Last edit by: rrgg

Aspire Benefits (T&C here)

Unchanged:

Unchanged:

Unchanged:

Unchanged:

- Annual free night certificate with cardmember anniversary. Separate thread here.

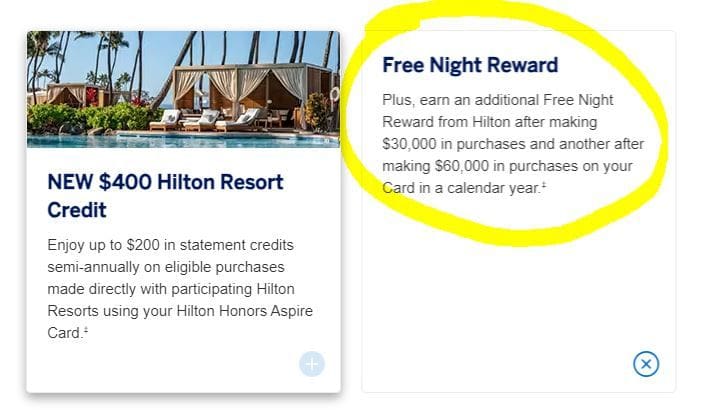

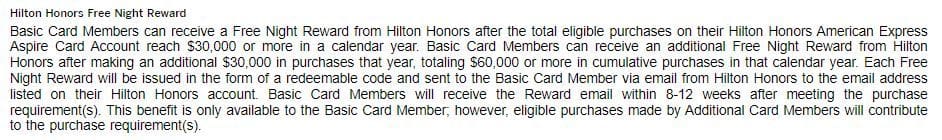

- Additional free night certificate for $60k spent in a calendar year

- Same spending bonus categories (14x @ Hilton; 7x @ US restaurants, airlines & car rental; 3x @ all other)

- Diamond status

- $100 statement credit benefit for some Waldorf/Conrad stays. Separate thread here

- Additional free night certificate for $30k spent in a calendar year. Effective now so 2023 spending can earn this FNC

- $200 statement credit at Hilton Resorts in H1 and $200 in H2. Begins 1/1/24 for existing cardholders Resort credit discussion link

- $50 statement credit every quarter when a ticket is purchased from any airline or AmexTravel.

No airline selection required. Technically incidentals are ineligible, but it may depend on how they post. Travel agencies ineligible.

New counter is already showing in Amex login

Discussion in a separate thread. - CLEAR Plus $189 credit per calendar year

- $800 Cell phone insurance with $50 deductible

- National Car Executive status

- New physical card design

- Annual fee increased from $450 to $550. For existing cardholders, this is effective 2/1/2024

- $250 annual airline incidentals end 12/31/2023

- $250 credit at Hilton Resorts ends 12/31/2023 Resort credit discussion link

- Priority pass membership enrollment ends 1/31/2024. Must enroll by phone. If you enrolled before 2/1/2023 membership continues through 1/31/2024. If enrolled after, membership continues through 10/31/2024

Unchanged:

- Annual free night certificate with $15,000 spend

- Gold status

- Added 4x spend on US online retailers (all other categories unchanged -- 12x @ Hilton; 6x @ US restaurants, US supermarkets & US gas stations; 3x @ all other) (for the no-annual-fee card: 7x @ Hilton; 5x @ the three bonus categories; 3x @ all other)

- $200 credit for Hilton purchases (broken down to $50 per quarter)

- New physical card design

- Annual fee increased from $95 to $150. For existing cardholders, this is effective 2/1/2024

- National Car Rental Emerald Club Executive status

- Priority pass membership enrollment ends 1/31/2024. Must enroll by phone. If you enrolled before 2/1/2023 membership continues through 1/31/2024. If enrolled after, membership continues through 10/31/2024

Unchanged:

- Gold status

- Earn Diamond status at $40k spent

- Earn 12x at Hilton

- Added $60 Hilton credit per quarter

- Added National Executive status

- Added metal card design

- Non-Hilton spending earns 5x on the first $100k each calendar year, then 3x

- Annual fee raised from $95 to $195

- FNC program ends 6/30/24. Must meet spending thresholds by that date.

- Priority Pass ends 6/30/24. If enrolled before 6/30/23, your PP ends 7/1/24. If enrolled after, your PP ends 3/1/25

- Old spending bonus categories end 6/30/24

- New member bonus 175k on $8k spent in 6 months

Hilton AMEX Card Redesign; Higher Annual Fee; New Benefits

#16

Join Date: Sep 2022

Posts: 35

The moderate increase from $450 to $550 is what is saving this from being 'ehh' and not ugh. The changes to the airline fee credit suck, because the $250 credit could already effectively be used for flights if you knew the airline specific workarounds. Now it's $50 less and dispensed quarterly. Increase in the resort credit is only valuable if you visit qualifying properties twice yearly on Amex's set schedule, which I never have. Clear, PP, cell phone insurance are all meaningless additions/reductions for me, and probably many of us that have one or more cards that already provide that.

Still a net positive card, but less of a net positive than it was, at least for me.

I wonder when the annual fees will increase for existing cardmembers since my renewal is up in December.

Still a net positive card, but less of a net positive than it was, at least for me.

I wonder when the annual fees will increase for existing cardmembers since my renewal is up in December.

Personally I had no issue using the credit in the past (usually I just use it in Vegas or something) and doubt I will in the future. But yeah, if you donít generally use the resort credit to begin with then these changes are a much bigger bummer, I get it.

#17

Join Date: Jul 2013

Location: Gulf Coast

Programs: Hilton Honors Lifetime Diamond; National Car Rental Executive Elite

Posts: 2,322

Correct me if I'm wrong, but the FNC came after $60k in spending.

The website shows the following this morning:

Am I reading this correctly... one FNC after $30k in spending on the card, and another FNC at $60k in spending?

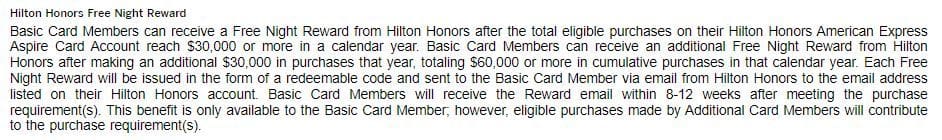

Screenshot from the AMEX T&Cs below:

That's worth the increase in AF to us.

The website shows the following this morning:

Am I reading this correctly... one FNC after $30k in spending on the card, and another FNC at $60k in spending?

Screenshot from the AMEX T&Cs below:

That's worth the increase in AF to us.

#18

FlyerTalk Evangelist

Join Date: Jul 2008

Location: IAH

Programs: DL DM, Hyatt Ist-iest, Stariott Platinum, Hilton Diamond

Posts: 12,792

#20

Join Date: Aug 2012

Location: VPS

Programs: IHG Diamond, Delta PM, Hilton Gold, Accor Gold, Marriott Silver

Posts: 7,268

I was actually considering upgrading the no fee Hilton card to the Surpass because it looks like an airport I use a bunch is going to get a Priority Pass lounge in 2024 but oh well, so much for that.

#21

FlyerTalk Evangelist

Join Date: Jul 1999

Location: ORD/MDW

Programs: BA/AA/AS/B6/WN/ UA/HH/MR and more like 'em but most felicitously & importantly MUCCI

Posts: 19,719

That said, I'm kind of sorry to lose the benefit, or chance of an occasional score. It's like the old joke-critique of Catskills resort cuisine: "The food is terrible here ... and such small portions!:"

Not sure if I will continue with the Amex card overall. I don't like being pressured into more Hilton stays to mitigate the jacked-up annual fee. Life is too short and Gold / Diamond worth too little, at least in the US.

#22

Join Date: Sep 2008

Location: AUS

Programs: BAEC Gold, AA PPro, Hyatt Globalist, Amex Plat

Posts: 7,043

I mostly meant relative to some other AF hikes we've seen recently, like the Bonvoy Brilliant, which went up to $650 from $450. With your adherences to %s, you must be really glad I didn't call the $55 increase of the Surpass fee "moderate" since that's a whopping 58%

Furthermore, I guess I'd point out that yes, the Bonvoy Brilliant did jump from $450 to $650, but the benefit changes in that rollout were (at least IMHO) more valuable and dramatic. For example, at the $450 level, the card did not include Marriott Platinum status, but that was added with the increased fee (and Marriott Gold to Platinum is pretty big jump). It also added a greater number of EQNs, thus making attaining Titanium within reach for many customers. It added a monthly dining benefit, which for many is very easy to use. Finally, it added at 85K cert upon really (can't remember if they had that at the $450 level). All and all, those are some pretty substantial changes for the $200 delta on the Marriott card.

In the case of Hilton, folks were already getting Diamond for their $450, so no positive change there. The change to quarterly flight credits is a turn off to me; just another crazy coupon to keep track of (vs. using it once and being done for the year).

Full disclosure; I do not have the card, but had been thinking about it. A little less sure now. For folks that stay at Hiltons a lot, I can certainly see the value, but Hilton would be very much a "back-up to the back-up" program for us. The previous type of credits and annual fee made it pretty easy to extract value (which of course is why they are making the changes

) and though its certainly still possible to get value, it might be moving into my "too hard" pile for the time being.

) and though its certainly still possible to get value, it might be moving into my "too hard" pile for the time being.Regards

#23

Join Date: Nov 2006

Location: Norway, Maine

Programs: United Silver and HH Diamond

Posts: 1,474

#24

Join Date: Oct 2023

Posts: 113

Well, I've had a string of negative / disappointing PP experiences, and several cases of denied entry, and no luck with the airport restaurant credit benefit because Amex-affinity members are (were) "select" second-tier members. I've always said I'm happy to have PP as a free card perk good for two or three positive visits per year, but I'd never pay for PP outright -- objectively, the PP program is a mess, with too many garbage lounges and too many cases of promised access denied.

That said, I'm kind of sorry to lose the benefit, or chance of an occasional score. It's like the old joke-critique of Catskills resort cuisine: "The food is terrible here ... and such small portions!:"

Not sure if I will continue with the Amex card overall. I don't like being pressured into more Hilton stays to mitigate the jacked-up annual fee. Life is too short and Gold / Diamond worth too little, at least in the US.

That said, I'm kind of sorry to lose the benefit, or chance of an occasional score. It's like the old joke-critique of Catskills resort cuisine: "The food is terrible here ... and such small portions!:"

Not sure if I will continue with the Amex card overall. I don't like being pressured into more Hilton stays to mitigate the jacked-up annual fee. Life is too short and Gold / Diamond worth too little, at least in the US.

#27

Join Date: Sep 2022

Posts: 35

#28

Join Date: Aug 2012

Location: VPS

Programs: IHG Diamond, Delta PM, Hilton Gold, Accor Gold, Marriott Silver

Posts: 7,268

Also it seems like every travel card these days gives PP. So they are going to be overcrowded anyway. Also letís th night be honest here, most hotel loyalty programs are worthless in the US with them giving status from credit cards and some hotels just ignoring the benefits anyway.

#29

FlyerTalk Evangelist

Join Date: Jul 1999

Location: ORD/MDW

Programs: BA/AA/AS/B6/WN/ UA/HH/MR and more like 'em but most felicitously & importantly MUCCI

Posts: 19,719

I think I'll probably downgrade to the no-fee card and feel freer to book properties I actually like, not places I feel yoked to because of mostly illusory Diamond / Gold privileges.

#30

Join Date: May 2009

Location: EUG

Programs: AS MVP, AA MM, HH Diamond, MR Gold

Posts: 8,220

The Aspire and Surpass are still too similar in color - always had a hard time making sure I grabbed the correct one out of my wallet, had to go by position, not color. Glad to see the no-fee will be completely different.