Last edit by: Boraxo

There are three services to pay your U.S. federal taxes: IRS Pay Your Taxes by Debit or Credit Card or Digital Wallet

pay1040.com 1.87% fee on credit (lowered from 1.99% on 01/02/2023). $2.50 flat fee on debit.

payUSAtax.com - 1.82% fee on credit (rate updated 01/03/2024 from 1.85%). $2.20 flat fee on debit.

Many states also permit online tax payment; check with your state or this list from MasterCard.

The IRS has a system to view payments, and it's good practice to confirm all payments within a short time frame, so that any rare lost payment issue can be disputed.

Be mindful of time zones if paying on the due date as pay1040.com uses CDT timestamp and payusatax.com uses EDT timestamp.

In general, you're allowed 2 payments per processor above per type of tax (annual and quarterlies being 2 different types, for example). They're not billed as cash advance fees. If 6 payments is not enough to pay your bill you can use a service such as plastiq (2.25% fee). If making multiple payments, it is advised you join here to track your payments link , you will be required to give your banking information and will receive a pin via snail mail

(Confirmed 4/2018 in post #429)

Fees are tax-deductible for C-Corps but not individuals (2018 tax reform eliminated "miscellaneous itemized deductions"). The majority of people will not be able to deduct that expense, check with your accountant.

When making multiple payments at or near your credit limit multiple times, allow yourself 3-5 days between payments for the charge to show up on your card and your bank payment to clear. If you wait until April 15th to make payments, you will only be able to clear the first payment.

Best Credit Cards to use/buy cheap points:

- Any credit card to hit minimum spend and achieve signup bonus or spend thresholds.

- BOA Premium Rewards 2.62% Cashback (Card holder needs to be a Preferred Rewards Platinum Honors member)

- Chase INK Premier 2.5% Cashback on purchases over $5k (Points are not transferable to airline or hotel programs)

- Capital One Venture X 2X Cap One Miles/Points (now transfer to most airline partners at 1:1)

- Amex Blue Business Plus 2X Membership Rewards (capped at $50,000 spend per calendar year)

- Chase United Business Club Card, 1.5X United Miles

- BOA Virgin Atlantic World Elite 1.5X Virgin Atlantic Points

- Chase Freedom Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Chase INK Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Amex Everyday Preferred 1.5X Membership Rewards, (need to make 30 transactions in a month for 50% bonus)

- Amex Business Platinum 1.5X Membership Rewards on purchases over $5K

Big Spend Bonuses:

- Amex Delta Reserve, spend $60k get 30k bonus miles and 30k MQM

- Citi Hilton HHonors Reserve, spend $10k get free weekend night, $40k, Platinum Status

- Chase Southwest, spend $135k get Companion Pass (WN points are redeemed at $.011, @ 1.87% fee, you're essentially buying the companion pass for $847)

- Chase Ritz Carlton Reserve, spend $10k get Gold Status spend $75k get Platinum Status

- Chase World of Hyatt, spend $15k get one free night

Cash Back cards:

Elan Fidelity 2%

Citi Double Cash 2%

Earn Status/Elite qualifying points:

- American, Delta, Alaska, Hyatt

Pre-Funding allowed:

Amex Charge Cards

Pre-Funding not-allowed:

Chase

Quarterly tax due dates: the 15th of April, June, September, January

pay1040.com 1.87% fee on credit (lowered from 1.99% on 01/02/2023). $2.50 flat fee on debit.

payUSAtax.com - 1.82% fee on credit (rate updated 01/03/2024 from 1.85%). $2.20 flat fee on debit.

See this thread about payUSAtax customer service. Many people have reported that they never respond to support requests.

ACI Payments, Inc - 1.98% fee on credit. $2.20 flat fee on debit.Many states also permit online tax payment; check with your state or this list from MasterCard.

The IRS has a system to view payments, and it's good practice to confirm all payments within a short time frame, so that any rare lost payment issue can be disputed.

Be mindful of time zones if paying on the due date as pay1040.com uses CDT timestamp and payusatax.com uses EDT timestamp.

In general, you're allowed 2 payments per processor above per type of tax (annual and quarterlies being 2 different types, for example). They're not billed as cash advance fees. If 6 payments is not enough to pay your bill you can use a service such as plastiq (2.25% fee). If making multiple payments, it is advised you join here to track your payments link , you will be required to give your banking information and will receive a pin via snail mail

(Confirmed 4/2018 in post #429)

Fees are tax-deductible for C-Corps but not individuals (2018 tax reform eliminated "miscellaneous itemized deductions"). The majority of people will not be able to deduct that expense, check with your accountant.

When making multiple payments at or near your credit limit multiple times, allow yourself 3-5 days between payments for the charge to show up on your card and your bank payment to clear. If you wait until April 15th to make payments, you will only be able to clear the first payment.

Best Credit Cards to use/buy cheap points:

- Any credit card to hit minimum spend and achieve signup bonus or spend thresholds.

- BOA Premium Rewards 2.62% Cashback (Card holder needs to be a Preferred Rewards Platinum Honors member)

- Chase INK Premier 2.5% Cashback on purchases over $5k (Points are not transferable to airline or hotel programs)

- Capital One Venture X 2X Cap One Miles/Points (now transfer to most airline partners at 1:1)

- Amex Blue Business Plus 2X Membership Rewards (capped at $50,000 spend per calendar year)

- Chase United Business Club Card, 1.5X United Miles

- BOA Virgin Atlantic World Elite 1.5X Virgin Atlantic Points

- Chase Freedom Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Chase INK Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Amex Everyday Preferred 1.5X Membership Rewards, (need to make 30 transactions in a month for 50% bonus)

- Amex Business Platinum 1.5X Membership Rewards on purchases over $5K

Big Spend Bonuses:

- Amex Delta Reserve, spend $60k get 30k bonus miles and 30k MQM

- Citi Hilton HHonors Reserve, spend $10k get free weekend night, $40k, Platinum Status

- Chase Southwest, spend $135k get Companion Pass (WN points are redeemed at $.011, @ 1.87% fee, you're essentially buying the companion pass for $847)

- Chase Ritz Carlton Reserve, spend $10k get Gold Status spend $75k get Platinum Status

- Chase World of Hyatt, spend $15k get one free night

Cash Back cards:

Elan Fidelity 2%

Citi Double Cash 2%

Earn Status/Elite qualifying points:

- American, Delta, Alaska, Hyatt

Pre-Funding allowed:

Amex Charge Cards

Pre-Funding not-allowed:

Chase

Quarterly tax due dates: the 15th of April, June, September, January

Paying USA income, property or other taxes with a credit card

#422

Join Date: Apr 2011

Posts: 567

Staples VGC

I need to get some UR points urgently for a trip so thinking of getting VGC at Staples for my 4q tax payments for payroll taxes. Am I limited to only 2vgc per provider? I remember some time back they would take more than 2 debit cards over the phone - is that still working?

#423

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,047

I need to get some UR points urgently for a trip so thinking of getting VGC at Staples for my 4q tax payments for payroll taxes. Am I limited to only 2vgc per provider? I remember some time back they would take more than 2 debit cards over the phone - is that still working?

#424

Join Date: Dec 2004

Posts: 7,905

This post is a year old, but is this really true? Does a tax payment via debit on Suntrust Delta MC really not earn miles? I thought it was only stated that way in their terms but in practice it works. Thanks.

#426

Join Date: Apr 2005

Location: ATL

Posts: 802

Edited wiki to reflect that www.payusatax.com has lowered their credit card fee to 1.97%. It was previously 1.99%

#428

Join Date: Jan 2016

Location: LAX/JFK/SFO

Programs: Amex Plat, Hyatt, IHG cards

Posts: 120

Wiki: "In general, you're allowed 2 payments per processor above per type of tax (annual and quarterlies being 2 different types, for example)."

Does this mean each quarterly payment is a different type of tax? Or that all quarters for a year are combined into one type of tax? For 2017, would there be five different types of tax (Q1, Q2, Q3, Q4, payment accompanying a return)?

With pay1040, I have made the following payments, all quarterly estimates:

2016 estimated taxes in 2017 once

2017 estimated taxes in 2017 twice

2017 estimated taxes in 2018 once

2018 estimated taxes in 2018 once

I'm not sure if this is unusual, but I've had no payments rejected, and received no relevant notices from the IRS.

Perhaps the wiki could be clarified in this respect?

Update: I have searched on pay1040 site using the "Payment Verification" tool, which asks for my SSN, the last 4 digits of my CC, and before-fee tax payment amount. All five payments have been confirmed by pay1040. Perhaps the definition of "year" needs to be revisited to reflect filing dates or due dates in some way? I made 3 payments for tax year 2017, and made 3 payments in calendar 2017.

Does this mean each quarterly payment is a different type of tax? Or that all quarters for a year are combined into one type of tax? For 2017, would there be five different types of tax (Q1, Q2, Q3, Q4, payment accompanying a return)?

With pay1040, I have made the following payments, all quarterly estimates:

2016 estimated taxes in 2017 once

2017 estimated taxes in 2017 twice

2017 estimated taxes in 2018 once

2018 estimated taxes in 2018 once

I'm not sure if this is unusual, but I've had no payments rejected, and received no relevant notices from the IRS.

Perhaps the wiki could be clarified in this respect?

Update: I have searched on pay1040 site using the "Payment Verification" tool, which asks for my SSN, the last 4 digits of my CC, and before-fee tax payment amount. All five payments have been confirmed by pay1040. Perhaps the definition of "year" needs to be revisited to reflect filing dates or due dates in some way? I made 3 payments for tax year 2017, and made 3 payments in calendar 2017.

Last edited by CarefulBuilder14; Apr 15, 2018 at 8:59 pm

#429

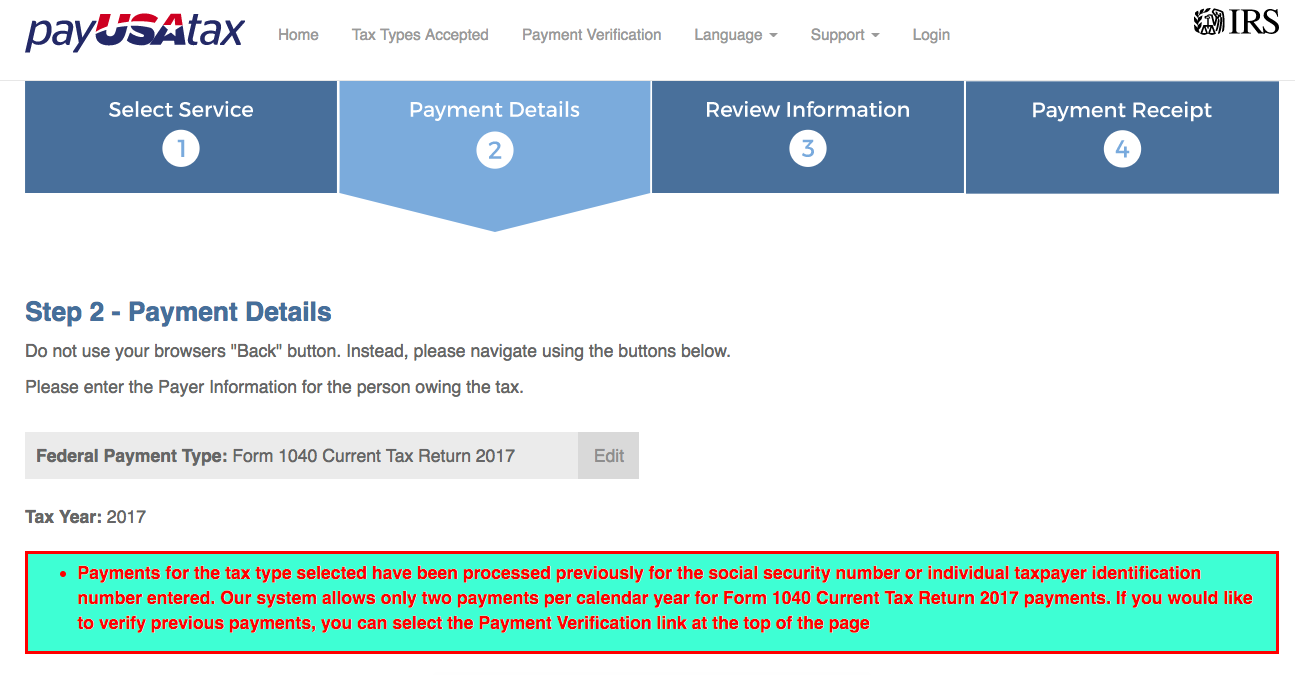

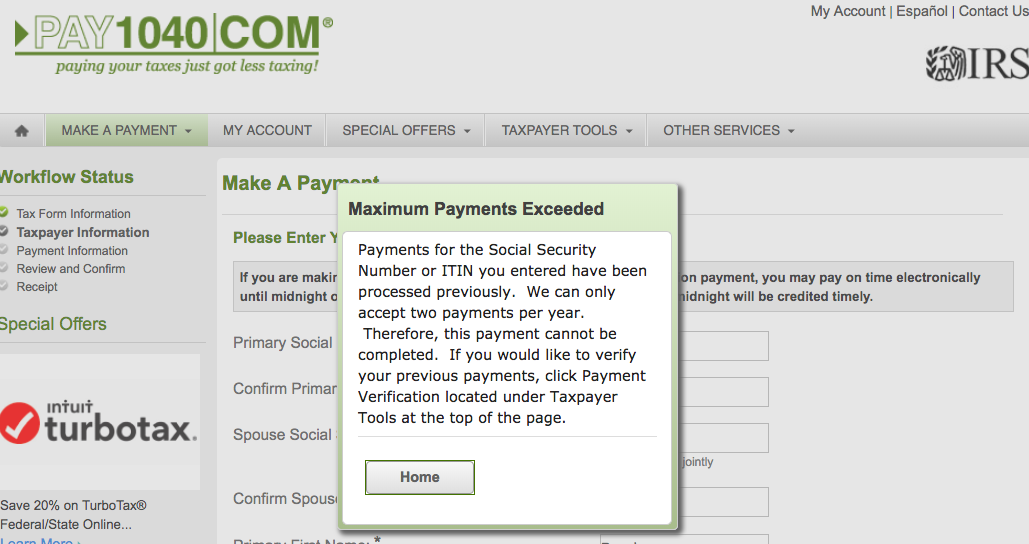

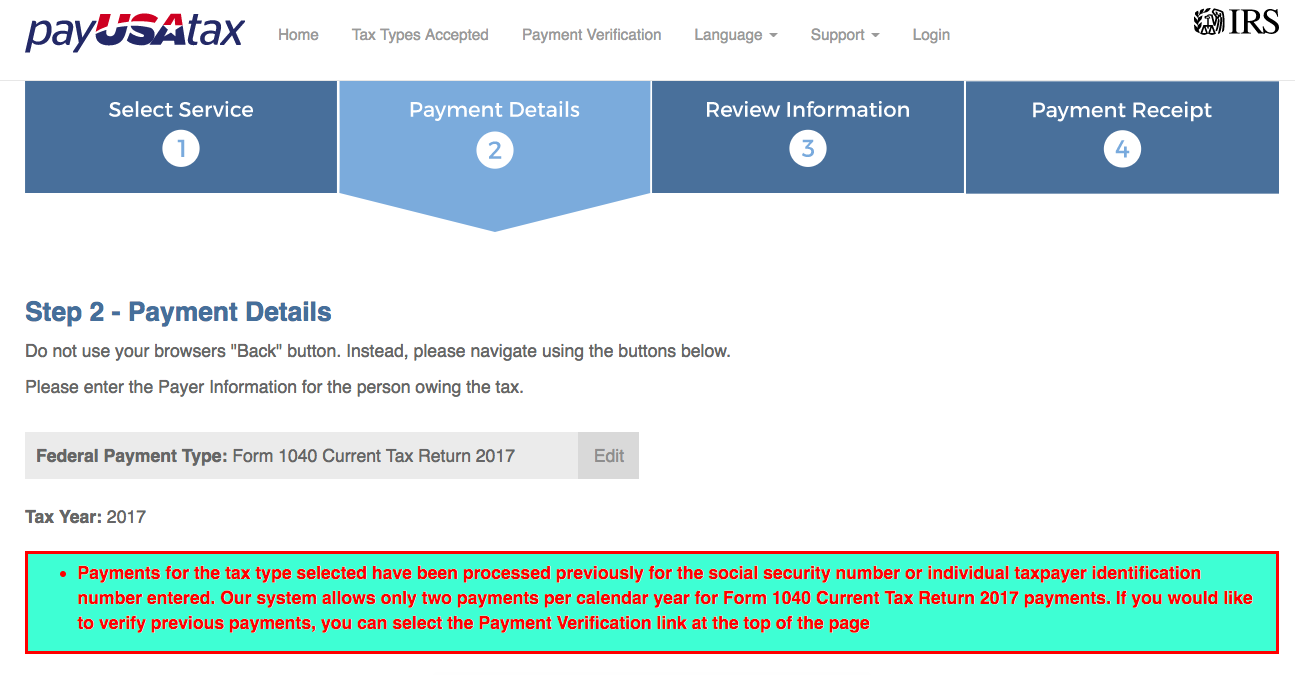

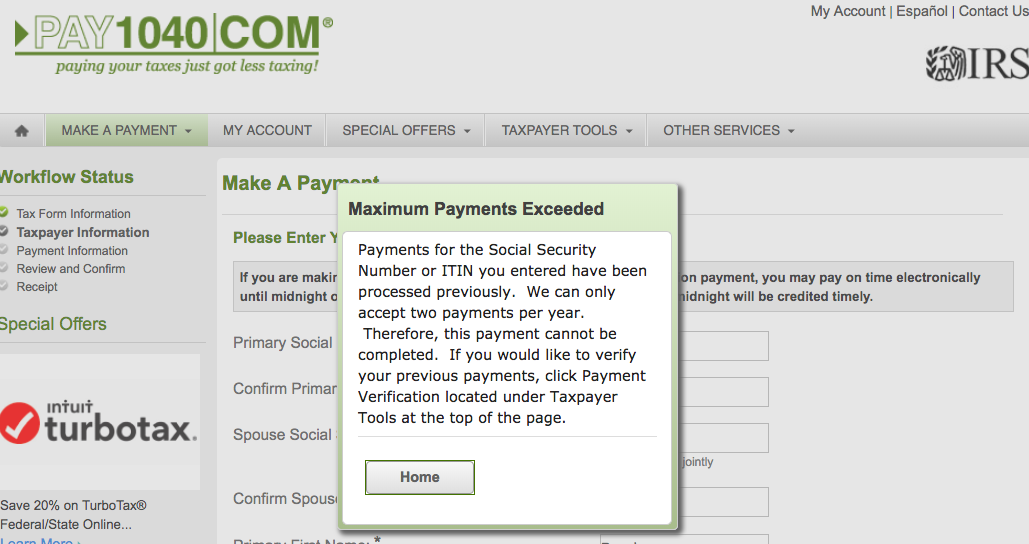

Just paid my 2017 1040 Taxes Owed by Credit Cards.

I made SIX payments total, 2 with each processor.

I want to confirm that the IRS does allow 2 payments per year per processor.

See screenshots below for each payment processor when I tried to use a 3rd card:

I want to confirm that the IRS does allow 2 payments per year per processor.

See screenshots below for each payment processor when I tried to use a 3rd card:

Last edited by 355F1; Apr 15, 2018 at 11:44 pm

#430

Join Date: Mar 2013

Location: Jackson, WY

Posts: 543

The bloggers hardly cover the topic in this thread, or don't cover it well, I have to say it is under-rated method to buy miles. My guess is the bloggers don't have big tax payments. Just paid $.012 for a bunch of UA miles (I average about $.03/mile redemption, my home airport is really expensive) and SPG points for $.019/mile (this was more the end of an experiment so I could get a travel package), not convinced yet the SPG points were a good method.

Combining UA Club card with buying miles via tax payments and saver tickets is a huge win for me. Only downside is I don't have status because I fly miles all the time.

Combining UA Club card with buying miles via tax payments and saver tickets is a huge win for me. Only downside is I don't have status because I fly miles all the time.

#431

Join Date: Sep 2003

Posts: 265

If you think about it, this is the only possible interpretation, since otherwise you wouldn't even be able to pay 4 quarters of estimates with a single processor! (The second "2" in the sentence above could be removed to make this more clear though.)

#433

Join Date: Feb 2015

Posts: 194

Please be careful here. Consult your accountant. You don't want to cause problems with the IRS.

#434

Join Date: Aug 2014

Posts: 92

Yeah, basically I've been holding off on paying, just out of sheer laziness. I have the money, but I would love to put 10k on my Amex Delta Plat, as that would get me to the 25k annual threshold. I will be giving my tax guy a quick call to see what he says. Thanks!

#435

No penalties, no red flags, nothing.

I've done this every year overpaying by $1-3k to meet minimum spends.

I don't know if $10k extra would cause a red flag, though...