Letís talk about alternatives to the SPG Amex after the massive Marriott devaluation

#631

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,051

Did you guys see the changes that look like they are coming to the PRG? For those who haven't the revamp looks like it is going to be: 4x Restaurants (possibly US only), 4x Grocery Stores (up to $25k/year), new $120 restuarant credit/year (only usable at specific places, $10/month), will keep the $100 airline credit. I could see myself moving to Amex and using a primary combo of the BBP and PRG.

Personally if Amex is improving its portfolio, I wish the Everyday Preferred would add a restaurant bonus category. I would have no problem hitting 30 transactions a month between frequent lunches out, coffee shop purchases, etc., but I don't necessarily reliably have 30 transactions a month to put on an EP once you exclude dining.

#632

Join Date: Jan 2001

Location: Boston, MA

Programs: AA Lifetime Platinum (3MM), QF Lifetime Gold, Bonvoy Lifetime Platinum, Ex-Hyatt Diamond

Posts: 7,541

For example, I can pay my rent with a credit card, and taxes...that costs about 2%, but I seek to redeem on business and first class international travel at 4-6+ cents per dollar.

SPG offered 1.25 miles/$ with the 25% transfer bonus. But that's now gone,

At a flat 1.5x to MR, which has a large number of airline partners, is there any card that approaches this benefit?

#633

Join Date: Jan 2001

Location: Boston, MA

Programs: AA Lifetime Platinum (3MM), QF Lifetime Gold, Bonvoy Lifetime Platinum, Ex-Hyatt Diamond

Posts: 7,541

If this proves to be a permanent and widespread change, it certainly makes the PRG more attractive (especially relative to its main competitor the CSP/CSR family), but for those who already had the CSR/CSP, PRG, or other common bonus cards and used the SPG Amex for non-bonus spend, it doesn't change much.

Personally if Amex is improving its portfolio, I wish the Everyday Preferred would add a restaurant bonus category. I would have no problem hitting 30 transactions a month between frequent lunches out, coffee shop purchases, etc., but I don't necessarily reliably have 30 transactions a month to put on an EP once you exclude dining.

Personally if Amex is improving its portfolio, I wish the Everyday Preferred would add a restaurant bonus category. I would have no problem hitting 30 transactions a month between frequent lunches out, coffee shop purchases, etc., but I don't necessarily reliably have 30 transactions a month to put on an EP once you exclude dining.

#634

Join Date: Jul 2003

Location: CT/ Germany - Ich spreche deutsch

Programs: UA 1K, Bonvoy LTTE, HH Dia, HY Expl

Posts: 4,657

I'm not sure why you are saying "no matter what" as the 1.5 only applies to your account when you exceed the 30 transactions.

#635

Join Date: Jul 2013

Posts: 107

The more I mess around with this, the more I'm convinced that I should just buy the CFU and get a minimum of $2.25 on the portal.

#636

Join Date: Jul 2013

Posts: 107

I think bgriff was referring to IF the Gold card gives the bonus on dining then he/she would have a hard time hitting the 30 transactions on the EDP card since that is what he/she uses right now for lunches to get over the 30 transactions on the EDP ..... which then kicks in the bonus to get 1.5 MR points on all EVERYDAY purchases.

I'm not sure why you are saying "no matter what" as the 1.5 only applies to your account when you exceed the 30 transactions.

I'm not sure why you are saying "no matter what" as the 1.5 only applies to your account when you exceed the 30 transactions.

#637

Join Date: Jan 2001

Location: Boston, MA

Programs: AA Lifetime Platinum (3MM), QF Lifetime Gold, Bonvoy Lifetime Platinum, Ex-Hyatt Diamond

Posts: 7,541

If he's willing to put his lunch charges on the Crafts, that's 20 or so charges right there. Most people can come up w 10 more charges per month .my understanding is that once you hit 30 charges, you get 1.5x on all your charges that month...thats what I meant by "no matter what."

This seems like the best card/program available by 50 percent.

This seems like the best card/program available by 50 percent.

#638

Join Date: Jul 2003

Location: CT/ Germany - Ich spreche deutsch

Programs: UA 1K, Bonvoy LTTE, HH Dia, HY Expl

Posts: 4,657

If he's willing to put his lunch charges on the Crafts, that's 20 or so charges right there. Most people can come up w 10 more charges per month .my understanding is that once you hit 30 charges, you get 1.5x on all your charges that month...thats what I meant by "no matter what."

On everyday purchases you can also go the route of the Chase Freedom Unlimited which gives you 1.5 if used with a CSR or CS card and you do NOT have to have 30 transactions a month to get the 1.5 points.

You do get the 50% bonus on ALL charges for the month if you achieve the 30 charges on the card in a billing cycle.

Last edited by christianj; Sep 24, 2018 at 7:21 am

#639

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,051

Unless you want to micro manage what card you use for different types of spends, is there any other card that gives 1.5x points convertible into 1.5 miles/$ spend on everyday purchases?

For example, I can pay my rent with a credit card, and taxes...that costs about 2%, but I seek to redeem on business and first class international travel at 4-6+ cents per dollar.

SPG offered 1.25 miles/$ with the 25% transfer bonus. But that's now gone,

At a flat 1.5x to MR, which has a large number of airline partners, is there any card that approaches this benefit?

For example, I can pay my rent with a credit card, and taxes...that costs about 2%, but I seek to redeem on business and first class international travel at 4-6+ cents per dollar.

SPG offered 1.25 miles/$ with the 25% transfer bonus. But that's now gone,

At a flat 1.5x to MR, which has a large number of airline partners, is there any card that approaches this benefit?

Personally I don't have an Everyday Preferred card because I also have & am happy with a Chase Sapphire Reserve card which earns 3x points on dining. So if I got the Everyday Preferred card, I wouldn't move my dining spend to it because that would be a downgrade in earnings. And without the 30 transactions a month, which I wouldn't necessarily have without dining spend, the EP is not attractive for other types of spend, so I can't justify getting it. But if the EP had a bonus on dining (say similar to what it gives on grocery stores), then it would both be attractive for dining by itself, and the transaction volume that dining creates would also ensure it was an attractive card for non-bonus spend.

That said, I would strongly recommend you consider being open to using a mix of 2 or 3 cards, because there are some great opportunities to quickly earn much more than 1.5 miles per dollar out there if you can keep a couple of cards straight.

#640

Join Date: Jul 2003

Location: CT/ Germany - Ich spreche deutsch

Programs: UA 1K, Bonvoy LTTE, HH Dia, HY Expl

Posts: 4,657

Personally I don't have an Everyday Preferred card because I also have & am happy with a Chase Sapphire Reserve card which earns 3x points on dining. So if I got the Everyday Preferred card, I wouldn't move my dining spend to it because that would be a downgrade in earnings.

#641

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,051

I think most would agree !00% but to make sure I get to the 30 transactions a month on the EDP I use the card every morning for my coffee at Starbucks. In the grand scheme of things, I can deal with loosing the 85 additional bonus points I would get using the CSR for those charges vs using the EDP. ($2.82 x 20 days x 1.5 points difference = 85 points) I would never put a larger dining charge on the EDP over the CSR but I have been known to put it on my Hilton Honors Ascend card until I achieve the $15k spend for a free night.

Especially when the CFU can achieve similar results (other than lacking the bonuses on grocery stores and gas stations) without the extra hassle. But, I probably need to bite the bullet on getting either the EP or the CFU soon -- personally I use the Delta Platinum Amex for $25K of non-bonus spend in order to hit the threshold bonus on that card, but I had a few big charges this year and ended up hitting the $25K sooner than I had expected. So with that done I suddenly found myself without an obvious non-bonus card with the SPG Amex now useless.

Part of my dithering on finding a replacement solution has been, as I mentioned somewhere far upthread, that unlike many, I actually liked to use SPG points for hotels, and rarely for airline transfers. And other than Chase UR->Hyatt, there really aren't any attractive ways to earn hotel stays on credit card spend these days. (And even Chase UR->Hyatt is arguably less attractive than other uses of Chase UR points.)

#642

Join Date: Jul 2003

Location: CT/ Germany - Ich spreche deutsch

Programs: UA 1K, Bonvoy LTTE, HH Dia, HY Expl

Posts: 4,657

Part of my dithering on finding a replacement solution has been, as I mentioned somewhere far upthread, that unlike many, I actually liked to use SPG points for hotels, and rarely for airline transfers. And other than Chase UR->Hyatt, there really aren't any attractive ways to earn hotel stays on credit card spend these days. (And even Chase UR->Hyatt is arguably less attractive than other uses of Chase UR points.)

Radisson Rewards US Bank card - IMHO a good alternative for everyday spend if you travel outside of the US as most of their properties in the US are not that great. Decent earning for everyday spend at 5 points per $1 so top redemptions require $15k in spend. Added benefits of up to 3 free nights (for each $10K spend per calendar year) and 40k annual renewal bonus. (Free nights for $10k spend are only good in the US!!!) https://www.radissonrewardsvisa.com/...PremierCard.do

#643

Join Date: Sep 2007

Location: stl

Programs: AA LT Plat/8.1mm now with 1350 miles left in my account and proud of it.. SPG LT Titanium.

Posts: 3,082

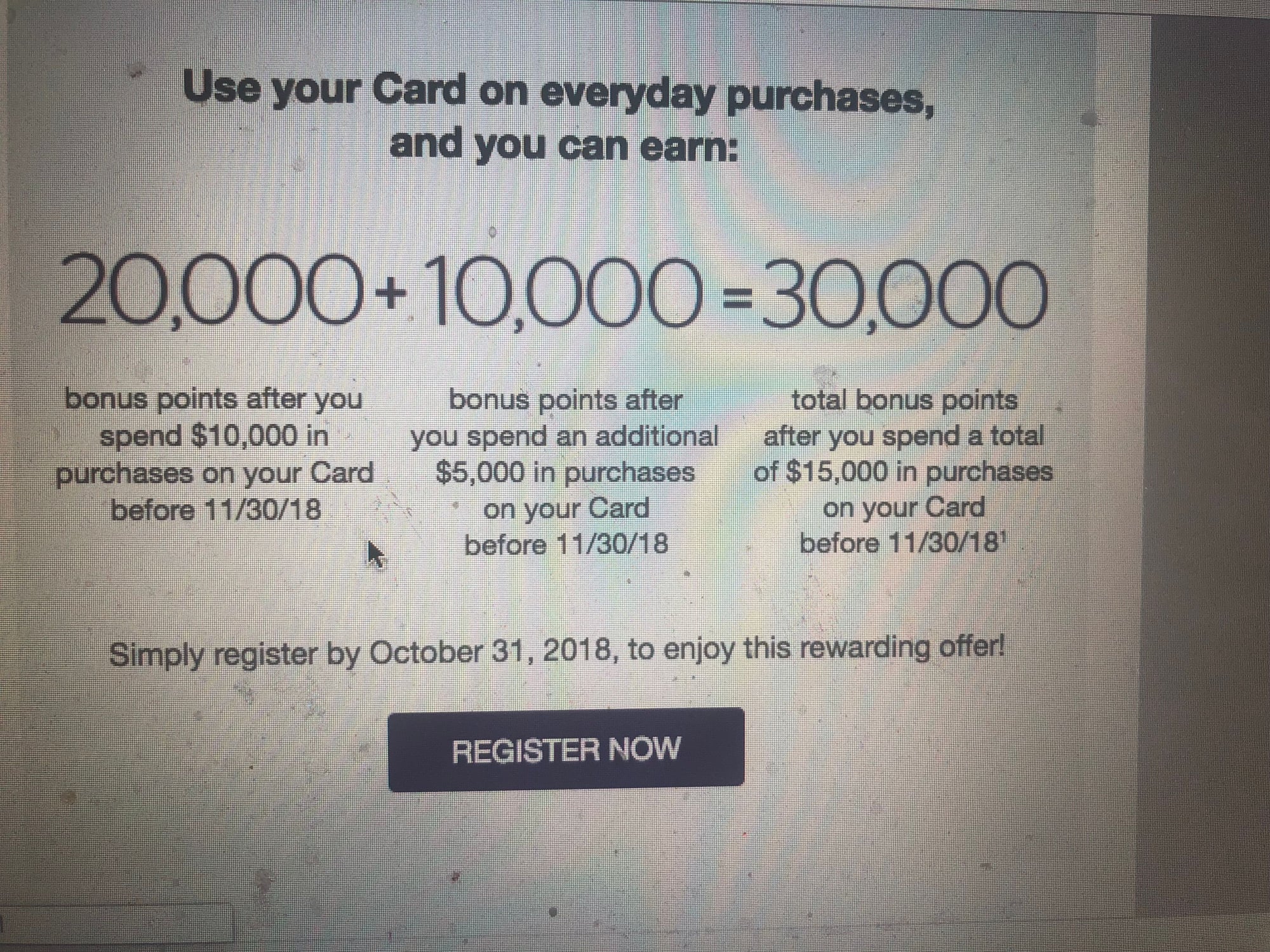

I received this yesterday. Looks like they are realizing that they have lost some major spend. I would do this but 60 days is to tight a window but for 90 I would be all in.

#644

Join Date: Nov 2012

Location: Los Angeles, CA

Programs: SPG, AA, UAL, Hyatt, Amex Plat

Posts: 38

That looks like a solid offer though. I haven't seen it yet unfortunately (also never got an upgrade points offer to move to luxury).

I did however get the offer for bonus points on restaurants and groceries through 10/31.

I did however get the offer for bonus points on restaurants and groceries through 10/31.

#645

Join Date: Jul 2013

Posts: 107

Part of my dithering on finding a replacement solution has been, as I mentioned somewhere far upthread, that unlike many, I actually liked to use SPG points for hotels, and rarely for airline transfers. And other than Chase UR->Hyatt, there really aren't any attractive ways to earn hotel stays on credit card spend these days. (And even Chase UR->Hyatt is arguably less attractive than other uses of Chase UR points.)