No Centurion offer after 10m+ annual spend and $5m in Amex savings account?

#1

Original Poster

Join Date: Mar 2005

Posts: 82

No Centurion offer after 10m+ annual spend and $5m in Amex savings account?

I am curious to find out why I have not received an invitation to get an Amex Centurion card. Any thoughts?

Background:

-Amex card holder since 2006

-$3m or so a year spend on my personal platinum card (but still mainly for biz expenses) for last 5 years

-$10m in total business spend over the last year on biz platinum, with recent spend about $2m/month

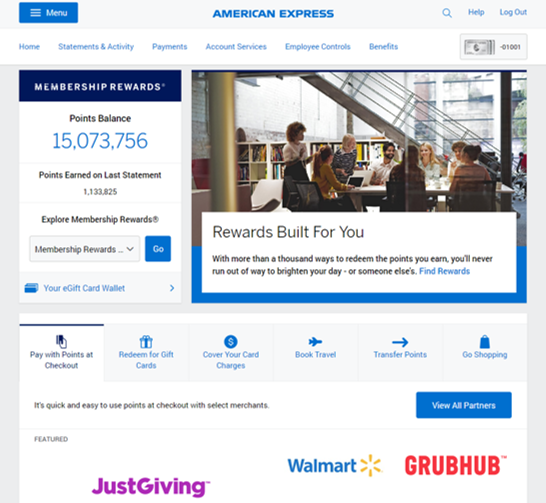

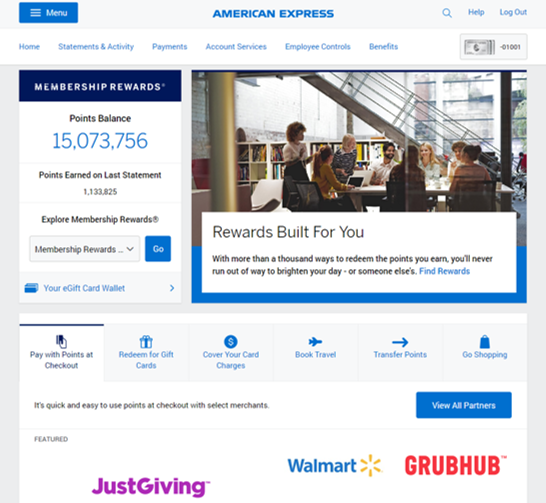

-Over 15m membership rewards points in current balance

->$1m annual income

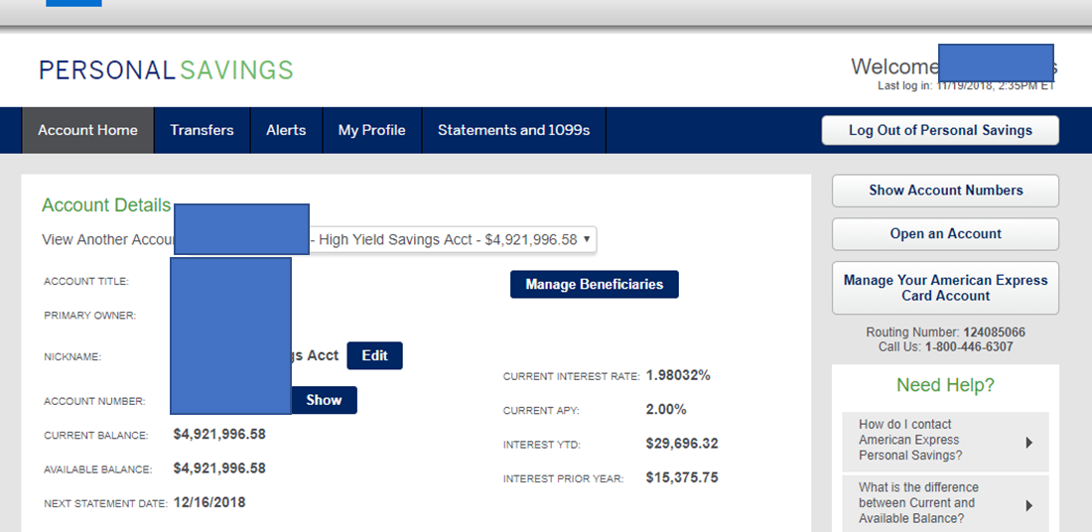

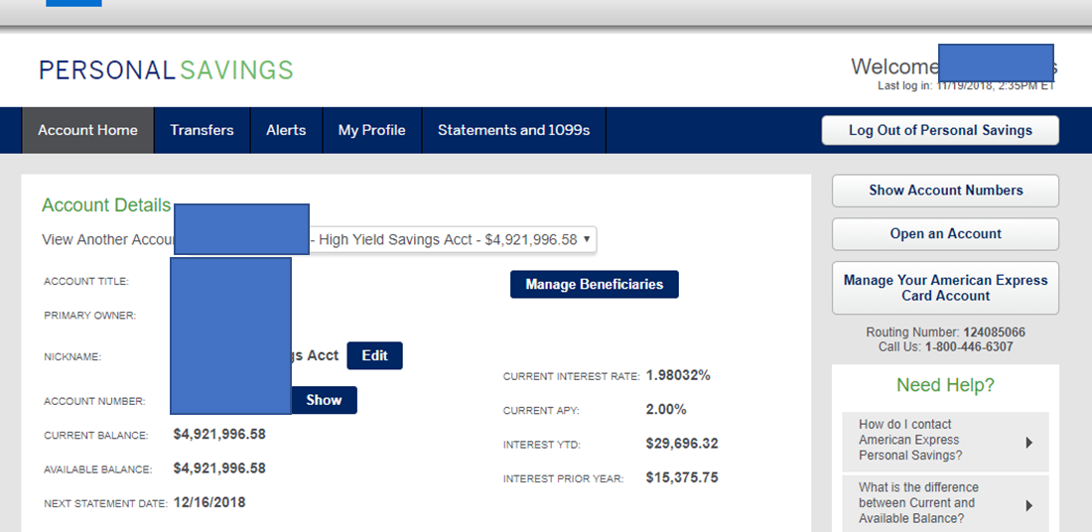

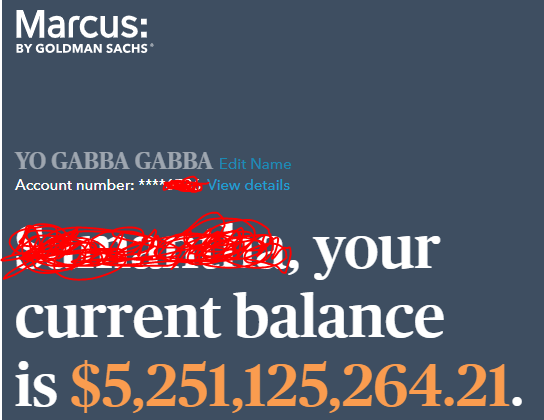

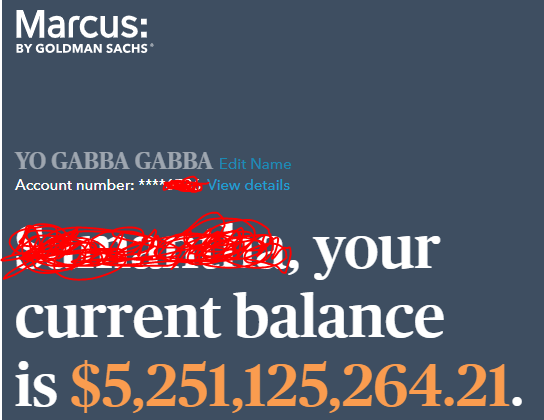

-$5m in my Amex savings account (not business account, my personal money; historically around $2m and recently increased)

I called in a couple years ago and asked to get on the list as I was interested, but never heard back. Just for fun I called in and said I would cancel my account if they didn't upgrade me, and they still didn't budge. I'm pretty cheap when it comes to luxury expenses, so probably don't match the spend profile of most people in my income bracket, but other than that I figure I would be right in the sweet spot.

Background:

-Amex card holder since 2006

-$3m or so a year spend on my personal platinum card (but still mainly for biz expenses) for last 5 years

-$10m in total business spend over the last year on biz platinum, with recent spend about $2m/month

-Over 15m membership rewards points in current balance

->$1m annual income

-$5m in my Amex savings account (not business account, my personal money; historically around $2m and recently increased)

I called in a couple years ago and asked to get on the list as I was interested, but never heard back. Just for fun I called in and said I would cancel my account if they didn't upgrade me, and they still didn't budge. I'm pretty cheap when it comes to luxury expenses, so probably don't match the spend profile of most people in my income bracket, but other than that I figure I would be right in the sweet spot.

Last edited by wtsuppr415; Nov 26, 2018 at 4:57 pm Reason: adding clarification

#4

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,854

I wouldn’t keep $5m in a single savings account, even with Amex (way beyond the FDIC limit, and you can get more interest elsewhere), but that’s beyond the question.

#5

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,193

I can't answer your question but I wonder why you even care. With the amount of wealth you've accumulated and your cash flow, you have opportunities about which most can only dream. Who cares whether AMEX wants to grant you an overpriced credit card?

#6

My sentiments exactly.... something sounds a bit fishy here.

Last edited by david55; Nov 26, 2018 at 9:41 pm

#7

Suspended

Join Date: Jun 2018

Posts: 1,186

I find it unusual that someone with that level of income would care about a measly 6,000 airline miles or get worked up over a $100 gas rebate card just a few years ago.

(I realize that those threads are old, but it’s probably pretty uncommon to go from desperately trying to score an additional $100 rebate card to having $5M in a savings account ten years later.)

Last edited by GFrye; Nov 26, 2018 at 10:44 pm

#8

Suspended

Join Date: Sep 2015

Posts: 2

Money in the savings account and business spending wonít help for the centurion invitation. Itís all based on personal spending structure on luxury things like travel, collections, shopping... if you are cheap, then no matter how much money you have, you are cheap. Itís not what Amex is looking for apparently.

#9

FlyerTalk Evangelist

Join Date: Jul 2006

Location: Upper Sternistan

Posts: 10,044

Money in the savings account and business spending won’t help for the centurion invitation. It’s all based on personal spending structure on luxury things like travel, collections, shopping... if you are cheap, then no matter how much money you have, you are cheap. It’s not what Amex is looking for apparently.

#10

Join Date: Dec 2016

Location: CA

Posts: 304

#11

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,957

#13

Join Date: Nov 2013

Location: NYC

Programs: OZ Diamond *A Gold / Delta Gold

Posts: 775

This is such a strange post. But I envy the 15m points that could be used for I don't know how many travels... though in fact, if I have that kind of money, I wouldn't even spend the MR on point, I would pay for tickets and just spend the MR somewhere else where there is less black outs.

As some said, I will never get the Centurion probably but I am fine with that ^^.

As some said, I will never get the Centurion probably but I am fine with that ^^.

#14

Join Date: Oct 2009

Location: New York

Programs: AA Exp / Marriott Titanium / Hilton Gold / Hyatt Globalist / United Silver

Posts: 958

Why would you put $5mil on Amex savings which is only insured up to $250,000?

Maybe that's why I am not rich.

But I can at least dream right?

Maybe that's why I am not rich.

But I can at least dream right?

Last edited by samwise6222; Nov 27, 2018 at 10:34 am

#15

Join Date: Dec 2017

Location: IN, US

Programs: Mariott SE, HH, SPG SE, LT S, 9W BP

Posts: 63

I suspect they analyse the spend category as much as the spend amount in these cases. Also the spend amount is not much given this is a business account. The threshold for business accounts are a lot more compared to personal accounts.