Last edit by: jbeckett

American Airlines announced that starting in 2022, the way to earn Elite status has changed. No more Elite Qualifying Miles (EQM), Elite Qualifying Segments (EQS), or Elite Qualifying Dollars (EQD)!

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

How do I earn LPs?

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Now, you can get AA Elite status by earning Loyalty Points (LPs): https://aadvantagestatus.com/?anchor...=newaadvantage

How many LPs do I need for elite status?

Code:

Gold: 40K Platinum: 75K Plat Pro: 125K EXP: 200K

Flying

What you get for redeemable miles (RDM) is what you'll get for LPs.

AA and B6 flights:

No status: 5 LPs per $ spent in base fare plus fees (excludes taxes)

Gold: 7 LPs per $

Platinum: 8 LPs per $

Plat Pro: 9 LPs per $

EXP: 11 LPs per $

Partner flights (other than B6):

Distance flown x accrual rate* x (1 + cabin bonus + elite bonus**)

* Certain discount fares earn less than 100% of miles flown. In those cases, the discounted accrual rate (0% to 75% depending on the partner and the fare class) should be applied to the flown miles. Otherwise, the accrual rate is 100%. If there is a cabin bonus, it should not be added to the accrual rate; it is applied separately within the parentheses. The accrual rate can never be more than 100%.

** 40% for GLD, 60% for PLT, 80% for PRO, 120% for EXP.

So for example, an EXP on a 5000-mile flight on QR booked in J would earn 5000 x 100% x (1 + 25% + 120%) = 5000 x 1 x 2.45 = 12250 LPs.

A PLT on the same flight booked in P would earn 5000 x 75% x (1 + 0% + 60%) = 5000 x .75 x 1.6 = 6000 LPs.

Earning chart for QR

Here's a great online LP calculator:

https://lpcalculator.com/#/calculator/

AAdvantage non-flying partners:

Generally, 1 LP per base mile earned. But in many cases you can earn large bonuses that post as base miles; see link here: https://exploreamerican.com/newaadva...nloyaltypoints

There are differences among how these programs work, ranging from minor to significant, in terms of awarding LPs. You will need to skim through the thread as there are too many different promo offers to address here. But here are the popular ones:

BookAAHotels and RocketMiles: You can earn large mileage bonuses here, separated into "base" miles and "promo" miles by the portals. For now they are all posting as base miles on aa.com, but there is a suspicion that the "promo" miles may start posting as bonus miles (and so would not count as LP). You don't even have to actually check in or stay at the hotel as long as you pay for the stay.

SimplyMiles: You must link a MasterCard to the account. Then you can add their promos to your card by activating the offers. When you accept one of their offers and then pay for it using your linked card, you will get the associated miles which currently post as base miles on aa.com.

AAdvantage eShopping: Once you click through the AAdvantage eShopping portal to a vendor offer and make a purchase, you will eventually get the associated miles posted to your AAdvantage account as both redeemable miles and Loyalty Points. If the merchant advertises an increase in the miles per dollar spent, you'll earn the higher amount in both redeemable miles and an equal number of Loyalty Points. The same applies if a merchant advertises a higher fixed amount per purchase, rather than a per dollar amount. Examples of this would appear on the portal as, "Extra miles. Was 1 mile/$. Now earn 3 miles/$" or "Extra miles. Was up to 3700 miles. Now up to 6200 miles." However, if the website advertises a "Limited-time bonus offer" for "bonus miles" after meeting a spending threshold, that bonus will only post as redeemable miles and not Loyalty Points. If a bonus is offered for some site-wide activity such as 1000 miles for installing an extension, or 500 miles for enrolling in the portal, or 2000 miles for meeting a spending threshold across multiple merchants, the bonus will only post as redeemable miles and not Loyalty Points.

- A separate thread exists to discuss the AAdvantage eShopping portal

- Another thread exists to discuss using the portal for a particular merchant, giftcards.com

- For additional questions about buying and using gift cards, refer to the separate Manufactured Spending forum.

(If a vendor has offers with both SimplyMiles and eShopping, activate the offer on SimplyMiles first and then make the purchase through eShopping with the MasterCard linked to your SimplyMiles account. Apparently that you can get a double-dip. You can also get a double-dip by stacking the promos with discount offers from your credit card issuers, basically reducing the cost to you.

Booking directly with hotels, car rental companies, etc.: The picture here is a bit unclear but it appears that if you book with a hotel that offers 5x miles, only 1 mile will post as base and the rest as bonus.

Credit card spend:

1 LP per $ spent on an AA branded card (except for one card which earns 0.50 LP per $ and several non-US cards which earn 2 LP per $). See the list of cards, and a lot more small print here: https://creditcards.aa.com/aadvantag...hange_ExecCard

What about spending bonuses?

E.g., your card gives 2x miles for hotels, or 3x for AA purchases, etc etc. These do NOT count.

These bonuses count:

Citi AAdvantage Executive World Elite Mastercard (the $450 annual fee card that gives Admirals Club access): 10K LP bonus when hitting $40K spend for the year.

AAdvantage Aviator Silver Mastercard: 5K LP bonus when hitting $20K spend, another 5K LP bonus when hitting $40K spend, and another 5K LP bonus when hitting $50K spend for the year.

Do miles earned at Bask Bank count?

No.

Will Loyalty Points count toward Million Miler℠ status?

No, Million Miler℠ status will still be earned the same way as today, based on miles earned from flying with American and its partners.

Loyalty Points discussion/questions - From 2022 now used for determining elite status

#2821

FlyerTalk Evangelist

Join Date: Mar 2004

Location: SJC

Programs: AA EXP, BA Silver, Hyatt Globalist, Hilton diamond, Marriott Platinum

Posts: 33,533

Cheers.

#2822

Join Date: Jan 2022

Posts: 192

Are you certain Plastiq gives loyalty miles and not bonus miles?

#2824

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,292

(Read through a good part of this thread, didn’t see this question addressed.)

Are “Hyatt Dual Accrual” Advantage redeemable miles (AA RDM) a thing of the past, perhaps due to conversion to Loyalty Points?

For the past 2.5 years, after a Hyatt stay I’ve been receiving AA RDM, posting as “Hyatt Dual Accrual” Base Miles and Total Miles. I had 3 Hyatt stays in January and I received Hyatt Dual Accrual RDM as expected, including 1,000 Bonus Journeys RDM (for a “participating hotels in 10 cities”). 3 Hyatt stays in February and 1 in March, no AA RDM. I did notice a day or 2 ago that my AA account on March 1st was credited with Loyalty Points exactly equal to the total number of Hyatt Dual Accrual RDM that posted in January.

(I called Advantage Account Services to inquire about the recent (February and March) missing Hyatt Dual Accrual RDM, of course the agent was clueless, she sent an email to the “hotel miles” department, said I should get an email in 7-10 days … probably the same time as I receive the “check that’s in the mail.” )

)

Thank you.

Are “Hyatt Dual Accrual” Advantage redeemable miles (AA RDM) a thing of the past, perhaps due to conversion to Loyalty Points?

For the past 2.5 years, after a Hyatt stay I’ve been receiving AA RDM, posting as “Hyatt Dual Accrual” Base Miles and Total Miles. I had 3 Hyatt stays in January and I received Hyatt Dual Accrual RDM as expected, including 1,000 Bonus Journeys RDM (for a “participating hotels in 10 cities”). 3 Hyatt stays in February and 1 in March, no AA RDM. I did notice a day or 2 ago that my AA account on March 1st was credited with Loyalty Points exactly equal to the total number of Hyatt Dual Accrual RDM that posted in January.

(I called Advantage Account Services to inquire about the recent (February and March) missing Hyatt Dual Accrual RDM, of course the agent was clueless, she sent an email to the “hotel miles” department, said I should get an email in 7-10 days … probably the same time as I receive the “check that’s in the mail.”

)

)Thank you.

#2825

Join Date: Feb 2002

Location: BOS

Programs: AA EXP 1MM, DL PM, Bonvoy Titanium (Plat Life), HH G, Amtrak, B6, MR

Posts: 1,548

How are you getting 36 LPs per dollar with Plastiq? Unless I'm missing something, that's just putting stuff on a credit card that you couldn't otherwise in exchange for the 2.75% fee. So a $3,000 mortgage payment charged to my AA credit card costs me $3,082.50 and earns 3,083 (I'm rounding up) LPs and award redeemable miles at the standard credit card earn rate. If you've got the higher level card you have the LP boosters at certain spend intervals, but that's about it... Or am I missing something?

#2827

#2828

FlyerTalk Evangelist

Join Date: Oct 2014

Posts: 10,904

How are you getting 36 LPs per dollar with Plastiq? Unless I'm missing something, that's just putting stuff on a credit card that you couldn't otherwise in exchange for the 2.75% fee. So a $3,000 mortgage payment charged to my AA credit card costs me $3,082.50 and earns 3,083 (I'm rounding up) LPs and award redeemable miles at the standard credit card earn rate. If you've got the higher level card you have the LP boosters at certain spend intervals, but that's about it... Or am I missing something?

In your case you can make a $3000 payment by check or ACH for free, and earn nothing, or pay an extra $82.50 in fees and pay with your CC. So you are paying $82.50 to get 3083 miles (37.3 miles per dollar). IMO this is not a great deal; there are better ones out there.

Last edited by VegasGambler; Mar 7, 2022 at 2:03 pm

#2829

FlyerTalk Evangelist

Join Date: Mar 2004

Location: SJC

Programs: AA EXP, BA Silver, Hyatt Globalist, Hilton diamond, Marriott Platinum

Posts: 33,533

In your case you can make a $3000 payment by check or ACH for free, and earn nothing, or pay an extra $82.50 in fees and pay with your CC. So you are paying $82.50 to get 3083 miles (37.3 miles per dollar). IMO this is not a great deal; there are better ones out there.

And, until our mortgage is paid off, this one is guaranteed to be available unlike some of the high-return options that are either one time, risky, or fleeting.

Cheers.

#2830

FlyerTalk Evangelist

Join Date: Mar 2004

Location: SJC

Programs: AA EXP, BA Silver, Hyatt Globalist, Hilton diamond, Marriott Platinum

Posts: 33,533

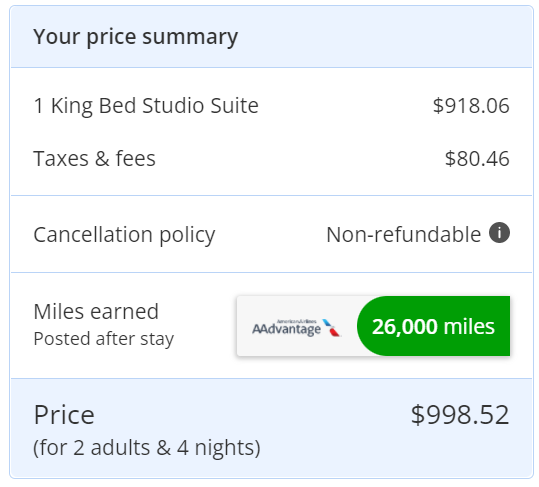

This is just 26 LP/$ and, as noted, there are better options out there. However, getting 26K LPs in one shot may be worth a lower return rate.

Of course, if this is somewhere you'd stay and you're not giving up elite benefits that you'd want to use, then you just need to look at the cost of booking here versus other channels and look at the incremental spend. In that case the return rate is much better.

Cheers.

Of course, if this is somewhere you'd stay and you're not giving up elite benefits that you'd want to use, then you just need to look at the cost of booking here versus other channels and look at the incremental spend. In that case the return rate is much better.

Cheers.

Last edited by brp; Mar 7, 2022 at 2:13 pm

#2831

Join Date: Feb 2002

Location: BOS

Programs: AA EXP 1MM, DL PM, Bonvoy Titanium (Plat Life), HH G, Amtrak, B6, MR

Posts: 1,548

The poster is referring to the extra money spent, over making a payment in a way that incurs no fees. That's the proper calculation when looking at a payment that you would make anyway (eg mortgage). It's very different from something you are buying only to get the miles (like a hotel res where you will no-show)

In your case you can make a $3000 payment by check or ACH for free, and earn nothing, or pay an extra $82.50 in fees and pay with your CC. So you are paying $82.50 to get 3083 miles (37.3 miles per dollar). IMO this is not a great deal; there are better ones out there.

In your case you can make a $3000 payment by check or ACH for free, and earn nothing, or pay an extra $82.50 in fees and pay with your CC. So you are paying $82.50 to get 3083 miles (37.3 miles per dollar). IMO this is not a great deal; there are better ones out there.

As to better options... They all require buying something, don't they? So it's great if I need the thing I'm buying, but if I don't.....

#2832

FlyerTalk Evangelist

Join Date: Oct 2014

Posts: 10,904

So you are paying $6 in fees for 768 miles; that's 128 miles per dollar, plus whatever you use to actually make the purchase. If you use these VGC for purchases that would others only earn you 1 mile or point per dollar then the 768 portal miles are just extra, in exchange for the $6 fee. The only issue is that it's $2k/month maximum.

I used them for my health insurance premiums, monthly utility bills, and to pay some medical bills last month. I plan on doing the same this month.

#2833

Join Date: Oct 2006

Location: Long Beach, CA

Programs: AA PLTPRO, HH Diamond, IHG Plat, Marriott Plat, Hyatt Globalist

Posts: 3,559

It's been a few years since I was on a cruise and spent much money/time at the casino. However, in the past, I seem to recall that I could charge my casino wager/chips to my onboard account that I would then settle with the credit card on file. It occurred to me at the time that this was a way of possibly generating spend as it wasn't charged as a cash advance on the card.

Does anyone have recent experience with this and if this actually still works?

Does anyone have recent experience with this and if this actually still works?

#2834

FlyerTalk Evangelist

Join Date: Mar 2004

Location: SJC

Programs: AA EXP, BA Silver, Hyatt Globalist, Hilton diamond, Marriott Platinum

Posts: 33,533

I know that some things show "Tracking" on the eShopping site as soon as the transaction is made to show that it was done through the portal. At present this one is not.

Cheers.

#2835

Join Date: Feb 2002

Location: BOS

Programs: AA EXP 1MM, DL PM, Bonvoy Titanium (Plat Life), HH G, Amtrak, B6, MR

Posts: 1,548

giftcards.com is still offering 3 miles per dollar on the shopping portal. The fees are $6 for a $250 virtual VGC (only usable online and over the phone -- "card not present" transactions).

So you are paying $6 in fees for 768 miles; that's 128 miles per dollar, plus whatever you use to actually make the purchase. If you use these VGC for purchases that would others only earn you 1 mile or point per dollar then the 768 portal miles are just extra, in exchange for the $6 fee. The only issue is that it's $2k/month maximum.

I used them for my health insurance premiums, monthly utility bills, and to pay some medical bills last month. I plan on doing the same this month.

So you are paying $6 in fees for 768 miles; that's 128 miles per dollar, plus whatever you use to actually make the purchase. If you use these VGC for purchases that would others only earn you 1 mile or point per dollar then the 768 portal miles are just extra, in exchange for the $6 fee. The only issue is that it's $2k/month maximum.

I used them for my health insurance premiums, monthly utility bills, and to pay some medical bills last month. I plan on doing the same this month.