Last edit by: mia

Current welcome offer is 50,000 30,000 Crystal points with $5,000 $3,000 spending in the first 90 days. First annual fee not waived. (as of telephone call with bank employee 8/7/2019)

Past bonuses were:

***** #1502 - signup bonus 1/16/18 BUT ANNUAL FEE NOT WAIVED ******

100,000 points after spending $5,000 in first three months. Offer expires 30 December 2015. EXPIRED

A 70,000 points offer was offered back in March 2017 and expired March 31st, 2017. EXPIRED

The requirements for the application process varies from bank to bank based on various online data points collected from FlyerTalk, Doctor of Credit, etc.

Some banks require that you go into a branch and apply personally. Other banks want you to have another account open for 90 days before you can get this card. Some banks (if you already have a relationship with them) let you apply via mail. Sometimes you have to be a resident of the state they operate in, while some were able to get the card without living in those states. It is very much YMMV. You will need proof of income (W2, check stubs, etc). The only states City National Bank operates in are: NY, DE (only trust office, no go), DC, GA, TN, MN, NV & CA. The bank is looking for high net worth individuals, but that's not exactly consistent either.

The card has no foreign transactions fees and is fee-free the first year, then $400 annually.

Register your card for online access (cno.cnb.com). This changed on Sept 19 2019.

Register separately for the award page (www.cnbrewards.com).

Register for Visa Infinite info and access at https://myvisainfinite.com/cnb/en_us/home.html

Click "my info" to see details on points awarded.

Best* redemption found to date is $1,000 prepaid visa for 105K pts. It's now 125K pts for a $1,000 prepaid visa. Link to catalog

*(other than spending for flights etc. & getting 1.2 cents each in value)

To set-up spending alerts, create an account here : http://citynationalbank.digitalcardservice.com

Point redemptions for flights have been reported as being as high as 1.35cpp (see here) by calling the Concierge service at +1 800 595 8950 and having them book direct from airline website for you

Significant benefits:

$250 per calendar year airline incidental credit - works on AU card as well - STARTING JAN 1ST, 2020 THE CREDIT WILL BE $350 PER ACCOUNT

$100 Global Entry fee credit - works on AU card as well Per DDResq post 842

Priority Pass lounge membership for up to 2 people. No fee for any number of guests, but lounge policy may limit the number of guests admitted.- STARTING JAN 1ST, 2020 EACH ADDITIONAL GUEST BEYOND ACCOUNT HOLDER WILL BE CHARGED $32

12 GoGo inflight passes - create an account at myvisainfinite.com/cnb. Once the account is created, you enter, then search for GoGo passes. You then input your card number again, create a GoGo account if you don't have one, and the 12 passes post to it ready to be used when you fly again on a participating airline. - works on AU card as well

$100 off when you book a qualifying airline itinerary via visa discount air portal (https://www.visadiscountair.com/CNB/default.aspx - STARTING JAN 1ST, 2020 THIS WILL NO LONGER BE OFFERED AS A BENEFIT

$30 off GroundLink car service (works with AU cards as well) plus instant 15% off rides. There are $25 current user referrals to go for first.

Airline fees are reimbursed up to $250 per calendar year. Fees must be from domestic carriers. There is no need to declare a carrier, and fees can be reimbursed from multiple carriers. Partial Ts and Cs:

Qualifying Airline Purchases are defined as incidental airline fee transactions made at eligible US Domestic Airline Carriers and include: ticket change/cancellation fees, checked baggage fees, inflight entertainment, onboard food and beverage charges, airport lounge membership fees and day passes, onboard wireless charges (excluding Gogo Wireless), and TSA Pre✓® membership application fee.

What works

AA: Award Fees/Taxes, Award Redeposit Fees ($150)

AA: e-Gift cards $250 including AUs (1x per card max 4)

AS: Award ticket fees, $16

AS: In flight food, entertainment.

AS: Premium Class Upgrade, $59

HA: Interisland Flight, $48.80

UA: award ticket fees, $51

WN: Award Fees/Taxes, Award Redeposit Fees (limit unknown, but it's between $75 and $80 per transaction), Early Bird boarding fees ($15)

DL: Baggage fees

B6: $53.30 airfare

What doesn't work

AS: Award ticket fees, $130ish

DL: GC; PGGM (reports of not working since April/2016)

DL: Just about anything. Don't use on Delta

UA: MPX, Award Fees (~$170)

UA: Gift card registry (up to $75) (No longer working as of 11/25/17)

UA: Seat Selection Fee

WN: GC

EY: Award Fees

TW: Change fee

UO: Seat fee

AA: Award Fees/Taxes on an itinerary originating outside the US.

To Be Confirmed

UA: Award Redeposit Fees ($200)

Global Entry reimbursements: (works on AU also)

user - mnsweeps ( https://www.flyertalk.com/forum/29336509-post1549.html )

Used mine and a AU card to register for GE for in laws

01/17/201801/18/2018USCUSTOMS TRUSTEDTRAVELER$100.00

01/17/201801/18/2018USCUSTOMS TRUSTEDTRAVELER$100.00

Credit posted today for both cards.

01/20/201801/24/2018GLOBAL ENTRY STMT CREDIT $100.00

01/20/201801/24/2018GLOBAL ENTRY STMT CREDIT $100.00

In 2016, 2017 AND 2018 airline incidental credits for transactions on-or-after January 1st did not start posting until the third week of January. In 2019 they started posting on Jan 11th.

For further information, see this

STARTING JAN 1ST, 2020 there are going to be major changes to this card, these being:[/s]

Sources:

discussion starting here

https://www.cnb.com/content/dam/cnbc...ewards2020.pdf

https://www.cnb.com/content/dam/cnbc...rystal2020.pdf

Past bonuses were:

The requirements for the application process varies from bank to bank based on various online data points collected from FlyerTalk, Doctor of Credit, etc.

Some banks require that you go into a branch and apply personally. Other banks want you to have another account open for 90 days before you can get this card. Some banks (if you already have a relationship with them) let you apply via mail. Sometimes you have to be a resident of the state they operate in, while some were able to get the card without living in those states. It is very much YMMV. You will need proof of income (W2, check stubs, etc). The only states City National Bank operates in are: NY, DE (only trust office, no go), DC, GA, TN, MN, NV & CA. The bank is looking for high net worth individuals, but that's not exactly consistent either.

The card has no foreign transactions fees and is fee-free the first year, then $400 annually.

Register your card for online access (cno.cnb.com). This changed on Sept 19 2019.

Register separately for the award page (www.cnbrewards.com).

Register for Visa Infinite info and access at https://myvisainfinite.com/cnb/en_us/home.html

Click "my info" to see details on points awarded.

*(other than spending for flights etc. & getting 1.2 cents each in value)

To set-up spending alerts, create an account here : http://citynationalbank.digitalcardservice.com

Point redemptions for flights have been reported as being as high as 1.35cpp (see here) by calling the Concierge service at +1 800 595 8950 and having them book direct from airline website for you

Significant benefits:

$250 per calendar year airline incidental credit - works on AU card as well - STARTING JAN 1ST, 2020 THE CREDIT WILL BE $350 PER ACCOUNT

$100 Global Entry fee credit - works on AU card as well Per DDResq post 842

Priority Pass lounge membership for up to 2 people. No fee for any number of guests, but lounge policy may limit the number of guests admitted.- STARTING JAN 1ST, 2020 EACH ADDITIONAL GUEST BEYOND ACCOUNT HOLDER WILL BE CHARGED $32

12 GoGo inflight passes - create an account at myvisainfinite.com/cnb. Once the account is created, you enter, then search for GoGo passes. You then input your card number again, create a GoGo account if you don't have one, and the 12 passes post to it ready to be used when you fly again on a participating airline. - works on AU card as well

$100 off when you book a qualifying airline itinerary via visa discount air portal (https://www.visadiscountair.com/CNB/default.aspx - STARTING JAN 1ST, 2020 THIS WILL NO LONGER BE OFFERED AS A BENEFIT

$30 off GroundLink car service (works with AU cards as well) plus instant 15% off rides. There are $25 current user referrals to go for first.

Airline fees are reimbursed up to $250 per calendar year. Fees must be from domestic carriers. There is no need to declare a carrier, and fees can be reimbursed from multiple carriers. Partial Ts and Cs:

Qualifying Airline Purchases are defined as incidental airline fee transactions made at eligible US Domestic Airline Carriers and include: ticket change/cancellation fees, checked baggage fees, inflight entertainment, onboard food and beverage charges, airport lounge membership fees and day passes, onboard wireless charges (excluding Gogo Wireless), and TSA Pre✓® membership application fee.

What works

AA: Award Fees/Taxes, Award Redeposit Fees ($150)

AA: e-Gift cards $250 including AUs (1x per card max 4)

AS: Award ticket fees, $16

AS: In flight food, entertainment.

AS: Premium Class Upgrade, $59

HA: Interisland Flight, $48.80

UA: award ticket fees, $51

WN: Award Fees/Taxes, Award Redeposit Fees (limit unknown, but it's between $75 and $80 per transaction), Early Bird boarding fees ($15)

DL: Baggage fees

B6: $53.30 airfare

What doesn't work

AS: Award ticket fees, $130ish

DL: GC; PGGM (reports of not working since April/2016)

DL: Just about anything. Don't use on Delta

UA: MPX, Award Fees (~$170)

UA: Gift card registry (up to $75) (No longer working as of 11/25/17)

UA: Seat Selection Fee

WN: GC

EY: Award Fees

TW: Change fee

UO: Seat fee

AA: Award Fees/Taxes on an itinerary originating outside the US.

To Be Confirmed

UA: Award Redeposit Fees ($200)

Global Entry reimbursements: (works on AU also)

user - mnsweeps ( https://www.flyertalk.com/forum/29336509-post1549.html )

Used mine and a AU card to register for GE for in laws

01/17/201801/18/2018USCUSTOMS TRUSTEDTRAVELER$100.00

01/17/201801/18/2018USCUSTOMS TRUSTEDTRAVELER$100.00

Credit posted today for both cards.

01/20/201801/24/2018GLOBAL ENTRY STMT CREDIT $100.00

01/20/201801/24/2018GLOBAL ENTRY STMT CREDIT $100.00

In 2016, 2017 AND 2018 airline incidental credits for transactions on-or-after January 1st did not start posting until the third week of January. In 2019 they started posting on Jan 11th.

For further information, see this

STARTING JAN 1ST, 2020 there are going to be major changes to this card, these being:[/s]

$350 airline incidental credit per account (was $250 per AU)$95 Annual Fee per AU$32 per guest using PriorityPass (used to be free & unlimited)Elimination of $100 Visa Air Discount BenefitGroceries and Gas only earn 1x (used to be 3x)

discussion starting here

https://www.cnb.com/content/dam/cnbc...ewards2020.pdf

https://www.cnb.com/content/dam/cnbc...rystal2020.pdf

City National Bank Crystal Visa Infinite (USA); NY GA TN NV CA MA DC & MN

#2941

Join Date: Dec 2015

Programs: AA EXP, UA Silver, Marriott Plat, SPG Plat, IHG Plat, Hilton Gold, Hyatt Discoverist

Posts: 81

So at this point, it seems like the best way for liquidation is statement credit? And I imagine that they will only issue it as credit against your spend, not something you can just "cash out" on.

#2943

Join Date: May 2003

Location: LAX

Programs: DL-Plat, UA-Plat 2MM, AA-PlatPro, B6-Mosaic 3, AY-Plat, HY-Globalist, MR-LT Plat, HH-Gold

Posts: 1,235

Not sure if it's been discussed yet (did a quick search but didn't spot it), but, it seems that you can no longer book travel through the concierge. Meaning you can no longer pay for the fight with the card and then redeem points for the statement credit. Lady at the concierge said this is a brand new policy, basically they can no longer see the points for which to redeem for the credit.

#2944

Join Date: May 2011

Location: Bay Area, CA

Programs: SPG, Hyatt Diamond Member, Club Calrson Silver, AA, Hilton Gold, BA

Posts: 476

CNB sucks. I cant believe how difficult it is to cancel this card. For some reason their customer service reps cant close it. They have to notify your "relationship manager." I told them how can I have a relationship manager without even knowing their name. What kind of relationship is that. lol. Anyways, they sent an inquiry to my relationship manager and he/she hasnt called me in two weeks. sigh

#2945

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

I just got off the phone with a concierge and was told something slightly different. I wanted to both apply the $100 discount and use points. She said that there is currently a system upgrade that is preventing them from seeing our points so they are unable to book it but can transfer to their travel team who would be able to book using points but would not be able to apply the $100 discount. I asked both whether the “system upgrade” was something short term and also whether they would normally be able to book the discount + points. She said they could normally do this and that I should try calling back tomorrow, but really didn’t have any idea how long the “upgrade” would take.

#2946

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,044

There truly must be some way to cancel this card without contacting a specific person.

There must be some postal address to which a certified letter can be sent or something. I know the CFPB has been gutted, but I'd think there's some regulation on the books about proper notice to close a credit account before fees are due.

There must be some postal address to which a certified letter can be sent or something. I know the CFPB has been gutted, but I'd think there's some regulation on the books about proper notice to close a credit account before fees are due.

#2947

Join Date: Jul 2014

Location: Western US

Programs: Costco Executive Member, Amazon Optimus Prime

Posts: 1,251

CNB sucks. I cant believe how difficult it is to cancel this card. For some reason their customer service reps cant close it. They have to notify your "relationship manager." I told them how can I have a relationship manager without even knowing their name. What kind of relationship is that. lol. Anyways, they sent an inquiry to my relationship manager and he/she hasnt called me in two weeks. sigh

#2948

Join Date: Jun 2005

Location: Mountain View, CA (near SJC and SFO)

Programs: Hilton Gold, Marriott Gold, IHG Platinum, and no status whatsoever on the airlines (!)

Posts: 468

I'm pretty stunned at this card and company.

It was clear that $250*4 AUs was not sustainable. But this mega-devaluation is... nuts.

Furthermore, I'd be delighted to have a personal banker / relationship manager if they were actually HELPFUL. And in fact, I expected (and might even have welcomed) my CNB banker to reach out to me occasionally to pitch opportunities that might be of interest to me (refinancing, checking account, etc.). But he's been completely AWOL except when I've had specific logistical requests ("please add an AU") or questions.

Adding amusement / insult to injury, I got a "one year anniversary" card 'signed' by the bank president, encouraging me to offer my feedback. Except there was not a hint of any way I could do so... not an email address, phone number, etc. Uh, yeah, clearly they're REALLY interested in feedback :\.

EDITED TO ADD:

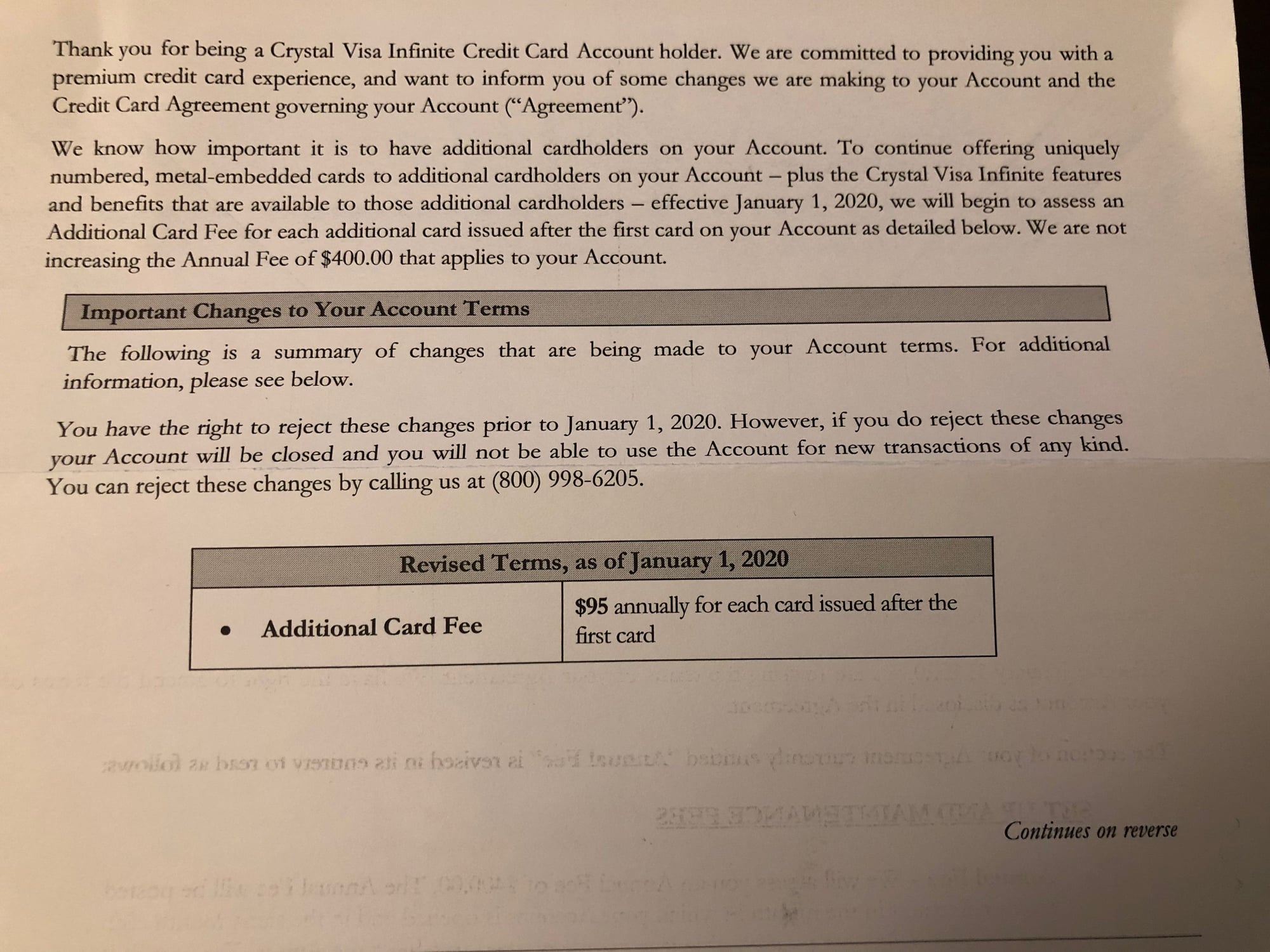

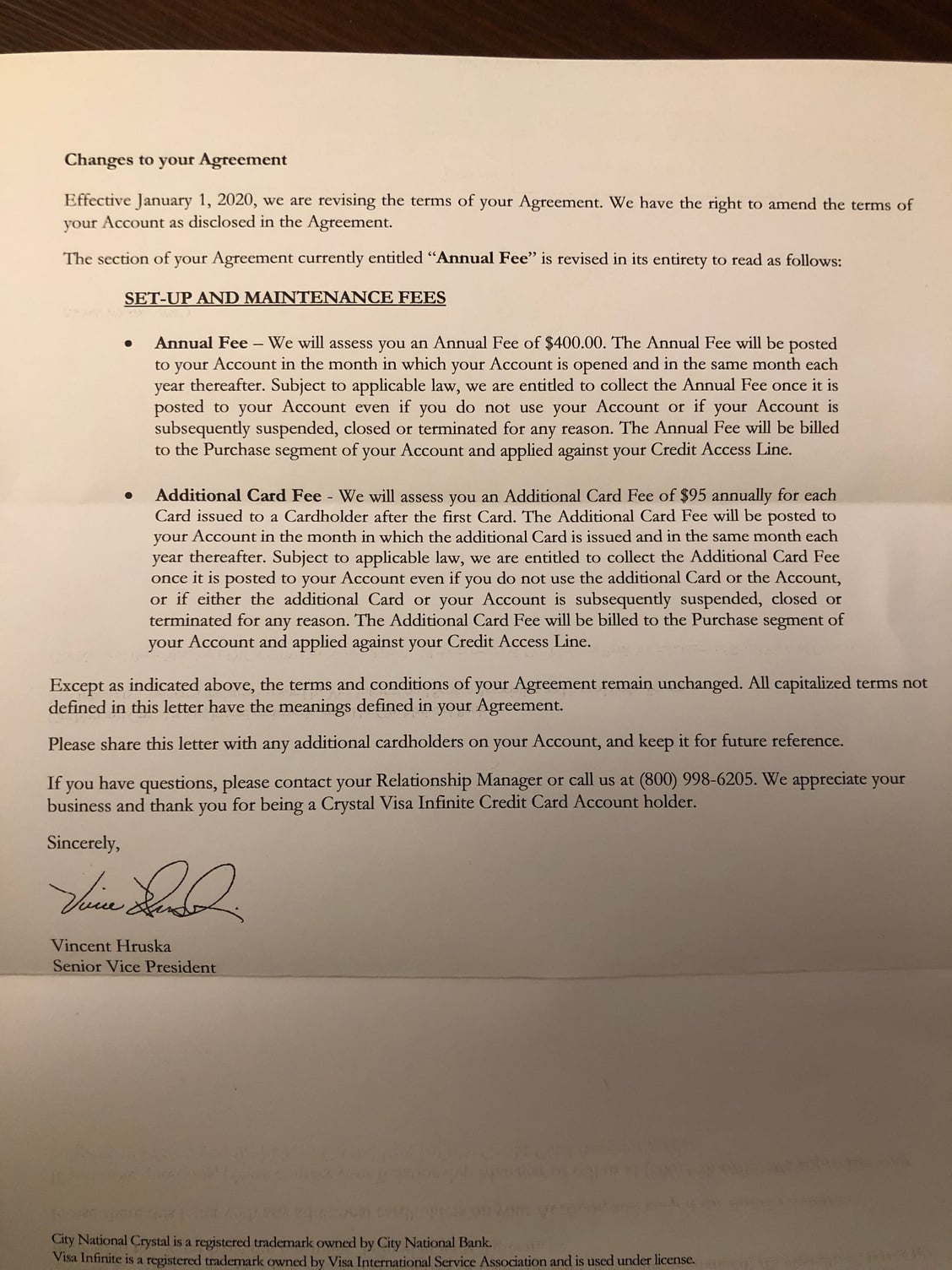

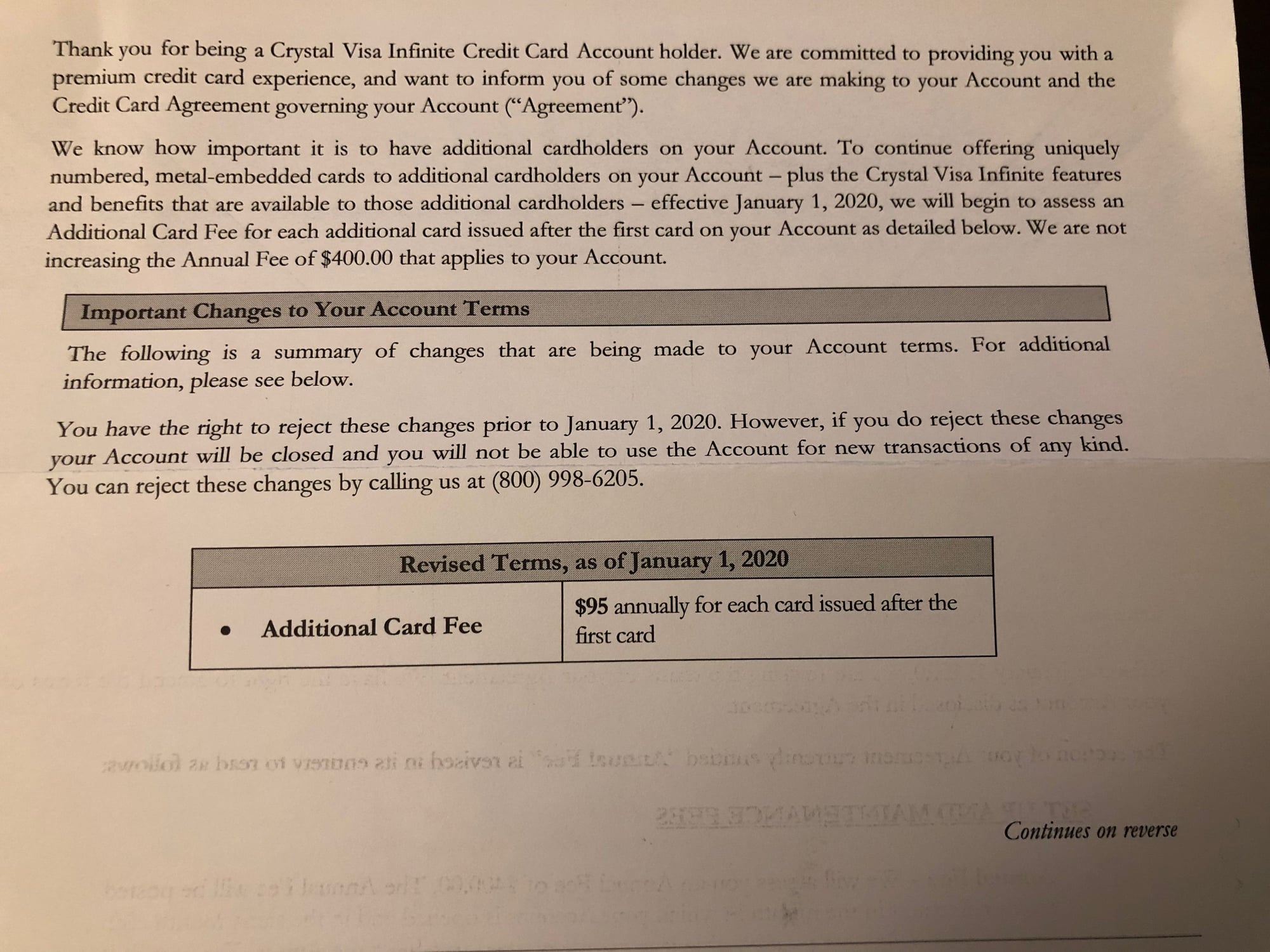

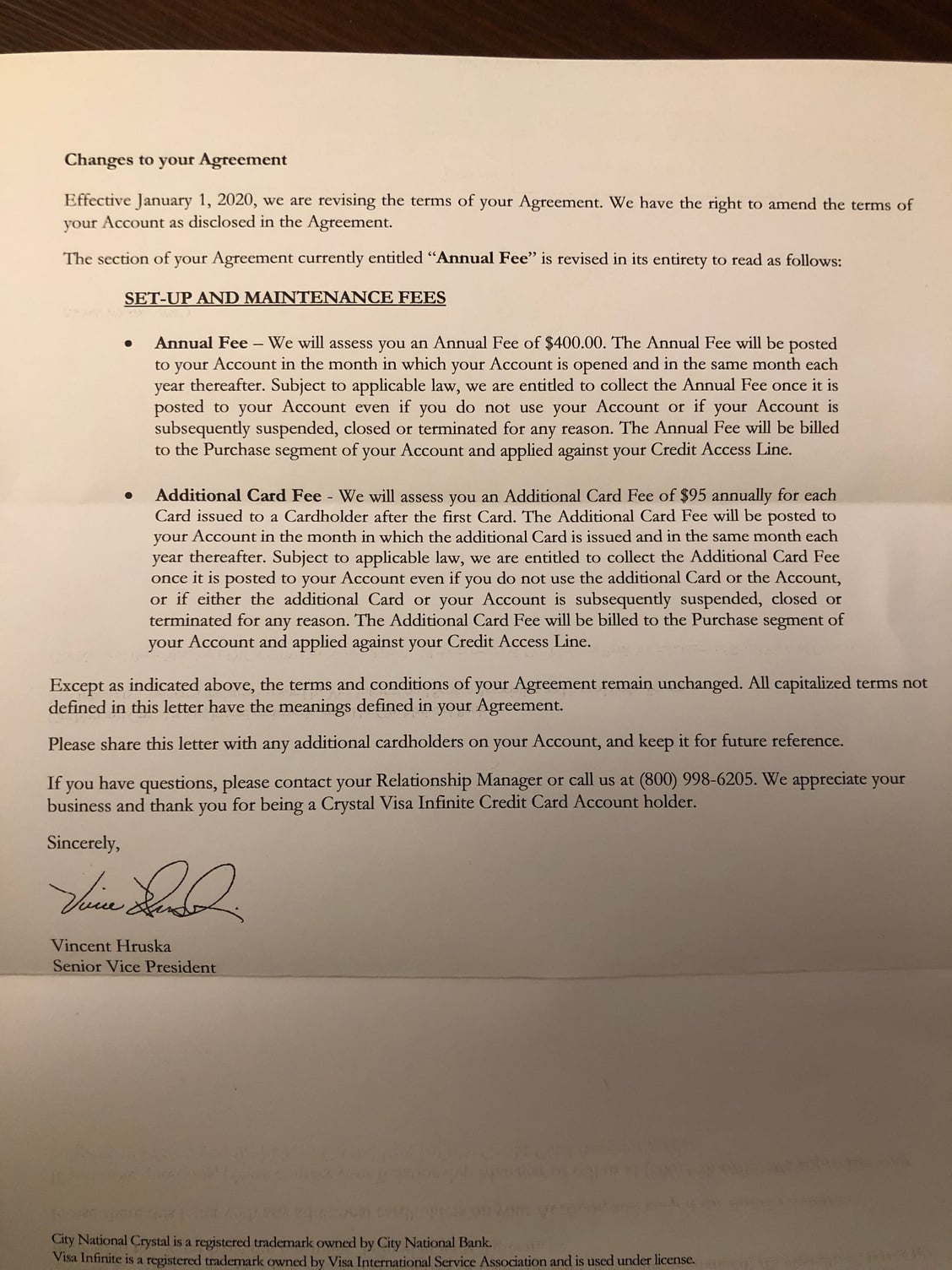

Just yesterday, I got the expected letter in the mail from CNB re new $95/AU fee. But not a mention of the revised incidentals credit. Are/were they planning on actually notifying any of us officially? Did any of you get official notice about this change?

It was clear that $250*4 AUs was not sustainable. But this mega-devaluation is... nuts.

Furthermore, I'd be delighted to have a personal banker / relationship manager if they were actually HELPFUL. And in fact, I expected (and might even have welcomed) my CNB banker to reach out to me occasionally to pitch opportunities that might be of interest to me (refinancing, checking account, etc.). But he's been completely AWOL except when I've had specific logistical requests ("please add an AU") or questions.

Adding amusement / insult to injury, I got a "one year anniversary" card 'signed' by the bank president, encouraging me to offer my feedback. Except there was not a hint of any way I could do so... not an email address, phone number, etc. Uh, yeah, clearly they're REALLY interested in feedback :\.

EDITED TO ADD:

Just yesterday, I got the expected letter in the mail from CNB re new $95/AU fee. But not a mention of the revised incidentals credit. Are/were they planning on actually notifying any of us officially? Did any of you get official notice about this change?

#2949

Join Date: Apr 2017

Posts: 470

I just had the chance to check the pile of mails from the week. Here is the letter. The way it's worded is very tricky....For some reason, you can interpret that they would charge $95 starting from the beginning of the year and for new applicants (after 1/1) whenever the AU is added.

#2950

Join Date: Feb 2001

Location: Ann Arbor, Michigan

Programs: Airline Free Agent, Fairmont Lifetime Platinum, Hyatt Globalist, Hilton Honors Diamond

Posts: 3,041

I'm pretty stunned at this card and company.

It was clear that $250*4 AUs was not sustainable. But this mega-devaluation is... nuts.

EDITED TO ADD:

Just yesterday, I got the expected letter in the mail from CNB re new $95/AU fee. But not a mention of the revised incidentals credit. Are/were they planning on actually notifying any of us officially? Did any of you get official notice about this change?

It was clear that $250*4 AUs was not sustainable. But this mega-devaluation is... nuts.

EDITED TO ADD:

Just yesterday, I got the expected letter in the mail from CNB re new $95/AU fee. But not a mention of the revised incidentals credit. Are/were they planning on actually notifying any of us officially? Did any of you get official notice about this change?

I have only received this letter as well. Unless the other changes will be noted in the next statement closing Nov. 28.

My AF posts on 1/31/20...so I plan to cancel all AU cards say on December 26. But what if my awol personal banker is on vacation and does not get to it until January...Oh man, dealing with this bank is the pits. Maybe I send her a certified mail telling her to cancel everything and move on after redeeming my points...

#2951

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

I just had the chance to check the pile of mails from the week. Here is the letter. The way it's worded is very tricky....For some reason, you can interpret that they would charge $95 starting from the beginning of the year and for new applicants (after 1/1) whenever the AU is added.

#2952

Join Date: May 2015

Posts: 140

DP: Just used concierge to book flight using points and used the $100 Visa Discount. Had a question though. Rep said that the statement credit for my flight (as they charge my card initially and then issue statement credit when they deduct the points) could take 10-15 business days, and I need to cancel my card by end of month. Any experience with how long this actually takes or if there's a way i can speed it up at all?

#2953

Join Date: Apr 2002

Posts: 2,949

#2954

Join Date: Jan 2014

Posts: 286

DP: Just used concierge to book flight using points and used the $100 Visa Discount. Had a question though. Rep said that the statement credit for my flight (as they charge my card initially and then issue statement credit when they deduct the points) could take 10-15 business days, and I need to cancel my card by end of month. Any experience with how long this actually takes or if there's a way i can speed it up at all?

#2955

Join Date: May 2015

Posts: 140

IME, it does take a while. I made a booking using the discount and points over the phone with concierge on 10/30. The points still haven't been used to credit the flights. I actually called in a 3 days ago and the rep said he would escalate it and get back to me in 2 business days. I still haven't heard anything. I'm not in as much of a bind because my AF already posted this month, so I'll end up keeping for another year, but I was hoping the points would be applied soon so that I don't have to make a payment by the due date. Last time I redeemed points and paid my statement balance I had a credit on my account for months. I just don't use this card for any spend.