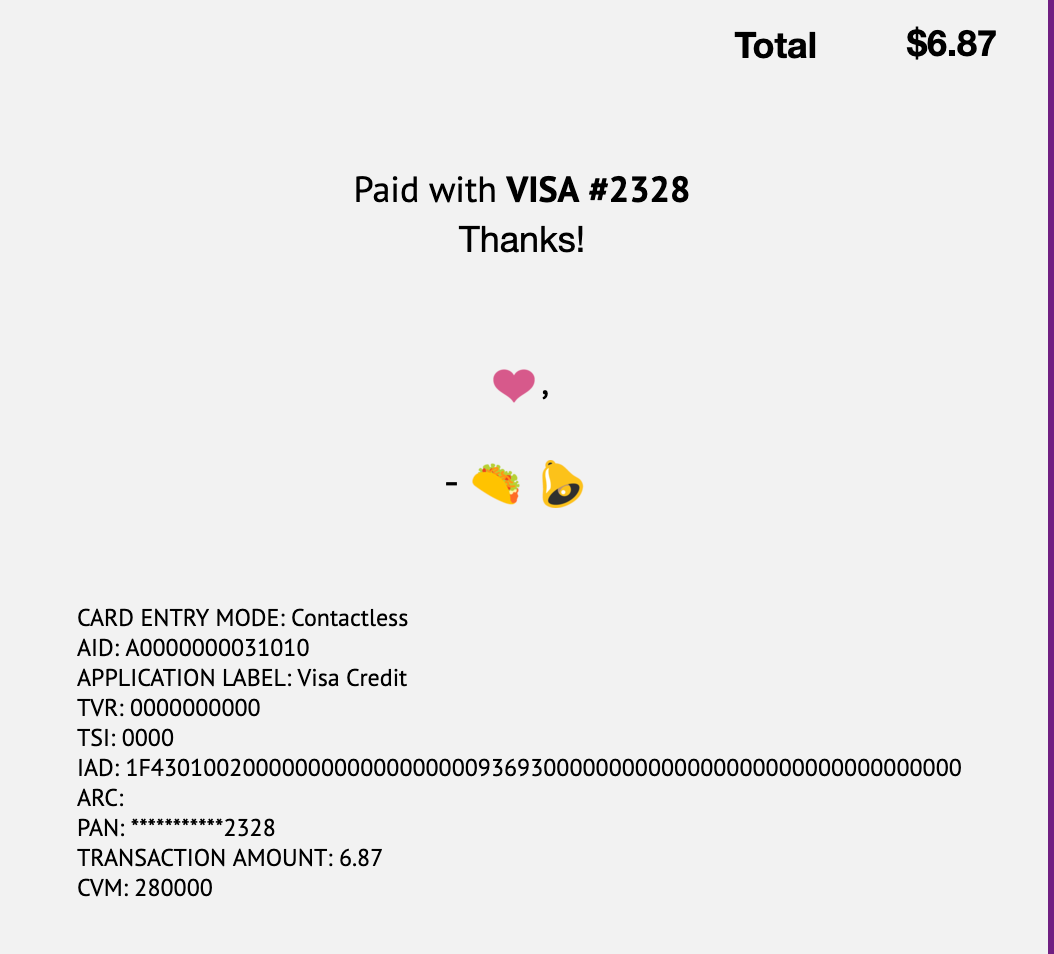

- How can I tell whether EMV contactless was used?

An easy way to tell if you have Apple Pay is to pay with a Visa or MC while in airplane mode. Wallet will then show a transaction amount next to "Payment" for the card that was used. Alternatively, EMV-related information will typically print on the receipt (AID, etc.) if EMV contactless was used.

(Non-exhaustive) list of EMV contactless supporting merchants in the US:

- 7-Eleven

- 99 Ranch

- Albertsons (Safeway, Vons, Pak N Save, Jewel, Acme, Shaws, Star, Carrs, Randalls, Tom Thumb, Haggen, Eagle, Lucky UT/SoCal)

- Apple Store*†

- Athleta

- Auntie Anne’s Pretzels

- Banana Republic

- Costco Wholesale

- CVS

- DuaneReade*

- El Pollo Loco

- EG Group US (Quik Stop, Kwik Shop, Tom Thumb, Turkey Hill) Note: cashier must press "Electronic Payment" to activate NFC

- Five Below*

- Five Guys

- GAP

- Grocery Outlet*

- Harmon's Grocery

- H&M*

- Jolibee

- Kohl's*

- Lush Cosmetics*

- Maverik

- McDonald's*

- Meijer

- Old Navy

- Panera Bread

- PetSmart

- Ray's Food Place

- Round Table Pizza

- Royal Farms

- Red Ribbon Bakeshop

- Sheetz

- Sherm's Thunderbird Discount Markets Inc.*

- Sprouts

- Staples*

- Starbucks*

- Subway

- Walgreens*

- Weis Markets

- All businesses that use Square and support contactless*

- All businesses that use Clover and support EMV†**

- All businesses that use First Data standalone terminals (e.g. FD100+FD35, FD130) with EMV enabled**

* CDCVM support confirmed

** CDCVM support depends on store/restaurant

† CDCVM supported in MSD mode

USA contactless credit/debit/transit (2017 - 2021)

#6377

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

More progress on dual interface cards: https://www.bloomberg.com/news/artic...-moves-forward

OMNY usage first weekend of operation: https://www.nydailynews.com/new-york...2wy-story.html

OMNY usage first weekend of operation: https://www.nydailynews.com/new-york...2wy-story.html

Also, hopefully the lucky BofA customers take to them quickly because it sounds like there's still a chance they might not bother with rolling them out to everyone.

#6378

Join Date: Apr 2017

Posts: 150

1.5% of all transactions. However, the 80% using mobile devices does seem to imply that a significant number of US residents are using it (vs. mostly foreign visitors). Maybe that will decrease over time as contactless cards become more common.

Also, hopefully the lucky BofA customers take to them quickly because it sounds like there's still a chance they might not bother with rolling them out to everyone.

Also, hopefully the lucky BofA customers take to them quickly because it sounds like there's still a chance they might not bother with rolling them out to everyone.

#6379

Join Date: Jun 2012

Posts: 3,385

2) contactless only works for pay-per-trip. If you have monthly pass, you still have to use MetroCard

Just got an email, boa rolling out contactless

#6380

Join Date: May 2011

Location: NYC (LGA, JFK), CT

Programs: Delta Platinum, American Gold, JetBlue Mosaic 4, Marriott Platinum, Hyatt Explorist, Hilton Diamond,

Posts: 4,897

I have new Chase contactless cards and have been using "tap to pay" more often. I've scrolled through this thread a bit. A few basic questions

1) Do you think the increase in contactless cards will also lead to more chip and pin options in the US?

2) Why do people in the thread seem to prefer contactless cards vs mobile devices?

I find that is a tad more time consuming to pull out my wallet, pull out my contactless card then tap the card versus pulling out my phone and "double clicking" to pay (two steps vs one steps)

1) Do you think the increase in contactless cards will also lead to more chip and pin options in the US?

2) Why do people in the thread seem to prefer contactless cards vs mobile devices?

I find that is a tad more time consuming to pull out my wallet, pull out my contactless card then tap the card versus pulling out my phone and "double clicking" to pay (two steps vs one steps)

#6381

Join Date: Jun 2012

Posts: 3,385

1) people refuse to memorize pin.

2) merchants won't enable chip n pin on their terminals (how long did it take to roll out chip terminal, and how long did the chip slot stay dormant before being enabled?)

3) regulation wise, dont see any push to make chip+pin more merchant friendly versus others (eg fraud protection from the merchant perspective)

heck, a lot of merchants run debit cards as signature, to make to hassle free for consumers, don't see them wanting to move to chip n pin (more friction).

Without all this, credit card companies can still rollout chip & pin. Costs money with little upside, doubt it'll happen

find that is a tad more time consuming to pull out my wallet, pull out my contactless card then tap the card versus pulling out my phone and "double clicking" to pay (two steps vs one steps)

Last edited by paperwastage; Jun 4, 2019 at 10:47 am

#6382

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

- Quick Chip: besides making it practically impossible to push PIN changes in a reliable manner (if offline PIN is supported by the card), it could cause PIN to be asked for with most contactless purchases (even small ones). While one could make the contactless interface signature-preferring, that also provides a way around PIN authentication in the first place--especially as contactless support at merchants becomes more common.

- A fair number of later EMV merchant rollouts don't support PIN at all. This is in large part due to the huge number of chip and signature cards on the market already. There's not much of a point if PIN's simply not going to be asked for most of the time anyway.

People already do for debit cards. I don't think this would preclude mandatory PIN for all cards on its own, but they very well may just set all their cards to the same PIN.

However, I find that newer businesses and EMV latecomers are far less likely to have PIN enabled, or even the required hardware for it. Granted, a fair number of those are restaurants who likely don't want to bother with something that only a few people would need anyway.

Also, I'm not convinced that making customers liable by default is required to make PIN a thing in the first place. Especially when lost/stolen fraud is supposedly too low for banks to justify it.

#6383

Join Date: Oct 2007

Programs: AA, WN, UA, Bonvoy, Hertz

Posts: 2,491

I saw Kroger Pay and Kroger debit card advertising/signage at a local Ralphs today. I was short on time, however, so I couldn't test Chase Pay. Not that I particularly want to encourage Kroger but at least it'd be an option that doesn't rely on having a Samsung device with MST support for the few times I go into one.

It is true that it would be the only way to use a non-SP, contactless method at Kroger stores since they continue to leave the NFC off as discussed.

#6384

Join Date: Apr 2019

Posts: 201

2) Why do people in the thread seem to prefer contactless cards vs mobile devices?

I find that is a tad more time consuming to pull out my wallet, pull out my contactless card then tap the card versus pulling out my phone and "double clicking" to pay (two steps vs one steps)

I find that is a tad more time consuming to pull out my wallet, pull out my contactless card then tap the card versus pulling out my phone and "double clicking" to pay (two steps vs one steps)

I don't use it as much, but I have a different default card on my Apple Watch that gets used at gas pumps and then I can leave my phone connected in my car. I probably could use it more at various retailers, but I almost always reach for my phone out of habit.

#6385

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

#6386

Join Date: Oct 2004

Location: Indianapolis area

Programs: Marriott Lifetime Titanium

Posts: 436

That said I'll use what's convenient at the time. When I had two contactless cards I just put one on the left side of the wallet and one on the right side, and would just tap the (opened) wallet on the correct side for the desired card without pulling anything out. Now that I've just received my third contactless card from Chase that strategy will only work for one side of the wallet since the other side now has two contactless cards. If the phone is already out and handy and has the desired card pre selected I'll just do that. Just depends on what is handy at the time.

#6387

Join Date: Oct 2014

Programs: Skymiles

Posts: 3,251

In my opinion they should have just deployed Vx805s everywhere, and ditched the Mx915, but I suppose line item displays in states that require it is an important reason why a lot of fast food went to these overkill terminals.

#6388

Join Date: Sep 2014

Posts: 1,723

I went to the manned register at my TB and despite it saying tap to pay no response from the mx915 but I went self ordering kiosk and it still worked just fine they must have really just had it enabled.

#6389

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

Where are line items required by law? Not sure they're required in California anyway considering the number that don't use those for that purpose.

#6390

Join Date: Oct 2014

Programs: Skymiles

Posts: 3,251