AC Provides Financial Update on COVID-19 (16Mar20); Long-term changes coming?

#76

Join Date: Mar 2010

Posts: 614

Still by no means an official answer but if all 3 agents have been told the same thing (that the temporary removal turned permanent) it's coming from somewhere and might potentially be correct.

#77

A FlyerTalk Posting Legend

Join Date: Sep 2012

Location: SFO

Programs: AC SE MM, BA Gold, SQ Silver, Bonvoy Tit LTG, Hyatt Glob, HH Diamond

Posts: 44,354

VP of loyalty and the notice on Aeroplan.com say it's coming back. Call center agents say it's not.

There's basically an entire thread on this: I work at the airport/for the airline. You're wrong.

#78

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,778

#79

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,778

@skybluesea , since this question isn't about AC's share price but about COVID-19's impact on its finances, I'm replying in this thread.

In short, I wouldn't be worried about your credits. You should either get to fly them or, worst case scenario, get reimbursed by your credit card. But most likely you'll get to use them to fly.

Detailed answers to your questions follow.

Or do I become an AC creditor in bankruptcy?

First of all, you're already a creditor to AC. You've paid money to AC for a service and not yet received said service, so you're owed either the service or your money back.

So How much of these future flight credits are embedded in current AC financials?

Your purchased tickets and credits show up as liabilities on AC's balance sheet in "Advance ticket sales", which were $2.94B at December 31.

AC also categorizes a portion of the ticket price as a purchase of Aeroplan miles. In 2019, $201MM out of $17.2B of ticket sales, or about 1.1%.

So let's say the total outstanding obligation for tickets already sold was $2.97B (2.94 ◊ 1.011 to account for the portion that's buried in Aeroplan deferred revenue). That number will include both credits such as yours as well as people with tickets that are still valid.

Usually in March, the number would be higher than in December, but with the current mess, forward bookings are way down. What it is now, hard to say. $1.5B? $2B? Maybe as low as $1B? Really hard to say.

Either way, it's a small component of AC's total liabilities at December 31, which were $23.4B.

For those with a crystal ball in the airline finance world, your views please?

Before discussing the details of insolvency, I will just reiterate that I see it as unlikely that AC becomes insolvent. Liquidity is still good, there are lots of unpledged assets, etc, and I also think it's likely the government would step in with some kind of assistance before insolvency.

But, if worst came to worst, broadly, there are two ways an insolvency could play out.

Option 2 is generally preferred by creditors and customers alike.

If AC goes with option 1, which is highly unlikely, you should be entitled to a refund through your credit card. The credit card companies would then litigate with AC to recover whatever they could. I've had trouble digging up the old Jetsgo documents to see exactly how it was resolved, but Moneris, which clears the credit card payments, was by far the largest creditor there.

I suspect that customers got their money back and that Moneris and the card issuers ate the difference between whatever they recovered and what they had to refund to customers, but I don't know for sure. With more digging, I might figure it out, but it's highly unlikely that AC will go this route. That requires a business to be a total train wreck, essentially, and AC was actually quite profitable before this externality whacked them.

If AC did become insolvent, if would be far more likely to continue operating and attempt a restructuring rather than a liquidation. This is what AC did in 2003, and what all the US majors (other than WN, which has never been insolvent) went through in the last 10-15 years. In Canada, this would be done under the Companies Creditors Arrangement Act, or "CCAA". The equivalent in the US is Chapter 11.

During CCAA, a business essentially continues to operate as normal. From a customer perspective, that means that existing bookings are honoured. Although, as I've explained above, customers with outstanding tickets are creditors, it generally doesn't make sense to try to haircut them.

For example, if someone is owed $200MM on a bond, it's easy to cut what's owed to them by reducing the amount owed, lengthening the maturity, lowering the interest rate, etc. But how do you give a haircut to someone who has a YYC-YYZ ticket? Do you drop them off in YQT? It's really not practical.

It would, in theory, be possible to haircut the value of unused credits, e.g. to say that your $12K worth of credits are now only worth $7K. But the problem is that those credits will be relatively small compared to regular advance ticket sales, so it will be complex and expensive to administer. Anyone holding those credits will then also become a creditor affected by the restructuring, entitled to vote on the plan, and needing to be organized, which costs time and money.

It's also not uncommon, in a large insolvency, to set a certain threshold below which small creditors won't be impacted - if there are billions of dollars of obligations, it's simply not worth the time to fight about $500 here and $200 there and so on. Most of the credits are going to be in that magnitude.

The biggest fish to fry will be the roughly $9B of long-term debt and leases. A lot of those will be secured against aircraft, so they may be difficult to modify, but they're the biggest item. There's a $4B liability for future Aeroplan redemptions, which can potentially be written down by devaluing Aeroplan points, I would think. There's $2.9B of pension liability. Similar size to the advance ticket sales, but much easier to do something on - you only have to negotiate with a handful of unions rather than deal with a retail class.

The bottom line is I think it's highly unlikely that credits for future travel get impacted in an insolvency, which is in and of itself pretty unlikely. So I wouldn't worry too much, if I were you.

Iím now sitting on an excess of $12k in AC flight credits + more with other carriers. My schedule allows advance booking months ahead so get excellent P / N fares for my clients.

[...]

So How much of these future flight credits are embedded in current AC financials? And Iím not keen on breakage.

Or do I become an AC creditor in bankruptcy?

For those with a crystal ball in the airline finance world, your views please?

[...]

So How much of these future flight credits are embedded in current AC financials? And Iím not keen on breakage.

Or do I become an AC creditor in bankruptcy?

For those with a crystal ball in the airline finance world, your views please?

Detailed answers to your questions follow.

Or do I become an AC creditor in bankruptcy?

First of all, you're already a creditor to AC. You've paid money to AC for a service and not yet received said service, so you're owed either the service or your money back.

So How much of these future flight credits are embedded in current AC financials?

Your purchased tickets and credits show up as liabilities on AC's balance sheet in "Advance ticket sales", which were $2.94B at December 31.

AC also categorizes a portion of the ticket price as a purchase of Aeroplan miles. In 2019, $201MM out of $17.2B of ticket sales, or about 1.1%.

So let's say the total outstanding obligation for tickets already sold was $2.97B (2.94 ◊ 1.011 to account for the portion that's buried in Aeroplan deferred revenue). That number will include both credits such as yours as well as people with tickets that are still valid.

Usually in March, the number would be higher than in December, but with the current mess, forward bookings are way down. What it is now, hard to say. $1.5B? $2B? Maybe as low as $1B? Really hard to say.

Either way, it's a small component of AC's total liabilities at December 31, which were $23.4B.

For those with a crystal ball in the airline finance world, your views please?

Before discussing the details of insolvency, I will just reiterate that I see it as unlikely that AC becomes insolvent. Liquidity is still good, there are lots of unpledged assets, etc, and I also think it's likely the government would step in with some kind of assistance before insolvency.

But, if worst came to worst, broadly, there are two ways an insolvency could play out.

- Liquidation: this is where the company has essentially run out of money and is no longer a viable business. The company ia shut down and assets are sold off to the highest bidder.

- Restructuring: the company negotiates with creditors to reduce debts and restructure other contracts.

Option 2 is generally preferred by creditors and customers alike.

If AC goes with option 1, which is highly unlikely, you should be entitled to a refund through your credit card. The credit card companies would then litigate with AC to recover whatever they could. I've had trouble digging up the old Jetsgo documents to see exactly how it was resolved, but Moneris, which clears the credit card payments, was by far the largest creditor there.

I suspect that customers got their money back and that Moneris and the card issuers ate the difference between whatever they recovered and what they had to refund to customers, but I don't know for sure. With more digging, I might figure it out, but it's highly unlikely that AC will go this route. That requires a business to be a total train wreck, essentially, and AC was actually quite profitable before this externality whacked them.

If AC did become insolvent, if would be far more likely to continue operating and attempt a restructuring rather than a liquidation. This is what AC did in 2003, and what all the US majors (other than WN, which has never been insolvent) went through in the last 10-15 years. In Canada, this would be done under the Companies Creditors Arrangement Act, or "CCAA". The equivalent in the US is Chapter 11.

During CCAA, a business essentially continues to operate as normal. From a customer perspective, that means that existing bookings are honoured. Although, as I've explained above, customers with outstanding tickets are creditors, it generally doesn't make sense to try to haircut them.

For example, if someone is owed $200MM on a bond, it's easy to cut what's owed to them by reducing the amount owed, lengthening the maturity, lowering the interest rate, etc. But how do you give a haircut to someone who has a YYC-YYZ ticket? Do you drop them off in YQT? It's really not practical.

It would, in theory, be possible to haircut the value of unused credits, e.g. to say that your $12K worth of credits are now only worth $7K. But the problem is that those credits will be relatively small compared to regular advance ticket sales, so it will be complex and expensive to administer. Anyone holding those credits will then also become a creditor affected by the restructuring, entitled to vote on the plan, and needing to be organized, which costs time and money.

It's also not uncommon, in a large insolvency, to set a certain threshold below which small creditors won't be impacted - if there are billions of dollars of obligations, it's simply not worth the time to fight about $500 here and $200 there and so on. Most of the credits are going to be in that magnitude.

The biggest fish to fry will be the roughly $9B of long-term debt and leases. A lot of those will be secured against aircraft, so they may be difficult to modify, but they're the biggest item. There's a $4B liability for future Aeroplan redemptions, which can potentially be written down by devaluing Aeroplan points, I would think. There's $2.9B of pension liability. Similar size to the advance ticket sales, but much easier to do something on - you only have to negotiate with a handful of unions rather than deal with a retail class.

The bottom line is I think it's highly unlikely that credits for future travel get impacted in an insolvency, which is in and of itself pretty unlikely. So I wouldn't worry too much, if I were you.

Last edited by Adam Smith; Mar 19, 2020 at 8:28 am Reason: Fixed formatting

#80

Join Date: Apr 2015

Location: YVR

Programs: UA Premier Platinum

Posts: 3,759

Thanks for all the analysis, Adam. And I agree - as someone sitting on around $5k in credits from various airlines at this point, I'm not too worried. There are however people that are facing a cash crunch of their own due to COVID-19 and could really benefit from retrieving $300 or $500 or whatever back from AC for a flight that will no longer be operated. They will be the ones who pay the price for this.

#82

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,778

Thanks for all the analysis, Adam. And I agree - as someone sitting on around $5k in credits from various airlines at this point, I'm not too worried. There are however people that are facing a cash crunch of their own due to COVID-19 and could really benefit from retrieving $300 or $500 or whatever back from AC for a flight that will no longer be operated. They will be the ones who pay the price for this.

I don't disagree that it sucks for people who need the cash. Forget about $300 or $500, there are probably families out there that are out of pocket thousands for their spring break trips with ACV that are now cancelled. My analysis was only about whether people should be worried about travel credits with AC though, as opposed to the rightness or wrongness of it

#85

Suspended

Join Date: Sep 2014

Programs: AC SE100K-1MM, NH, DL, AA, BA, Global Entry/Nexus, APEC..

Posts: 18,877

#87

Join Date: Dec 2006

Location: YEG

Posts: 3,925

Any bailout money should be used to keep the company solvent - that doesnít necessarily mean keeping/paying for employees that are non-essential.

Iím all for attaching certain strings though, such as no bonus payments to executives, etc. IMHO taxpayer bail out money shouldnít be spent for executives to enrich themselves - if they want to do that the executives should arrange for financing from non-taxpayer / government sources that might allow them to collect such bonuses.

#88

Join Date: Jan 2008

Posts: 3,946

Why? If the employees get laid off temporarily, I’d rather the money go directly to the employees via EI. We already have a social safety net for loss of employment, I say let’s use that.

Any bailout money should be used to keep the company solvent - that doesn’t necessarily mean keeping/paying for employees that are non-essential.

I’m all for attaching certain strings though, such as no bonus payments to executives, etc. IMHO taxpayer bail out money shouldn’t be spent for executives to enrich themselves - if they want to do that the executives should arrange for financing from non-taxpayer / government sources that might allow them to collect such bonuses.

Any bailout money should be used to keep the company solvent - that doesn’t necessarily mean keeping/paying for employees that are non-essential.

I’m all for attaching certain strings though, such as no bonus payments to executives, etc. IMHO taxpayer bail out money shouldn’t be spent for executives to enrich themselves - if they want to do that the executives should arrange for financing from non-taxpayer / government sources that might allow them to collect such bonuses.

#89

Join Date: May 2015

Location: Vancouver

Programs: Aeroplan, Mileage Plus, WestJet Gold, AMEX Plat

Posts: 2,026

https://twitter.com/richard680news/s...44071066837003

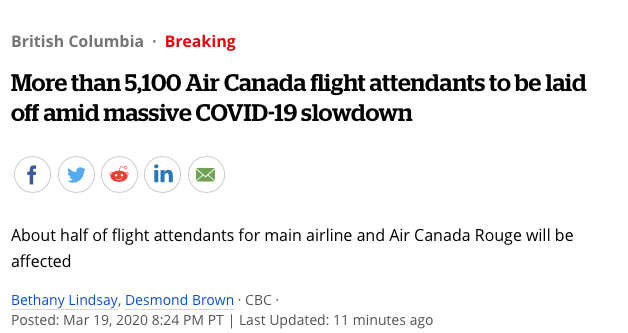

#BREAKING - Big layoffs at Air Canada. 3,600 employees at Air Canada mainline, and all 1,549 employees at Air Canada Rouge will be temporarily laid off.

#BREAKING - Big layoffs at Air Canada. 3,600 employees at Air Canada mainline, and all 1,549 employees at Air Canada Rouge will be temporarily laid off.

Sad but needed.

#90

Join Date: Jan 2009

Location: YOW

Programs: AC-SE100K, AC-3MM, Marriott- LT Titanium, SPG RIP

Posts: 2,959

Unfortunately this is the tip of the iceberg in terms of the job losses that are coming in our country.