Last edit by: StartinSanDiego

Please read this Wiki before posting questions in the thread.

Do not post offers or requests for referral links in this thread! The proper thread for referral offers is here.

All Chase issued cards are here: https://creditcards.chase.com/sitemap

This thread--a continuation of previous discussions through May 2015 and December 2016--focuses on general Chase policies & practices for new applications. For information on specific Chase cards and their bonuses/terms/benefits, see the following threads and their associated wikis: Table of Contents

Does Chase have a limit on the number or frequency of applications like Citi's 8/65 rule?

What's this I hear about Chase denying applications to people who have recently opened a lot of credit cards?

Does the 5/24 rule apply to applications for all Chase cards?

How does Chase calculate the number of an applicant's new cards for purposes of the 5/24 rule?

How does Chase calculate the relevant 24-month period? By calendar months? By exact days?

Can I get around the 5/24 policy by closing cards I've opened in the past 24 months?

Is there any way around the 5/24 policy (targeted mailers, pre-approvals, Chase Private Client status)?

Can I apply for a specific Chase card and earn the bonus again after doing so previously?

I'm an authorized user for a card issued to my spouse/parent. Does that prevent me from signing up for the same card and earning a bonus?

I already have several Chase cards with a substantial aggregate line of credit. Will it improve my odds if I close an existing account (or lower its credit line) before applying for another?

I wasn't auto-approved. Should I call in?

How can I determine the deadline for meeting the spend requirement to earn the signup bonus?

Once I meet the card's spend requirement, how soon will I receive my signup bonus points?

Should I downgrade or cancel my existing cards before applying?

Useful Chase telephone numbers

This thread--a continuation of previous discussions through May 2015 and December 2016--focuses on general Chase policies & practices for new applications. For information on specific Chase cards and their bonuses/terms/benefits, see the following threads and their associated wikis:

- Chase Freedom

- Chase Freedom Unlimited

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Plus

- Chase Ink Business Preferred

- Marriott Premier Visa

- IHG Rewards Visa/MC

- Hyatt Rewards Card from Chase

- Chase BA Visa

- United MileagePlus Explorer Card; business card

- United MileagePlus Club Card (and business card)

- Southwest Airlines, 4 cards currently available

- Chase Amazon Visa

- Does Chase have a limit on the number or frequency of applications like Citi's 8/65 rule?

- What's this I hear about Chase denying applications to people who have recently opened a lot of credit cards?

- Does the 5/24 rule apply to applications for all Chase cards?

- How does Chase calculate the number of an applicant's new cards for purposes of the 5/24 rule?

- How does Chase calculate the relevant 24-month period? By calendar months? By exact days?

- Can I get around the 5/24 policy by closing cards I've opened in the past 24 months?

- Is there any way around the 5/24 policy (targeted mailers, pre-approvals, Chase Private Client status)?

- Can I apply for a specific Chase card and earn the bonus again after doing so previously?

- I'm an authorized user for a card issued to my spouse/parent. Does that prevent me from signing up for the same card and earning a bonus?

- I already have several Chase cards with a substantial aggregate line of credit. Will it improve my odds if I close an existing account (or lower its credit line) before applying for another?

- I wasn't auto-approved. Should I call in?

- How can I determine the deadline for meeting the spend requirement to earn the signup bonus?

- Once I meet the card's spend requirement, how soon will I receive my signup bonus points?

- Should I downgrade or cancel my existing cards before applying?

- Useful Chase telephone numbers

Does Chase have a limit on the number or frequency of applications like Citi's 8/65 rule?

Chase does not have a known limit. However, several reports (for example) indicate that Chase is highly sensitive to multiple applications within a short time period, and that the second (or subsequent) applications run a substantial risk of being denied. In many cases, this is likely related to Chase's practice of allocating a large credit line (up to an applicant's personal maximum) when approving a new card such as the first application in a series. (See also the discussion below concerning aggregate Chase credit lines.)

What's this I hear about Chase denying applications to people who have recently opened a lot of credit cards?

Starting in May 2015, Chase began denying applications for its own personal cards (e.g., Sapphire Preferred, Freedom, Slate & Freedom Unlimited) if the applicant's credit report shows that she or he opened 5 or more credit cards with any card issuer in the prior 24 months ("the 5/24 rule").

For a few days in early September 2016, Chase included explicit language ("You will not be approved for this card if you have opened 5 or more bank cards in the past 24 months") on the application page for the Sapphire Reserve card--and then promptly removed it. The absence of this language on landing/application pages for the CSR or any other Chase card is not a reliable indicator of whether the 5/24 policy applies.

See the next section for co-branded cards exempt from the 5/24 policy, and the later section discussing potential ways around 5/24.

For a few days in early September 2016, Chase included explicit language ("You will not be approved for this card if you have opened 5 or more bank cards in the past 24 months") on the application page for the Sapphire Reserve card--and then promptly removed it. The absence of this language on landing/application pages for the CSR or any other Chase card is not a reliable indicator of whether the 5/24 policy applies.

See the next section for co-branded cards exempt from the 5/24 policy, and the later section discussing potential ways around 5/24.

Does the 5/24 rule apply to applications for all Chase cards?

Previously the rule did not apply to applications for the Ink Plus business card or to co-branded cards such as United, Hyatt, IHG, etc. However, on May 22, 2016 Chase extended its 5/24 rule to cover Ink business cards and some co-branded cards. (Note that there were premature reports that Chase Ink Plus would be made subject to the rule in March 2016 (which did not happen), and that all co-branded cards would follow in April 2016 (also did not happen).)

Although we had numerous reports of applications prior to May 22 being denied for a United/Hyatt/IHG/WN card by a CSR citing the 5/24 rule, the available evidence strongly suggested that those applicants had other serious issues--multiple Chase applications in a short period; large existing Chase credit line--and that overzealous CSRs gratuitously (and erroneously) invoked the 5/24 rule in the past as an additional supposed justification for the denial. Thus, it is difficult to separate such false positives from any change in Chase policy.

Instead, the most useful data points are those where an applicant is approved for a Chase card despite being over 5/24. Since May 22, 2016, we have such reports for these co-branded cards (in order from oldest to newest for each card):

For a longer list of cards apparently not subject to 5/24, check this link:

In November 2018, Chase seems to have possibly expanded 5/24 to more cards, possibly including some mentioned above. See this link:

Please follow discussion in the thread for current updates.

Although we had numerous reports of applications prior to May 22 being denied for a United/Hyatt/IHG/WN card by a CSR citing the 5/24 rule, the available evidence strongly suggested that those applicants had other serious issues--multiple Chase applications in a short period; large existing Chase credit line--and that overzealous CSRs gratuitously (and erroneously) invoked the 5/24 rule in the past as an additional supposed justification for the denial. Thus, it is difficult to separate such false positives from any change in Chase policy.

Instead, the most useful data points are those where an applicant is approved for a Chase card despite being over 5/24. Since May 22, 2016, we have such reports for these co-branded cards (in order from oldest to newest for each card):

- Hyatt (link; link; link; link; link; link; link; link; link; link)

- Marriott business card (link; link; link; link; link; link; link; link; link; link)

- IHG (link; link; link; link; link; link)

- BA (link; link)

For a longer list of cards apparently not subject to 5/24, check this link:

In November 2018, Chase seems to have possibly expanded 5/24 to more cards, possibly including some mentioned above. See this link:

Please follow discussion in the thread for current updates.

How does Chase calculate the number of an applicant's new cards for purposes of the 5/24 rule?

The 24-month count includes personal cards opened at other banks, and even cards on which the applicant is only an authorized user and not the primary cardholder. Chase has been extremely inflexible with this policy, with agents stating that there is nothing they can do to circumvent this restriction. However, in some cases Chase may reconsider a denial if the applicant has <5 new cards excluding cards on which s/he is an authorized user. You may need to escalate to the next level of customer service agent, as many front-line agents seem to be unable or unwilling to remove the authorized user accounts from the count.

Note:

Note:

- The actual cut-off number of recently opened cards may not be 5; it may be lower or perhaps higher, and it may differ for different applicants. Note also that the number of inquiries on a given credit reporting agency (or the total across all CRAs) is irrelevant.

- Cards not reported to EQ/TU/EX, such as most business cards and store charge cards, don't count towards this 5-card limit (for the simple reason that Chase cannot see them). Two FTers had previously reported that even Chase business cards are NOT included in the 5/24 tally, and more recently a third FTer has documented a case where they would have been 6/24 if a Chase business card had been counted. Similar conclusions have also been made by some travel bloggers.

How does Chase calculate the relevant 24-month period? By calendar months? By exact days?

In February 2017, a FTer reported a successful application a day or two after dropping from 5/24 to 4/24. However, because Chase sometimes approves applicants who are at 5/24 exactly (see above), this data point does not conclusively prove that Chase drops cards from its calculation on the exact 24-month anniversary of the previous bonus.

Can I get around the 5/24 policy by closing cards I've opened in the past 24 months?

No. Chase uses the information from your credit report, and closing an account doesn't make it disappear.

Is there any way around the 5/24 policy (targeted mailers, pre-approvals, Chase Private Client status)?

As to targeted mailers, we have insufficient anecdotal evidence to reach any reliable conclusions. (Reports suggesting no exemption from 5/24 here and here.)

There have been reports of people with more than 5 cards opened in the last 24 months being successful if they are already pre-approved for the card in question. To find out if you are pre-approved, you can call or go into a branch to ask. Success stories appear to be connected to Chase Private Client (CPC) status and the rollout of the Chase Sapphire Reserve card. In-branch pre-approvals (showing a green screen on the banker's computer) result in automatic approvals. Some (but not all) CPC clients had success in recon calls[[I]citation needed].

There have been reports of people with more than 5 cards opened in the last 24 months being successful if they are already pre-approved for the card in question. To find out if you are pre-approved, you can call or go into a branch to ask. Success stories appear to be connected to Chase Private Client (CPC) status and the rollout of the Chase Sapphire Reserve card. In-branch pre-approvals (showing a green screen on the banker's computer) result in automatic approvals. Some (but not all) CPC clients had success in recon calls[[I]citation needed].

Can I apply for a specific Chase card and earn the bonus again after doing so previously?

It depends. A Chase card may be "churned" when an entirely new version becomes available. For example, business cards are distinct from personal/consumer cards. Note that simple variations among bonus offers do not amount to new versions/products for purposes of this rule.

Beginning in 2014, Chase began including explicit language in most of its offers, such as the following:

Effective August 2018, Chase imposed stringent additional restrictions on receiving the signup bonus for any version of the Sapphire card. See Sapphire (CSR & CSP) 48 months between bonuses, August 2018 and the master threads for each card (listed above) for details and discussion.

There are four key considerations in determining whether you can churn a given card:

Beginning in 2014, Chase began including explicit language in most of its offers, such as the following:

This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.

There are four key considerations in determining whether you can churn a given card:

- The 5/24 policy discussed in detail above.

- The 24-month bonus waiting period--in the case of Sapphire cards, the collective 48-month period--is measured not from the date of your previous application (or approval date, if different), but instead from the date you received the signup-related bonus on the previous card, which may be 3-4 months later than the approval date. The same rule applies regardless of the type of signup bonus received (points, miles, or free-night certs); anniversary benefits unrelated to spending requirements, such as annual IHG & Marriott certs, do not count as signup bonuses.

- For cards such as BA Visa where the signup bonus is earned in multiple stages, the most recent reports are that the 24-month clock starts running only on receipt of the last bonus installment. In an older report, one FTer found that the 24 months appear to run from the initial bonus; after some difficulty, another FTer was told the same thing.

- If you still have your old card of the same type, you're ineligible.

- Chase's policy does not indicate whether there is also a minimum waiting period between cancellation and reapplication, and there is not yet sufficient anecdotal evidence from FTers to draw firm conclusions. At a minimum, a prudent churner will wait at least a week or two after cancellation before reapplying so that all of Chase's systems fully reflect that closure. (See first bullet point above.) At least one FTer has reported re-applying successfully 14 days after canceling the previous card.

I'm an authorized user for a card issued to my spouse/parent. Does that prevent me from signing up for the same card and earning a bonus?

No. Being an additional user on someone else's account poses no bar to applying for that same card & bonus, except insofar as such cards may count toward the 5/24 rule (as discussed above).

I already have several Chase cards with a substantial aggregate line of credit. Will it improve my odds if I close an existing account (or lower its credit line) before applying for another?

Yes.

In the past, the conventional wisdom among FTers was that you were more likely to hurt your chances by closing an account or reducing CL unilaterally. However, substantial evidence from 2014 onward strongly indicates that Chase is increasingly likely to reject applications (or at least not auto-approve them) where an applicant has an existing total credit line that is high compared to his/her income & spending patterns. (For many members, the threshold appears to be in the $45K-60K range, but that is highly speculative.)

Recent reports suggest that closing accounts and/or voluntarily reducing credit lines increases the odds of auto-approval or in-branch pre-approval. (You can do either by calling or simply sending a secure message through your Chase online account. You do not need to provide a reason for the request.) For best results, keep at least $5K-10K in excess credit; if your application is not approved, you can always contact the reconsideration department and offer to reallocate that portion of your existing credit line. Note: despite allowing credit line to be moved between personal and business accounts in the past, Chase is no longer permitting such reallocation in either direction.

With respect to timing, it is better to reduce any CL as soon as you can conveniently do so, e.g., after meeting the bonus spend on a card you do not plan to use regularly thereafter. (Do not reduce CL on a given card if it would increase your "credit utiilization"--that is, the ratio of outstanding balance to CL--above ~30%. A high credit utilization number is a red flag for banks and can adversely affect your credit score.) Waiting until one's next application to lower a CL is less than optimal, as the reduced CL is not immediately recognized by all of Chase's systems.

There is no known minimum wait between lowering a CL and having the freed-up amount become available for purposes of a new application. A prudent applicant will, as recommended above, plan well in advance; failing that, an applicant would be wise to wait at least 24 hours between lowering a CL and applying for a new card.

In the past, the conventional wisdom among FTers was that you were more likely to hurt your chances by closing an account or reducing CL unilaterally. However, substantial evidence from 2014 onward strongly indicates that Chase is increasingly likely to reject applications (or at least not auto-approve them) where an applicant has an existing total credit line that is high compared to his/her income & spending patterns. (For many members, the threshold appears to be in the $45K-60K range, but that is highly speculative.)

Recent reports suggest that closing accounts and/or voluntarily reducing credit lines increases the odds of auto-approval or in-branch pre-approval. (You can do either by calling or simply sending a secure message through your Chase online account. You do not need to provide a reason for the request.) For best results, keep at least $5K-10K in excess credit; if your application is not approved, you can always contact the reconsideration department and offer to reallocate that portion of your existing credit line. Note: despite allowing credit line to be moved between personal and business accounts in the past, Chase is no longer permitting such reallocation in either direction.

With respect to timing, it is better to reduce any CL as soon as you can conveniently do so, e.g., after meeting the bonus spend on a card you do not plan to use regularly thereafter. (Do not reduce CL on a given card if it would increase your "credit utiilization"--that is, the ratio of outstanding balance to CL--above ~30%. A high credit utilization number is a red flag for banks and can adversely affect your credit score.) Waiting until one's next application to lower a CL is less than optimal, as the reduced CL is not immediately recognized by all of Chase's systems.

There is no known minimum wait between lowering a CL and having the freed-up amount become available for purposes of a new application. A prudent applicant will, as recommended above, plan well in advance; failing that, an applicant would be wise to wait at least 24 hours between lowering a CL and applying for a new card.

I wasn't auto-approved. Should I call in?

It may be better to avoid calling Chase unless your application is denied. Many recent calls on pending applications led to denials, and many people report having success letting applications work their way through the system. Be patient. Time is on your side; increasingly, Chase CSRs are not.

If you do call, expect extensive and possibly hostile questioning. Be prepared to answer questions regarding the need for more credit, past credit apps for both Chase and other banks, income, business finances, etc. Know your CLs with Chase before you call so you know which card/s you are willing to decrease the CLs on. If the app is for a significant other who dislikes such calls, they can authorize you to speak on their behalf and hand the phone over to you.

If you do call, expect extensive and possibly hostile questioning. Be prepared to answer questions regarding the need for more credit, past credit apps for both Chase and other banks, income, business finances, etc. Know your CLs with Chase before you call so you know which card/s you are willing to decrease the CLs on. If the app is for a significant other who dislikes such calls, they can authorize you to speak on their behalf and hand the phone over to you.

How can I determine the deadline for meeting the spend requirement to earn the signup bonus?

Just send Chase a secure message (SM) through your online account. Although the deadline should in theory be N months from the date of approval (not the date of application or card activation)--where N is the number of months specified in the offer--Chase typically pads this period to account for the time required to fabricate and deliver physical cards. For example, a recent "3-month" deadline was in fact 114 days, as confirmed by Chase's SM confirmation.

Once I meet the card's spend requirement, how soon will I receive my signup bonus points?

Bonus points typically accrue at the close of the billing period in which you incur the corresponding charges. Points should appear in your hotel/airline account within a few days thereafter.

NOTE: If you complete your required spending in the last 7-10 days of the statement period, the bonus may not post until the following month's statement, even if the regular per-dollar points post on the first statement. This is normal behavior for Chase and is not worth a phone call.

NOTE: If you complete your required spending in the last 7-10 days of the statement period, the bonus may not post until the following month's statement, even if the regular per-dollar points post on the first statement. This is normal behavior for Chase and is not worth a phone call.

Should I downgrade or cancel my existing cards before applying?

See the discussion at

Useful Chase telephone numbers

(800) 432-3117 – General Application Status Line, automated

(800) 436-7927 – Alternative General Application Status Line, automated

(888) 609-7805 – Alternative Personal Reconsideration line with live rep

(888) 269-8690 - Business Credit Card Application Status Line, automated

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 955-9900 – General Card Services and Application status, automated

(888) 298-5623 – Credit Reallocation Office (Personal cards)

(800) 453-9719 – Credit Reallocation Office (Business cards)

(888) 622-7547 – Executive Offices

(877) 470-9042 – Personal Application Verification line with live rep

Twitter: @ChaseSupport

Note: In the past, automated telephone status reports stating that Chase would notify you in 2 weeks often resulted in an approval, whereas the "7-10 days" telephone recording often indicated imminent denial. In 2016, this pattern became increasingly unpredictable, with many applicants receiving approval despite an earlier "7-10 days" automated telephone message. As a result, automated telephone responses should not be regarded as reliable indicators of an application's likely outcome.

(800) 436-7927 – Alternative General Application Status Line, automated

(888) 609-7805 – Alternative Personal Reconsideration line with live rep

(888) 269-8690 - Business Credit Card Application Status Line, automated

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 955-9900 – General Card Services and Application status, automated

(888) 298-5623 – Credit Reallocation Office (Personal cards)

(800) 453-9719 – Credit Reallocation Office (Business cards)

(888) 622-7547 – Executive Offices

(877) 470-9042 – Personal Application Verification line with live rep

Twitter: @ChaseSupport

Note: In the past, automated telephone status reports stating that Chase would notify you in 2 weeks often resulted in an approval, whereas the "7-10 days" telephone recording often indicated imminent denial. In 2016, this pattern became increasingly unpredictable, with many applicants receiving approval despite an earlier "7-10 days" automated telephone message. As a result, automated telephone responses should not be regarded as reliable indicators of an application's likely outcome.

Applying for Chase Credit Cards, 2017-2019

#1983

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

This is a recurring source of confusion. All personal card accounts opened in the past 24 months count for the 5/24 rule, but the rule does not apply to some Chase applications.

#1984

Join Date: Dec 2017

Posts: 1,107

#1985

Join Date: Sep 2018

Posts: 7

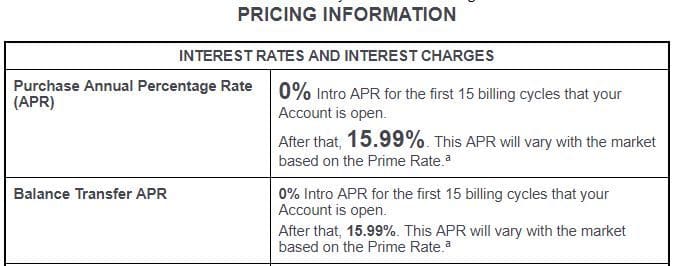

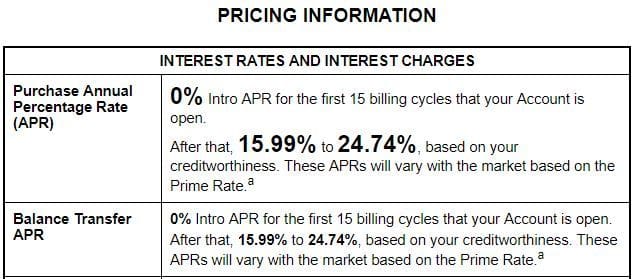

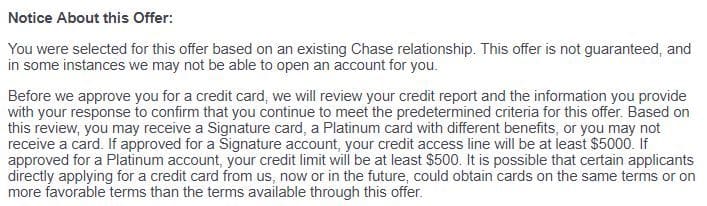

The APR range on your disclosure form indicates one of 2 things:

- You weren't pre-approved

- You were pre-approved however the banker applied via a regular link rather than the pre-approval link

To say I'm extremely annoyed right now would be an understatement. I only applied after getting assurances from three different Chase employees that I had an in-branch pre-approval for the card. I'm planning to head to my branch after work to try to figure out what went wrong. The funny thing is that they've been trying to convince me for the past few months to transfer some funds over to Chase and become a CPC but I've brushed them off. A screwup like this doesn't increase my confidence in them.

#1986

Join Date: Sep 2011

Posts: 1,857

I guess the discussion is moot now because I came home on my lunch break and a letter from Chase was in the mailbox. It stated that my application for the CSR was denied for "Too many credit cards opened in the last two years associated with you" in other words the 5/24 rule.

To say I'm extremely annoyed right now would be an understatement. I only applied after getting assurances from three different Chase employees that I had an in-branch pre-approval for the card. I'm planning to head to my branch after work to try to figure out what went wrong. The funny thing is that they've been trying to convince me for the past few months to transfer some funds over to Chase and become a CPC but I've brushed them off. A screwup like this doesn't increase my confidence in them.

To say I'm extremely annoyed right now would be an understatement. I only applied after getting assurances from three different Chase employees that I had an in-branch pre-approval for the card. I'm planning to head to my branch after work to try to figure out what went wrong. The funny thing is that they've been trying to convince me for the past few months to transfer some funds over to Chase and become a CPC but I've brushed them off. A screwup like this doesn't increase my confidence in them.

Compare that to a regular offer...

You also know what language to look for--see below. On the bright side, you might still be pre-approved for CSR.

#1987

Join Date: Sep 2011

Posts: 1,857

- Cards that don't appear on your current credit report. That includes most business cards. It also includes recently approved personal cards that have not yet shown up on your report. For Amex cards, that could take up to 2 months.

- Some store cards. If you look at the description of a store card on your credit report, you'll see something like "Charge Account" listed, which is different from all your Visa/MC/Amex descriptions. Those don't count.

#1988

Join Date: Sep 2017

Posts: 332

I'm 4/24. Applied for and was approved for a CIU on 7/11/18. Just completed the spending requirement with the statement that closed this month. But now I have unexpected medical bills so even though i was hoping for a better signup bonus for the CSR I'm going to apply in the next week or so. Just wondering has there been enough time since receiving my last card. Thanks

#1990

Join Date: Sep 2018

Programs: united, hyatt

Posts: 2

will chase close my account?

Hi,

I've had a chase amazon, chase united club card, and amex blue sky for over 5 years. In June I applied for and received a chase sapphire reserve, and in July I applied for and received the chase hyatt card. Yesterday I applied for the new SPG luxury amex card and was immediately approved. I applied for the chase freedom card that night but it said they would need to consider my application more and they would let me know within 30 days by mail. Do I need to worry about my chase accounts being closed?

I'm not too familiar with all the terminology in this thread but it looks like I was 3/24 before I applied for the chase freedom (2 chase, 1 amex with three hard pulls). My credit score is 820 and my credit utilization is very low (I never carry a balance). I wouldn't normally worry about this but the three hard pulls (four if you count the chase freedom) were all within 3-4 months.

Thanks!

Dan

I've had a chase amazon, chase united club card, and amex blue sky for over 5 years. In June I applied for and received a chase sapphire reserve, and in July I applied for and received the chase hyatt card. Yesterday I applied for the new SPG luxury amex card and was immediately approved. I applied for the chase freedom card that night but it said they would need to consider my application more and they would let me know within 30 days by mail. Do I need to worry about my chase accounts being closed?

I'm not too familiar with all the terminology in this thread but it looks like I was 3/24 before I applied for the chase freedom (2 chase, 1 amex with three hard pulls). My credit score is 820 and my credit utilization is very low (I never carry a balance). I wouldn't normally worry about this but the three hard pulls (four if you count the chase freedom) were all within 3-4 months.

Thanks!

Dan

#1991

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,934

Hi,

I've had a chase amazon, chase united club card, and amex blue sky for over 5 years. In June I applied for and received a chase sapphire reserve, and in July I applied for and received the chase hyatt card. Yesterday I applied for the new SPG luxury amex card and was immediately approved. I applied for the chase freedom card that night but it said they would need to consider my application more and they would let me know within 30 days by mail. Do I need to worry about my chase accounts being closed?

I'm not too familiar with all the terminology in this thread but it looks like I was 3/24 before I applied for the chase freedom (2 chase, 1 amex with three hard pulls). My credit score is 820 and my credit utilization is very low (I never carry a balance). I wouldn't normally worry about this but the three hard pulls (four if you count the chase freedom) were all within 3-4 months.

Thanks!

Dan

I've had a chase amazon, chase united club card, and amex blue sky for over 5 years. In June I applied for and received a chase sapphire reserve, and in July I applied for and received the chase hyatt card. Yesterday I applied for the new SPG luxury amex card and was immediately approved. I applied for the chase freedom card that night but it said they would need to consider my application more and they would let me know within 30 days by mail. Do I need to worry about my chase accounts being closed?

I'm not too familiar with all the terminology in this thread but it looks like I was 3/24 before I applied for the chase freedom (2 chase, 1 amex with three hard pulls). My credit score is 820 and my credit utilization is very low (I never carry a balance). I wouldn't normally worry about this but the three hard pulls (four if you count the chase freedom) were all within 3-4 months.

Thanks!

Dan

Second, you may run into an issue with total credit limit at Chase when adding so many Chase cards. If so, you may need to ask to have credit limit moved around from one your old cards to the newest card. (You might not be able to move credit limit from a card you've had less than a year.)

As to pulls, banks tend to look at pulls totals over whatever period of time they look at. They're less likely to look at whether those pulls were "clustered" in time (unless perhaps they're doing serious manual poring over your credit info). So I wouldn't worry about 3 or 4 pulls in 3-4 months if it's also 3 or 4 in 6 months, in 1 year, and in 2 years.

#1992

Join Date: Sep 2017

Posts: 332

I'm 4/24. Applied for and was approved for a CIU on 7/11/18. Just completed the spending requirement with the statement that closed this month. But now I have unexpected medical bills so even though i was hoping for a better signup bonus for the CSR I'm going to apply in the next week or so. Just wondering has there been enough time since receiving my last card. Thanks

#1994

Join Date: Apr 2014

Programs: Coffee Shop Buy 10 Get 1 Free

Posts: 295

Applied for United Club card and randomly go the "we'll notify you by mail in 30 days" after it processed for a few minutes. Really odd, 800+ credit, good standing with Chase well under 5/24. Last card I opened was a CSP later last year (Dec) and instant approval and use it as my primary everyday spend card. before that was my Amex Plat 3 years ago- which I am trying to replace with the United Club since work is shifting all of our travel to UA. Never not been instantly approved before. Guess best to wait it out?

Chase has all my info so not sure why the long process time here. Currently don't fly UA a lot maybe triggered a "why do you want this?" A few years ago (3, maybe more like 4) I opened a Marriott and cancelled it at the 1 year renewal so maybe that triggered something? Def not a churner like others. Those are the only 2 Chase cards I have ever had

Chase has all my info so not sure why the long process time here. Currently don't fly UA a lot maybe triggered a "why do you want this?" A few years ago (3, maybe more like 4) I opened a Marriott and cancelled it at the 1 year renewal so maybe that triggered something? Def not a churner like others. Those are the only 2 Chase cards I have ever had

Last edited by DG206; Sep 9, 2018 at 10:37 am

#1995

Join Date: Jun 2014

Location: TPA

Programs: BA Silver; Hilton Gold; IHG Diamond Ambassador; Marriott Gold

Posts: 2,811

My recent Chase history is 1) a CSR opened 18 months ago and still open (and heavily used), and 2) a Marriott closed last Feb at the 2 year mark.

I applied for the BA card online on Aug 23, and the immediate response was to call them to discuss shifting CLs. No problem with that -- the CSR CL is much higher than I need. But when I called I instead got the 3rd degree: What was the breakdown of my income (I'm retired so It's Complicated); What were my last few employers and residences; etc. Then questions based on "the Public Record", which I already knew was full of bogus info. Sure enough, I apparently "failed" that and was told to fax in proof of DoB and address.

Instead, I went to the nearest branch to sort it out. Long story short, I still got the 3rd degree and Public Records questions but apparently passed this time.

This was in preparation for a BA trip probably in Feb, and I would also like to have the IHG card before then. But now I'm gun-shy. I don't know whether the banker can handle it in house (he can UA but not BA, he said). I don't know whether trying in Jan is too soon; an old DoctorOfCredit article said I probably wouldn't see any pre-authorizations for 6 months. Any thoughts?

I applied for the BA card online on Aug 23, and the immediate response was to call them to discuss shifting CLs. No problem with that -- the CSR CL is much higher than I need. But when I called I instead got the 3rd degree: What was the breakdown of my income (I'm retired so It's Complicated); What were my last few employers and residences; etc. Then questions based on "the Public Record", which I already knew was full of bogus info. Sure enough, I apparently "failed" that and was told to fax in proof of DoB and address.

Instead, I went to the nearest branch to sort it out. Long story short, I still got the 3rd degree and Public Records questions but apparently passed this time.

This was in preparation for a BA trip probably in Feb, and I would also like to have the IHG card before then. But now I'm gun-shy. I don't know whether the banker can handle it in house (he can UA but not BA, he said). I don't know whether trying in Jan is too soon; an old DoctorOfCredit article said I probably wouldn't see any pre-authorizations for 6 months. Any thoughts?