Last edit by: mia

The Benefits Guide for Capital One Venture X is here: https://ecm.capitalone.com/WCM/card/...g-proof_v1.pdf

Capital One Venture X (General Discussion)

#1

Moderator

Original Poster

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,956

Capital One Venture X (General Discussion)

Applications accepted beginning November 9, 2021

2 miles per dollar on all spending.

Bonuses for using travel portal (Bonus miles and $300 annual credit)

Priority Pass with two free guests

Hertz President’s Circle status

Free Authorized Users (AU apparently receive Priority Pass and Hertz status)

Global Entry / TSA Precheck credit

Vacation rental (i.e. Airbnb and VRBO) $200 credit (temporary offer)

Cell phone insurance.

Anniversary bonus 10,000 miles

Annual free $395

https://www.cnbc.com/select/capital-...l-credit-card/

2 miles per dollar on all spending.

Bonuses for using travel portal (Bonus miles and $300 annual credit)

Priority Pass with two free guests

Hertz President’s Circle status

Free Authorized Users (AU apparently receive Priority Pass and Hertz status)

Global Entry / TSA Precheck credit

Vacation rental (i.e. Airbnb and VRBO) $200 credit (temporary offer)

Cell phone insurance.

Anniversary bonus 10,000 miles

Annual free $395

https://www.cnbc.com/select/capital-...l-credit-card/

Last edited by mia; Nov 4, 2021 at 10:04 am

#2

Join Date: Aug 2010

Location: ORF

Programs: Amex Plat, AA, BA Silver, Marriott Plat, Choice Gold, HHonors Gold, IHG Diamond

Posts: 3,749

Interesting option. For a premium card, I don't think a $10K spending requirement is onerous, and in combination with their reputation regarding manufactured spending, it might be one way that Capital One thins out undesirable applicants up front. Capital One has had the opportunity to see the premium offerings from the other card issuers, including the mistakes made, especially by Citi and Barclays, but also by Chase and Amex. C1 has also had the chance to see how Amex first enjoyed success and then bungled the issue of access to Centurion Lounges. C1 may have learned enough to price the annual fee competitively while offering a suite of benefits that is mostly sustainable. I think we'll eventually--maybe in a year or two--see a rise in the annual fee since at $395, they have plenty of room for an increase without reaching the annual fees of the CSR and Amex Plat. I think we'll also eventually see some trimming of the benefits but not the gutting we've seen with Citi.

I've been waiting for a card that would convince me to apply with C1 for one of their travel cards. I have a very old, no annual fee card with them. With their recent changes in their miles program as well as the prospect of decent lounges, including at Dulles, a frequent departure point for me for international flights, the Venture X might finally convince me to apply.

I've been waiting for a card that would convince me to apply with C1 for one of their travel cards. I have a very old, no annual fee card with them. With their recent changes in their miles program as well as the prospect of decent lounges, including at Dulles, a frequent departure point for me for international flights, the Venture X might finally convince me to apply.

#5

Join Date: Jul 2004

Location: Live: IWI; Work: DCA/Everywhere; Play: LAS/SJU/MLE

Programs: AA EXP, DL PM, Hyatt Glob, Marriott Ambassador/LTP, Nat'l Exec Elite, LEYE Gold

Posts: 6,670

#6

Join Date: Jul 2014

Location: JRF

Programs: AA Gold, Marriott Platinum, Hilton Diamond, National Executive Elite

Posts: 1,784

Am I the only one very offended by CapitalOne thinking this is a "premium" product? Forced to use their OTA, Airbnb credits instead of proper hotels (can I use this at Marriott Home & Villas?), points being worth 1/2 a cent (it's like a Barclays Arrival/Premier on steroids), and the usual 3 hard pulls...

#7

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

Am I the only one very offended by CapitalOne thinking this is a "premium" product? Forced to use their OTA, Airbnb credits instead of proper hotels (can I use this at Marriott Home & Villas?), points being worth 1/2 a cent (it's like a Barclays Arrival/Premier on steroids), and the usual 3 hard pulls...

The AirBnB credit is a one time extra on top of 100k points.

Capital one says:

For example, some vacation rental agencies may use a "hotel" code rather than a "rental" code. Capital One is not responsible for merchant category codes used by merchants. Eligible vacation rental merchants include Airbnb, Turnkey, Vacasa, and VRBO.

Chase and AMEX and US Bank require you to go through their travel portal for increased earnings — except AMEX 5x on flights.

#8

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,459

Am I the only one very offended by CapitalOne thinking this is a "premium" product? Forced to use their OTA, Airbnb credits instead of proper hotels (can I use this at Marriott Home & Villas?), points being worth 1/2 a cent (it's like a Barclays Arrival/Premier on steroids), and the usual 3 hard pulls...

If not interested, don't apply.

#9

Join Date: Feb 2006

Posts: 1,064

Apologies in advance, as I'm not trying to hijack this thread, but I am on the fence for applying and need some feedback.

I already have a few premium cards, so the benefits aren't important. I also am concerned that Capital One doesn't offer the same breadth of travel protections of Amex and Chase. However, the signup bonus is enticing.

Looking ahead to year 2, I would anticipate downgrading to the no-fee Venture card. Compared to the existing cards in my portfolio, the Venture seems to align best with the Citi Double Cash.

I know both have the ability to earn points and be transferred to airlines. However Citi requires either the Premier or Prestige, much like Chase requires either a CSR or CSP. I currently don't have any premium Citi cards, but was wondering if Citi allows customers to convert cashback to Thank You points and combine those points with existing Thank You points, once a customer gets a premium Citi card?

If I keep the Venture, it would replace my Citi Double Cash for everyday spend. If I decide to apply for a Citi Premier card next year, will Citi allow me to convert my DC cashback to Thank You points and combine with those Thank You points from the Premier?

I already have a few premium cards, so the benefits aren't important. I also am concerned that Capital One doesn't offer the same breadth of travel protections of Amex and Chase. However, the signup bonus is enticing.

Looking ahead to year 2, I would anticipate downgrading to the no-fee Venture card. Compared to the existing cards in my portfolio, the Venture seems to align best with the Citi Double Cash.

I know both have the ability to earn points and be transferred to airlines. However Citi requires either the Premier or Prestige, much like Chase requires either a CSR or CSP. I currently don't have any premium Citi cards, but was wondering if Citi allows customers to convert cashback to Thank You points and combine those points with existing Thank You points, once a customer gets a premium Citi card?

If I keep the Venture, it would replace my Citi Double Cash for everyday spend. If I decide to apply for a Citi Premier card next year, will Citi allow me to convert my DC cashback to Thank You points and combine with those Thank You points from the Premier?

Last edited by diesteldorf; Nov 10, 2021 at 2:27 pm

#10

Join Date: Feb 2016

Location: EZE

Programs: UA Gold,Delta Gold Bonvoy Titanium Elite, HH Diamond , AA Platinum, EENational, Hyatt Globalist

Posts: 1,548

I received a complimentary entry by the operator. The lounge is outstanding. I would rate it at least twice as nice as DFW Centurion Lounge. As long as it doesn't get overwhelmed (I worry about the Grab-and-Go), the experience is so much more relaxing than the CL. The individual bathrooms felt luxurious.

As for the chef-prepared food, the bibimbap and the mac and cheese with bacon (also available without) were outstanding.

As for the chef-prepared food, the bibimbap and the mac and cheese with bacon (also available without) were outstanding.

#11

Moderator: Alaska Mileage Plan

Join Date: Feb 2005

Posts: 12,318

New Venture X cardmembers can show a copy of their acceptance email or a screen print of their new account info for complimentary entry until they receive their new card.

#13

Join Date: Feb 2006

Posts: 1,064

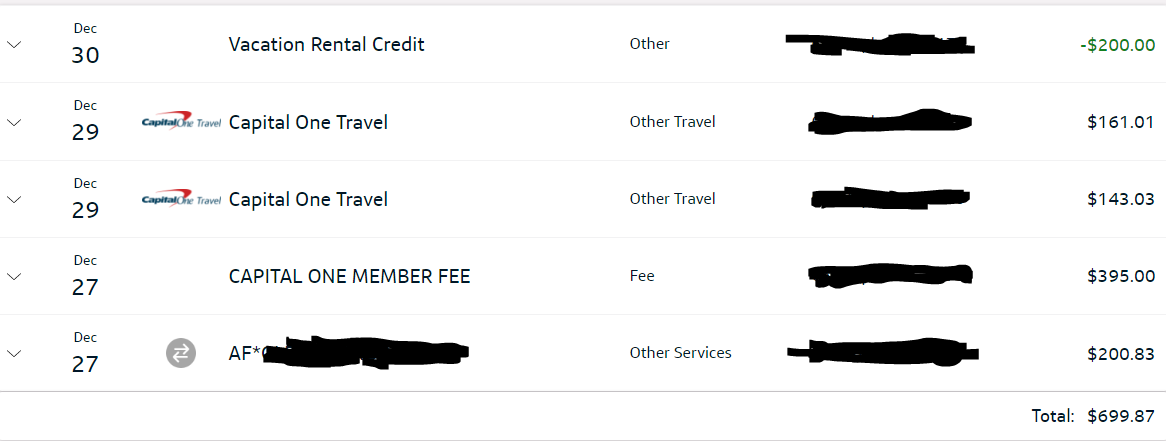

Another data point on the vacation rental credit -- I paid home association dues with my Venture X and got the $200 vacation rental credit.

Association is managed by CWD using Zego/PayLease as the payment processor.

Payment Charged 12/18

Payment Posted 12/20

Credit Posted 12/23

Charge shows as "Other Services" so it seems basically anything remotely "housing" related counts.

Association is managed by CWD using Zego/PayLease as the payment processor.

Payment Charged 12/18

Payment Posted 12/20

Credit Posted 12/23

Charge shows as "Other Services" so it seems basically anything remotely "housing" related counts.

My apartment allows electronic payments through APPFOLIO. https://www.appfolio.com/

They charge a 2.99% processing fee for credit cards, but I decided to take a chance and made a $195.00 payment with a $5.83 processing fee. The charge posted on December 26 and the vacation rental credit for $200.00 posted last night on December 30.

I would've definitely found value from VRBO/Airbnb, but using it for rent lowers the effective annual fee to $200.00 ($395.00-$195.00). I doubt the signup bonus will ever get any better than now.

My thoughts on the card:

I applied on December 25, verified my identity and got the virtual card number through the app on December 26, and accessed the travel portal.

I don't like booking flights through 3rd parties, so I made two hotel reservations.

The first was for a stay at the Wyndham New Yorker hotel near Penn Station/MSG. The portal price was $161.00, which was cheaper than booking directly with Wyndham ($186.00) EXCEPT it mentioned a $40.00 resort fee to be paid on arrival. I had a planned a two-night stay, so I booked the first night through Wyndham and the 2nd night through the portal. If I am able to get the $40.00 resort fee waived on the 2nd night, it'll be a good deal, but, if not, I am effectively paying more and also forfeiting my Wyndham elite benefits and points.

The second was for a stay at Home2Suites Milwaukee Airport. The portal price was actually $15 cheaper than booking the best available rate with Hilton, though I am sacrificing my elite benefits and Honors points. To be fair, both of these hotels are mid-tier, so wouldn't have expected many elite benefits/upgrades to begin with, and I am earning 10X points on hotels through the portal.

If you are booking flights or higher-end hotels, it'll be easy to utilize the $300 travel credit in one shot, but lower and mid-tier hotels may take 2-4 bookings. I actually spent $20 more at Home2Suites ($4.00 beyond the $300 credit) to utilize the entire amount without having to book a 3rd stay. The additional 160 (20x8) miles and larger room should make up for the $4 overspend. As a side note, even the premium room was $17.00 cheaper than booking with Hilton direct.

I don't know if I'll keep this card long-term, but is a great option for non-bonus spend. I currently utilize Priority Pass through the Chase Ritz card and have 6 authorized users, so many of my Venture X benefits are duplicated. I'm also curious how long it'll be before Capital One either increases the fee or reduces benefits. From experience, it is harder to cancel a card when you have multiple AUs that are utilizing and enjoying the Priority Pass benefits, even if the annual fee goes up in the future.

Last edited by diesteldorf; Dec 31, 2021 at 10:46 am

#14

Join Date: Jan 2022

Posts: 86

I applied for CapOne Venture X and was approved on Monday January 10. The email I received said I would receive the card in 3 business days. It is now beyond 3 business days, but haven't received anything yet. Does anyone have recent datapoints on how long it takes to receive the card after approval? I want to receive the card and activate it soon, as I have a property tax payment that is due by Jan 31, 2022, and I want to put the payment on the Venture X to help meet the minimum spend.

Thanks.

Thanks.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Data point about the $200 vacation rental credit:

We booked an Airbnb on Dec 12 and got the credit on Dec 15. But we had to cancel the booking, and were refunded the entire amount, which posted to our account on Dec 22. It's been almost a month since then, and the $200 credit is still there, no clawback.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Data point about the travel portal price match guarantee:

We booked a hotel through the portal and found a cheaper rate through a deal on agoda.com. Called in to request a match, and they said they would look over it. They reached out to us the next day to tell us that our match request was denied. I suspect this is either because agoda had a special promotion going on, or because the booking was non-refundable, whereas the only option we had through the travel portal was for a refundable booking.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Has anyone tried to use the Hertz President's Circle status that comes with this card (or any of the other rental car benefits that come with Visa Infinite) when booking through the travel portal? I called Capital One to ask about how that would work, since there isn't a way to put in a Hertz loyalty number when making the booking through the portal, and they said I could call Hertz after making the booking and ask them to add the loyalty info to the booking by hand. Has anyone tried this?

If that doesn't work, what benefits can you still get from the status? Can you tell someone at the Hertz counter when you get there that you have status and still get a free upgrade or something?

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Does anyone know if the TSA pre-check/Global entry credit applies to each AU, so like you get the credit twice if two AUs pay for TSAPC/GE with the card, or is it just a single credit?

Last edited by travelcards; Jan 19, 2022 at 6:05 pm Reason: Combine consecutive replies.

#15

Join Date: Aug 2018

Programs: Hyatt Globalist, American Plat, Marriott Plat, Hilton Gold, Caesar Diamond

Posts: 28

Capital One Venture X (General Discussion)

Does anybody know for the Venture X card, if buying coins from the US Mint will not code as cash advance and will qualify for minimum spend requirements?