4x miles on AA purchases with Citi AAdvantage Executive Card through 12/31/22

#61

Join Date: Jun 1999

Location: NYC/LA

Programs: DL Plat, AA Plat Pro, Marriott Titanium, IHG Diamond Amb

Posts: 7,489

That would actually be a good benefit that could justify the higher AF for me. And I wonder if the first 10k LP boost would count toward achieving the 90k LP boost (at which point earning 80k LPs would translate into 100k LP banked)

#62

Join Date: Oct 2003

Location: DCA

Programs: UA LT 1K, AA EXP, Bonvoy LT Titan, Avis PC, Hilton Gold

Posts: 9,658

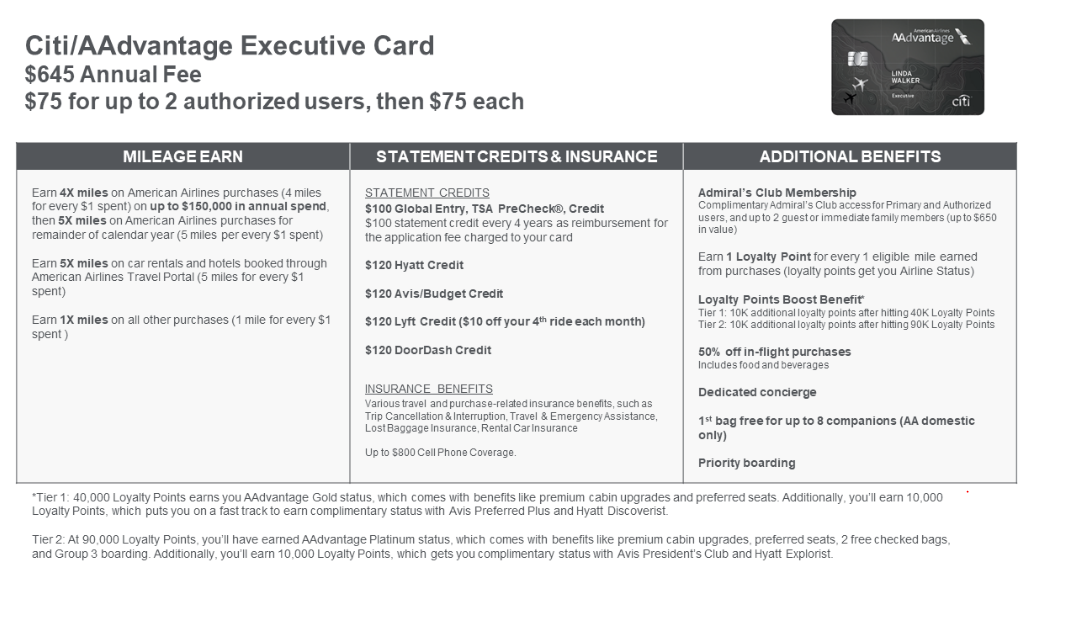

Just got a survey from a marketing research firm on Citi's behalf for the Exec card. They basically showed the Exec card with a ton of new benefits and new price tag. This was the first one they showed and most expensive. Was not impressed with any of the added offerings.

#63

Join Date: Sep 2013

Location: ORD

Programs: Once a somebody now a nobody

Posts: 518

What confidentiality agreement? There wasn't one in the body of the email nor the survey itself. Citi is welcomed to sue me....one thing I am long is family members with law degrees. Honestly they should be paying me for putting this out there. If 100% of the online chatter about a product is negative....maybe the product isn't as good as they think.

Last edited by chicago747; Oct 27, 2022 at 8:49 am

#65

Join Date: Jun 1999

Location: NYC/LA

Programs: DL Plat, AA Plat Pro, Marriott Titanium, IHG Diamond Amb

Posts: 7,489

#67

Join Date: Sep 2005

Location: MHK

Programs: AA Exec Plat - some level of status in IHG, Marriot & HIlton

Posts: 1,516

It probably wouldn't cause me to cancel, but would be a major downgrade for me and would make very little difference in crowds. Both of our college aged kids are AU mostly because they use my card for certain purchases and I want the points. Only once have they used it to access the club and they were with us and had to since I could only bring in two guests without one of them showing a card. My wife is also an AU. She rarely flies without me, but has a few times this year to visit her aging parents. She has popped into the club a couple times on those trips when her layover is around 2 hours. So if they charge for AU's, I would probably pay for my wife and drop my kids and put them on one of my other cards. I may end up dropping her as well, I guess it just depends on the deal. So in the long run, it may cost AA money as far as my family goes, as their credit card spend would all end up elsewhere.

#68

Join Date: Oct 2003

Location: DCA

Programs: UA LT 1K, AA EXP, Bonvoy LT Titan, Avis PC, Hilton Gold

Posts: 9,658

What confidentiality agreement? There wasn't one in the body of the email nor the survey itself. Citi is welcomed to sue me....one thing I am long is family members with law degrees. Honestly they should be paying me for putting this out there. If 100% of the online chatter about a product is negative....maybe the product isn't as good as they think.

I guess worst thing that could happen is they cancel your CC.

#69

Join Date: Sep 2013

Location: ORD

Programs: Once a somebody now a nobody

Posts: 518

you must have gotten a different survey then. Nothing in my survey had any legalese at all. Even if it did, I'd still post it. It's not like posting the code from the president's "football". I figure if JonNYC still is posting (who has way more "top secret" info)...... I'm probably pretty safe. If not and they cancel my Exec card,I guess i'll get the Aviator card for the 10th time

#70

Join Date: Sep 2008

Location: AUS

Programs: BAEC Gold, AA PPro, Hyatt Globalist, Amex Plat

Posts: 7,043

Regards

#71

Join Date: Oct 2003

Location: DCA

Programs: UA LT 1K, AA EXP, Bonvoy LT Titan, Avis PC, Hilton Gold

Posts: 9,658

Just pointing out - I guess some people ignore confidentially agreements - that is why there are so many leaks around Washington DC.

I have never taken a survey before that was so specific on the confidentially. You had to answer a questionaire to determine if you were eligible to take the survey before it started. One question was you agreed not to share the information on social media and other public forums. If you said no - then you would have been kicked out before the survey started.

I am not sure if that was a good idea on Citi's part - some companies purposely leak information to get feedback before they formally annouce it. Happens here on flyertalk with posts from Jon (previously) and Gary as they have connections and receive leaks - like newsreporters.

This survey came out beginning of June and their were no leaks until recently. I am sure many others on FT got the survey and observed the confidentially.

As the OP says - they did not have to check the box for confidentially - so if it was reissued and received 4 months after June - maybe Citi opened it up so it would make its way here.

I would have posted myself if there was no restriction. No fault here to the OP.

I have never taken a survey before that was so specific on the confidentially. You had to answer a questionaire to determine if you were eligible to take the survey before it started. One question was you agreed not to share the information on social media and other public forums. If you said no - then you would have been kicked out before the survey started.

I am not sure if that was a good idea on Citi's part - some companies purposely leak information to get feedback before they formally annouce it. Happens here on flyertalk with posts from Jon (previously) and Gary as they have connections and receive leaks - like newsreporters.

This survey came out beginning of June and their were no leaks until recently. I am sure many others on FT got the survey and observed the confidentially.

As the OP says - they did not have to check the box for confidentially - so if it was reissued and received 4 months after June - maybe Citi opened it up so it would make its way here.

I would have posted myself if there was no restriction. No fault here to the OP.

#72

Join Date: Nov 2016

Posts: 532

#73

Join Date: Aug 2018

Posts: 61

Am I just misreading the the text on the promo page?

How does "Earn a total of 4x AAdvantage miles" and "with every eligible AAdvantage mile earned, you'll earn 1 Loyalty Point" not add up to 4x LPs?

Earn a total of 4X AAdvantage miles on eligible American Airlines purchases for a limited time.1

Along with the 2 miles per dollar you already earn with your Citi® / AAdvantage® Executive Card, from September 28, 2022 through December 31, 2022, you will earn an additional 2 miles per dollar, for a total of 4 miles per dollar.

Don't forget — with every eligible AAdvantage® mile earned, you'll earn 1 Loyalty Point, helping you achieve AAdvantage® status.2

Along with the 2 miles per dollar you already earn with your Citi® / AAdvantage® Executive Card, from September 28, 2022 through December 31, 2022, you will earn an additional 2 miles per dollar, for a total of 4 miles per dollar.

Don't forget — with every eligible AAdvantage® mile earned, you'll earn 1 Loyalty Point, helping you achieve AAdvantage® status.2

#74

Join Date: Aug 2022

Programs: AA Executive Platinum (Oneworld Emerald)

Posts: 135

Am I just misreading the the text on the promo page?

How does "Earn a total of 4x AAdvantage miles" and "with every eligible AAdvantage mile earned, you'll earn 1 Loyalty Point" not add up to 4x LPs?

How does "Earn a total of 4x AAdvantage miles" and "with every eligible AAdvantage mile earned, you'll earn 1 Loyalty Point" not add up to 4x LPs?

#75

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,647

Am I just misreading the the text on the promo page?

How does "Earn a total of 4x AAdvantage miles" and "with every eligible AAdvantage mile earned, you'll earn 1 Loyalty Point" not add up to 4x LPs?

How does "Earn a total of 4x AAdvantage miles" and "with every eligible AAdvantage mile earned, you'll earn 1 Loyalty Point" not add up to 4x LPs?

From the email which I received announcing this promotion:

1 Loyalty Point per eligible AAdvantage® mile 1 Loyalty Point accrues for every eligible AAdvantage® mile earned on purchases, excluding balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Eligible AAdvantage® miles include the base miles earned on purchases, and do not include any bonus miles or accelerators. Loyalty Points may be earned on miles on purchases made by primary credit cardmembers and authorized users. Loyalty Points earned will be posted to the primary credit cardmember’s AAdvantage® account in 8 to 10 weeks.