Last edit by: Boraxo

Note: because of state laws, the CDW that Chase provides on several of its higher-end cards is only secondary coverage, not primary, for residents of Minnesota, New York, North Dakota, Rhode Island, and Texas. (report)

For MN Specifically: Statute 65b.49.5a requires that auto policies issued in the state must cover damage to rental cars with a $0 deductible as part of property liability coverage, even if the policy holder does not have comprehensive or collision coverage on their personal vehicle. This requires insurers to cover "loss of use" and damage with a minimum limit of $35,000 (even if the policy general property damage limit is lower) in 1995 dollars with a paragraph stating this number should be adjusted with CPI, so that's nearly $70k of minimum coverage as of 2023. Even if you are renting in a different state, your MN auto policy will still apply. Chase Benefit Administrators have interpreted this statute to mean that your personal auto insurance supersedes the coverage provided by Indemnity Insurance Company of North America.

Important Note: Uhaul cargo vans are specifically excluded from coverage so do not rely on Chase card for CDW if renting UHaul or similar.

Links to coverage documentation: CSR CSP INK Preferred

Submit claim at eclaimsline.com

For MN Specifically: Statute 65b.49.5a requires that auto policies issued in the state must cover damage to rental cars with a $0 deductible as part of property liability coverage, even if the policy holder does not have comprehensive or collision coverage on their personal vehicle. This requires insurers to cover "loss of use" and damage with a minimum limit of $35,000 (even if the policy general property damage limit is lower) in 1995 dollars with a paragraph stating this number should be adjusted with CPI, so that's nearly $70k of minimum coverage as of 2023. Even if you are renting in a different state, your MN auto policy will still apply. Chase Benefit Administrators have interpreted this statute to mean that your personal auto insurance supersedes the coverage provided by Indemnity Insurance Company of North America.

Important Note: Uhaul cargo vans are specifically excluded from coverage so do not rely on Chase card for CDW if renting UHaul or similar.

Links to coverage documentation: CSR CSP INK Preferred

Submit claim at eclaimsline.com

Chase Auto Rental CDW; questions & experiences [Consolidated]

#391

Join Date: Aug 2003

Location: Seattle, WA. USA

Programs: MR, AA, UA, DL, AVIS and growing

Posts: 1,172

I've made claims on my CSR (not CSP) card for car rental damage, trip cancellation, and emergency medical. I'm pretty sure all Chase cards use the same insurance provider. All documentation was accepted electronically for all three claims. I never had to send anything by snail mail. But if you have any questions or issues you will want to pick up the phone and call them, as they are NOT responsive to electronic correspondence.

1. Chubb Inc provides car rental insurance. Eclaims is a pseudo name for Chase Card Members Benefits ---- aka Allianz is real name oc this claim administrator.

2. Trip insurance and Medical would most like be Chubb Inc.

https://awardwallet.com/blog/chase-s...nefits-detail/ - summary of benefits

#392

Join Date: Jan 2003

Location: NYC

Posts: 8,498

They do this all the time. Just send them what they ask for, even if you've already sent it. It's much easier than arguing with them about it.

#393

Join Date: Jan 2010

Location: SFO, SJC, SEA

Programs: A3 Gold, AA Plat

Posts: 203

I normally would use my CSR for car rentals, but the fact that they may not cover any damages as a secondary insurance is making me re-think this for my upcoming plans.

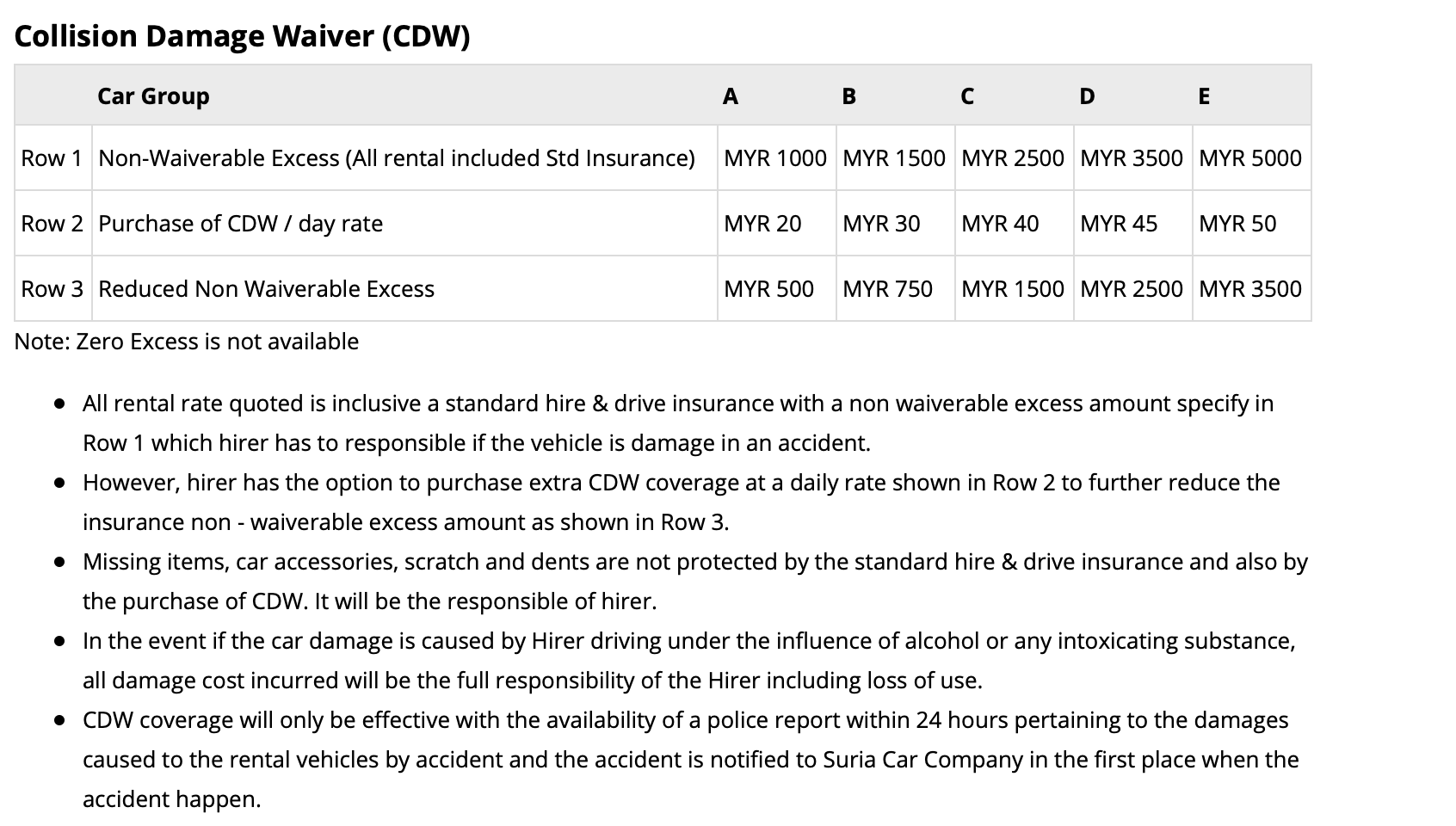

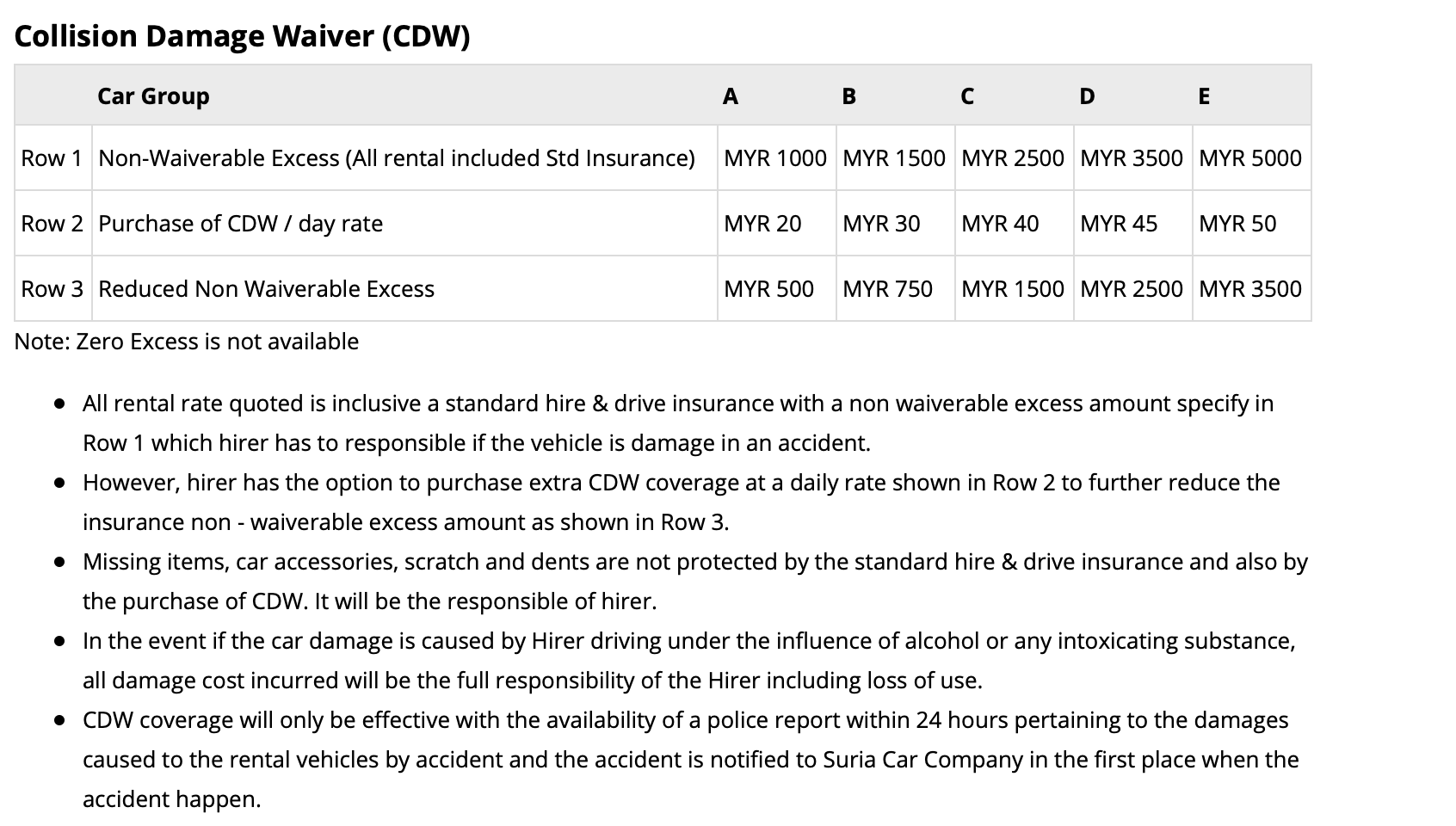

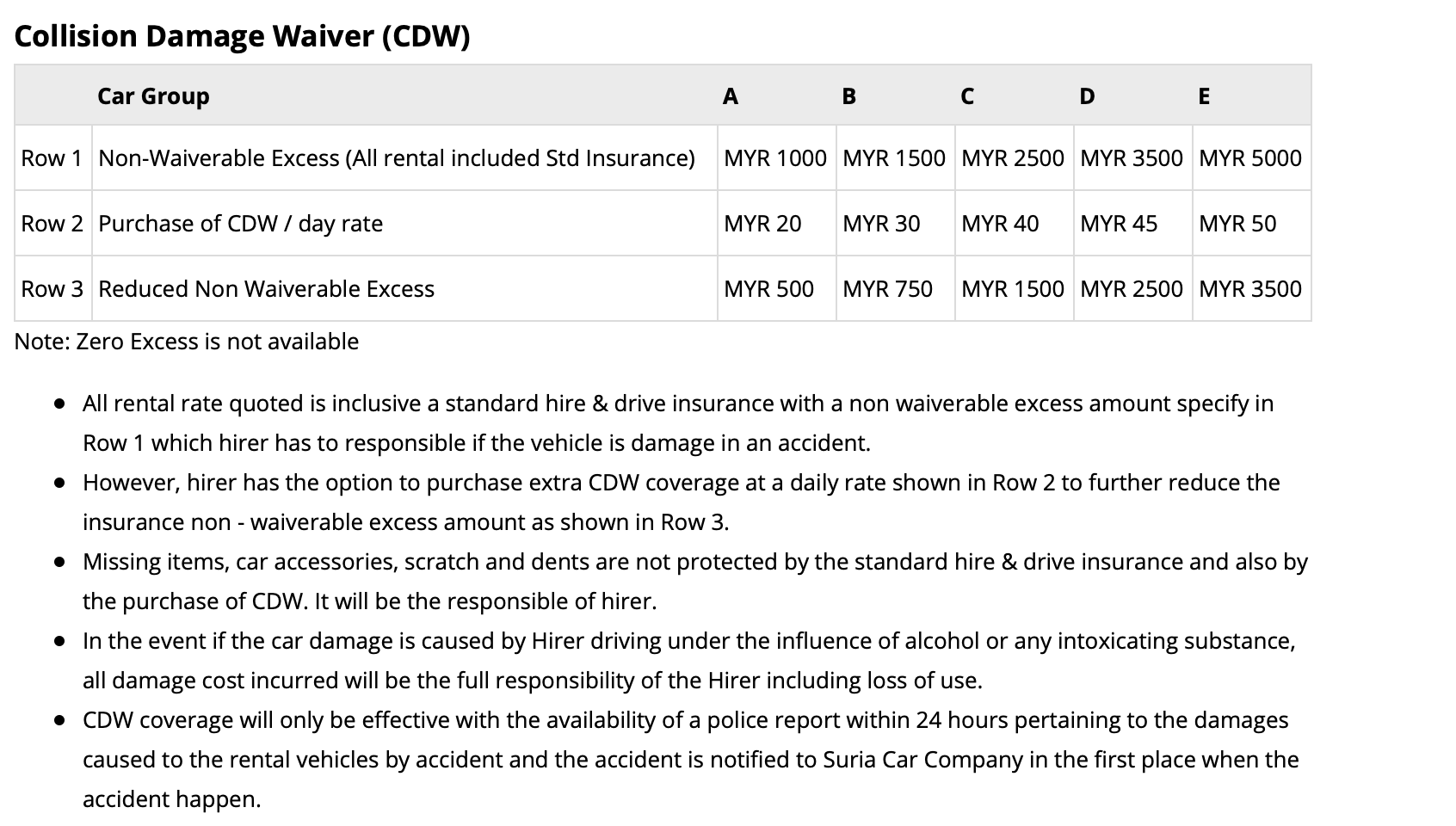

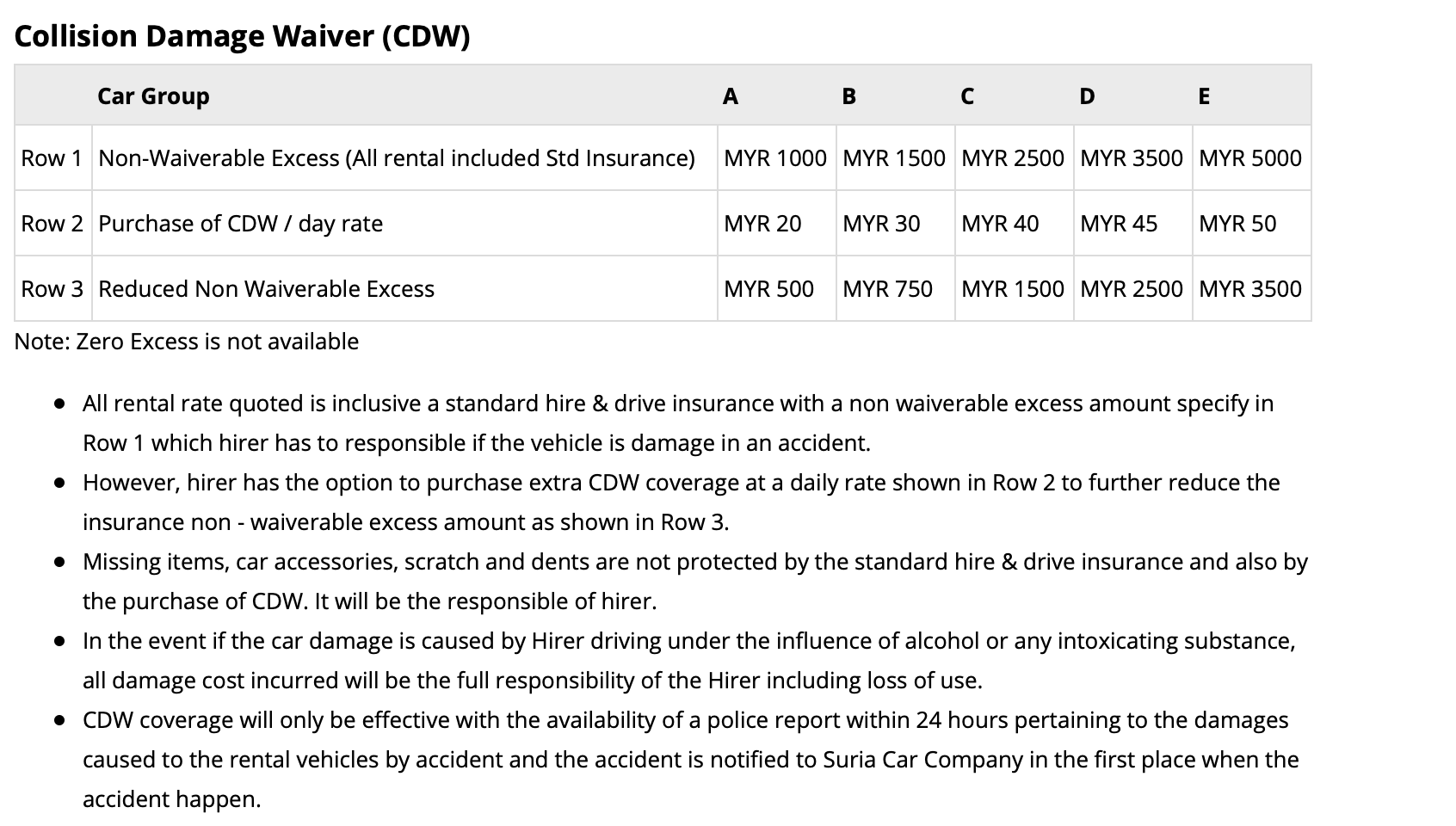

I am planning to rent a car in Malaysia and I can't seem to confirm whether car rental insurance is mandatory by government regulations or not. The car rental agency includes "standard hire & drive insurance" as part of the base rate, which basically appears to be a plan where I'm on the hook for the excess in the event of a collision. The excess can be further reduced if I buy additional coverage. The agency seems to refer to the basic plan as the "standard hire & drive insurance" and CDW interchangeably per the snip I attached.

In this case, would CSR not cover the excess even it's included as part of the base rate? From what I'm reading here, it appears that offering the plan as part of the base rate isn't enough and that it has to be mandated by the government for the coverage to kick in as a secondary. If that's the case, I'm thinking about using my Capital One Quicksilver since that looks like a secondary insurance plan to me and I can't confirm whether Malaysia makes CDW mandatory for car rentals.

I am planning to rent a car in Malaysia and I can't seem to confirm whether car rental insurance is mandatory by government regulations or not. The car rental agency includes "standard hire & drive insurance" as part of the base rate, which basically appears to be a plan where I'm on the hook for the excess in the event of a collision. The excess can be further reduced if I buy additional coverage. The agency seems to refer to the basic plan as the "standard hire & drive insurance" and CDW interchangeably per the snip I attached.

In this case, would CSR not cover the excess even it's included as part of the base rate? From what I'm reading here, it appears that offering the plan as part of the base rate isn't enough and that it has to be mandated by the government for the coverage to kick in as a secondary. If that's the case, I'm thinking about using my Capital One Quicksilver since that looks like a secondary insurance plan to me and I can't confirm whether Malaysia makes CDW mandatory for car rentals.

#394

Join Date: Sep 2014

Posts: 2,531

Just a quick datapoint about timing:

July 13: car damaged while parked, drove to Hertz and exchanged for new car. I took pictures of front and back of original rental agreement and also accident report, and of course the damage. Highly recommend doing this. I also filed a police report (see below)

July 21: end of trip, returned new car. Charge for the car rental sat as pending for a loooooooong time, then eventually posted as a higher amount. Checked my bill and I was charged for FRANCHISE REDUITE for EUR 115 and I was also charged for returning my (broken) car without a full tank. Took picture of front and back of new rental agreement.

Jul 23: Started the claim process with eclaimsline to make sure I was within deadline, but didn't upload any documents. Got an email saying I had to supply all the needed documents with 365 days. They wanted a Demand Letter, Final Rental Agreement, and cc bill showing the charges.

Aug 14: Filed Hertz inquiry asking if there would be any additional charges and asking what EUR 115 for FRANCHISE REDUITE was on my bill.

Aug 27: Hertz wrote back saying the EUR 115 was for damage and that Hertz France would be getting back to me soon with more info and to direct further inquires to [email protected] . I didn't want to finalize my claim because I was worried there would be additional charges coming at me.

Oct 22: Hertz France wrote back saying EUR 115 was from their damage matrix and included scans of the accident report, the rental agreement, and their damage matrix. They didn't explicitly say there would be no more charges but I felt more confident that they had evaluated the damage and chosen to charge me this much.

Oct 22: I replied to last eclaimsline email and attached accident report, new and old rental agreements, picture of damage, police report, bill from Hertz, email from Hertz saying that FRANCHISE REDUITE was for damages, and all the scans they had sent me, along with credit card statement showing the charge and last 4 digits.

Oct 24: Notified by eclaimsline that my claim for EUR 115 had been approved. I couldn't get the direct deposit option to work so they will send me a check.

Extremely satisfied with Chase here, with only 2-day turnaround on the claim once they had the documents. Extremely frustrated that the Hertz bill didn't just say what the charge was for and that they took almost 2 months to get back to a simple inquiry.

Note on police report:

This rental was in France and the car window was smashed overnight and personal belongings stolen. I called the police and was told to go to the station to make a report. I went to the police station and they had me fill out the multi-lingual report form, made we wait 2 hours, then told me (in fairly good English) that if I didn't speak French they would have to set me up with an appointment with a translator, for later that day, at a different station. Since I had spoken 0 words of French to them the whole time I don't know why they waited 2 hours to tell me this.

I took the intervening time to return my car to Hertz and get a new one, since there seemed a 0% chance they were going to collect any evidence from the car. The check-in employee filled out an accident report form and gave me a form to go get a new car from the counter.

Then back to the police station to file a report, took over an hour, basically the translator read my form out loud to a police officer who typed it in very slowly. All in all I spent 4 hours in police stations to get a 3-page report and some good stories from the translator, while we were waiting for the officer.

In retrospect I probably wouldn't have wasted half a day making the police report if I'd known it would only be EUR 115 and that it would take 6 hours total plus some hefty parking fees near the police station. Was thinking at the time that the damage might be more like EUR 500 and that I would also file a homeowner's insurance claim for some of the stolen property (later decided not to, once we had sorted out what was stolen), so for EUR ~1000 seemed worth spending what I thought would be an hour or two getting the police report. Didn't turn out that way.

If I was doing it again for <$200 I would definitely just exchange with Hertz, file the insurance claim without the police report (not even clear they needed it), and if it was denied just pay out of pocket.

July 13: car damaged while parked, drove to Hertz and exchanged for new car. I took pictures of front and back of original rental agreement and also accident report, and of course the damage. Highly recommend doing this. I also filed a police report (see below)

July 21: end of trip, returned new car. Charge for the car rental sat as pending for a loooooooong time, then eventually posted as a higher amount. Checked my bill and I was charged for FRANCHISE REDUITE for EUR 115 and I was also charged for returning my (broken) car without a full tank. Took picture of front and back of new rental agreement.

Jul 23: Started the claim process with eclaimsline to make sure I was within deadline, but didn't upload any documents. Got an email saying I had to supply all the needed documents with 365 days. They wanted a Demand Letter, Final Rental Agreement, and cc bill showing the charges.

Aug 14: Filed Hertz inquiry asking if there would be any additional charges and asking what EUR 115 for FRANCHISE REDUITE was on my bill.

Aug 27: Hertz wrote back saying the EUR 115 was for damage and that Hertz France would be getting back to me soon with more info and to direct further inquires to [email protected] . I didn't want to finalize my claim because I was worried there would be additional charges coming at me.

Oct 22: Hertz France wrote back saying EUR 115 was from their damage matrix and included scans of the accident report, the rental agreement, and their damage matrix. They didn't explicitly say there would be no more charges but I felt more confident that they had evaluated the damage and chosen to charge me this much.

Oct 22: I replied to last eclaimsline email and attached accident report, new and old rental agreements, picture of damage, police report, bill from Hertz, email from Hertz saying that FRANCHISE REDUITE was for damages, and all the scans they had sent me, along with credit card statement showing the charge and last 4 digits.

Oct 24: Notified by eclaimsline that my claim for EUR 115 had been approved. I couldn't get the direct deposit option to work so they will send me a check.

Extremely satisfied with Chase here, with only 2-day turnaround on the claim once they had the documents. Extremely frustrated that the Hertz bill didn't just say what the charge was for and that they took almost 2 months to get back to a simple inquiry.

Note on police report:

This rental was in France and the car window was smashed overnight and personal belongings stolen. I called the police and was told to go to the station to make a report. I went to the police station and they had me fill out the multi-lingual report form, made we wait 2 hours, then told me (in fairly good English) that if I didn't speak French they would have to set me up with an appointment with a translator, for later that day, at a different station. Since I had spoken 0 words of French to them the whole time I don't know why they waited 2 hours to tell me this.

I took the intervening time to return my car to Hertz and get a new one, since there seemed a 0% chance they were going to collect any evidence from the car. The check-in employee filled out an accident report form and gave me a form to go get a new car from the counter.

Then back to the police station to file a report, took over an hour, basically the translator read my form out loud to a police officer who typed it in very slowly. All in all I spent 4 hours in police stations to get a 3-page report and some good stories from the translator, while we were waiting for the officer.

In retrospect I probably wouldn't have wasted half a day making the police report if I'd known it would only be EUR 115 and that it would take 6 hours total plus some hefty parking fees near the police station. Was thinking at the time that the damage might be more like EUR 500 and that I would also file a homeowner's insurance claim for some of the stolen property (later decided not to, once we had sorted out what was stolen), so for EUR ~1000 seemed worth spending what I thought would be an hour or two getting the police report. Didn't turn out that way.

If I was doing it again for <$200 I would definitely just exchange with Hertz, file the insurance claim without the police report (not even clear they needed it), and if it was denied just pay out of pocket.

#395

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,763

One quick and dirty way to find out if there is mandatory CDW is to go to Avis and do a dummy booking - if the CDW is mandatory by the government, the box to decline CDW would be checked and grayed out. i.e. there is no option to decline.

When it is government mandated CDW coverage, Chase would cover the excess, PROVIDED you do NOT buy it down.

The information you quoted, looks like Malaysia has mandatory CDW coverage with high excess, and the rental car company entices you to buy down the excess - once you do that, you LOSE any credit card coverage, be it Chase or Citi or AMEX.

Note the key words of Nonwaivable, (for the coverage), as well as "buy down" the excess which does not look buy it down much because you are still responsible for anywhere from 50% to 70% of the original excess!

The excess is the maximum you would have to pay when you incur damages. Usually the rental car company would charge that upfront, then you file claim to get most of it back if the claim is approved. The excess itself ONLY for the actual repair cost, BEFORE taxes / excise fees / airport surcharges etc. Those can be additional 30 to 40% of the excess. Not all the add-on items are covered. Airport surcharge on repair estimate is specifically NOT covered per the T&Cs of benefits.

When it is government mandated CDW coverage, Chase would cover the excess, PROVIDED you do NOT buy it down.

The information you quoted, looks like Malaysia has mandatory CDW coverage with high excess, and the rental car company entices you to buy down the excess - once you do that, you LOSE any credit card coverage, be it Chase or Citi or AMEX.

Note the key words of Nonwaivable, (for the coverage), as well as "buy down" the excess which does not look buy it down much because you are still responsible for anywhere from 50% to 70% of the original excess!

The excess is the maximum you would have to pay when you incur damages. Usually the rental car company would charge that upfront, then you file claim to get most of it back if the claim is approved. The excess itself ONLY for the actual repair cost, BEFORE taxes / excise fees / airport surcharges etc. Those can be additional 30 to 40% of the excess. Not all the add-on items are covered. Airport surcharge on repair estimate is specifically NOT covered per the T&Cs of benefits.

I normally would use my CSR for car rentals, but the fact that they may not cover any damages as a secondary insurance is making me re-think this for my upcoming plans as an example.

I am planning to rent a car in Malaysia and I can't seem to confirm whether car rental insurance is mandatory by government regulations or not. The car rental agency includes "standard hire & drive insurance" as part of the base rate, which basically appears to be a plan where I'm on the hook for the excess in the event of a collision. The excess can be further reduced if I buy additional coverage. The agency seems to refer to the basic plan as the "standard hire & drive insurance" and CDW interchangeably per the snip I attached.

In this case, would CSR not cover the excess even it's included as part of the base rate? From what I'm reading here, it appears that offering the plan as part of the base rate isn't enough and that it has to be mandated by the government for the coverage to kick in as a secondary. If that's the case, I'm thinking about using my Capital One Quicksilver since that looks like a secondary insurance plan to me and I can't confirm whether Malaysia makes CDW mandatory for car rentals.

I am planning to rent a car in Malaysia and I can't seem to confirm whether car rental insurance is mandatory by government regulations or not. The car rental agency includes "standard hire & drive insurance" as part of the base rate, which basically appears to be a plan where I'm on the hook for the excess in the event of a collision. The excess can be further reduced if I buy additional coverage. The agency seems to refer to the basic plan as the "standard hire & drive insurance" and CDW interchangeably per the snip I attached.

In this case, would CSR not cover the excess even it's included as part of the base rate? From what I'm reading here, it appears that offering the plan as part of the base rate isn't enough and that it has to be mandated by the government for the coverage to kick in as a secondary. If that's the case, I'm thinking about using my Capital One Quicksilver since that looks like a secondary insurance plan to me and I can't confirm whether Malaysia makes CDW mandatory for car rentals.

#396

Join Date: Jan 2010

Location: SFO, SJC, SEA

Programs: A3 Gold, AA Plat

Posts: 203

One quick and dirty way to find out if there is mandatory CDW is to go to Avis and do a dummy booking - if the CDW is mandatory by the government, the box to decline CDW would be checked and grayed out. i.e. there is no option to decline.

When it is government mandated CDW coverage, Chase would cover the excess, PROVIDED you do NOT buy it down.

The information you quoted, looks like Malaysia has mandatory CDW coverage with high excess, and the rental car company entices you to buy down the excess - once you do that, you LOSE any credit card coverage, be it Chase or Citi or AMEX.

Note the key words of Nonwaivable, (for the coverage), as well as "buy down" the excess which does not look buy it down much because you are still responsible for anywhere from 50% to 70% of the original excess!

The excess is the maximum you would have to pay when you incur damages. Usually the rental car company would charge that upfront, then you file claim to get most of it back if the claim is approved. The excess itself ONLY for the actual repair cost, BEFORE taxes / excise fees / airport surcharges etc. Those can be additional 30 to 40% of the excess. Not all the add-on items are covered. Airport surcharge on repair estimate is specifically NOT covered per the T&Cs of benefits.

When it is government mandated CDW coverage, Chase would cover the excess, PROVIDED you do NOT buy it down.

The information you quoted, looks like Malaysia has mandatory CDW coverage with high excess, and the rental car company entices you to buy down the excess - once you do that, you LOSE any credit card coverage, be it Chase or Citi or AMEX.

Note the key words of Nonwaivable, (for the coverage), as well as "buy down" the excess which does not look buy it down much because you are still responsible for anywhere from 50% to 70% of the original excess!

The excess is the maximum you would have to pay when you incur damages. Usually the rental car company would charge that upfront, then you file claim to get most of it back if the claim is approved. The excess itself ONLY for the actual repair cost, BEFORE taxes / excise fees / airport surcharges etc. Those can be additional 30 to 40% of the excess. Not all the add-on items are covered. Airport surcharge on repair estimate is specifically NOT covered per the T&Cs of benefits.

Since it looks like it is mandatory/nonwaivable, I guess the CSR CDW should kick in as a secondary. Will sharing that screenshot with Chase be enough to prove that it is mandatory?

#397

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,763

Thanks. I looked at Avis and it just says that it is included in the rate (not declinable), so it looks like basic CDW with excess is mandatory - other competitors like EuropCar also describe premium CDW as an excess reducing plan.

Since it looks like it is mandatory/nonwaivable, I guess the CSR CDW should kick in as a secondary. Will sharing that screenshot with Chase be enough to prove that it is mandatory?

Since it looks like it is mandatory/nonwaivable, I guess the CSR CDW should kick in as a secondary. Will sharing that screenshot with Chase be enough to prove that it is mandatory?

I have posted a very detailed report on a claim from our May 2018 trip at Sicily where we had some bad scratches to the car. Italy is a mandatory CDW country, and is excluded from AMEX coverage in case you are not aware of this. Chase covered the 1000 euro excess plus taxes and even paid a portion of the not-covered airport surcharges on the 1000 euro.

Go back to last year correspondent period to find my report - that should give anyone a very good idea on how to file eClaim (Chase's insurance handler) efficiently.

Our claim was settled extremely swiftly - from filing to money ACHed to our bank account, it took only 7 business days. eClaim did not ask any extra doc nor even communicate to us after filing - the next email we received was to ask how we would like the money be paid. (direct deposit via ACH or a check sent)

One of the Key to have quick settlement is due to Budget at Catania airport being very efficient in processing the return, charge on the damage, and the supporting documents - all done within 10 min, with the docs emailed to us while we were in the return lot. Then we spent 20 min back at the counter to get the Final Rental Agreement (required to file the claim) as well as to make sure the charges were all billed in Euro, not being DCCed to USD. eClaim paid the exact amount of Budget's Damage Repair Invoice.

#399

Join Date: May 2009

Location: Washington, DC

Programs: UA 1K 1MM, AA, DL

Posts: 7,418

Does the coverage terminate when the card is cancelled? To be more precise, if I rented a car (billed to Chase MP Explorer), it was damaged, and then cancel the card (because the annual fee is due), can I seek coverage after that? What if I submit the claim, but then cancel the card after submitting the claim?

#400

Join Date: Jan 2010

Location: Houston (HOU/IAH)

Programs: WN, UA, DL, AA, Chase UR, Amex MR

Posts: 2,269

Finally had my claim approved. Here's what happened:

Went to Iceland back in August. Everything went fine until my last evening there when the wind was gusting up to 75 mph. At one of my final stops of the trip I happened to park in a way that the wind was blowing directly into the back of the vehicle so when I opened the door the wind caught it and slammed it forward causing damage. After that the door could only about 1/3rd of the way and even then with a bit of difficulty. The next morning I left about an hour earlier than I would have to get to Keflavik with enough time to fill out whatever I would need to fill out. Returning the car was fairly smooth and the agent handling the return made sure to give me email and hard copies of everything. On the layover on the way home I started the claim and submitted everything hoping for a speedy resolution. However, Card Benefit Services kept asking me to resubmit my rental voucher and contract claiming that the voucher I had submitted did not match. OK, I sent it again, and again, and again. I lost count but I think they asked for it a total of about 4 or 5 times. At this point I was getting frustrated and just decided to forget about it for a few weeks then tried again finally getting an approval. I'm not sure but I had made the booking using Auto Europe and I believe that there might have been an issue in that the actual rental contract showed Auto Europe's corporate account number even though I had used my CSR. I normally try to book directly but this time I could only seem to get this particular rate using the Auto Europe site. It ultimately took about 4 months from start to finish but that does include the couple of weeks where I got tired of dealing with it.

Went to Iceland back in August. Everything went fine until my last evening there when the wind was gusting up to 75 mph. At one of my final stops of the trip I happened to park in a way that the wind was blowing directly into the back of the vehicle so when I opened the door the wind caught it and slammed it forward causing damage. After that the door could only about 1/3rd of the way and even then with a bit of difficulty. The next morning I left about an hour earlier than I would have to get to Keflavik with enough time to fill out whatever I would need to fill out. Returning the car was fairly smooth and the agent handling the return made sure to give me email and hard copies of everything. On the layover on the way home I started the claim and submitted everything hoping for a speedy resolution. However, Card Benefit Services kept asking me to resubmit my rental voucher and contract claiming that the voucher I had submitted did not match. OK, I sent it again, and again, and again. I lost count but I think they asked for it a total of about 4 or 5 times. At this point I was getting frustrated and just decided to forget about it for a few weeks then tried again finally getting an approval. I'm not sure but I had made the booking using Auto Europe and I believe that there might have been an issue in that the actual rental contract showed Auto Europe's corporate account number even though I had used my CSR. I normally try to book directly but this time I could only seem to get this particular rate using the Auto Europe site. It ultimately took about 4 months from start to finish but that does include the couple of weeks where I got tired of dealing with it.

#401

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,763

Does the coverage terminate when the card is cancelled? To be more precise, if I rented a car (billed to Chase MP Explorer), it was damaged, and then cancel the card (because the annual fee is due), can I seek coverage after that? What if I submit the claim, but then cancel the card after submitting the claim?

#402

Join Date: Dec 2019

Posts: 72

I'll be going to New Zealand where they require basic insurance on the vehicle. From reading the above comments, it seems like Chase will help me pay for the excess (deductible) if I do get in an accident. Question I have is liability as the chase coverage is only for damages to my vehicle but not other vehicles. In New Zealand, the medical costs will be covered by ACC. But I do want to know if the basic insurance liability will cover the other parties vehicle? In the event that the basic insurance isn't enough, it'll be out of pocket on my end?

Also, there seems to be an option for additional CDW and also protection for windshields, tires, and headlights. I plan to decline the additional CDW, but wanted to opt in for protection of windshields, tires, and headlights. Does chase cover protection for the windshields, tires, and headlights in the event they do get damaged? Not sure why Enterprise marks the coverage as not part of CDW?

Also, there seems to be an option for additional CDW and also protection for windshields, tires, and headlights. I plan to decline the additional CDW, but wanted to opt in for protection of windshields, tires, and headlights. Does chase cover protection for the windshields, tires, and headlights in the event they do get damaged? Not sure why Enterprise marks the coverage as not part of CDW?

#403

Join Date: Aug 2003

Location: Seattle, WA. USA

Programs: MR, AA, UA, DL, AVIS and growing

Posts: 1,172

I'll be going to New Zealand where they require basic insurance on the vehicle. From reading the above comments, it seems like Chase will help me pay for the excess (deductible) if I do get in an accident. Question I have is liability as the chase coverage is only for damages to my vehicle but not other vehicles. In New Zealand, the medical costs will be covered by ACC. But I do want to know if the basic insurance liability will cover the other parties vehicle? In the event that the basic insurance isn't enough, it'll be out of pocket on my end?

Also, there seems to be an option for additional CDW and also protection for windshields, tires, and headlights. I plan to decline the additional CDW, but wanted to opt in for protection of windshields, tires, and headlights. Does chase cover protection for the windshields, tires, and headlights in the event they do get damaged? Not sure why Enterprise marks the coverage as not part of CDW?

Also, there seems to be an option for additional CDW and also protection for windshields, tires, and headlights. I plan to decline the additional CDW, but wanted to opt in for protection of windshields, tires, and headlights. Does chase cover protection for the windshields, tires, and headlights in the event they do get damaged? Not sure why Enterprise marks the coverage as not part of CDW?

Chubb will list only advise countries like Republic of Ireland, Northern Iran , Israel, and Jamica are covered which basic VISA car insurance is not.

However, there are many car agencies like around the world that require you purchase additional insurance which conflicts with CSR to deny all coverage.

New Zealand along Italy, Australia, Iraq, Iran, etc etc...........are some of these countries where some card holders have had problems being told to buy additional insurance.

Be careful --- I know I don't trust the limited knowledge of Chase Benefits staff on where insurance is applicable.

#404

Join Date: Aug 2003

Location: Seattle, WA. USA

Programs: MR, AA, UA, DL, AVIS and growing

Posts: 1,172

You do NOT need to do anything. The insurance provider KNOWS which country has mandatory CDW and process your claim accordingly. Or if you still feel the need, you can google such as Does Malaysia require mandatory CDW coverage on rental car? something like that and see what you can find and print. Personally I would not be bothered.

I have posted a very detailed report on a claim from our May 2018 trip at Sicily where we had some bad scratches to the car. Italy is a mandatory CDW country, and is excluded from AMEX coverage in case you are not aware of this. Chase covered the 1000 euro excess plus taxes and even paid a portion of the not-covered airport surcharges on the 1000 euro.

Go back to last year correspondent period to find my report - that should give anyone a very good idea on how to file eClaim (Chase's insurance handler) efficiently.

Our claim was settled extremely swiftly - from filing to money ACHed to our bank account, it took only 7 business days. eClaim did not ask any extra doc nor even communicate to us after filing - the next email we received was to ask how we would like the money be paid. (direct deposit via ACH or a check sent)

One of the Key to have quick settlement is due to Budget at Catania airport being very efficient in processing the return, charge on the damage, and the supporting documents - all done within 10 min, with the docs emailed to us while we were in the return lot. Then we spent 20 min back at the counter to get the Final Rental Agreement (required to file the claim) as well as to make sure the charges were all billed in Euro, not being DCCed to USD. eClaim paid the exact amount of Budget's Damage Repair Invoice.

I have posted a very detailed report on a claim from our May 2018 trip at Sicily where we had some bad scratches to the car. Italy is a mandatory CDW country, and is excluded from AMEX coverage in case you are not aware of this. Chase covered the 1000 euro excess plus taxes and even paid a portion of the not-covered airport surcharges on the 1000 euro.

Go back to last year correspondent period to find my report - that should give anyone a very good idea on how to file eClaim (Chase's insurance handler) efficiently.

Our claim was settled extremely swiftly - from filing to money ACHed to our bank account, it took only 7 business days. eClaim did not ask any extra doc nor even communicate to us after filing - the next email we received was to ask how we would like the money be paid. (direct deposit via ACH or a check sent)

One of the Key to have quick settlement is due to Budget at Catania airport being very efficient in processing the return, charge on the damage, and the supporting documents - all done within 10 min, with the docs emailed to us while we were in the return lot. Then we spent 20 min back at the counter to get the Final Rental Agreement (required to file the claim) as well as to make sure the charges were all billed in Euro, not being DCCed to USD. eClaim paid the exact amount of Budget's Damage Repair Invoice.

Chase on the other hand the underwriter Chubb Inc refuses to document Italy or any of the other countries making many card holders confused.

Suspect there are over 25 countries requiring mandatory additional insurance voiding the Chase insurance but chase won't support in identifying these countries.

#405

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

BEWARE of Chase car rental insurance as the underwriter CHUBB INc makes minimal attempts to identify where collision coverages NOT applicable.

Chubb will list only advise countries like Republic of Ireland, Northern Iran , Israel, and Jamica are covered which basic VISA car insurance is not.

However, there are many car agencies like around the world that require you purchase additional insurance which conflicts with CSR to deny all coverage.

New Zealand along Italy, Australia, Iraq, Iran, etc etc...........are some of these countries where some card holders have had problems being told to buy additional insurance.

Be careful --- I know I don't trust the limited knowledge of Chase Benefits staff on where insurance is applicable.

Chubb will list only advise countries like Republic of Ireland, Northern Iran , Israel, and Jamica are covered which basic VISA car insurance is not.

However, there are many car agencies like around the world that require you purchase additional insurance which conflicts with CSR to deny all coverage.

New Zealand along Italy, Australia, Iraq, Iran, etc etc...........are some of these countries where some card holders have had problems being told to buy additional insurance.

Be careful --- I know I don't trust the limited knowledge of Chase Benefits staff on where insurance is applicable.