2019 Has anyone actually received a Centurion Card invite (except UK)?

#16

Original Poster

Join Date: Jun 2002

Location: California USA

Posts: 652

So...is your rep designated as a manager of business development? The way I understand it is that if you have $10mil spend, you're automatically qualified. At $5 mil, they'll consider giving you one. If you aren't using a biz developer and just using your dedicated relationship manager, they may not have the same pull.

I don't have one and I haven't been invited, but this is what I've been told.

I don't have one and I haven't been invited, but this is what I've been told.

#17

Join Date: Apr 2018

Posts: 9

Summary of my 2018 spend and 2019 so far. No way does $250,000 annual or even $500,000 qualify you for a Centurion based on the frequency and volume of high spenders I see here.

Largest purchases last year were Cartier at $510,000 and Luis Vuitton at $240,000

Next month I am purchasing a Mercedes G wagon ($160,000) and more Cartier items at around $650,000

No idea what they are looking for.

Largest purchases last year were Cartier at $510,000 and Luis Vuitton at $240,000

Next month I am purchasing a Mercedes G wagon ($160,000) and more Cartier items at around $650,000

No idea what they are looking for.

Last edited by ringmeister01; Jan 14, 2019 at 10:19 am Reason: Additiona items added

#18

Join Date: Mar 2015

Posts: 110

AMEX will automatically assign you a biz dev rep once your profile reaches a certain spend amount. Not sure what the minimum thresholds are. After 5 million you are enrolled into their Tier1 program.

#19

Join Date: Nov 2013

Location: NYC

Programs: OZ Diamond *A Gold / Delta Gold

Posts: 775

Summary of my 2018 spend and 2019 so far. No way does $250,000 annual or even $500,000 qualify you for a Centurion based on the frequency and volume of high spenders I see here.

Largest purchases last year were Cartier at $510,000 and Luis Vuitton at $240,000

Next month I am purchasing a Mercedes G wagon ($160,000) and more Cartier items at around $650,000

No idea what they are looking for.

Largest purchases last year were Cartier at $510,000 and Luis Vuitton at $240,000

Next month I am purchasing a Mercedes G wagon ($160,000) and more Cartier items at around $650,000

No idea what they are looking for.

Last edited by mia; Jan 14, 2019 at 12:10 pm Reason: Remove quoted images

#20

Join Date: Apr 2018

Posts: 9

I just want the bragging rights of the card. Im lame like that.

#21

Join Date: Dec 2018

Posts: 42

I purchased three Mercedes in 2018: 2018 S63, 2011 SLS, and 2019 G63 (which is sitting at port due to Fed furlough/still haven't taken possession) with my AMEX Mercedes Platinum in full. The reason I did it is because you can get 5x points, so I quickly got close to 3 million points.

With all that being said, it cost me 3% to pay the dealer to process it each time, which at 5x, I still win. I don't know why you would on a normal platinum- the 3% fee wouldn't offset a G-Wagon 1.5x points rebate + 35% MR back.

They discontinued Mercedes Platinum on Jan 11 of this year probably because of me or people like me.

With all that being said, it cost me 3% to pay the dealer to process it each time, which at 5x, I still win. I don't know why you would on a normal platinum- the 3% fee wouldn't offset a G-Wagon 1.5x points rebate + 35% MR back.

They discontinued Mercedes Platinum on Jan 11 of this year probably because of me or people like me.

#22

Join Date: Apr 2018

Posts: 9

While I have no idea how it actually works, it does look like overall spend should be in the right ball-park, but not sure what goes into "Merchandise & Supplies". That said, even if you take out the two lumpy purchases you mention you have $600k+ spend. They do like to see a sustained level of spending (not one-off) and continued use of CTS (FHR), concierge etc. (i.e. high level travel, entertainment/dining and luxury purchases). My guess would be that if you continue like this you will get offered one fairly soon.

Still amazes me that in the US you can buy a G-Wagon on an Amex. Wish could do that in the UK (without having to pay $10k for the privilege). Also at $1m+ spend at Cartier you must be one of their more important clients and get attention much greater than Amex will ever give you! Your other half (or you) must have some spectacular pieces.....

Still amazes me that in the US you can buy a G-Wagon on an Amex. Wish could do that in the UK (without having to pay $10k for the privilege). Also at $1m+ spend at Cartier you must be one of their more important clients and get attention much greater than Amex will ever give you! Your other half (or you) must have some spectacular pieces.....

Full disclosure after a few months with the platinum I was subject to financial review. The reason given was a spike in spending. After the review a limit was placed on my card of $75,000/month. I found this to be ridiculous but there was no way to get back on the no pre-set spend. On anything greater than $75,000 I wire funds to Amex and I have the available spend on my card in that amount within 2-3 hours.

I'm worried that this will hinder my chances of a black card, not matter how much or where I spend. Thoughts?

#23

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

What type of documentation did you submit during the Financial Review? For example, if they looked at a transcript of your USA Federal income tax returns, but you have substantial income that is not subject to USA taxes, the limit would be based on an incomplete view.

#24

Join Date: Jul 2012

Location: RDU

Programs: DL(PM), UA(Silver), AA(EXP) Marriott(Ti), HH(Gold), Hertz(PC)

Posts: 2,669

My spend is nowhere near yours, and yet I got invited the previous year (I didn't follow-through, though). You could search the 2017 and 2018 Centurion invites thread to find my posts about that.

#25

Join Date: Mar 2017

Posts: 120

I have been invited in the past to the business centurion. I did not know what it was nor was 'into' credit cards at the time. I just remember the 10k initial cost and was immediately put off.

On average 1 million a year on it with major categories being dining, travel and inventory. When I was invited the spend was less around 500k.

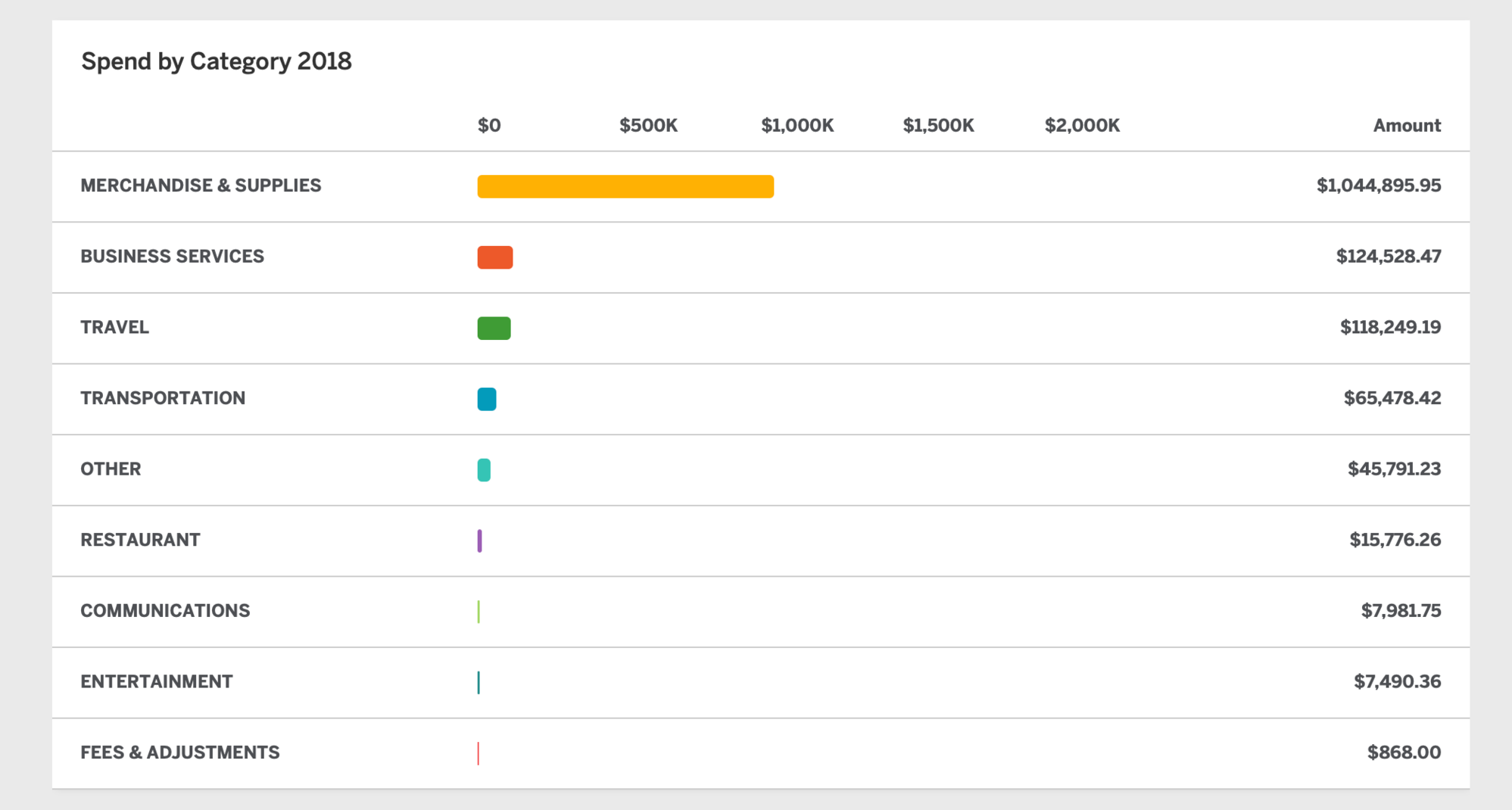

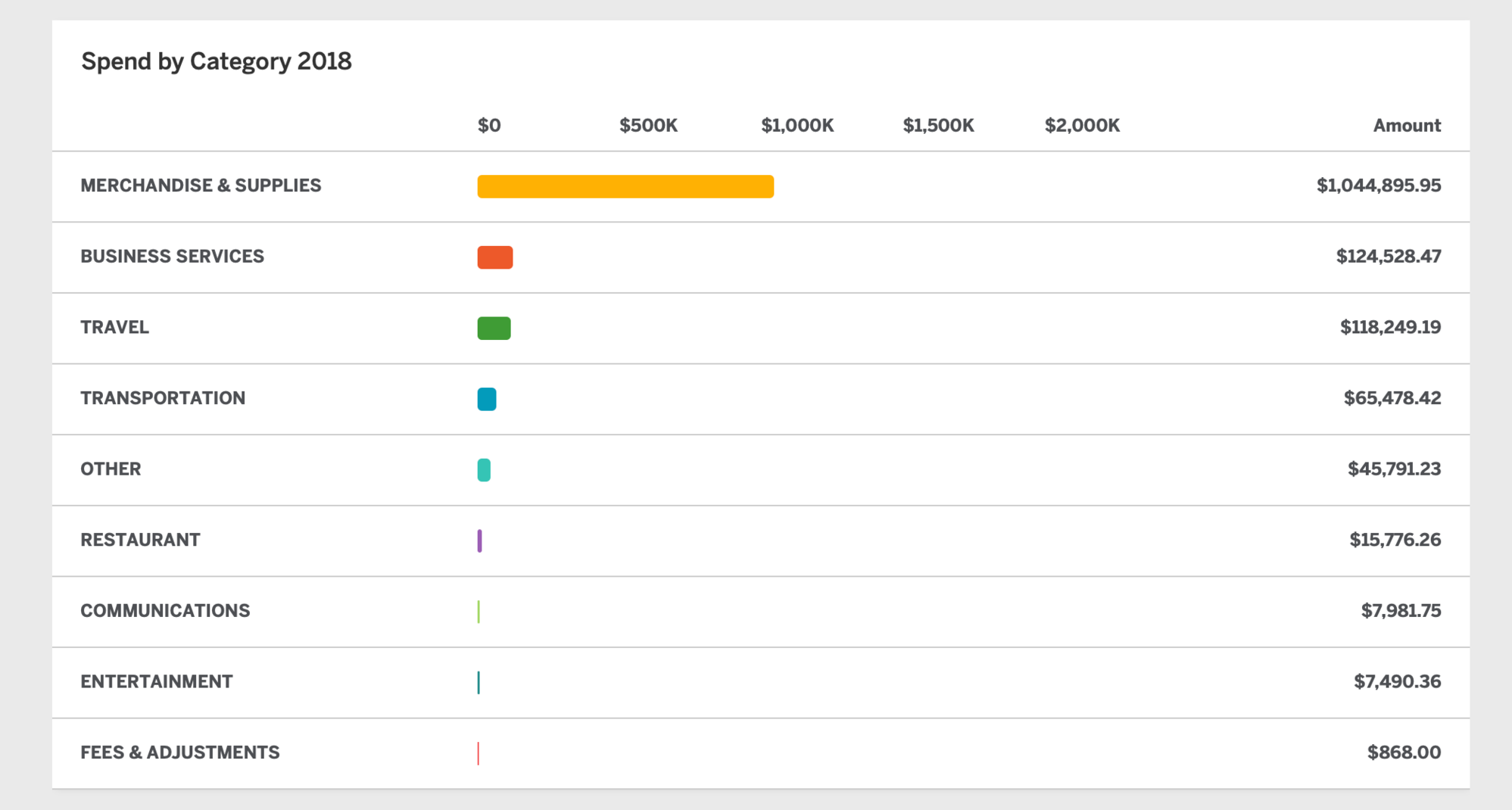

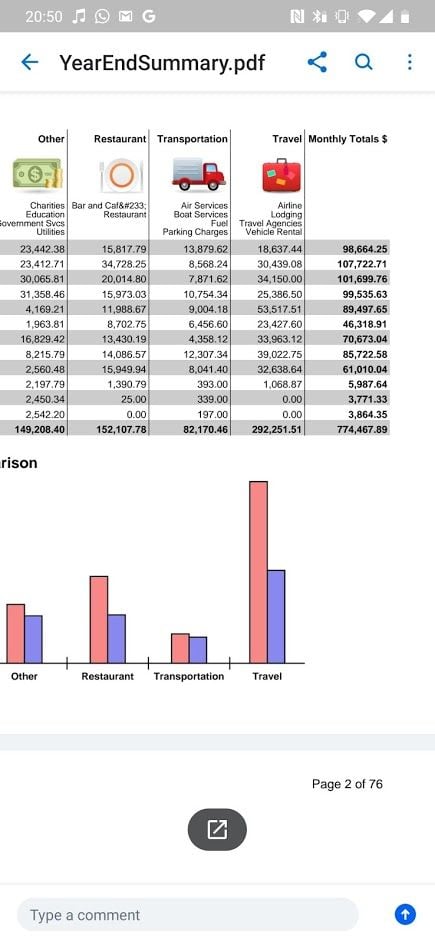

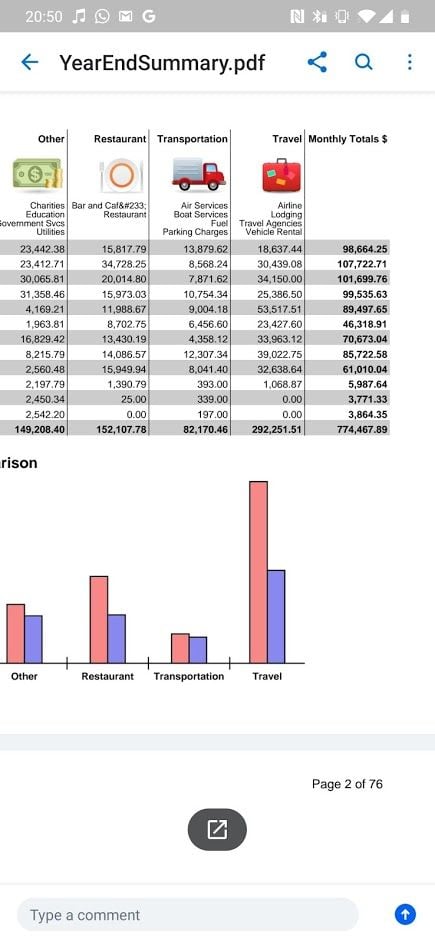

Without divulging too much information I attached one of the year's summary. Major categories being travel and dining. The year before these numbers were double.

A note for this kind of spend: I did have a financial review in the first year after putting 500k. It was a bit tricky since revenue was $0. I was able to satisfy by sharing tax returns and maybe already being a member had some influence.

Going back I probably would still have not accepted. From a business perspective $10k and $2500 a year didn't make sense.

If I get the invite today on my personal card I will accept it just to try it out. Not sure how long I would keep it though.

On average 1 million a year on it with major categories being dining, travel and inventory. When I was invited the spend was less around 500k.

Without divulging too much information I attached one of the year's summary. Major categories being travel and dining. The year before these numbers were double.

A note for this kind of spend: I did have a financial review in the first year after putting 500k. It was a bit tricky since revenue was $0. I was able to satisfy by sharing tax returns and maybe already being a member had some influence.

Going back I probably would still have not accepted. From a business perspective $10k and $2500 a year didn't make sense.

If I get the invite today on my personal card I will accept it just to try it out. Not sure how long I would keep it though.

Last edited by Ali380; Jan 16, 2019 at 9:07 am Reason: add image

#26

Join Date: Mar 2018

Posts: 25

I just got my invite call a few hours ago. Called, did the whole 30 min process of confirming a ton of stuff and now waiting up to 72 hours for whatever review they are doing. Used to have a business centurion back in 2007. This is for my personal card. Will let you all know whats next. I expected that after the call they would simply conclude and send over the card, but not the case. Got an email showing the "we are excited that you have decided to apply for centurion etc..." Grateful to definitely get the invite and use all resources available to me.

#27

Join Date: Aug 2007

Location: London

Programs: BA GfL & GGL, LH Sen, EK & VS Gold, Amex Cent

Posts: 1,719

I just got my invite call a few hours ago. Called, did the whole 30 min process of confirming a ton of stuff and now waiting up to 72 hours for whatever review they are doing. Used to have a business centurion back in 2007. This is for my personal card. Will let you all know whats next. I expected that after the call they would simply conclude and send over the card, but not the case. Got an email showing the "we are excited that you have decided to apply for centurion etc..." Grateful to definitely get the invite and use all resources available to me.

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

#28

Join Date: Mar 2018

Posts: 25

Welcome to FT! And in the Amex community quite an opener. And welcome to the club  . The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....Fast forward some years, in 2017 I opened a personal platinum card to replace my AA executive daily card. I travel maybe 6-8 times per year to a different country. My spend at the time (during the change of cards) was about 60k mo, so you can imagine I had to make an online payment to amex for 30-50k so they could allow me to spend. Maybe 3mo into the card I was put a limit. My spend was around 80-100k per month, so they stated that if I wanted to to raise my revolving limit and have it on auto pay without making any payments until payment is due I would need a limit of around 250k. I would be required to show close to 20M liquid as a reserve. I said, could not show that, and I did not mind paying my card 3-4 times per month. So they put me on a 50k limit, and for the last 1.5 years I simply pay it once it gets close to the limit. Obviously my balance is always revolving around 40kish, but I am always paying it... Never any issues. I maximize all of the AMEX services available to me. I have build amazing relationships within AMEX, so amazing that they even assigned a dedicated rep! I expressed my interest multiple times throughout the year, and had these great relationships reach out for me.

For the last few months I stopped reaching out, and finally got the call (which I was expecting a mail invite). Took a video of the call too, which I may share (to add value) later once I get the card.

I will tell you now that after receiving the invitation call, most of the comments/speculation regarding spend is mainly off. You can spend all you want on whatever you want to, but understand that its a two way street. AMEX needs way more than just $$ from you. It's a partnership at the end of the day. In my fashion business we call our customers are brand ambassadors/models. AMEX does the same. Their best customers are their best BA's

I have a decent social media following, and spend a lot of time dressing celebs, taking them out. Whether its me personally or someone in my brand, its definitely "that lifestyle." From Sept-Dec I was in Lake Como, Switzerland, Paris, Santorini, Hong Kong. Dinned in all the 3 star Michelin restaurants, and maybe spent around 50k in jewelry. 2 hours before I headed to the Airport in HK I went to the Peninsula Hotel with the intentions of having some tea with my wife and ended up buying a 30K Rolex at the store they have there. The Peninsula Hotel gave me a pretty cool gift bag! I suppose thats definitely part of it. During the year I maybe spent around 300k in watches. Total spend was around 1.2M, but I can see a lot of you have much higher spend. It's not just about the spend, nor is it about the FICO score too much, as my FICO score will go from 620-720 every month depending on what my balance shows on my other cards. I pay everything in full but sometimes they report when the balance is super high. I don't pay too much attention to it at all. I have never had an issue being approved for a jumbo loan, balloon for my 2-300k cars, none of that. Anyone who pulls my credit can clearly see I have a good amount of cashflow, and my debt-to-income ration is super low.

My absolute best advice if you really want one is to actually stop "trying" to get one. Be you, let AMEX see who you really are, as "gaming the system" to just get the card and stop using it is useless to them. I see a lot of people here trying. Its just like a lot of entrepreneur stories... Things always happen when you were just about to quit!

Will report back throughout the process.

#29

Join Date: Mar 2018

Posts: 25

Welcome to FT! And in the Amex community quite an opener. And welcome to the club  . The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....

. The inevitable questions will be: which country (US presumably), which State, how much did you spend and on what and for how many years and on which Amex cards...... (incidentally same would go for the Business Cent you used to have)....Sorry to now answer the basic questions (maybe I sprinkled them in there) Location in Parkland, FL. Used my Platinum actively 1.5 years. Been Amex member since 05. Spend 1.2M Average around Low 50k/High 130k mo. I never let it go over 40kish as I have a hard 50k limit. At the beginning of this year I noticed my card still had the 50k limit but let me go way over. I didn't pay it down at all and simply let my Autopay take care of it. Once my payment cleared a day later I got the invite call

FICO score right now is not the best, at around 640ish but thats because one of my cards reported a 30k out of 36k limit. Although I pay it in full every month FICO dropped like 60 points. I really don't pay much attention to that at all simply because I know why. If I really want to I can stop using my other CC's show a zero balance and have a high FICO. The reality is that I love my reward points!

FICO score right now is not the best, at around 640ish but thats because one of my cards reported a 30k out of 36k limit. Although I pay it in full every month FICO dropped like 60 points. I really don't pay much attention to that at all simply because I know why. If I really want to I can stop using my other CC's show a zero balance and have a high FICO. The reality is that I love my reward points! Let me know if you all have any other questions. Will be more than happy to clarify.

#30

Join Date: Nov 2012

Location: ES

Programs: BAEC GGL, IHG RA, Globalist, ALL Diamond

Posts: 110

Received my invite the other day, I've had a Plat card since it came out in Norway some years ago — did a global card transfer to Spain 2 years ago. I've since then put approx. €150-200K on the Plat card annually, from premium travel and high-end shopping to daily groceries. Initiation fee is €3000 and the annual fee is €2000, while MR earning is 1.5 per €1 instead of the normal 1:1.

Will report back on the benefits once I get the card.

Will report back on the benefits once I get the card.

Will be interested to hear your experiences, Robbiedeluxe ... received an invitation (I'm based in Spain) and have just called the number to see what hotel chains they were giving the top level card for etc.

Couldn't believe they had no one in the department who could speak to me in English !! Now, my Spanish is pretty good, but I prefer to speak in English if possible for financial dealings, especially with an annual fee of 2,000 EUR and a sign on of 3,000 EUR.

Information I did manage to get: hotel chains ... Hilton, Accor, Jumeriah, Relais, Carlson, Melia, ShangriLa.

Iberia added to list of airlines that give some discounts. 1.5 MR per EUR

Having read the small leaflet with the invite, there seem to be higher limits to the Insurance cover, including Winter Sports ... not much else of note over the Platinum Card, except of course the "prestige" of having one !!