Important changes to the Aeroplan program (2015)

#76

Join Date: Aug 2010

Location: YWG

Programs: Aeroplan, MileagePlus, Marriott Rewards

Posts: 2,159

Can this really be blamed on credit cards, considering that conventional wisdom suggests that the vast majority of redemptions are for domestic/TB Y?

I'd wager that people booking premium longhauls RTWs probably earn as a result of FF activity, not signing up for Aerogold (although of course, yes, some do it through the latter route). And it's more than likely that they represent a tiny percentage of overall AE redemptions anyway.

I'd wager that people booking premium longhauls RTWs probably earn as a result of FF activity, not signing up for Aerogold (although of course, yes, some do it through the latter route). And it's more than likely that they represent a tiny percentage of overall AE redemptions anyway.

#77

Suspended

Join Date: Dec 2010

Posts: 4,153

Can this really be blamed on credit cards, considering that conventional wisdom suggests that the vast majority of redemptions are for domestic/TB Y?

I'd wager that people booking premium longhauls RTWs probably earn as a result of FF activity, not signing up for Aerogold (although of course, yes, some do it through the latter route). And it's more than likely that they represent a tiny percentage of overall AE redemptions anyway.

I'd wager that people booking premium longhauls RTWs probably earn as a result of FF activity, not signing up for Aerogold (although of course, yes, some do it through the latter route). And it's more than likely that they represent a tiny percentage of overall AE redemptions anyway.

I have been buying "toasters" and gift cards with Diner's points.

#79

Suspended

Join Date: Dec 2010

Posts: 4,153

I think so. But your city pair probably need to remain the same, while date changes should be alright. Just my 2 cents on that.

#80

Join Date: Jan 2011

Location: YVR to SEA

Posts: 2,535

HSBC premier world MasterCard has travel partners, but it seems like you need to log in to see what the rates are. I expect it to be 1:1, but no guarantee

#81

Join Date: Nov 2011

Posts: 6,385

HSBC Premier World MasterCard cardholders enrolled in the HSBC Premier World Rewards Program can convert Rewards Points into frequent flyer miles of participating airlines.

To my knowledge, partners as I just said are CX, BA, and SQ. I recall it was a 1:0.9 transfer ratio.

#82

BA Avios raised business class to TRIPLE the price of economy and first class QUADRUPLE. Up until this year I had benchmarked Aeroplan against BA charges and thought that would be the upper bound of pricing, but now, I fear for the future.

At 200k for a J ticket to Asia, that would be when I will have to tap out and give up

Also, BA gives up to 300% miles when flying F + another 100% bonus for BA Gold elite members. How many miles can you earn while flying Air Canada on F fares with LH/NH/OZ? Only 150%. Even UA gives more miles for flying based on ticket price paid so for Aeroplan to benchmark itself against United Mileage Plus in terms of redemption but ignoring the much lower earning potential vs. United is a major miscalculation on the part of Air Canada and Aeroplan. Logically, if you are one of the few corporate travellers who can fly paid Business / First Class fares, there is an incentive for you to direct your business to UA since you can book most of AC flights out of Canada using UA code anyway and have UA being the ticket issuer. Considering that UA Mileage Plus doesn't charge fuel surcharge, the decision to stay with Aeroplan vs. UA Mileage Plus if you fly paid Business / First Class fare becomes plainly obvious. This will further push Aeroplan away from being a frequent flyer program into a frequent credit card churning program since earning Aeroplan miles via flying is no where nearly as effective as credit card churning. Over time, the retailers like TD and Esso will notice a drop in customer volume due to these devaluations, forcing them to sweeten the deal, hence we are seeing TD up the ante with the Infinite Privilege card giving a 50K bonus until end of October. The vicious cycle continues but even among sheep, there will likely be a ceiling when and where even the sheep will jump the fence.

Given the prices charged by Asia Miles for their own members (HKG-HND in F is 40k one way and 70k roundtrip), AS and AA's award charts are extremely ripe for a devaluation. I don't expect those to last long either, especially if Asia Miles goes through their own further devaluation as expected.

1) So long as the segments ex-Japan or ex-China are protected in F, they are the ones that really matter. The shorter hops are less of a concern.

2) CX/KA will pay you a cash compensation (or miles) if they switch equipment on you, even when on award. How much you can get depends on your negotiation power and skill. Speaking for myself, they paid me the fare difference between F and J + $50 USD, after some smooth talking on my part of course. Once you establish a precedent and you know who to talk to, this is no longer a concern. I rather like collecting those fare differences vs. a short hop of little difference in J vs. F, as long as my segments to HND/KIX are protected in actual F, which they always are.

3) You still have F lounge access if they equipment swap on you, they will simply write you a F lounge invitation if necessary and CX F lounges in HKG. If you are OWE, then this is irrelevant.

This is where BA points come in handy (to redeem for CX Asia 1 to Asia 1). Although their long haul first/business class awards are even more expensive compared to Aeroplan, their short haul awards are relatively a better deal.

BA uses a distance based award chart as opposed to zone based.

BA uses a distance based award chart as opposed to zone based.

The strategy for those who have a Canadian AMEX Platinum or Gold Rewards card would be to convert AMEX MR points to Aeroplan for your transpacific first/business class flight. For flights within Asia, convert AMEX MR points to BA Executive Club to get the short haul awards.

The caveat is they are looking for people with $$$. If you qualify, you don't even need to pay an annual fee and the card gives up to 2X points or 1.5X for grocery, gas and drugstores.

Yes, to my knowledge, the only CC in Canada that has a direct transfer option to SQ assuming the SPG transfer does not count as direct transfer. If you transfer to SQ, you can use their miles to fly AC if you so choose to. But then again, why would one want to transfer points to SQ and use them on AC instead of SQ? @:-)

#83

Suspended

Join Date: Jun 2009

Location: YYZ

Programs: AC E50K (*G) WS Gold | SPG/Fairmont Plat Hilton/Hyatt Diamond Marriott Silver | National Exec Elite

Posts: 19,284

https://www.hsbc.ca/1/2/personal/ban...ewards-details

HSBC Premier World MasterCard cardholders enrolled in the HSBC Premier World Rewards Program can convert Rewards Points into frequent flyer miles of participating airlines.

To my knowledge, partners as I just said are CX, BA, and SQ. I recall it was a 1:0.9 transfer ratio.

HSBC Premier World MasterCard cardholders enrolled in the HSBC Premier World Rewards Program can convert Rewards Points into frequent flyer miles of participating airlines.

To my knowledge, partners as I just said are CX, BA, and SQ. I recall it was a 1:0.9 transfer ratio.

Sure, here you go: https://www.hsbc.ca/1/2/personal/ban...ewards-details

The caveat is they are looking for people with $$$. If you qualify, you don't even need to pay an annual fee and the card gives up to 2X points or 1.5X for grocery, gas and drugstores.

The caveat is they are looking for people with $$$. If you qualify, you don't even need to pay an annual fee and the card gives up to 2X points or 1.5X for grocery, gas and drugstores.

And wow. Thanks folks. ^^ (learned something new today)

I have emailed my banker prior to getting this card. I will report back with transfer ratios and participating airlines.

#84

Join Date: Nov 2010

Location: ZRH/YXU

Programs: A3*G, OZ*G, OW Sapphire

Posts: 526

I would assume if you try to make any changes after Dec 15, even only dates, you will be upcharged the new miles. Or just hope for an opportune sched change!

#85

https://www.hsbc.ca/1/2/personal/ban...ewards-details

HSBC Premier World MasterCard cardholders enrolled in the HSBC Premier World Rewards Program can convert Rewards Points into frequent flyer miles of participating airlines.

To my knowledge, partners as I just said are CX, BA, and SQ. I recall it was a 1:0.9 transfer ratio.

HSBC Premier World MasterCard cardholders enrolled in the HSBC Premier World Rewards Program can convert Rewards Points into frequent flyer miles of participating airlines.

To my knowledge, partners as I just said are CX, BA, and SQ. I recall it was a 1:0.9 transfer ratio.

(yes, qualification means that one has to have 6 figures in "stuff" with HSBC - so TFSA's, RRSP's, cash, InvestDirect etc).

And wow. Thanks folks. ^^ (learned something new today)

I have emailed my banker prior to getting this card. I will report back with transfer ratios and participating airlines.

And wow. Thanks folks. ^^ (learned something new today)

I have emailed my banker prior to getting this card. I will report back with transfer ratios and participating airlines.

#86

Suspended

Join Date: Jun 2009

Location: YYZ

Programs: AC E50K (*G) WS Gold | SPG/Fairmont Plat Hilton/Hyatt Diamond Marriott Silver | National Exec Elite

Posts: 19,284

#88

Maybe I am, I am usually very quiet these days after almost 15 years here? Makes me feel old.  The new sheep need to be herd towards the right direction however or we will soon see 1 million Aeroplan miles to fly to Europe in Y.

The new sheep need to be herd towards the right direction however or we will soon see 1 million Aeroplan miles to fly to Europe in Y.

The new sheep need to be herd towards the right direction however or we will soon see 1 million Aeroplan miles to fly to Europe in Y.

The new sheep need to be herd towards the right direction however or we will soon see 1 million Aeroplan miles to fly to Europe in Y.

#89

Join Date: Jan 2011

Location: YVR to SEA

Posts: 2,535

I live in Vancouver (as stated under my handle)

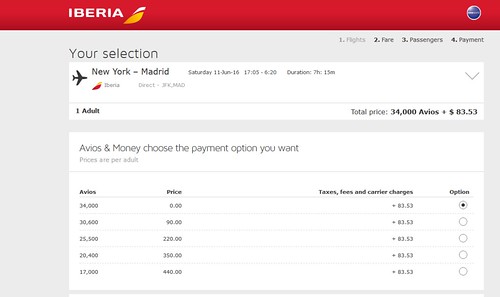

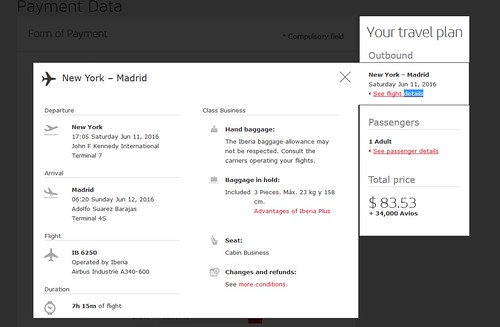

The Iberia comparison to JFK you keep using has so many caveats that it's funny.

Requires off season travel.

Additional mileage required if you need to connect at all. Given that we're in Canada, that's a minimum of 4.5k extra if you're on the east coast, or 7.5k from the west coast (YVR to lax in economy), and that's not even counting if you aren't looking to just stay in Barcelona or Madrid.

Pricing only valid on Iberia metal, which means extremely limited destinations.

So for me: CX J to JFK is 37.5k plus your 34k to Madrid is 71.5k. Even if I took economy to JFK that's 46.5k total assuming I want to go to Madrid only.

Heck, Aeroplan doesn't charge yq on Turkish, United, Swiss or Brussels, so why only compare Iberia against Lufthansa? LH surcharges are comparable with BA's

AA has travel partners, credit card partners (with huge sign-up bonuses, like some people getting multiple 100k signups from Citi), dining partners and shopping partners

AS has travel partners, a credit card partner that allowed people to sign up for 5 cards at once up until recently, dining partners and shopping partners.

I don't see Asia miles being materially different to the above, and am certain that AA will go through it's own correction to align more closely to United and delta.

The Asia 1 devaluation is bad, and will requiring shifting the short haul and mid haul to Avios, but Aeroplan is hardly the worst program there.

My family is in Hong Kong so that's where I'll visit the most (remember yq is capped to HKG)

Alaska would be 100k round trip (but with 10 percent cash fare for infants)

Asia miles is 120k roundtrip (infant fare 10 percent cash fare)

United is 140k assuming I fly United, or 160k on partners (10 percent cash fare)

Aeroplan is 150k with $100 flat rate infant fare

Avios is 180k roundtrip plus 10 percent in miles plus 10 percent cash taxes (so 18k plus twenty bucks or so)

The Iberia comparison to JFK you keep using has so many caveats that it's funny.

Requires off season travel.

Additional mileage required if you need to connect at all. Given that we're in Canada, that's a minimum of 4.5k extra if you're on the east coast, or 7.5k from the west coast (YVR to lax in economy), and that's not even counting if you aren't looking to just stay in Barcelona or Madrid.

Pricing only valid on Iberia metal, which means extremely limited destinations.

So for me: CX J to JFK is 37.5k plus your 34k to Madrid is 71.5k. Even if I took economy to JFK that's 46.5k total assuming I want to go to Madrid only.

Heck, Aeroplan doesn't charge yq on Turkish, United, Swiss or Brussels, so why only compare Iberia against Lufthansa? LH surcharges are comparable with BA's

AA has travel partners, credit card partners (with huge sign-up bonuses, like some people getting multiple 100k signups from Citi), dining partners and shopping partners

AS has travel partners, a credit card partner that allowed people to sign up for 5 cards at once up until recently, dining partners and shopping partners.

I don't see Asia miles being materially different to the above, and am certain that AA will go through it's own correction to align more closely to United and delta.

The Asia 1 devaluation is bad, and will requiring shifting the short haul and mid haul to Avios, but Aeroplan is hardly the worst program there.

My family is in Hong Kong so that's where I'll visit the most (remember yq is capped to HKG)

Alaska would be 100k round trip (but with 10 percent cash fare for infants)

Asia miles is 120k roundtrip (infant fare 10 percent cash fare)

United is 140k assuming I fly United, or 160k on partners (10 percent cash fare)

Aeroplan is 150k with $100 flat rate infant fare

Avios is 180k roundtrip plus 10 percent in miles plus 10 percent cash taxes (so 18k plus twenty bucks or so)

#90

Join Date: Jul 2002

Location: Canada

Posts: 1,875

Redemption Levels increasing

I didn't see this posted anywhere else but effective Dec 15th it will cost you more points to travel in some markets. Intra Asia has basically doubled.

https://www3.aeroplan.com/static/pdf...s-Chart-en.pdf

https://www3.aeroplan.com/static/pdf...s-Chart-en.pdf