Last edit by: philemer

Posts from 1/1/16 onward can be found here: http://www.flyertalk.com/forum/credit-card-programs/1739359-2016-onward-usa-emv-cards-availability-q-chip-pin-signature.html

EMV wikipost volunteers: kebosabi

What is EMV?

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

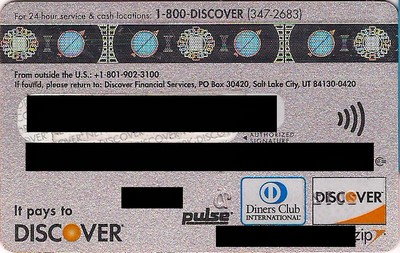

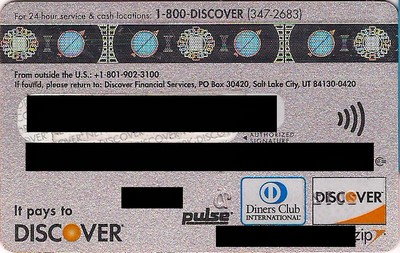

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

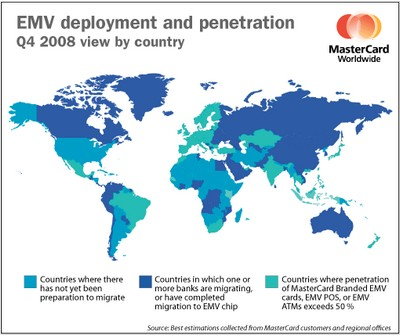

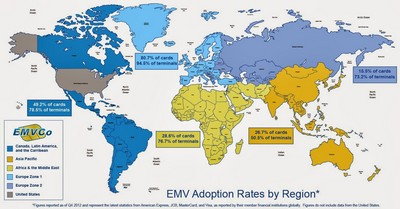

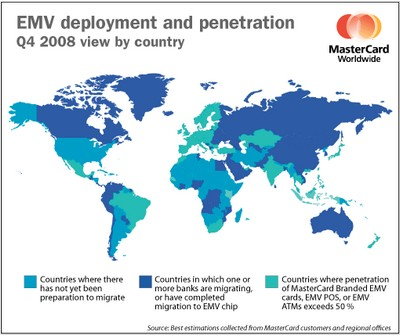

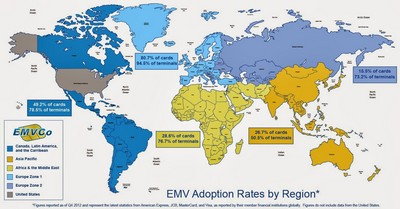

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

EMV wikipost volunteers: kebosabi

What is EMV?

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

USA EMV cards: Availability, Q&A (Chip & PIN -or- Chip & Signature) [2012-2015]

Join Date: Oct 2014

Location: SAN

Posts: 61

I did use the card in a non-touristy area Paris supermarket and the woman was startled, but then she pulled out a pen and handed me the slip to sign without issue. I didn't get the impression that anyone was not happy about a signature card. I had one guy (I can't recall where it was, probably another supermarket) that had trouble finding a pen but his coworker had one (he was able to find a pen faster than my wife was able to get one out of her purse).

Join Date: Apr 2014

Posts: 409

Similar experience using a chip+sig card in and around Paris. Absolutely no issues whatsoever. Key takeaway for me is that this experience was exponentially better than when I was there two years ago with just a swipe card. This time, no searching for the 'swipe machine', no wondering if they will even have a swipe reader, no stress.

I did use the card in a non-touristy area Paris supermarket and the woman was startled, but then she pulled out a pen and handed me the slip to sign without issue. I didn't get the impression that anyone was not happy about a signature card. I had one guy (I can't recall where it was, probably another supermarket) that had trouble finding a pen but his coworker had one (he was able to find a pen faster than my wife was able to get one out of her purse).

Join Date: Oct 2011

Posts: 60

We have it now - you can give someone your credit card without sharing the pin. Yes, authorized cardholder can go to the bank to do cash advance, but chances that he leaks the pin to someone are zero.

If you are given one bank and one store, chances are bank has better protection than store

That is a matter of priority - 25 years ago, protecting from Lost/Stolen fraud was much more important than now - when bigger chunk of fraud is from internet transactions (and skimming mag stripe cards). I think, pin lost a lot of relevance, especially since online authentication became the norm.

Doing traveler notification now is so much easier than before - just login to the web site and click some buttons

US don't have really have many offline-only terminals (if any at all). and bank's task is domestic market. And there are still enough US EMV cards with pin backup and no FTF - exactly what traveler needs.

If you are given one bank and one store, chances are bank has better protection than store

That is a matter of priority - 25 years ago, protecting from Lost/Stolen fraud was much more important than now - when bigger chunk of fraud is from internet transactions (and skimming mag stripe cards). I think, pin lost a lot of relevance, especially since online authentication became the norm.

I get doing it for international travel and it's still a good idea to do so even with EMV, but the real-time fraud detection algorithms are arguably a worse cardholder experience than a PIN domestically. Especially if you're one of those people who only has a single card (likely debit card) for whatever reason.

The big differences between those other countries and us are:

- Those other countries' cards work in offline-only terminals.

- Those other countries' cards have purchase PINs for kiosks.

Join Date: Oct 2014

Location: Portland, OR, USA

Programs: Delta + United Airmiles

Posts: 703

Data points:

Nice, France: Monoprix required SIGNATURE using HSBC card at self checkout - delayed checkout about 5 minutes waiting for a clerk who ignored signature and was a bit confused about the process. Sure felt secure - NOT!

Italy: The five cards I tried, including chipped and non-chipped debit cards, all worked, without pin, at coffee vending machines on several train platforms.

Ventimiglia (Italy): ticket agency accepted only cash and was quite slow - didn't see any ticket machines.

Monaco (France): Bus ticket machine in Monaco required pin (tried both Arrival+ and HSBC). Took a long time to approve so assume online.

Italy: Many small shops and bars accepted only cash.

Nice, France: Monoprix required SIGNATURE using HSBC card at self checkout - delayed checkout about 5 minutes waiting for a clerk who ignored signature and was a bit confused about the process. Sure felt secure - NOT!

Italy: The five cards I tried, including chipped and non-chipped debit cards, all worked, without pin, at coffee vending machines on several train platforms.

Ventimiglia (Italy): ticket agency accepted only cash and was quite slow - didn't see any ticket machines.

Monaco (France): Bus ticket machine in Monaco required pin (tried both Arrival+ and HSBC). Took a long time to approve so assume online.

Italy: Many small shops and bars accepted only cash.

Join Date: Mar 2013

Location: Hong Kong

Programs: Marriott Platinum, United Silver

Posts: 88

I've never had anyone upset that it was a signature card. The worst is usually that start frantically patting themselves down and looking for a pen. I've gotten used to this and always carry one with me now and when I call their attention to it they are quite relieved.

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

FlyerTalk Evangelist

Join Date: Aug 2001

Location: RSW

Programs: Delta - Silver; UA - Silver; HHonors - Diamond; IHG - Spire Ambassador; Marriott Bonvoy - Titanium

Posts: 14,185

I've never had anyone upset that it was a signature card. The worst is usually that start frantically patting themselves down and looking for a pen. I've gotten used to this and always carry one with me now and when I call their attention to it they are quite relieved.

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Data points:

Nice, France: Monoprix required SIGNATURE using HSBC card at self checkout - delayed checkout about 5 minutes waiting for a clerk who ignored signature and was a bit confused about the process. Sure felt secure - NOT!

Italy: The five cards I tried, including chipped and non-chipped debit cards, all worked, without pin, at coffee vending machines on several train platforms.

Ventimiglia (Italy): ticket agency accepted only cash and was quite slow - didn't see any ticket machines.

Monaco (France): Bus ticket machine in Monaco required pin (tried both Arrival+ and HSBC). Took a long time to approve so assume online.

Italy: Many small shops and bars accepted only cash.

Nice, France: Monoprix required SIGNATURE using HSBC card at self checkout - delayed checkout about 5 minutes waiting for a clerk who ignored signature and was a bit confused about the process. Sure felt secure - NOT!

Italy: The five cards I tried, including chipped and non-chipped debit cards, all worked, without pin, at coffee vending machines on several train platforms.

Ventimiglia (Italy): ticket agency accepted only cash and was quite slow - didn't see any ticket machines.

Monaco (France): Bus ticket machine in Monaco required pin (tried both Arrival+ and HSBC). Took a long time to approve so assume online.

Italy: Many small shops and bars accepted only cash.

(However, one can also argue that grocery store self-checkouts are not a common use case for travelers abroad. Thus, adding PIN just to make something that is "rare" easier might not make sense.)

I don't know, but I would be pretty unhappy if I were a merchant. At the very least I could have purchased some sort of chip and signature only solution (Square EMV dongle/attachment if I were smaller, possibly something custom from one of the major manufacturers just for the US market if I were big enough) and saved tons of money and time from not having to do the extra approvals necessary for PIN. Granted I'd probably have to support PIN debit anyway if I were large enough but still.

This is all mostly moot though because IMO the US will never become PIN preferring. As far as the major banks are concerned, we're only doing EMV to maintain compatibility with the rest of the world and because most terminals here are too old to make a direct jump to NFC possible.

Speaking of maintaining compatibility, there are still a significant number of credit cards that do not have a PIN at all according to http://www.spotterswiki.com/emv/card...e%5B%5D=credit. Others (like Bank of America) have a PIN but you'd never know it from their EMV materials. This would be okay if Visa was doing its job at policing the kiosk operators but apparently they don't know or don't care that it's still a problem after the supposed "no CVM" mandate. The casual traveler unfortunately won't know why they had problems at ticket machines unless they Google afterward and find this thread. Sure they'll probably just pay cash or wait in line at the booth with the attendant, but what if there's no attendant?

At the very least, backup PIN should be required regardless of the card, like in (most) chip and signature countries. "Most" because I think HK's cards don't have a PIN based on the random reading of banks' websites; I'm not 100% sure on that though.

FlyerTalk Evangelist

Join Date: Dec 2009

Location: HaMerkaz/Exit 145

Programs: UA, LY, BA, AA

Posts: 13,167

I've never had anyone upset that it was a signature card. The worst is usually that start frantically patting themselves down and looking for a pen. I've gotten used to this and always carry one with me now and when I call their attention to it they are quite relieved.

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

I guess if you don't have Chip & PIN, make sure you have Chip & PEN. :P

Join Date: Jul 2012

Location: Canada

Programs: BA Gold (OWE), Star Alliance Gold, Hilton Diamond

Posts: 2,194

I kinda think Visa/MC should permit self-checkouts to behave just like any other UCAT. Technically it's "attended" because someone's watching 4-10 machines, but still. On the other hand it would mean that expensive purchases would likely go through without CVM, which isn't ideal either.

Join Date: May 2010

Location: ORDwest

Posts: 333

Heh, heh. If the VISA marketing pukes keep an eye on FT, this could become their new slogan for EMV roll-out!

Since you're in Portugal, what is typical EMV acceptance like in/around Lisbon? Will be there next month, touring from Barcelona west, then down to Lisbon?

Since you're in Portugal, what is typical EMV acceptance like in/around Lisbon? Will be there next month, touring from Barcelona west, then down to Lisbon?

FlyerTalk Evangelist

Join Date: Aug 2001

Location: RSW

Programs: Delta - Silver; UA - Silver; HHonors - Diamond; IHG - Spire Ambassador; Marriott Bonvoy - Titanium

Posts: 14,185

I've read anecdotes that Spain can be full of I. D. fanatics regarding signatures, but perhaps that was back in the pre-chip era.

Join Date: Mar 2013

Location: Hong Kong

Programs: Marriott Platinum, United Silver

Posts: 88

The bigger problem is that they have a separate network called Multibanco, which is more of a debit card network between most of the banks here, and that is what almost all of the locals use. And, while most major places will also take Visa/Mastercard, some smaller places are Multibanco only and then some others are cash only.

Join Date: Oct 2012

Location: San Diego

Posts: 3

Well, I'll be Mr. Contrary Minded once again. When the thread started, it started because many of those here felt they were victims of not being able to use their credit cards or being inconvenienced while abroad and there were many stories of not being able to purchase petrol on Sunday afternoons in rural France, of merchants deciding mid transaction not to complete a purchase because of lack of a pin, of being inconvenienced at the Gare du Nord because one couldn't use their pinless cards in the ticketing machines and being forced to wait on a queue (my big complaint) for 45 minutes, by being inconvenienced by not being able to use self service checkout. Quite frankly, the number of such complaints has fallen off dramatically and I don't remember any in the last 100 or so pages.

So I ask once again. Are some people here, in all due respect to them, making a mountain out of a molehill? Has the problem more or less been resolved? Do people here lay awake at night worrying about the increased possibility of fraud with a lost card because signature is used instead of a pin?

Now if anybody has any recent experiences of difficulty with a chip and signature card while out of the country, I would want to hear it. If not, and again in all due respect, are we just beating a dead horse in continuing to moan and whine about lack of chip and pin or should we be rejoicing in that most of our prayers from early in the thread have been resolved.

So I ask once again. Are some people here, in all due respect to them, making a mountain out of a molehill? Has the problem more or less been resolved? Do people here lay awake at night worrying about the increased possibility of fraud with a lost card because signature is used instead of a pin?

Now if anybody has any recent experiences of difficulty with a chip and signature card while out of the country, I would want to hear it. If not, and again in all due respect, are we just beating a dead horse in continuing to moan and whine about lack of chip and pin or should we be rejoicing in that most of our prayers from early in the thread have been resolved.

I'm not downplaying the problems that people HAVE had, but I think the thread represents something that is very common on internet fora: Someone who has a problem is far more likely to log on than someone for whom everything has gone smoothly.

EDIT: forgot to say - 3 years ago, I used the SDFCU EMV card (with PIN fallback) at an unattended kiosk at Gare du Nord when buying tickets to Versailles. Worked fine. But I also have to correct the "not a single problem" statement, because we did have one very minor issue, in Venice. I wanted a multi-day pass for the vaporetti, and tried to buy it at an unattended kiosk - no joy, wouldn't take the PIN - had to stand in a (thankfully short) line to buy from the attendant, using CHIP & Sig.

Last edited by NoGoodNames; Apr 24, 2015 at 11:03 am

Join Date: Apr 2015

Location: ATL

Programs: DL PM

Posts: 53

They have started notifying some existing Quicksilver customers very recently. I would guess they are starting with those who have some international activity, but I have no idea. I suspect we are still talking about chip and signature as per the previous versions of what they offered and their website references ("...no additional PIN to remember").

So, most of the major issuers are on their way to getting chips on all their cards (Citi, BofA, Chase and Capital One).

Rasheed

So, most of the major issuers are on their way to getting chips on all their cards (Citi, BofA, Chase and Capital One).

Rasheed

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

BTW, what about the issuers (Andrews for example) who call their cards "chip and PIN" when they're actually not? That's pretty misleading IMO.