Chase closed my CSR. Why?

#61

Join Date: Sep 2008

Location: AUS

Programs: BAEC Gold, AA PPro, Hyatt Globalist, Amex Plat

Posts: 7,039

The skepticism is purely based on reading countless similar threads in this forum over the years that start out with, "Chase closed my account and I didn't do anything wrong!"

Then, as the onion is peeled, we begin to hear "well, I might have done one thing..."

Followed by, "Yea, I actually did another thing too, but I didn't think it would matter"

Etc, etc... These threads tend to have a very predictable pattern.

Happy to be proven wrong in this case, (there is always a first time), but in my experience, someone with 1 million UR points on the line, that didn't have more to their story, wouldn't generally respond with "I'll call when I get back to the states" and "I'll try to get them back. But there are lot more important things in life than 1 million UR points."

Regards

Then, as the onion is peeled, we begin to hear "well, I might have done one thing..."

Followed by, "Yea, I actually did another thing too, but I didn't think it would matter"

Etc, etc... These threads tend to have a very predictable pattern.

Happy to be proven wrong in this case, (there is always a first time), but in my experience, someone with 1 million UR points on the line, that didn't have more to their story, wouldn't generally respond with "I'll call when I get back to the states" and "I'll try to get them back. But there are lot more important things in life than 1 million UR points."

Regards

#62

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

Finally called Chase few minutes ago. I am currently in China and sometimes internet is limited. The agent understands the frustration. But she can't look further. Instead, she said I'll get a letter and I can contact Chase after that. I won't return to home for another month or two to get the letter.

Here is a summary of my last 3 statements.

July Statement

New Balance $286

Minimum Payment $35

Due 8/3/2020

Your next AutoPay payment for $286.45 will be deducted from your Pay From account and credited on your due date.

August Statement

Payment/Credit $588

New Balance $82

Minimum Payment $35

Due 9/3/2020

Your next AutoPay payment for $82.48 will be deducted from your Pay From account and credited on your due date.

September Statement

Payment/Credit $625

New Balance $174 (Credit)

Minimum Payment $0

Due to credits, AuroPay has been zero for 2 billing circles.

Meanwhile, I received this final message from Chase:

We understand your concern about your account and will be more than happy to help you. Let me share that statement credits are not considered payments. On review, I confirm that minimum payment are not made for three month by the due date. Hence, your account was closed.

However, my card statement says: Your AutoPay amount will be reduced by any payments or merchant credits that post to your account before we process your AutoPay payment. If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

Now Chase blames me for that? This is totally nuts.

Not really. See above.

Not really. Called Chase and went nowhere.

No worries. I'll transfer my 1 million UR points to my wife or son. They have probably another half million UR points. We are Chase Sapphire family and everyone has a sapphire card.

Maybe we don't need 3 CSR cards at this time when COVID-19 drastically cuts our spending. It might actually be good idea to close my account.

See detailed info about my last 3 statements. I totally followed Chase rule with AutoPay.

It has never been an issue in the past when credits/payments exceeded the balance of previous month, AutoPay was zero.

I don't know what to say.

This is crazy. Chase said this explicitly: If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

Here is a summary of my last 3 statements.

July Statement

New Balance $286

Minimum Payment $35

Due 8/3/2020

Your next AutoPay payment for $286.45 will be deducted from your Pay From account and credited on your due date.

August Statement

Payment/Credit $588

New Balance $82

Minimum Payment $35

Due 9/3/2020

Your next AutoPay payment for $82.48 will be deducted from your Pay From account and credited on your due date.

September Statement

Payment/Credit $625

New Balance $174 (Credit)

Minimum Payment $0

Due to credits, AuroPay has been zero for 2 billing circles.

Meanwhile, I received this final message from Chase:

We understand your concern about your account and will be more than happy to help you. Let me share that statement credits are not considered payments. On review, I confirm that minimum payment are not made for three month by the due date. Hence, your account was closed.

However, my card statement says: Your AutoPay amount will be reduced by any payments or merchant credits that post to your account before we process your AutoPay payment. If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

Now Chase blames me for that? This is totally nuts.

Not really. See above.

Agreed, 100% (and there almost always is in these type of threads)

The OP continues to resist simply picking up the phone and calling Chase, with "I will when I get back to the states" In today's world of WiFi calling, Skype, etc. there is absolutely no reason one would have to wait until they "return to the states," particularly when a 30 day clock is ticking on 1 million UR points and time is of the essence...

Definitely more to the story here...

The OP continues to resist simply picking up the phone and calling Chase, with "I will when I get back to the states" In today's world of WiFi calling, Skype, etc. there is absolutely no reason one would have to wait until they "return to the states," particularly when a 30 day clock is ticking on 1 million UR points and time is of the essence...

Definitely more to the story here...

No worries. I'll transfer my 1 million UR points to my wife or son. They have probably another half million UR points. We are Chase Sapphire family and everyone has a sapphire card.

Maybe we don't need 3 CSR cards at this time when COVID-19 drastically cuts our spending. It might actually be good idea to close my account.

Exactly!

What the original poster did not say was whether the monthly statement immediately preceding the credits to his/her account closed with a (positive) balance. If the last monthly statement before the credits had a (positive) balance, then at least the minimum payment was required to be made even if subsequent credits made the online account show a negative balance. The monthly statement is the legally binding document that we all agree to follow when we accept a credit card; not the balances shown in the online account.

With that said, Chase AutoPay will not deduct a payment if the online account shows a (negative) balance. In that case you will have to manually make the payment; which might even require pushing the payment from your bank.

What the original poster did not say was whether the monthly statement immediately preceding the credits to his/her account closed with a (positive) balance. If the last monthly statement before the credits had a (positive) balance, then at least the minimum payment was required to be made even if subsequent credits made the online account show a negative balance. The monthly statement is the legally binding document that we all agree to follow when we accept a credit card; not the balances shown in the online account.

With that said, Chase AutoPay will not deduct a payment if the online account shows a (negative) balance. In that case you will have to manually make the payment; which might even require pushing the payment from your bank.

It has never been an issue in the past when credits/payments exceeded the balance of previous month, AutoPay was zero.

I don't know what to say.

This is crazy. Chase said this explicitly: If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

#63

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,755

Agreed, 100% (and there almost always is in these type of threads)

The OP continues to resist simply picking up the phone and calling Chase, with "I will when I get back to the states" In today's world of WiFi calling, Skype, etc. there is absolutely no reason one would have to wait until they "return to the states," particularly when a 30 day clock is ticking on 1 million UR points and time is of the essence...

Definitely more to the story here...

Regards

The OP continues to resist simply picking up the phone and calling Chase, with "I will when I get back to the states" In today's world of WiFi calling, Skype, etc. there is absolutely no reason one would have to wait until they "return to the states," particularly when a 30 day clock is ticking on 1 million UR points and time is of the essence...

Definitely more to the story here...

Regards

Before putting on suspicion glasses, I would suggest not to judge others so quick and read thru all the poster's posts which in the latest one he mentioned he currently is not in the country.

Even at the best time, calling / contact Chase from aboard has NEVER been an easy task (personal experiences after being pickpocketed in Rome for example), let alone during the Pandemic when hold time is extremely long and often calls are dropped.

Something as simple as trying to schedule an appointment to visit a branch or have a phone appointment meeting, Chase website does not make it easy - I just did this task, took me multiple attempts to figure where is the "schedule a meeting" is located - which also does not provide a link to tell you WHICH Branches are completely closed...

To the contrary, having the same need with BB&T, which right on their first website page, there are 2 BIG boxes across the screen - one is to schedule an appointment, one is a PDF file to show which branch across the nation is still operating, albeit with limited services.

I honestly think Chase website is lacking comparing to many other banks It becomes our main bank(s) only because of they offer credit cards that are more useful to us, and the majority of people here. Otherwise, Chase customer services are truly not up to par as its image suggests.

#64

Join Date: Sep 2014

Location: TPA/DFW/K15

Programs: AA EXP, Mar AMB, HH LT DIA

Posts: 1,652

Meanwhile, I received this final message from Chase:

We understand your concern about your account and will be more than happy to help you. Let me share that statement credits are not considered payments. On review, I confirm that minimum payment are not made for three month by the due date. Hence, your account was closed.

However, my card statement says: Your AutoPay amount will be reduced by any payments or merchant credits that post to your account before we process your AutoPay payment. If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

Now Chase blames me for that? This is totally nuts.

We understand your concern about your account and will be more than happy to help you. Let me share that statement credits are not considered payments. On review, I confirm that minimum payment are not made for three month by the due date. Hence, your account was closed.

However, my card statement says: Your AutoPay amount will be reduced by any payments or merchant credits that post to your account before we process your AutoPay payment. If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that month will be zero.

Now Chase blames me for that? This is totally nuts.

#65

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,755

I pay every card manually (utilities get auto-paid). But I still have auto-pay set up to pay the minimum amount on the day the payment is due, as a safety net. One of the downsides of optimizing credit card use and reads is that I have a dozen cards. Not all will have a charge every month, but on average six or seven will have a balance due every month. I review the charges on a regular basis and manually schedule payments when the statement closes (I have a spreadsheet to track this). The safety net of auto-pay is for the case where I am unable to manually pay, e.g., if I get hit by a bus and end up in a coma for a month. I don’t want my wife to have to deal with my credit card scheme, especially not in that circumstance, so it’s auto-pilot time to “keep the plane in the air” while I am recovering. At a cost, of course, because minimum payment means interest, but I accept that risk.

The scenario the OP encountered seems fairly unusual (I rarely return something and very rarely have a credit balance). And it seems like a Chase bug they should be willing to fix.

The scenario the OP encountered seems fairly unusual (I rarely return something and very rarely have a credit balance). And it seems like a Chase bug they should be willing to fix.

Besides, with MONEY software, you do NOT need that spreadsheet. It is a tremendous tool to help people manage their financial transactions of ANY KIND. The mere fact that Microsoft discontinued the product 10 years ago yet there is still a VERY ACTIVE USER FORUM on this product speaks for the product's functionality and usefulness. Personally the ONLY thing on my computer that I diligently back up every 7 to 10 days is MONEY. Everything else I can easily afford to lose should the computer crash, but I definitely would be in pain if I lost MONEY without a back up copy within current 30 days. It keeps track of every single financial transaction in our household - from banking to brokerage to lowly retailer gift card balances etc, at any given time, provided I keep my update entries on a timely basis. It works N times better than a spreadsheet, much better than its peer offerings (such as Quicken and Mint) at the time and still now.

#66

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

The skepticism is purely based on reading countless similar threads in this forum over the years that start out with, "Chase closed my account and I didn't do anything wrong!"

Then, as the onion is peeled, we begin to hear "well, I might have done one thing..."

Followed by, "Yea, I actually did another thing too, but I didn't think it would matter"

Etc, etc... These threads tend to have a very predictable pattern.

Happy to be proven wrong in this case, (there is always a first time), but in my experience, someone with 1 million UR points on the line, that didn't have more to their story, wouldn't generally respond with "I'll call when I get back to the states" and "I'll try to get them back. But there are lot more important things in life than 1 million UR points."

Then, as the onion is peeled, we begin to hear "well, I might have done one thing..."

Followed by, "Yea, I actually did another thing too, but I didn't think it would matter"

Etc, etc... These threads tend to have a very predictable pattern.

Happy to be proven wrong in this case, (there is always a first time), but in my experience, someone with 1 million UR points on the line, that didn't have more to their story, wouldn't generally respond with "I'll call when I get back to the states" and "I'll try to get them back. But there are lot more important things in life than 1 million UR points."

Thanks for the skepticism. Yes, people come here to tell a story, then disappear. You never hear from them again. Usually these people just registered their FT account :-)

But, this is a long term FT member of nearly 20 years with over 8,000 posts. My reputation is on the line. There is no need to make up a story.

I am currently in China, just finished my government imposed, forced 14-day quarantine, to attend my dad's funeral service.

Now you can understand, this CSR card is really not something important to me at this point.

Yeah, 1 million UR points are valuable, I simply transfer to my wife or son. It can be done in few seconds.

#67

Join Date: Sep 2011

Posts: 1,857

Call Chase's Executive Office at 888-214-7712 and explain the situation well before you need to do anything with your points. That department is the only one that can resolve this for you.

#68

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,050

This actually happened to me for another Chase card (Hyatt). Similar to OP, had >$5K spend / month on the card historically ... but that was reduced significantly due to the pandemic (<$1K / month).

Due to refunds from COVID-related cancellations, autopay ended up not being needed as credits satisfied my total charges. Unfortunately for me, this was something I didn't realize was a Chase issue and I wasn't keeping too close of a track of my balance / Chase notices as everything was automated - had no additional pulls/pushes from my bank account so assumed credits were OK.

Then in August my card started to get declined, checked my Chase app, and saw account closed.

After my account was closed, I dug into my Chase notices and saw the below note. Note: it wasn't true that only merchant credits were posted to this account (still had daily spend), but the large travel refunds more than accounted for food/coffees/etc. I tried reaching out to on the phone several times (managers, etc.) and via SM, but no avail - while some of the reps could empathise with the situation, it was an automated bank action and there was no way to undo the closure. Explained how it was due to COVID-19 and I still wanted to use card for daily purchases, longstanding history with good behavior w/ Chase, etc. ..... nada. Couldn't be undone.

Additionally, my annual fee was charged during this time frame and had to pay for the whole year, even though the account was closed 1-2 months afterwards. Reps couldn't help with this either. That was the most frustrating part to me.

Due to refunds from COVID-related cancellations, autopay ended up not being needed as credits satisfied my total charges. Unfortunately for me, this was something I didn't realize was a Chase issue and I wasn't keeping too close of a track of my balance / Chase notices as everything was automated - had no additional pulls/pushes from my bank account so assumed credits were OK.

Then in August my card started to get declined, checked my Chase app, and saw account closed.

After my account was closed, I dug into my Chase notices and saw the below note. Note: it wasn't true that only merchant credits were posted to this account (still had daily spend), but the large travel refunds more than accounted for food/coffees/etc. I tried reaching out to on the phone several times (managers, etc.) and via SM, but no avail - while some of the reps could empathise with the situation, it was an automated bank action and there was no way to undo the closure. Explained how it was due to COVID-19 and I still wanted to use card for daily purchases, longstanding history with good behavior w/ Chase, etc. ..... nada. Couldn't be undone.

Additionally, my annual fee was charged during this time frame and had to pay for the whole year, even though the account was closed 1-2 months afterwards. Reps couldn't help with this either. That was the most frustrating part to me.

"You have a credit balance, so no payment is required. You may make charges against the credit or request a refund by contacting Cardmember Service at the address above. If after 6 months the credit balance is $1.00 or more, we will refund the credit within 30 days"

Which ... seems like exactly the opposite of what the notice posted above was? Maybe you get this notice the first month and then the opposite notice the second month, which seems like a real problem? Or possibly the rules are different for different accounts for some reason?

(Granted, personally I keep an eye out for fraudulent activity by monitoring my account activity on the website and rarely look at the full statement anyway, so I would have missed both.)

#69

Join Date: Apr 2015

Programs: United Global Services, Amtrak Select Executive

Posts: 4,095

Exactly!

What the original poster did not say was whether the monthly statement immediately preceding the credits to his/her account closed with a (positive) balance. If the last monthly statement before the credits had a (positive) balance, then at least the minimum payment was required to be made even if subsequent credits made the online account show a negative balance. The monthly statement is the legally binding document that we all agree to follow when we accept a credit card; not the balances shown in the online account.

With that said, Chase AutoPay will not deduct a payment if the online account shows a (negative) balance. In that case you will have to manually make the payment; which might even require pushing the payment from your bank.

What the original poster did not say was whether the monthly statement immediately preceding the credits to his/her account closed with a (positive) balance. If the last monthly statement before the credits had a (positive) balance, then at least the minimum payment was required to be made even if subsequent credits made the online account show a negative balance. The monthly statement is the legally binding document that we all agree to follow when we accept a credit card; not the balances shown in the online account.

With that said, Chase AutoPay will not deduct a payment if the online account shows a (negative) balance. In that case you will have to manually make the payment; which might even require pushing the payment from your bank.

#70

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

This has the potential of putting wife or son's account(s) at risk of closure as well. It's happened before.

Call Chase's Executive Office at 888-214-7712 and explain the situation well before you need to do anything with your points. That department is the only one that can resolve this for you.

Call Chase's Executive Office at 888-214-7712 and explain the situation well before you need to do anything with your points. That department is the only one that can resolve this for you.

Thanks for the suggestion. Does Chase's Executive Office at 888-214-7712 accept phone calls?

I am currently in China, often with limited internet service.

OP mentioned in recent post that he is currently OUTSIDE US. He said he would call Chase once he returns to US.

Before putting on suspicion glasses, I would suggest not to judge others so quick and read thru all the poster's posts which in the latest one he mentioned he currently is not in the country.

I honestly think Chase website is lacking comparing to many other banks It becomes our main bank(s) only because of they offer credit cards that are more useful to us, and the majority of people here. Otherwise, Chase customer services are truly not up to par as its image suggests.

Before putting on suspicion glasses, I would suggest not to judge others so quick and read thru all the poster's posts which in the latest one he mentioned he currently is not in the country.

I honestly think Chase website is lacking comparing to many other banks It becomes our main bank(s) only because of they offer credit cards that are more useful to us, and the majority of people here. Otherwise, Chase customer services are truly not up to par as its image suggests.

I've been following this thread & I'm still kind of confused about what exactly is the scenario. Is it that if, between when your statement hits and the payment due date, credits post to your account that reduce your current balance to zero or below, Chase still considers you obligated to pay the minimum due on the statement? And that this obligation is not taken into account by Autopay, which sees the zero current balance and thus pays nothing?

But somehow we are still obligated to pay minimum balance? This is not what Chase has been advertising about AutoPay:

It’s easy to make sure your credit card is paid on time each month. Here’s how:

https://www.chase.com/digital/custom...set-up-autopay

With AutoPay, my card is paid every month. How can they still shut down my account when I did everything correctly according to Chase?

I rest my case.

#71

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,755

The IRONY of this fiasco is, Had the poster not had AutoPay set up, he would NOT trigger the system flag of not paying his minimum balance because he has NO balance to pay due to the existing statement credit!

Our CSR has NOT paid any minimum balance since June thanks to credit balance in the account :

1) Travel refund,

2) Pay Yourself Back redemption. Since we have not had AutoPay, as long as the site shows ZERO of current statement balance, I completely ignore the new charges on the card (pending for the next round of PYB). Nothing happens.

Similar situations have happened multiple times in the past on Ink cards when statement credits literally wiped out current statement balances, there is NOTHING to pay. Period. Of course since we dont have AutoPay. we are not caught by the Chase erroneous algorithm to determine default. The algorithm obviously is designed to catch missing AutoPay as a sign of default but totally FAILS to account for credit balances in the accounts, regardless what are the reasons for the credit balances.

How can a cardholder default the bank when the bank actually owes the cardholder money in the form of a credit balance on the account ?! Just by this reasoning, OP should have a very strong case to get his account reinstated.

The AutoPay failure is Chase own programming error. A case the Exec Office should be able to review and resolve. OP could call, and then follow up with a precise and concise, only fact listing, letter to the Exec Office to ask for a reinstation resolution.

The difficult thing is, given he is in China right now, the mail may take 3 months to get to Chase! I am not kidding. Recently we received 2 mails from Hong Kong, one dated June 1st, arrived us on August 31st! That is a full 3 months journey for the mail to come apparently via Surface, i.e. by boat! The second mail was dated Jul 6th, arrived us on Sept 12th - a small improvement because this only took 2 months and 1 week!

None of the mails I sent from US to Hong Kong between June and August, has ever received by the addressees.

My next door neighbor wanted to send a greeting card to her grandson in Okinawa Japan. Post office here told her the mail will go by the boat, once there are "enough" mails to go to Japan...

This is the new normal we are living in, folks!

Our CSR has NOT paid any minimum balance since June thanks to credit balance in the account :

1) Travel refund,

2) Pay Yourself Back redemption. Since we have not had AutoPay, as long as the site shows ZERO of current statement balance, I completely ignore the new charges on the card (pending for the next round of PYB). Nothing happens.

Similar situations have happened multiple times in the past on Ink cards when statement credits literally wiped out current statement balances, there is NOTHING to pay. Period. Of course since we dont have AutoPay. we are not caught by the Chase erroneous algorithm to determine default. The algorithm obviously is designed to catch missing AutoPay as a sign of default but totally FAILS to account for credit balances in the accounts, regardless what are the reasons for the credit balances.

How can a cardholder default the bank when the bank actually owes the cardholder money in the form of a credit balance on the account ?! Just by this reasoning, OP should have a very strong case to get his account reinstated.

The AutoPay failure is Chase own programming error. A case the Exec Office should be able to review and resolve. OP could call, and then follow up with a precise and concise, only fact listing, letter to the Exec Office to ask for a reinstation resolution.

The difficult thing is, given he is in China right now, the mail may take 3 months to get to Chase! I am not kidding. Recently we received 2 mails from Hong Kong, one dated June 1st, arrived us on August 31st! That is a full 3 months journey for the mail to come apparently via Surface, i.e. by boat! The second mail was dated Jul 6th, arrived us on Sept 12th - a small improvement because this only took 2 months and 1 week!

None of the mails I sent from US to Hong Kong between June and August, has ever received by the addressees.

My next door neighbor wanted to send a greeting card to her grandson in Okinawa Japan. Post office here told her the mail will go by the boat, once there are "enough" mails to go to Japan...

This is the new normal we are living in, folks!

Last edited by Happy; Sep 15, 2020 at 2:35 pm

#72

Join Date: Sep 2018

Posts: 7

I've been following this thread & I'm still kind of confused about what exactly is the scenario. Is it that if, between when your statement hits and the payment due date, credits post to your account that reduce your current balance to zero or below, Chase still considers you obligated to pay the minimum due on the statement? And that this obligation is not taken into account by Autopay, which sees the zero current balance and thus pays nothing?

AutoPay is based on the running balance shown in your online account so it wouldn't deduct a payment if you have a negative running balance. However, the cardholder's obligation is to follow the monthly statement which would have shown that a payment was due. Now I'm sure that many people will argue that AutoPay should have been designed differently but that's the situation that has existed for some time. Consequently I always follow the monthly statement even though I only get online statements and its sometimes a hassle to open a PDF file. AutoPay for me is only a backup in case I'm unable to manually make a required payment.

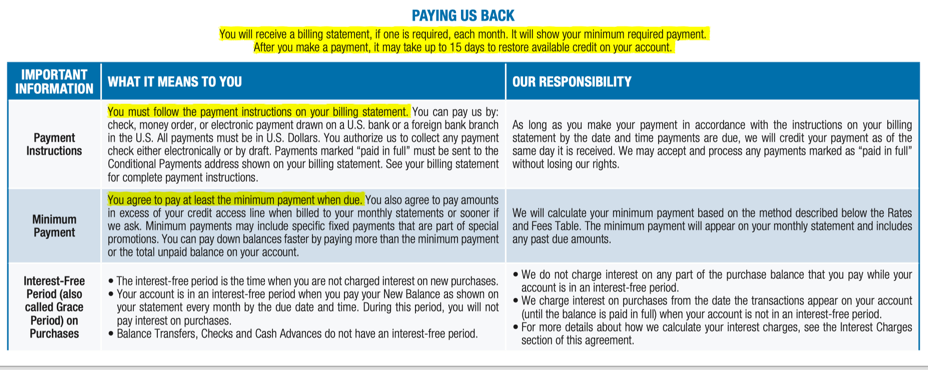

Here's the relevant portion of the Sapphire Reserve Cardholder Agreement:

#73

Join Date: Feb 2011

Posts: 1,353

This is a pretty crappy trap that Chase has (hopefully unintentionally) set that while rare, many of us could fall for. Autopay does indeed reduce by the amount of any credits received after the statement close -- and, importantly, that’s still enough to avoid interest when you pay “in full”. I wouldn’t have known that was allowed (to reduce payment by post-close credits) until I saw them to it. For example:

Statement balance: $1000, min payment $10. New charges of $200 and refund credits of $100 afterward. Autopay pays $900 of the $1100 balance, and no interest is charged. All good.

On the flip side, I always assumed that Autopay would meet any other minimums:

Statement balance: $1000, min payment $10. New charges of $200 and refund credits of $1000. If Chase really wants at least $10 of the “remaining”, the Autopay should not reduce below that.

Or

Statement balance: $1000, min payment $10. New charges $0 and refund credits of $1000. Now the account balance at payment time is $0 -- wouldn’t even people making a manual payment fall for that and skip the payment?

This feels so like a bug in Chase’s system, or at least 2 groups of policymakers or enforcement programmers (autopay reduction and min payment no matter what) not being in sync, compounded by customer service staff forced into rigid responses and unable to correct for an obvious “weird” scenario. Especially since the OP's third statement had a negative balance and $0 min payment -- are they considering that to be the 3rd month of "no minimum payment"?

Statement balance: $1000, min payment $10. New charges of $200 and refund credits of $100 afterward. Autopay pays $900 of the $1100 balance, and no interest is charged. All good.

On the flip side, I always assumed that Autopay would meet any other minimums:

Statement balance: $1000, min payment $10. New charges of $200 and refund credits of $1000. If Chase really wants at least $10 of the “remaining”, the Autopay should not reduce below that.

Or

Statement balance: $1000, min payment $10. New charges $0 and refund credits of $1000. Now the account balance at payment time is $0 -- wouldn’t even people making a manual payment fall for that and skip the payment?

This feels so like a bug in Chase’s system, or at least 2 groups of policymakers or enforcement programmers (autopay reduction and min payment no matter what) not being in sync, compounded by customer service staff forced into rigid responses and unable to correct for an obvious “weird” scenario. Especially since the OP's third statement had a negative balance and $0 min payment -- are they considering that to be the 3rd month of "no minimum payment"?

Last edited by jmastron; Sep 15, 2020 at 4:05 pm Reason: formatting coming out weird

#75

Join Date: Sep 2011

Posts: 1,857

If you're not willing to call them, or if that call leads to no resolution, I would throw in the towel and redeem the points for cash or transfer them all to your travel partner of choice. I personally wouldn't combine them onto a family member's card unless the family member had no points of their own to risk.