AMEX 1099-INT or 1099-MISC who got one?

#16

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

#19

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

I received two: one for $550 one for $450 on referrals.

I always want to mark these down 40% because that’s what AMEX let’s you take a statement credit for (0.006/pt)

I always want to mark these down 40% because that’s what AMEX let’s you take a statement credit for (0.006/pt)

#20

A FlyerTalk Posting Legend

Join Date: Feb 2001

Location: Berkeley, CA USA

Programs: Piggly Wiggly "Shop the Pig!" Preferred Shopper

Posts: 57,084

#21

Suspended

Join Date: Aug 2010

Location: DCA

Programs: UA US CO AA DL FL

Posts: 50,262

One need not accept the valuation on a 1099. But, one must then provide one's own fair market value and a written explanation of the reasoning.

Make sure it's worth it to you as marked down 1099's are an audit red flag with a flare shooting out of the flag.

Make sure it's worth it to you as marked down 1099's are an audit red flag with a flare shooting out of the flag.

#22

A FlyerTalk Posting Legend

Join Date: Feb 2001

Location: Berkeley, CA USA

Programs: Piggly Wiggly "Shop the Pig!" Preferred Shopper

Posts: 57,084

I've never tangled with the IRS over anything, but I wouldn't hesitate to defend my position if I felt confident that I'd ultimately win. That said, I wouldn't have that confidence with a battle over FMV of airline miles. Thankfully, Amex is keeping its FMV claim reasonable at 1¢ per MR point.

#23

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

Bask Bank, which awards AA miles in lieu of interest, issues 1099-INT based on $0.0042 per mile. One could make an argument that points convertible to airline miles should be similarly valued. There is, of course, a counterargument based on other redemptions.

#24

A FlyerTalk Posting Legend

Join Date: Feb 2001

Location: Berkeley, CA USA

Programs: Piggly Wiggly "Shop the Pig!" Preferred Shopper

Posts: 57,084

Wow, that's low. As you say, there are arguments and counterarguments on this. We see them all the time on FlyerTalk. As far as I know, this has never been litigated to resolution in any reported court decision in a tax case.

#27

A FlyerTalk Posting Legend

Join Date: Feb 2001

Location: Berkeley, CA USA

Programs: Piggly Wiggly "Shop the Pig!" Preferred Shopper

Posts: 57,084

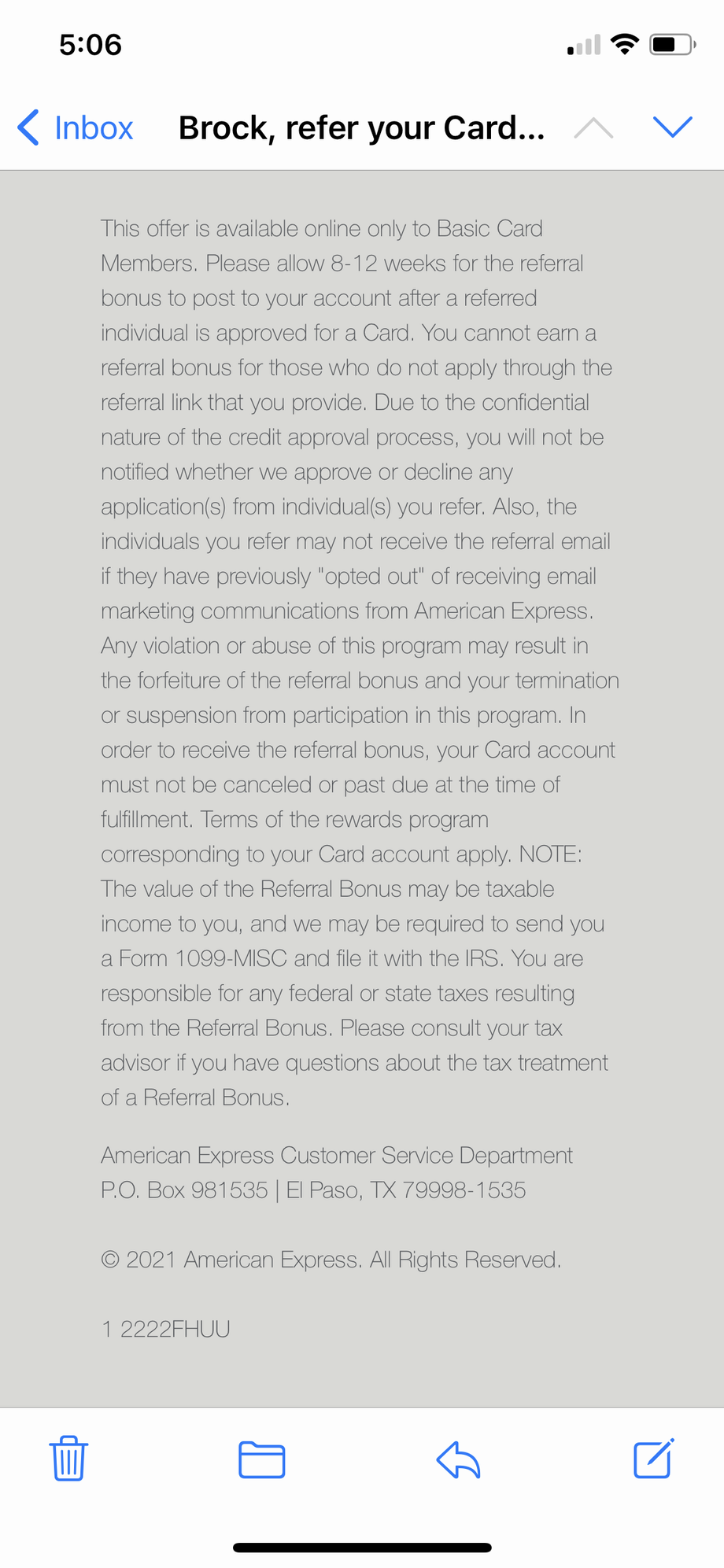

It's worth noting that a 1099-MISC never creates a tax liability for anyone. It's merely a tax-compliance mechanism. Failure to account for 1099-MISC data in your return might trigger an IRS request explain the discrepancy. It might be that without the 1099-MISC form, the IRS would never have known about the undeclared income, but that's akin to a situation where no cop was there to see you run a red light.

#28

Join Date: Feb 2012

Posts: 4,477

When bank accountants start doing something new, somehow I doubt they are motivated to improve somebody else's IRS compliance. Is there perhaps some benefit to the banks in classifying former expenses as customer income?

#29

A FlyerTalk Posting Legend

Join Date: Feb 2001

Location: Berkeley, CA USA

Programs: Piggly Wiggly "Shop the Pig!" Preferred Shopper

Posts: 57,084