Last edit by: jbeckett

American Airlines announced that starting in 2022, the way to earn Elite status has changed. No more Elite Qualifying Miles (EQM), Elite Qualifying Segments (EQS), or Elite Qualifying Dollars (EQD)!

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

How do I earn LPs?

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

Code:

Gold: 40K Platinum: 75K Plat Pro: 125K EXP: 200K

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

- A separate thread exists to discuss the AAdvantage eShopping portal

- Another thread exists to discuss using the portal for a particular merchant, giftcards.com

- For additional questions about buying and using gift cards, refer to the separate Manufactured Spending forum.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Loyalty Points discussion/questions - From 2022 now used for determining elite status

#3872

FlyerTalk Evangelist

Join Date: Feb 2001

Location: RDU <|> MMX

Programs: AA EXP 2MM, SK EBS

Posts: 12,481

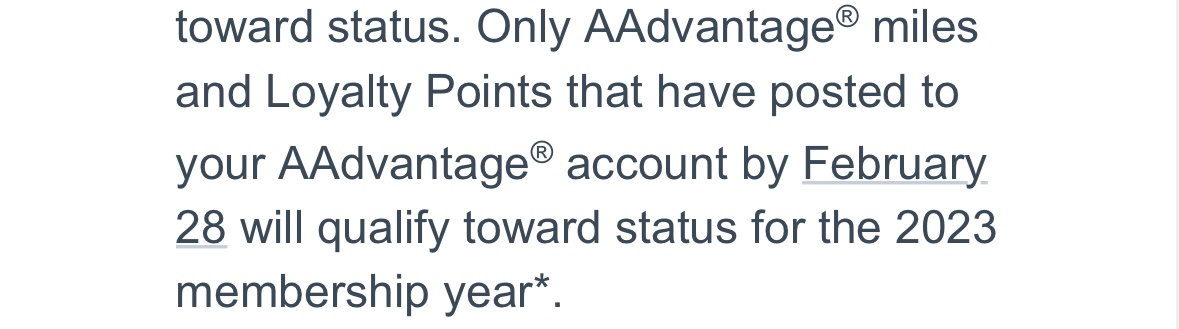

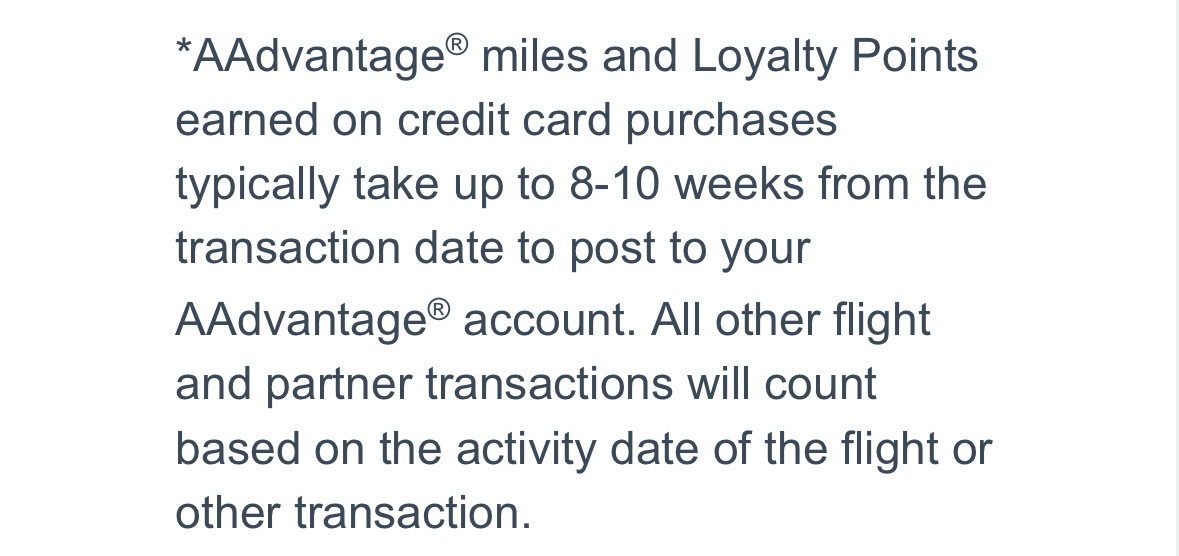

LP's from credit card spend count based on the date they're posted to your AA account each month, not the date of each individual charge. All other LP transactions count based on the date of the individual transaction (flights, hotels, eShopping, etc.).

In order for any credit card spend to count for the current qualifying year, it needs to post to your AA account before 2/28. This will be whenever your February statement closes (or 1-2 days after when it posts to AA).

So if your statement closes on the 15th of each month, you need to make sure any charges are included on the 2/15 statement if you want the LP's to count for this year. Otherwise any charges later in Feb. will post to the 3/15 statement and count towards next year's qualification.

#3873

Join Date: Feb 2009

Location: UK

Posts: 774

So a question for the rest of Jan and Feb for someone already EXP.

My thought is to be booking, checking in and entering lounge etc as AA EXP but then switch FF on the booking to whomever credits the most miles on a per-flight and per-class basis.

Does this make sense? There's nowhere else to go in AAdvantage, I don't need the miles and could use them elsewhere and I don't hate the idea of status in another program as backup.

If so, when and how to change based on others experience? Can you still change online on eg Finnair site after checking in or does it need to be at the Gate?

Any advice appreciated!

My thought is to be booking, checking in and entering lounge etc as AA EXP but then switch FF on the booking to whomever credits the most miles on a per-flight and per-class basis.

Does this make sense? There's nowhere else to go in AAdvantage, I don't need the miles and could use them elsewhere and I don't hate the idea of status in another program as backup.

If so, when and how to change based on others experience? Can you still change online on eg Finnair site after checking in or does it need to be at the Gate?

Any advice appreciated!

#3874

Join Date: Apr 2010

Posts: 1,546

- You cannot accrue partner airline miles with your partner frequent flyer number if you have already used your AAdvantage® number to obtain AAdvantage®program benefits such as First or Business Class upgrades, baggage fee waivers or complimentary access to Preferred/Main Cabin Extra seats. Additionally, you cannot redeem partner airline miles with your partner frequent flyer number and obtain AAdvantage® program benefits such as priority boarding and access to preferred seats.

#3875

Join Date: Jan 2015

Location: NYC

Programs: AA - EXP

Posts: 233

Does anyone have experience regarding the time it will take for Royal Air Maroc to post to AAdvantage? Cutting it close to equal and considering a run to CAI returning 2/22 and want to make sure I don't get caught out!

Thanks!

Thanks!

#3876

Join Date: Mar 2007

Location: ABQ & RNO

Programs: AA EXP 4MM, Piper Dakota, Admirals Club, Hyatt Glob, Hilton Gold, Wyndham Diamond

Posts: 1,426

I don't think it's that confusing, that's exactly what they're saying.

LP's from credit card spend count based on the date they're posted to your AA account each month, not the date of each individual charge. All other LP transactions count based on the date of the individual transaction (flights, hotels, eShopping, etc.).

In order for any credit card spend to count for the current qualifying year, it needs to post to your AA account before 2/28. This will be whenever your February statement closes (or 1-2 days after when it posts to AA).

So if your statement closes on the 15th of each month, you need to make sure any charges are included on the 2/15 statement if you want the LP's to count for this year. Otherwise any charges later in Feb. will post to the 3/15 statement and count towards next year's qualification.

LP's from credit card spend count based on the date they're posted to your AA account each month, not the date of each individual charge. All other LP transactions count based on the date of the individual transaction (flights, hotels, eShopping, etc.).

In order for any credit card spend to count for the current qualifying year, it needs to post to your AA account before 2/28. This will be whenever your February statement closes (or 1-2 days after when it posts to AA).

So if your statement closes on the 15th of each month, you need to make sure any charges are included on the 2/15 statement if you want the LP's to count for this year. Otherwise any charges later in Feb. will post to the 3/15 statement and count towards next year's qualification.

Citi: When they post to your AA account.

Barclay: Date of transaction.

#3877

Join Date: Sep 2002

Location: District of Columbia

Programs: AA ExecPl, AT Gold, Hyatt Globalist, IHG Diamond, Hilton Diamond, National

Posts: 2,440

I don't have the answer to that one, but flights will post with the date of travel as the applicable date, so even if the flight posts after 3/1, it will count toward this year's status. (Of course, that could mean you'd have a few days gap.)

#3878

FlyerTalk Evangelist

Join Date: Feb 2001

Location: RDU <|> MMX

Programs: AA EXP 2MM, SK EBS

Posts: 12,481

#3879

Join Date: Mar 2007

Location: ABQ & RNO

Programs: AA EXP 4MM, Piper Dakota, Admirals Club, Hyatt Glob, Hilton Gold, Wyndham Diamond

Posts: 1,426

#3880

FlyerTalk Evangelist

Join Date: Feb 2001

Location: RDU <|> MMX

Programs: AA EXP 2MM, SK EBS

Posts: 12,481

#3881

Original Member and FlyerTalk Evangelist

Join Date: May 1998

Location: Kansas City, MO, USA

Programs: DL PM/MM, AA ExPlat, Hyatt Glob, HH Dia, National ECE, Hertz PC

Posts: 16,579

For earning the LP tier bonuses transaction date does matter, they post those bonuses separately than the statement.

#3882

Join Date: Mar 2007

Location: ABQ & RNO

Programs: AA EXP 4MM, Piper Dakota, Admirals Club, Hyatt Glob, Hilton Gold, Wyndham Diamond

Posts: 1,426

click on the benefit information footnote at the bottom.

As others have stated, Citi LP count to the period within they post.

#3883

Original Member and FlyerTalk Evangelist

Join Date: May 1998

Location: Kansas City, MO, USA

Programs: DL PM/MM, AA ExPlat, Hyatt Glob, HH Dia, National ECE, Hertz PC

Posts: 16,579

Go to this Barclay Silver AA card application link: https://creditcards.aa.com/barclay-credit-card-aviator-silver-american-airlines-aadvantage/?c=SEM%7CGOOG%7Calways_on%7CMKT%7CUSM%7CTXT%7C%7CU S_US_MKT_Google_PMax_X_EN_X$$&c=SEM%7CGOOG%7Calway s_on%7CMKT%7CUSM%7CTXT%7C%7CUS_US_MKT_Google_PMax_ X_EN_X$$&gclid=Cj0KCQiAq5meBhCyARIsAJrtdr4317qGy5r zcB1Epl5uomrXqOvVS8FcNmGL9XsCji0fou3pUgdXbXAaAglME ALw_wcB

click on the benefit information footnote at the bottom.

As others have stated, Citi LP count to the period within they post.

click on the benefit information footnote at the bottom.

As others have stated, Citi LP count to the period within they post.

I can confirm this is consistent with my earning in January 2022 when my statement closed with both 2021 and 2022 transaction dates, all transactions counted as LP in January 2022. When I earned my most recent tier bonus I was (pleasantly) surprised those bonuses post separately from the statement based on transaction date.

This is also consistent with what KDCAFlyer posted.

#3884

FlyerTalk Evangelist

Join Date: Feb 2001

Location: RDU <|> MMX

Programs: AA EXP 2MM, SK EBS

Posts: 12,481

Go to this Barclay Silver AA card application link: https://creditcards.aa.com/barclay-credit-card-aviator-silver-american-airlines-aadvantage/?c=SEM%7CGOOG%7Calways_on%7CMKT%7CUSM%7CTXT%7C%7CU S_US_MKT_Google_PMax_X_EN_X$$&c=SEM%7CGOOG%7Calway s_on%7CMKT%7CUSM%7CTXT%7C%7CUS_US_MKT_Google_PMax_ X_EN_X$$&gclid=Cj0KCQiAq5meBhCyARIsAJrtdr4317qGy5r zcB1Epl5uomrXqOvVS8FcNmGL9XsCji0fou3pUgdXbXAaAglME ALw_wcB

click on the benefit information footnote at the bottom.

As others have stated, Citi LP count to the period within they post.

click on the benefit information footnote at the bottom.

As others have stated, Citi LP count to the period within they post.

My Barclays posts on the exact closing date and my Citi posts a day or two after.

Looking at the T&C's in that link there's nothing to suggest otherwise. The only context in which the specific card purchase transaction date matters is for the LP bonuses, i.e. spend $50k and get a 15k LP bonus or whatever, but that's something completely different than what we've been discussing.

The T&C's for the Aviator make this pretty clear, from Barclaycardus.com:

All AAdvantage® miles earned by the primary cardmember and any authorized user(s), through use of the Card Account, will be transferred to the primary cardmember’s AAdvantage® Account after the close of each Card Account billing statement.

#3885

Join Date: Mar 2007

Location: ABQ & RNO

Programs: AA EXP 4MM, Piper Dakota, Admirals Club, Hyatt Glob, Hilton Gold, Wyndham Diamond

Posts: 1,426

We're in unchartered ground here with the transition from one LP year to the next. Since I have both the Citi and Barclay cards, I'll withhold Barclay charges until after February.