UK Business class airfare duty could rise - Telegraph

#46

Join Date: Apr 2016

Location: Isle of Man

Programs: IHG Platinum Elite, BA Pleb

Posts: 347

APD is a different matter though and the calculations are very different. First of all, there is evidence of its original implementation and its subsequent increases to see what effect it had then. Second, it's a relatively small amount in the purchase of a ticket and, currently at least, fares are relatively low from LHR. Third, it's difficult to avoid as you have to leave the country somehow and most people aren't into ex-EUs. Fourth politically it ticks green boxes, anti airport expansion boxes and BA is a foreign company anyway so if it affects them, who cares?

The contrary arguments revolve around discouraging business travel to the UK and the massive economic hit which the UK would take if that becomes a factor. On its own, I suspect that HMT will conclude that this increase will only affect that at the margin but the problem is that the UK is becoming increasingly hostile to business - EU countries may conclude that but unfortunately we are also becoming hostile to non-EU business also - and the increase will serve to confirm that impression.

The contrary arguments revolve around discouraging business travel to the UK and the massive economic hit which the UK would take if that becomes a factor. On its own, I suspect that HMT will conclude that this increase will only affect that at the margin but the problem is that the UK is becoming increasingly hostile to business - EU countries may conclude that but unfortunately we are also becoming hostile to non-EU business also - and the increase will serve to confirm that impression.

Business demand will sit outside of APD.

Leisure travel, though? Premium Economy attracts the same APD as Business Class, and the extra APD will change the dynamics of that particular product. It's also telling that most of the complaints on this thread relate to the additional costs for a reward ticket.

As for the economic impact of tourists not stopping over in London on their way to/from somewhere else, a look at room rates and occupancy rates in London suggests that the impact is negligible.

I still think the UK leaving the EU is what moved the dial here. Changing the rules wasn't about increasing the VAT take from non-EU tourists. The issue was EU tourists, who never used to be able to reclaim VAT.

#47

FlyerTalk Evangelist

Join Date: Jan 2000

Posts: 15,347

Enough with the shipping thing, that is a canard at best. No one wants to ship high value goods internationally, forgetting the subtext about whether one needs to pay tax or declare if bringing something physically into the country or not, there are many places in the world where shipping means, days of customs hassles, and all sorts of other issues on top of taxes. Again if something is used or not greatly impacts its customs value/tax. There are many countries that exempt a personal computer, if it is "used". So you buy one and get the VAT back, use it and bring it back to your country, and there is no customs tax, whether a $200 Chromebook, or a maxed out gaming book, or Macbook. That is something you cannot do if you are shipping in such a way. (and yes I have witnessed parents with kids all carrying shopping bags straight from the Apple store filled with thousands of dollars worth of unopened equipment to open everything up and use their purchases before hitting customs at their home airports....There is nothing stupider than seeing a Brazilian or Turkish person arrive home with a gigantic Hermes bag or whatever that they are carrying whoa re surprised that they are always being picked on by customs when coming home!)

#48

Join Date: Jan 2016

Location: LHR/ATH

Programs: Amex Platinum, LH SEN (Gold), BA Bronze

Posts: 4,489

Flying is an exceptionally easy target for this sort of thing, unfortunately. Impacts a small percentage of the population, Hunt can badge it as hitting the wealthy and also hitting a polluting industry.

Meanwhile in reality, the amount raised will be chicken feed in the context of funding a tax 'cut' for a direct tax like NI. It's all rumours, but I wouldn't be surprised to see a lot of things like this put up so the Chancellor can grab himself a headline.

Meanwhile in reality, the amount raised will be chicken feed in the context of funding a tax 'cut' for a direct tax like NI. It's all rumours, but I wouldn't be surprised to see a lot of things like this put up so the Chancellor can grab himself a headline.

Amazing. Do we have a labour government or a conservative government? All I ever hear is tax tax tax. The more they tax people, the less time wealthy people will spend in the UK. The gap between rich and poor has never been bigger, this will continue to get worse.

#50

Original Poster

Join Date: Oct 2012

Location: Kent, UK

Programs: M&S Elite+

Posts: 3,658

Mr Hunt also confirms a "one-off adjustment" to rates of air passenger duty "on non-economy flights only to account for high inflation in recent years".

#52

FlyerTalk Evangelist

Join Date: Feb 2004

Location: London

Programs: BA, VS, HH, IHG, MB, MR

Posts: 26,871

.... which is the point. The key number is the Gini coefficient which is the gap between the richest and poorest in the country. Whilst one option would be to make the poorer better off, an easier way to improve your Gini score is to persuade some wealthy people to leave.

#53

Join Date: Jul 2019

Location: UK

Programs: BA Silver, IHG Platinum

Posts: 943

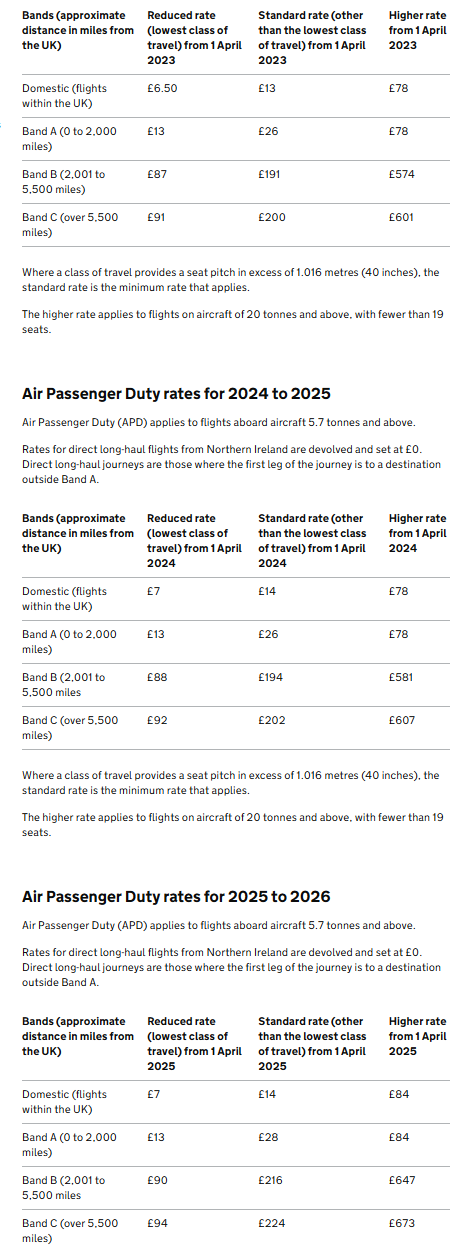

Up by around 10%

https://www.gov.uk/government/public...s#indirect-tax

Haven't included the table as it won't format properly.

https://www.gov.uk/government/public...s#indirect-tax

Air Passenger Duty rates for 2025 to 2026Air Passenger Duty (APD) applies to flights aboard aircraft 5.7 tonnes and above. Rates for direct long-haul flights from Northern Ireland are devolved and set at £0. Direct long-haul journeys are those where the first leg of the journey is to a destination outside Band A.

#56

Ambassador, British Airways; FlyerTalk Posting Legend

Join Date: Apr 2012

Location: Leeds, UK

Programs: BA GGL/CCR, GfL, HH Diamond

Posts: 42,977

No, the April 2024 rises were already announced before and you will have paid at that rate when you booked. The only change is for April 2025 rates, and you won't have been able to buy a ticket for that yet.

#57

Join Date: Jan 2010

Posts: 9,307

Thanks, I probably read about the 2024 increases before but filed the information where I thought it belonged.

#58

FlyerTalk Evangelist

Join Date: Jan 2009

Location: London & Sonoma CA

Programs: UA 1K, MM *G for life, BAEC Gold

Posts: 10,227

I simply cannot understand why Huntak want to take the blame for increasing this tax but not get the revenue which, nearly all of which will come in after the other lot will be in power.

#59

Join Date: Dec 2022

Location: United Kingdom

Posts: 476

It is going to raise £130 million a year so absolutely nothing by Government metrics.

it's just a political point to 'hammer the rich'. You would be right to think 'why would a so called conservative government want to portray that message?'.

The budget yesterday seemed to involve stealing the majority of Labour's tax plans. Further proof of my view that we are run by a high tax, low growth uniparty.

On the APD issue, I will enjoy satisfaction adding £20 to my slush fund during my little mini breaks in Europe before boarding my long haul flights in J!

I do entirely recognise that being self employed allows me this time to do this. I do sympathise once again with hardworking people who don't have that flexibility once again being used as a cash cow by the very unconservative party that should traditionally have been looking out for them.

it's just a political point to 'hammer the rich'. You would be right to think 'why would a so called conservative government want to portray that message?'.

The budget yesterday seemed to involve stealing the majority of Labour's tax plans. Further proof of my view that we are run by a high tax, low growth uniparty.

On the APD issue, I will enjoy satisfaction adding £20 to my slush fund during my little mini breaks in Europe before boarding my long haul flights in J!

I do entirely recognise that being self employed allows me this time to do this. I do sympathise once again with hardworking people who don't have that flexibility once again being used as a cash cow by the very unconservative party that should traditionally have been looking out for them.

#60

Join Date: Nov 2018

Programs: CX, BA

Posts: 91

A very good friend of mine in China, whose Chinese wife was pre Covid, running a company taking Chinese tourists to London. On average, each month, they were taking 500 to 700 tourists directly to LHR, of which 30% would opt to travel in either Business or First. From their own surveys with returning travellers, the average spend (for reclaiming VAT) was £6,250.00. This figure excluded 5 regular couples who would spend in excess of £100,000 on each of their 8-10 visits a year.

50% of all her tourists would also visit Paris, but the spend there was approximately half of the amount in the UK.

Covid obviously stopped her business entirely, however she has been extremely busy during the last 9 months.

However, her tourist numbers to London now hardly reach 100 a month, nearly everyone travelling economy, and an average spend of £1,200, whilst the numbers to Paris now exceed 1,000 a month with average spend at £7,800 (exchanged at 1.17).

She sells her packages for Paris vs London firstly for saving on APD (Chinese hate paying extra for tax - like most of us), and secondly on the VAT savings.

I really don't think the UK Government has a clue about the losses it is enforcing on retailers and hoteliers, nor the loss of business to the airlines.

Only good note, if these numbers of tourists are replicated from other countries, the massive reduction of travellers to London, should reduce the queues at LHR...............unless the staffing has been reduced.................

50% of all her tourists would also visit Paris, but the spend there was approximately half of the amount in the UK.

Covid obviously stopped her business entirely, however she has been extremely busy during the last 9 months.

However, her tourist numbers to London now hardly reach 100 a month, nearly everyone travelling economy, and an average spend of £1,200, whilst the numbers to Paris now exceed 1,000 a month with average spend at £7,800 (exchanged at 1.17).

She sells her packages for Paris vs London firstly for saving on APD (Chinese hate paying extra for tax - like most of us), and secondly on the VAT savings.

I really don't think the UK Government has a clue about the losses it is enforcing on retailers and hoteliers, nor the loss of business to the airlines.

Only good note, if these numbers of tourists are replicated from other countries, the massive reduction of travellers to London, should reduce the queues at LHR...............unless the staffing has been reduced.................

Last edited by EMIC; Mar 8, 2024 at 11:32 pm Reason: spelling