New (2019) Membership Rewards Summary [Consolidated]

#31

Join Date: Mar 2004

Location: EWR, ORD, IAH, LGA

Programs: UA GS, AA CK, DL PLT, HH DIA, MARRIOTT PLT, FAIRMONT LT PLT, HYATT DIA, SIXT PLT, AVIS PC

Posts: 506

I would strongly recommend everyone file a CFPB complaint against Amex as the new system does not allow reconciliation as such they can take and remove points without letting us know: https://www.consumerfinance.gov/complaint/

#32

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

Different doesn't mean worse. For decades American Express sent the physical signed carbon copy of every charge slip back to the member with the monthly bill. The envelopes where chubby. Then, they changed to sending scanned copies of those slips. The envelopes were thinner, but still thick. Later, they discontinued the slip based billing and sent a computer generated list of transactions. Today we think this normal, but at the time people were suspicious - because it was different. Itemizing every individual Membership Rewards transaction is maximum transparency.

#33

Join Date: Jul 2010

Posts: 1,224

Different doesn't mean worse. For decades American Express sent the physical signed carbon copy of every charge slip back to the member with the monthly bill. The envelopes where chubby. Then, they changed to sending scanned copies of those slips. The envelopes were thinner, but still thick. Later, they discontinued the slip based billing and sent a computer generated list of transactions. Today we think this normal, but at the time people were suspicious - because it was different. Itemizing every individual Membership Rewards transaction is maximum transparency.

#34

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,050

I agree that I don't think it implies Amex is descending into all-out untrustworthiness. It's just annoying.

#35

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#36

Join Date: Jul 2010

Posts: 1,224

My main complaint with the current MR reporting system is that they don't seem to have a clear definition of what "pending" means. I think in most places where Amex refers to pending points now, they mean "points which have been earned for spending on your current statement that hasn't yet closed." But then after the statement closes, points (usually) disappear from the pending bucket and go into limbo, until they are credited at some later time (for me, it seems to be a day after I pay for my Plat card points, and a day or so after my next statement closes on my Gold card, the traditional approach -- that it's different for the two cards doesn't help anything). They either need to add a display for points sitting in that additional pending-limbo category, or keep those points in the existing pending bucket until they actually post.

I agree that I don't think it implies Amex is descending into all-out untrustworthiness. It's just annoying.

I agree that I don't think it implies Amex is descending into all-out untrustworthiness. It's just annoying.

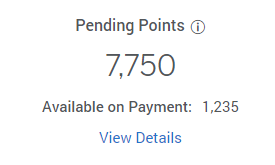

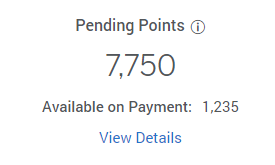

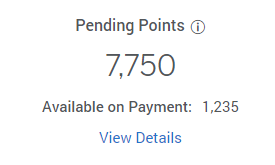

You can then view the Pending points by Calendar month...as you cannot filter based on Statement month (or a date range), you cannot tell which transactions are going to move from PENDING to EARNED upon payment (easily)

Available on Payment"

#37

Join Date: Mar 2004

Location: EWR, ORD, IAH, LGA

Programs: UA GS, AA CK, DL PLT, HH DIA, MARRIOTT PLT, FAIRMONT LT PLT, HYATT DIA, SIXT PLT, AVIS PC

Posts: 506

Different doesn't mean worse. For decades American Express sent the physical signed carbon copy of every charge slip back to the member with the monthly bill. The envelopes where chubby. Then, they changed to sending scanned copies of those slips. The envelopes were thinner, but still thick. Later, they discontinued the slip based billing and sent a computer generated list of transactions. Today we think this normal, but at the time people were suspicious - because it was different. Itemizing every individual Membership Rewards transaction is maximum transparency.

#38

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,050

Hmm - my pending points definitely continue to rack up under the broader "PENDING" category....but I have a section beneath it that says "Available on Payment:" - this seems pretty clear to me

You can then view the Pending points by Calendar month...as you cannot filter based on Statement month (or a date range), you cannot tell which transactions are going to move from PENDING to EARNED upon payment (easily)

Available on Payment"

You can then view the Pending points by Calendar month...as you cannot filter based on Statement month (or a date range), you cannot tell which transactions are going to move from PENDING to EARNED upon payment (easily)

Available on Payment"

Or is that just me?

It's also possible that I'm just a month off in my Gold card points tracking but I'm pretty sure not, and if I am, I think that would have meant I lost a month of points somewhere along the line, but the current interface makes it impossible to be sure. I might need to stop using my Gold card for a month to track what happens with the points.

#39

Join Date: Jul 2010

Posts: 1,224

As far as I can tell, that seems to be how it works for me on the Platinum card, but the Gold card is different -- Gold card points move to Points Available on Payment after statement closes, then I pay, but then the points disappear from Points Available on Payment and don't become earned until a day after the next statement closes. (I.e., the way MR points used to work, before "points accelerated" came about, at least on some cards.)

Or is that just me?

It's also possible that I'm just a month off in my Gold card points tracking but I'm pretty sure not, and if I am, I think that would have meant I lost a month of points somewhere along the line, but the current interface makes it impossible to be sure. I might need to stop using my Gold card for a month to track what happens with the points.

Or is that just me?

It's also possible that I'm just a month off in my Gold card points tracking but I'm pretty sure not, and if I am, I think that would have meant I lost a month of points somewhere along the line, but the current interface makes it impossible to be sure. I might need to stop using my Gold card for a month to track what happens with the points.

Points across all three of those cards move from PENDING to EARNED upon payment - Pending Points and Available Upon Payment update to reflect - this all seems to work as expected for me...

Still want the available to track points per statement month vs. calendar month though...

#40

Join Date: Aug 2005

Location: Brooklyn

Programs: Delta Diamond, Bonvoy something good; sometimes other things too

Posts: 5,050

Do you have two different MR accounts? The Plat and Gold Reward (and EveryDay Preferred for that matter) Point Summary pages look the same to me

Points across all three of those cards move from PENDING to EARNED upon payment - Pending Points and Available Upon Payment update to reflect - this all seems to work as expected for me...

Still want the available to track points per statement month vs. calendar month though...

Points across all three of those cards move from PENDING to EARNED upon payment - Pending Points and Available Upon Payment update to reflect - this all seems to work as expected for me...

Still want the available to track points per statement month vs. calendar month though...

#41

Join Date: Nov 2013

Location: NYC

Programs: OZ Diamond *A Gold / Delta Gold

Posts: 775

With the new system, it's hard to know how to reconcile the dollar amount spent with the corresponding MR points. Sometimes there is a slight difference but it's very hard to pin point what the difference is.

Maybe I could compare the PDF statement line items vs the one in the MR summary, but that sounds like a lot of work for me then...

Edit: Actually, I looked at my statement summary and I found out some reimbursement from Uber that counted as MR points deduction... which I still find it odd because those are just Uber correcting the amounts after being notified of an abuse, It's a shame this is counted as a credit as if I returned something... when companies pay me back as a commercial gesture, that shouldn't penalize the MR points in my opinion.

Maybe I could compare the PDF statement line items vs the one in the MR summary, but that sounds like a lot of work for me then...

Edit: Actually, I looked at my statement summary and I found out some reimbursement from Uber that counted as MR points deduction... which I still find it odd because those are just Uber correcting the amounts after being notified of an abuse, It's a shame this is counted as a credit as if I returned something... when companies pay me back as a commercial gesture, that shouldn't penalize the MR points in my opinion.

Last edited by Gasolin; Sep 23, 2019 at 10:30 am

#42

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#43

Join Date: Nov 2007

Programs: Marriott Bonvoy Platinum, Hilton Honors Diamond, Delta Gold

Posts: 4,347

When you click on View Details under "Available on Payment: xxx" it says the following:

Points are available on payment for the Card you make payment on. If we receive your Minimum Payment by the Payment Due Date, we will add these points to your Points Balance. This typically happens 24–72 hours after the payment is applied to your Card account.

So what happens if someone doesn't pay by the due date? Is there a way to reinstate forfeited points like there was before? I pay all my cards in full by the due date every month, but it's happened in the past 15+ years that once or twice I thought I paid but due to a glitch (browser timing out or something going awry on my mobile) that the payment in fact did not go through unbeknownst to me. I didn't realize until a day or two after the due date at which point I immediately paid in full and contacted Amex to apologize and they reinstated the points as a one time exception. Even if they wouldn't do it as a goodwill gesture there was always the option to reinstate for a fee and I'm curious what happens now should this ever occur to me again (of course, I hope not, but I am human after all and the few times that it did happen is still in my bones and I would have been extremely disappointed to have completely forfeited those points).

Points are available on payment for the Card you make payment on. If we receive your Minimum Payment by the Payment Due Date, we will add these points to your Points Balance. This typically happens 24–72 hours after the payment is applied to your Card account.

So what happens if someone doesn't pay by the due date? Is there a way to reinstate forfeited points like there was before? I pay all my cards in full by the due date every month, but it's happened in the past 15+ years that once or twice I thought I paid but due to a glitch (browser timing out or something going awry on my mobile) that the payment in fact did not go through unbeknownst to me. I didn't realize until a day or two after the due date at which point I immediately paid in full and contacted Amex to apologize and they reinstated the points as a one time exception. Even if they wouldn't do it as a goodwill gesture there was always the option to reinstate for a fee and I'm curious what happens now should this ever occur to me again (of course, I hope not, but I am human after all and the few times that it did happen is still in my bones and I would have been extremely disappointed to have completely forfeited those points).

#44

Join Date: Nov 2013

Location: NYC

Programs: OZ Diamond *A Gold / Delta Gold

Posts: 775

I get it if you return objects or whatever can be returned as you don't own it, but the service I received for the price doesn't disappear just because the service company decides they want to do me a commercial favor.

#45

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,041

My screenshots show me that I've had exactly one new transaction since the previous screenshot. It was for an Amex offer, so negative 50 points.

My balance went down over 700 points.

Love this new interface.

My balance went down over 700 points.

Love this new interface.