Last edit by: emilio911

What is it?

Dynamic Currency Conversion (DCC) is a "service" some merchants and ATM operators offer that will charge a cardholder in the native currency of the card rather than the local currency. A more complete definition and examples are available via this Wikipedia article on DCC. While sold as a convenience to cardholders traveling outside of their home country, it is a pure profit play by the merchants. You may end up paying a fee of up to 8% over the purchase price for accepting DCC. Always decline DCC and asked to be billed in the local currency!

Where will I see it?

You can be hit with DCC anywhere there is a difference between your debit or credit card's denominated currency and the currency of the location where you're trying to use the card. The most common example will be at a merchant overseas, but now some ATMs are offering the service too. While many US cardholders complain about getting tricked into accepting DCC overseas, some merchants in the US have started to use DCC as well.

What is the issue?

Unless you're the merchant or ATM operator, there isn't much benefit to using DCC. Some customers say they prefer knowing exactly how much they'll be charged in their home currency or may not know the exchange rate of the place where they are visiting. For example, if you are in Prague for two days and you don't know how much the Czech Koruna is worth relative to the US Dollar, you might feel more comfortable knowing that you're buying an item for $205.00 versus 4000 CZK. However, the real exchange rate as of January 18, 2014 would place 4000 CZK at $197.18. You just paid an extra $7.82 for the "convenience" of knowing how much you'd be charged!

DCC often charges about a 4% premium over the true exchange rate. The problems don't stop there since many US banks still charge a 3% foreign transaction fee (FTF) for purchases made outside of the US. Not only would you get hit with the $205.00 charge, you could also find yourself facing a total charge of $211.15 if your card has a 3% FTF.

This is a pure money grab from the merchants, and it's billed as an easy way to squeeze additional revenue out of the transaction. Numerous [1, 2] articles have talked about DCC duping many consumers. Discover even has a warning about being tricked into DCC when using a card abroad.

For example, this FlyerTalk member reported that Avis charged his Saudi credit card in Saudi riyals instead of USD for a car rental in Florida without his consent. This has also been a trend for hotels, particularly large chains as indicated here and here.

DCC is simply not worth it for the consumer. Unless you like paying a convenience fee of up to 5% of the total transaction just to know how much you will be billed, you should always decline DCC and ask to be billed in local currency when handing over your card.

Furthermore, it is in your interest to obtain a card that has a 0% FTF. FlyerTalk member kebosabi maintains a fairly comprehensive spreadsheet of EMV-enabled cards ideal for overseas travel, many of which offer a low or 0% FTF as a feature. There is also a wiki at FlyerGuide of various FTF of debit and credit cards.

What can I do to avoid DCC?

American Express currently does not support DCC on its network, so you are safe from DCC if using an American Express card. However, Visa and MasterCard card networks can support DCC, so be vigilant when purchasing abroad with a Visa or MasterCard branded card. There have been reports of being charged DCC with a Discover card in China [citation needed], but primarily the issue is happening with Visa and MasterCard cards.

Before handing your card to the merchant, always specify clearly that you want to be charged in the local currency and that you do not want DCC. For some transactions, you retain control of your card as you dip it into a chip reader and can view on a screen to select which currency you want to use for the transaction. Always select the local currencyto get the best exchange rate. Do not select the card's native currency!

Similarly, for ATM withdrawals, make sure you decline any kind of conversions. Some good examples of what to look for when using an ATM overseas are here and here. You're probably coming off of a long flight and fatigued, but educating yourself beforehand can save you from getting ripped off. The user interfaces on almost all of these ATMs are set up to encourage you to take the bait, and you have to be extremely vigilant not to fall for it.

If you are doing a PIN-based transaction, you should have the opportunity to review the total amount and denomination of the transaction before entering your PIN. If you are doing a signature transaction and the merchant has processed your transaction with DCC, cross out the amount and write "DCC refused" on the receipt. Do not sign the receipt, and demand that the merchant reverse the transaction and run it in the local currency. If no verification is required due to a small purchase amount, ask the merchant to reverse the charge and repeat the transaction using local currency. If all else fails, file a dispute with your card issuer when you return home. Even if it's immaterial, the banks will get the message like they did with EMV.

Some merchants will claim that their systems have to bill you in your native currency. This is a complete lie. But just like a mag stripe only card, this is battle where you have to be prepared. Don't settle for merchants claiming that "it has to be done this way" or "pay cash if you don't want this". Be prepared to walk away, and, if you must complete the transaction, write "DCC refused & merchant didn't give a choice" on the receipt and cross out the amount. Let the merchant know that you will be filing a dispute with your bank.

Disabling DCC

Disabling DCC on ANZ terminals in Australia

ANZ markets DCC as Customer Preferred Currency (CPC). Terminal operators can contact ANZ Merchant Services at 1800 039 025 to have this feature disabled. Currently, your Visa or MasterCard will be subjected to DCC if denominated in: CAD, CHF, DKK, EUR, GBP, HKD, JPY, MYR, NOK, NZD, SEK, SGD, THB, USD, or ZAR. All DCC transactions on ANZ will cause a 2.5% markup. Steps to avoid DCC:

If you see a signature slip with DCC verbiage and a checkbox indicating a currency selection, kindly ask the merchant to void the transaction. If it's a PIN-based transaction, you have an additional opportunity to cancel the transaction because it will ask for your PIN a second time. For instance, if you see "EUR 17.29 KEY PIN" refuse to enter your PIN and start again.

Disabling DCC in China

There are many reports of forced DCC in China, and there is a great thread [closed to new posts] on DCC in China on the the China Destinations forum.

Disabling DCC on Bankcomm terminals in Beijing http://www.hongkongcard.com/forum/fo...p?id=12272&p=2 #19

jair101's DCC instructions of March 2011 http://www.etveg.com/misc/DCC_China.pdf

Disabling DCC in Eurozone and UK

DCC offered in tourist traps (Harrods Knightsbridge/Galleries Lafayette Montparnesse/El Cortes Ingles Grand Via Madrid)

Unlike the rest of the world, Visa Europe does not require merchants to collect a ticked box on the slip (presumably because merchants there don't keep signed slips under Chip-and-PIN)

El Cortes Ingles collects a signature electronically and the DCC selection is made on the signature pad - the choice is respected.

Harrods and GL rely on cashier input in the POS for the currency choice - the cashier may forget to ask. The POS do not offer voiding (only refunds), but since you're given a slip to sign the best thing to do is to deface it before signing and submit chargeback request to issuer bank on return home.

There may be smaller merchants who also collect DCC but I seemed to have pre-empted most of them by saying "charge Euros (Pounds) please"

In Spain all merchants by law are required to provide you with a complaint form called an hoja de reclamaciones if requested. The form has two carbon copies. The customer retains one copy as a record of the complaint. The merchant maintains another copy, and the third is sent to the local consumer protection bureau. Merchants are also required to post a sign conspicuously informing the customer of the right to complain (usually in Spanish and English). Do not accept the lie that they don't have any forms. This is illegal, and you are able to call the police if the merchant refuses to provide you with this official form. It's interesting to see merchants start to squirm when you know the rules, and most merchants will start to be accommodating after you mention it. (Please still fill out the form even if the merchant cooperates after mentioning it because these are likely the merchants who won't otherwise change their behavior.)

Disabling DCC in Hong Kong and Macau

Hong Kong and Macau can get as non-compliant as China, possibly because many acquirers have cross-border operations and know they can get away with non-compliant firmware and procedures.

In practice, if you are given a DCC slip, and the cashier has not taken a choice before giving you your copy, the slip will be processed in your home currency - be prepared to dispute.

Unable to disable Global Payments DCC in Hong Kong instance #1, instance #2

Unable to disable DBS DCC in Fortress Electronics HK

Unable to disable BoC DCC in Free Duty HK

Disabling DCC in Japan and Korea

Japan's just starting out http://www.flyertalk.com/forum/japan...ing-japan.html and http://www.hongkongcard.com/forum/fo...p?id=3939&p=17 #168 but there are no reports I know of where cardholders are compelled to use DCC against their will.

Korea is also not much affected by DCC but where offered, trying to opt out is harder than Japan due to the language barrier (both verbal and written)

http://www.hongkongcard.com/forum/fo...hp?id=4303&p=3 #23

http://www.hongkongcard.com/forum/fo...p?id=12272&p=2 #11

Disabling DCC in the Maldives

Disabling DCC on Global Payment terminals in the Maldives

Disabling DCC in Thailand and Taiwan

DCC present but generally not an issue. Cashier will generate quote slip is usually generated and pass to cardholder. When cardholder refuses, a verbage-free slip denominated in THB/TWD will be produced.

Certain Taiwan hotels may take deposits in cardholder currency. But these are only pre-authorisations and can be voided in full for TWD-only final checkout payments.

Disabling DCC on Websites

Airbnb - (Since the "loophole" seem not to work anymore, please report if you chargeback the DCC. )

)

Hotwire - You need to select your preferred currency before making a search.

PayPal - The instructions to stop the DCC on a recurring charge are here.

I got duped by DCC already before I found this thread. Is there anything I can do?

If you've been hit with DCC and the merchant did not follow the Visa/MC rules, you should file a dispute with your card issuer. Even if the transaction is a small amount, it's worth it to dispute the charge on principle. Do not let merchants get away with this scam uncontested!

If you were not clearly given a choice of currencies and did not specifically communicate a preference to be billed in your card's native currency - if you did not accept DCC - then you have recourse when filing a dispute with your card issuer. The Visa Product and Service Rules clearly state (p 339):

You can even use terminology from Visa Product and Service Rules when filing the dispute, giving Reason Code 76: Incorrect Currency or Transaction Code. Reason Code 76 is used when the transaction was processed with an incorrect transaction code, or an incorrect currency code, or one of the following:

MasterCard's rules also clearly state that the POI Currency Conversion must be decided by both the merchant and customer. When filing a dispute with a MasterCard, list chargeback Reason Code 4846 from the MasterCard Chargeback Guide, which covers POI currency conversion disputes in the following circumstances:

You do have a choice of currencies. Exercise that choice!

Do not get taken by surprise when faced with DCC, and know your options. As Visa/MC purport, you do have a choice of currencies, but you need to make that choice heard! Don't be complacent in this sneaky tactic by some merchants to pad revenues.

Before going to a different country, get educated. Understand the exchange rate relative to your native currency. Know how to recognize when the merchant is trying to force DCC on the transaction, and pull out all of the stops to make sure it doesn't happen to you.

If you have a chip-and-PIN credit card, it's easier to control the transaction to try to prevent DCC. With chip-and-signature, if you get an uncooperative merchant, deface the merchant's copy of the receipt. Write LOCAL OPTION NOT OFFERED, cross out the DCC currency amount, and sign the receipt.

This will give additional evidence when filing a dispute to get the DCC charges refunded. When filing the dispute, you can use the Visa Exchange Rate Calculator or MasterCard's Currency Conversion Tool to determine the Visa or MasterCard exchange rate on the date the transaction posted to your credit card. Compare this to the DCC value to figure out the amount by which the merchant overcharged you. Don't forget to add in any Foreign Transaction Fee if your card has one. (If it does, you should really consider finding a card for use overseas without a FTF. )

)

Example Images (click for a larger image)

Hotel receipts in China, the Netherlands, and Dubai respectively:

Purchase receipts in China and Korea:

Cancelled translation in Hong Kong:

Novotel in Shenzen:

Dynamic Currency Conversion (DCC) is a "service" some merchants and ATM operators offer that will charge a cardholder in the native currency of the card rather than the local currency. A more complete definition and examples are available via this Wikipedia article on DCC. While sold as a convenience to cardholders traveling outside of their home country, it is a pure profit play by the merchants. You may end up paying a fee of up to 8% over the purchase price for accepting DCC. Always decline DCC and asked to be billed in the local currency!

Where will I see it?

You can be hit with DCC anywhere there is a difference between your debit or credit card's denominated currency and the currency of the location where you're trying to use the card. The most common example will be at a merchant overseas, but now some ATMs are offering the service too. While many US cardholders complain about getting tricked into accepting DCC overseas, some merchants in the US have started to use DCC as well.

What is the issue?

Unless you're the merchant or ATM operator, there isn't much benefit to using DCC. Some customers say they prefer knowing exactly how much they'll be charged in their home currency or may not know the exchange rate of the place where they are visiting. For example, if you are in Prague for two days and you don't know how much the Czech Koruna is worth relative to the US Dollar, you might feel more comfortable knowing that you're buying an item for $205.00 versus 4000 CZK. However, the real exchange rate as of January 18, 2014 would place 4000 CZK at $197.18. You just paid an extra $7.82 for the "convenience" of knowing how much you'd be charged!

DCC often charges about a 4% premium over the true exchange rate. The problems don't stop there since many US banks still charge a 3% foreign transaction fee (FTF) for purchases made outside of the US. Not only would you get hit with the $205.00 charge, you could also find yourself facing a total charge of $211.15 if your card has a 3% FTF.

This is a pure money grab from the merchants, and it's billed as an easy way to squeeze additional revenue out of the transaction. Numerous [1, 2] articles have talked about DCC duping many consumers. Discover even has a warning about being tricked into DCC when using a card abroad.

For example, this FlyerTalk member reported that Avis charged his Saudi credit card in Saudi riyals instead of USD for a car rental in Florida without his consent. This has also been a trend for hotels, particularly large chains as indicated here and here.

DCC is simply not worth it for the consumer. Unless you like paying a convenience fee of up to 5% of the total transaction just to know how much you will be billed, you should always decline DCC and ask to be billed in local currency when handing over your card.

Furthermore, it is in your interest to obtain a card that has a 0% FTF. FlyerTalk member kebosabi maintains a fairly comprehensive spreadsheet of EMV-enabled cards ideal for overseas travel, many of which offer a low or 0% FTF as a feature. There is also a wiki at FlyerGuide of various FTF of debit and credit cards.

What can I do to avoid DCC?

American Express currently does not support DCC on its network, so you are safe from DCC if using an American Express card. However, Visa and MasterCard card networks can support DCC, so be vigilant when purchasing abroad with a Visa or MasterCard branded card. There have been reports of being charged DCC with a Discover card in China [citation needed], but primarily the issue is happening with Visa and MasterCard cards.

Before handing your card to the merchant, always specify clearly that you want to be charged in the local currency and that you do not want DCC. For some transactions, you retain control of your card as you dip it into a chip reader and can view on a screen to select which currency you want to use for the transaction. Always select the local currencyto get the best exchange rate. Do not select the card's native currency!

Similarly, for ATM withdrawals, make sure you decline any kind of conversions. Some good examples of what to look for when using an ATM overseas are here and here. You're probably coming off of a long flight and fatigued, but educating yourself beforehand can save you from getting ripped off. The user interfaces on almost all of these ATMs are set up to encourage you to take the bait, and you have to be extremely vigilant not to fall for it.

If you are doing a PIN-based transaction, you should have the opportunity to review the total amount and denomination of the transaction before entering your PIN. If you are doing a signature transaction and the merchant has processed your transaction with DCC, cross out the amount and write "DCC refused" on the receipt. Do not sign the receipt, and demand that the merchant reverse the transaction and run it in the local currency. If no verification is required due to a small purchase amount, ask the merchant to reverse the charge and repeat the transaction using local currency. If all else fails, file a dispute with your card issuer when you return home. Even if it's immaterial, the banks will get the message like they did with EMV.

Some merchants will claim that their systems have to bill you in your native currency. This is a complete lie. But just like a mag stripe only card, this is battle where you have to be prepared. Don't settle for merchants claiming that "it has to be done this way" or "pay cash if you don't want this". Be prepared to walk away, and, if you must complete the transaction, write "DCC refused & merchant didn't give a choice" on the receipt and cross out the amount. Let the merchant know that you will be filing a dispute with your bank.

Disabling DCC

Disabling DCC on ANZ terminals in Australia

ANZ markets DCC as Customer Preferred Currency (CPC). Terminal operators can contact ANZ Merchant Services at 1800 039 025 to have this feature disabled. Currently, your Visa or MasterCard will be subjected to DCC if denominated in: CAD, CHF, DKK, EUR, GBP, HKD, JPY, MYR, NOK, NZD, SEK, SGD, THB, USD, or ZAR. All DCC transactions on ANZ will cause a 2.5% markup. Steps to avoid DCC:

- Insert, swipe, or tap your payment card

- Have the cashier select credit (CR)

- The terminal will display CREDIT ACCOUNT

- If applicable, enter your PIN

- The terminal will display PROCESSING \ PLEASE WAIT

- The terminal will display EXCH <exchange rate> \ <currency> <amount> \ ACCEPT RATE? \ ENTER=YES CLR=NO

- Instruct the cashier to press the yellow CLEAR (CLR) button (If entering a PIN, you can retain the terminal to perform this step yourself. If entering a signature, you can ask for the terminal to control this process, not indicating that it's a chip-and-signature card.)

- The transaction should now process without DCC

If you see a signature slip with DCC verbiage and a checkbox indicating a currency selection, kindly ask the merchant to void the transaction. If it's a PIN-based transaction, you have an additional opportunity to cancel the transaction because it will ask for your PIN a second time. For instance, if you see "EUR 17.29 KEY PIN" refuse to enter your PIN and start again.

Disabling DCC in China

There are many reports of forced DCC in China, and there is a great thread [closed to new posts] on DCC in China on the the China Destinations forum.

Disabling DCC on Bankcomm terminals in Beijing http://www.hongkongcard.com/forum/fo...p?id=12272&p=2 #19

jair101's DCC instructions of March 2011 http://www.etveg.com/misc/DCC_China.pdf

Disabling DCC in Eurozone and UK

DCC offered in tourist traps (Harrods Knightsbridge/Galleries Lafayette Montparnesse/El Cortes Ingles Grand Via Madrid)

Unlike the rest of the world, Visa Europe does not require merchants to collect a ticked box on the slip (presumably because merchants there don't keep signed slips under Chip-and-PIN)

El Cortes Ingles collects a signature electronically and the DCC selection is made on the signature pad - the choice is respected.

Harrods and GL rely on cashier input in the POS for the currency choice - the cashier may forget to ask. The POS do not offer voiding (only refunds), but since you're given a slip to sign the best thing to do is to deface it before signing and submit chargeback request to issuer bank on return home.

There may be smaller merchants who also collect DCC but I seemed to have pre-empted most of them by saying "charge Euros (Pounds) please"

In Spain all merchants by law are required to provide you with a complaint form called an hoja de reclamaciones if requested. The form has two carbon copies. The customer retains one copy as a record of the complaint. The merchant maintains another copy, and the third is sent to the local consumer protection bureau. Merchants are also required to post a sign conspicuously informing the customer of the right to complain (usually in Spanish and English). Do not accept the lie that they don't have any forms. This is illegal, and you are able to call the police if the merchant refuses to provide you with this official form. It's interesting to see merchants start to squirm when you know the rules, and most merchants will start to be accommodating after you mention it. (Please still fill out the form even if the merchant cooperates after mentioning it because these are likely the merchants who won't otherwise change their behavior.)

Disabling DCC in Hong Kong and Macau

Hong Kong and Macau can get as non-compliant as China, possibly because many acquirers have cross-border operations and know they can get away with non-compliant firmware and procedures.

In practice, if you are given a DCC slip, and the cashier has not taken a choice before giving you your copy, the slip will be processed in your home currency - be prepared to dispute.

Unable to disable Global Payments DCC in Hong Kong instance #1, instance #2

Unable to disable DBS DCC in Fortress Electronics HK

Unable to disable BoC DCC in Free Duty HK

Disabling DCC in Japan and Korea

Japan's just starting out http://www.flyertalk.com/forum/japan...ing-japan.html and http://www.hongkongcard.com/forum/fo...p?id=3939&p=17 #168 but there are no reports I know of where cardholders are compelled to use DCC against their will.

Korea is also not much affected by DCC but where offered, trying to opt out is harder than Japan due to the language barrier (both verbal and written)

http://www.hongkongcard.com/forum/fo...hp?id=4303&p=3 #23

http://www.hongkongcard.com/forum/fo...p?id=12272&p=2 #11

Disabling DCC in the Maldives

Disabling DCC on Global Payment terminals in the Maldives

Disabling DCC in Thailand and Taiwan

DCC present but generally not an issue. Cashier will generate quote slip is usually generated and pass to cardholder. When cardholder refuses, a verbage-free slip denominated in THB/TWD will be produced.

Certain Taiwan hotels may take deposits in cardholder currency. But these are only pre-authorisations and can be voided in full for TWD-only final checkout payments.

Disabling DCC on Websites

Airbnb - (Since the "loophole" seem not to work anymore, please report if you chargeback the DCC.

)

)Hotwire - You need to select your preferred currency before making a search.

PayPal - The instructions to stop the DCC on a recurring charge are here.

I got duped by DCC already before I found this thread. Is there anything I can do?

If you've been hit with DCC and the merchant did not follow the Visa/MC rules, you should file a dispute with your card issuer. Even if the transaction is a small amount, it's worth it to dispute the charge on principle. Do not let merchants get away with this scam uncontested!

If you were not clearly given a choice of currencies and did not specifically communicate a preference to be billed in your card's native currency - if you did not accept DCC - then you have recourse when filing a dispute with your card issuer. The Visa Product and Service Rules clearly state (p 339):

- Merchants that offer DCC must be compliant with the regulations

- Inform the cardholder that DCC is optional

- Not impose any additional requirements to use local currency

- Not use any language or procedures that may cause the cardholder to choose DCC by default

- Not convert a transaction in the local currency to the card's billing currency after the transaction has completed

- Ensure that the cardholder expressly agrees to DCC

You can even use terminology from Visa Product and Service Rules when filing the dispute, giving Reason Code 76: Incorrect Currency or Transaction Code. Reason Code 76 is used when the transaction was processed with an incorrect transaction code, or an incorrect currency code, or one of the following:

- Merchant did not deposit a transaction receipt in the country where the transaction occurred

- Cardholder was not advised that Dynamic Currency Conversion (DCC) would occur

- Cardholder was refused the choice of paying in the merchant’s local currency

- Merchant processed a credit refund and did not process a reversal or adjustment within 30 calendar days for a transaction receipt processed in error

MasterCard's rules also clearly state that the POI Currency Conversion must be decided by both the merchant and customer. When filing a dispute with a MasterCard, list chargeback Reason Code 4846 from the MasterCard Chargeback Guide, which covers POI currency conversion disputes in the following circumstances:

- The cardholder states that he or she was not given the opportunity to choose the desired currency in which the transactions was completed or did not agree to the currency of the transaction, or

- POI currency conversion took place into a currency that is not the cardholder's billing currency, or

- POI currency conversion took place when the goods or services were priced in the cardholder's billing currency, or

- POI currency conversion took place when cash was disbursed in the cardholdeer's billing currency.

You do have a choice of currencies. Exercise that choice!

Do not get taken by surprise when faced with DCC, and know your options. As Visa/MC purport, you do have a choice of currencies, but you need to make that choice heard! Don't be complacent in this sneaky tactic by some merchants to pad revenues.

Before going to a different country, get educated. Understand the exchange rate relative to your native currency. Know how to recognize when the merchant is trying to force DCC on the transaction, and pull out all of the stops to make sure it doesn't happen to you.

If you have a chip-and-PIN credit card, it's easier to control the transaction to try to prevent DCC. With chip-and-signature, if you get an uncooperative merchant, deface the merchant's copy of the receipt. Write LOCAL OPTION NOT OFFERED, cross out the DCC currency amount, and sign the receipt.

This will give additional evidence when filing a dispute to get the DCC charges refunded. When filing the dispute, you can use the Visa Exchange Rate Calculator or MasterCard's Currency Conversion Tool to determine the Visa or MasterCard exchange rate on the date the transaction posted to your credit card. Compare this to the DCC value to figure out the amount by which the merchant overcharged you. Don't forget to add in any Foreign Transaction Fee if your card has one. (If it does, you should really consider finding a card for use overseas without a FTF.

)

)Example Images (click for a larger image)

Hotel receipts in China, the Netherlands, and Dubai respectively:

Purchase receipts in China and Korea:

Cancelled translation in Hong Kong:

Novotel in Shenzen:

Dynamic Currency Conversion (DCC) [2014-2016]

#2146

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

I generally have to go out of my way to find DCC in Japan. And even if I do the cashiers give quote slip and respectfully wait before proceeding.

#2147

Join Date: Feb 2013

Location: Irvine CA & PEK

Programs: Hyatt Globalist, Marriott Titanium, Hilton Diamond, IHG Spire Ambassador, Qantas Platinum, United S

Posts: 664

I know of the cancel trick, but that didn't work when percysmith and I tried at Greyhound Cafe last year. So, in 90% of cases if I say local currency in China I will be alright? For some reason, I thought the problem was much more widespread. I'll definitely keep my Discover at the ready to use instead.

What I said is that for the forced-DCC machines, 90% needs cancel trick, and so forth. Non-compliant machines (those don't show clearly what is going on and those don't give you options) are like 100% here in China. Nowhere is safe here...

Some places even have a separate machine for foreign cards (we all can guess why). Usually these machines are from 交行.

Of course, if you go to Ritz Carlton or Westin, they definitely know how to disable DCC so no problem there~

Regarding the Greyhound Café thing, I do believe that machine needs post-transaction inputs like those Global Payment machines do. The owner however doesn't know how to do that, or the business providing the machine to that owner doesn't want the owner to know how to do. Kind of hard for me to believe there is a hard-wired-to-the-bone DCC-forcing machine in HK, not China. I'll say 99% of the chance the DCC-disabling feature is hidden somewhere in that machine, very deeply hidden!

I didn't know it was so widespread. Even though the UK gets a lot of Eurozone cards most machines are set to GBP only. And even if they have the other option since you actually insert the card into the machine and make the transaction, you control what happens.

I'd hate to have someone "help" me by giving me a crappy exchange rate with DCC. I wonder which eastern countries predominantly do DCC, I plan to go to Japan and I wonder what they do there.

I'd hate to have someone "help" me by giving me a crappy exchange rate with DCC. I wonder which eastern countries predominantly do DCC, I plan to go to Japan and I wonder what they do there.

Don't worry about Japan. As percysmith said, you do need to go VERY out of the way to find a DCC there. Japan is not famous for this kind of nefarious business practices at all. I've spent half a month in Kansai area last month living mostly on credit cards and encountered none DCC.

#2148

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,066

My experience in London and Paris is really good. Only did I encounter DCC at Fortrum and Mason, and I was offered a choice on the keypad with clear instructions.

Don't worry about Japan. As percysmith said, you do need to go VERY out of the way to find a DCC there. Japan is not famous for this kind of nefarious business practices at all. I've spent half a month in Kansai area last month living mostly on credit cards and encountered none DCC.

Don't worry about Japan. As percysmith said, you do need to go VERY out of the way to find a DCC there. Japan is not famous for this kind of nefarious business practices at all. I've spent half a month in Kansai area last month living mostly on credit cards and encountered none DCC.

Regarding the Greyhound Café thing, I do believe that machine needs post-transaction inputs like those Global Payment machines do. The owner however doesn't know how to do that, or the business providing the machine to that owner doesn't want the owner to know how to do. Kind of hard for me to believe there is a hard-wired-to-the-bone DCC-forcing machine in HK, not China. I'll say 99% of the chance the DCC-disabling feature is hidden somewhere in that machine, very deeply hidden!

I guess I'm still in trouble in Mainland China since I can only speak a few phrases of Mandarin. I might as well brush up on my banking/DCC terms as well. In contrast, Taiwan is well behaved when it comes to DCC, so I've never had to worry.

#2149

Join Date: Dec 2007

Location: Cambridge, UK

Posts: 261

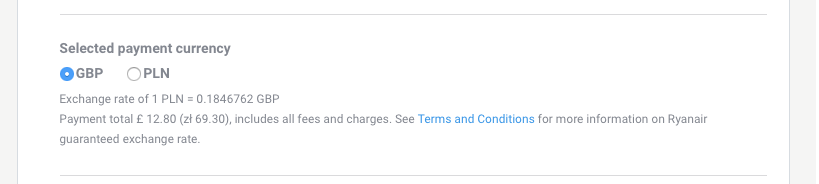

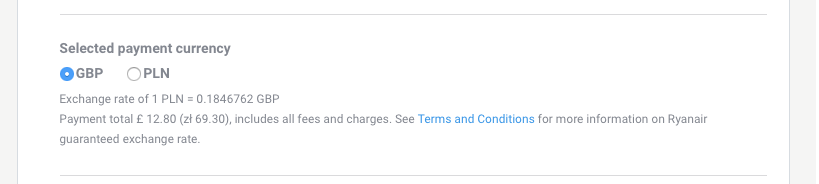

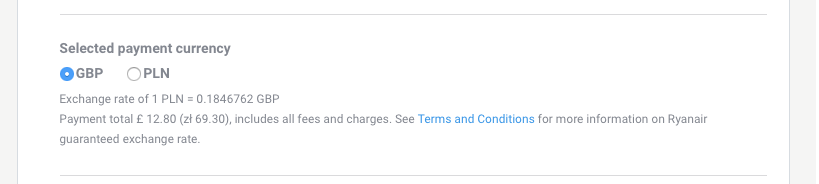

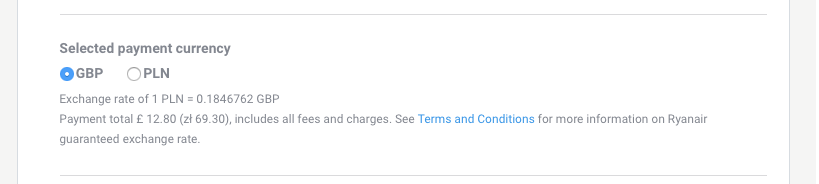

Update on Ryanair: they have a new (well, Beta) website!

DCC is very obvious on the new site and very easy to opt out.

To give an idea of the markup, my card was charged £12.10 for this PLN69.30 transaction. Ryanair's rate was £12.80.

For those without fee free cards, wishing to take advance of the "Ryanair journeys originating in the UK but return flight cheaper to book as a single in the destination currency" issue, this could be worth opting into as some UK cards charge a fixed fee plus a percentage.

DCC is very obvious on the new site and very easy to opt out.

To give an idea of the markup, my card was charged £12.10 for this PLN69.30 transaction. Ryanair's rate was £12.80.

For those without fee free cards, wishing to take advance of the "Ryanair journeys originating in the UK but return flight cheaper to book as a single in the destination currency" issue, this could be worth opting into as some UK cards charge a fixed fee plus a percentage.

#2150

Join Date: Nov 2012

Posts: 3,537

Update on Ryanair: they have a new (well, Beta) website!

DCC is very obvious on the new site and very easy to opt out.

To give an idea of the markup, my card was charged £12.10 for this PLN69.30 transaction. Ryanair's rate was £12.80.

For those without fee free cards, wishing to take advance of the "Ryanair journeys originating in the UK but return flight cheaper to book as a single in the destination currency" issue, this could be worth opting into as some UK cards charge a fixed fee plus a percentage.

DCC is very obvious on the new site and very easy to opt out.

To give an idea of the markup, my card was charged £12.10 for this PLN69.30 transaction. Ryanair's rate was £12.80.

For those without fee free cards, wishing to take advance of the "Ryanair journeys originating in the UK but return flight cheaper to book as a single in the destination currency" issue, this could be worth opting into as some UK cards charge a fixed fee plus a percentage.

#2151

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

PITA for us in HK, I started a thread tracking online merchants charging HKD outside HK http://www.hongkongcard.com/forum/fo...p?id=11968&p=1

(In HK the term Foreign Transaction Fee is not used; the terminology is not uniform (Citi HK even calls their FTF a DCC fee) but I used "Cross-Border Fee" after the first bank who started applying the fee in a big way called it that)

I've been mainly using dollar blue cash in Argentina, but I've done some cross border day trips to Chile and Brazil where there were some small entry fee or a meal to be paid and I carded those - no DCC despite the obvious tourist orientation of those locations. I also carded my prepaid data card at EZE also without DCC.

#2154

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

Alliekat: oh okay. Funny how UK banks are so conservative on fees viz-a-viz US and HK.

In other news, DCC chargeback in Singapore: can be done but PITA http://www.flyertalk.com/forum/singa...l#post25604402

In other news, DCC chargeback in Singapore: can be done but PITA http://www.flyertalk.com/forum/singa...l#post25604402

#2155

A FlyerTalk Posting Legend

Join Date: Dec 2000

Location: Shanghai

Posts: 42,048

My hypothesis wrt the "cancel trick"

Based on my recent observances of boc and HSBC pos machines, here's what I think is really going on:

-there usually IS a dcc selection step

-on intuitive pos machines, you choose 1 for card currency and 2 for local currency

-but, in the case of boc, HSBC, 交行, etc...simply replace 1 with the "enter" button and 2 with the "cancel" button

-to put it another way, during this step the "cancel" button functions EXACTLY the same way as the 2 button on other pos machines

*I sent percysmith a pic of a boc pos machine that makes this semi clear (if you study the still photo in detail)

Key point (based on this hypothesis) is that the "cancel" button relinquishes its cancel function during this step.

..and, waitresses have no clue about such (they will always press the "enter" button for you).

My advice:

-if you get hit with DCC (in China), void the transaction

*lengthy explanation as to why is not a good idea

-redo it a second time with yourself in the driver's seat

-you WILL win if you focus

#2156

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

I think this is the "intuitive" DCC terminal moondog mentioned:

http://m.hongkongcard.com/webeditor/..._674653811.jpg (I'll reduce the size of this when I get back to HK and link this photo on this post directly)

I don't agree with much of moondog's hypthesis:

1. The four banks are not as corrobated as moondog makes out. Not to mention there are second-tier banks such as Bankcomm and foreign banks such as HSBC who are also offenders. In one bank (or few) the Enter/Cancel is all that's requires. I don't see why that is the opt-out for all of them (why can't it be answering "no" to "Print Next Slip?" as in the Maldives?)

2. I think in the PRC all terminals have an opt-out just in case the acquirer is asked to demonstrate an opt-out exists before the PBOC. Except triggering that opt-put is akin to triggering the test mode on a Volkswagen diesel in a EPA test lab - once back in the wild the terminals do their normal non-compliant thing again.

3. Moondog talks about the focusing of the mechanics of the DCC but I posit the card charging workflow of most PRC merchants is part of the "mechanics" facilitating DCC non-compliance - in Australia, Italy and EU in general (I hope to be able to report on Canada next year), the SOP is for terminals are brought to the customer because of Chip and PIN. This is also done in PRC for Unionpay cards (which traditionally required a PIN). But for V/M in PRC my experience is non-detachable terminal since only a signature is required. So there is much reduced scope to play our whack-a-mole or Mastermind games.

3A. Furthermore there is very limited cooperation we can seek from PRC cashiers/service staff (especially tourists not resident expats) - they will just insist on the "tick RMB and you will be charged in RMB" or its Putonhua translation.

4. Certain acquirers in HK (Global Payments seems to be the most profligate given the Coyote and Greyhound cases I've been involved in) don't even have to pretend to be compliant because they fall into a regulatory black hole - the HKMA doesn't cover non-banks. Visa and (to a slightly lesser extent) MC don't do much about non-compliance (with regard to the purported BOC instructions Visa /dev/nulled me whereas MC is treating more or less like an individual exception case) so they do not seem to see the need for an opt out switch at all no matter how obscure.

4A. I don't have direct evidence for this but I posit the same for Macau for the same reasons as HK.

http://m.hongkongcard.com/webeditor/..._674653811.jpg (I'll reduce the size of this when I get back to HK and link this photo on this post directly)

I don't agree with much of moondog's hypthesis:

1. The four banks are not as corrobated as moondog makes out. Not to mention there are second-tier banks such as Bankcomm and foreign banks such as HSBC who are also offenders. In one bank (or few) the Enter/Cancel is all that's requires. I don't see why that is the opt-out for all of them (why can't it be answering "no" to "Print Next Slip?" as in the Maldives?)

2. I think in the PRC all terminals have an opt-out just in case the acquirer is asked to demonstrate an opt-out exists before the PBOC. Except triggering that opt-put is akin to triggering the test mode on a Volkswagen diesel in a EPA test lab - once back in the wild the terminals do their normal non-compliant thing again.

3. Moondog talks about the focusing of the mechanics of the DCC but I posit the card charging workflow of most PRC merchants is part of the "mechanics" facilitating DCC non-compliance - in Australia, Italy and EU in general (I hope to be able to report on Canada next year), the SOP is for terminals are brought to the customer because of Chip and PIN. This is also done in PRC for Unionpay cards (which traditionally required a PIN). But for V/M in PRC my experience is non-detachable terminal since only a signature is required. So there is much reduced scope to play our whack-a-mole or Mastermind games.

3A. Furthermore there is very limited cooperation we can seek from PRC cashiers/service staff (especially tourists not resident expats) - they will just insist on the "tick RMB and you will be charged in RMB" or its Putonhua translation.

4. Certain acquirers in HK (Global Payments seems to be the most profligate given the Coyote and Greyhound cases I've been involved in) don't even have to pretend to be compliant because they fall into a regulatory black hole - the HKMA doesn't cover non-banks. Visa and (to a slightly lesser extent) MC don't do much about non-compliance (with regard to the purported BOC instructions Visa /dev/nulled me whereas MC is treating more or less like an individual exception case) so they do not seem to see the need for an opt out switch at all no matter how obscure.

4A. I don't have direct evidence for this but I posit the same for Macau for the same reasons as HK.

Last edited by percysmith; Oct 23, 2015 at 7:29 pm

#2157

Join Date: Jul 2010

Location: YYZ

Posts: 1,666

After more than 2 months in Denmark, I am happy to report that the DCC disease is virtually non-existant here. I've never been prompted for DCC anywhere, even at the major department stores in the city centre (e.g. Illum, Magasin du Nord), brand name stores and shops of varying sizes.

The only case of it I encountered was a Euronet ATM offering DCC. All other major bank ATMs (e.g. Danske Bank, Nordea, etc.) have never prompted me for DCC.

Of course, the nasty surprise here is that some places charge extra for using foreign cards, while not charging extra for Danish debit cards. This happens frequently at the discount supermarkets (1.8-2.8%). What shocked me was how many high-end restaurants (e.g. 2 Michelin starred) charge such fees as well (Geranium, Studio and AOC all asked for a foreign card fee.)

The only case of it I encountered was a Euronet ATM offering DCC. All other major bank ATMs (e.g. Danske Bank, Nordea, etc.) have never prompted me for DCC.

Of course, the nasty surprise here is that some places charge extra for using foreign cards, while not charging extra for Danish debit cards. This happens frequently at the discount supermarkets (1.8-2.8%). What shocked me was how many high-end restaurants (e.g. 2 Michelin starred) charge such fees as well (Geranium, Studio and AOC all asked for a foreign card fee.)

#2158

Join Date: Dec 2007

Location: Cambridge, UK

Posts: 261

Of course, the nasty surprise here is that some places charge extra for using foreign cards, while not charging extra for Danish debit cards. This happens frequently at the discount supermarkets (1.8-2.8%). What shocked me was how many high-end restaurants (e.g. 2 Michelin starred) charge such fees as well (Geranium, Studio and AOC all asked for a foreign card fee.)

Interestingly none of the fast food chains appear to have a surcharge.

#2159

Join Date: Jul 2007

Posts: 1,762

Also, I noticed Diners Club does not charge this fee; at least it didn't when I went to Tivoli. Of course while I don't have a Diners Club, outside the USA, discover is diners club. I think this is true in general but didn't use it anywhere else as I was only in Copenhagen overnight one day waiting for a Baltic cruise.

#2160

Join Date: May 2006

Location: PMD

Programs: UA*G, NW, AA-G. WR-P, HH-G, IHG-S, ALL. TT-GE.

Posts: 2,911

Also, I noticed Diners Club does not charge this fee; at least it didn't when I went to Tivoli. Of course while I don't have a Diners Club, outside the USA, discover is diners club. I think this is true in general but didn't use it anywhere else as I was only in Copenhagen overnight one day waiting for a Baltic cruise.