Flair Airlines and Lynx Air in merger talks; Lynx files for CCAA creditor protection.

#16

Join Date: Nov 2019

Location: YMJ (YQR)

Programs: Qantas LTG, WestJet Plat

Posts: 330

Transport Minister Pablo Rodriguez addressed the news via social media on Thursday evening. In a statement posted to X, formerly known as Twitter, Rodriguez said he is following the announcement closely.

"For any travellers that had a return flight booked with Lynx, I expect Lynx to help you get back home as soon as possible. I expect Lynx to fully refund you if your fare won't be honoured," the statement reads.

"My office has been in touch with Lynx, we will continue to communicate with all parties, and we've convened calls with other airlines to see how they can help, to ensure that passengers are put first."

"For any travellers that had a return flight booked with Lynx, I expect Lynx to help you get back home as soon as possible. I expect Lynx to fully refund you if your fare won't be honoured," the statement reads.

"My office has been in touch with Lynx, we will continue to communicate with all parties, and we've convened calls with other airlines to see how they can help, to ensure that passengers are put first."

#17

Join Date: Dec 2015

Location: YVR/YUL/LHR/HKG

Programs: TK Gold

Posts: 577

He expects Lynx to refund passenger - if they are able to refund passenger, probably they wouldn't be able to go bust. LOL....

#18

Join Date: Apr 2000

Posts: 3,126

What a meaningless statement from the Minister of Transportation. It is clear that he doesn't understand what bankruptcy is.

Previously when airlines have gone bankrupt, the credit cards wouldn't allow a chargeback until after the flight you booked was supposed to fly. It didn't matter if you had booked a flight in June and the airline went bankrupt today; you had to wait until June to get your money back.

Previously when airlines have gone bankrupt, the credit cards wouldn't allow a chargeback until after the flight you booked was supposed to fly. It didn't matter if you had booked a flight in June and the airline went bankrupt today; you had to wait until June to get your money back.

#19

Join Date: Apr 2016

Posts: 297

Probably not news for anyone here, beyond chargebacks from credit cards, some (all?) premium cards usually cover this under trip interruption if you're stuck somewhere

From BMO Ascend:

https://www.bmo.com/pdf/Ascend_World...ertificate.pdf

What I do wonder is how things work with CTA/APPR claims. Pre-bankruptcy ones I guess would become an unsecured creditor but could take years to come to a decision after appeals? I doubt the bankruptcy trustee will be happy to keep things open until they're resolved. Can new claims be made?

From BMO Ascend:

the extra cost to change your ticket to a one-way economy fare, via the most cost-effective route, by regular scheduled transportation back to your departure point or the next destination on your trip; or

b) if your existing ticket cannot be changed, the cost of a one-way economy fare by regular scheduled transportation back to your departure point or the next destination on your trip; and

b) if your existing ticket cannot be changed, the cost of a one-way economy fare by regular scheduled transportation back to your departure point or the next destination on your trip; and

Note: In the event your trip is interrupted or delayed as a result of the bankruptcy or insolvency of a travel supplier, as listed under Transportation covered reason below, you will only be eligible for benefits a) or b) listed above.

What I do wonder is how things work with CTA/APPR claims. Pre-bankruptcy ones I guess would become an unsecured creditor but could take years to come to a decision after appeals? I doubt the bankruptcy trustee will be happy to keep things open until they're resolved. Can new claims be made?

#20

Join Date: Aug 2012

Programs: ba silver

Posts: 729

What a shame!

Airlines should be required to keep funds paid by passengers in a trust account that can only be accessed after completion of service, as well as keeping enough funds on hand that if they do shut down they can still keep enough staff members on hand to rebook passengers onto other airlines or have some kind of insurance that would pay a third party site that can handle the rebookings.

Everyone would benefit as passengers would know that when they book on any airline their money is safe and that they won't be stranded.

Airlines should be required to keep funds paid by passengers in a trust account that can only be accessed after completion of service, as well as keeping enough funds on hand that if they do shut down they can still keep enough staff members on hand to rebook passengers onto other airlines or have some kind of insurance that would pay a third party site that can handle the rebookings.

Everyone would benefit as passengers would know that when they book on any airline their money is safe and that they won't be stranded.

#21

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,778

Jetsgo, on the other hand, shut down overnight with no warning, and its assets and liabilities were dealt with via CCAA.

The Lynx situation will be closer to the latter than the former, but they at least provided a couple days' notice.

What I do wonder is how things work with CTA/APPR claims. Pre-bankruptcy ones I guess would become an unsecured creditor but could take years to come to a decision after appeals? I doubt the bankruptcy trustee will be happy to keep things open until they're resolved. Can new claims be made?

Certain liabilities take precedence over others, and while the popular perception is often that banks get paid first, the first group to get paid (after the advisors working on the restructuring) are governments. A case called Redwater established a few years ago that even provincially mandated environmental liabilities can rank ahead of secured creditors.

I believe this is the first airline CCAA fling since APPR, so I don't think there's any precedent to establish where those do or should rank.

Airlines should be required to keep funds paid by passengers in a trust account that can only be accessed after completion of service, as well as keeping enough funds on hand that if they do shut down they can still keep enough staff members on hand to rebook passengers onto other airlines or have some kind of insurance that would pay a third party site that can handle the rebookings. Everyone would benefit as passengers would know that when they book on any airline their money is safe and that they won't be stranded.

#22

Join Date: Nov 2004

Posts: 583

What a shame!

Airlines should be required to keep funds paid by passengers in a trust account that can only be accessed after completion of service, as well as keeping enough funds on hand that if they do shut down they can still keep enough staff members on hand to rebook passengers onto other airlines or have some kind of insurance that would pay a third party site that can handle the rebookings.

Everyone would benefit as passengers would know that when they book on any airline their money is safe and that they won't be stranded.

Airlines should be required to keep funds paid by passengers in a trust account that can only be accessed after completion of service, as well as keeping enough funds on hand that if they do shut down they can still keep enough staff members on hand to rebook passengers onto other airlines or have some kind of insurance that would pay a third party site that can handle the rebookings.

Everyone would benefit as passengers would know that when they book on any airline their money is safe and that they won't be stranded.

Airlines do have a number of expenses that are paid well in advance, fuel hedging, for example.

#23

Join Date: Dec 2008

Posts: 797

I wonder in an alternate universe if Flair and Lynx were able to merge-- how successful that might have been. They could have been the Ryanair of Canada. But totally agree that there are too many players on the Canadian landscape.

Hmmm... Porter is like what WS used to be like. hmm... that's a topic for another thread.

Hmmm... Porter is like what WS used to be like. hmm... that's a topic for another thread.

Porterís E2 operation is a high unit cost airline operating long haul domestic and transborder flights with an average flight length over 1,100 miles with a very low utilization schedule operating out of the fortress hub of the nationís dominant airline.

WS was profitable after 3 months.

Porterís E2 operation is hemorraging cash.

Their average 1,235 mile trip costs about $28,500 to operate, with about 73 trips a day, but increasing by about 2.5 trips a day every time they add to their current fleet of 29 tails.

Porter requires about $95 per seat per block hour ex-taxes to break even with an 80% l/f , with their current average flight length being 2hrs 47 mins.

On that sort of domestic flight length, (a little less than YYZ-YYT) Porter needs an average one way fare of about $273 a seat including taxes with a net of $50 per seat in ancillary revenues.

For transborder, (roughly YYZ-FLL) itís $341 per seat, taxes-in with the same $50 net ancillary revenue, (revenue - the cost of delivering that revenue).

Next time you book a seat on Porter with the perpetual 20-35% off sales, keep those numbers in mind.

Thereís better be a lot of ďsomebodiesĒ booking the highest yield fares.

Porter is likely sitting on a a lot more cash from buoyant investors these days who are enjoying the free ride in the media, only because of the ineptness of both Lynx and Flair, but make no mistake: Porter are burning through cash at a precipitous rate.

Last edited by HangTen; Feb 25, 2024 at 6:32 pm

#24

Join Date: Sep 2000

Location: Ottawa, Ontario, Canada

Programs: Aeroplan SE AND 1MM, HHonors Gold, Marriott Bonvoy Platinum , L'Accor Platinum

Posts: 9,580

Is Flair in the long-term any more viable than Lynx.

Can even 1 ultra-low discount carrier survive in Canada?

Per this article, does Flair owe millions to the CRA? if it can not pay, then what...

https://edmontonjournal.com/business...cra-67-million

Should anyone book on Flair Airlines? or book on alternative airlines- with more expensive fares?

Can even 1 ultra-low discount carrier survive in Canada?

Per this article, does Flair owe millions to the CRA? if it can not pay, then what...

https://edmontonjournal.com/business...cra-67-million

Should anyone book on Flair Airlines? or book on alternative airlines- with more expensive fares?

#25

Join Date: Dec 2008

Posts: 797

Is Flair in the long-term any more viable than Lynx.

Can even 1 ultra-low discount carrier survive in Canada?

Per this article, does Flair owe millions to the CRA? if it can not pay, then what...

https://edmontonjournal.com/business...cra-67-million

Should anyone book on Flair Airlines? or book on alternative airlines- with more expensive fares?

Can even 1 ultra-low discount carrier survive in Canada?

Per this article, does Flair owe millions to the CRA? if it can not pay, then what...

https://edmontonjournal.com/business...cra-67-million

Should anyone book on Flair Airlines? or book on alternative airlines- with more expensive fares?

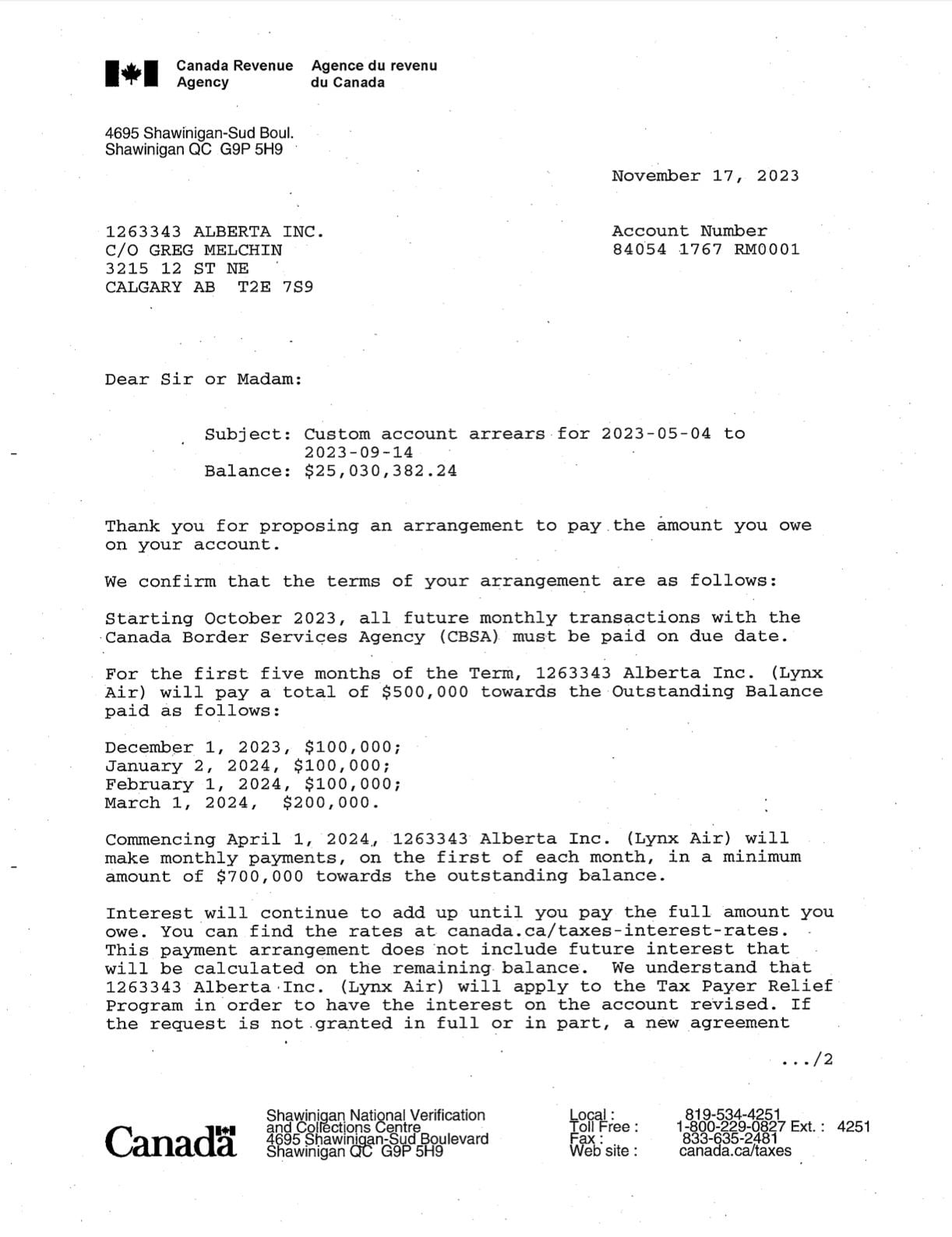

As identified in the CCAA filing that is publicly available, here are the terms for Lynxís $25m debt +10% interest paid quarterly owing to the CRA. Lynx had 9 operating tails to generate the revenue required to start the $700k a month payments in April. Flair has 20 tails to repay the $67m + interest owed. If Lynxís payment was $700k a month as of April, and Flair has 2.2x the revenue generating capability as Lynx, Flair will be writing a monthly cheque for $1,540,00 to the CRA every month till Jan 2029 to clear the debt.

Thatís the equivalent of lease payments on 3 Max 8ís.

And then there are all the other bills to deal with, not to mention the 18% debt they are carrying.

Things could spiral out of control a lot faster than many would think.

#26

Join Date: Dec 2015

Location: YVR/YUL/LHR/HKG

Programs: TK Gold

Posts: 577

On a side note, an interesting programme with the Ontario Travel Regulator (TICO)

https://www.tico.ca/news/advisory/72...-lynx-air.html

https://www.tico.ca/news/advisory/72...-lynx-air.html

#27

Join Date: Dec 2015

Location: YVR/YUL/LHR/HKG

Programs: TK Gold

Posts: 577

ynx Air has announced it will cease operations effective February 26, 2024.

On February 22, 2024, Lynx Air, a Canadian ultra-low-cost airline, announced that it will cease operations effective Monday, February 26, 2024.

TICO is in the process of obtaining additional information from the Receiver appointed under the Companies’ Creditors Arrangement Act (CCAA) process for Lynx Air. As soon as we have additional information, it will be shared on TICO’s website, including potential eligibility for claims under the Ontario Travel Industry Compensation Fund (Compensation Fund).

Please see below for the information we can share at this time with respect to general eligibility provisions of the Compensation Fund:

Airfare purchased directly from Lynx Air or through a travel agency/booking website outside of Ontario is NOT eligible for reimbursement through the Compensation Fund.

Affected passengers should note the Compensation Fund does not reimburse consumers for the cost of replacement travel services purchased.

Consumers who booked with a TICO registered travel agency or website and who have tickets for Lynx flights that are still scheduled to operate:

On February 22, 2024, Lynx Air, a Canadian ultra-low-cost airline, announced that it will cease operations effective Monday, February 26, 2024.

TICO is in the process of obtaining additional information from the Receiver appointed under the Companies’ Creditors Arrangement Act (CCAA) process for Lynx Air. As soon as we have additional information, it will be shared on TICO’s website, including potential eligibility for claims under the Ontario Travel Industry Compensation Fund (Compensation Fund).

Please see below for the information we can share at this time with respect to general eligibility provisions of the Compensation Fund:

Airfare purchased directly from Lynx Air or through a travel agency/booking website outside of Ontario is NOT eligible for reimbursement through the Compensation Fund.

Affected passengers should note the Compensation Fund does not reimburse consumers for the cost of replacement travel services purchased.

Consumers who booked with a TICO registered travel agency or website and who have tickets for Lynx flights that are still scheduled to operate:

- The Compensation Fund does not cover travel services that are available to be received.

- Travel services that are available to be used until February 26 will not be eligible for possible future reimbursement under the Compensation Fund.

- The Compensation Fund does not allow for trip completion claims as a result of an end supplier failure (e.g., airline).

- Consumers will have to make their own arrangements to return home and TICO recommends they contact a travel agent for assistance.

- We will provide additional information as soon as possible for consumers who purchased their Lynx Air travel services through a TICO registered travel agency or website and did not receive their services.

- More information about potential claims against the Compensation Fund will be provided once TICO has additional details from the Receiver.

- In the meantime, affected consumers can contact their credit card company and travel insurance provider, if applicable, to seek refunds. These steps will be required should the claims process open for Lynx Air against the Compensation Fund.

- If the credit card or travel insurance company denies your refund, please seek a letter from them confirming that a refund will not be provided.

- Unfortunately, there is no provision under Ontario Regulation 26/05 of the Travel Industry Act, 2002for a consumer to claim on the Compensation Fund when they purchased travel services from a travel agency outside of Ontario or directly from the end supplier. You may wish to contact your credit card or travel insurance company for potential reimbursement options.

- UNREDEEMED future travel credits, vouchers or similar documents issued by an airline for future travel are not eligible for reimbursement from the Compensation Fund. You may wish to contact your credit card company about a refund or wait to see if further instructions will be provided by the Receiver involved.

#28

Join Date: Mar 2023

Location: Under the Big Oak Tree

Programs: Air Bukovina Elite, Circassian Air Gold, Carthaginian Airlines Platinum

Posts: 520

Many Canadians across the country have complained for years about the high fares at the two largest airlines, and have been anxious to see more competition. Yet now that competitive alternatives to the two big airlines are here, many of those same folks are musing about not booking with LCCs like Flair and just going with AC or WS.

And then if Flair disappears alongside Lynx, those same Canadians will go back to complaining that there isn't enough competition in the domestic airline industry and that fares are too high.

#29

Join Date: Sep 2000

Location: Ottawa, Ontario, Canada

Programs: Aeroplan SE AND 1MM, HHonors Gold, Marriott Bonvoy Platinum , L'Accor Platinum

Posts: 9,580

The problem is that if consumers follow your advice and don't book with Flair, its demise becomes a self-fulfilling prophecy.

Many Canadians across the country have complained for years about the high fares at the two largest airlines, and have been anxious to see more competition. Yet now that competitive alternatives to the two big airlines are here, many of those same folks are musing about not booking with LCCs like Flair and just going with AC or WS.

And then if Flair disappears alongside Lynx, those same Canadians will go back to complaining that there isn't enough competition in the domestic airline industry and that fares are too high.

Many Canadians across the country have complained for years about the high fares at the two largest airlines, and have been anxious to see more competition. Yet now that competitive alternatives to the two big airlines are here, many of those same folks are musing about not booking with LCCs like Flair and just going with AC or WS.

And then if Flair disappears alongside Lynx, those same Canadians will go back to complaining that there isn't enough competition in the domestic airline industry and that fares are too high.

But if there is a risk that Flair might go bankrupt before or during the time I plan to fly with Flair- why should I book with Flair.

I am concerned that what happened to Lynx will happen to Flair. I do not want to risk going through the ordeal that Lynxe customers this past week have gone through; or other customers who have booked future flights are now in limbo as to whether they will ever get a refund from their credit card companies.

#30

Join Date: Feb 2022

Location: YEG/KWI

Programs: EK Gold, QR Gold, WY Gold, Delta Silver Medallion

Posts: 461