Rumor: Possible fee increase and benefits change for the Amex Hilton Aspire

#1

Original Poster

Join Date: Feb 2006

Posts: 1,145

Rumor: Possible fee increase and benefits change for the Amex Hilton Aspire

I know there were rumors before Amex refreshed the Bonvoy Brilliant, changed benefits, and increased the annual fee. Moreover, sending out surveys to existing cardmembers is nothing new. However, I've seen a few posts on Reddit, and rumors on at least one travel blog , so I wanted to open a thread on Flyertalk as well.

At this point, these are just rumors. However, as someone that holds 2 Aspires and is working on getting a 3rd one at the end of May, I hope they hold off.

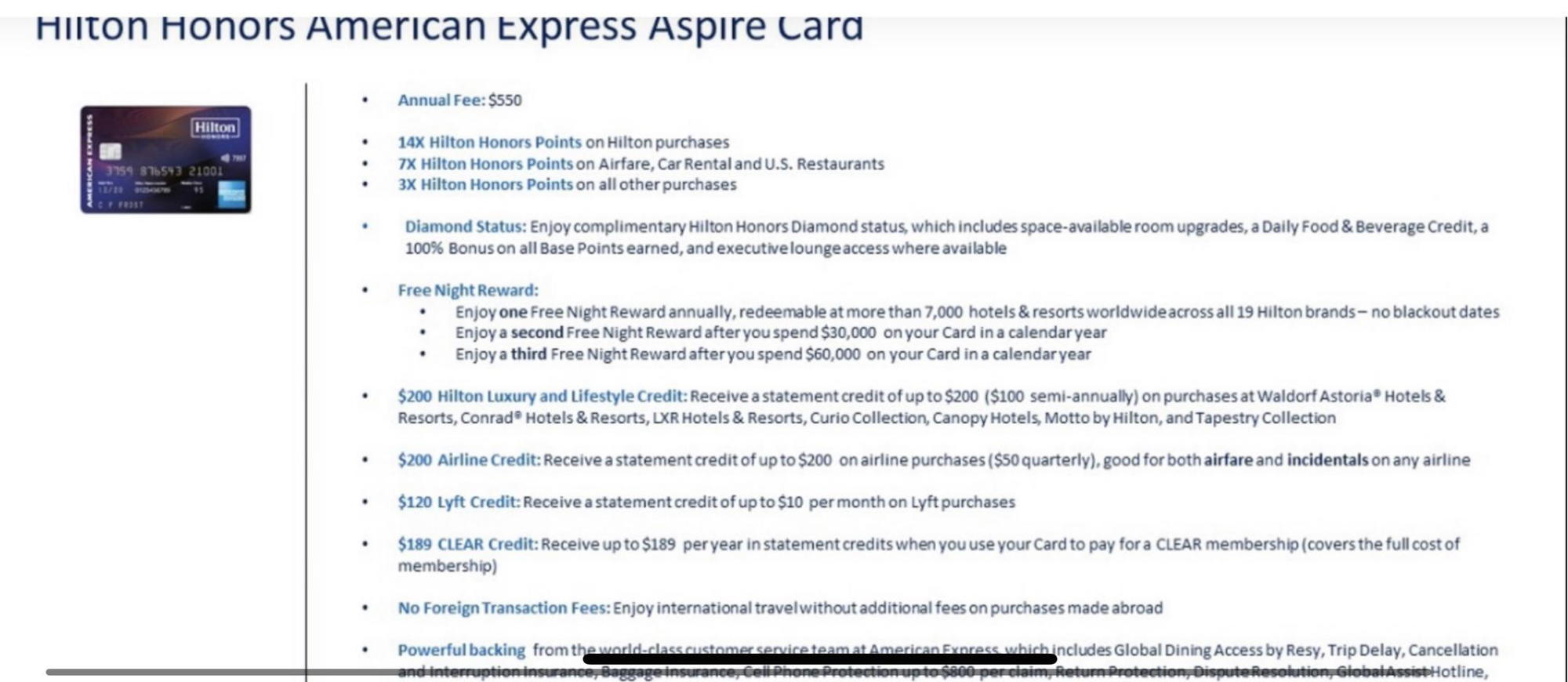

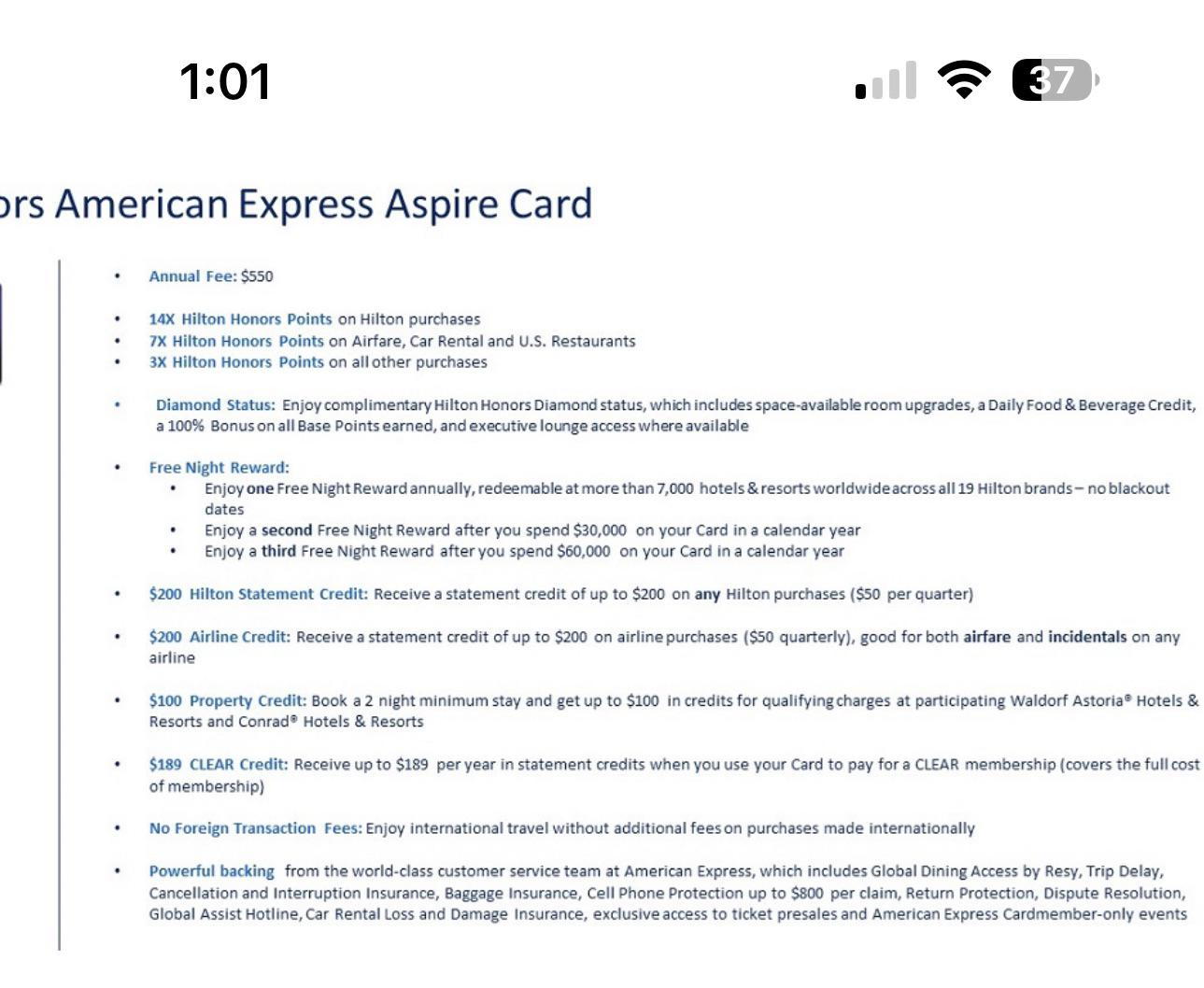

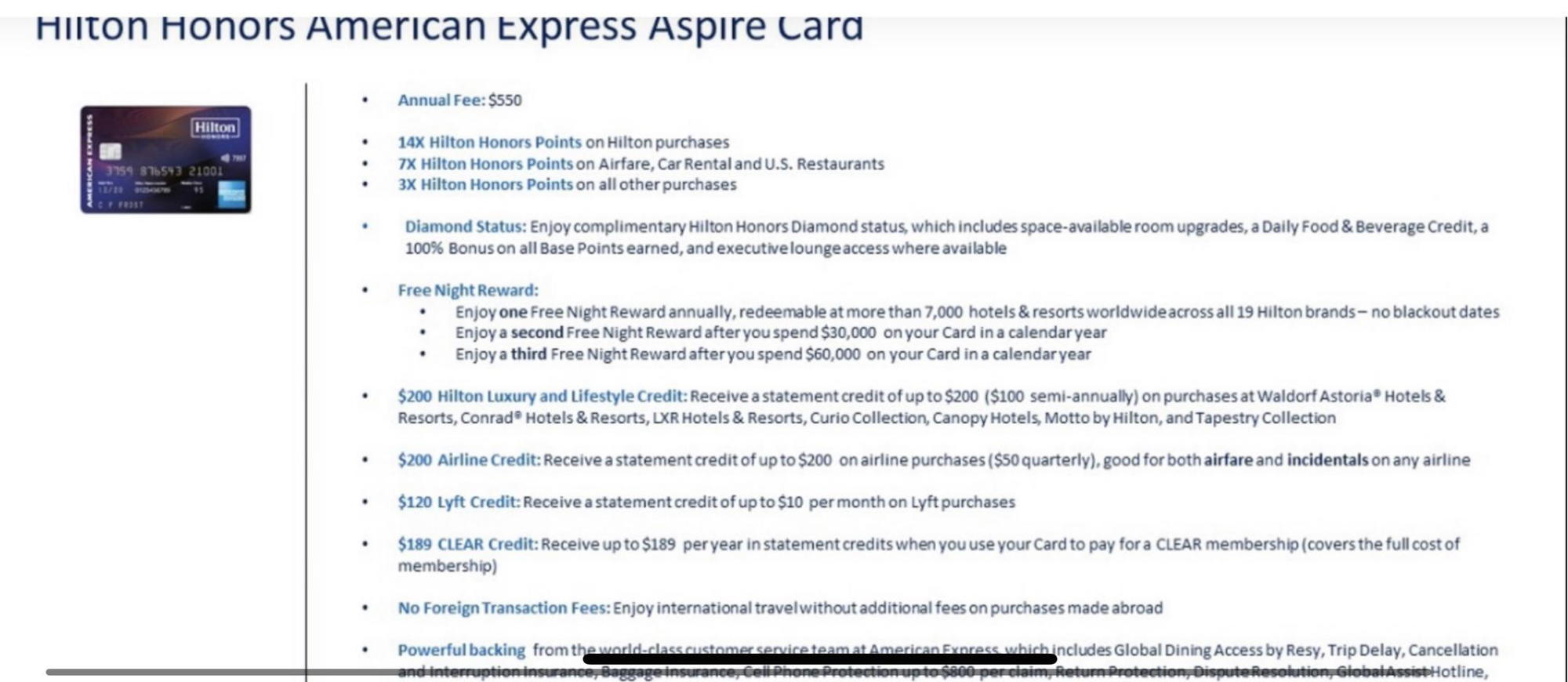

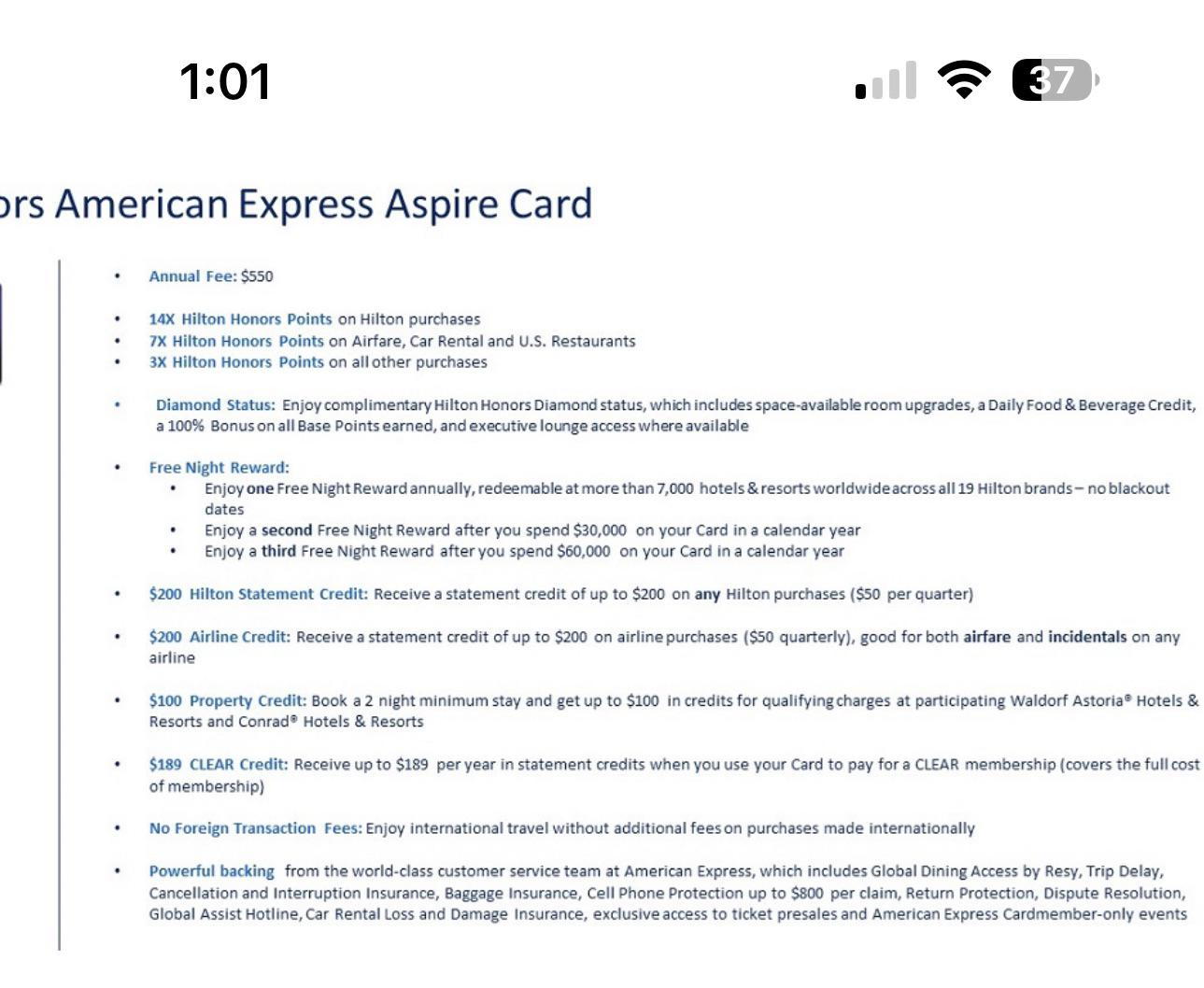

It looks like they may be eliminating the Resort credit, breaking up the airline and hotel credits into $50 quarterly credits, and increasing the annual fee to $550.00.

Here is a link to Thrifty Traveler: https://thriftytraveler.com/news/cre...-card-changes/

Here is a link to Reddit: https://www.reddit.com/r/amex/commen...ntial_changes/

It'll also be interesting if they add a monthly Lyft benefit, considering Amex partners with Uber, though Hilton has a partnership with Lyft.

The images posted below were originally taken from Reddit:

At this point, these are just rumors. However, as someone that holds 2 Aspires and is working on getting a 3rd one at the end of May, I hope they hold off.

It looks like they may be eliminating the Resort credit, breaking up the airline and hotel credits into $50 quarterly credits, and increasing the annual fee to $550.00.

Here is a link to Thrifty Traveler: https://thriftytraveler.com/news/cre...-card-changes/

Here is a link to Reddit: https://www.reddit.com/r/amex/commen...ntial_changes/

It'll also be interesting if they add a monthly Lyft benefit, considering Amex partners with Uber, though Hilton has a partnership with Lyft.

The images posted below were originally taken from Reddit:

Last edited by diesteldorf; Mar 9, 2023 at 4:57 pm

#2

Join Date: Jun 2015

Location: DAY

Programs: Rapid Rewards, Skymiles, Hilton HHonors, SPG/Marriott Rewards

Posts: 5,130

I know there were rumors before Amex refreshed the Bonvoy Brilliant, changed benefits, and increased the annual fee. Moreover, sending out surveys to existing cardmembers is nothing new. However, I've seen a few posts on Reddit, and rumors on at least one travel blog , so I wanted to open a thread on Flyertalk as well.

At this point, these are just rumors. However, as someone that holds 2 Aspires and is working on getting a 3rd one at the end of May, I hope they hold off.

It looks like they may be eliminating the Resort credit, breaking up the airline and hotel credits into $50 quarterly credits, and increasing the annual fee to $550.00.

Here is a link to Reddit: https://www.reddit.com/r/amex/commen...ntial_changes/

Here is a link to Thrifty Traveler: https://thriftytraveler.com/news/cre...-card-changes/

It'll also be interesting if they add a monthly Lyft benefit, considering Amex partners with Uber, though Hilton has a partnership with Lyft.

The images posted below were originally taken from Reddit:

At this point, these are just rumors. However, as someone that holds 2 Aspires and is working on getting a 3rd one at the end of May, I hope they hold off.

It looks like they may be eliminating the Resort credit, breaking up the airline and hotel credits into $50 quarterly credits, and increasing the annual fee to $550.00.

Here is a link to Reddit: https://www.reddit.com/r/amex/commen...ntial_changes/

Here is a link to Thrifty Traveler: https://thriftytraveler.com/news/cre...-card-changes/

It'll also be interesting if they add a monthly Lyft benefit, considering Amex partners with Uber, though Hilton has a partnership with Lyft.

The images posted below were originally taken from Reddit:

#3

Join Date: Jul 2013

Location: Gulf Coast

Programs: Hilton Honors Lifetime Diamond; National Car Rental Executive Elite

Posts: 2,381

Right now, for the annual airline credit, you have to lock in your airline selection in January. For us infrequent flyers, this is a disadvantage when we use other airlines. If the quarterly airline benefit allowed you to switch your airline selection each quarter, this would be a net positive.

Eliminating the resort credit, but adding a $200 "lifestyle and luxury" credit seems OK. The list of true resorts isn't huge, so adding brands but decreasing the value is a wash.

Adding tiered free-night earnings seems like a net positive. These FNCs can be worth $500+ in value.

I'm not a typical user though as my company travel (100+ nights per year) is allowed to be purchased on my personal Aspire card.

Eliminating the resort credit, but adding a $200 "lifestyle and luxury" credit seems OK. The list of true resorts isn't huge, so adding brands but decreasing the value is a wash.

Adding tiered free-night earnings seems like a net positive. These FNCs can be worth $500+ in value.

I'm not a typical user though as my company travel (100+ nights per year) is allowed to be purchased on my personal Aspire card.

#4

FlyerTalk Evangelist

Join Date: Aug 2011

Location: Barcelona, London, on a plane

Programs: BA Silver, TK E+, AA PP, Hyatt Globalist, Marriott LT Plat, Hilton Diamond

Posts: 13,220

Like resort fee charging hotels, AMEX wants to offer credits that LOOK valuable, but a minority of cardholders actually use. (CLEAR, LYFT, on-property non-room rate spend, etc.) They also want people to put non-hotel spend through the credit card - therefore the airline credit being split into 4 separate chunks.

Where Amex and Hilton are burning money unnecessarily is the statement credits for hotel spend. People are already getting this card for the Diamond status and the 14x on hotel spend. I'd be willing to bet that the vast majority of cardholders wouldn't cancel the card (and their Diamond status) just because some statement credits went away...

Where Amex and Hilton are burning money unnecessarily is the statement credits for hotel spend. People are already getting this card for the Diamond status and the 14x on hotel spend. I'd be willing to bet that the vast majority of cardholders wouldn't cancel the card (and their Diamond status) just because some statement credits went away...

#5

Join Date: Nov 2015

Programs: DL, Marriott & IHG Platty; HH Diamonte

Posts: 861

Like resort fee charging hotels, AMEX wants to offer credits that LOOK valuable, but a minority of cardholders actually use. (CLEAR, LYFT, on-property non-room rate spend, etc.) They also want people to put non-hotel spend through the credit card - therefore the airline credit being split into 4 separate chunks.

Where Amex and Hilton are burning money unnecessarily is the statement credits for hotel spend. People are already getting this card for the Diamond status and the 14x on hotel spend. I'd be willing to bet that the vast majority of cardholders wouldn't cancel the card (and their Diamond status) just because some statement credits went away...

Where Amex and Hilton are burning money unnecessarily is the statement credits for hotel spend. People are already getting this card for the Diamond status and the 14x on hotel spend. I'd be willing to bet that the vast majority of cardholders wouldn't cancel the card (and their Diamond status) just because some statement credits went away...

With the progressive reductions in the breakfast (food&beverage) benefit, most resorts saying 'there are too many diamonds to provide upgrades' and the lack of guaranteed late checkout, the loss of the resort credit and breaking up of the airline credit will tip the scales for me and hilton will go bye bye.

#6

Join Date: May 2022

Posts: 171

Actually, if the resort credit and airline credit gets broken up, I'll no longer keep this card.

With the progressive reductions in the breakfast (food&beverage) benefit, most resorts saying 'there are too many diamonds to provide upgrades' and the lack of guaranteed late checkout, the loss of the resort credit and breaking up of the airline credit will tip the scales for me and hilton will go bye bye.

With the progressive reductions in the breakfast (food&beverage) benefit, most resorts saying 'there are too many diamonds to provide upgrades' and the lack of guaranteed late checkout, the loss of the resort credit and breaking up of the airline credit will tip the scales for me and hilton will go bye bye.

#7

Join Date: Feb 2015

Posts: 178

Actually, if the resort credit and airline credit gets broken up, I'll no longer keep this card.

With the progressive reductions in the breakfast (food&beverage) benefit, most resorts saying 'there are too many diamonds to provide upgrades' and the lack of guaranteed late checkout, the loss of the resort credit and breaking up of the airline credit will tip the scales for me and hilton will go bye bye.

With the progressive reductions in the breakfast (food&beverage) benefit, most resorts saying 'there are too many diamonds to provide upgrades' and the lack of guaranteed late checkout, the loss of the resort credit and breaking up of the airline credit will tip the scales for me and hilton will go bye bye.

#8

Join Date: Nov 2018

Location: DFW

Posts: 316

A more flexible Airline and Hilton credit would be a nice improvement, offsetting the annual fee increase IMO. Also glad Hilton also kept the flexibility of the free night to be any day of the week, and no points caps. As long as those stay, I'm a happy camper!

#9

Join Date: Aug 2002

Location: St. Louis, MO

Posts: 1,425

Is Priority Pass being removed as a benefit of this card? I don't see it listed. That benefit is somewhat limited for me, but I still like to have it.

#10

Join Date: Jan 2020

Location: Houston

Programs: UA, Hyatt Globolist, Marriott Pla, Hilton Diamond

Posts: 45

Expect it is coming from monthly/semi year credit on other AMEX premium cards. Proposed changes make negative impact on how to use these credits fully without actually spending more. I would probably cancel the card with these changes.

#11

Join Date: May 2011

Location: NYC (LGA, JFK), CT

Programs: Delta Platinum, American Gold, JetBlue Mosaic 4, Marriott Platinum, Hyatt Explorist, Hilton Diamond,

Posts: 4,983

Amex is clearly moving to a model that encourages you to spend on their cards - 30K on this card for an extra free night, 30K on a Delta Reserve for MQM boost, 60K on a Marriott card for an extra free night, 75K on the Amex Platinum for free guest access to Centurion Lounge, etc. They want you to have a few cards and to spend a lot on them to get the benefits. These changes, if true, fit into that. And to be fair - cardholders that hold an Amex Aspire, or any card, and simply use it a few times a year to max out the benefits, with no other spend, are not profitable customers.

IMO, a better deal than the card as proposed would be to downgrade to the $95 Surpass, and to spend 15K on that card for a free night annually. The main thing is that Gold and Diamond status are more or less indistinguishable. If Diamond status were better, maybe there would be more value in the Aspire fee.

The changes to the credits depend entirely on your stay and spend patterns...

IMO, a better deal than the card as proposed would be to downgrade to the $95 Surpass, and to spend 15K on that card for a free night annually. The main thing is that Gold and Diamond status are more or less indistinguishable. If Diamond status were better, maybe there would be more value in the Aspire fee.

The changes to the credits depend entirely on your stay and spend patterns...

#12

Join Date: Jan 2005

Location: If only I knew

Programs: Several of my own making in which I was recently fast-tracked to super-duper-über-elite status

Posts: 1,081

The food and beverage credit fiasco definitely makes Diamond much less valuable. Just hope they don't extend it to properties worldwide.

That being said, I'll probably still keep the card and the rumored changes might actually work out better for the way I use the card. The fact that the airline credits would cover airfare is nice, especially if it covers award fees and if UA travel bank purchases still get reimbursed. If it applies to any airline without having to choose one, that's another plus. In my book, the credits for any Hilton purchases (or Hilton Luxury/Lifestyle purchases) are better than the resort credits, as I have to work hard to get to a resort every year to use up the credit. Although, breaking the credits into quarterly/semi-annual payments will make it cumbersome and will be one more thing to monitor.

I'll definitely use most of the Clear credit, so assuming I can get full value out of the airline and Hilton credits, I'm still ahead of the game.

Loss of Priority Pass would be a disappointment, but not life changing.

So overall a mixed bag, but I'm ok with the changes if true.

That being said, I'll probably still keep the card and the rumored changes might actually work out better for the way I use the card. The fact that the airline credits would cover airfare is nice, especially if it covers award fees and if UA travel bank purchases still get reimbursed. If it applies to any airline without having to choose one, that's another plus. In my book, the credits for any Hilton purchases (or Hilton Luxury/Lifestyle purchases) are better than the resort credits, as I have to work hard to get to a resort every year to use up the credit. Although, breaking the credits into quarterly/semi-annual payments will make it cumbersome and will be one more thing to monitor.

I'll definitely use most of the Clear credit, so assuming I can get full value out of the airline and Hilton credits, I'm still ahead of the game.

Loss of Priority Pass would be a disappointment, but not life changing.

So overall a mixed bag, but I'm ok with the changes if true.

#13

Join Date: Aug 2017

Programs: Hilton Diamond, IHG Spire Ambassador, Global Entry

Posts: 3,447

Right now, for the annual airline credit, you have to lock in your airline selection in January. For us infrequent flyers, this is a disadvantage when we use other airlines. If the quarterly airline benefit allowed you to switch your airline selection each quarter, this would be a net positive.

The rest seems like the new garbage AMEX business model. Showing you "value," but placing so many hurdles to actually get said value. I agree this card was too good of a value. However, they are really nuking it here.

#14

Join Date: Jan 2008

Location: Michigan, USA

Programs: Hilton Diamond; Delta Platinum

Posts: 556

While anyone COULD find a scenario that works better for them, this change would absolutely be a net loss for most. First off, you are missing the $50 decrease in value from $250 to $200. Then you would have to book a flight every quarter, with incidentals. Finally, you are assuming they will let you change airlines.

The rest seems like the new garbage AMEX business model. Showing you "value," but placing so many hurdles to actually get said value. I agree this card was too good of a value. However, they are really nuking it here.

The rest seems like the new garbage AMEX business model. Showing you "value," but placing so many hurdles to actually get said value. I agree this card was too good of a value. However, they are really nuking it here.

“What if” they didn’t make you select an airline, what if it worked for all?

Seems like things like selecting an airline is their way to advertise a benefit but make it hard to redeem. If they make it quarterly, I’d say that makes it difficult enough, it would be nice if they opened it up to more airline choices

#15

Join Date: Jan 2005

Location: If only I knew

Programs: Several of my own making in which I was recently fast-tracked to super-duper-über-elite status

Posts: 1,081

The flight credit line says good for “airfare” not just incidentals. That would be a mild improvement.

“What if” they didn’t make you select an airline, what if it worked for all?

Seems like things like selecting an airline is their way to advertise a benefit but make it hard to redeem. If they make it quarterly, I’d say that makes it difficult enough, it would be nice if they opened it up to more airline choices

“What if” they didn’t make you select an airline, what if it worked for all?

Seems like things like selecting an airline is their way to advertise a benefit but make it hard to redeem. If they make it quarterly, I’d say that makes it difficult enough, it would be nice if they opened it up to more airline choices