Marriott points accrual for old credit cards?

#1

Original Poster

Join Date: Apr 2005

Location: SFO

Programs: UA MM, SQ KrisFlyer, SPG/Marriott Titanium

Posts: 1,231

Marriott points accrual for old credit cards?

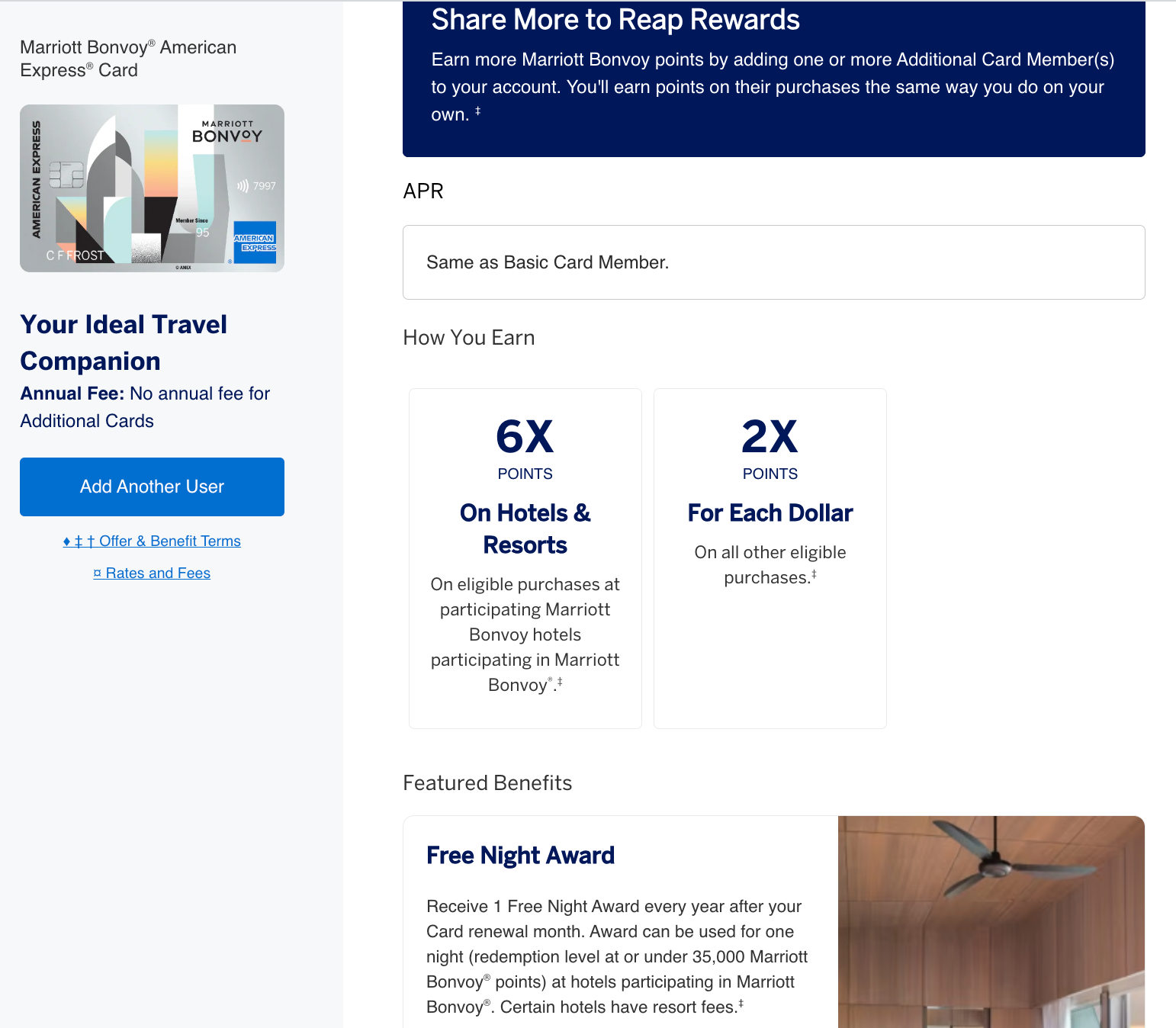

I currently have a Bonvoy AMEX (former SPG card) and a Chase Bonvoy Visa (the black one). Does anyone here in Bonvoyland happen to know off the top of their heads how many Bonvoy points per dollar spent at Marriott hotels on these cards?

I used to know this but forgot...TIA

I used to know this but forgot...TIA

#2

#4

FlyerTalk Evangelist

Join Date: Mar 2002

Location: Saipan, MP 96950 USA (Commonwealth of the Northern Mariana Islands = the CNMI)

Programs: UA Silver, Hilton Silver. Life: UA .57 MM, United & Admirals Clubs (spousal), Marriott Platinum

Posts: 15,308

I had both, but after the 2016 merger was fully implemented in 2018, I cancelled my Marriott BONV�Y AmEx in favor of my Chase Marriott BONV�Y Premier Visa, notwithstanding the reduced points earning. The Elite Qualifying Night (EQN) for each $3K spend was the tie-breaker for me.

They keep on offering points to try to get me to "upgrade" to the newer Visa, which also has a 35K-point free night award (FNA) certificate instead of my current 25K FNA. However, even as a lifetime Platinum Elite, I do not want to reduce my EQNs to one per $5K spend.

They keep on offering points to try to get me to "upgrade" to the newer Visa, which also has a 35K-point free night award (FNA) certificate instead of my current 25K FNA. However, even as a lifetime Platinum Elite, I do not want to reduce my EQNs to one per $5K spend.

Last edited by SPN Lifer; Jan 26, 2024 at 12:13 am

#6

Join Date: May 2022

Posts: 2,360

How much spend do you put on the card? Is it mostly Marriott spend? You might get more nights but does that offset the 1x less you are getting on your spend?

#7

FlyerTalk Evangelist

Join Date: Mar 2002

Location: Saipan, MP 96950 USA (Commonwealth of the Northern Mariana Islands = the CNMI)

Programs: UA Silver, Hilton Silver. Life: UA .57 MM, United & Admirals Clubs (spousal), Marriott Platinum

Posts: 15,308

Mostly non-Marriott, about $30K to $60K per year, a vast preponderance of my personal spend. I am satisfied with my choice of Elite Qualifying Nights (EQN) versus the additional points I could have earned if I had kept the "duplicate" SPG AmEx card in 2018, especially as AmEx is not widely accepted in this part of the U.S.

#8

Join Date: Feb 2013

Location: Miami, FL

Programs: UA 1MM, AA Plat, Marriott LT Titanium, Hyatt Glob, IHG ♢ Amb, Hilton ♢, Hertz Pres

Posts: 6,026

Mostly non-Marriott, about $30K to $60K per year, a vast preponderance of my personal spend. I am satisfied with my choice of Elite Qualifying Nights (EQN) versus the additional points I could have earned if I had kept the "duplicate" SPG AmEx card in 2018, especially as AmEx is not widely accepted in this part of the U.S.

#9

FlyerTalk Evangelist

Join Date: Aug 2007

Location: SEA, but up and down the coast a lot

Programs: Oceanic Airlines Gold Elite

Posts: 20,444

Personally I’d go with the return on spend on literally any other card that is giving me better than 1x Marriott but it takes all kinds I guess. God bless people who do this kind of suboptimal spend which makes Chase money on the difference between 3% transaction fees and what they pay for 1x Marriott, so I can churn SUBs.

(FWIW a no annual fee 2% Visa or MC can buy 120k of Marriott points against 60k spend when the points are on sale, and still have money left over- and it’s hardly the most lucrative way to use spend.)

Last edited by eponymous_coward; Jan 29, 2024 at 11:02 pm

#10

FlyerTalk Evangelist

Join Date: Mar 2002

Location: Saipan, MP 96950 USA (Commonwealth of the Northern Mariana Islands = the CNMI)

Programs: UA Silver, Hilton Silver. Life: UA .57 MM, United & Admirals Clubs (spousal), Marriott Platinum

Posts: 15,308

#11

Join Date: May 2024

Posts: 1

I had both, but after the 2016 merger was fully implemented in 2018, I cancelled my Marriott BONV�Y AmEx in favor of my Chase Marriott BONV�Y Premier Visa, notwithstanding the reduced points earning. The Elite Qualifying Night (EQN) for each $3K spend was the tie-breaker for me.

They keep on offering points to try to get me to "upgrade" to the newer Visa, which also has a 35K-point free night award (FNA) certificate instead of my current 25K FNA. However, even as a lifetime Platinum Elite, I do not want to reduce my EQNs to one per $5K spend.

They keep on offering points to try to get me to "upgrade" to the newer Visa, which also has a 35K-point free night award (FNA) certificate instead of my current 25K FNA. However, even as a lifetime Platinum Elite, I do not want to reduce my EQNs to one per $5K spend.

#12

FlyerTalk Evangelist

Join Date: Mar 2002

Location: Saipan, MP 96950 USA (Commonwealth of the Northern Mariana Islands = the CNMI)

Programs: UA Silver, Hilton Silver. Life: UA .57 MM, United & Admirals Clubs (spousal), Marriott Platinum

Posts: 15,308

Welcome to FlyerTalk (FT), rayho12! I hope you will enjoy participating in the FT Marriott sub-forum and other areas of interest.

https://www.flyertalk.com/forum/index.php

https://www.flyertalk.com/forum/index.php

#13

Join Date: Apr 2017

Programs: Bonvoy ambassador - lifetime plat / Hilton diamond / hyatt globalist / AA CK baby!

Posts: 986

I guess if you really do amazing stuff with 10 extra NUAs every year?

Personally I�d go with the return on spend on literally any other card that is giving me better than 1x Marriott but it takes all kinds I guess. God bless people who do this kind of suboptimal spend which makes Chase money on the difference between 3% transaction fees and what they pay for 1x Marriott, so I can churn SUBs.

(FWIW a no annual fee 2% Visa or MC can buy 120k of Marriott points against 60k spend when the points are on sale, and still have money left over- and it�s hardly the most lucrative way to use spend.)

Personally I�d go with the return on spend on literally any other card that is giving me better than 1x Marriott but it takes all kinds I guess. God bless people who do this kind of suboptimal spend which makes Chase money on the difference between 3% transaction fees and what they pay for 1x Marriott, so I can churn SUBs.

(FWIW a no annual fee 2% Visa or MC can buy 120k of Marriott points against 60k spend when the points are on sale, and still have money left over- and it�s hardly the most lucrative way to use spend.)