Last edit by: percysmith

This is a continuation of this previous thread which contains discussion from 2014 and prior: http://www.flyertalk.com/forum/catha...es-hk-164.html

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

1. BEA Flyer World Master - 1 mile per $5 for local purchases / overseas purchases / Octopus / Bill Payment (Excluding the following categories: Education, Insurance and Tax) (no fee)

2. [From 4 Jan 2016] HSBC Visa Signature for 9X (6X: select one category only below, 1 mile per $4.16 under this promotion, cap at $100,000; plus 3X on all categories, 1 mile per $6.25 cap at $100,000 - total $1 mile per $2.78), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016]

Credit Cards that are by Invitation Only or Applied in lieu with an Account:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16 from 4 Jan 2016. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for dining/travel/dept store, 1 mile per $3 for dining/travel/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16 from 4 Jan 2016. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016] (Need to be HSBC Advance customer)

5. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no fee) (Need to be Citigold Private Client customer AND by Invitation only)

6. SCB Priority Banking Visa Infinite - $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

7. BEA Supreme Gold World Master - 1 mile per $5 for local /overseas / Octopus / Bill Payment (Excluding the following categories: Education, Insurance and Tax) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

8. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

9. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

Full list:

I. Overseas

** ++ 1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (DO NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)

2. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) (no fee) - *registration required*

3. [to 31 Dec 16] (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $75000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles AM min $100)

^ 4. [to 29 Feb 16] Fubon Platinum / Titanium - 1 mile / $3 spent ($50/5,000AM min $250 max $500) (plus 167 Sure win miles if txn amt >$600)

Note: 1 mile per $0.6 for TWD spendings in Taiwan (max $10,000/year), and 1 mile per $1.5 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)

** ++ ^ 5. Citibank Prestige / Premiermiles - 1 mile per $4 spent (no fee)

^ 6. DBS Black World Master / Amex - 1 mile per $4 spent overseas (no fee)

** ++ 7. Amex CX Elite - 1 mile per $4 spent (automatic conversion)

^ 8. BEA Flyer World Master / Supreme Gold World Master - 1 mile per $5 (no fee)

9. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles AM min $100)

** 10. [from 2 May 14] SCB Priority Banking Visa Infinite - 1 mile per $5 spent ($300 flat fee redemption)

^: DO NOT Award points for DCC Transactions

II. Supermarket, dept store, Telecommunications bills on autopay:

** ++1A . [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1B. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1C. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++2. Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2

3. [to 31 Dec 16] (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $75000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles AM min $100)

III. Dining

** ++1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1b. [From 4 Jan 2016] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)

** ++1c. [From 4 Jan 2016] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions)

2. DBS Platinum (Excluding ALL Co-Branded cards and Compass Cards) / Eminent - 1 mile / $5 ($50 per 5,000 miles redeemed, max $300)

3. BEA Flyer World Master - 1 mile / $5 (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) + 4%selected rebate (with HK Airline, HK Express, Zuji, Priceline) (no fee) - *registration required*

3. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)2. [to 31 Dec 16]

V. Other retail spending

1. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) (no fee) - *registration required*

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE or PAYWAVE Spending ONLY, else $15 per mile)

3. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent (no fee) Note 3

** 4. SCB WorldMiles AE - 1 mile per $5 spent ($300 flat redemption fee)

** ++ 5. Citibank Prestige - 1 mile per $6 spent (no fee)

6. Amex CX Elite - 1 mile per $6 spent (automatic conversion)

7. DBS Black World Master - 1 mile per $6 spent (no fee)

8. [to 28 Feb 16] Fubon Platinum / Titanium - 1 mile per $6 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 167 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 9. SCB Priority Banking Visa Infinite - 1 mile per $7.5 spent ($300 flat redemption fee)

109. CCB HK Premier Banking Visa Infinite - 1 mile per $7.5 spent ($50 per 5,000 miles AM min $100)

** ++ 11. Amex (Gold grade and higher) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops)

** ++ 12. Citibank Premiermiles - 1 mile per $8 spent (no fee)

13. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments (EXCLUDING Insurance and Education)

1. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent on bill payment (Excluding the following categories: Education, Insurance) (no fee) Note 3

2. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

3. Fubon Platinum / Titanium - 1 mile per $12 spent ($50/5,000AM min $250 max $500) (pre-registration required w.e.f. 15 Apr 2014)

4. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

6. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

7. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

VI B. Education Bill Payments

1. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

2. Fubon Platinum / Titanium - 1 mile per $12 spent ($50/5,000AM min $250 max $500) (pre-registration required w.e.f. 15 Apr 2014)

4. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

5. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

6. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

VI C. Insurance Bill Payments

1. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

1. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 2. Citibank Prestige - 1 mile per $6 spent (no fee)

3. Bankcomm Diamond Dual Currency Card - 1 mile per HK$6 spent for $500 recharges, 1 mile per HK$12 spent for $250 recharges ($100 flat redemption fee)

** 4. SCB Priority Banking Visa Infinite - 1 mile per $7.5 spent ($300 flat redemption fee)

5. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

VIII. China Unionpay RMB spending

** ++1. [From 4 Jan 2016] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($100 flat redemption fee)

3. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

Note 2:

** can opt for Krisflyer miles in lieu

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

1. BEA Flyer World Master - 1 mile per $5 for local purchases / overseas purchases / Octopus / Bill Payment (Excluding the following categories: Education, Insurance and Tax) (no fee)

2. [From 4 Jan 2016] HSBC Visa Signature for 9X (6X: select one category only below, 1 mile per $4.16 under this promotion, cap at $100,000; plus 3X on all categories, 1 mile per $6.25 cap at $100,000 - total $1 mile per $2.78), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016]

Credit Cards that are by Invitation Only or Applied in lieu with an Account:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16 from 4 Jan 2016. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for dining/travel/dept store, 1 mile per $3 for dining/travel/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16 from 4 Jan 2016. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2016] (Need to be HSBC Advance customer)

5. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no fee) (Need to be Citigold Private Client customer AND by Invitation only)

6. SCB Priority Banking Visa Infinite - $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

7. BEA Supreme Gold World Master - 1 mile per $5 for local /overseas / Octopus / Bill Payment (Excluding the following categories: Education, Insurance and Tax) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

8. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

9. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

Full list:

I. Overseas

** ++ 1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (DO NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)

2. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) (no fee) - *registration required*

3. [to 31 Dec 16] (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $75000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles AM min $100)

^ 4. [to 29 Feb 16] Fubon Platinum / Titanium - 1 mile / $3 spent ($50/5,000AM min $250 max $500) (plus 167 Sure win miles if txn amt >$600)

Note: 1 mile per $0.6 for TWD spendings in Taiwan (max $10,000/year), and 1 mile per $1.5 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)

** ++ ^ 5. Citibank Prestige / Premiermiles - 1 mile per $4 spent (no fee)

^ 6. DBS Black World Master / Amex - 1 mile per $4 spent overseas (no fee)

** ++ 7. Amex CX Elite - 1 mile per $4 spent (automatic conversion)

^ 8. BEA Flyer World Master / Supreme Gold World Master - 1 mile per $5 (no fee)

9. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles AM min $100)

** 10. [from 2 May 14] SCB Priority Banking Visa Infinite - 1 mile per $5 spent ($300 flat fee redemption)

^: DO NOT Award points for DCC Transactions

II. Supermarket, dept store, Telecommunications bills on autopay:

** ++1A . [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1B. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1C. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++2. Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2

3. [to 31 Dec 16] (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $75000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles AM min $100)

III. Dining

** ++1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)

** ++1b. [From 4 Jan 2016] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)

** ++1c. [From 4 Jan 2016] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions)

2. DBS Platinum (Excluding ALL Co-Branded cards and Compass Cards) / Eminent - 1 mile / $5 ($50 per 5,000 miles redeemed, max $300)

3. BEA Flyer World Master - 1 mile / $5 (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [From 4 Jan 2016] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) + 4%selected rebate (with HK Airline, HK Express, Zuji, Priceline) (no fee) - *registration required*

3. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)2. [to 31 Dec 16]

V. Other retail spending

1. [to 30 April 16] (if online) DBS Eminent - 1 mile per $15 + 6% spending credit rebate (Minimum any spending (online spending inclusive) $5,000 per month, maximum rabate $300 (i.e.online spending $5,000) per month) (no fee) - *registration required*

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE or PAYWAVE Spending ONLY, else $15 per mile)

3. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent (no fee) Note 3

** 4. SCB WorldMiles AE - 1 mile per $5 spent ($300 flat redemption fee)

** ++ 5. Citibank Prestige - 1 mile per $6 spent (no fee)

6. Amex CX Elite - 1 mile per $6 spent (automatic conversion)

7. DBS Black World Master - 1 mile per $6 spent (no fee)

8. [to 28 Feb 16] Fubon Platinum / Titanium - 1 mile per $6 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 167 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 9. SCB Priority Banking Visa Infinite - 1 mile per $7.5 spent ($300 flat redemption fee)

109. CCB HK Premier Banking Visa Infinite - 1 mile per $7.5 spent ($50 per 5,000 miles AM min $100)

** ++ 11. Amex (Gold grade and higher) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops)

** ++ 12. Citibank Premiermiles - 1 mile per $8 spent (no fee)

13. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments (EXCLUDING Insurance and Education)

1. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent on bill payment (Excluding the following categories: Education, Insurance) (no fee) Note 3

2. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

3. Fubon Platinum / Titanium - 1 mile per $12 spent ($50/5,000AM min $250 max $500) (pre-registration required w.e.f. 15 Apr 2014)

4. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

6. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

7. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

VI B. Education Bill Payments

1. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

2. Fubon Platinum / Titanium - 1 mile per $12 spent ($50/5,000AM min $250 max $500) (pre-registration required w.e.f. 15 Apr 2014)

4. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

5. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

6. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

VI C. Insurance Bill Payments

1. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite/BoC Platinum Visa/BoC Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. [From 4 Jan 2016] HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Green Card - 1 mile per $25 spent

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

1. BEA Flyer World Master / BEA Supreme Gold World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 2. Citibank Prestige - 1 mile per $6 spent (no fee)

3. Bankcomm Diamond Dual Currency Card - 1 mile per HK$6 spent for $500 recharges, 1 mile per HK$12 spent for $250 recharges ($100 flat redemption fee)

** 4. SCB Priority Banking Visa Infinite - 1 mile per $7.5 spent ($300 flat redemption fee)

5. CCB HK Visa Infinite - 1 mile per $8 spent ($50 per 5,000 miles AM min $100)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

VIII. China Unionpay RMB spending

** ++1. [From 4 Jan 2016] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($100 flat redemption fee)

3. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

Note 2:

** can opt for Krisflyer miles in lieu

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

Best credit card conversion rate to Asiamiles (HK) - 2015

#676

Join Date: Jan 2014

Programs: CX DM, TK Elite, Hilton DM, Shangrila DM

Posts: 32

Advice on new primary asia miles earning card

Sorry about this but I seem to have trouble finding the wiki now. Can percysmith or a frequent poster kindly direct me to the latest version of it? I need to consult it for advice on changing my primary asia miles earning card. I have previously been using the Citibank Ultima card but have found the service and benefits level dropping quite substantially so don't plan on renewing this year. I have a HSBC card with the 6x allocated for dining so need a card for everything else. Not too disciplined so planning for just 1 more card to use for everything else instead of a few more targeted cards. Missus will kill me if I try to complicate things further. LOL!!! I do hold the SCB Wordlmiles card but not sure if that works well as a replacement. Advice very much appreciated and thanks in advance to the wise sages on this forum.

#677

Join Date: Jul 2015

Posts: 92

It doesn't matter for Citi Prestige welcome offer if you're not a Citi new customer cos you get the same welcome offer for being an existing customer anyway.

But it does count for Citi Rewards.

I wouldn't churn.

Just apply for Rewards and Prestige now for the normal earn rates. Bear in mind you're only getting 15K AM for the $2,500 annual fee, and 20K AM per renewal thereafter (unless Citi changes the renewal gift again).

Citi welcome offers are getting worse and worse, there's no guarantee the 150K point offer will be here this time next year.

But it does count for Citi Rewards.

I wouldn't churn.

Just apply for Rewards and Prestige now for the normal earn rates. Bear in mind you're only getting 15K AM for the $2,500 annual fee, and 20K AM per renewal thereafter (unless Citi changes the renewal gift again).

Citi welcome offers are getting worse and worse, there's no guarantee the 150K point offer will be here this time next year.

Sorry i meant the Citibank PremierMiles card. The welcome offer is 8000 miles.

Should I churn or no?

#678

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

#679

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

Sorry about this but I seem to have trouble finding the wiki now. Can percysmith or a frequent poster kindly direct me to the latest version of it? I need to consult it for advice on changing my primary asia miles earning card. I have previously been using the Citibank Ultima card but have found the service and benefits level dropping quite substantially so don't plan on renewing this year. I have a HSBC card with the 6x allocated for dining so need a card for everything else. Not too disciplined so planning for just 1 more card to use for everything else instead of a few more targeted cards. Missus will kill me if I try to complicate things further. LOL!!! I do hold the SCB Wordlmiles card but not sure if that works well as a replacement. Advice very much appreciated and thanks in advance to the wise sages on this forum.

#680

Join Date: Jan 2014

Programs: CX DM, TK Elite, Hilton DM, Shangrila DM

Posts: 32

Hahaha. Thanks very much. The full site was the answer. Not sure why my Mac kept sending me to the mobile site. And there I was thinking the website revamp was not to my liking. Thanks v much.

#681

Join Date: Jan 2014

Programs: CX DM, TK Elite, Hilton DM, Shangrila DM

Posts: 32

And the answer is ... BEA Flyer World Master

Sorry about this but I seem to have trouble finding the wiki now. Can percysmith or a frequent poster kindly direct me to the latest version of it? I need to consult it for advice on changing my primary asia miles earning card. I have previously been using the Citibank Ultima card but have found the service and benefits level dropping quite substantially so don't plan on renewing this year. I have a HSBC card with the 6x allocated for dining so need a card for everything else. Not too disciplined so planning for just 1 more card to use for everything else instead of a few more targeted cards. Missus will kill me if I try to complicate things further. LOL!!! I do hold the SCB Wordlmiles card but not sure if that works well as a replacement. Advice very much appreciated and thanks in advance to the wise sages on this forum.

#682

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

Ok, looks like I will be applying for the BEA Flyer World Master. It is only 1HKD more per mile compared to my Ultima card. Just could not justify paying the fee further for it considering the card services and benefits have gotten worse and worse since I joined on its launch (or relaunch in present form). The BEA card combined with the HSBC card for dining, should still net me quite a lot of miles so that I can continue to upgrade for the long hauls. Thanks.

Last year's deal was 120,000 AM and $4/mile for $23,800 http://www.hongkongcard.com/forum/fo...w.php?id=13230 #2

If you value miles at $0.1, and the best substitute V/M we had was $6/mile back then (DBS Black), you needed $1.4M annual spend to breakeven.

Now we have the Flyer World ($5/mile), the breakeven has gone up to $2.36M.

But have they also changed the 2014 deal (120,000 AM and $4/mile for $23,800) as well?

#683

Join Date: Jan 2014

Programs: CX DM, TK Elite, Hilton DM, Shangrila DM

Posts: 32

Just curious, what's the current deal now?

Last year's deal was 120,000 AM and $4/mile for $23,800 http://www.hongkongcard.com/forum/fo...w.php?id=13230 #2

If you value miles at $0.1, and the best substitute V/M we had was $6/mile back then (DBS Black), you needed $1.4M annual spend to breakeven.

Now we have the Flyer World ($5/mile), the breakeven has gone up to $2.36M.

But have they also changed the 2014 deal (120,000 AM and $4/mile for $23,800) as well?

Last year's deal was 120,000 AM and $4/mile for $23,800 http://www.hongkongcard.com/forum/fo...w.php?id=13230 #2

If you value miles at $0.1, and the best substitute V/M we had was $6/mile back then (DBS Black), you needed $1.4M annual spend to breakeven.

Now we have the Flyer World ($5/mile), the breakeven has gone up to $2.36M.

But have they also changed the 2014 deal (120,000 AM and $4/mile for $23,800) as well?

#684

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

Thanks for response.

Okay, at least it's not devalued like Prestige.

Recently it's like impossible http://www.flyertalk.com/forum/catha...l#post25138043 . You're more likely to get an op-up than upgrade <-- so I get why you don't need to pay CX (indirectly) for miles

Visa Infinite concierge not Ten (like Prestige)? IMHO Ten > VI concierge

I think one of the down factors for Ultima this year is Flyer World closed the earn gap - you needed only $1.4M local spend for breakeven in 2014. It's $2.36M now.

Okay, at least it's not devalued like Prestige.

I think one of the down factors for Ultima this year is Flyer World closed the earn gap - you needed only $1.4M local spend for breakeven in 2014. It's $2.36M now.

Last edited by percysmith; Jul 20, 2015 at 10:02 pm

#685

Join Date: Jun 2008

Location: DUS

Posts: 318

I know this thread is about Asia Miles and not Avios but somehow I am not very tempted by the BEA World Flyer @5$/mile vs. the Dah Sing BA card @6$/mile for "other spend" given the much higher value of Avios.

To me, Avios are ~42% more valuable than AM if only talking about redemptions up to 4,000 flown miles one-way (beyond that, AM wins, especially if you want stopovers instead of simple non-stops). I made a spreadsheet with CX/KA routes ex-HKG (n=45) up to 4,000 miles and Avios beat AM every time, with PER and CNS being the lowest by "only" 13% less miles needed while for example BOM needs 80% less Avios than AM.

Side by side, the Dah Sing generates 21% more value to me despite the lower earn rate. Am I overlooking something great about this card or is it just that BA cards are out of competition in this thread?

Also, given that BA just devalued their award chart earlier this year with no effect to the zones where BA are most valuable, thus no devaluation is too likely in the near future, yet we can anticipate a devaluation of AM in the coming 6-8 months, I'm trying to hold off on investing into AM too much as well.

To me, Avios are ~42% more valuable than AM if only talking about redemptions up to 4,000 flown miles one-way (beyond that, AM wins, especially if you want stopovers instead of simple non-stops). I made a spreadsheet with CX/KA routes ex-HKG (n=45) up to 4,000 miles and Avios beat AM every time, with PER and CNS being the lowest by "only" 13% less miles needed while for example BOM needs 80% less Avios than AM.

Side by side, the Dah Sing generates 21% more value to me despite the lower earn rate. Am I overlooking something great about this card or is it just that BA cards are out of competition in this thread?

Also, given that BA just devalued their award chart earlier this year with no effect to the zones where BA are most valuable, thus no devaluation is too likely in the near future, yet we can anticipate a devaluation of AM in the coming 6-8 months, I'm trying to hold off on investing into AM too much as well.

#686

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

I used Dah Sing BA as my "other" card for much of last year, but I was earning Avios far faster than my ability to spend them down.

I switched to the BEA Flyer World as my main "other" card pretty soon after it was released. I burn far more AM than Avios due to larger requirements for LH redemptions, even tho by number of trips Avios and AM are 1-1.

I only earn Avios when there is a 20% redemption bonus over AM eg Citi in May, HSBC now.

I switched to the BEA Flyer World as my main "other" card pretty soon after it was released. I burn far more AM than Avios due to larger requirements for LH redemptions, even tho by number of trips Avios and AM are 1-1.

I only earn Avios when there is a 20% redemption bonus over AM eg Citi in May, HSBC now.

#688

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

I think primarily hongkongcard.com. I don't think Citi printed a pamphlet to advertise the 20%

#689

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,803

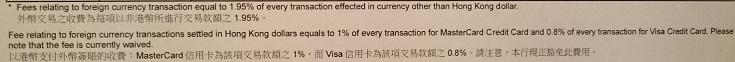

CCB officially puts the 0.8% cross-border fee on hold

http://www.hongkongcard.com/forum/forum_show.php?id=11968&p=1

Change of T&C notice from CCB w.e.f. 1 Jun 14:

"3.1 Cross Border Transactions in Hong Kong Currency Handling Fee - a fee will be charged for every transaction if (i) such transaction is made outside of Hong Kong or with a merchant not registered in Hong Kong; and (ii) the transaction amount of which has been simultaneously converted into Hong Kong currency by the merchant"

The fee is disclosed as 0.8%.

Change of T&C notice from CCB w.e.f. 1 Jun 14:

"3.1 Cross Border Transactions in Hong Kong Currency Handling Fee - a fee will be charged for every transaction if (i) such transaction is made outside of Hong Kong or with a merchant not registered in Hong Kong; and (ii) the transaction amount of which has been simultaneously converted into Hong Kong currency by the merchant"

The fee is disclosed as 0.8%.

Latest experience appears to suggest CCB has *not* assessed the fee on HKD non-HK Visa transactions (eye cards in particular) even after 1 June http://www.hongkongcard.com/forum/fo...?id=9750&p=191 #1907 .

But just because they don't do it now does not mean they won't do it in the future - you charge HKD non-HK transactions to CCB at your peril.

Dah Sing definitely asseses the fee, charging 0.8% even for ba.com Avios HK YQ payments (even though they award $3/Avios for it)

But just because they don't do it now does not mean they won't do it in the future - you charge HKD non-HK transactions to CCB at your peril.

Dah Sing definitely asseses the fee, charging 0.8% even for ba.com Avios HK YQ payments (even though they award $3/Avios for it)

But I don't know how long this waiver will exist. Will advise if we hear the waiver will be scrapped.

#690

Join Date: Nov 2012

Programs: SPG Platinum

Posts: 1,692

I know this thread is about Asia Miles and not Avios but somehow I am not very tempted by the BEA World Flyer @5$/mile vs. the Dah Sing BA card @6$/mile for "other spend" given the much higher value of Avios.

To me, Avios are ~42% more valuable than AM if only talking about redemptions up to 4,000 flown miles one-way (beyond that, AM wins, especially if you want stopovers instead of simple non-stops). I made a spreadsheet with CX/KA routes ex-HKG (n=45) up to 4,000 miles and Avios beat AM every time, with PER and CNS being the lowest by "only" 13% less miles needed while for example BOM needs 80% less Avios than AM.

Side by side, the Dah Sing generates 21% more value to me despite the lower earn rate. Am I overlooking something great about this card or is it just that BA cards are out of competition in this thread?

Also, given that BA just devalued their award chart earlier this year with no effect to the zones where BA are most valuable, thus no devaluation is too likely in the near future, yet we can anticipate a devaluation of AM in the coming 6-8 months, I'm trying to hold off on investing into AM too much as well.

To me, Avios are ~42% more valuable than AM if only talking about redemptions up to 4,000 flown miles one-way (beyond that, AM wins, especially if you want stopovers instead of simple non-stops). I made a spreadsheet with CX/KA routes ex-HKG (n=45) up to 4,000 miles and Avios beat AM every time, with PER and CNS being the lowest by "only" 13% less miles needed while for example BOM needs 80% less Avios than AM.

Side by side, the Dah Sing generates 21% more value to me despite the lower earn rate. Am I overlooking something great about this card or is it just that BA cards are out of competition in this thread?

Also, given that BA just devalued their award chart earlier this year with no effect to the zones where BA are most valuable, thus no devaluation is too likely in the near future, yet we can anticipate a devaluation of AM in the coming 6-8 months, I'm trying to hold off on investing into AM too much as well.