UA Q4/Full Year 2020 Results 20 Jan 2021 / Conference Call 21 Jan 2021

#1

FlyerTalk Evangelist

Original Poster

Join Date: Oct 1999

Posts: 11,468

UA Q4/Full Year 2020 Results 20 Jan 2021 / Conference Call 21 Jan 2021

https://ir.united.com/events/event-d...-earnings-call

Earnings report to be released 1/20 after market close.

Call at 9:30 a.m. CST.

Earnings report to be released 1/20 after market close.

Call at 9:30 a.m. CST.

#2

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,855

United Announces 2020 Financial Results: 2021 Will Focus On Transition To Recovery; Expects To Exceed 2019 Adjusted EBITDA Margin By 2023*

Company continues to improve core cash burn in the face of continued COVID-19 headwinds; sharpens focus to prepare for recovery

CHICAGO, Jan. 20, 2021

-- United Airlines (UAL) today announced fourth-quarter and full-year 2020 financial results. The company continues its efforts to lead the industry as it manages the most disruptive crisis in aviation history.

Since the beginning of the COVID-19 crisis, United has raised over $26 billion in liquidity and made important progress in reducing core cash burn (see detailed chart below) to ensure the company's survival. Over the last three quarters, the company has identified $1.4 billion of annual cost savings and has a path to achieve at least $2.0 billion in structural reductions moving forward. United ended 2020 with $19.7 billion in available liquidity1, including an undrawn revolver capacity and funds available under the CARES Act loan program from the U.S. Treasury.

Having stabilized its financial foundation, the company expects 2021 to be a transition year that's focused on preparing for a recovery. United has resumed heavy maintenance and engine overhauls, investments that are essential to recovery when demand returns. The combination of structural cost reduction and timely investments will help set up United to exceed its 2019 adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margin in 2023. The company expressed high confidence that it would achieve this target by 2023 – and said its ongoing recovery planning would help ensure the company was equipped to reach this level even sooner, if demand returns more quickly.

"Aggressively managing the challenges of 2020 depended on our innovation and fast-paced decision making. But, the truth is that COVID-19 has changed United Airlines forever," said United Airlines CEO Scott Kirby. "The passion, teamwork and perseverance that the United team showed in 2020 is exactly what will help us build a new United Airlines that's better, stronger and more profitable than ever. I could not be prouder of – and more grateful to – this team, which is going to lead us there."

* Adjusted EBITDA margin is a non-GAAP financial measure calculated as Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), excluding special charges and unrealized (gains) losses on investments, divided by total operating revenue. We are not providing a target or a reconciliation to profit margin (net income/total operating revenue), the most directly comparable GAAP measure, because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts. Adjusted EBITDA margin does not reflect certain items, including special charges and unrealized (gains) losses on investments, which may be significant. For a reconciliation of adjusted EBITDA to net income for the years ended December 31, 2020 and 2019, please see the accompanying tables to this release.

Fourth-Quarter and Full-Year 2020 Financial Results

1 Total available liquidity includes cash and cash equivalents, short-term investments and $1 billion available under our undrawn revolving credit facility, as well as $7 billion available under the CARES Act loan program.

2 Excludes operating and non-operating special charges, and unrealized gains and losses on investments. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release.

3 Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release.

4 Cash burn, as previously guided, is defined as: Net cash from operations, less investing and financing activities. Proceeds from the issuance of new debt (excluding expected aircraft financing), government grants associated with the Payroll Support Program of the CARES Act, issuance of new stock, net proceeds from the sale of short-term and other investments and changes in certain restricted cash balances are not included in this figure. Core cash burn is defined as: Cash burn, as further adjusted to exclude: debt principal payments, timing of certain payments, capital expenditures (net of flight equipment purchase deposit returns), investments in the recovery and severance payments. Amounts may not add due to rounding. See the tables accompanying this release for further information.

5 Timing of certain payments refers to exclusion of payments in the quarter that had been deferred from prior periods or additions of payments that were deferred to a future period to maximize cash preservation.

6 Investments in the recovery primarily include, but are not limited to, spending on engine and airframe maintenance to prepare for the efficient operations ramp up as air travel demand returns.

Earnings Call

UAL will hold a conference call to discuss fourth-quarter and full-year 2020 financial results as well as its financial and operational outlook for the first quarter 2021, on Thursday, January 21, at 9:30 a.m. CT/10:30 a.m. ET. A live, listen-only webcast of the conference call will be available at ir.united.com.

The webcast will be available for replay within 24 hours of the conference call and then archived on the website for three months.

Company continues to improve core cash burn in the face of continued COVID-19 headwinds; sharpens focus to prepare for recovery

CHICAGO, Jan. 20, 2021

-- United Airlines (UAL) today announced fourth-quarter and full-year 2020 financial results. The company continues its efforts to lead the industry as it manages the most disruptive crisis in aviation history.

Since the beginning of the COVID-19 crisis, United has raised over $26 billion in liquidity and made important progress in reducing core cash burn (see detailed chart below) to ensure the company's survival. Over the last three quarters, the company has identified $1.4 billion of annual cost savings and has a path to achieve at least $2.0 billion in structural reductions moving forward. United ended 2020 with $19.7 billion in available liquidity1, including an undrawn revolver capacity and funds available under the CARES Act loan program from the U.S. Treasury.

Having stabilized its financial foundation, the company expects 2021 to be a transition year that's focused on preparing for a recovery. United has resumed heavy maintenance and engine overhauls, investments that are essential to recovery when demand returns. The combination of structural cost reduction and timely investments will help set up United to exceed its 2019 adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margin in 2023. The company expressed high confidence that it would achieve this target by 2023 – and said its ongoing recovery planning would help ensure the company was equipped to reach this level even sooner, if demand returns more quickly.

"Aggressively managing the challenges of 2020 depended on our innovation and fast-paced decision making. But, the truth is that COVID-19 has changed United Airlines forever," said United Airlines CEO Scott Kirby. "The passion, teamwork and perseverance that the United team showed in 2020 is exactly what will help us build a new United Airlines that's better, stronger and more profitable than ever. I could not be prouder of – and more grateful to – this team, which is going to lead us there."

* Adjusted EBITDA margin is a non-GAAP financial measure calculated as Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), excluding special charges and unrealized (gains) losses on investments, divided by total operating revenue. We are not providing a target or a reconciliation to profit margin (net income/total operating revenue), the most directly comparable GAAP measure, because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts. Adjusted EBITDA margin does not reflect certain items, including special charges and unrealized (gains) losses on investments, which may be significant. For a reconciliation of adjusted EBITDA to net income for the years ended December 31, 2020 and 2019, please see the accompanying tables to this release.

Fourth-Quarter and Full-Year 2020 Financial Results

- Reported fourth-quarter net loss of $1.9 billion, $7.1 billion for the full-year 2020.

- Reported fourth-quarter adjusted net loss2 of $2.1 billion, $7.7 billion for the full-year 2020.

- Reported fourth-quarter total operating revenue of $3.4 billion, down 69% versus fourth-quarter 2019.

- Reported fourth-quarter operating expenses down 45% versus fourth-quarter 2019, down 42% excluding special charges3.

Core Cash Burn

- Reported fourth-quarter daily cash burn4 of $23 million, plus $10 million of average debt principal payments and severance payments per day.

- Reported fourth-quarter core cash burn4 of $19 million per day, an improvement of an average of $5 million per day versus the third-quarter 2020.

- Core cash burn captures underlying operational performance of the company throughout the pandemic; a reconciliation with cash burn4 is provided below.

First Quarter 2021 Outlook

- Based on current trends, the company expects first quarter 2021 total operating revenue to be down 65 percent to 70 percent versus the first quarter 2019. Accelerated distribution of the COVID-19 vaccine may lead to faster improvement, however, the company is not including this potential improvement in its first quarter 2021 revenue outlook.

- Expects first quarter 2021 capacity to be down at least 51 percent versus the first quarter of 2019.

- Expects first quarter 2021 ending available liquidity to be similar to year-end 2020 available liquidity of around $19.7 billion1.

Fourth-Quarter and Full-Year Highlights

- Completed $3 billion Enhanced Equipment Trust Certificate (EETC) transaction; the largest deal of this type in aviation history.

- First U.S. airline to leverage its loyalty program, MileagePlus®, as collateral for a $6.8B loan.

- Received $968 million in net proceeds from the sale of 20.8 million shares in the ATM program in the fourth quarter 2020. For the full year 2020, total net proceeds were $989 million from the sale of 21.4 million shares through the ATM program.

- Only airline to partner with the Defense Advanced Research Projects Agency (DARPA), U.S. Transportation Command (USTRANSCOM) and Air Mobility Command (AMC) to study how effectively the unique airflow configuration on board an aircraft can prevent the spread of aerosolized particles among passengers and crew.

- First airline to safely transport the first delivery of Pfizer and BioNTech's COVID-19 vaccine into the U.S.

- First among U.S. global airlines to permanently eliminate change fees on all standard economy and premium cabin tickets for travel within the U.S., and starting January 1, 2021, any United customer can fly standby for free on a flight departing the day of their travel regardless of the type of ticket or class of service.

- Announced bold environmental commitment unmatched by any airline; pledging 100% green by reducing greenhouse gas emissions 100% by 2050.

- First U.S. airline to implement schedule reductions due to sharp travel demand drop.

- Increased cargo revenue by an industry-leading 77 percent in the fourth quarter by leveraging international flying and deploying strategic international cargo-only missions.

- Launched the world's first free transatlantic COVID-19 testing pilot for customers.

- First U.S. airline to launch a COVID-19 testing program for customers traveling on United from San Francisco International Airport to Hawaii.

- Since COVID-19 began, first major U.S. airline to require masks onboard. In the third quarter, extended mask requirements to airport terminals.

- One of the first U.S. airlines to enforce policy banning customers for refusing to follow mask requirements.

- First major U.S. airline to ask all passengers to complete a health self-assessment during their check-in process based on recommendations from the Cleveland Clinic.

- First airline to contact customers when flights are more than 70% full to give them the opportunity to change their plans for free.

- First U.S. airline to introduce a tool like the Destination Travel Guide, a new interactive map tool on united.com and the United mobile app that allows customers to filter and view destinations' COVID-19 related travel restrictions.

- First U.S. airline to introduce an interactive map feature for customers on united.com, powered by Google Flight Search Enterprise Technology, to easily compare and shop for flights based on departure city, budget, and location type. Customers can simultaneously compare travel to various destinations in a single search.

- First U.S. airline whose CEO took a 100% salary cut.

Taking Care of Our Customers

- Launched United CleanPlusSM to reinforce the company's commitment to putting health and safety at the forefront of the entire customer experience, with the goal of delivering an industry-leading standard of cleanliness, including partnerships with Clorox and experts from the Cleveland Clinic.

- First and only airline to maximize ventilation systems by running the auxiliary power on mainline aircraft during the entire boarding and deplaning process, so customers and crew get the important safety benefits provided by high-efficiency particulate air (HEPA) filtration systems.

- Electrostatic spraying aircraft interiors on all U.S. flights.

- Began using new Clorox® Electrostatic Sprayers to disinfect airport terminals.

- Introduced customer COVID-19 testing from Houston to Latin American and Caribbean destinations.

- Began working with the Centers for Disease Control (CDC) on the first contact tracing initiative for all international and domestic flights.

- Added Zoono Microbe Shield, an EPA-registered antimicrobial coating that forms a long-lasting bond with surfaces and inhibits the growth of microbes, to the airline's already rigorous safety and cleaning procedures.

- Launched an automated assistant chat function that gives customers a contactless option to receive immediate access to information about cleaning and safety procedures put in place due to COVID-19.

- Began cleaning pilot flight decks with Ultraviolet C (UVC) lighting technology on most aircraft at hub airports to disinfect the flight deck interior and continue providing pilots with a sanitary work environment.

- Expanded touchless check-in capabilities to kiosks at more than 215 airports.

- Launched free COVID-19 testing to all employees and checks their temperatures before they begin work at all U.S. airports.

- In May, started providing individually wrapped hand wipes and snack bag with pretzels, Stroopwafel and water to reduce touchpoints.

- Redesigned United's Mobile App to be more accessible for people with visual disabilities.

- Announced changes to the MileagePlus Premier® program that will make it easier to earn status in 2021 for the 2022 program year.

- Launched virtual, on-demand customer service at the airport.

- Announced plan to continue installing United Polaris® Business Class on Boeing 787 fleet.

Reimagining the Route Network

- In 2020, started 43 domestic routes and 10 international routes, with 15 more international routes planned to launch in 2021.

- In 4Q, responded to Thanksgiving travel demand by adding over 1,400 domestic flights to the November schedule.

- In 4Q, expanded service to India with 4 daily flights including the addition of O'Hare to Delhi; United remains the only U.S. carrier to serve India.

- Compared to September, United had nonstop service in 23 more domestic and 8 more international routes in October, 37 more domestic and 32 more international routes in November, and 95 more domestic and 53 more international routes in December.

- Announced plans to return service to New York/JFK after a five-year absence, with two daily round-trips to both San Francisco and Los Angeles starting in February 2021.

Assisting the Communities We Serve

- Through a combination of cargo-only flights and passenger flights, United has transported more than 401 million pounds of freight, which includes 87 million pounds of vital shipments, such as COVID-19 vaccines, medical kits, PPE, pharmaceuticals, and medical equipment, and more than 3.4 million pounds of military mail and packages.

- Booked over 2,900 free flights for medical professionals to support COVID-19 response in New Jersey/New York and California.

- Using crowdsourcing platform - Miles on a Mission - donated more than 11 million miles for charities like the Thurgood Marshall College Fund, College to Congress, and Compass to Care.

- More than 19.2 million miles were donated by MileagePlus members and 7.6 million miles were matched by United to help organizations providing relief during COVID-19.

- Donated nearly 1.2 million pounds of food from United Polaris lounges, United Club locations, and catering kitchens to local food banks and charities.

- Over 7,500 face masks were made from upcycled unused employee uniforms.

- More than 800 gallons of hand sanitizer produced by United employees in San Francisco for use by United employees.

- Donated 15,000 pillows, 2,800 amenity kits, and 5,000 self-care products to charities and homeless shelters.

- More than 2.2 million pounds of food and household goods were processed by United employees at the Houston Food Bank.

- More than 2,500 United employees worldwide have volunteered, with over 36,800 hours served.

Additional Noteworthy Accomplishments

- For the ninth consecutive year received a perfect score of 100% on the Corporate Equality Index (CEI), a premier benchmarking survey and report on corporate policies and practices related to LGBTQ+ workplace equality, administered by the Human Rights Campaign (HRC) Foundation.

- Honored by DiversityInc with their "DiversityInc Top 50" designation, lauding the airline's leadership in promoting diversity through a diversity-focused talent pipeline and talent development, leadership accountability and a top supplier diversity program.

- Recognized for the fifth consecutive year as a top-scoring company and best place to work for disability inclusion with a perfect score of 100 on the 2020 Disability Equality Index (DEI).

- Teamed up with Peerspace to bundle flights with work and meeting spaces for remotely distanced companies.

- Named best overall airline in the world by Global Traveler Readers.

- Selected by the Commission on Presidential Debates as the official airline for the 2020 Presidential and Vice Presidential Debates.

- Announced signing of The Board Challenge and committed to adding a second Black board member to the Board of Directors.

1 Total available liquidity includes cash and cash equivalents, short-term investments and $1 billion available under our undrawn revolving credit facility, as well as $7 billion available under the CARES Act loan program.

2 Excludes operating and non-operating special charges, and unrealized gains and losses on investments. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release.

3 Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release.

4 Cash burn, as previously guided, is defined as: Net cash from operations, less investing and financing activities. Proceeds from the issuance of new debt (excluding expected aircraft financing), government grants associated with the Payroll Support Program of the CARES Act, issuance of new stock, net proceeds from the sale of short-term and other investments and changes in certain restricted cash balances are not included in this figure. Core cash burn is defined as: Cash burn, as further adjusted to exclude: debt principal payments, timing of certain payments, capital expenditures (net of flight equipment purchase deposit returns), investments in the recovery and severance payments. Amounts may not add due to rounding. See the tables accompanying this release for further information.

5 Timing of certain payments refers to exclusion of payments in the quarter that had been deferred from prior periods or additions of payments that were deferred to a future period to maximize cash preservation.

6 Investments in the recovery primarily include, but are not limited to, spending on engine and airframe maintenance to prepare for the efficient operations ramp up as air travel demand returns.

Earnings Call

UAL will hold a conference call to discuss fourth-quarter and full-year 2020 financial results as well as its financial and operational outlook for the first quarter 2021, on Thursday, January 21, at 9:30 a.m. CT/10:30 a.m. ET. A live, listen-only webcast of the conference call will be available at ir.united.com.

The webcast will be available for replay within 24 hours of the conference call and then archived on the website for three months.

8-K 20 January 2021

Links

Q4 / 2020 Full Year presentation link (has been none in recent reports)

Q4 / 2020 Full Year call transcript link (AlphaStreet)

Q4 / 2020 Full Year call transcript link (SeekingAlpha)

Beware these third-party sources now require a free registration. The transcripts have not be reviewed by UA and have been known to have errors, check against the recorded call

Q4 / 2020 Full Year webcast recording link (1:35 in length)

Q4 / 2020 Full Year 10-Q

Investor Update -- 2x Jan 2021

Past reports

UA Announces Q3 2020 Financial Results 14 Oct / Conference Call 15 Oct UA Q4/Full Year 2019 Results/Conference Call 22 Jan 2020

Last edited by WineCountryUA; Jan 21, 2021 at 7:55 pm Reason: formatting

#3

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,855

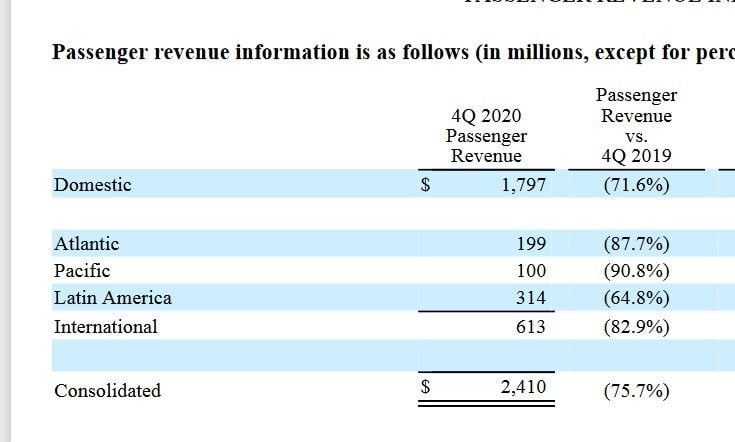

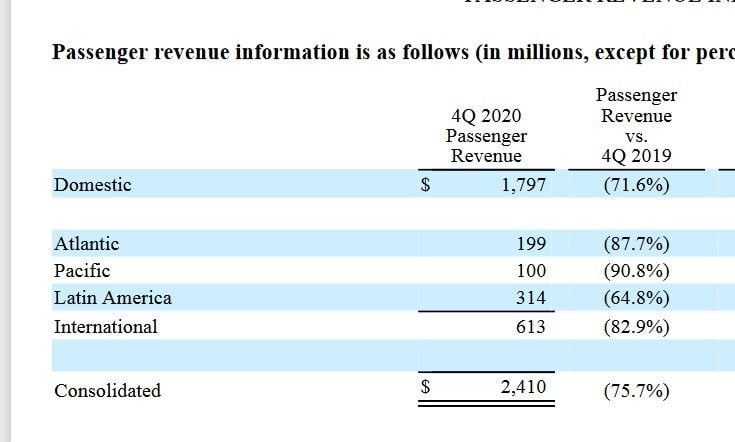

Interesting chart in the UA 8-K 20 January 2021

Pacific revenue is at 9% of last year and Europe 12%

Domestic 28% and Latin America 35% (the "bright spot" - over half of all international revenue!)

Overall barely 24%

Pacific revenue is at 9% of last year and Europe 12%

Domestic 28% and Latin America 35% (the "bright spot" - over half of all international revenue!)

Overall barely 24%

Last edited by WineCountryUA; Jan 21, 2021 at 9:27 am

#4

Join Date: Jan 2005

Location: New York, NY

Programs: UA, AA, DL, Hertz, Avis, National, Hyatt, Hilton, SPG, Marriott

Posts: 9,454

Cutting costs a top priority at United Airlines

BOHICA...

Welcome back to the cyclical world of the airline industry. Hopefully everyone enjoyed some of the little perks of the last boom cycle, because all of that is gone now, and it ain't coming back...

BOHICA...

Welcome back to the cyclical world of the airline industry. Hopefully everyone enjoyed some of the little perks of the last boom cycle, because all of that is gone now, and it ain't coming back...

#5

FlyerTalk Evangelist

Original Poster

Join Date: Oct 1999

Posts: 11,468

#6

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,855

Q4 / 2020 Full Year call transcript link (AlphaStreet)

Beware these third-party sources now require a free registration The transcripts have not be reviewed by UA and have been known to have errors, check against the recorded call

Q4 / 2020 Full Year webcast recording link (1:35 in length)

Note there was no presentation (PowerPoint) used in the call, the lack of formal presentation has been the norm in recent calls

Last edited by WineCountryUA; Jan 21, 2021 at 7:58 pm Reason: no presentation

#7

FlyerTalk Evangelist

Original Poster

Join Date: Oct 1999

Posts: 11,468

A few takes from the call

1. Financials

"we look forward to exceeding our 2019 EBITDA margins by 2023"

"we are confident in our commitment to achieve 2023 CASM-ex flat to 2019 and 2023 EBITDA margins that will exceed 2019 levels.

"we currently expect to end the first quarter with about as much liquidity as we ended 2020 due largely to at least $2.6 billion we expect to receive under the Payroll Support Program extension.

"deferred heavy maintenance checks and engine overhauls as we simply grounded aircraft not required to support our schedule. However, in order to prepare for the recovery, we've restarted that work.

"Interest expense for the next few years is going to run really pretty high.

2. Competitive positioning overseas market

"One, we're counting the number of 747s that -- and A380s that have been pointed at the United States that are no longer in the flying fleets of many airlines around the globe. Two, we're looking at a significant portion of capacity operated by someone across the Atlantic that has publicly said they're not going to do it anymore.

"So I add up all those facts. There are simply fewer wide-body aircraft in the fleets around the world. There's, in particular, fewer the very large ones with the very large business class cabins. And then there's at least one big competitor that's no longer flying across the Atlantic.

3. Rebound of demand

"we have lots of data, lots of surveys, lots of evidence. There's huge, huge pent-up demand. And you'll see a really steep inflection in demand.

1. Financials

"we look forward to exceeding our 2019 EBITDA margins by 2023"

"we are confident in our commitment to achieve 2023 CASM-ex flat to 2019 and 2023 EBITDA margins that will exceed 2019 levels.

"we currently expect to end the first quarter with about as much liquidity as we ended 2020 due largely to at least $2.6 billion we expect to receive under the Payroll Support Program extension.

"deferred heavy maintenance checks and engine overhauls as we simply grounded aircraft not required to support our schedule. However, in order to prepare for the recovery, we've restarted that work.

"Interest expense for the next few years is going to run really pretty high.

2. Competitive positioning overseas market

"One, we're counting the number of 747s that -- and A380s that have been pointed at the United States that are no longer in the flying fleets of many airlines around the globe. Two, we're looking at a significant portion of capacity operated by someone across the Atlantic that has publicly said they're not going to do it anymore.

"So I add up all those facts. There are simply fewer wide-body aircraft in the fleets around the world. There's, in particular, fewer the very large ones with the very large business class cabins. And then there's at least one big competitor that's no longer flying across the Atlantic.

3. Rebound of demand

"we have lots of data, lots of surveys, lots of evidence. There's huge, huge pent-up demand. And you'll see a really steep inflection in demand.

#8

Join Date: Jun 2004

Location: What I write is my opinion alone..don't read into it anything not written.

Posts: 9,686

#9

FlyerTalk Evangelist

Original Poster

Join Date: Oct 1999

Posts: 11,468

#10

FlyerTalk Evangelist

Join Date: Jun 2010

Location: TOA

Programs: HH Diamond, Marriott LTPP/Platinum Premier, Hyatt Lame-ist, UA !K

Posts: 20,061

Interesting chart in the UA 8-K 20 January 2021

Pacific revenue is at 9% of last year and Europe 12%

Domestic 28% and Latin America 35% (the "bright spot" - over half of all international revenue!)

Overall barely 24%

Pacific revenue is at 9% of last year and Europe 12%

Domestic 28% and Latin America 35% (the "bright spot" - over half of all international revenue!)

Overall barely 24%

David

#11

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,855