Last edit by: jbeckett

American Airlines announced that starting in 2022, the way to earn Elite status has changed. No more Elite Qualifying Miles (EQM), Elite Qualifying Segments (EQS), or Elite Qualifying Dollars (EQD)!

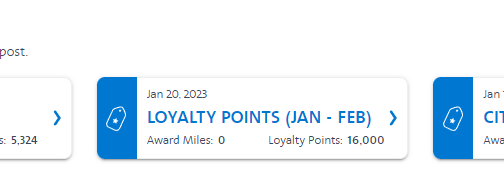

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

How do I earn LPs?

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

Code:

Gold: 40K Platinum: 75K Plat Pro: 125K EXP: 200K

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

- A separate thread exists to discuss the AAdvantage eShopping portal

- Another thread exists to discuss using the portal for a particular merchant, giftcards.com

- For additional questions about buying and using gift cards, refer to the separate Manufactured Spending forum.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Loyalty Points discussion/questions - From 2022 now used for determining elite status

#3946

Join Date: Sep 2000

Location: DCA/IAD

Programs: AA EXP; 1W Emerald; HHonors Diamond; Marriott Gold; UA dirt

Posts: 7,816

#3947

Join Date: Sep 2000

Location: DCA/IAD

Programs: AA EXP; 1W Emerald; HHonors Diamond; Marriott Gold; UA dirt

Posts: 7,816

#3948

Join Date: Aug 2010

Location: LAX oriented World Digital Nomad

Programs: AA Exec Plat, Hyatt Globalist, MLife/Cosmo Identity Gold, Other Vegas too...

Posts: 1,317

Thank you, I went through several of my emails and even tried to find the terms but missed that note somehow. Oh well, Hyatt, RocketMiles and flying it is for me, and AAdvantage only when I need the item anyways and its the cheapest price. Thanks.

#3949

Join Date: Jan 2011

Location: Washington, D.C.

Programs: AA, but I play the field

Posts: 1,440

Then I think you do have to compare that cost to how often you intend, or would like to fly AA going forward. If it's only a handful of flights, $2000 might be better spent purchasing MCE or a higher class ticket than taking a chance on getting an upgrade -- unless you are generating the LPs through organic spend, that's arguably a pretty expensive lottery ticket. Another consideration is whether you will be taking any international flights on AA or other Oneworld airlines. PlatPro (or EXP) will get you international lounge access. But whether that's worthwhile for the price will depend again on your flight plans going forward. There is of course also priority boarding and a free checked bag allowance, but those benefits are potentially available through other less expensive means Good luck!

#3950

Join Date: Aug 2011

Posts: 21

Hm... My statement close on the 3rd of the month. Does that mean, I can start spending after Feb 4th and those transactions will be in March 3rd to count for next year's status.

Credit card miles post by statement, so you can start spending when your February statement posts. So anything you spend in Feb that ends on the statement closing in March would count for 2023 status. My card statement is the 15th of the month so I would get an extra week or two if I was looking to spend strong in the start of the year.

#3951

Join Date: Jul 2021

Location: Dallas, TX

Programs: AA, WN

Posts: 153

#3952

Join Date: Oct 2022

Location: Sub Carolina

Programs: AC, AA, TK, OW Emerald

Posts: 1,335

Credit card miles post by statement, so you can start spending when your February statement posts. So anything you spend in Feb that ends on the statement closing in March would count for 2023 status. My card statement is the 15th of the month so I would get an extra week or two if I was looking to spend strong in the start of the year.

And I'm sure I can persuade myself to try a some wine clubs through the eShopping portal in March as well.

#3955

Join Date: Sep 2020

Programs: AA EXP, BA Gold, VS Gold, Hyatt Globalist, Marriott Platinum, Hilton Diamond

Posts: 3,947

#3956

Join Date: May 2021

Location: PHF/RIC

Programs: AA EXP., UA Silver, Marriott Ti/LT Gold, Sixt P. National EXE

Posts: 55

#3957

Join Date: Jul 2018

Location: SE Wisconsin

Programs: AA EXP, Hilton Diamond for Life

Posts: 337

I am personally VERY unlikely to book a hotel that I do not intend to stay in, however… sometimes my work travel plans change. If I pre-pay a non-refundable room and then have to travel somewhere else, I expect to get those points.

#3958

Join Date: Apr 2007

Posts: 43

I think you have to check-in to the hotel to get the points, right?

#3960

Join Date: Apr 2007

Posts: 43