Chase closed my CSR. Why?

#121

Join Date: Jan 2017

Posts: 126

I've never used auto-pay for a credit card but theoretically you could reduce this risk with chase to only one day if their auto-pay system allows a choice of payment date for auto-pay.

For example, if a Chase CC has a closing date of the 5th it will ALWAYS be on the 5th, (weekdays, weekends, or holidays).

In this case if you could set the auto-pay date to the 6th of each month the only risk would be if a credit posted on the 6th resulting in a zero or credit balance prior to auto-pay being triggered.

#122

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,763

But the missed payment and the auto-pay are two different things, aren't they? If Chase expects a payment and doesn't get it, that's a missed payment, whether the payment would have come by auto-pay, bill-pay, check, or other means. It is true that I wouldn't find out about it until the payment had been missed, but to my mind that's a lot better than finding out about it a month later or when Chase closes the account.

First, I'm glad you said that, because I had not considered future months, when there might be charges but still a net credit, like the discussion in the other thread. I was only looking at the current month.

But would I need to suspend auto-pay? If I simply pay in full manually before the due date, then auto-pay should draw nothing even if there really had been a balance due. In other words, why wouldn't I want belt and suspenders?

First, I'm glad you said that, because I had not considered future months, when there might be charges but still a net credit, like the discussion in the other thread. I was only looking at the current month.

But would I need to suspend auto-pay? If I simply pay in full manually before the due date, then auto-pay should draw nothing even if there really had been a balance due. In other words, why wouldn't I want belt and suspenders?

On the other hand, our CSR since the PYB in place, the statement balance would soon be wiped out by PYB redemption. Since I do not have Auto Pay, the system does NOT ever require a minimum payment. The card has gone on for 3 months without making any payment after statement closed before payment due date because the balance to pay is wiped out by PYB... Our account has neveer had any hiccup yet, the OP of the other thread got his account shut down, AND there are at least 3 or 4 posters reported the same fate, with some were bumping at stone wall without account reinstatement.

The whole thing boils down to, is Chase design on catching account default from missing payment is seriously flawed - with the flaw usually would not show up UNTIL Pandemic time when so much travel refunds creating negative balances while the card holders continue to use their cards for many things, but the new charges were offset by the travel refunds in subsequent billing cycle, but Chase STILL REQUIRE YOU TO PAY even they actually now owe you money, not the other way round... That STUPID SET UP ONLY MANIFEST ITSELF WHEN AUTOPAY IS SET UP. With manual payment, such STUPIDITY never shows up as it should never require cardmember to pay when the bank actually owes the cardmember money!

#123

Join Date: Feb 2015

Posts: 229

Bank of America allows you to set-up Auto Pay such that payment is made on the same day the statement is generated. Chase should introduce this option. Amex's earliest is 15 days from date of statement generation (would be great if they also have the same option as BofA).

#124

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

Back to this thread, OP here with an update.

After Chase reinstated my CSR in Sept. 2020, I have successfully applied for 3 more Chase cards.

Chase Freedom

United Quest

Marriott Boundless

I loved 80000 United miles and 60000 Marriott points!

I am still keeping my CSR, but my wife and son closed their CSR due to lack of travel.

My current balance for 4 Chase cards is over $30,000 with combined credit exceeding $120,000.

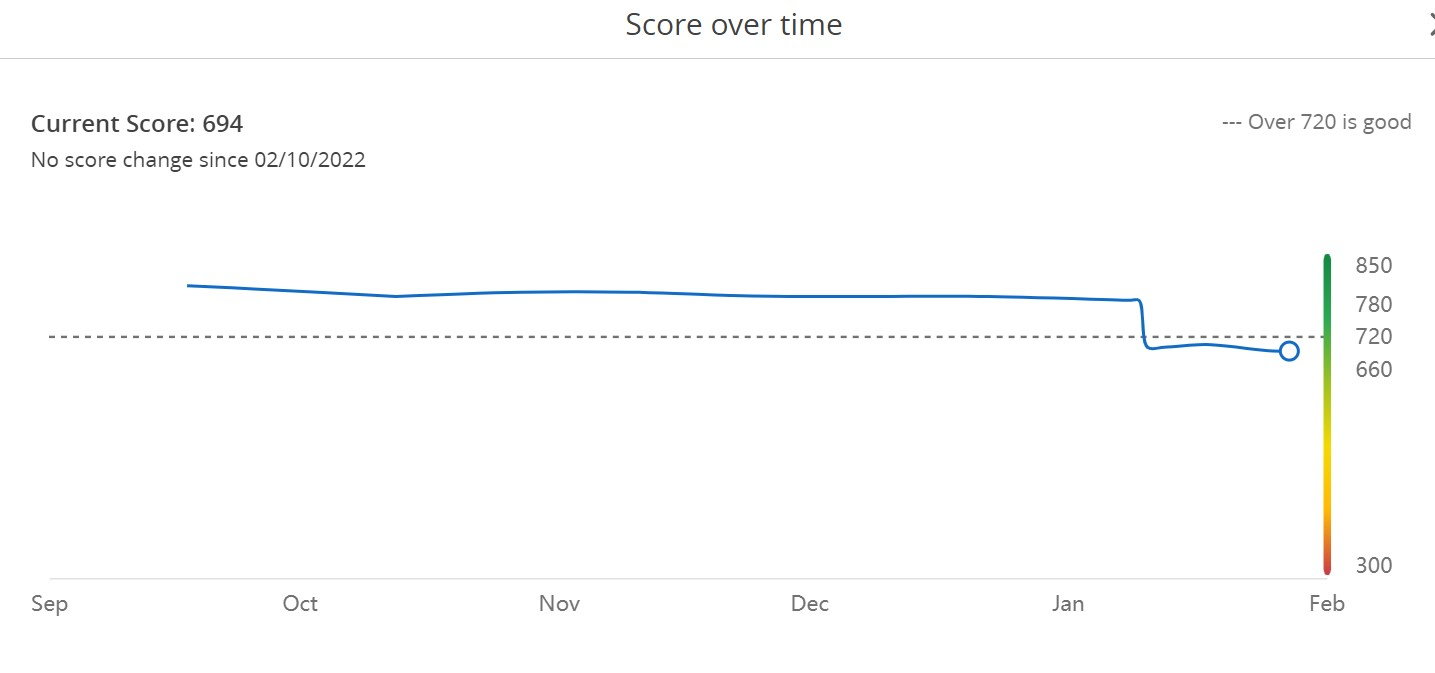

However, my credit score is down to 680 from 830. I only have Chase cards. Why?

After Chase reinstated my CSR in Sept. 2020, I have successfully applied for 3 more Chase cards.

Chase Freedom

United Quest

Marriott Boundless

I loved 80000 United miles and 60000 Marriott points!

I am still keeping my CSR, but my wife and son closed their CSR due to lack of travel.

My current balance for 4 Chase cards is over $30,000 with combined credit exceeding $120,000.

However, my credit score is down to 680 from 830. I only have Chase cards. Why?

#125

Join Date: Apr 2000

Location: HNL,HI,USA

Posts: 256

Your utilization average is 25%. That will affect your score. Check your score again after you pay off the balances on all cards. The 4 hard inquiries in the last 18 months will also affect your score but likely to a lessor degree than the utilization hit. If Chase reported the late payments to the bureaus, that would affect your score, too.

#126

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

Your utilization average is 25%. That will affect your score. Check your score again after you pay off the balances on all cards. The 4 hard inquiries in the last 18 months will also affect your score but likely to a lessor degree than the utilization hit. If Chase reported the late payments to the bureaus, that would affect your score, too.

I always pay off statement balance on time. Never missed a payment.

I did request a credit line increase for my United Quest Card from $25K to $35K, and was denied.

My annual income is $200K.

All of a sudden, my credit score went down by 100 points.

#127

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,051

Also, I assume you have already checked your credit report in general to make sure there isn't an error or any fraud going on that could affect your score.

ETA: Chase of course knows better your payment habits on their cards than what shows up in your general credit report, so they are using more data than just your credit score to assess your request for a credit line increase. But, Chase also tends to be aggressive with credit lines up front (lots of people got $30K+ on their CSPs and CSRs) but then have a pretty hard target of how much credit they will extend to any one individual, so if you're at that limit it may not be indicative of any broader issue if they won't increase your credit line. They will reallocate available credit among your existing cards if that helps though.

Last edited by bgriff; Feb 16, 2022 at 5:19 am

#128

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

Your utilization average is 25%. That will affect your score. Check your score again after you pay off the balances on all cards. The 4 hard inquiries in the last 18 months will also affect your score but likely to a lessor degree than the utilization hit. If Chase reported the late payments to the bureaus, that would affect your score, too.

Credit utilization skyrocketing and high total balances are where I'd focus to get the score back up. That is after making sure the accounts and payment history on accounts on file are all solid still.

Last edited by GUWonder; Feb 16, 2022 at 6:04 am

#129

Join Date: Sep 2011

Posts: 1,857

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

#130

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

#131

Join Date: Mar 2008

Posts: 1,536

That's a 5th credit inquiry, fyi.

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

#132

FlyerTalk Evangelist

Original Poster

Join Date: Jul 2003

Location: BOS, PVG

Programs: United 1K and 1MM, Marriott Ambassador

Posts: 10,000

Your credit report doesn't actually "know" whether you pay your cards every month or not -- it mainly just gets a report of what the balance is when the statement closes on each card. So if you spend a lot each month, even if you pay it after statement close every month and never accrue any interest, your credit report can still look similar to that of someone who is financing large balances over time. Try paying all or most of your balance on each card a day or two before statement close for the next month and see what it does to your score.

Also, I assume you have already checked your credit report in general to make sure there isn't an error or any fraud going on that could affect your score.

ETA: Chase of course knows better your payment habits on their cards than what shows up in your general credit report, so they are using more data than just your credit score to assess your request for a credit line increase. But, Chase also tends to be aggressive with credit lines up front (lots of people got $30K+ on their CSPs and CSRs) but then have a pretty hard target of how much credit they will extend to any one individual, so if you're at that limit it may not be indicative of any broader issue if they won't increase your credit line. They will reallocate available credit among your existing cards if that helps though.

Also, I assume you have already checked your credit report in general to make sure there isn't an error or any fraud going on that could affect your score.

ETA: Chase of course knows better your payment habits on their cards than what shows up in your general credit report, so they are using more data than just your credit score to assess your request for a credit line increase. But, Chase also tends to be aggressive with credit lines up front (lots of people got $30K+ on their CSPs and CSRs) but then have a pretty hard target of how much credit they will extend to any one individual, so if you're at that limit it may not be indicative of any broader issue if they won't increase your credit line. They will reallocate available credit among your existing cards if that helps though.

Never checked my credit report in general. Chase has score for me when I logged on.

Yes, once I asked a raise of credit line, Chase offered to switch some credit from one card to another.

That's a 5th credit inquiry, fyi.

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

What "credit score" are you referring to? Using data from which credit report? A true FICO score is not likely to swing that wildly without a delinquency on your credit report. Have you looked over any of your current credit reports? Check your FICO 8 credit score for free using Experian or Discover Scorecard.

When I log on my Chase account, it has "credit journey" showing credit scores.

I'll check my FICO 8 score today.

4 hard inquiries drive down a score from 830 to 680? I think that 4 hard inquiries is unlikely to be a significant driver of the credit score dropping that much -- and it probably would not even amount to a third or quarter of that kind of score drop. But then there are reports like kb1992.

Credit utilization skyrocketing and high total balances are where I'd focus to get the score back up. That is after making sure the accounts and payment history on accounts on file are all solid still.

Credit utilization skyrocketing and high total balances are where I'd focus to get the score back up. That is after making sure the accounts and payment history on accounts on file are all solid still.

#133

Join Date: Sep 2011

Posts: 1,857

Depends on which bureau. AFAIK, TransUnion is the most heavily weighted when it comes to utilization. I've had as much as a 60 point different (FICO, not the fake ones) between the 3 bureaus with only have ONE card at almost full utilization (total utilization still at 1-2%). And the big point spread was with TransUnion at the bottom (lowest score). I can imagine having 4 cards almost maxed out would really ding some scores. Espeically if they were recently opened cards. But Pay them off next cycle and you should rebound about 80-90%

#134

Join Date: Oct 2004

Location: Indianapolis area

Programs: Marriott Lifetime Titanium

Posts: 436

This makes little sense as FICO 8 is a single algorithm and doesn't care from which bureau it receives its inputs. Different scores from different bureaus is a function of different data on each report, not different math/weighting. One reason for having a lower score on TU could be that TU is the bureau that all of your recent credit inquires pulled from.

#135

Join Date: Mar 2008

Posts: 1,536

This makes little sense as FICO 8 is a single algorithm and doesn't care from which bureau it receives its inputs. Different scores from different bureaus is a function of different data on each report, not different math/weighting. One reason for having a lower score on TU could be that TU is the bureau that all of your recent credit inquires pulled from.

If the singular algorithm is true, then the only difference would be inquiries. At least I've never had a credit card NOT show up on certain reports, same with payments, etc. Now, granted, different banks report on different dates, but even then if you were to check all 3 the first of the month, middle, and end of the month, you shouldn't have a 150 point difference.

In which case, 4 inquiries would equal almost 20% of the OP's score.

This link doesn't show inquiries as being anywhere in the FICO score mix (I don't see inquiries listed anywhere, do you?)

https://www.creditcardinsider.com/bl...%20the%20score.