Last edit by: derek2010

Churning and Welcome Offers: Credit Card Asiamiles Churning and Welcome Offers discussion (HK) - continuously upda

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

(Just one for now) BEA Flyer World Master - 1 mile per $5 for local and overseas purchases; 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee)

Credit Cards that are by Invitation Only / Applied in lieu with an Account / Needs possessing certain membership for Application:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $3 for dining/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Advance customer)

6. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no redemption fee, $23,800 non-waivable annual fee) (Need to be Citigold Private Client customer AND by Invitation only)

7. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2, [from 28 Feb 2020] $12.5 per mile for local spending ($25 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $8.33 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

8. BEA Supreme Gold World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

9. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

10. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

11. BEA Hong Kong Racehorse Owners Association (HKROA) World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be member of Hong Kong Racehorse Owners Association (香港馬主協會)) Note 3

12. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent for local / online / octopus spendings, 1 mile per $4 for overseas spendings (no fee, $19,800 non-waivable annual fee with 120000 miles awarded annually) (Need to be OCBC Wing Hang Premier Banking (宏富理財) customer)

13. Shacom Shanghai Fraternity Association (上海總會) UnionPay Dual Currency Diamond - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be member of Shanghai Fraternity Association (上海總會))

Full list:

I. Overseas

1. BOC Travel Rewards Visa Signature Card - 8% rebate for each transaction >$500 overseas spending (max $500 per month) (requirement: 1. overseas transaction for that month (any amount per transaction) > $6,000; 2. three times local spending (any amount)) plus 1 mile per $15

2. BoC Wealth Management Visa Infinite - 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. [to 31 Dec 2019] HSBC (excluding amounts billed in HK and PRC) - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)** ++

4. (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $50,000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles min $100)

5. Citibank Premiermiles (>=$20K per billing cycle) (excluding RMB and MOP) - 1 mile per $3 spent (no redemption fee)** ++ ^

6. [to 31 Dec 2018] DBS Eminent (excluding MOP) - 1 mile per $3.6 spent ($50 fee per 5,000 miles)

7. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $3.75 spent ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600)

Note: 1 mile per $0.75 for TWD spendings in Taiwan (max $5,000/month and $10,000/year), and 1 mile per $1.875 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)^

8. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

9. Citibank Prestige / PremierMiles (<$20K) (excluding RMB and MOP) - 1 mile per $4 spent (no redemption fee, $3,800 non-waivable annual fee for the Prestige)** ++ ^

10. DBS Black World Master (excluding MOP) - 1 mile per $4 spent overseas (no fee)^

11. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion)

12. AMEX CX Elite - 1 mile per $4 spent (automatic conversion)

13. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 (no fee)^

14. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu) ** ++

15. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles min $100)

16. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $8.33 spent ($300 flat redemption fee)

17. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

18. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $4 for overseas spendings (no fee)

^: DO NOT Award points for DCC Transactions

II. Supermarket, Department store, Telecommunications bills on autopay:

1A . [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1B. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1C. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

2. [till 14 Jan 2021] Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2 ** ++

3. (if ONLINE / PAYWAVE) CCB HK Eye Card - 1 mile / $3 (inclusive of 5X online bonus, cap at $75000 per calender year ($50 per 5,000 miles AM min $100)

4. HSBC Red World Master - 1 mile / $5 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

III. Dining

1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1b. [to 31 Dec 2019] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)** ++

1c. [to 31 Dec 2019] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions) ** ++

2. SCB Asia Miles World Master - 1 mile / $4 (automatic conversion)

3. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile / $5 (no fee) Note 3

4. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)

3. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

V. Other retail spending

1. [to 14 Mar 19] (if online or Apple Pay) CCB HK Premier Banking Visa Infinite - 1 mile per $2.67 spent ($50 per 5,000 miles AM min $100) (first $12.5K spending ONLINE per month only, else $8 per mile)

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (PAYWAVE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 5. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu)

** 6. SCB WorldMiles AE - 1 mile per $6 spent ($300 flat redemption fee)

** ++ 7. Citi Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

8. AMEX CX Elite - 1 mile per $6 spent (automatic conversion)

** ++ 9. DBS Black World Master - 1 mile per $6 spent (no fee)

10. [to 31 Dec 2018] DBS Eminent - 1 mile per $7.2 spent ($50 fee per 5,000 miles)

11. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $7.5 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 12. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

** ++ 13. AMEX (Gold grade and higher, except Platinum Credit) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops, $7,800 non-waiveable annual fee for AMEX Platinum Charge)

** ++ 14. Citi Premiermiles - 1 mile per $8 spent (no fee)

15. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

16. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

17. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments

1. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite / BOC Travel Rewards Visa Signature Card / BoC Platinum Visa & Master (including co-branded cards like Sogo) / BoC Platinum Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Red World Master - 1 mile per $25 spent (cap at $10,000 per Month)

VI B. Specific bill payment merchants who accept autopay for higher earn rates (by merchant)

1. Towngas autopay - Citi Prestige $6/mile

2. CLP autopay - Citi Prestige $6/mile, BEA $5/AM

3. HKE - AlipayHK (rever to IX.iii earn rates), DBS Black $6/AM

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

** ++ 1. Citibank Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

2. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

** 3. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $8 spent (no fee) Note 3

5. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

8. Bankcomm Diamond Dual Currency Card - 1 mile per HK$12 spent ($50 per 5,000 AM min $100 max $300)

9. HSBC (all HKD cards) - 1 mile per $25 spent

10. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VIII. China Unionpay RMB spending

** ++1. [to 31 Dec 2019] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($50 per 5,000 AM min $100 max $300)

3. CCB HK Diamond Prestige - 1 mile per RMB8 spent ($50 per 5,000 miles AM min $100 max $300)

4. Shacom Diamond UnionPay - 1 mile per RMB8 spent ($10 per 1,000AM min $100 max $500)

5. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

IX. Electronic wallets (in descending chronological order):

i. Payme

https://www.mrmiles.hk/payme/

http://flyformiles.hk/8847

ii. Wechat

http://flyformiles.hk/8847

https://www.mrmiles.hk/wechat-pay/

iii. Alipay P2P

http://flyformiles.hk/8847

https://www.mrmiles.hk/alipay/

iv. O!epay (Oepay): see VII. Octopus Automatic Add-Value above

X. Online spending in HKD

1. HSBC Red World Master - 1 mile / $2.5 spent ($300 fee for a year's worth of redemptions)** ++

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion) (ONLINE spending ONLY, else $6 per mile)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) (EXCLUDING PayMe transactions) Note 3

Note 2:

** can opt for Krisflyer miles in lieu (conversion of Krisflyer for SCB Non-AM cards will end at 27 Feb 2020)

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master / BEA HKROA World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening / co-branded card application), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

(Just one for now) BEA Flyer World Master - 1 mile per $5 for local and overseas purchases; 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee)

Credit Cards that are by Invitation Only / Applied in lieu with an Account / Needs possessing certain membership for Application:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $3 for dining/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Advance customer)

6. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no redemption fee, $23,800 non-waivable annual fee) (Need to be Citigold Private Client customer AND by Invitation only)

7. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2, [from 28 Feb 2020] $12.5 per mile for local spending ($25 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $8.33 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

8. BEA Supreme Gold World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

9. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

10. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

11. BEA Hong Kong Racehorse Owners Association (HKROA) World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be member of Hong Kong Racehorse Owners Association (香港馬主協會)) Note 3

12. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent for local / online / octopus spendings, 1 mile per $4 for overseas spendings (no fee, $19,800 non-waivable annual fee with 120000 miles awarded annually) (Need to be OCBC Wing Hang Premier Banking (宏富理財) customer)

13. Shacom Shanghai Fraternity Association (上海總會) UnionPay Dual Currency Diamond - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be member of Shanghai Fraternity Association (上海總會))

Full list:

I. Overseas

1. BOC Travel Rewards Visa Signature Card - 8% rebate for each transaction >$500 overseas spending (max $500 per month) (requirement: 1. overseas transaction for that month (any amount per transaction) > $6,000; 2. three times local spending (any amount)) plus 1 mile per $15

2. BoC Wealth Management Visa Infinite - 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. [to 31 Dec 2019] HSBC (excluding amounts billed in HK and PRC) - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)** ++

4. (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $50,000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles min $100)

5. Citibank Premiermiles (>=$20K per billing cycle) (excluding RMB and MOP) - 1 mile per $3 spent (no redemption fee)** ++ ^

6. [to 31 Dec 2018] DBS Eminent (excluding MOP) - 1 mile per $3.6 spent ($50 fee per 5,000 miles)

7. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $3.75 spent ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600)

Note: 1 mile per $0.75 for TWD spendings in Taiwan (max $5,000/month and $10,000/year), and 1 mile per $1.875 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)^

8. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

9. Citibank Prestige / PremierMiles (<$20K) (excluding RMB and MOP) - 1 mile per $4 spent (no redemption fee, $3,800 non-waivable annual fee for the Prestige)** ++ ^

10. DBS Black World Master (excluding MOP) - 1 mile per $4 spent overseas (no fee)^

11. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion)

12. AMEX CX Elite - 1 mile per $4 spent (automatic conversion)

13. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 (no fee)^

14. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu) ** ++

15. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles min $100)

16. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $8.33 spent ($300 flat redemption fee)

17. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

18. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $4 for overseas spendings (no fee)

^: DO NOT Award points for DCC Transactions

II. Supermarket, Department store, Telecommunications bills on autopay:

1A . [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1B. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1C. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

2. [till 14 Jan 2021] Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2 ** ++

3. (if ONLINE / PAYWAVE) CCB HK Eye Card - 1 mile / $3 (inclusive of 5X online bonus, cap at $75000 per calender year ($50 per 5,000 miles AM min $100)

4. HSBC Red World Master - 1 mile / $5 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

III. Dining

1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1b. [to 31 Dec 2019] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)** ++

1c. [to 31 Dec 2019] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions) ** ++

2. SCB Asia Miles World Master - 1 mile / $4 (automatic conversion)

3. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile / $5 (no fee) Note 3

4. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)

3. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

V. Other retail spending

1. [to 14 Mar 19] (if online or Apple Pay) CCB HK Premier Banking Visa Infinite - 1 mile per $2.67 spent ($50 per 5,000 miles AM min $100) (first $12.5K spending ONLINE per month only, else $8 per mile)

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (PAYWAVE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 5. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu)

** 6. SCB WorldMiles AE - 1 mile per $6 spent ($300 flat redemption fee)

** ++ 7. Citi Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

8. AMEX CX Elite - 1 mile per $6 spent (automatic conversion)

** ++ 9. DBS Black World Master - 1 mile per $6 spent (no fee)

10. [to 31 Dec 2018] DBS Eminent - 1 mile per $7.2 spent ($50 fee per 5,000 miles)

11. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $7.5 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 12. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

** ++ 13. AMEX (Gold grade and higher, except Platinum Credit) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops, $7,800 non-waiveable annual fee for AMEX Platinum Charge)

** ++ 14. Citi Premiermiles - 1 mile per $8 spent (no fee)

15. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

16. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

17. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments

1. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite / BOC Travel Rewards Visa Signature Card / BoC Platinum Visa & Master (including co-branded cards like Sogo) / BoC Platinum Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Red World Master - 1 mile per $25 spent (cap at $10,000 per Month)

VI B. Specific bill payment merchants who accept autopay for higher earn rates (by merchant)

1. Towngas autopay - Citi Prestige $6/mile

2. CLP autopay - Citi Prestige $6/mile, BEA $5/AM

3. HKE - AlipayHK (rever to IX.iii earn rates), DBS Black $6/AM

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

** ++ 1. Citibank Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

2. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

** 3. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $8 spent (no fee) Note 3

5. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

8. Bankcomm Diamond Dual Currency Card - 1 mile per HK$12 spent ($50 per 5,000 AM min $100 max $300)

9. HSBC (all HKD cards) - 1 mile per $25 spent

10. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VIII. China Unionpay RMB spending

** ++1. [to 31 Dec 2019] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($50 per 5,000 AM min $100 max $300)

3. CCB HK Diamond Prestige - 1 mile per RMB8 spent ($50 per 5,000 miles AM min $100 max $300)

4. Shacom Diamond UnionPay - 1 mile per RMB8 spent ($10 per 1,000AM min $100 max $500)

5. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

IX. Electronic wallets (in descending chronological order):

i. Payme

https://www.mrmiles.hk/payme/

http://flyformiles.hk/8847

ii. Wechat

http://flyformiles.hk/8847

https://www.mrmiles.hk/wechat-pay/

iii. Alipay P2P

http://flyformiles.hk/8847

https://www.mrmiles.hk/alipay/

iv. O!epay (Oepay): see VII. Octopus Automatic Add-Value above

X. Online spending in HKD

1. HSBC Red World Master - 1 mile / $2.5 spent ($300 fee for a year's worth of redemptions)** ++

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion) (ONLINE spending ONLY, else $6 per mile)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) (EXCLUDING PayMe transactions) Note 3

Note 2:

** can opt for Krisflyer miles in lieu (conversion of Krisflyer for SCB Non-AM cards will end at 27 Feb 2020)

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master / BEA HKROA World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening / co-branded card application), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

Credit card Asia Miles earning opportunities (HK) 2020

#61

Join Date: Mar 2006

Location: HKG

Programs: BA

Posts: 392

Can I get points for Octopus AAVS on Amex plat and Citi Prestige?

#62

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

Citi Prestige yes https://www.octopus.com.hk/en/consum...-up/index.html

#63

Join Date: May 2006

Location: SIN

Programs: KF, MPC, BAEC // Bonvoy, WoH, Honors

Posts: 1,464

I got the following SMS:

Is this offer on top of the basic $2.78 / mile for Visa Signature (which I have set to Overseas)? And if yes, what is the earn rate with this promo? I still have no idea how the "rebate" works..

HSBC: Enquiry/Unsubscribe 27488033. From now until 31/12/2020, earn 3.6% RewardCash rebate on overseas spending all year round with your HSBC Visa Signature Card. Online spending can also earn 2.4% rebate. Call 82283188 to register. Rebate on overseas spending can be combined with the Red Hot Rewards of Your Choice offer to reach a total of up to 5.6%. Terms apply. To borrow or not to borrow? Borrow only if you can repay!

#64

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

0.4% basic

2% for Rewards of Your Choice to overseas

2% for Online/Overseas

1.2% for overseas on your Visa SIgnature

2% for Rewards of Your Choice to overseas

2% for Online/Overseas

1.2% for overseas on your Visa SIgnature

#65

Join Date: May 2006

Location: SIN

Programs: KF, MPC, BAEC // Bonvoy, WoH, Honors

Posts: 1,464

EDIT: Just noticed that the rebate rate for Premier Mastercard is 6.6%. Would I need to register that card separately or does the registration sit at the customer level instead of at the card level?

#66

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

1% = 10 AM.

Sorry suffering from HSBC fatigue https://www.flyertalk.com/forum/cath...C#post27287570

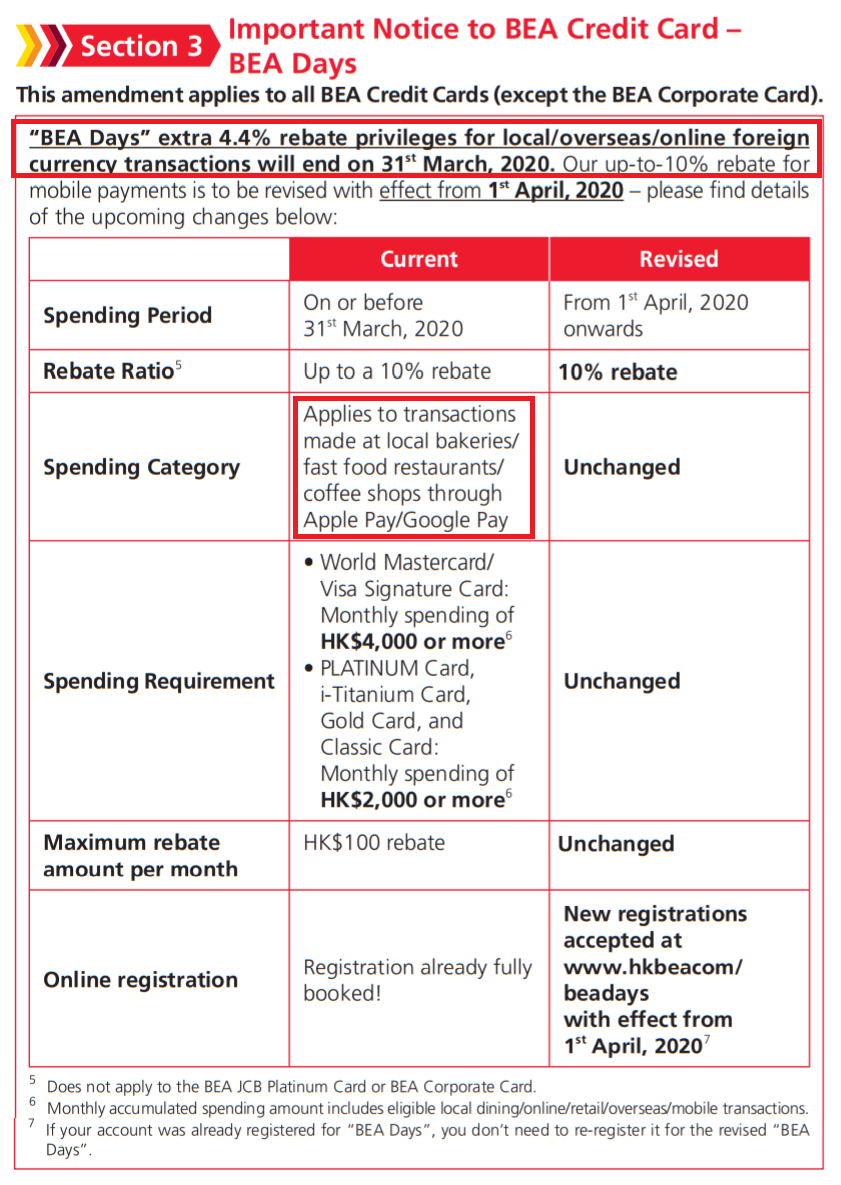

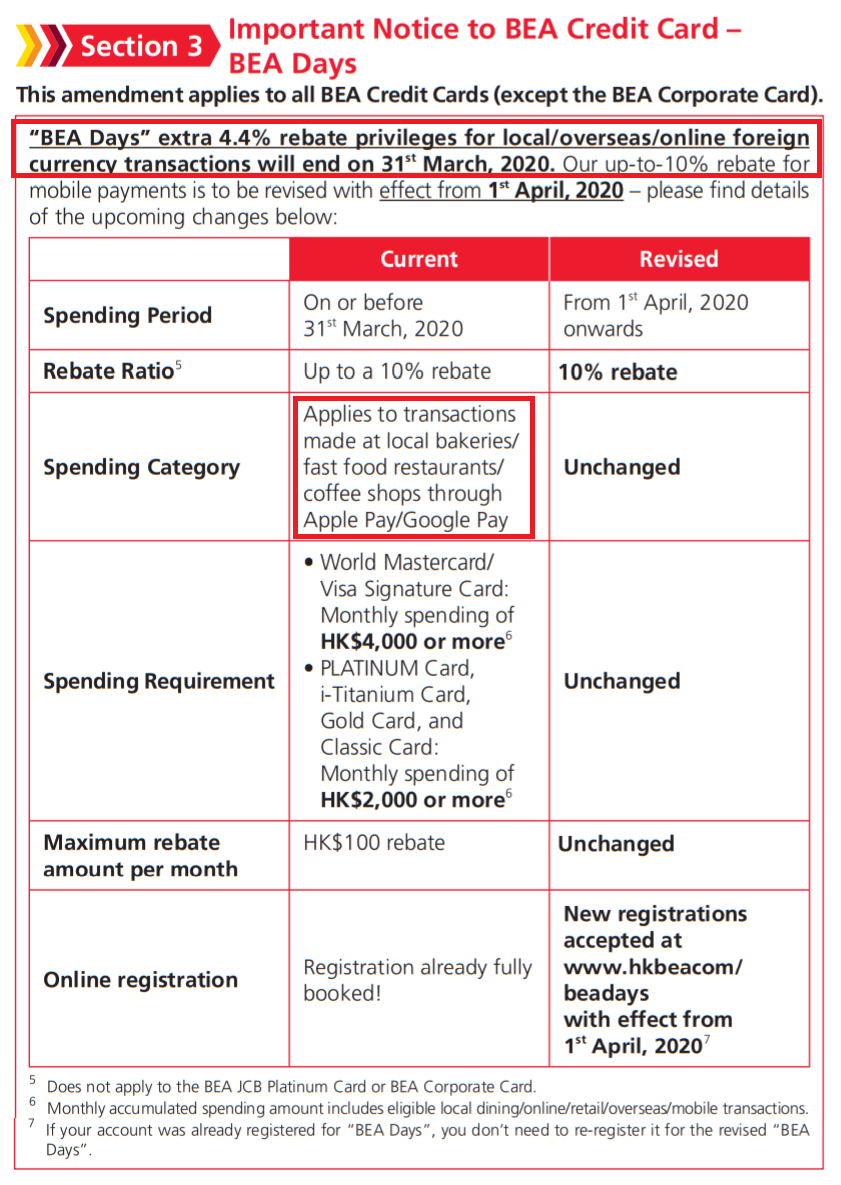

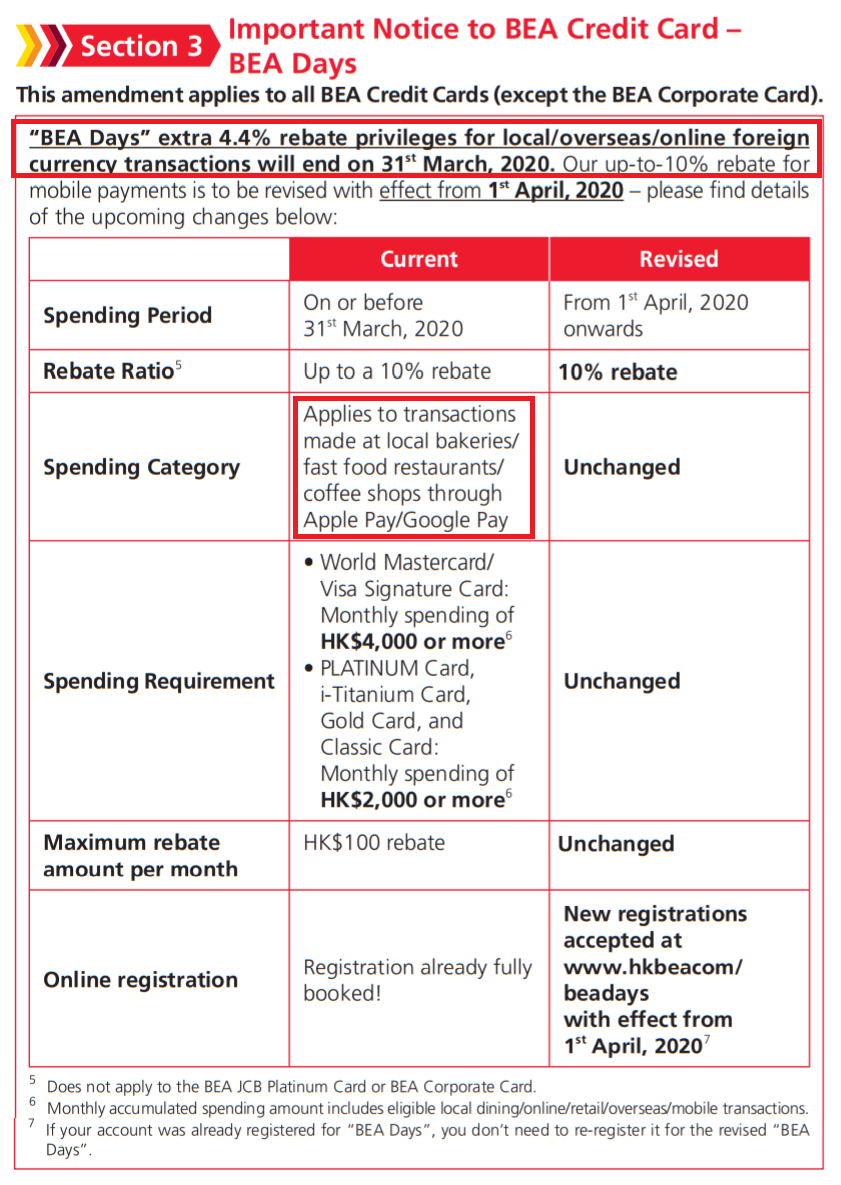

(A little OT so I'm not creating a new post - BEA Day 4.8% to terminate Apr 2020

https://www.hongkongcard.com/forum/show/29079 )

Sorry suffering from HSBC fatigue https://www.flyertalk.com/forum/cath...C#post27287570

(A little OT so I'm not creating a new post - BEA Day 4.8% to terminate Apr 2020

https://www.hongkongcard.com/forum/show/29079 )

Last edited by percysmith; Jan 18, 2020 at 4:58 am

#67

Join Date: May 2006

Location: SIN

Programs: KF, MPC, BAEC // Bonvoy, WoH, Honors

Posts: 1,464

1% = 10 AM.

Sorry suffering from HSBC fatigue https://www.flyertalk.com/forum/cath...C#post27287570

(A little OT so I'm not creating a new post - BEA Day 4.8% to terminate Apr 2020

https://www.hongkongcard.com/forum/show/29079 )

Sorry suffering from HSBC fatigue https://www.flyertalk.com/forum/cath...C#post27287570

(A little OT so I'm not creating a new post - BEA Day 4.8% to terminate Apr 2020

https://www.hongkongcard.com/forum/show/29079 )

"1. 2.4% RewardCash rebate is equivalent to 6 times RewardCash, which includes the basic 1 time RewardCash plus an extra 5 times RewardCash earned under this promotion. The total maximum amount of extra RewardCash on eligible transactions to be awarded to each cardholder in each phase is $300.

2. An extra 2% RewardCash rebate exclusively for HSBC Premier MasterCard Credit Card is equivalent to an extra 5 times RewardCash. The total maximum amount of extra RewardCash on eligible overseas transactions to be awarded to each HSBC Premier MasterCard Credit Card cardholder in each phase is $300."

Would this mean the spend limit (at the 1.56 / mile level) per phase is a mere $4,687.50?

#68

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

Thanks Percy, my own math takes it to HKD 1.56 / mile for HSBC Premier Mastercard during this promo.

"1. 2.4% RewardCash rebate is equivalent to 6 times RewardCash, which includes the basic 1 time RewardCash plus an extra 5 times RewardCash earned under this promotion. The total maximum amount of extra RewardCash on eligible transactions to be awarded to each cardholder in each phase is $300.

2. An extra 2% RewardCash rebate exclusively for HSBC Premier MasterCard Credit Card is equivalent to an extra 5 times RewardCash. The total maximum amount of extra RewardCash on eligible overseas transactions to be awarded to each HSBC Premier MasterCard Credit Card cardholder in each phase is $300."

Would this mean the spend limit (at the 1.56 / mile level) per phase is a mere $4,687.50?

"1. 2.4% RewardCash rebate is equivalent to 6 times RewardCash, which includes the basic 1 time RewardCash plus an extra 5 times RewardCash earned under this promotion. The total maximum amount of extra RewardCash on eligible transactions to be awarded to each cardholder in each phase is $300.

2. An extra 2% RewardCash rebate exclusively for HSBC Premier MasterCard Credit Card is equivalent to an extra 5 times RewardCash. The total maximum amount of extra RewardCash on eligible overseas transactions to be awarded to each HSBC Premier MasterCard Credit Card cardholder in each phase is $300."

Would this mean the spend limit (at the 1.56 / mile level) per phase is a mere $4,687.50?

#70

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

#71

Join Date: May 2006

Location: SIN

Programs: KF, MPC, BAEC // Bonvoy, WoH, Honors

Posts: 1,464

It's just a change in focus and not a goodbye The 'Best credit cards for KF miles accrual' master thread

And we lived in SG prior to moving to HK so I have my card strategy pretty much sorted already -- I'm even holding a few cards still that I'll put back in the wallet once we move over.

#72

Join Date: Sep 2017

Location: Hong Kong

Programs: CX DM/OWE, Marriott Platinum

Posts: 155

Hi has anyone converted RC to Asia miles recently directly?

The website says 4-6 weeks, but I'm wondering if it really takes that long ... I have some left over after converting through MoneyBack, and thinking to take advantage of the extra 10%.

The website says 4-6 weeks, but I'm wondering if it really takes that long ... I have some left over after converting through MoneyBack, and thinking to take advantage of the extra 10%.

#73

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,807

Beaxit

Sorry, Overseas should read SCB AM $4/AM --> 2.2% > Citi Cash Back 2% (just...) . I forgot I included BEA Days in there, which is no longer accepting new registrations

Best rates in the wiki (AM) vs best cash rebate or supermarket coupon rates https://www.hongkongcard.com/forum/show/4979

Best rates in the wiki (AM) vs best cash rebate or supermarket coupon rates https://www.hongkongcard.com/forum/show/4979

Using $0.08 per AM valuation and $0.94 valuation for BEA points

Overseas: HSBC VS 5.6% > CCB eye $2.14/AM (3.73%)

Contactless: BoC Sogo VS 5.4% > BEA Flyer World $5/AM (1.6%)

Online: HSBC Red 4% > CCB VI $2.67/AM (3%)

Dining: BEA VS 2.256% > SCB AM $4/AM (2%)

Alipay: BoC GBA Diamond 4.4% > BEA i-Titanium 3.4% > CCB eye $3/AM (2.67%) > BoC GBA Plat 2.4%

Ordinary: BEA Flyer World $5/AM (1.6%) > SCB Simply Cash 1.5%

www.hongkongcard.com/forum/show/29106

https://www.hkbea.com/pdf/noa3.pdf

Last edited by percysmith; Jan 22, 2020 at 8:59 pm

#74

Join Date: Jan 2011

Posts: 2,346

Slightly OT but need to rework my spend after 31/3/2021, BEA Days local and overseas is getting axed (the continued part is only fast food mobile payments)

Using $0.08 per AM valuation and $0.94 valuation for BEA points

Overseas: HSBC VS 5.6% > CCB eye $2.14/AM (3.73%)

Contactless: BoC Sogo VS 5.4% > BEA Flyer World $5/AM (1.6%)

Online: HSBC Red 4% > CCB VI $2.67/AM (3%)

Dining: BEA VS 2.256% > SCB AM $4/AM (2%)

Alipay: BoC GBA Diamond 4.4% > BEA i-Titanium 3.4% > CCB eye $3/AM (2.67%) > BoC GBA Plat 2.4%

Ordinary: BEA Flyer World $5/AM (1.6%) > SCB Simply Cash 1.5%

www.hongkongcard.com/forum/show/29106

https://www.hkbea.com/pdf/noa3.pdf

Using $0.08 per AM valuation and $0.94 valuation for BEA points

Overseas: HSBC VS 5.6% > CCB eye $2.14/AM (3.73%)

Contactless: BoC Sogo VS 5.4% > BEA Flyer World $5/AM (1.6%)

Online: HSBC Red 4% > CCB VI $2.67/AM (3%)

Dining: BEA VS 2.256% > SCB AM $4/AM (2%)

Alipay: BoC GBA Diamond 4.4% > BEA i-Titanium 3.4% > CCB eye $3/AM (2.67%) > BoC GBA Plat 2.4%

Ordinary: BEA Flyer World $5/AM (1.6%) > SCB Simply Cash 1.5%

www.hongkongcard.com/forum/show/29106

https://www.hkbea.com/pdf/noa3.pdf