Last edit by: ninim2200

This thread is a continuation of: Citi AA Executive [Late 2014 - 2015]

For questions NOT related to the application process - such as experiences using benefits - refer to the AA forum thread on this card: AA Citibank Executive / AAdvantage World Elite MasterCard (Master Thread)

Recommended Application Procedure:

Clear cache and cookies prior to applying or use an incognito or private browsing session to apply. Opening multiple different apps in different windows or tabs or failing to clear cookies/cache has resulted in people receiving a lesser offer for some Citi cards. [B]We do not know, and Citi has not indicated, how long these offers will last. Citi has left other offers alive for over a year beyond the 'apply by' date in the past. These links could be here all year or gone tomorrow. If the application loads, it is good, based on past Citi applications that survived past the landing page expiration, regardless of any posted or advertised 'apply by' date.

MOST CURRENT LINKS:

"American Airlines AAdvantage® bonus miles are not available if you have had a Citi Executive® / AAdvantage® World EliteTM MasterCard® opened or closed in the past 24 months"

CURRENT PUBLIC OFFER: 75k

1_ 75k Bonus Landing Page 7.5K Spending in 3 months. Here is the Application Page

2_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

3_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

4_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

EXPEDITED SHIPPING

While reconsideration/application reps do not seem to be aware of this, these cards are expedited and usually arrive 1-2 days after approval.The CSR will not take a request to expedite the card.

Who is eligible for this card? Anyone as long as you can be approved for the minimum $5K credit line, subject to the standard Citi rules of 1 Citi app or card of any kind per 8 days and 2 Citi cards or apps of any kind per 65 days. It is always advisable to wait 65 days from any type of Citi denial before applying for another Citi card. Many have reported getting approved for this card in spite of having several open AA cards over the past year as well as having previously had this card.

Not sure about the 8 and 65 day rules? If your most recent application for any Citi card is less than click here - 8 days ago, you need to wait. Also, if your previous (second-to-last) Citi application is less than click here - 65 days ago, you need to wait. These are not rules published or known by Citi CSRs but rather based on thousands of Citi card applications and datapoints across several threads.

Credit inquiry history

Some have reported more approval success with no more than 5 or 6 Experian inquiries within the last 6 months. And Citi credit reviewers have told some applicants that too many inquiries is a problem, even with an excellent credit score. Multiple inquiries from other banks seem to be especially problematic, because Citi can't see their current balances as easily. Other applicants have been approved with more inquiries, especially with a long term Citi tenure and a favorable income to debt ratio.

This card can be churned. Recent datapoints concerning multiple Executive cards include posts 917, 1059 and starting at 1365. For in-depth datapoints and advice on churning Citi cards, read and study the extensive wiki posts in the HH thread and the AA Plat/gold thread. Click the plus on the right hand side of the wiki if you do not see the wiki text. Datapoints for bonus points posting on multiple cards include post 2579.

Getting around the $450 annual fee: Many people have been able to meet the spending requirement before the first statement posts and then cancel and have the fee refunded after the miles post. Details and datapoints include starting at post 74. T&C state that the card must be cancelled within 30 days of the fee posting to get it refunded; in practice you have 37 days. Potential problems with this plans include a very short (1 week or less) first "month" as well as delays in miles posting which have been reported by several FTers.

Once you cancel the card (within the 37 day window of AF posting) the refund will post on the account between 1-3 business days. Leave a $450 balance and it will be zeroed out.

Retention Bonus Offers: User have been offered the following retention bonus offers when calling to cancel the card:

- 5,000 points + $100 credit with $1,500 spend per month for 3 months 5333

- 2 additional club member passes 6862

- 1,000 bonus miles each month for 16 month, min $1k spend/month 6862

- [3/15] 15,000 bonus miles for spending $5k

- $450 Credit for spending $5k for next three statements

Already a member? If you already purchased an AC membership (for example, using the credit from Amex Plat) and apply and are approved for this card, AA will refund you the pro-rated AF from any time left on your membership.

When do miles post? Usually two days after your statement closing date. In some cases your statement will show the correct miles earned but will show 0 miles reported to AA. In this case see this thread.

Helpful points from post #3794 and others, especially for those new to Citi:

1) Citi CSRs are clueless, so disregard everything they say that seems to contradict anything you have read on F/T. And take everything else with a big grain of salt. I was told 3 times VERY CLEARLY "You will not got your annual fee refunded" while I was cancelling, but I did get it.

2a)With Citi, if you are approved for a card, and meet the minimum spend requirement, you will get the bonus listed for the offer you applied for. Every time ! Unlike Chase or AMEX, who will send you a card, wait for you to pay the fee and spend, and then say "sorry, you don't qualify for a bonus". If Citi doesn't intend to give you the bonus, they will just deny your app. They won't even do a pull, they will just instantly deny your app. If they send you the card, and you meet the spend on time, you will get the bonus. My attorney insists I add "that could change tomorrow", but from the Big Bang thru today, that has always been true.Recently, Citi has been approving Exec cards but not giving the bonus, e.g. when there has been less than 18 months from the previous application. Therefore, (a) use an application link that does not list the 18-month wait requirement; (b) check the letter you get via UPS to see if it explicitly promises the bonus; if it's in the letter, it will be honored (c) if in doubt, call and ask.

2b) Another helpful post discussing timeframe for meeting min spend: 6279

3) Any expectation that Citi will do things that make sense is just plain silly. They won't.

Admiral Club Access: You do not need to be flying AA that particular day of travel. (Ex: you're flying DL on the day of travel...you could still enter the AC lounge, even though you're not on an AA flight that day.) Beware, though, that individual lounges have individual rules (see the link below). Alternate rules usually come w/ Qantas lounges, not AA lounges. Furthermore, AC access "comes with" US Air access (19 locations). As of December 2015, authorized users have AC access (but not partner lounge access) even if they are not with the primary card holder.

For reference, an AC lounge list: http://www.aa.com/i18n/travelInforma...#admirals-club

For questions and discussions on lounge access: Help Desk: Lounge Access and Lounge Access Rules

Information on new authorized user AC lounge access: Citi Authorized User Admirals Club Benefit Terms

Also, please note that these cards do not include the 10% miles rebate offered by some other Citi AA products.

What about the EQM? AA tracks your miles earned on Executive card(s) and adds 10K Elite Qualifying Miles to your EQM balance once you earn 40,000 miles during a calendar year on Executive card(s). Any number of Executive cards can add up to the 40K, and you cannot earn more than 10K EQM each year. No redeemable miles are added, and this is of no consequence or value unless you will also earn at least 15K additional EQM in a given year by flying and 10K will bump you up to the next status level.

Direct phone number to Citi Fraud Prevention department: +18664705331

Concierge service enrollment (allows for electronic requests). Concierge number is +18778812668

Here are the minimum credit limit required amounts in order to keep an account open (for purposes of new card applications and reconsiderations)

Citi Amex 1k (likely citi gold as well)

Citi Visa signature/world MasterCard 3k (as low as 1k on some accounts YYMV)

Citi World elite Mastercards (including exec) 5k

Advice to those new to Citi American Airlines cards,

If you are just starting out please apply and use the lower level citi AA card for a while before moving on to this thread and card. This will help you in the long run in more ways than one. Most of us here have opened and used lower level AA cards before moving on to this thread and card

Also,

Check out this thread

http://www.flyertalk.com/forum/citi-...-benefits.html

For questions NOT related to the application process - such as experiences using benefits - refer to the AA forum thread on this card: AA Citibank Executive / AAdvantage World Elite MasterCard (Master Thread)

Recommended Application Procedure:

Clear cache and cookies prior to applying or use an incognito or private browsing session to apply. Opening multiple different apps in different windows or tabs or failing to clear cookies/cache has resulted in people receiving a lesser offer for some Citi cards. [B]We do not know, and Citi has not indicated, how long these offers will last. Citi has left other offers alive for over a year beyond the 'apply by' date in the past. These links could be here all year or gone tomorrow. If the application loads, it is good, based on past Citi applications that survived past the landing page expiration, regardless of any posted or advertised 'apply by' date.

MOST CURRENT LINKS:

"American Airlines AAdvantage® bonus miles are not available if you have had a Citi Executive® / AAdvantage® World EliteTM MasterCard® opened or closed in the past 24 months"

CURRENT PUBLIC OFFER: 75k

1_ 75k Bonus Landing Page 7.5K Spending in 3 months. Here is the Application Page

2_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

3_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

4_75k Bonus 7.5K Spending in 3 Months Application Page No Landing Page.

EXPEDITED SHIPPING

While reconsideration/application reps do not seem to be aware of this, these cards are expedited and usually arrive 1-2 days after approval.The CSR will not take a request to expedite the card.

Who is eligible for this card? Anyone as long as you can be approved for the minimum $5K credit line, subject to the standard Citi rules of 1 Citi app or card of any kind per 8 days and 2 Citi cards or apps of any kind per 65 days. It is always advisable to wait 65 days from any type of Citi denial before applying for another Citi card. Many have reported getting approved for this card in spite of having several open AA cards over the past year as well as having previously had this card.

Not sure about the 8 and 65 day rules? If your most recent application for any Citi card is less than click here - 8 days ago, you need to wait. Also, if your previous (second-to-last) Citi application is less than click here - 65 days ago, you need to wait. These are not rules published or known by Citi CSRs but rather based on thousands of Citi card applications and datapoints across several threads.

Credit inquiry history

Some have reported more approval success with no more than 5 or 6 Experian inquiries within the last 6 months. And Citi credit reviewers have told some applicants that too many inquiries is a problem, even with an excellent credit score. Multiple inquiries from other banks seem to be especially problematic, because Citi can't see their current balances as easily. Other applicants have been approved with more inquiries, especially with a long term Citi tenure and a favorable income to debt ratio.

This card can be churned. Recent datapoints concerning multiple Executive cards include posts 917, 1059 and starting at 1365. For in-depth datapoints and advice on churning Citi cards, read and study the extensive wiki posts in the HH thread and the AA Plat/gold thread. Click the plus on the right hand side of the wiki if you do not see the wiki text. Datapoints for bonus points posting on multiple cards include post 2579.

Getting around the $450 annual fee: Many people have been able to meet the spending requirement before the first statement posts and then cancel and have the fee refunded after the miles post. Details and datapoints include starting at post 74. T&C state that the card must be cancelled within 30 days of the fee posting to get it refunded; in practice you have 37 days. Potential problems with this plans include a very short (1 week or less) first "month" as well as delays in miles posting which have been reported by several FTers.

Once you cancel the card (within the 37 day window of AF posting) the refund will post on the account between 1-3 business days. Leave a $450 balance and it will be zeroed out.

Retention Bonus Offers: User have been offered the following retention bonus offers when calling to cancel the card:

- 5,000 points + $100 credit with $1,500 spend per month for 3 months 5333

- 2 additional club member passes 6862

- 1,000 bonus miles each month for 16 month, min $1k spend/month 6862

- [3/15] 15,000 bonus miles for spending $5k

- $450 Credit for spending $5k for next three statements

Already a member? If you already purchased an AC membership (for example, using the credit from Amex Plat) and apply and are approved for this card, AA will refund you the pro-rated AF from any time left on your membership.

When do miles post? Usually two days after your statement closing date. In some cases your statement will show the correct miles earned but will show 0 miles reported to AA. In this case see this thread.

Helpful points from post #3794 and others, especially for those new to Citi:

1) Citi CSRs are clueless, so disregard everything they say that seems to contradict anything you have read on F/T. And take everything else with a big grain of salt. I was told 3 times VERY CLEARLY "You will not got your annual fee refunded" while I was cancelling, but I did get it.

2a)

2b) Another helpful post discussing timeframe for meeting min spend: 6279

3) Any expectation that Citi will do things that make sense is just plain silly. They won't.

Citibank Contacts/Resources

- Application status: https://www.accountonline.com/cards/...?screenID=3187

- (800) 695-5171 – Personal Application Status and Reconsideration Line with live rep

- (800) 763-9795 – General Personal Application Inquiries with live rep

- (866) 606-2787 – General Application and Account Questions with live rep

- (888) 201-4523 – Application status

- (866) 606-2961 – Reconsideration Line.

- Twitter : @AskCiti. Very powerful tool.

- Executive Office - useful for getting a more empowered agent for reconsideration purposes: CitiBank Executive Review Department, P.O. Box 6000, Sioux Falls, SD 57117

For reference, an AC lounge list: http://www.aa.com/i18n/travelInforma...#admirals-club

For questions and discussions on lounge access: Help Desk: Lounge Access and Lounge Access Rules

Information on new authorized user AC lounge access: Citi Authorized User Admirals Club Benefit Terms

Also, please note that these cards do not include the 10% miles rebate offered by some other Citi AA products.

What about the EQM? AA tracks your miles earned on Executive card(s) and adds 10K Elite Qualifying Miles to your EQM balance once you earn 40,000 miles during a calendar year on Executive card(s). Any number of Executive cards can add up to the 40K, and you cannot earn more than 10K EQM each year. No redeemable miles are added, and this is of no consequence or value unless you will also earn at least 15K additional EQM in a given year by flying and 10K will bump you up to the next status level.

Direct phone number to Citi Fraud Prevention department: +18664705331

Concierge service enrollment (allows for electronic requests). Concierge number is +18778812668

Here are the minimum credit limit required amounts in order to keep an account open (for purposes of new card applications and reconsiderations)

Citi Amex 1k (likely citi gold as well)

Citi Visa signature/world MasterCard 3k (as low as 1k on some accounts YYMV)

Citi World elite Mastercards (including exec) 5k

Advice to those new to Citi American Airlines cards,

If you are just starting out please apply and use the lower level citi AA card for a while before moving on to this thread and card. This will help you in the long run in more ways than one. Most of us here have opened and used lower level AA cards before moving on to this thread and card

Also,

Check out this thread

http://www.flyertalk.com/forum/citi-...-benefits.html

Citi AA Executive MasterCard [2016-2017]

#271

Join Date: Jul 2005

Location: Chicago, IL

Programs: AA EP; WN CP;UA SILVER; MARRIOTT TITANIUM; HH DIAMOND; IHG PLAT; RADISSON PLAT; HYATT GLOBAL

Posts: 1,938

Looking at adding a friend as an authorized user since four of us are taking a trip in the near future and we would all like to have AC access. Planning on adding him as an auth. user about a month before the trip and cancelling the card right after.

Does anyone know if it will affect his credit score if I do this? Last time I added an auth. user, it never asked for a SSN or anything like that. Anyone have any experience with this?

Does anyone know if it will affect his credit score if I do this? Last time I added an auth. user, it never asked for a SSN or anything like that. Anyone have any experience with this?

#272

Join Date: Aug 2017

Location: Stilllwater OK (SWO)

Programs: AAdvantage ExecPlat, World of Hyatt Globalist, plain "member" of Marriott, IHG, enterprise, etc.

Posts: 1,848

I've reached 8K in spending on this in one month, I expect to see my 75K bonus miles official with the statement tomorrow -- mostly, I ended up just advancing my normally last minute end-of-year donations to the card and went ahead and bought AA tickets for my known travel for the early part of next year.

As a bonus, after my card was flagged two days in row for 'possible suspicious activity' that I had to call to clear up, prompted first by my multiple air tickets in one day, and then by my paypal donation to charity the next (lame to do that on a credit card, but it was a sure-fire way to just get my target met so that I can sock-drawer this card, FYI, I did add an extra 3% over my normal donation amount to cover the paypal expenses on their side) -- anyways, I got a 2K mile bonus (confirmed via email this morning) for 'my inconvenience'. Not bad citi, not bad at all.

As a bonus, after my card was flagged two days in row for 'possible suspicious activity' that I had to call to clear up, prompted first by my multiple air tickets in one day, and then by my paypal donation to charity the next (lame to do that on a credit card, but it was a sure-fire way to just get my target met so that I can sock-drawer this card, FYI, I did add an extra 3% over my normal donation amount to cover the paypal expenses on their side) -- anyways, I got a 2K mile bonus (confirmed via email this morning) for 'my inconvenience'. Not bad citi, not bad at all.

#273

Join Date: Nov 2015

Location: FL, USA

Programs: AA Plat, Hyatt Explorist, Hilton Diamond, IHG Plat, Marriot Gold

Posts: 1,666

As an AU, do the benefits apply the same?

I know they get Admirals Club Access but do they also get priority boarding and screening and all the other benefits?

I know they get Admirals Club Access but do they also get priority boarding and screening and all the other benefits?

#274

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,959

Suggest looking at the thread in the AA forum, LINK in Wikipost.

Looking at the terms of the benefits:

Looking at the terms of the benefits:

First Checked Bag Free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Enhanced Airport Experience

For benefits to apply, the Citi® / AAdvantage® Executive World EliteTM MasterCard® account must be open 7 days prior to air travel AND reservation must include the primary cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4

For benefits to apply, the Citi® / AAdvantage® Executive World EliteTM MasterCard® account must be open 7 days prior to air travel AND reservation must include the primary cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4

#275

Join Date: Nov 2015

Location: FL, USA

Programs: AA Plat, Hyatt Explorist, Hilton Diamond, IHG Plat, Marriot Gold

Posts: 1,666

Suggest looking at the thread in the AA forum, LINK in Wikipost.

Looking at the terms of the benefits:

Looking at the terms of the benefits:

thanks

#276

Join Date: Aug 2011

Location: BCN

Programs: AA EXP, Marriott Titanium & LT Gold

Posts: 126

I currently have the Citi AA Platinum Select, I got it a year ago. I've been considering upgrading to the Executive as most of my travel is in AA (SAT based, nearly all my flights go through DFW). Here's my dilemma: do I upgrade my AA Platinum to the Executive and save a hit/AAoA drop or do I cold-apply for a new one. I won't be eligible for the bonus either way, as I got an AA card in the last 24 months. The pro for cold-applying is I get to keep the Plat for the 10% mileage rebate, but other than that it just becomes a bit useless.

#277

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,959

https://www.flyertalk.com/forum/cred...st-2017-a.html

#278

Join Date: Aug 2011

Location: BCN

Programs: AA EXP, Marriott Titanium & LT Gold

Posts: 126

I might convert the Citi AA Platinum to Executive, and apply for the Barclays AA Red which also offers the 10% rebate feature.

https://www.flyertalk.com/forum/cred...st-2017-a.html

https://www.flyertalk.com/forum/cred...st-2017-a.html

Plot twist: I got offered on reddit a 9 digit invitation code without the 24 month language - so I might just apply and get the bonus and probably cancel the Plat Select in March after my 0% APR offer expires since the CL is not that big.

#279

Join Date: Feb 2012

Programs: AA Gold, HIltonHonors Diamond, KrisFlyer Silver, BW Diamond

Posts: 109

Looks like the 75K links are gone. The only one that loads says 50k bonus.

#280

Join Date: Jan 2013

Location: California

Programs: AA EXP 2MM, HH DIA, Hertz PC, GE + Pre✓, Amazon Super Special Prime

Posts: 1,008

So after reading through 279 posts, I feel I have a good grasp on my situation. But would love the insight of others.

Got the AA Plat MC in November 2014. Waived AF a few times. Called up this year to have the AF conversation. 3 separate calls and no agent could give me any offer - since I had a bonus miles for spending in a statement period offer active in the last few months (It had expired statement before the AF posted).

So with the dilemma of canceling the card and having to wait 24 months to re-apply and garner a new sign up bonus on Plat, paying the $95 AF to maintain the status quo, or upgrading the card to the Exec - I went with option #3 . Have some travel coming up where the AC membership would be a nice feature, and I have a global entry renewal coming up. No bonus offers were attached to the upgrade to exec, just the new benefits it has.

My question is, I am well past the 24 month since account opening window -Can I elect to apply for another Plat card whenever it works for me and be eligible for the sign up bonus available at the time? Or did that card "upgrade" to exec count as an account opening? I would think it did not count as one, since my card # is same, same login for Citi online, no other changes besides the standard card upgrade process. But logic and Citibank are not exactly synonymous.

Appreciate the help!

Got the AA Plat MC in November 2014. Waived AF a few times. Called up this year to have the AF conversation. 3 separate calls and no agent could give me any offer - since I had a bonus miles for spending in a statement period offer active in the last few months (It had expired statement before the AF posted).

So with the dilemma of canceling the card and having to wait 24 months to re-apply and garner a new sign up bonus on Plat, paying the $95 AF to maintain the status quo, or upgrading the card to the Exec - I went with option #3 . Have some travel coming up where the AC membership would be a nice feature, and I have a global entry renewal coming up. No bonus offers were attached to the upgrade to exec, just the new benefits it has.

My question is, I am well past the 24 month since account opening window -Can I elect to apply for another Plat card whenever it works for me and be eligible for the sign up bonus available at the time? Or did that card "upgrade" to exec count as an account opening? I would think it did not count as one, since my card # is same, same login for Citi online, no other changes besides the standard card upgrade process. But logic and Citibank are not exactly synonymous.

Appreciate the help!

#281

Join Date: Aug 2011

Location: BCN

Programs: AA EXP, Marriott Titanium & LT Gold

Posts: 126

After going back and forth deciding if I want to upgrade or cold apply to the Citi AAdvantage Executive card, I got a mailer with no 24 month language for the 75,000 miles offer. I decided to take the plunge and apply using the mailer and I got approved instantly around 9am CST this morning. Does anyone know if they expedite this card by default? The email does say "Look for a package from FedEx", but it also says 7-10 days - so any DP's are appreciated. Would CSR's have tracking number if I call in? (I have UPS/FedEx/USPS notifications, but nothing has triggered yet)

#282

Join Date: Mar 2003

Posts: 1,111

Datapoint

I applied for this card on 10/9 and spent the required $7.5k almost immediately after receiving it. The annual fee posted at the end of my first cycle on 11/9. The 75k posted on 11/14 in my AA account. I canceled on 11/20. The fee was refunded with a posting date of 11/20. I think it may have taken 2 days or so before this showed up in the transaction history.

#283

Join Date: Feb 2012

Programs: AA Gold, HIltonHonors Diamond, KrisFlyer Silver, BW Diamond

Posts: 109

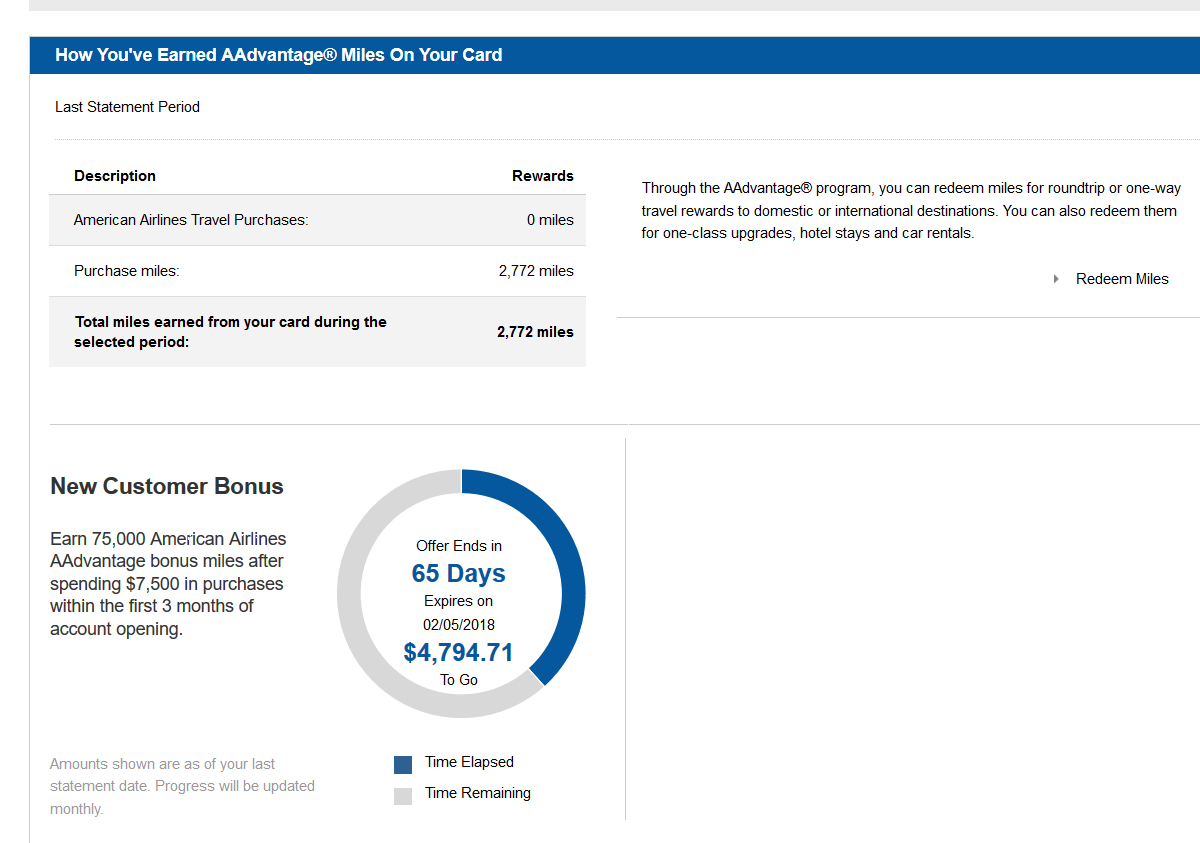

How to check your bonus status

I signed up via the link above to get a the 75K bonus, with $7500 spend. I always worry about whether I am meeting the bonus or even if I am getting it. Then I noticed on the Citicard website just click on the link to check your miles. I came across this lovely graphic which tells me how much I must spend, by when I must spend it and how close I am to achieving the spend! Nice!

BTW the 75K link in the WIKI was no longer linking to a 75K bonus signup page, but a 50K sign up page.

Last edited by wolfie52; Dec 5, 2017 at 5:46 pm

#284

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,959