Changes to Citi AA Executive card July 2023

#2

Join Date: Jan 2000

Posts: 3,026

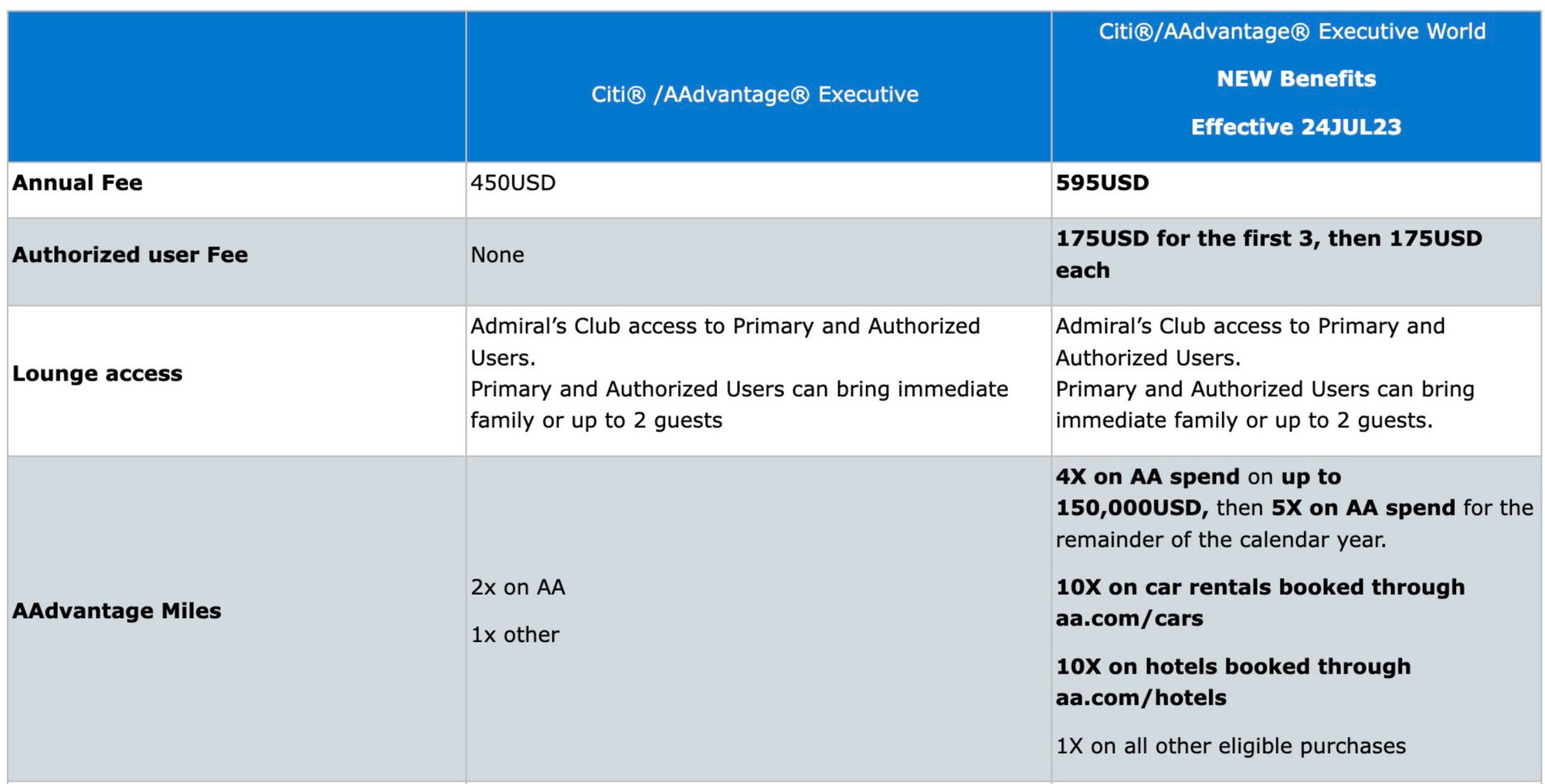

Hmmm. This pretty much takes away the main reason I have the card. Lounge access. What's now $450 for 5 of us becomes $945. Thanks but no thanks. Possibly would be ok if my AU's used the lounges a lot but they don't. It's just a convenient benefit.

Last edited by mia; Jul 10, 2023 at 11:33 am Reason: Remove quoted image.

#3

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,047

Frankly, though, we also used the lounge very little, so we weren't really causing AA to incur many costs.

#5

Join Date: Jun 2011

Posts: 3,528

Press release:

https://news.aa.com/news/news-detail...7/default.aspx

I wonder if this kicks in immediately?

https://news.aa.com/news/news-detail...7/default.aspx

- Loyalty Point bonuses to reach AAdvantage status faster

- A 10,000 Loyalty Point bonus after reaching 50,000 Loyalty Points in a status qualification year.

- An additional 10,000 Loyalty Point bonus after reaching 90,000 Loyalty Points in the same status qualification year.

#6

Join Date: Dec 2018

Programs: $9 Fare Club

Posts: 1,484

That's a bit opaque, is it an automatic 10k boost just for having the card and hitting 50k/90k in whatever manner it takes (flights, BAAH, SimplyMiles etc) or is it requiring $50k spend on the card, that being = 50k LPs.

#7

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,644

From the linked announcement:

- Loyalty Point bonuses to reach AAdvantage status faster

- A 10,000 Loyalty Point bonus after reaching 50,000 Loyalty Points in a status qualification year.

- An additional 10,000 Loyalty Point bonus after reaching 90,000 Loyalty Points in the same status qualification year.

#9

Join Date: Jun 1999

Location: NYC/LA

Programs: DL Plat, AA Plat Pro, Marriott Titanium, IHG Diamond Amb

Posts: 7,489

#10

Join Date: Jun 2013

Location: LAX

Programs: AA EXP

Posts: 946

I've been considering this card, and to be honest it is actually more appealing with the additional statement credits and LPs. The changes in lounge access are a big negative for a lot of people, that's a bummer.

#11

Join Date: Nov 2007

Location: PHX

Posts: 4,787

Press release:

https://news.aa.com/news/news-detail...7/default.aspx

I wonder if this kicks in immediately?

https://news.aa.com/news/news-detail...7/default.aspx

I wonder if this kicks in immediately?

And do the 10,000 you get for getting to 50,000 count toward the 90,000 you need for the next 10,000? Like, you hit 50,000, your 10,000 gets you to 60,000, now you need 30,000 more to get to 100,000. That' a pretty nice perk.

#13

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,644

#14

Join Date: Oct 2003

Location: DCA

Programs: UA LT 1K, AA EXP, Bonvoy LT Titan, Avis PC, Hilton Gold

Posts: 9,658

Press release:

https://news.aa.com/news/news-detail...7/default.aspx

I wonder if this kicks in immediately?

https://news.aa.com/news/news-detail...7/default.aspx

I wonder if this kicks in immediately?

I do like the Avis $120 credit - I assume it kicks in also on July 23. This almost pays the increase for me.

Will be cancelling the authorized user, since my authorized users always travels when I am traveling. So no need for the card.

Wonder what Barclay will do - as my AA tickets will switch from Barclay to Citi. I know most here charge all tickets to AmEx - so they likely will continue with AmEx for 5x.

More likely to spend the $175 for authorized AmEx Plat user - so they can get in AmEx lounge. AA will still allows guests.

Last edited by cova; Jul 10, 2023 at 8:56 pm

#15

Join Date: May 2011

Location: DFW

Programs: AA EXP, LT Gold

Posts: 3,148

I think this will thin the crowds at the AC lounges. Good move. This card was underpriced for along time for all of the maximized benefits you could squeeze out of it.

I still think the Barclary Silver card adds up more reward per annual fee. 15K LP after spending $50K on the card. So you get 5K less LP bonus with Barclay vs. Citi.

$50 Wifi credit and $25 food credit per day are also big winners with the Barclay card.

And with the AC costs going up for the card, it really evens the playing field.

I still think the Barclary Silver card adds up more reward per annual fee. 15K LP after spending $50K on the card. So you get 5K less LP bonus with Barclay vs. Citi.

$50 Wifi credit and $25 food credit per day are also big winners with the Barclay card.

And with the AC costs going up for the card, it really evens the playing field.