Last edit by: pgary

Best welcome bonus is 120,000

120,000 points, $75 annual fee, not waived (Premier Rewards Visa Signature Card) offer:

https://www.radissonrewardsvisa.com/...rect=plat32172

85,000 points, $75 annual fee, not waived (Premier Rewards Visa Signature Card) offer:

http://www.clubcarlsonvisa.com/credi...PremierCard.do

10x on Radisson, 5x else, Gold status. Up to 3 free nights for each $10K spend

60,000 points, $50 annual fee, not waived (Rewards Visa Signature Card) offer:

http://www.clubcarlsonvisa.com/credi...gnatureCard.do

6x on Radisson, 3x else, Silver status. Up to 3 free nights for each $10K spend

30,000 points, $0 annual fee (Rewards Visa Card) offer:

https://www.radissonrewardsvisa.com/credit/visaCard.do

6x on Radisson, 3x else. Up to 3 free nights for each $10K spend

85,000 points, $60 annual fee, not waived (Business Rewards Visa Card) offer:

http://www.clubcarlsonvisa.com/credi...usinessCard.do

10x on Radisson, 5x else, Gold status. Up to 3 free nights for each $10K spend

_______________________________________________

For discussion of posting time on the annual 40k bonus, see this thread: CC visa annual 40,000 points bonus

US Bank Reconsideration Line: 800-947-1444

Use this phone number to check your application status as well. US Bank does not send you an approval/denial email. Many data points show 8-10 business days for decision is normal. Add another 2-3 weeks after that to receive physical card.

U.S. Bank Fraud Department - 800-260-8469. This is the number to call if your card starts getting declined when you try to make a purchase.

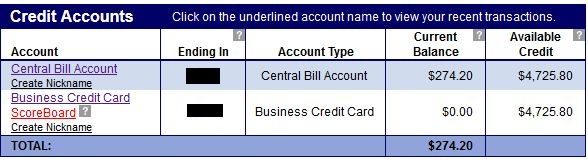

Why is the balance due on my business card always shown as $0?

There are TWO account numbers linked to your business card: The card itself, which shows up in the same website account as any personal cards you may have. This will always show a $0 balance due.

There is a SECOND account - labeled the "Central Bill Account" - with its own account number. You must set up a separate website account with its own username and password to access the Central Bill Account. This is the account that will actually show the balance due and let you schedule a payment. Somewhere in the paperwork you received with the card or the first paper invoice, you should be able to find the Central Bill Account's number.

Setting up separate website account for business card:

These are the instructions that US Bank emailed me:

To enroll in Online Banking for your U.S. Bank Business account, start by going to usbank.com. You do not need a Personal Identification Number (PIN) in order to enroll.

Please follow these instructions to enroll in Online Banking to view or pay your account:

1. Click on the Enroll Now link on the right side of the screen.

2. Select the Business Accounts option.

3. View the Terms and Conditions and then select Enroll Now.

4. Select I do not have a U.S. Bank small business checking or savings account.

5. Select I am an authorized officer of a U.S. Bank Business Credit Card.

6. Complete Step 2 of 2.

Once you have successfully logged in, you will be able to view your business account in its entirety. When you are making a payment you will need to select the Accounts Payable account number.

Until the end of May 2015: "Bonus Award Night - Redeem Gold Points for two or more consecutive Award Nights and the last night is free. Exclusively for cardmembers.

From June 1 2015: free night after $10,000 spend in a year plus payment of annual fee. Note: can only be used in the U.S.

"New Account Bonus is not available to applicants who have had this Card or another Club Carlson credit card product within the last 12 months."

Forex fee is 3%

For complaints about the changes slated for May 2015, try twitter, Facebook, emails to corporate, letter writing, etc.

Facebook: https://www.facebook.com/clubcarlson?fref=ts

Twitter: https://twitter.com/ClubCarlson

USA contact # +1 (888) 288 8889

120,000 points, $75 annual fee, not waived (Premier Rewards Visa Signature Card) offer:

https://www.radissonrewardsvisa.com/...rect=plat32172

85,000 points, $75 annual fee, not waived (Premier Rewards Visa Signature Card) offer:

http://www.clubcarlsonvisa.com/credi...PremierCard.do

10x on Radisson, 5x else, Gold status. Up to 3 free nights for each $10K spend

60,000 points, $50 annual fee, not waived (Rewards Visa Signature Card) offer:

http://www.clubcarlsonvisa.com/credi...gnatureCard.do

6x on Radisson, 3x else, Silver status. Up to 3 free nights for each $10K spend

30,000 points, $0 annual fee (Rewards Visa Card) offer:

https://www.radissonrewardsvisa.com/credit/visaCard.do

6x on Radisson, 3x else. Up to 3 free nights for each $10K spend

85,000 points, $60 annual fee, not waived (Business Rewards Visa Card) offer:

http://www.clubcarlsonvisa.com/credi...usinessCard.do

10x on Radisson, 5x else, Gold status. Up to 3 free nights for each $10K spend

_______________________________________________

For discussion of posting time on the annual 40k bonus, see this thread: CC visa annual 40,000 points bonus

US Bank Reconsideration Line: 800-947-1444

Use this phone number to check your application status as well. US Bank does not send you an approval/denial email. Many data points show 8-10 business days for decision is normal. Add another 2-3 weeks after that to receive physical card.

U.S. Bank Fraud Department - 800-260-8469. This is the number to call if your card starts getting declined when you try to make a purchase.

Why is the balance due on my business card always shown as $0?

There are TWO account numbers linked to your business card: The card itself, which shows up in the same website account as any personal cards you may have. This will always show a $0 balance due.

There is a SECOND account - labeled the "Central Bill Account" - with its own account number. You must set up a separate website account with its own username and password to access the Central Bill Account. This is the account that will actually show the balance due and let you schedule a payment. Somewhere in the paperwork you received with the card or the first paper invoice, you should be able to find the Central Bill Account's number.

Setting up separate website account for business card:

These are the instructions that US Bank emailed me:

To enroll in Online Banking for your U.S. Bank Business account, start by going to usbank.com. You do not need a Personal Identification Number (PIN) in order to enroll.

Please follow these instructions to enroll in Online Banking to view or pay your account:

1. Click on the Enroll Now link on the right side of the screen.

2. Select the Business Accounts option.

3. View the Terms and Conditions and then select Enroll Now.

4. Select I do not have a U.S. Bank small business checking or savings account.

5. Select I am an authorized officer of a U.S. Bank Business Credit Card.

6. Complete Step 2 of 2.

Once you have successfully logged in, you will be able to view your business account in its entirety. When you are making a payment you will need to select the Accounts Payable account number.

From June 1 2015: free night after $10,000 spend in a year plus payment of annual fee. Note: can only be used in the U.S.

"New Account Bonus is not available to applicants who have had this Card or another Club Carlson credit card product within the last 12 months."

Forex fee is 3%

For complaints about the changes slated for May 2015, try twitter, Facebook, emails to corporate, letter writing, etc.

Facebook: https://www.facebook.com/clubcarlson?fref=ts

Twitter: https://twitter.com/ClubCarlson

USA contact # +1 (888) 288 8889

US Bank Radisson Rewards VISA (discontinued April 2022; cards to be converted)

#887

Join Date: Sep 2011

Posts: 143

I can attest to that as well. Applied Monday, received the 7-10 day message and was fully expecting a rejection letter. To my surprise, I was sent an approval e-mail today. They pulled EQ for me (in CA). 15 inq (2 years), 9 inq (12 months), 4 inq (6 months). 11 new accts in past 12 months.

#888

Join Date: Dec 2009

Location: NYC (often in Thailand, Israel and Sweden)

Programs: Turkish Elite, AA Platinum, Royal Orchid Plus Silver

Posts: 382

I can attest to that as well. Applied Monday, received the 7-10 day message and was fully expecting a rejection letter. To my surprise, I was sent an approval e-mail today. They pulled EQ for me (in CA). 15 inq (2 years), 9 inq (12 months), 4 inq (6 months). 11 new accts in past 12 months.

#889

Join Date: May 2012

Location: SNA

Programs: hilton gold,hyatt

Posts: 208

can we book 2 reservations for 2 nights with 2 days of in between to get 2 award night at same hotel.lets say i check in on Sunday for 2 nights and then 2 nights on my wifes points and then 2nights on my acccount as i have club carlson card.

#890

Join Date: Sep 2011

Location: USA

Posts: 1,179

#891

Join Date: Oct 2011

Posts: 4,166

So I went into a branch to ask about changing my due date. They said the business accounts can have either the 1st or 16th of each month and that's it. Also, they refused to entertain a credit limit increase. I have a $5,000 limit on this Carlson card and an $18,000 limit on my Ink Bold card with other high limit Chase cards. I do have a business and run into the $5,000 limit each month so US Bank is missing out on spend that now goes to Chase. Even with tons of cash in the bank and stellar credit records they could care less.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

#892

Join Date: May 2009

Location: USA

Programs: Marriott Titanium -> United Silver

Posts: 937

So I went into a branch to ask about changing my due date. They said the business accounts can have either the 1st or 16th of each month and that's it. Also, they refused to entertain a credit limit increase. I have a $5,000 limit on this Carlson card and an $18,000 limit on my Ink Bold card with other high limit Chase cards. I do have a business and run into the $5,000 limit each month so US Bank is missing out on spend that now goes to Chase. Even with tons of cash in the bank and stellar credit records they could care less.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

#893

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,762

So I went into a branch to ask about changing my due date. They said the business accounts can have either the 1st or 16th of each month and that's it. Also, they refused to entertain a credit limit increase. I have a $5,000 limit on this Carlson card and an $18,000 limit on my Ink Bold card with other high limit Chase cards. I do have a business and run into the $5,000 limit each month so US Bank is missing out on spend that now goes to Chase. Even with tons of cash in the bank and stellar credit records they could care less.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

They said after a year they'll do a review and if I want the limit raised they can do another hard pull. I'm not sure it's worth it though.

The tough part is, US Bank's site does NOT give any information on Available credit at all - so no way to tell unless calling in to ask for the "number".

It really depends on individual's own needs to determine where to put the spend (in order to earn the particular "currency" that would save one's out of pocket cash.) No one answer suits everyone.

#895

Join Date: Dec 2011

Posts: 122

35k bonus - primary business holder has to spend $2500?

My statement (after cumulative $2500 spend) closed couple of weeks ago and I still have not received the 35k bonus points. Called customer service and was first given a generic response that I need to wait 4 weeks after 3 month period. When I asked him to check if I had met the spend threshold he says I am about $1000 short because as primary holder of business account I have about $1500 spent. Hmm thats a bummer if true, because none of the other major bank issuers seem to count that way.

Anyone got the 35k bonus on their business card with less than $2500 spent as primary holder?

I also wonder if this primary vs secondary spending distinction is true for their personal card (plan to get one in future).

Also how well does US Bank tolerate $1k charges on AP or at CVS?

Anyone got the 35k bonus on their business card with less than $2500 spent as primary holder?

I also wonder if this primary vs secondary spending distinction is true for their personal card (plan to get one in future).

Also how well does US Bank tolerate $1k charges on AP or at CVS?

#896

Join Date: Oct 2011

Posts: 4,166

#897

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,762

The personal account does not show credit line nor available credit as the way other issuers do - AMEX, Citi and Chase all give you that info, not US Bank.

This topic has been discussed at the beginning when this offer came about either on this thread or on the related thread in the Club Carlson forum.

More over, it does not show any pending charges which can take up to 4 or more days to post.

On top of that, there is NO Payment History to be found! Although luckily it does post payment timely.

The Mobil site does show the pending charges and the URL can be accessed via PC. Discussion in the Club Carlson forum's related thread.

In short, US Bank's online banking functions for the credit card side LACK many important features its competitors have.

#898

Join Date: May 2008

Location: ORD

Programs: UA Silver, HH Gold

Posts: 102

I felt creative the other day and tried something. Just for reference, this is an interesting sequence:

Book 1&2

Book 4&5

Book 3

Couldn't be more obviously against terms after the fact... but it technically works. YMMV!!

Book 1&2

Book 4&5

Book 3

Couldn't be more obviously against terms after the fact... but it technically works. YMMV!!

#899

Join Date: Sep 2011

Location: USA

Posts: 1,179

US Bank credit card site is absolutely pathetic. I can't view pending transactions and they take a while to even post the completed transactions. Also, they've yet to credit my payment that was supposedly delivered on 2/27.

/end rant

/end rant