Chase closed my CSR. Why?

#136

Join Date: Sep 2011

Posts: 1,857

In my case, no, all the inquiries are on Experian, not TU (Chase doesn't pull TU in my state). Only ones that do pull TU that I've ever had are Barclays, Citibank, and BofA.

If the singular algorithm is true, then the only difference would be inquiries. At least I've never had a credit card NOT show up on certain reports, same with payments, etc. Now, granted, different banks report on different dates, but even then if you were to check all 3 the first of the month, middle, and end of the month, you shouldn't have a 150 point difference.

In which case, 4 inquiries would equal almost 20% of the OP's score.

This link doesn't show inquiries as being anywhere in the FICO score mix (I don't see inquiries listed anywhere, do you?)

https://www.creditcardinsider.com/bl...%20the%20score.

If the singular algorithm is true, then the only difference would be inquiries. At least I've never had a credit card NOT show up on certain reports, same with payments, etc. Now, granted, different banks report on different dates, but even then if you were to check all 3 the first of the month, middle, and end of the month, you shouldn't have a 150 point difference.

In which case, 4 inquiries would equal almost 20% of the OP's score.

This link doesn't show inquiries as being anywhere in the FICO score mix (I don't see inquiries listed anywhere, do you?)

https://www.creditcardinsider.com/bl...%20the%20score.

As far as the link you provided, the 10% weighting called "New Credit" equates to Inquiries.

https://www.myfico.com/credit-educat...res/new-credit

#137

Join Date: Mar 2008

Posts: 1,536

The FICO Bankcard Score 8 is different model with different weightings and, as you said, a different scale. I'm not sure why you felt the need to add an unnecessary level of complexity to this particular conversation.

If you've compared all your credit reports and they're the same with the exception of inquiries, I'm out of ideas regarding your strange score.

As far as the link you provided, the 10% weighting called "New Credit" equates to Inquiries.

https://www.myfico.com/credit-educat...res/new-credit

If you've compared all your credit reports and they're the same with the exception of inquiries, I'm out of ideas regarding your strange score.

As far as the link you provided, the 10% weighting called "New Credit" equates to Inquiries.

https://www.myfico.com/credit-educat...res/new-credit

But perhaps they (FICO) are being obtuse/vague and its getting lumped into the same bucket (it's their score they can do what they want I suppose).

#138

Join Date: Sep 2011

Posts: 1,857

#139

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

Back to this thread, OP here with an update.

After Chase reinstated my CSR in Sept. 2020, I have successfully applied for 3 more Chase cards.

Chase Freedom

United Quest

Marriott Boundless

I loved 80000 United miles and 60000 Marriott points!

I am still keeping my CSR, but my wife and son closed their CSR due to lack of travel.

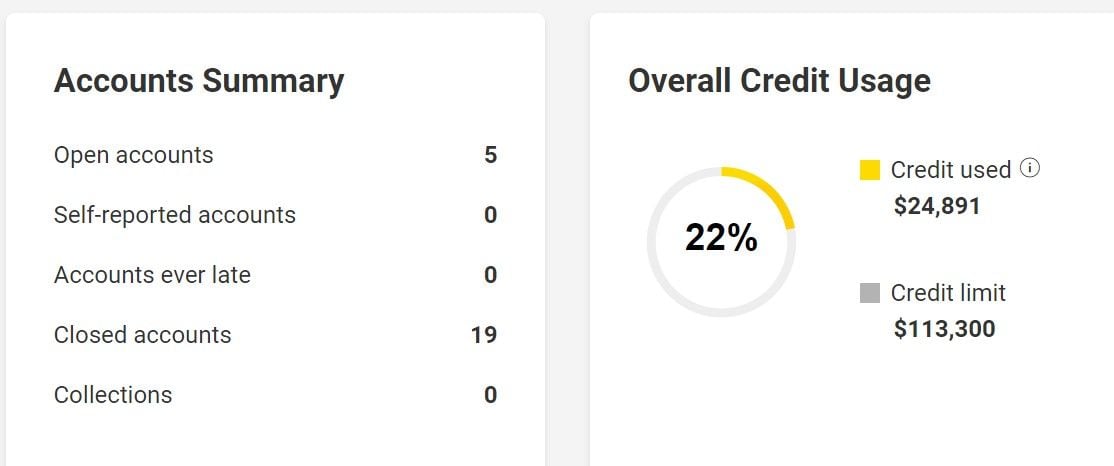

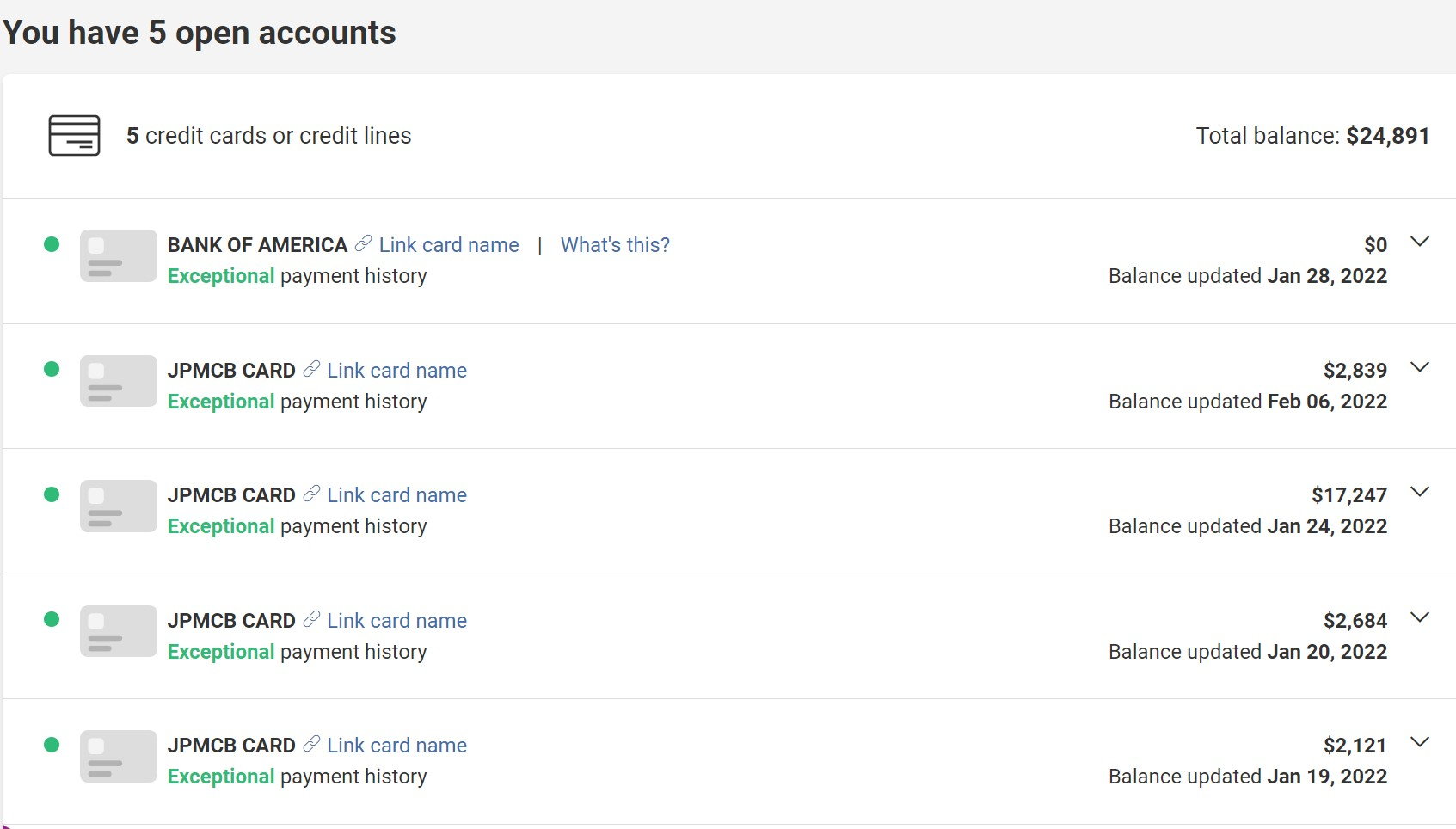

My current balance for 4 Chase cards is over $30,000 with combined credit exceeding $120,000.

However, my credit score is down to 680 from 830. I only have Chase cards. Why?

After Chase reinstated my CSR in Sept. 2020, I have successfully applied for 3 more Chase cards.

Chase Freedom

United Quest

Marriott Boundless

I loved 80000 United miles and 60000 Marriott points!

I am still keeping my CSR, but my wife and son closed their CSR due to lack of travel.

My current balance for 4 Chase cards is over $30,000 with combined credit exceeding $120,000.

However, my credit score is down to 680 from 830. I only have Chase cards. Why?

Your credit report doesn't actually "know" whether you pay your cards every month or not -- it mainly just gets a report of what the balance is when the statement closes on each card. So if you spend a lot each month, even if you pay it after statement close every month and never accrue any interest, your credit report can still look similar to that of someone who is financing large balances over time. Try paying all or most of your balance on each card a day or two before statement close for the next month and see what it does to your score.

Also, I assume you have already checked your credit report in general to make sure there isn't an error or any fraud going on that could affect your score.

ETA: Chase of course knows better your payment habits on their cards than what shows up in your general credit report, so they are using more data than just your credit score to assess your request for a credit line increase. But, Chase also tends to be aggressive with credit lines up front (lots of people got $30K+ on their CSPs and CSRs) but then have a pretty hard target of how much credit they will extend to any one individual, so if you're at that limit it may not be indicative of any broader issue if they won't increase your credit line. They will reallocate available credit among your existing cards if that helps though.

Also, I assume you have already checked your credit report in general to make sure there isn't an error or any fraud going on that could affect your score.

ETA: Chase of course knows better your payment habits on their cards than what shows up in your general credit report, so they are using more data than just your credit score to assess your request for a credit line increase. But, Chase also tends to be aggressive with credit lines up front (lots of people got $30K+ on their CSPs and CSRs) but then have a pretty hard target of how much credit they will extend to any one individual, so if you're at that limit it may not be indicative of any broader issue if they won't increase your credit line. They will reallocate available credit among your existing cards if that helps though.

4 hard inquiries drive down a score from 830 to 680? I think that 4 hard inquiries is unlikely to be a significant driver of the credit score dropping that much -- and it probably would not even amount to a third or quarter of that kind of score drop. But then there are reports like kb1992.

Credit utilization skyrocketing and high total balances are where I'd focus to get the score back up. That is after making sure the accounts and payment history on accounts on file are all solid still.

Credit utilization skyrocketing and high total balances are where I'd focus to get the score back up. That is after making sure the accounts and payment history on accounts on file are all solid still.

That's a 5th credit inquiry, fyi.

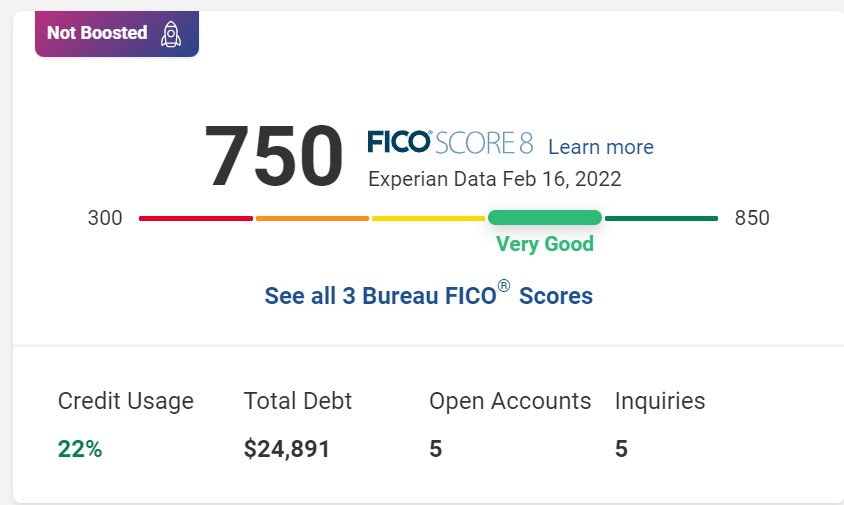

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

I checked my FICO 8 score which is 750. This is significantly better than Chase Credit journey score 694.

I don't see any negative factor other than 5 inquiries and a little high credit use at 22%.

Exceptional payment history is expected because I always pay everything off.

Still surprised by such difference.

#140

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,959

#141

Join Date: Sep 2011

Posts: 1,857

I'm not at all surprised. I place little to no value in monitoring one's VantageScore. It's ultimately a distraction as you have discovered.

#142

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

It's not unusual for a score that Citibank shows its credit card users being different than both of the scores that Amex shows its card users; but often one of those two Amex-shown credit scores matches pretty closely to what the Chase-shown credit score shows for Chase credit card users. Part of these score differences are based on different dates for the scores, but other differences are not.

#143

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

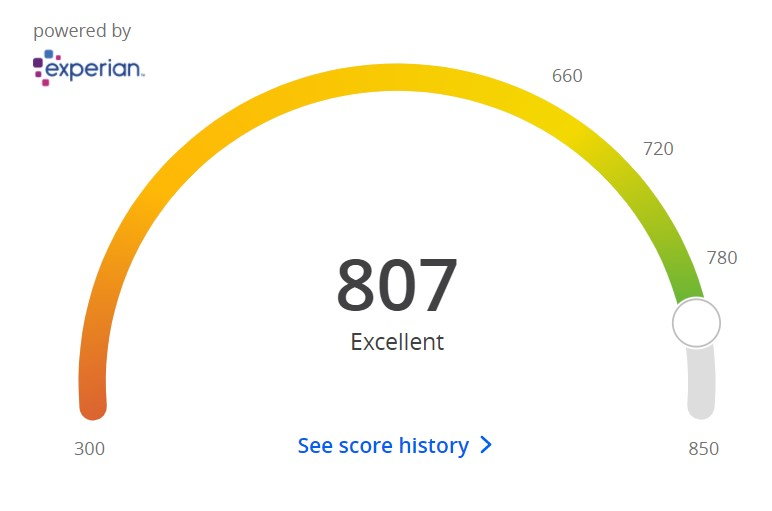

Update: after I paid off most of my balances last week, my Chase Credit Score went up more than 100 points, from 694 to 807.

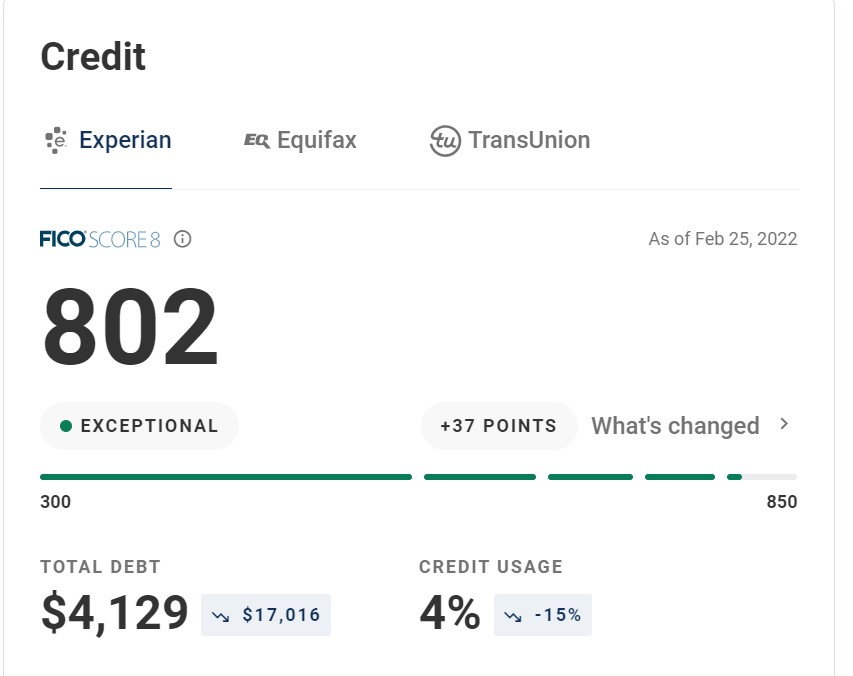

My FICO 8 score also went up from 750 to 802.

#144

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

So you addressed the "credit utilization skyrocketing and high total balances" and the score skyrocketed when improving the credit utilization and total balance aspects of scoring.

About Chase CSR accounts being closed unilaterally by Chase, doesn't Chase use something like Thomson Reuters World Check and things like that at times to close down bank card customers?

About Chase CSR accounts being closed unilaterally by Chase, doesn't Chase use something like Thomson Reuters World Check and things like that at times to close down bank card customers?