View Poll Results: Is Emirates A Financial Scam?

Yes

27

15.52%

No

106

60.92%

Dont care

35

20.11%

Undecided

6

3.45%

Voters: 174. You may not vote on this poll

Is Emirates a financial scam?

#2101

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,751

IAG is a scam!!! Call the US3 - tell AA they're in bed with a fraudster. Tell the Obama administration to tear up the US/EU Open Skies deal!

And level the playing field!!! (I guess that metaphor works for American football just as much as for "soccer"!!)

#2102

Suspended

Join Date: Aug 2008

Programs: Everything is refundable

Posts: 3,727

Are you really surprised that people do not want to hear the truth as long as they can buy a ticket for a really low fare on an airline that seems to be too good to be true...

Are you surprised that people made fun of Lafontaine 25 years ago, when he predicted dire times for Eastern Germany instead of Kohl who predicted the exact difference.

Are you really surprised that some experts came up with a sum totalling 42 or 44 Billion? Do you really believe that such a sum has been taken out of Alice in Wonderland and is pure fiction to be put into a movie by Tim Burton?

Are you really suprised that Bernie Madoff could not really deliver the interest he promised to all his clients?

What do you think happened to a guy asking whether Lehman or Madoff really have substance 10 years ago?

You guessed right, the consensus of the people in the tent was clearly that Lehman was rock solid and that Bernie was simply just an expert at Finance.

Again, it is about substance (financially) not style and showers on an aircraft resulting in debt 2 times the annual GDP...

And an A380 without Cargo flying for 15 hours to connect low fare pax to India is not really all about substance, you do not need a degree in Aviation from MIT or Cranfield to figure that out.

#2103

Suspended

Join Date: Aug 2008

Programs: Everything is refundable

Posts: 3,727

Of course, there's no denying that IB's profit center is the South American market and that was a major rationale for the merger - bigger rival (BA), sees lucrative route access in new markets available on the cheap due to IBs losses in 2008/2009 and general weakness in the Spanish economy, its attractive cash on balance sheet that it could potentially use to plug its pension deficit and the bar to higher profits in IB being structurally high costs, which Willie Walsh is quite skilled at cutting.

It's taken him 5 years, but I think that strategy is bearing fruit.

But it's still inaccurate to state now that IB and South America provides (and has ever provided) the bulk of IAGs profits. BA is still the profitable airline that has had to support IB during cost cutting and turnaround, wouldn't you say - given the last 5 year results, not just 1 year.

Of course in future, I would expect to see profits coming out of IBs operations as the long-term strategy starts to work.

It's taken him 5 years, but I think that strategy is bearing fruit.

But it's still inaccurate to state now that IB and South America provides (and has ever provided) the bulk of IAGs profits. BA is still the profitable airline that has had to support IB during cost cutting and turnaround, wouldn't you say - given the last 5 year results, not just 1 year.

Of course in future, I would expect to see profits coming out of IBs operations as the long-term strategy starts to work.

To be honest with you, I spent quite some time camouflaging income streams with new internal pricing mechanisms, so with all due respect, give me a weekend looking at the books of IAG and all of a sudden (completely legal) IB is highly profitable and both Vueling and BA are bucket cases...

Hence, I do not really care which part of a Group is profitable as long as we have quite some room when it comes to cost and revenue allocation...

But as pointed out before, GDP growth in the UK was at 2.6% last year and the word on the street is that the banks and insurance companies are spending again, which should be benefitial for BA ex LHR.

Two of the big spenders in Germany, E.ON and RWE are not really in the same mood, not to mention good old Siemens, which is restructuring its corporate travel approach completely...

Maybe a good time for EK to approach them, undercutting LH ex Germany in C might be a good idea this time around, throw in a few Platinum Cards for free and you might have a Siemens guy willing to connect in the middle of the night in the middle of nowhere instead of leaving from T2 in MUC.

#2104

Join Date: Nov 2013

Posts: 5,454

The HHI calculation for the TATL market even in 2008-09 was over 1800 based on 3 virtual airlines having 25% share. By US standards that's a cause for concern for antitrust authorities and wouldn't be allowed usually.

Obviously part of the argument at the time (back in the 90s!) was that it would be economically unsustainable without the sanctioned-collusion, and more efficient for alliance partners to operate virtual airlines which would in theory create competitive pressures to reduce fares as the three virtual airlines compete against each other, as if TATL was a monolithic market.

Now in 2015, YMMV of course whether you think that economic efficiencies in operating virtual airlines in collusion have been passed on to consumers and with new entrants trying to see whether it's viable to offer more competition of different models.

As an aside, the US Justice Department itself thinks there is case that antitrust immunity has, after all, harmed consumers. http://www.justice.gov/atr/public/eag/267513.htm.

In this article, using data for the period 2005-2009, we have provided newer findings on the effects of antitrust immunity grants on the fares paid by trans-Atlantic passengers. The data support the presumption that the loss of competition in trans-Atlantic routes with non-stop service as a result of antitrust immunity grants adversely affects consumers. The data also show that antitrust immunity is not reasonably necessary for alliance participants to deliver pricing efficiencies to connecting passengers. This evidence does not support broad regulatory exemptions from the U.S. antitrust laws for international airline alliances.

#2105

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,751

You guessed right, the consensus of the people in the tent was clearly that Lehman was rock solid and that Bernie was simply just an expert at Finance.

Again, it is about substance (financially) not style and showers on an aircraft resulting in debt 2 times the annual GDP...

And an A380 without Cargo flying for 15 hours to connect low fare pax to India is not really all about substance, you do not need a degree in Aviation from MIT or Cranfield to figure that out.

Again, it is about substance (financially) not style and showers on an aircraft resulting in debt 2 times the annual GDP...

And an A380 without Cargo flying for 15 hours to connect low fare pax to India is not really all about substance, you do not need a degree in Aviation from MIT or Cranfield to figure that out.

Nothing concrete has yet been produced as evidence to validate either of the two "camps" in this discourse. But, seeing as you seem to think that all the experts are in your camp - don't you find this rather troublesome?

India does remain Emirates' single biggest market, on seats, but it is not their only market; it is not their make-or-break market; and it is not their fastest-growing market. And it is not all low-yield either, as you know.

(This graphic is from 1H 2013/2014 so it is not current - but it gives you an idea of how constantly banging on about India is, in the context of the entirety of Emirates' entire network, rather missing the wood for the trees!)

Emirates seat capacity by region: 1H2013/2014 (from CAPA)

#2106

Suspended

Join Date: Aug 2008

Programs: Everything is refundable

Posts: 3,727

IIRC, Branson did it already for quite some time with lots of success, well, at least during the early stages...

#2107

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,751

Maybe a good time for EK to approach them, undercutting LH ex Germany in C might be a good idea this time around, throw in a few Platinum Cards for free and you might have a Siemens guy willing to connect in the middle of the night in the middle of nowhere instead of leaving from T2 in MUC.

a) each of the Gulf carriers have multiple "waves" of departures; so a "middle of the night" connection is by no means necessary on all itineraries, particularly from ports with multiple daily frequencies;

b) in the context of long-haul travel, where the passenger is going to experience jet lag in some form or another, a "middle of the night stop" may actually be at a time when their body-clock wants them to be awake anyway; indeed, such stopovers may even be better for the traveller (such as on Europe to Australia flights)

On my last visit to the Etihad Premium lounge, earlier this month, there were a group of German guys beside me in the lounge, awaiting a flight to Shanghai. They didn't seem to mind the stopover one bit - although, it wasn't quite the "middle of the night".

#2108

Join Date: Nov 2013

Posts: 5,454

To be honest with you, I spent quite some time camouflaging income streams with new internal pricing mechanisms, so with all due respect, give me a weekend looking at the books of IAG and all of a sudden (completely legal) IB is highly profitable and both Vueling and BA are bucket cases...

Hence, I do not really care which part of a Group is profitable as long as we have quite some room when it comes to cost and revenue allocation...

Hence, I do not really care which part of a Group is profitable as long as we have quite some room when it comes to cost and revenue allocation...

Still, I can't help but think that it just shows that the accusations against EK being a scam are really just based on innuendo:

- it's possible anywhere to play with balance sheets and accounts all perfectly legally to highlight and obscure the true financial position (or at least, minimise existential risks)

- EK is based in Dubai

- Dubai is an autocracy with less than transparent (by western standards) politics and economics

- Dubai has debt, so because of this opacity, they "must" be giving it to EK

- therefore it is likely that EK cooks the books just because they can

It's a rather unfair indictment, I think, given the fact that every insinuation and tenuous link in the chain has an innocent and more plausible explanation.

#2109

Suspended

Join Date: Aug 2008

Programs: Everything is refundable

Posts: 3,727

All of your scenarios were eventually "proven" to be incorrect.

Nothing concrete has yet been produced as evidence to validate either of the two "camps" in this discourse. But, seeing as you seem to think that all the experts are in your camp - don't you find this rather troublesome?

India does remain Emirates' single biggest market, on seats, but it is not their only market; it is not their make-or-break market; and it is not their fastest-growing market. And it is not all low-yield either, as you know.

(This graphic is from 1H 2013/2014 so it is not current - but it gives you an idea of how constantly banging on about India is, in the context of the entirety of Emirates' entire network, rather missing the wood for the trees!)

Emirates seat capacity by region: 1H2013/2014 (from CAPA)

Nothing concrete has yet been produced as evidence to validate either of the two "camps" in this discourse. But, seeing as you seem to think that all the experts are in your camp - don't you find this rather troublesome?

India does remain Emirates' single biggest market, on seats, but it is not their only market; it is not their make-or-break market; and it is not their fastest-growing market. And it is not all low-yield either, as you know.

(This graphic is from 1H 2013/2014 so it is not current - but it gives you an idea of how constantly banging on about India is, in the context of the entirety of Emirates' entire network, rather missing the wood for the trees!)

Emirates seat capacity by region: 1H2013/2014 (from CAPA)

As pointed out so often, traffic to and from India has been great for LH and KL as part of their mix on highly profitable TATL routes. The Standard for Excellence is still KL/NW and not even Lufty achieved that kind of partnership across the pond.

It was highly profitable for both KL and NW and both were taken over by airlines with a far less impressive track record financially, two of the all time loss leaders, Delta and Air France.

Remember, DL lost more than $5 Billion in a single year once, 3 of them came from ops.

Even Qatar and Etihad look awfully good against that amount of money...

But again, being able to fill a plane is one thing, making money on this flight is a completely different story...

#2110

Suspended

Join Date: Aug 2008

Programs: Everything is refundable

Posts: 3,727

[QUOTE=eternaltransit;24842807..., given BAs pensions trustees wanting to grab all the cash they can ....[/QUOTE]

eternal, I have to sign off for today, but please do not get us started with provisions for retired employees, I am still busy trying to explain the rationale behind it to all the Nekkies on the LH forum.

Isn't it just great not to have any trouble with retired employees?

You simply throw them out of the country and fly them back to India, Nepal or Pakistan on a 77W.

eternal, I have to sign off for today, but please do not get us started with provisions for retired employees, I am still busy trying to explain the rationale behind it to all the Nekkies on the LH forum.

Isn't it just great not to have any trouble with retired employees?

You simply throw them out of the country and fly them back to India, Nepal or Pakistan on a 77W.

#2111

Join Date: Nov 2013

Posts: 5,454

The only relevant facts are of course - revenue per sector and costs per sector. The problem is a disbelief that EK has the right yield mix on a flight to be profitable. Given the range of fares available and load factors that imply non-zero premium demand, then the question remains: what is the probability that some of the seats are not taken up with below cost el-cheapo Y, and that some of the seats are on excellent yield top-dollar F/J fares.

Without a leak of a lot of data from EK HQ in DXB we'll never know.

Given the weight of anecdotal evidence that people do in fact pay sometimes quite extortionate fares and that EK only cares about 4-5% margins, the balance of probabilities leans towards the network being slightly profitable, as the scenario for losses requires planes full of the cheapest fares which is unlikely to be true (if you ever fly on the airline).

Without a leak of a lot of data from EK HQ in DXB we'll never know.

Given the weight of anecdotal evidence that people do in fact pay sometimes quite extortionate fares and that EK only cares about 4-5% margins, the balance of probabilities leans towards the network being slightly profitable, as the scenario for losses requires planes full of the cheapest fares which is unlikely to be true (if you ever fly on the airline).

#2112

Join Date: Nov 2013

Posts: 5,454

eternal, I have to sign off for today, but please do not get us started with provisions for retired employees, I am still busy trying to explain the rationale behind it to all the Nekkies on the LH forum.

Isn't it just great not to have any trouble with retired employees?

You simply throw them out of the country and fly them back to India, Nepal or Pakistan on a 77W.

Isn't it just great not to have any trouble with retired employees?

You simply throw them out of the country and fly them back to India, Nepal or Pakistan on a 77W.

If employee costs are 20% of revenue (IAG) and you can reduce that by 30% by being in Dubai - that's another 6% of margin you have to play with. IAG with 20% of revenue going to wages still comes out with net margin of 10% - so imagine if you cut another 6% off net margin requirements.

Just by being EK in Dubai means you have 12% of margin (rough, back of the envelope calculation, I admit) which you can spend/absorb losses on those two factors alone (we haven't even started on the fuel efficiency of a brand-new fleet on perfect stage lengths EU-Asia - another 3-4% of margin).

In an industry where margins of 2-3% are average on some routes, I think this goes more to explaining why EK can plausibly work than the conspiracy funding angle.

#2113

Join Date: Apr 2015

Posts: 430

US Airline CEOs speaking at National Press Club luncheon on May 15, 2015.

Can someone post Tim Clark and Al Baker's videos and/or transcripts from ATM2015. Thank you.

Can someone post Tim Clark and Al Baker's videos and/or transcripts from ATM2015. Thank you.

#2114

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,751

However, you always seem to suggest that Emirates seems not to make money on ANY of its market segments; or, at best, that the loss-making ones outweigh the profitable ones. This is not a fact - if it was, you'd have shown the proof; so it's just your opinion. And not a very convincing one.

It's widely known that shorthaul networks (at least among European carriers) are often loss-making; however, they support the longhaul operations, which would themselves be hurt by the removal of loss-making shorthaul routes; not all of LH's passengers want to terminate in FRA or MUC; not all of KL's passengers want to terminate in AMS, etc - and when they degrade their European coverage, they will, of course, lose those customers who travel from far-flung continents with the aim of visiting these "loss-making" cities on the shorthaul network and make the entire network less attractive.

However, no-one appears to be suggesting that the German government is secretly handing cash over to LH to support loss-making routes; nor KL, nor any other European airline. So, we can assume that most airlines in operation today will tolerate some loss-making routes on their networks. (And I am not sure that any airline really thinks along those lines...how do you compare a connecting passenger from North America or Asia travelling on a short-haul or domestic service with a passenger who paid a cheap, maybe even clearly loss-making bargain basement fare of €99 return, for instance?).

I fail to see the logic that therefore goes from saying: EK can tolerate a certain number of loss-making routes/services (whether seasonal, or constantly loss-making) in its network, given that a wide palette of frequently-served ports makes the entire network more attractive, and therefore supports those other routes that are consistently profitable - which is a view that I think any reasonable person would agree with - to your apparent position, which seems to be either that none of the routes are profitable, or that the loss-making routes outstrip the profitable ones.

Great, talk about your 15-hour A380s with no cargo all you want; talk about your low-yield backpackers; talk about the low-yield reliance on India. But each of these "aspects" of Emirates is not a true representation of the airline.

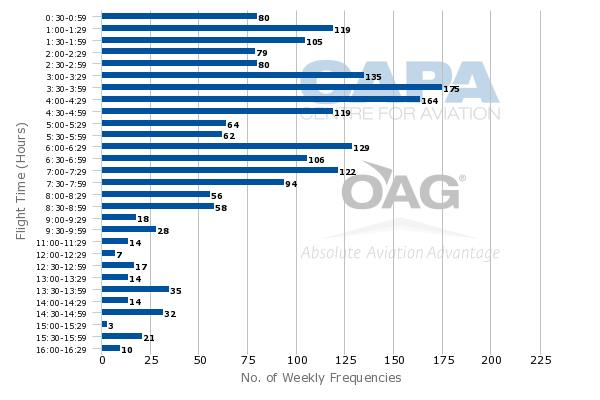

This graphic relates to Etihad: but you can see that the stage lengths are not as long as you perhaps might have thought:

Etihad sectors by length of flight: 4-May-2015 to 10-May-2015

The graphic appears in a recent CAPA article that you can read here. Of course, Emirates profile of stage lengths will be slightly different - but probably not hugely so.

What we do know, from that article, though, is that 36% of EK and EY's passengers on US routes are coming to/from India, while Qatar is behind on 28%. But the US is still a rather tiny segment for each of the 3 - Australia is still as important a market for most of the ME3, for instance. Certainly, India is the most important supporting market for the US services of all 3 Gulf carriers. Above, you have seemed to agree that US-to-India pax have been lucrative in the past for carriers such as LH and BA. Why are these pax now not lucrative, just because they are increasingly moving to EK and EY? Again, your suggestion that the seats are being dumped on the market, or sold for ridiculously low prices, just does not seem to hold any water.

I saw a figure somewhere, rather recently, that cargo rarely contributes more than 10% of a passenger airline's revenues. Of course, in an industry where every fraction of a percentage point matters, every little helps. But I am unconvinced that EK is a worse performer when it comes to cargo than any other airline. Can you back up your "15-hour A380 flights without cargo" claims?

Last edited by irishguy28; May 20, 2015 at 5:00 am

#2115

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

With regard to reference to the so-called German masters of the universe purchase habits to try to critique EK, note that Team Contra-EK don't have proof of EK being a financial scam; so their reliance is upon "evidence" that is just "evidence" but not legitimate, conclusive proof of EK being a financial scam. That kind of mud-slinging approach (to throw mud and hope at least some of it sticks) might work on the uneducated and otherwise ignorant/gullible, but it doesn't move me.

Last edited by GUWonder; May 20, 2015 at 6:37 am