Last edit by: Global Adventurer

*Equinox $25 Credit will not be issued for ANY products you buy online at their merchandise Shop which is coded as "Equinox The Shop". However, it appears that you can purchase Gift Cards straight off the site, but lowest denomination is $100. Gift cards can be used for merchandise and memberships.

USA personal Platinum annual fee increase to $695, July 2021.

#16

Join Date: Mar 2015

Location: SLC

Programs: AA EXP, Marriott Titanium + LT Gold

Posts: 198

#18

Join Date: Apr 2021

Posts: 11

Yeah these benefits suck. Initially I thought I'd keep this card around and cancel my Green but now I might just cancel both once the time comes.

In the meantime, maximize the value the best I can I guess? There's student rates for the NYTimes and SiriusXM and a steaming only rate for Audible so I guess I'll try those three out for the next year (I'm trapped with Xfinity, so Peacock is already free... and better with .......). But yeah I thought that $240 would be less crap.

Also annoyed that they're filtering out the hotel credit to be used only with THC and FHR places and obviously Equinox is annoying (funnily enough, attempting to enable the benefit thru the link gave me an error that it was already active?) but those were expected.

The entertainment credit would have made the card worth keeping for me if it was as broad as it was in the midst of the pandemic - as it stands this seems like Amex only got a few interested desperate parties to shill memberships with.

In the meantime, maximize the value the best I can I guess? There's student rates for the NYTimes and SiriusXM and a steaming only rate for Audible so I guess I'll try those three out for the next year (I'm trapped with Xfinity, so Peacock is already free... and better with .......). But yeah I thought that $240 would be less crap.

Also annoyed that they're filtering out the hotel credit to be used only with THC and FHR places and obviously Equinox is annoying (funnily enough, attempting to enable the benefit thru the link gave me an error that it was already active?) but those were expected.

The entertainment credit would have made the card worth keeping for me if it was as broad as it was in the midst of the pandemic - as it stands this seems like Amex only got a few interested desperate parties to shill memberships with.

#19

Join Date: Jul 2019

Location: Los Angeles, CA

Programs: American Express Platinum, Chase Sapphire Reserve

Posts: 619

The digital streaming credit is only good for a limited number of partners. For many people, that is not worthwhile. Not sure how you can value the Uber credits at face when you are prepaying for them. Even Uber doesn't value prepaid credits at face value and sells them at a discount (currently 15% rn). Overall think this was a slight net negative for most people but not a massive loss.

$200 Hotel FHR/THC credit

$179 Clear Credit (really worth more like $109 or $119 depending on what discount you get)

$240 Digital Entertainment Credit (worth $0, though if we have this might as well sign up for the services since they're basically free)

$300 Equinox Credit ($25/month) (worth $0 to me)

$200 Uber credit

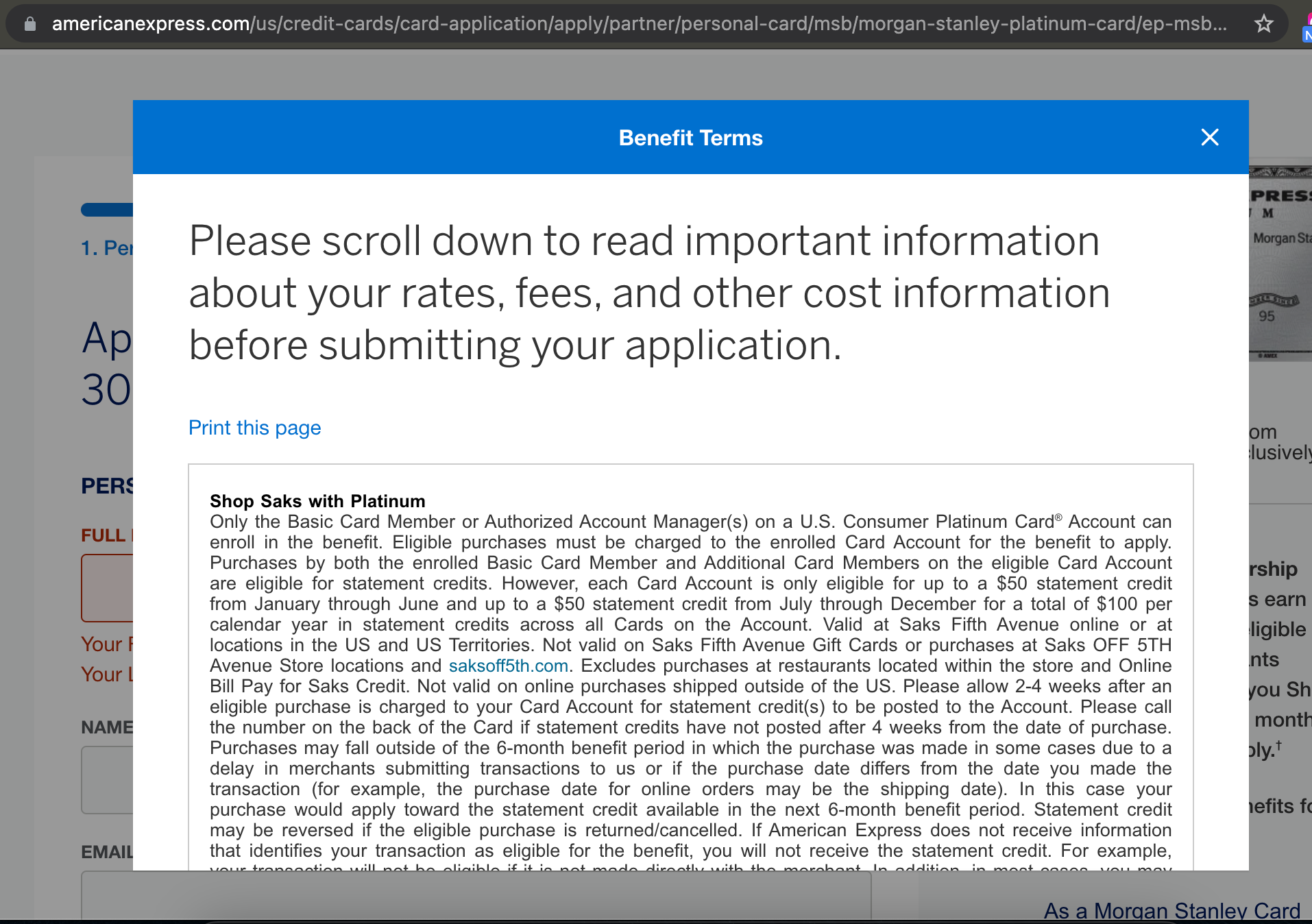

$100 Saks

$200 Airline credit

As for Uber - I use it for food delivery pickup, electric scooter rides, as well as the cheapest rideshare rides, easily hitting the max spend every month. If there's some reliable and easy way to get 15% off of all that by prepaying, great, but for now I value this at face value.

Saks, similarly, there's always something I would want to buy anyway, and you can get free shipping with that shopping membership which I have through both Amex and at least one other card.

The airline credit is also, for the moment, still usable for me, though perhaps not something I would always get the full $200 for.'

So I'd reframe this as: $200 FHR/THC + $109 CLEAR + $200 Uber + $100 Saks + $0 - $200 airline credit = $609 - $809, assuming the rumored Resy credit doesn't materialize. Not nearly as much of a win, but I guess you get free Audible, NYT, etc. To recoup the annual fee means still doing the airline credit thing, but there are still workarounds for it, so, it's still a win for me.

#20

Join Date: Aug 2005

Programs: AA LTP, UA, DL, HH, Marriott/SPG

Posts: 585

Interesting, it looks like the Clear $179 credit benefit has also been added to my business platinum benefits.

As far as the other new benefits, the $240 Digital entertainment credit is disappointing. I can get some use but not enough to make use of the $20/month. The Equinox has $0 value to me.

As far as the other new benefits, the $240 Digital entertainment credit is disappointing. I can get some use but not enough to make use of the $20/month. The Equinox has $0 value to me.

Last edited by I Love to Travel; Jun 30, 2021 at 11:42 pm

#21

Join Date: Apr 2021

Location: Manhattan, Palm Beach Island, San Francisco, Boston, & Hong Kong

Programs: Lifetime United Global Services, Delta Plat, Hyatt Globalist, Marriott Ambassador, & Hilton Diamond

Posts: 3,165

That is an extremely limited list, you're right. So I'll reframe my calculation:

$200 Hotel FHR/THC credit

$179 Clear Credit (really worth more like $109 or $119 depending on what discount you get)

$240 Digital Entertainment Credit (worth $0, though if we have this might as well sign up for the services since they're basically free)

$300 Equinox Credit ($25/month) (worth $0 to me)

$200 Uber credit

$100 Saks

$200 Airline credit

As for Uber - I use it for food delivery pickup, electric scooter rides, as well as the cheapest rideshare rides, easily hitting the max spend every month. If there's some reliable and easy way to get 15% off of all that by prepaying, great, but for now I value this at face value.

Saks, similarly, there's always something I would want to buy anyway, and you can get free shipping with that shopping membership which I have through both Amex and at least one other card.

The airline credit is also, for the moment, still usable for me, though perhaps not something I would always get the full $200 for.'

So I'd reframe this as: $200 FHR/THC + $109 CLEAR + $200 Uber + $100 Saks + $0 - $200 airline credit = $609 - $809, assuming the rumored Resy credit doesn't materialize. Not nearly as much of a win, but I guess you get free Audible, NYT, etc. To recoup the annual fee means still doing the airline credit thing, but there are still workarounds for it, so, it's still a win for me.

$200 Hotel FHR/THC credit

$179 Clear Credit (really worth more like $109 or $119 depending on what discount you get)

$240 Digital Entertainment Credit (worth $0, though if we have this might as well sign up for the services since they're basically free)

$300 Equinox Credit ($25/month) (worth $0 to me)

$200 Uber credit

$100 Saks

$200 Airline credit

As for Uber - I use it for food delivery pickup, electric scooter rides, as well as the cheapest rideshare rides, easily hitting the max spend every month. If there's some reliable and easy way to get 15% off of all that by prepaying, great, but for now I value this at face value.

Saks, similarly, there's always something I would want to buy anyway, and you can get free shipping with that shopping membership which I have through both Amex and at least one other card.

The airline credit is also, for the moment, still usable for me, though perhaps not something I would always get the full $200 for.'

So I'd reframe this as: $200 FHR/THC + $109 CLEAR + $200 Uber + $100 Saks + $0 - $200 airline credit = $609 - $809, assuming the rumored Resy credit doesn't materialize. Not nearly as much of a win, but I guess you get free Audible, NYT, etc. To recoup the annual fee means still doing the airline credit thing, but there are still workarounds for it, so, it's still a win for me.

Greg from frequent miler does a better job of explaining this than I can:

I recommend looking at each of the annual credits and major perks and asking yourself: if I could pay separately for a subscription to this thing, how much would I pay? The answer should never be face value: you would never pay $240 in advance to get $240 in entertainment credits spread out $20 per month, would you? I hope not. You’d only pay in advance if you could get a substantial discount.

I also agree with how he discounts the credits https://frequentmiler.com/the-revise...ls-and-review/

Uber doesn’t value it’s prepaid gift cards at face value. The Amex Platinum provides credits that are strictly worse than even normal Uber gift cards. If they won’t value it at face, I won’t either.

#22

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,859

What value do you assign the lounge access? For me, that is the primary reason for having the card. The prepaid credits are just a way for me to make the AF palatable, but I would see no reason to have/keep the card just for those “coupon book” offers.

#23

Join Date: Sep 2011

Programs: Virgin Atlantic Silver, IHG Diamond, Bonvoy Gold, Hilton Diamond, AA Platinum Pro

Posts: 1,386

I am perplexed that they don't see the value in adding 2X on spend with no FX fees. The only other player (partially) offering that with transferrable points is CapitalOne. It would be big bragging rights and fit in with the travel/global motif.

It would certainly keep me on, even without the Equinox, Uber, Clear, and Entertainment credits.

It would certainly keep me on, even without the Equinox, Uber, Clear, and Entertainment credits.

#25

Original Poster

Join Date: Apr 2019

Posts: 165

It would be nice to have Admiral/Alaska/United Club added to Plat benefit. — I know I am dreaming.

#26

Join Date: Mar 2018

Programs: AS MVP Gold 75k, Hyatt Globalist, National Executive Elite

Posts: 272

Seatac is getting a new lounge late 2022 I believe. Also you do have access to the N gate AS lounge -- just forever waitlisted now lmao

#27

FlyerTalk Evangelist

Join Date: Mar 2010

Programs: DL, OZ, AC, AS, AA, BA, Hilton, Hyatt, Marriott, IHG

Posts: 19,905

I see the airline fee in my account. I already used it up earlier this year and it's asking me to select an airline again?

#28

Join Date: Oct 2009

Location: Somewhere over the rainbow

Programs: Airline Free Agent, Bonvoy Platinum, Hyatt Globalist

Posts: 3,812

I don't see AX offering 2X pts with no cap on the AX Plat with the # of heavy spenders they have who spend high six or seven figures every year.

#29

Join Date: Jul 2008

Location: LAS ORD

Programs: AA Pro (mostly B6) OZ♦ (flying BR/UA), BA Silver Hyatt LT, Wynn Black, Cosmo Plat, Mlife Noir

Posts: 5,992

#30

Join Date: Apr 2019

Posts: 251

At my home airport I have non-Amex lounge access in every terminal and I have access to three other lounges in the same terminal as the single Amex lounge. And all the other lounges give me access for my family members as well which Amex doesn't, so for me the answer is really not much. At this point the coupon book aspect certainly looks worse but maybe we don't know all the details yet.