Last edit by: WineCountryUA

Chase United Club Infinite Card

Previous Club Card -- Chase MP Club credit card {Archive}

- Earn 80,000 bonus miles

- United Club℠ membership

- Premier Access® travel services

- First and second checked bags free

- New! Earn 4 miles per $1 spent on United purchases

- New! Earn 2 miles per $1 spent on dining and all other travel

- Earn 1 mile per $1 spent on all other purchases

- New! Up to $100 Global Entry® or TSA PreCheckTM fee credit

- Enjoy 25% back United inflight purchases

- No foreign transaction fees

- Avis President's Club®

- Premier upgrades on award tickets

- $525 annual fee

- This card product is available to you if you do not have any United Club card and have not received a new Cardmember bonus for any United Club card in the past 24 months

- Platinum IHG status -- signup

United ClubSM Infinite Card benefits

Credit card benefits

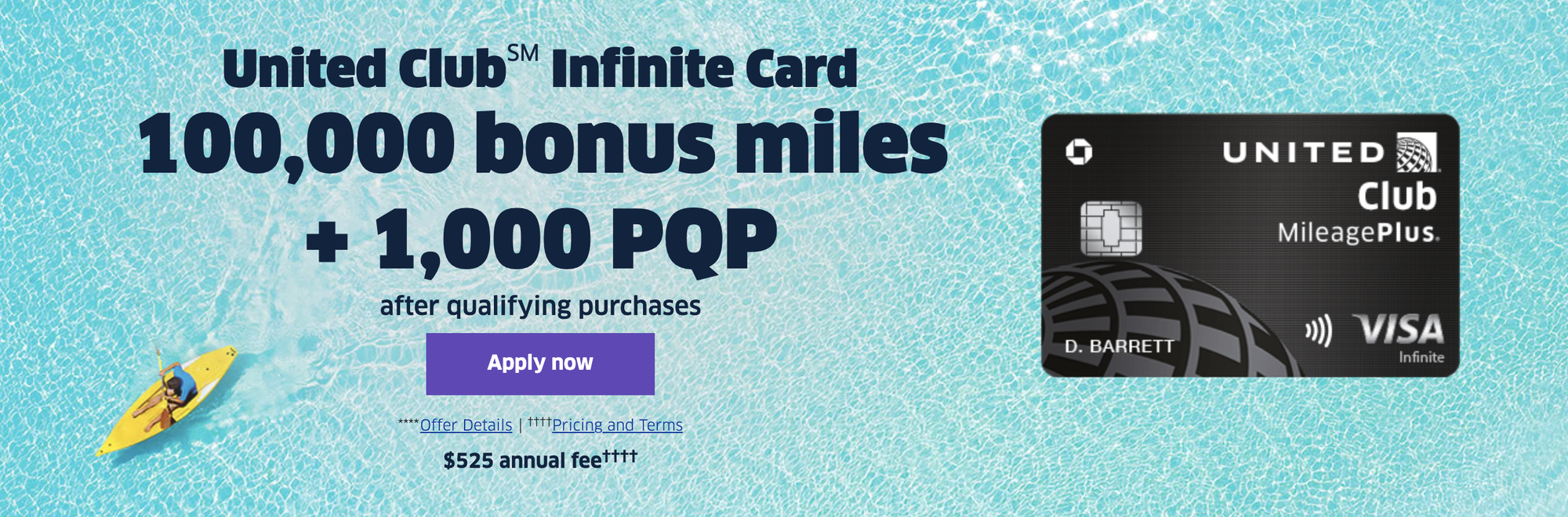

100,000 bonus miles

You'll earn 100,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.*** This product is available to you if you do not have any United Club card and have not received a new Cardmember bonus for any United Club card in the past 24 months.

United ClubSM membership

Up to a $650 value per year. As the primary Cardmember, you and your eligible travel companions will enjoy access to 45+ United Club locations and participating Star Alliance™ affiliated lounges worldwide.***

Current United Club members

If you are a current United Club member, you can apply for the United Club Card and be reimbursed for the unused portion of your United Club membership once approved for the card.***

NEW! Earn 4 miles per $1 spent on United® purchases

You'll earn 4 miles per $1 spent on purchases from United, including tickets, Economy Plus®, inflight food, beverages and Wi-Fi, and other United charges.*** You'll also earn 4 miles per $1 spent on United Events from Chase purchases.*** For more information on United Events from Chase visit InsideAccess.com

NEW! Earn 2 miles per $1 spent on dining at restaurants and travel

You'll earn 2 miles per $1 spent on dining at restaurants and on all other travel, including airfare, trains, local transit, cruise lines, hotels, car rentals, taxicabs, resorts, ride share services and tolls.***

Earn with every purchase

You'll earn 1 mile per $1 spent on all other purchases.***

No blackout dates

As the primary Cardmember, you will also enjoy expanded award availability when you use miles to book any United-operated flight, any time, with no restrictions or blackout dates.*** For more information, please visit united.com/AirAwards [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image003.png[/img].

Premier upgrades on award tickets

The primary Cardmember who is also a MileagePlus Premier® member and traveling on an award ticket can take advantage of Complimentary Premier Upgrades on United flights (when available).***

More ways to use miles

You can use miles to book award travel on Star Alliance™ and other partner airlines. Or use them to enhance your travel with upgrades, inflight Wi-Fi, hotel stays and car rentals. Miles can also be used for merchandise, gift cards and once-in-a-lifetime events. To learn more, please visit united.com/UseMiles [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image003.png[/img].

Free first and second checked bags

A savings of up to $320 per roundtrip. The primary Cardmember and one companion traveling on the same reservation will each receive their first and second standard checked bags free (up to $35 value for the first checked bag and up to $45 value for the second checked bag, each way, per person) on United-operated flights when the primary Cardmember includes their United MileagePlus® number in their reservation and purchases their tickets from United with their card.*** For complete details, please visit united.com/ChaseBag [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image002.png[/img].

Premier Access® travel services

Receive preferential treatment to ease your way through the airport with priority check-in, security screening (where available), boarding and baggage handling privileges.***

NEW! Up to $100 Global Entry or TSA PreCheckTM fee credit

Receive a statement credit of up to $100 every 4 years as reimbursement for the application fee for Global Entry or TSA PreCheckTM when charged to your card.***

25% back on United inflight purchases

25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United®-operated flights when you pay with your Club Card.***

Hertz Gold Plus Rewards® President's Circle®

The primary Cardmember is invited to enroll in the Hertz Gold Plus Rewards program's exclusive President's Circle tier and enjoy a 50% bonus on Hertz Gold Plus Rewards Points, upgrades, exclusive offers and more.*** To enroll, please visit united.com/HertzChaseBenefit [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image004.png[/img].

No foreign transaction fees

Purchases made with your Club Card outside the U.S. will not be subject to foreign transaction fees.††† For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Travel & purchase protection

Trip Cancellation / Trip Interruption Insurance

If your trip is cancelled or cut short by sickness, severe weather, and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.^^^

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.^^^

Lost Luggage Reimbursement

If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger.^^^

Trip Delay Reimbursement

If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.^^^

Auto Rental Collision Damage Waiver

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad.^^^

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year.^^^

Return Protection

You can be reimbursed for eligible items that the store won't take back within 90 days of purchase, up to $500 per item, $1,000 per year.^^^

Extended Warranty Protection

Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less.^^^

^^^These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Luxury hotels & experiences

The Luxury Hotel & Resort Collection

This exceptional group of over 900 properties includes many of the world's most exquisite hotels, resorts, lodges and spas, each of which extend you complimentary Cardmember benefits with every stay.*** Make a reservation through the program using your Chase card to receive the following benefits including:

United Card Events from Chase and United MileagePlus Events

Pursue more of your passions with United Events from Chase. As a Cardmember you will be delighted with opportunities to purchase private, curated once-in-a-lifetime experiences. Sample select wines and satisfy your palate with culinary events at some of the world’s best restaurants, meet a sporting legend or make memories with your family. United MileagePlus® Visa Infinite® Cardmembers may also enjoy exclusive experiences using your award miles such as private winemaker dinners and VIP access to live theater and museum events. Please visit InsideAccess.com to learn more.

Visa Infinite® Concierge Services

Enjoy 24/7 personalized assistance for travel planning, dinner reservations, sports, entertainment tickets and more. Available 365 days a year from home or abroad.***

Credit card benefits

100,000 bonus miles

You'll earn 100,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.*** This product is available to you if you do not have any United Club card and have not received a new Cardmember bonus for any United Club card in the past 24 months.

United ClubSM membership

Up to a $650 value per year. As the primary Cardmember, you and your eligible travel companions will enjoy access to 45+ United Club locations and participating Star Alliance™ affiliated lounges worldwide.***

Current United Club members

If you are a current United Club member, you can apply for the United Club Card and be reimbursed for the unused portion of your United Club membership once approved for the card.***

NEW! Earn 4 miles per $1 spent on United® purchases

You'll earn 4 miles per $1 spent on purchases from United, including tickets, Economy Plus®, inflight food, beverages and Wi-Fi, and other United charges.*** You'll also earn 4 miles per $1 spent on United Events from Chase purchases.*** For more information on United Events from Chase visit InsideAccess.com

NEW! Earn 2 miles per $1 spent on dining at restaurants and travel

You'll earn 2 miles per $1 spent on dining at restaurants and on all other travel, including airfare, trains, local transit, cruise lines, hotels, car rentals, taxicabs, resorts, ride share services and tolls.***

Earn with every purchase

You'll earn 1 mile per $1 spent on all other purchases.***

No blackout dates

As the primary Cardmember, you will also enjoy expanded award availability when you use miles to book any United-operated flight, any time, with no restrictions or blackout dates.*** For more information, please visit united.com/AirAwards [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image003.png[/img].

Premier upgrades on award tickets

The primary Cardmember who is also a MileagePlus Premier® member and traveling on an award ticket can take advantage of Complimentary Premier Upgrades on United flights (when available).***

More ways to use miles

You can use miles to book award travel on Star Alliance™ and other partner airlines. Or use them to enhance your travel with upgrades, inflight Wi-Fi, hotel stays and car rentals. Miles can also be used for merchandise, gift cards and once-in-a-lifetime events. To learn more, please visit united.com/UseMiles [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image003.png[/img].

Free first and second checked bags

A savings of up to $320 per roundtrip. The primary Cardmember and one companion traveling on the same reservation will each receive their first and second standard checked bags free (up to $35 value for the first checked bag and up to $45 value for the second checked bag, each way, per person) on United-operated flights when the primary Cardmember includes their United MileagePlus® number in their reservation and purchases their tickets from United with their card.*** For complete details, please visit united.com/ChaseBag [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image002.png[/img].

Premier Access® travel services

Receive preferential treatment to ease your way through the airport with priority check-in, security screening (where available), boarding and baggage handling privileges.***

NEW! Up to $100 Global Entry or TSA PreCheckTM fee credit

Receive a statement credit of up to $100 every 4 years as reimbursement for the application fee for Global Entry or TSA PreCheckTM when charged to your card.***

25% back on United inflight purchases

25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United®-operated flights when you pay with your Club Card.***

Hertz Gold Plus Rewards® President's Circle®

The primary Cardmember is invited to enroll in the Hertz Gold Plus Rewards program's exclusive President's Circle tier and enjoy a 50% bonus on Hertz Gold Plus Rewards Points, upgrades, exclusive offers and more.*** To enroll, please visit united.com/HertzChaseBenefit [img]file:///C:\Users\John\AppData\Local\Temp\msohtmlclip1\01\c lip_image004.png[/img].

No foreign transaction fees

Purchases made with your Club Card outside the U.S. will not be subject to foreign transaction fees.††† For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Travel & purchase protection

Trip Cancellation / Trip Interruption Insurance

If your trip is cancelled or cut short by sickness, severe weather, and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.^^^

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.^^^

Lost Luggage Reimbursement

If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger.^^^

Trip Delay Reimbursement

If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.^^^

Auto Rental Collision Damage Waiver

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad.^^^

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year.^^^

Return Protection

You can be reimbursed for eligible items that the store won't take back within 90 days of purchase, up to $500 per item, $1,000 per year.^^^

Extended Warranty Protection

Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less.^^^

^^^These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Luxury hotels & experiences

The Luxury Hotel & Resort Collection

This exceptional group of over 900 properties includes many of the world's most exquisite hotels, resorts, lodges and spas, each of which extend you complimentary Cardmember benefits with every stay.*** Make a reservation through the program using your Chase card to receive the following benefits including:

- Daily breakfast for two

- A special benefit unique to each property, such as a dining or spa credit

- Complimentary Wi-Fi

- A room upgrade, if available

- Early check-in and late checkout, if available

United Card Events from Chase and United MileagePlus Events

Pursue more of your passions with United Events from Chase. As a Cardmember you will be delighted with opportunities to purchase private, curated once-in-a-lifetime experiences. Sample select wines and satisfy your palate with culinary events at some of the world’s best restaurants, meet a sporting legend or make memories with your family. United MileagePlus® Visa Infinite® Cardmembers may also enjoy exclusive experiences using your award miles such as private winemaker dinners and VIP access to live theater and museum events. Please visit InsideAccess.com to learn more.

Visa Infinite® Concierge Services

Enjoy 24/7 personalized assistance for travel planning, dinner reservations, sports, entertainment tickets and more. Available 365 days a year from home or abroad.***

Previous Club Card -- Chase MP Club credit card {Archive}

Chase United Club Infinite Credit Card

#166

FlyerTalk Evangelist

Join Date: Mar 2002

Location: Saipan, MP 96950 USA (Commonwealth of the Northern Mariana Islands = the CNMI)

Programs: UA Silver, Hilton Silver. Life: UA .57 MM, United & Admirals Clubs (spousal), Marriott Platinum

Posts: 15,051

https://www.chase.com/personal/credit-cards/united

If you are concerned about keeping credit history, product change to the no-fee Gateway card. That also gives 2 miles per $1 spent at gas stations and on local transit and commuting, a benefit not offered by the other two.

#167

Join Date: Jun 2014

Location: ORD

Posts: 132

Paying AF with points

I just got this card and and diligently spending on it to get the bonus. I see that my AF was posted as soon as I added the card to my online account management. I was planning to pay the AF with points, but didn't realize it would post so soon. I am hoping to bang out the minimum spend as quickly as possible, but does anyone have suggestions on how I might pay with points despite not having many united points in my MileagePlus account yet? I'm loathe to transfer URs in from Chase, but it looks like I might have to. Guess I didn't consider the timing here. And most folks who got this card already are sitting on a pile of United points and then whenever the bonus comes through they are essentially covering the up-front outlay from their existing pile of points.

Thanks for any advice!

Thanks for any advice!

#168

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,854

Unclear if transferred points would qualify

Go to https://choices.unitedmileageplus.com/ to see your Choice Points balance. Maybe try to a small transfer to see what happens

Note you have 90 days from posting to redeem your Choice Points.

#170

Join Date: Oct 2013

Location: SFO

Programs: UA 1K, AA EXP, Hyatt Glob, Hilton Diamond, Marriott Plat, Total Wine & More Reserve

Posts: 4,509

#171

Join Date: Jun 2014

Location: ORD

Posts: 132

Beware that only miles earned from the card (such as not flight miles) can be used to pay the card AF, card signup bonuses do count.

Unclear if transferred points would qualify

Go to https://choices.unitedmileageplus.com/ to see your Choice Points balance. Maybe try to a small transfer to see what happens

Note you have 90 days from posting to redeem your Choice Points.

Unclear if transferred points would qualify

Go to https://choices.unitedmileageplus.com/ to see your Choice Points balance. Maybe try to a small transfer to see what happens

Note you have 90 days from posting to redeem your Choice Points.

It would be kind of weird if you could only use points earned from the card because many folks won't get the SUB before they have to pay the AF which is posted as soon as the card is open. I'll report back, thanks!

#172

Join Date: Dec 2009

Location: BOS (South End)

Programs: UA 1K, AA EXP, TrueBlue, IHG Plat Amb, SPG Gold, Marriott Gold, Accor Platinum, National Exec Elite

Posts: 907

Can't recall if cardholders that were "upgraded" from the $450 AF Visa Club card would be charged the new $525 AF for the Infinite in '22 but saw the "old" $450 charge post the other day...

#173

#174

Join Date: Jun 2011

Location: Chicago ORD

Programs: AA PLT, Admirals Club, United Club, Hilton Gold, Bonvoy Gold, IHG Platinum, Langham Gateway, Avis PC

Posts: 6

United Chase Club Infinite Card Benefits

Curious if anyone has recently applied for the Chase United Club Infinite Card and has any advise about how long it takes for the benefits to "link" to Mileage Plus. I see the club membership card in my account but when I called into MP customer service they said the card had not liked for the other benefits. Also when I try to redeem the IHG elite status and Avis presidents club via the redemption portals it says that either my card or MP account is not eligible for the benefits which it clearly is as a card member. Any advise is appreciated!

#175

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,854

It can take 2 weeks to propagate thru the various systems, perhaps a bit more for some of the external partners

#176

Join Date: Jun 2011

Location: Chicago ORD

Programs: AA PLT, Admirals Club, United Club, Hilton Gold, Bonvoy Gold, IHG Platinum, Langham Gateway, Avis PC

Posts: 6

#177

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,854

Thanks so much! Would you recommend waiting to book travel to be sure the premier access benefits apply to the reservation or do those auto update on existing reservations. I have a trip early June that Id like to have the benefits. As a non UA elite coming from AA Elite status this is a whole new world

Bag benefits will be determined at check-in

Premier access will be determined at time BP issued

Some award inventory is determined at booking

benefits will auto-update are your circumstances evolve.

#180

Join Date: Feb 2007

Location: Between ORD and MKE

Programs: AA ExecPlat; UA 1K

Posts: 147

I was charged the "old" $450 and got a snail mail a couple weeks later reminding me that next year it would go up to the new $525 AF. I called to cancel the card anyways based on decline in quality of UCs and dilution of card benefits (mainly reduction from 1.5 to 1 mile per dollar). This past January we shifted vast majority of spend to AA Executive Card, where the club is somewhat better, authorized users can visit without the primary, and the spend accrues status through the AA Loyalty Point scheme. When I cancelled they made a token $100 offer to reduce the annual fee this year but when I declined they didn't seem surprised. Annual fee is refunded as long as you cancel during the first billing cycle, after that it's nonrefundable.