Last edit by: cesco.g

="3"%This thread is a continuation of the archived mega thread, found here:

http://www.flyertalk.com/forum/chase...t-credit.html]

Public Offer:40k for $2K spend + 25K for $10K spend.. Other goodies. ($95 annual fee waived the first year)

="2"%Public 40k + 25k ($95 annual fee waived the first year)

https://www.theexplorercard.com

="2"%Targeted 50k + 5k ($95 annual fee waived the first year)

Landing page

Targeted 60k + 3k ($95 annual fee waived the first year) good thru 9/22/21

Landing Page.

Note: For targeted offers, you will be required to login to your MileagePlus account.

If, after logging in, you're redirected to a lower offer, it means you're not targeted.

__________________________________________________ ____________________

Public 50k + 5k AU + $50 SC offer (AF not waived, expired 6/30/16)

Landing page Redirect page Application page

Targeted 70k + 5k AU + $50 SC offer (AF not waived, reappeared 2/1/17)

Landing page Redirect page Application page Alternate Landing Page expired 7/31/17)

Targeted 70k + 5k AU offer (AF not waived, expired 6/30/16)

Landing page Alternate Landing Page expired 7/31/17)

Chase Private Clients may be pre-approved for better or different offers, it's worth asking your banker.

__________________________________________________ _____________________

My math says a 50K offer. Where do the extra points come from?

The extra 5000 points come from adding an authorized user after you have been approved for the card. no longer available

Is there a business card?

Yes, and Flyertalk has a thread devoted to the business card: United business card currently offering 30K miles: United MP Business card: public offer now 50K miles!!

Can I apply for this card and earn the bonus after doing so previously?

How long should I wait between canceling a card and then reapplying?

What's the Chase "5/24" policy I keep hearing about?

Now that I've completed the required spend, when will my signup bonus post?

See the wiki and related discussion in Applying for Chase Credit Cards, 2017 onward

Where can I find an online copy of the guide to the card's benefits (such as purchase protection, car rental CDW coverage, etc.)?

Go to https://www.chasebenefits.com/unitedVW4

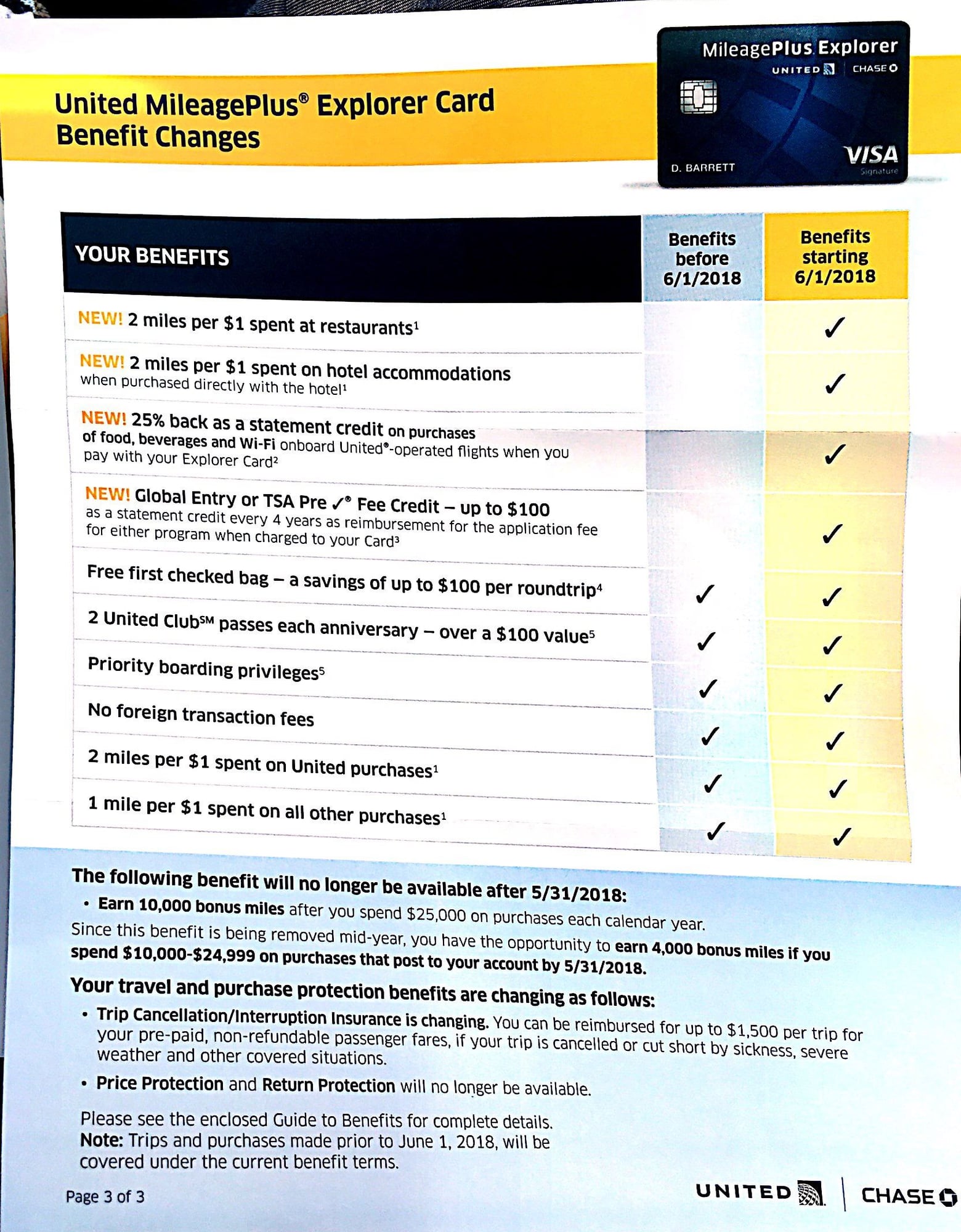

A few of the best features of the card include priority boarding, a free checked bag, and increased award ticket availability. Priority boarding and the free checked bag for cardholders is included even on the new "basic economy" fares.

For discussion of Mileage Plus benefits, see the master thread in the United forum, found here: United MileagePlus Master Wiki

http://www.flyertalk.com/forum/chase...t-credit.html]

Public Offer:40k for $2K spend + 25K for $10K spend.. Other goodies. ($95 annual fee waived the first year)

="2"%Public 40k + 25k ($95 annual fee waived the first year)

https://www.theexplorercard.com

="2"%Targeted 50k + 5k ($95 annual fee waived the first year)

Landing page

Landing Page.

Note: For targeted offers, you will be required to login to your MileagePlus account.

If, after logging in, you're redirected to a lower offer, it means you're not targeted.

__________________________________________________ ____________________

Landing page Redirect page Application page

Landing page Redirect page Application page Alternate Landing Page expired 7/31/17)

Landing page Alternate Landing Page expired 7/31/17)

Chase Private Clients may be pre-approved for better or different offers, it's worth asking your banker.

__________________________________________________ _____________________

The extra 5000 points come from adding an authorized user after you have been approved for the card.

Is there a business card?

Yes, and Flyertalk has a thread devoted to the business card: United business card currently offering 30K miles: United MP Business card: public offer now 50K miles!!

Can I apply for this card and earn the bonus after doing so previously?

How long should I wait between canceling a card and then reapplying?

What's the Chase "5/24" policy I keep hearing about?

Now that I've completed the required spend, when will my signup bonus post?

See the wiki and related discussion in Applying for Chase Credit Cards, 2017 onward

Where can I find an online copy of the guide to the card's benefits (such as purchase protection, car rental CDW coverage, etc.)?

Go to https://www.chasebenefits.com/unitedVW4

A few of the best features of the card include priority boarding, a free checked bag, and increased award ticket availability. Priority boarding and the free checked bag for cardholders is included even on the new "basic economy" fares.

For discussion of Mileage Plus benefits, see the master thread in the United forum, found here: United MileagePlus Master Wiki

United Explorer Card (2015 - 2021)

#601

Join Date: Nov 2014

Programs: UA 2MM

Posts: 1,679

It appears to be listed on the TPG post.

https://thepointsguy.com/news/united...r-credit-card/

https://thepointsguy.com/news/united...r-credit-card/

#602

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

The rumors say it will still be $95.

#603

Join Date: Aug 2016

Posts: 58

This might be a stupid question...but when a sign-up benefit offers a $100 statement credit after first purchase, when does the statement credit actually show up? Does it show up on the statement when the billing cycle closes? Or does it show up immediately like the CSR travel credit?

#604

Join Date: Nov 2014

Programs: UA 2MM

Posts: 1,679

This might be a stupid question...but when a sign-up benefit offers a $100 statement credit after first purchase, when does the statement credit actually show up? Does it show up on the statement when the billing cycle closes? Or does it show up immediately like the CSR travel credit?

#605

Join Date: Dec 2017

Location: SFO/YYZ

Programs: AC 25K, AS MVP Gold, BA Bronze, UA Silver, Marriott Titanium, Hilton Diamond, Hyatt Globalist

Posts: 2,471

This might be a stupid question...but when a sign-up benefit offers a $100 statement credit after first purchase, when does the statement credit actually show up? Does it show up on the statement when the billing cycle closes? Or does it show up immediately like the CSR travel credit?

#606

Join Date: Jul 2012

Posts: 1,319

I was about to chuck this card and Chase made that decision even easier.

#607

FlyerTalk Evangelist

Join Date: Nov 2014

Location: MSP

Programs: DL PM, UA Gold, WN, Global Entry; +others wherever miles/points are found

Posts: 14,422

Oh well, to the sock drawer this card goes..

#608

Join Date: Jul 2012

Posts: 1,319

Par for the course for Chase - they just did the same to IHG card.

#609

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

You guys were spending over $25,000/year on the United card at mostly 1x miles? Aside from the insurance changes, which are happening almost across the board, it's hard to believe these changes aren't a net positive for the vast majority of cardholders.

#610

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

What is the basis for this belief? In general, card issuers cannot make changes to the terms of personal cards during the first 12 months after initial issue, but changes can be made thereafter.

#611

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

Somebody on Reddit says so.

#612

Join Date: Jul 2012

Posts: 1,319

Conveniently, I decided to qualify for another *G program just a month ago - so, good timing. Even better because I am getting the extra 4K miles from the card as I am spending $10K by the end of May, and right after that the annual fee is due and it's time to cancel.

That would be 3 Chase cards gone in a matter of a few months (IHG, Ink and now this). Hopefully, Chase is getting something in exchange for their savvy tactics.

#613

Join Date: Jul 2012

Posts: 1,319

IHG card changes were made within 5 months of me getting a card, so clearly there is no "initial 12 month" rule either.

#614

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

Personally, I was spending $25K to qualify for MP Gold/Platinum. At leastI had a bonus 10K miles to go with that. These changes would decrease my earning by those 10K miles and give nothing in return (I use other cards for the new "bonus" categories, and that's not the main part of my spending anyway).

Conveniently, I decided to qualify for another *G program just a month ago - so, good timing. Even better because I am getting the extra 4K miles from the card as I am spending $10K by the end of May, and right after that the annual fee is due and it's time to cancel.

That would be 3 Chase cards gone in a matter of a few months (IHG, Ink and now this). Hopefully, Chase is getting something in exchange for their savvy tactics.

Conveniently, I decided to qualify for another *G program just a month ago - so, good timing. Even better because I am getting the extra 4K miles from the card as I am spending $10K by the end of May, and right after that the annual fee is due and it's time to cancel.

That would be 3 Chase cards gone in a matter of a few months (IHG, Ink and now this). Hopefully, Chase is getting something in exchange for their savvy tactics.

Well, the anniversary-night change won't affect you for at least 12 months.

#615

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

https://www.consumerfinance.gov/complaint/