Last edit by: NoonRadar

Nov 24, 2015

Dear XXXXXXXXX,

We want to let you know that we are making a change to your Target Prepaid REDcard® by American Express, and you will no longer be able to add money from your debit card at Target stores. As always, you can continue to add money to your Prepaid REDcard by using:

• Your debit card online through your Account

• Cash at a Target Store

• Direct Deposit (You can automatically add all or part of your paycheck, government benefits and federal tax refunds to your Prepaid REDcard)

DEAD FOR DEBIT CARD LOADS EFFECTIVE 10/12/2015 - MEMO: http://frequentmiler.boardingarea.co...uests-can-use/

DEAD FOR CREDIT CARD LOADS. (Amex GCs Included)

Effective May 6, 2015 registers are hard-coded to not allow credit card reload. PIN-based debit cards are working, however YMMV. PIN-based debit cards may be refused by cashiers.

WHAT IS TARGET PREPAID REDCARD?

Prepaid Redcard is a reloadable American Express card. It is only available to purchase at select Target stores.

WEBSITE:

This site may error when in Firefox, especially with adding payees / bill pay. Customer service says to use Chrome or Internet Explorer.

https://amex.serve.com/prepaidredcard

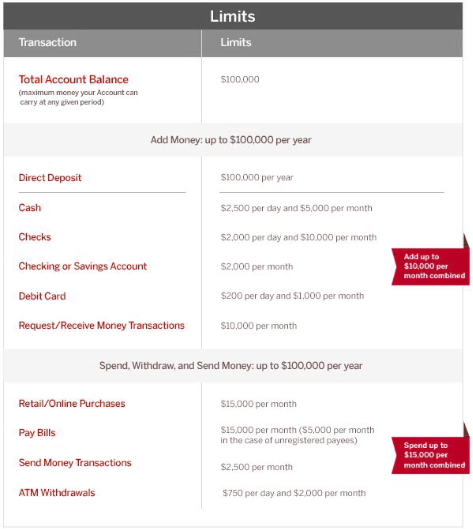

PREPAID REDCARD LOAD LIMITS

Cash (or debit card) loading at Target: ** - $1,000/transaction, $2,500/day and $5,000/month

Online Debit Card Load * - $200/day and $1,000/month

Checking/Savings Account - $2,000/month

Checks - $2,000/day and $10,000/month

ATM Withdrawals - $750/day and $2,000/month

All "Monthly" limits are per calendar month and reset on the 1st of each month.

Daily limits reset at midnight Eastern time, 9 PM Pacific time.

*For online debit load, only use of bank-issued cards is allowed. The use of pre-paid debit cards (Netspend, Paypower, Univision, Paypal, etc.) and VGC/MGC/AGCs is not allowed. Your account will be flagged upon first/second attempt.

ATM Withdrawals:

No-fee ATM usage at US Target stores* and U.S. Allpoint network ATMs. (ATM usage not available at any other ATMs.) Find an Allpoint ATM at: www.allpointnetwork.com Note that some ATMs only allow $400/transaction. There is a $750/day and $2,000/month limit to ATM withdrawals.

RedCard is only available in specific Target stores and is not available in all states. Go to this site to find a list of available locations:https://amex.serve.com/prepaidredcard

FREQUENTLY ASKED QUESTIONS

Q: Can I reload a RB at a Target that doesn't sell RB?

Yes. However, the cashier may not know how to do it. You may be able to coach them through it by saying "It's like reloading a Starbucks (or Gift) card". For step-by-step instructions on one method of 'coaching' new cashiers see Post#1904

Q: Can I buy or reload a RB in North Carolina?

See post here: http://www.flyertalk.com/forum/manuf...a-63.html#2520

There is currently a software issue preventing any reload of any kind in NC. It is a known issue but there is no ETA on a fix.

Q: Can I reload the RB at any register, or just at the Customer Service desk?

It can be done at any register, however some cashiers are not trained on how to do this and you may have to go to Customer Service.

Q: What is the most efficient way to drain a RedCard?

Use BillPay to pay bills. For example, pay the credit card you used to load RedCard with. You can also withdraw money at ATMs.

Q: I cant access the BillPay feature through the RB website!

Verify that your account information correctly reflects a 10-digit phone number (including area code). Numerous people have reported that their account only had a 7-digit phone number (no area code) and that, after updating to a 10-digit phone number, BillPay miraculously started working.

Q: Can we buy a temporary Redbird card while we still have a Bluebird or Serve account?

Yes.

Q: How many Redbird cards can you purchase at once?

You can only purchase one Redbird card a day per SSN. If you plan to purchase more than one, be sure to use a different SSN for each purchase to avoid activation issues.

Q: Can we register our temporary Redbird online while we still have a Bluebird or Serve account?

No. You will have to cancel your Bluebird or Serve account first before registering.

Q: How do I cancel my BlueBird or Serve Account online? Do I need to call them?

Frequent Miler posted a useful trick that will help you cancel online How to cancel Bluebird online This works for both BlueBird and Serve.

Q: Cancelled Bluebird, why does registering Redbird error out saying Bluebird is still active?

If you have open transactions that have not been settled, like BillPay checks that have not yet been cashed, the account cannot settle and will not be truly closed. Thus Target will reject it until it's permanently closed.

Q: Can we get Redbird online?

No. The only way to get Redbird is to find a participating Target store and buy a temporary card there. Some people have purchased RB on Ebay, Amazon, or through private deals. Be aware that doing so may violate the TOS of one or more of these services. Also be aware that buying an un-activated RB, you are potentially buying "stolen" merchandise; the seller *may* have simply taken the un-activated RB cards from a target store without permission. At best they got permission from a low-level employee; they certainly are not getting permission from someone authorized to allow sale of RB outside of the current Target-authorized roll out markets. It is highly recommended to only buy already activated Redbirds because many Targets which do not offer Redbirds also will not be able to activate them and you will spend a month with the Customer Service line trying to get a new one.

Q: Does the initial load you put in when purchasing the Redbird count against the monthly limit?

No. After registering the Redbird online, any loads done will count against your monthly limit, even on your temp card.

Q: Can we load Redbird with Target gift cards at Target?NO.

When loading, the register displays a large message saying that gift cards cannot be used to pay for this transaction.

Q: What are the card’s load limits per transaction at Target?

[B]As of 2/2/2015 there is a maximum $1,000 load per transaction. You can no longer load the same RB multiple times (multiple swipes) in 1 transaction. Likewise, you can no longer load multiple RBs (say your's and your spouse's) in 1 transaction. Maximum of 1 load, for $1,000 per debit card payment. End of story.

Q: What credit cards can I use to reload RedCard in Target stores?

NONE. As of May 6, 2015, credit cards cannot be used to reload.

Q: Can I reload with a debit card?

Yes, but only if the debit card can be authenticated with PIN-number. Signature-based debit that processes on the Visa/MasterCard/AmEx networks will NOT work.

Q: Can I reload with a prepaid debit card or Vanilla Visa?

Yes, but only if you have a PIN for that card.

Q: How can I load 2 debit cards in one transaction? Example 2x$500.

1. Swipe debit card on my terminal after total comes up $1000.

2. PIN pad comes up. Enter 4 digit PIN.

3. Do you want cash back? press NO

4. Do you want full amount on this card? press NO <<<Note: I pressed YES and did not have a step 5. - PHLisa

5. Cashier reads something on register, asks how much on this card. $500. They push something to continue.

6. Swipe card #2. Enter PIN

7. Repeat 3 to 5. Total: 0.00

8. Receipt prints. Thank cashier. The end.

(thanks to Mamibear)

Q: Can someone else buy a Redbird card for you?

Yes. When you buy a temp Redbird card at Target, you have to give them your drivers license info, your SSN (can be any set of numbers, does not need to be real), birthdate, and more. Then, you have to register the card online in order to get a permanent card. In the process of registering online, they ask for the birthday of the original buyer on the first screen, but you can put your own and it will still work. Either way, you can still change the details on the following screens. I did this for my wife. I bought the card at Target and used my own driver’s license, SSN, etc. But, when I got home, I registered the card to my wife. I can’t promise this will work for everyone, but it worked for me.

Q: Can you reload Serve/Bluebird at Target?

No.

Q: How do I contact Target's support team to resolve an issue with my RedCard?

Call Target's Prepaid Resolution Team, their direct telephone number is 800 438 6468 (open from 8AM to 430PM MST).

Q: Can you have both Redbird and AFT cards?

Yes.

You can have both Redbird and AFT since they are independent products.

Q: I got a "Pending" notice that the registration is being reviewed, what now?

Add [email protected] to your address book, and check your spam folder for an email about it. You can also call in. They will need images or faxes of:

• Social Security Documentation (must clearly show full 9 digit Social Security Number). Choose 1 of the following options:

◦ Social Security Card, OR

◦ A Medicare insurance card

Plus...

• Picture ID

◦ A valid driver's license card OR

◦ A valid state issued ID OR

◦ A valid United States Government ID Card (e.g. Green Card) OR

◦ A valid United States Passport (photo page only)

◦ Social Security Card, OR

◦ A Medicare insurance card

Plus...

• Picture ID

◦ A valid driver's license card OR

◦ A valid state issued ID OR

◦ A valid United States Government ID Card (e.g. Green Card) OR

◦ A valid United States Passport (photo page only)

Secure Document Upload

Here's the link to upload secure documents to REDcard: https://secure.prepaidredcard.com/User/SecureFileUpload

Prepaid REDcard (Target) 2015-2016

#1471

Join Date: Sep 2013

Programs: AA Lifetime Gold

Posts: 3,677

Amount TOO SMALL?

I know I've read about people encountering this, but don't remember anyone having a solution. I went to load $2K to my new second RB this afternoon. Tried using my DW's somewhat new HH Res card ($400 in regular spend on it already), and got the weird message "amount too small". CSR thought that was strange, but she was pretty smart, and tried $1500. The computer accepted that, but it didn't go thru do to a FA.

Obviously I couldn't call in on that, since it was my DW's card, so I went to her AMEX Bus Gold that I had intended to load tomorrow. Same message "amount too small". We tried $1500, and that went thru no problem. But of course, trying to load an additional $500 was blocked by a FA.

If it hadn't been the next to last day of the month, because I was using a third card I just got working, none of this would have mattered. I could have just done $1K per day, as OPs above have mentioned. But being so close to the end of the month, I wanted to get the full $5K loaded, and tomorrow I will, regardless of which ccs I need to use.

Two questions:

Does "amount too small" come from Target? Or is it the bank refusing to even try to process a too large amount?

If you get this stupid message, is there a work-around, or do you just have to load a smaller amount?

Obviously I couldn't call in on that, since it was my DW's card, so I went to her AMEX Bus Gold that I had intended to load tomorrow. Same message "amount too small". We tried $1500, and that went thru no problem. But of course, trying to load an additional $500 was blocked by a FA.

If it hadn't been the next to last day of the month, because I was using a third card I just got working, none of this would have mattered. I could have just done $1K per day, as OPs above have mentioned. But being so close to the end of the month, I wanted to get the full $5K loaded, and tomorrow I will, regardless of which ccs I need to use.

Two questions:

Does "amount too small" come from Target? Or is it the bank refusing to even try to process a too large amount?

If you get this stupid message, is there a work-around, or do you just have to load a smaller amount?

#1472

Join Date: Sep 2013

Programs: AA Lifetime Gold

Posts: 3,677

Totally Off Topic

Yes, this is totally off topic for this thread. But there are Eleventy-seven FT threads, and I'm having trouble finding the right one for this question. I'm not even asking for an answer, just for someone to direct me to the best thread to ask this. Ok?

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

#1473

Join Date: Jul 2011

Location: CT

Programs: HH Diamond, Marriott Platinum

Posts: 429

I know I've read about people encountering this, but don't remember anyone having a solution. I went to load $2K to my new second RB this afternoon. Tried using my DW's somewhat new HH Res card ($400 in regular spend on it already), and got the weird message "amount too small". CSR thought that was strange, but she was pretty smart, and tried $1500. The computer accepted that, but it didn't go thru do to a FA.

Obviously I couldn't call in on that, since it was my DW's card, so I went to her AMEX Bus Gold that I had intended to load tomorrow. Same message "amount too small". We tried $1500, and that went thru no problem. But of course, trying to load an additional $500 was blocked by a FA.

If it hadn't been the next to last day of the month, because I was using a third card I just got working, none of this would have mattered. I could have just done $1K per day, as OPs above have mentioned. But being so close to the end of the month, I wanted to get the full $5K loaded, and tomorrow I will, regardless of which ccs I need to use.

Two questions:

Does "amount too small" come from Target? Or is it the bank refusing to even try to process a too large amount?

If you get this stupid message, is there a work-around, or do you just have to load a smaller amount?

Obviously I couldn't call in on that, since it was my DW's card, so I went to her AMEX Bus Gold that I had intended to load tomorrow. Same message "amount too small". We tried $1500, and that went thru no problem. But of course, trying to load an additional $500 was blocked by a FA.

If it hadn't been the next to last day of the month, because I was using a third card I just got working, none of this would have mattered. I could have just done $1K per day, as OPs above have mentioned. But being so close to the end of the month, I wanted to get the full $5K loaded, and tomorrow I will, regardless of which ccs I need to use.

Two questions:

Does "amount too small" come from Target? Or is it the bank refusing to even try to process a too large amount?

If you get this stupid message, is there a work-around, or do you just have to load a smaller amount?

#1474

Join Date: Jul 2011

Location: CT

Programs: HH Diamond, Marriott Platinum

Posts: 429

Yes, this is totally off topic for this thread. But there are Eleventy-seven FT threads, and I'm having trouble finding the right one for this question. I'm not even asking for an answer, just for someone to direct me to the best thread to ask this. Ok?

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

#1475

Join Date: Aug 2010

Posts: 149

Apologize if this has been answered but not finding it... if loading for both my spouse and I, any reason i can't combine $2500 across 3 swipes for my card, then $2500 across 3 swipes for my wife's card, such that I can just swipe 1 credit card for $5000? I have heavy spending history on this card such that i'm not worried about fraud alerts. More concerned about the Target side and whether it will work.

#1476

Join Date: Oct 2014

Posts: 114

Yes, this is totally off topic for this thread. But there are Eleventy-seven FT threads, and I'm having trouble finding the right one for this question. I'm not even asking for an answer, just for someone to direct me to the best thread to ask this. Ok?

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

#1477

Join Date: Jun 2010

Location: PDX

Programs: AA, AS, WN, Marriott, Hilton

Posts: 180

Yes, this is totally off topic for this thread. But there are Eleventy-seven FT threads, and I'm having trouble finding the right one for this question. I'm not even asking for an answer, just for someone to direct me to the best thread to ask this. Ok?

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

My wife's boss wants to get into the miles and points game. But she just got turned down for a Citi Plat AA card because she had a bankruptcy 4 years ago. All she has are mostly worthless ( for building a credit rating) department store ccs. Is there a genuine credit building card she can get before that BK drops off her CR years from now? Maybe one where she puts up a cash deposit to cover her charges? Buehler? Anyone?

PM me if that seems better than posting it here.

https://www.wellsfargo.com/credit-cards/secured/

#1478

Join Date: Nov 2011

Posts: 1,944

Wells Fargo has a secured card. Basically she would deposit some money into a special savings account, and they would give her a card with the same limit as what she deposits in the account.

https://www.wellsfargo.com/credit-cards/secured/

https://www.wellsfargo.com/credit-cards/secured/

#1479

Join Date: Oct 2014

Posts: 14

Tried loading Arrival Plus yesterday and it got declined. Followed up with an attempt with US Airways card which was insta declined too.

Went outside to call and said "I am here in line at Target and am super embarrassed because both of my cards were declined? What's going on, why is this happening? I just want to check out and go home."

Rep was super friendly and unfroze the card. Went back in and it was approved no problem.

We'll see what happens next time.

Went outside to call and said "I am here in line at Target and am super embarrassed because both of my cards were declined? What's going on, why is this happening? I just want to check out and go home."

Rep was super friendly and unfroze the card. Went back in and it was approved no problem.

We'll see what happens next time.

#1480

Join Date: Apr 2014

Posts: 121

Tried loading Arrival Plus yesterday and it got declined. Followed up with an attempt with US Airways card which was insta declined too.

Went outside to call and said "I am here in line at Target and am super embarrassed because both of my cards were declined? What's going on, why is this happening? I just want to check out and go home."

Rep was super friendly and unfroze the card. Went back in and it was approved no problem.

We'll see what happens next time.

Went outside to call and said "I am here in line at Target and am super embarrassed because both of my cards were declined? What's going on, why is this happening? I just want to check out and go home."

Rep was super friendly and unfroze the card. Went back in and it was approved no problem.

We'll see what happens next time.

#1481

Join Date: Jan 2015

Posts: 29

Had a temp card declined at two ATMs yesterday. Had just loaded and withdrew $400 yesterday. Didn't call nor did I get a call. I'm not gonna push it because the card isn't in my name, plus the permanent card shipped shortly there after.

Moral: watch the ATM withdraws.

Moral: watch the ATM withdraws.

#1484

Join Date: Aug 2011

Posts: 100

Had a temp card declined at two ATMs yesterday. Had just loaded and withdrew $400 yesterday. Didn't call nor did I get a call. I'm not gonna push it because the card isn't in my name, plus the permanent card shipped shortly there after.

Moral: watch the ATM withdraws.

Moral: watch the ATM withdraws.

#1485

Join Date: Dec 2014

Location: DFW

Programs: SPG Gold, SW Companion Pass, Hilton Gold

Posts: 128

I do 3 separate transactions when I load. $1k, $1k and then $500, each on a separate credit card. The CSR are always nice and don't seem to care.