Dynamic Currency Conversion (DCC)

#406

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,767

I remember your issue with the restaurant in Dubai. Calling Chase might be the easiest option, but part of me dislikes that the merchants are getting away with the scam. I love Reason Code 76 chargebacks because the merchant at least feels a sting, even if the merchant has to contest it. Enough of those situations might motivate the merchant to change its behavior.

#407

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,068

Merchants could not care less. It is only making you feel good by doing the Code 76 dispute, or wishfully thinking that enough people pursuit such route would make merchants change their behaviors. Dream on. In all reality it just creates more work to the banks which absorb the difference almost all the times. I dont think Chase ever charges back to the restaurant in Dubai, but simply paid me $40 for a $2.70 difference had the charge being rebilled. It costs Chase, not the merchant who just contested the dispute and Chase gave up because it is totally NOT cost-effective for the bank to pursuit.

I'll be the first to admit that it's a dispute on principle most of the time, and that was the reason I started this thread over four years ago. However, I would argue that it's also the FlyerTalk way. People howl when they are shortchanged 500 miles. Why not $5? To think about DCC another way, if you paid €100 cash on a restaurant bill that was €95 and you received no change, what would you do? Would you demand your change or accept the loss? The only reason why DCC is so pervasive is largely out of customer ignorance that they're effectively getting shortchanged.

#408

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

Nah. It has nothing to do with the profile. We booked thru Budget without using Fast Track account but in Italy the billing is done by Avis. The RA has Avis Budget Group Italy heading. It is the opposite in Turkey where we booked thru Avis but the billing was done by Budget. I would say it is 100% depending on how helpful the agent is. i.e. willing to go thru the trouble and remove the clause from the system. Though sometimes it still does not work.

Had that happened in Frankfurt a few years ago but in that particular time, the rate used was the rate at reservation. USD went down A Lot by the time rental happened. We were billed the EXACT amount of USD shown on reservation, resulted to $30+ cheaper bill than if it was billed in Euro then converted to USD on market rate by the bank.

#409

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

Merchants could not care less. It is only making you feel good by doing the Code 76 dispute, or wishfully thinking that enough people pursuit such route would make merchants change their behaviors. Dream on. In all reality it just creates more work to the banks which absorb the difference almost all the times. I dont think Chase ever charges back to the restaurant in Dubai, but simply paid me $40 for a $2.70 difference had the charge being rebilled. It costs Chase, not the merchant who just contested the dispute and Chase gave up because it is totally NOT cost-effective for the bank to pursuit.

#410

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,767

More like cost-effective analysis for both the bank and the customer. I spent many hours on that Charge Code 76 dispute that I wish I have never taken the route. It is also very irritating when the promised credit did not show up and the disputed amount resurfaced so I had to keep calling that number only having an ext number could go thru but always to the handling agent's inbox and she never returned the calls. Wasted more googling time to finally use the Chase catch-all customer service number to voice my complain - all for disputing a few bucks "in principle". Very much a waste of time / effort and energy.

#411

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

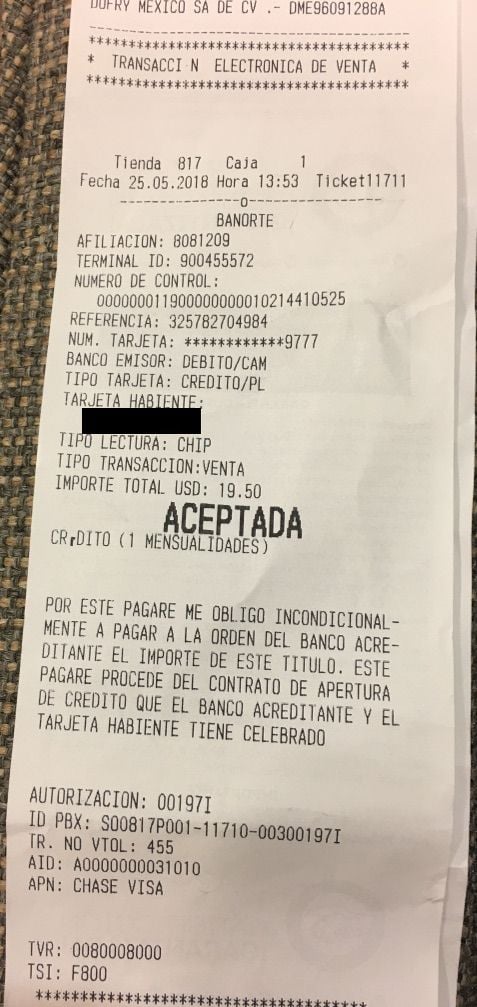

Not DCC but I had an interesting experience at a store in MEX post-security. While buying a new phone charger, the clerk scanned my boarding pass and passport and proceeded to ring me up in USD. (Prices on items were marked in both MXP and USD.) The person in front of me, on the other hand, looked to have a Peruvian passport and was given a currency choice before her card was inserted. I didn't see any prompts on the PIN pad itself, which of course was on the cashier side as is Mexican custom.

Anyway, I'll have to look at the receipts more closely to see if MXP would have been significantly better.

Anyway, I'll have to look at the receipts more closely to see if MXP would have been significantly better.

#412

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,068

On another note, I've got a contender for most egregious DCC offer that I've ever seen when klashn withdrew money from a Euronet ATM at Henri Coandă International Airport last night. The offer was as follows:

Exchange rate 3.4865 RON/USD

DCC Amount: $229.45

Mastercard Amount: $202.81

Amount of DCC overcharge: $26.64

Effective DCC rate: 13.1%

I thought Mastercard requires the percentage to be listed as well as the exchange rate? There were also two prompts to opt out of DCC. While we didn't try the DCC option of course, I would have liked to have seen if there was a, "Are you really sure you don't want to use DCC?" prompt if accepting DCC. I'm also pretty sure that according to both Visa and Mastercard the choice needs to be neutral and not try to steer a customer toward one choice.

#413

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

Yes, please let us know. This is similar to places like the Cayman Islands that price in Cayman Islands dollars but then complete credit card transactions in USD using their own exchange rate of 0.80 KYD = 1 USD. In reality the exchange rate is 1 USD = 1.20 KYD, so the restaurant's exchange rate is 4% worse, but there is no way to opt out because they have USD capable credit card terminals. They also say they have no way to use the KYD terminal unless one's card is KYD. In another case, there are certain restaurants in Aruba that also price in USD even though their native currency is the florin. I don't know if a local comes in whether or not the person would be able to pay in AWG or use of USD is mandatory. There's another case with Lotte in Korea where there are products priced in USD. Again, I don't know how it works if a Korean comes in and wants to buy something with a card denominated in KRW. Perhaps percysmith might know in the Lotte case.

On another note, I've got a contender for most egregious DCC offer that I've ever seen when klashn withdrew money from a Euronet ATM at Henri Coandă International Airport last night. The offer was as follows:

Exchange rate 3.4865 RON/USD

DCC Amount: $229.45

Mastercard Amount: $202.81

Amount of DCC overcharge: $26.64

Effective DCC rate: 13.1%

I thought Mastercard requires the percentage to be listed as well as the exchange rate? There were also two prompts to opt out of DCC. While we didn't try the DCC option of course, I would have liked to have seen if there was a, "Are you really sure you don't want to use DCC?" prompt if accepting DCC. I'm also pretty sure that according to both Visa and Mastercard the choice needs to be neutral and not try to steer a customer toward one choice.

On another note, I've got a contender for most egregious DCC offer that I've ever seen when klashn withdrew money from a Euronet ATM at Henri Coandă International Airport last night. The offer was as follows:

Exchange rate 3.4865 RON/USD

DCC Amount: $229.45

Mastercard Amount: $202.81

Amount of DCC overcharge: $26.64

Effective DCC rate: 13.1%

I thought Mastercard requires the percentage to be listed as well as the exchange rate? There were also two prompts to opt out of DCC. While we didn't try the DCC option of course, I would have liked to have seen if there was a, "Are you really sure you don't want to use DCC?" prompt if accepting DCC. I'm also pretty sure that according to both Visa and Mastercard the choice needs to be neutral and not try to steer a customer toward one choice.

Unfortunately, I don't think I have much recourse, but at least it's something to keep in mind for next time.

#414

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,195

Yes, please let us know. This is similar to places like the Cayman Islands that price in Cayman Islands dollars but then complete credit card transactions in USD using their own exchange rate of 0.80 KYD = 1 USD. In reality the exchange rate is 1 USD = 1.20 KYD, so the restaurant's exchange rate is 4% worse, but there is no way to opt out because they have USD capable credit card terminals.

(Put another way: in one instance, 100 USD gets you 80 KYD and in the other 100 USD gets you 120 KYD.)

#415

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,068

Fortunately it doesn't seem too bad in terms of a rate. With minor fluctuations of the dollar and peso, it could go either way, depending how quickly they change prices. While this is slightly outside the region of benefit of the doubt - I view this within 1% of the true exchange rate - about 1.5% is not in the same range as 3%-5%+ commonly found with DCC.

#416

Join Date: Sep 2013

Posts: 42

#417

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,068

#418

Join Date: Nov 2012

Programs: SPG Platinum

Posts: 1,693

Just got DCCed at Lavo Jazz Bar in Shenzhen - they had Agricultural Bank of China machines and the DCC was automatic - nothing showed up - you signed on the screen and it was only at the end when the receipt was printed that I noticed after leaving that the DCC verbiage was on the receipt (place was too dark to read the fine print) and in any event I had already signed. Will be fun filing the Reason Code 76 complaint now.

#419

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,068

Just got DCCed at Lavo Jazz Bar in Shenzhen - they had Agricultural Bank of China machines and the DCC was automatic - nothing showed up - you signed on the screen and it was only at the end when the receipt was printed that I noticed after leaving that the DCC verbiage was on the receipt (place was too dark to read the fine print) and in any event I had already signed. Will be fun filing the Reason Code 76 complaint now.

Who is your card issuer?

#420

Join Date: Nov 2012

Programs: SPG Platinum

Posts: 1,693

2 receipts have check boxes at the bottom but 1 doesn't; in any event the receipt also contains the standard wording saying I've been offered a choice and chosen DCC blah blah.

Citi and HSBC.