Last edit by: mia

In April 2020 Chase criteria for approving BUSINESS card applications have become more stringent. All Chase INK products are business cards. Chase also issues co-branded business cards for United Airlines and Southwest Airlines.

Chase business cards are subject to the 5/24 restriction. Approval of a Chase business application has not increased the N/24 count, but there are a few reports in the 4th quarter of 2022 that this may have changed, review THIS thread. There will always be some uncertainty, because 5/24 is an unpublished rule which Chase can modify without notice or explanation.

For general information about applying for Chase cards, including explanation of the unpublished 5/24 rule, please review the Wikipost of the PERSONAL card thread: HERE

Anyone can apply for a business card as a sole proprietor. If your business has a registered company name, which Chase can verify, you may use the name to apply. Otherwise, use your legal First and Last name as the business name. Do not add any extra words, do not use a made up name. If Chase cannot verify the name the application will fail.

Useful Chase telephone numbers

(888) 269-8690 - Business Credit Card Application Status Line, automated

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 453-9719 – Credit Reallocation Office (Business cards)

(888) 622-7547 – Executive Offices

Twitter: @ChaseSupport

Note: In the past, automated telephone status reports stating that Chase would notify you in 2 weeks often resulted in an approval, whereas the "7-10 days" telephone recording often indicated imminent denial. In 2016, this pattern became increasingly unpredictable, with many applicants receiving approval despite an earlier "7-10 days" automated telephone message. As a result, automated telephone responses should not be regarded as reliable indicators of an application's likely outcome.

?? Chase business credit cards [must / may] use [the same / a different] user name [as / from] personal cards. The same [applies / does not apply] to the e-mail address used. ??

Chase business cards are subject to the 5/24 restriction. Approval of a Chase business application has not increased the N/24 count, but there are a few reports in the 4th quarter of 2022 that this may have changed, review THIS thread. There will always be some uncertainty, because 5/24 is an unpublished rule which Chase can modify without notice or explanation.

For general information about applying for Chase cards, including explanation of the unpublished 5/24 rule, please review the Wikipost of the PERSONAL card thread: HERE

Anyone can apply for a business card as a sole proprietor. If your business has a registered company name, which Chase can verify, you may use the name to apply. Otherwise, use your legal First and Last name as the business name. Do not add any extra words, do not use a made up name. If Chase cannot verify the name the application will fail.

Useful Chase telephone numbers

(888) 269-8690 - Business Credit Card Application Status Line, automated

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 453-9719 – Credit Reallocation Office (Business cards)

(888) 622-7547 – Executive Offices

Twitter: @ChaseSupport

Note: In the past, automated telephone status reports stating that Chase would notify you in 2 weeks often resulted in an approval, whereas the "7-10 days" telephone recording often indicated imminent denial. In 2016, this pattern became increasingly unpredictable, with many applicants receiving approval despite an earlier "7-10 days" automated telephone message. As a result, automated telephone responses should not be regarded as reliable indicators of an application's likely outcome.

?? Chase business credit cards [must / may] use [the same / a different] user name [as / from] personal cards. The same [applies / does not apply] to the e-mail address used. ??

Applying for Chase BUSINESS Cards (April 2020 - 2022)

#737

Join Date: May 2022

Posts: 2,263

Chase also will not approve more than 2 applications within 30 days. They will approve 2 but in my experience it is not as easy to get auto approved for more than 1 in 30 days post-covid. Unless you need the points for something specific ASAP I suggest canceling and waiting 30 days before applying, and waiting 30 days between applications.

#739

Join Date: Feb 2016

Location: New York

Programs: Navy A-4 Skyhawk, B727 FE/FO, S80 FO, B757/767 FO, B737 CA

Posts: 1,342

In general you shouldn't apply for a card within 30 days of canceling it. People report getting approved sooner, but 30 days is a safe bet.

Chase also will not approve more than 2 applications within 30 days. They will approve 2 but in my experience it is not as easy to get auto approved for more than 1 in 30 days post-covid. Unless you need the points for something specific ASAP I suggest canceling and waiting 30 days before applying, and waiting 30 days between applications.

Chase also will not approve more than 2 applications within 30 days. They will approve 2 but in my experience it is not as easy to get auto approved for more than 1 in 30 days post-covid. Unless you need the points for something specific ASAP I suggest canceling and waiting 30 days before applying, and waiting 30 days between applications.

Having just said that, I applied for a personal card this morning and, for the first time

Last edited by fredc84; Aug 9, 2022 at 10:05 am

#740

Join Date: May 2022

Posts: 2,263

This is definitely YMMV. I started applying for Chase cards a year ago (as of yesterday, actually) and have never been approved for a card less than 90 days out from the previous card...and this includes both personal and business.

Having just said that, I applied for a personal card this morning and, for the first timethis year ever, I got an automatic approval (it has usually taken about 36 hours until now). It was 91 days since my previous app.

Having just said that, I applied for a personal card this morning and, for the first time

Outside of 1 business card (during the peak of the pandemic, when they were rejecting every business application), I have never not been approved. Including the time I accidently applied for 3 cards in 30 days (February messed me up), a quick recon call got me approved. Between P1+P2 I have successfully opened 18 cards with Chase in the last 3 years.

#741

Join Date: Nov 2011

Location: Iowa

Posts: 730

When you were not approved did you call reconsideration line?

Outside of 1 business card (during the peak of the pandemic, when they were rejecting every business application), I have never not been approved. Including the time I accidently applied for 3 cards in 30 days (February messed me up), a quick recon call got me approved. Between P1+P2 I have successfully opened 18 cards with Chase in the last 3 years.

Outside of 1 business card (during the peak of the pandemic, when they were rejecting every business application), I have never not been approved. Including the time I accidently applied for 3 cards in 30 days (February messed me up), a quick recon call got me approved. Between P1+P2 I have successfully opened 18 cards with Chase in the last 3 years.

#742

Join Date: Sep 2008

Location: AUS

Programs: BAEC Gold, AA PPro, Hyatt Globalist, Amex Plat

Posts: 7,043

#743

Join Date: Feb 2016

Location: New York

Programs: Navy A-4 Skyhawk, B727 FE/FO, S80 FO, B757/767 FO, B737 CA

Posts: 1,342

When you were not approved did you call reconsideration line?

Outside of 1 business card (during the peak of the pandemic, when they were rejecting every business application), I have never not been approved. Including the time I accidently applied for 3 cards in 30 days (February messed me up), a quick recon call got me approved. Between P1+P2 I have successfully opened 18 cards with Chase in the last 3 years.

Outside of 1 business card (during the peak of the pandemic, when they were rejecting every business application), I have never not been approved. Including the time I accidently applied for 3 cards in 30 days (February messed me up), a quick recon call got me approved. Between P1+P2 I have successfully opened 18 cards with Chase in the last 3 years.

I did have another app, two personals about 35 days apart where the 2nd got denied, but I didn't call in for it.

Last edited by fredc84; Aug 9, 2022 at 10:12 am

#744

Join Date: Sep 2005

Location: JZRO

Posts: 9,169

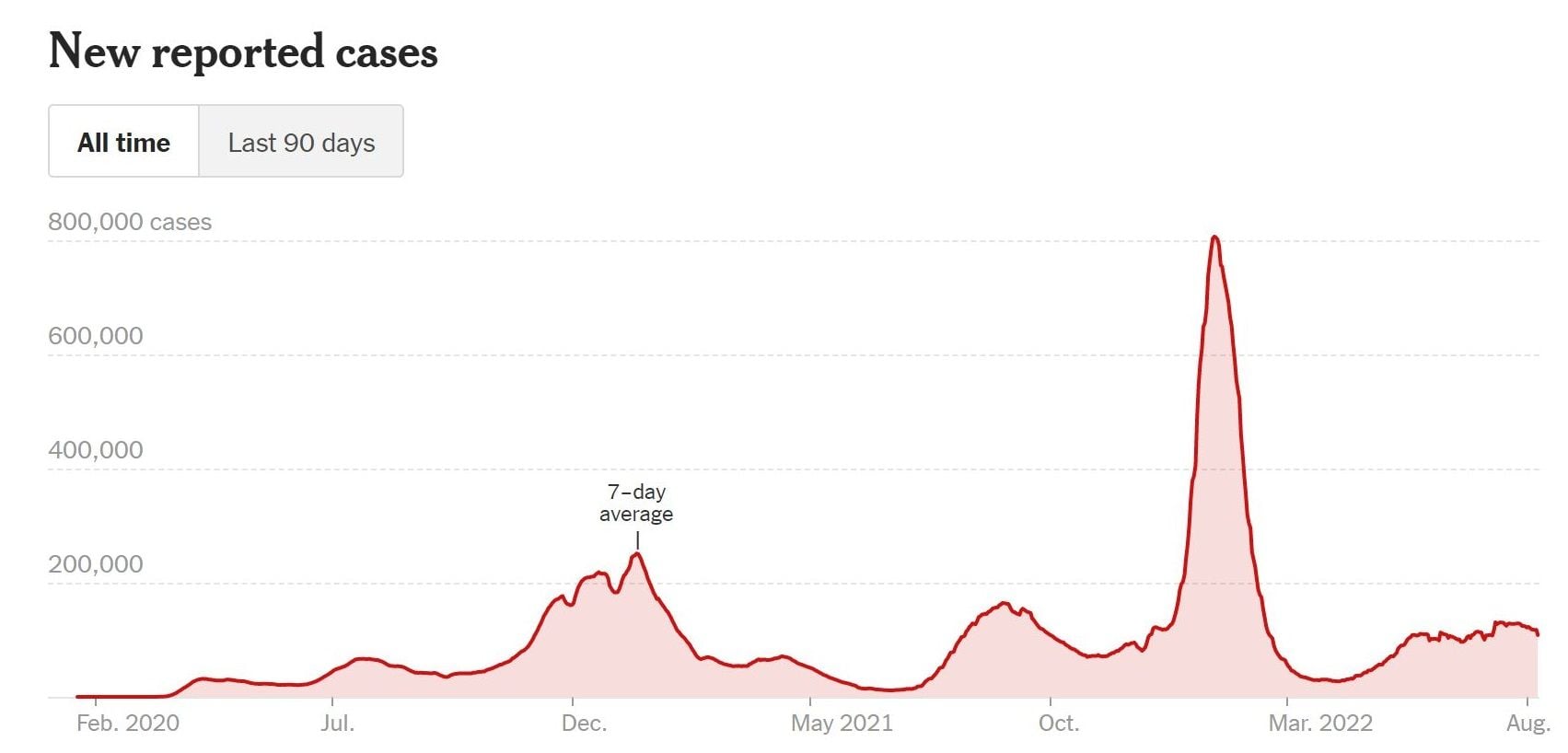

Source: New York Times

#746

Join Date: May 2022

Posts: 2,263

I stand corrected. I went back and looked and I have gotten biz and personals with 90 of each other, but not biz-biz or personal-personal. The last one (Sapph Pref) was just over a month (outside 30 days) after my previous Ink Unlimited and got denied. When I called in, they looked and said I had an app just over a month before, but she resubmitted my app and it was eventually approved.

I did have another app, two personals about 35 days apart where the 2nd got denied, but I didn't call in for it.

I did have another app, two personals about 35 days apart where the 2nd got denied, but I didn't call in for it.

An auto rejection can normally be converted into approval with a quick call

Where's that myth coming from? I was auto-approved for an Ink Unlimited on 1/8/2021 during the first peak in COVID cases, a winter when vaccines, while available, were still scarce and strictly limited, and nobody knew how well or when they'd have any mitigating effect. While there was a greater peak a year later (as the chart shows), that was after widespread vaccinations and vaccine availability, i.e. fewer bad outcomes from infections.

Last edited by Schnit; Aug 9, 2022 at 10:43 am Reason: Adding a second reply

#747

Join Date: Feb 2018

Posts: 89

Quick question - if I have multiple businesses, can each business get chase credit cards and sign up bonuses?

#748

Join Date: May 2022

Posts: 2,263

Never tried opening a co-branded card on more than one business so I cannot speak to that.

#749

Join Date: Sep 2011

Posts: 1,857

There isn't one for Ink cards. You don't even need to close the first one before applying for the second. to be clear, I'm referring to applying for the same flavor of Ink.