Last edit by: philemer

Use this thread to discuss the Sapphire Reserve card offer.

Application page with bonus offer (60,000 UR after spending $4,000 in 90 days):

https://creditcards.chase.com/rewards-credit-cards/sapphire/reserve?CELL=6TKX

There are separate threads to discuss:

$300 Travel Credit

Priority Pass

Concierge Service

Travel Insurance

Global Entry/TSA PreCheck reimbursement.

This card is subject to Chase's 5/24 policy. For information on (and discussion of) the policy, see Applying for Chase Credit Cards, 2017 onward. You can override 5/24 by having an in-branch pre-approval (only! online prequalification does NOT override 5/24), or by already being Chase Private Client (as in you see the "Chase Private Client" text on the login screen of the Chase mobile app.)

As of August 2018, all Chase Sapphire cards are (with limited exceptions) subject to an additional restriction:

See Sapphire (CSR & CSP) 48 months between bonuses, August 2018 for details and ongoing discussion.

50,000 UR points is worth $500 as statement credit, $750 when used for travel through the Chase portal, or potentially more if transferred to a partner.

Card features are here: https://www.chase.com/card-benefits/...reserve/travel. The card's Priority Pass includes unlimited guests. (verified in Post #2635 ; also verified by Chase)

Chase Sapphire Reserve Ultimate Rewards Program Agreement

https://chaseonline.chase.com/resources/RPA0511_Web.pdf

Chase Sapphire Reserve Guide to Benefits

https://www.chasebenefits.com/sapphirereserve

The card is made of the same material as the CSP, and is being shipped UPS Next Day Air.

How to determine your account number, expiration date, and shipping date before receiving the card

(** Note that this no longer seems to work checking on 5/18 - the account number in the secure message header is XXXXXX'd out except for last 4 digits)

(** Also I do not see any recent comments 5/18 on timely shipping or shipping method)

1. Send a secure message (SM) from the account. A common SM would be to ask about the sign-up bonus and last day to complete the spend requirement (which appears to be approximately 3.5 months from the date of approval).

2. Check the Sent Messages folder, and the full account number will be listed in the header of the message that you just sent. The number starts with 414720.

3. The expiration date is five years from the month of approval. So, if you were approved on August 31, 2016, your expiration date will be August 2021.

4. CVV2 number is not available, so if a merchant requires it for payment, you must wait for the physical card.

5. According to many reports, the card is not activated until it is shipped, which happens to be via UPS Next Day Air Saver (if shipped on Friday, you will not receive the card until Monday or the next business day). To find out when it is shipped, go to My UPS and sign up for a free account. You'll be notified when a shipment is destined for your address.

6. Contrary to what the customer service rep may tell you about the delivery of the card—such as the card will take 1-2 weeks or that expedited shipping is not available—the card is actually expedited and shipped via express shipping, as mentioned in #5. There is no need to ask for expedited shipping.

Priority Pass Select

Click HERE to read the separate thread discussing this benefit.

As soon as the account shows up online:

1. Click on Go To Ultimate Rewards.

2. Scroll down to the very bottom left and click on "Card Benefits"

3. Activate Membership to request card.

4. Card will take 1-2 weeks and can't be expedited, but members have reported success in charging the lounge access to the card and requesting a refund from Customer Service.

5. PP cards will be issued for the account holder and any AU(s)

6. According to Chase, CSR's PP membership includes guest access.

Duplicate Card

1. If you receive the plastic card, wait for the metal card to arrive automatically.

2. If you receive the metal card, send SM or call to request plastic card (for use with overseas merchants that require a card imprint, because you hate metal cards, whatever).

3. DO NOT request a replacement card (especially under any pretense that the card was lost or misplaced).

4. Both cards will have the same number, expiration and CVV. Both cards will work.

5. It appears that all CSR cards are sent overnight once produced, including the plastic 'replacement' cards. No need to request expedited shipping.

Authorized User Card:

1. $75 each authorized card each year.

2. Same Priority Pass membership as the main card.

3. Same earning rate on spending. Same fringe benefits as the main card like purchase, car rental and travel insurance etc.

4. No additional Global Entry/TSA credit. Only one credit for the entire account.

5. No additional annual travel credit.

How to get bonus points on the first statement

Act very quickly; you may have less than a week. It depends on the timing of your first statement and when you receive the card. 4K in spending has to clear (not pending) about a week before the statement cuts in order to get the bonus points on that statement. Under "account details" you can see your first payment due date. Your closing date is usually three calendar days after your due date. For instance, if your very first bill is due October 20 that statement would close on September 23, and spending would have to clear by approximately September 16 in order to get the bonus points.

The prior, archived version of this thread can be found here: https://www.flyertalk.com/forum/chase-ultimate-rewards/1814294-chase-sapphire-reserve-csr-50k-ur-benefit-reductions-august-2018-a.html

Application page with bonus offer (60,000 UR after spending $4,000 in 90 days):

https://creditcards.chase.com/rewards-credit-cards/sapphire/reserve?CELL=6TKX

There are separate threads to discuss:

$300 Travel Credit

Priority Pass

Concierge Service

Travel Insurance

Global Entry/TSA PreCheck reimbursement.

This card is subject to Chase's 5/24 policy. For information on (and discussion of) the policy, see Applying for Chase Credit Cards, 2017 onward. You can override 5/24 by having an in-branch pre-approval (only! online prequalification does NOT override 5/24), or by already being Chase Private Client (as in you see the "Chase Private Client" text on the login screen of the Chase mobile app.)

As of August 2018, all Chase Sapphire cards are (with limited exceptions) subject to an additional restriction:

The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months.

50,000 UR points is worth $500 as statement credit, $750 when used for travel through the Chase portal, or potentially more if transferred to a partner.

Card features are here: https://www.chase.com/card-benefits/...reserve/travel. The card's Priority Pass includes unlimited guests. (verified in Post #2635 ; also verified by Chase)

Chase Sapphire Reserve Ultimate Rewards Program Agreement

https://chaseonline.chase.com/resources/RPA0511_Web.pdf

Chase Sapphire Reserve Guide to Benefits

https://www.chasebenefits.com/sapphirereserve

The card is made of the same material as the CSP, and is being shipped UPS Next Day Air.

How to determine your account number, expiration date, and shipping date before receiving the card

(** Note that this no longer seems to work checking on 5/18 - the account number in the secure message header is XXXXXX'd out except for last 4 digits)

(** Also I do not see any recent comments 5/18 on timely shipping or shipping method)

1. Send a secure message (SM) from the account. A common SM would be to ask about the sign-up bonus and last day to complete the spend requirement (which appears to be approximately 3.5 months from the date of approval).

2. Check the Sent Messages folder, and the full account number will be listed in the header of the message that you just sent. The number starts with 414720.

3. The expiration date is five years from the month of approval. So, if you were approved on August 31, 2016, your expiration date will be August 2021.

4. CVV2 number is not available, so if a merchant requires it for payment, you must wait for the physical card.

5. According to many reports, the card is not activated until it is shipped, which happens to be via UPS Next Day Air Saver (if shipped on Friday, you will not receive the card until Monday or the next business day). To find out when it is shipped, go to My UPS and sign up for a free account. You'll be notified when a shipment is destined for your address.

6. Contrary to what the customer service rep may tell you about the delivery of the card—such as the card will take 1-2 weeks or that expedited shipping is not available—the card is actually expedited and shipped via express shipping, as mentioned in #5. There is no need to ask for expedited shipping.

Priority Pass Select

Click HERE to read the separate thread discussing this benefit.

As soon as the account shows up online:

1. Click on Go To Ultimate Rewards.

2. Scroll down to the very bottom left and click on "Card Benefits"

3. Activate Membership to request card.

4. Card will take 1-2 weeks and can't be expedited, but members have reported success in charging the lounge access to the card and requesting a refund from Customer Service.

5. PP cards will be issued for the account holder and any AU(s)

6. According to Chase, CSR's PP membership includes guest access.

Duplicate Card

1. If you receive the plastic card, wait for the metal card to arrive automatically.

2. If you receive the metal card, send SM or call to request plastic card (for use with overseas merchants that require a card imprint, because you hate metal cards, whatever).

3. DO NOT request a replacement card (especially under any pretense that the card was lost or misplaced).

4. Both cards will have the same number, expiration and CVV. Both cards will work.

5. It appears that all CSR cards are sent overnight once produced, including the plastic 'replacement' cards. No need to request expedited shipping.

Authorized User Card:

1. $75 each authorized card each year.

2. Same Priority Pass membership as the main card.

3. Same earning rate on spending. Same fringe benefits as the main card like purchase, car rental and travel insurance etc.

4. No additional Global Entry/TSA credit. Only one credit for the entire account.

5. No additional annual travel credit.

How to get bonus points on the first statement

Act very quickly; you may have less than a week. It depends on the timing of your first statement and when you receive the card. 4K in spending has to clear (not pending) about a week before the statement cuts in order to get the bonus points on that statement. Under "account details" you can see your first payment due date. Your closing date is usually three calendar days after your due date. For instance, if your very first bill is due October 20 that statement would close on September 23, and spending would have to clear by approximately September 16 in order to get the bonus points.

The prior, archived version of this thread can be found here: https://www.flyertalk.com/forum/chase-ultimate-rewards/1814294-chase-sapphire-reserve-csr-50k-ur-benefit-reductions-august-2018-a.html

Sapphire Reserve 60k, $4,000 spend in 3 months, $550 fee.

#136

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

If they raise fees, we'll probably be grandfathered in for a year. Just like how Amex did. Let's just hope if they do increase annual fee that they have better earnings or credits to make up the fee. It be remit nice if they can add a gas category. But I doubt it.

#137

Join Date: Aug 2017

Programs: Hilton Diamond, IHG Spire Ambassador, Global Entry

Posts: 2,871

Won't happen, at least not long-term. There may be a transition period for existing card holders, but why would they lock them in at $450? I'd be willing to be that those who would drop the card over a $100 increase probably aren't Chase's bread and butter anyways.

#138

Join Date: Feb 2005

Location: MD/DC

Programs: Hilton Diamond, IHG Platinum, Marriott Titanium, TK Gold

Posts: 1,536

The old Ritz card oweners are being grandfathered for several years now and with no end in sight. Just a data point.

#139

Join Date: Sep 2005

Location: JZRO

Posts: 9,169

Who said anything about locking in? I'm just thinking Chase is going to have some gambit at the 48-month mark, a possibility woefully unconsidered in this thread.

#141

Join Date: Feb 2005

Location: MD/DC

Programs: Hilton Diamond, IHG Platinum, Marriott Titanium, TK Gold

Posts: 1,536

But of course the fee increase on the Ritz was done while they were still taking applications to the card (couple of years of that). At that time it was just a "fee increase" as well.

#142

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

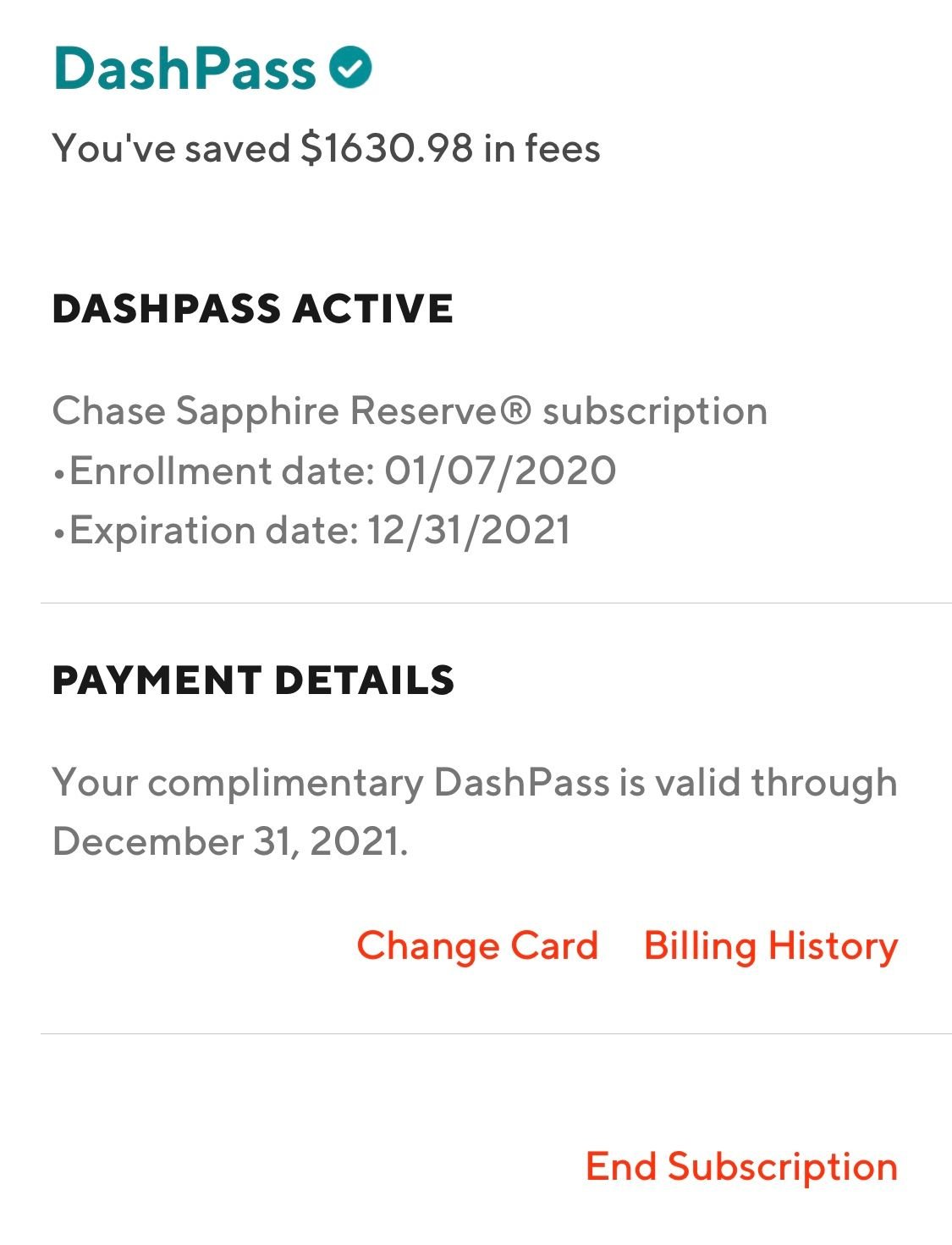

Anyone notice door dash pass is under CSR benifits? I noticed it today. Other forums are seeing it. I wonder if this is the rumor.

#143

Join Date: Apr 2014

Programs: Coffee Shop Buy 10 Get 1 Free

Posts: 295

I like CSR because it's easy. No choosing your airline for incidentals that are hard to use, $15 Uber that is hard to use if you don't have Uber in your area, $50 Saks credit, etc.

#144

Join Date: Feb 2011

Programs: AA Lifetime Gold, HH Diamond

Posts: 879

Saw it, and signed up for it. I don't think I'll use it very much. Restaurants near me raise prices when you use DoorDash and the local help isn't the best. I hope this isn't precursor to raising the fee?

#145

Original Poster

Join Date: Apr 2019

Posts: 251

https://help.doordash.com/consumers/...language=en_US

That they broke out the CSR/JPMR benefits from the CSP benefits even though they are currently identical is ominous.

That they broke out the CSR/JPMR benefits from the CSP benefits even though they are currently identical is ominous.

#146

Join Date: May 2011

Location: NYC (LGA, JFK), CT

Programs: Delta Platinum, American Gold, JetBlue Mosaic 4, Marriott Platinum, Hyatt Explorist, Hilton Diamond,

Posts: 4,897

2020 will likely be the year of downgrades for me. Every $450-$600 card has the same exact features (bonus on spend, priority pass, Pre Check, travel insurance, etc). With higher fees you only need premium cards from one or two banks. For me the CSR and probably the Delta Reserve are on the chopping block. I may even drop the Amex Gold for the Amex Green.

#147

Join Date: Jun 2003

Location: La Jolla, CA

Programs: Marriott Ambassador, Lifetime Titanium, Delta Plat, Hilton Diamond , Hyatt Globalist

Posts: 2,615

I use DoorDash a lot. Lol

I cancelled my paid membership and signed up for the Chase complimentary- a real savings of $120/year for me

I cancelled my paid membership and signed up for the Chase complimentary- a real savings of $120/year for me

#148

Join Date: May 2005

Location: Los Angeles

Posts: 600

https://help.doordash.com/consumers/...language=en_US

That they broke out the CSR/JPMR benefits from the CSP benefits even though they are currently identical is ominous.

That they broke out the CSR/JPMR benefits from the CSP benefits even though they are currently identical is ominous.

These are TERRIBLE benefits for a $100 increase in annual fees.

Free Lyft pink membership to be added 01/12 for reserve

$60 doordash credit in 2020 and 2021 only

Annual fee $550 from April for existing card holders, asap or 01/12 for new applicants

$60 doordash credit in 2020 and 2021 only

Annual fee $550 from April for existing card holders, asap or 01/12 for new applicants

#149

Join Date: May 2011

Location: NYC (LGA, JFK), CT

Programs: Delta Platinum, American Gold, JetBlue Mosaic 4, Marriott Platinum, Hyatt Explorist, Hilton Diamond,

Posts: 4,897

Comment in Doctor of Credit says CSR annual fee will be bumped to $550. This is based on a memo that was circulated in his local branch. Chuck from DoC also seems to confirm this in a comment.

These are TERRIBLE benefits for a $100 increase in annual fees.

https://www.doctorofcredit.com/chase...onth-for-free/

These are TERRIBLE benefits for a $100 increase in annual fees.

https://www.doctorofcredit.com/chase...onth-for-free/

EDIT - another issue is that Lyft and Uber often change the availability of these passes. For example Uber recently ended Ride Pass in a number of cities - this was basically a discount scheme where you pay a fee ($25 for Uber, $20 for Lyft) for discounts (10-15%). For daily Uber/Lyft users, this was always a no brainer, but it probably got too expensive for Uber as they try to actually make money

Last edited by Adelphos; Jan 7, 2020 at 12:52 pm

#150

Join Date: Jun 2013

Programs: DL Plat, Hilton Diamond, Marriott Plat, IHG Plat, Hertz Prez Circle, National Exec

Posts: 1,357

Lyft Pink is pretty useful for regular Lyft users, but that is probably a minority of cardholders.

EDIT - another issue is that Lyft and Uber often change the availability of these passes. For example Uber recently ended Ride Pass in a number of cities - this was basically a discount scheme where you pay a fee ($25 for Uber, $20 for Lyft) for discounts (10-15%). For daily Uber/Lyft users, this was always a no brainer, but it probably got too expensive for Uber as they try to actually make money

EDIT - another issue is that Lyft and Uber often change the availability of these passes. For example Uber recently ended Ride Pass in a number of cities - this was basically a discount scheme where you pay a fee ($25 for Uber, $20 for Lyft) for discounts (10-15%). For daily Uber/Lyft users, this was always a no brainer, but it probably got too expensive for Uber as they try to actually make money

I view the DoorDash subscription thing the same way I do the Shoprunner subscription I get from AmEx... it's fine and I'll sign up for it but I don't attach a value to it because it isn't anything I ever would have spent a single dollar on if it wasn't complementary with the card.

Last edited by Zeeb; Jan 7, 2020 at 1:10 pm