Winning the West Coast

#91

Join Date: Apr 2005

Location: LAX

Programs: UA Silver, AA, WN, DL

Posts: 4,091

I think what I and the OP really want is UA to be sufficiently committed to the West Coast so that there's flights and is frankly an alternative to WN.

DL is moving into the role that UA once had up and down the West Coast and that fed traffic into its network. Yes, LAX will not be anybody's fortress hub but there's plenty of demand both there as well as across Southern California and the Northwest.

Right now UA's West Coast traffic lives and dies by SFO's operational challenges.

David

DL is moving into the role that UA once had up and down the West Coast and that fed traffic into its network. Yes, LAX will not be anybody's fortress hub but there's plenty of demand both there as well as across Southern California and the Northwest.

Right now UA's West Coast traffic lives and dies by SFO's operational challenges.

David

But I do agree with assessment that SFO, as a hub, sucks due to weather issues.

#92

Join Date: Aug 2006

Location: SJC

Programs: DL PM MM, Marriott Titanium

Posts: 3,276

As an anecdote I was on SFO- DCA United yesterday. The guy I sat next to lived south of SJC and travels at least weekly for work; but he said that when he goes to DC, NYC, Chicago he always flies UA from SFO, just for the miles and for the abundance of nonstop. For trips down to LA he will take whoever is cheapest from SJC. So perhaps there's room there. But an anecdote that demonstrates the power of the offering at SFO.

#93

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

2013-15 was golden for all the full service airline stocks.

UA and DL had opps to get 3-4x, but the real big ones were AS, JBLU after mint, SW, and well AA just before it was clear the DOJ would put the last screw on with that merger.

You'd be flying private to Hawaii with investments in those or a basket.

Thd next step for intra CA / West Coast are the semi private carriers - there will and are intersting choices there for high yield fliers.

#94

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,478

#95

FlyerTalk Evangelist

Join Date: Aug 2002

Location: Bay Area, CA

Programs: UA Plat 2MM; AS MVP Gold 75K

Posts: 35,068

#96

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

OK outcome for VX shareholders but others did even better.

I am am curious to see how B6's West Coast footprint evolves with the larger AS and pressure from DL on the secondary Mint markets.

#97

Join Date: Jan 2007

Location: Bellingham/Gainesville

Programs: UA-G MM, Priority Club Platinum, Avis First, Hertz 5*, Red Lion

Posts: 2,808

Anyway, just my few cents. UA, like any carrier, has limited resources, and they have to decide how to allocate them. Just like any other company. Will they be all things to al people? Probably not. But no company can be. In any industry. Instead, they alocate their resources to the biggest opportunity and biggest strength. On the west coast, that's SF, which they dominate like no other airline does any other city on the west coast. Something that I'm sure DL or AA would love to do.

from: http://www.oliverwyman.com/our-exper...2016-2017.html

#98

Join Date: Feb 2006

Programs: UA, Starwood, Priority Club, Hertz, Starbucks Gold Card

Posts: 3,953

At the risk of derailing this thread, I interpreted the VX sale to AS as VX throwing in the towel. For years, VX stock was just treading water (I was a stockholder, bought in after its failure at DAL.) VX's inability to expand beyond SFO signaled 1) its limited growth potential as a standalone carrier, and 2) the staleness of the Virgin brand. VX also repeatedly delayed aircraft deliveries, because it had no new routes to deploy them. Months prior to the sale, it was clear that VX investors were clamoring for a sale in order to benefit from the rally that most other US carriers were experiencing at that time. Yes, AS paid a 47% premium from the previous day's closing price (I fondly remember where I was when the news broke  ), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

UA won the battle with VX at SFO. We'll see how AS copes with UA there.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.UA won the battle with VX at SFO. We'll see how AS copes with UA there.

#99

Join Date: Jan 2007

Location: Bellingham/Gainesville

Programs: UA-G MM, Priority Club Platinum, Avis First, Hertz 5*, Red Lion

Posts: 2,808

Or you spread your short-haul business around among the carriers (especially WN) who have a better point-to-point network within the state, while still giving your long-haul business to UA. I would suspect for most GS, that's still enough business to maintain GS status.

The place where this model falls apart for UA (ceding the short-haul) is status levels below GS, where the handcuffs have become very very loose due to constant devaluation of benefits.

The place where this model falls apart for UA (ceding the short-haul) is status levels below GS, where the handcuffs have become very very loose due to constant devaluation of benefits.

#100

Join Date: May 2013

Posts: 3,361

The UA strategy of pulling people from the region to fly out of their hub, in an increased traffic environment, and in light of new competitors bringing more options, is no longer a slam dunk like it used to be. You can even attribute some of the phenomenon to the mileage program deterioration (e.g., sit in traffic for 60-90 minutes to catch UA and get very few difficult-to-use miles for it, or just fly whomever is most convenient?).

#101

Join Date: Apr 2004

Location: Washington, DC

Posts: 1,309

Hmm. Core business markets. Tell me again why SFO, IAH, ORD, EWR, LAX are not core business markets?

Anyway, this isn't a larger conversation about United's overall health or lack thereof- there are scores of other threads on that so I'm not going to dive into scope creep here.

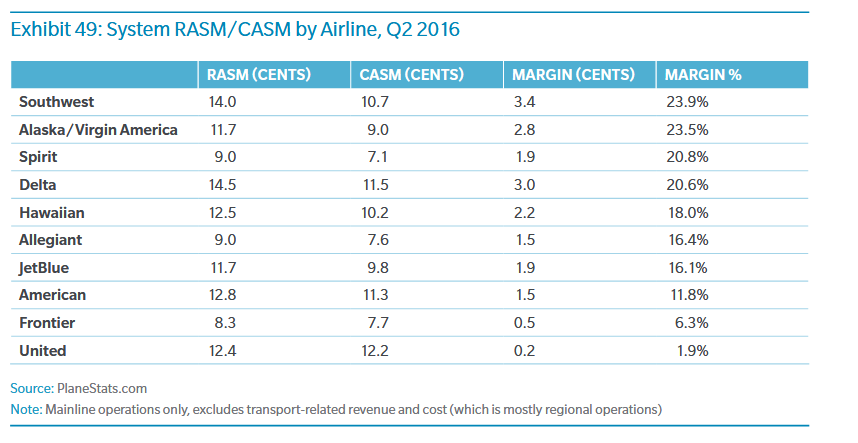

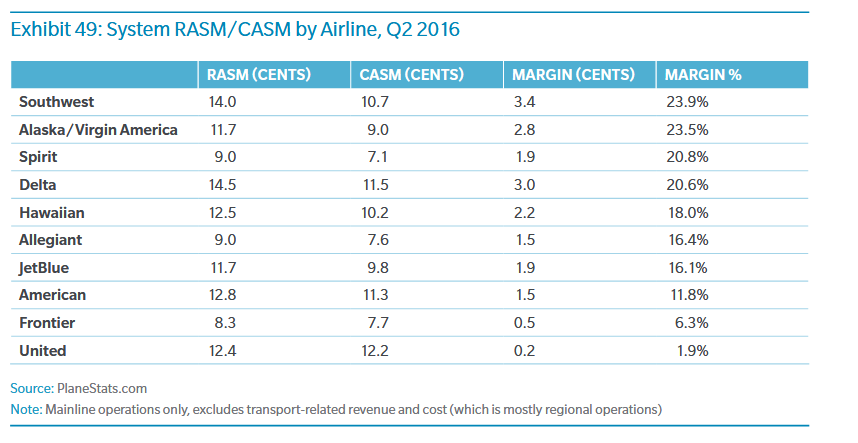

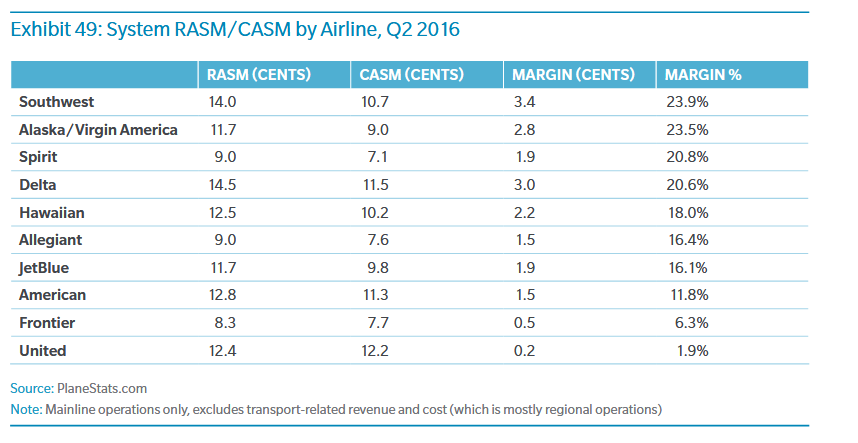

Either way, UA is pretty solid in its core California business markets. There are many many many other reasons for the rasm you mention below (WN primarily on short hops where they don't have much competition (i.e. check out Love Field yields, check out Houston HOU yields, etc where there is no competition, RASM is sky high etc, or DL, which has dominant positions in important business markets with limited competition, vs United with tons of competition in all its markets).

Regardless, for this thread, cutting a few regional jet flights within California does not equate at all to "abandoning core, large business market". Beefing up and becoming a dominant airline in SFO does seem to me like a move oriented towards being responsive to core business markets.

Anyway, this isn't a larger conversation about United's overall health or lack thereof- there are scores of other threads on that so I'm not going to dive into scope creep here.

Either way, UA is pretty solid in its core California business markets. There are many many many other reasons for the rasm you mention below (WN primarily on short hops where they don't have much competition (i.e. check out Love Field yields, check out Houston HOU yields, etc where there is no competition, RASM is sky high etc, or DL, which has dominant positions in important business markets with limited competition, vs United with tons of competition in all its markets).

Regardless, for this thread, cutting a few regional jet flights within California does not equate at all to "abandoning core, large business market". Beefing up and becoming a dominant airline in SFO does seem to me like a move oriented towards being responsive to core business markets.

Well from the PRASM and CASM is does not look like UA has been allocating its resources to revenue generating activities, at least vs ALL of its competitors since they have been at the bottom of operating margin post merger ad infinitum. Do you really think abandoning core, large business markets and expecting frequent fliers to just follow in spite of the cuts and costs is just a coincidence?

from: http://www.oliverwyman.com/our-exper...2016-2017.html

from: http://www.oliverwyman.com/our-exper...2016-2017.html

#102

Join Date: Jan 2007

Location: Bellingham/Gainesville

Programs: UA-G MM, Priority Club Platinum, Avis First, Hertz 5*, Red Lion

Posts: 2,808

At the risk of derailing this thread, I interpreted the VX sale to AS as VX throwing in the towel. For years, VX stock was just treading water (I was a stockholder, bought in after its failure at DAL.) VX's inability to expand beyond SFO signaled 1) its limited growth potential as a standalone carrier, and 2) the staleness of the Virgin brand. VX also repeatedly delayed aircraft deliveries, because it had no new routes to deploy them. Months prior to the sale, it was clear that VX investors were clamoring for a sale in order to benefit from the rally that most other US carriers were experiencing at that time. Yes, AS paid a 47% premium from the previous day's closing price (I fondly remember where I was when the news broke  ), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

UA won the battle with VX at SFO. We'll see how AS copes with UA there.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.UA won the battle with VX at SFO. We'll see how AS copes with UA there.

#103

Join Date: Apr 2004

Location: Washington, DC

Posts: 1,309

exactly

Shareholders made out well - they got out and demanded to get out when the getting was good. VX never was a very viable carrier, and the repeated years of losses, delivery delays, and inability to do much in SF, let alone at SF, speaks volumes. The fact that they started flying JFK-FLL shows they had no better place to put their planes. it was a disaster and not a viable company, though fun to fly when it was still new and novel for a few years.

At the risk of derailing this thread, I interpreted the VX sale to AS as VX throwing in the towel. For years, VX stock was just treading water (I was a stockholder, bought in after its failure at DAL.) VX's inability to expand beyond SFO signaled 1) its limited growth potential as a standalone carrier, and 2) the staleness of the Virgin brand. VX also repeatedly delayed aircraft deliveries, because it had no new routes to deploy them. Months prior to the sale, it was clear that VX investors were clamoring for a sale in order to benefit from the rally that most other US carriers were experiencing at that time. Yes, AS paid a 47% premium from the previous day's closing price (I fondly remember where I was when the news broke  ), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

UA won the battle with VX at SFO. We'll see how AS copes with UA there.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.

), but it was more like a 80% premium over the price that VX had been stuck at several months before (about $30). Compared to the $23 IPO price, VX was less than a stellar performer.UA won the battle with VX at SFO. We'll see how AS copes with UA there.

#104

Join Date: Apr 2004

Location: Washington, DC

Posts: 1,309

Yeah they "made it" as a carrier that benefitted from a booming market that sold itself and its shareholders a nice chunk of change. But I don't think that's what Branson and the employees wanted when they started it - they wanted a viable, profitable carrier that would thrive. There they utterly failed.

#105

FlyerTalk Evangelist

Join Date: Aug 2002

Location: Bay Area, CA

Programs: UA Plat 2MM; AS MVP Gold 75K

Posts: 35,068

Southwest very much has a winning strategy. They are able to carry people from one place to another within the West Coast.