SAS Shareholder Program Benefits and Discussions

#76

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

As an American this kinda appealed, until I learned of the residency requirements. Seeing as SAS trades in the US as an ADR, and many Americans have security accounts that can directly hold shares traded in the EU, wonder if this violates US securities rules? It is my understanding that it is quite illegal to treat different shareholders within the same tranche differently.

In the case of unsponsored ADRs, investors in the unsponsored ADRs may easily lack shareholder benefits and voting rights for the company's class of security represented by the ADR.

The SAS ADR registration statement was filed with certification under Rule 466 to be an unsponsored ADR back in 2008. That was when this kind of unsponsored ADR thing took off like crazy in the US.

Last edited by GUWonder; Feb 12, 2021 at 7:03 pm

#77

Join Date: May 2017

Posts: 2,016

As an American this kinda appealed, until I learned of the residency requirements. Seeing as SAS trades in the US as an ADR, and many Americans have security accounts that can directly hold shares traded in the EU, wonder if this violates US securities rules? It is my understanding that it is quite illegal to treat different shareholders within the same tranche differently.

#78

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

Depository receipt instruments for some foreign company stocks aren't so weird since there are plenty of non-American equivalents: there are EDRs and GDRs in Europe, IDRs in India, LDRs in Luxembourg and so on.

#79

Join Date: Feb 2006

Location: Verdi, NV, SFO & Olympic (aka Squaw )Valley.

Programs: Ikon Pass Full + AS Gold + Marriott Titanium + Hilton Gold. Recovering UA Plat. LT lounge AA+DL+UA

Posts: 3,823

There are two categories of ADRs in the US: sponsored ADRs and unsponsored ADRs.

In the case of unsponsored ADRs, investors in the unsponsored ADRs may easily lack shareholder benefits and voting rights for the company's class of security represented by the ADR.

The SAS ADR registration statement was filed with certification under Rule 466 to be an unsponsored ADR back in 2008. That was when this kind of unsponsored ADR thing took off like crazy in the US.

In the case of unsponsored ADRs, investors in the unsponsored ADRs may easily lack shareholder benefits and voting rights for the company's class of security represented by the ADR.

The SAS ADR registration statement was filed with certification under Rule 466 to be an unsponsored ADR back in 2008. That was when this kind of unsponsored ADR thing took off like crazy in the US.

#80

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

That's easily the most fascinating thing I've learned here in ages. Even though I'm a recovering investment banker, and work in the adjacent venture capital industry, I had no idea that ADRs could be unsponsored. It also brings up the question of what non-US securities I can directly hold with a US fiduciary. As a US citizen most foreign financial institutions are afraid of the regulatory risk in having me as a customer. The combination of US tax policy and unsponsored ADRs creates real governance issues!

Unsponsored ADRs took off like crazy in the US in 2008. And even with the Dodd-Frank Act era coming into play after the 2008-2009 financial crisis, there are these kind of ADRs around being traded today OTC. Caveat emptor is what I say about putting money into these kind of securities -- and I would say the same thing about sponsored ADRs too. These ADRs do have some use for retail investors; but, in this case, one use they don't have is to be easily useful toward getting the shareholder benefits from SAS that SAS markets to its registered individual investors resident in its home market countries.

#81

Join Date: Feb 2006

Location: Verdi, NV, SFO & Olympic (aka Squaw )Valley.

Programs: Ikon Pass Full + AS Gold + Marriott Titanium + Hilton Gold. Recovering UA Plat. LT lounge AA+DL+UA

Posts: 3,823

If you're more interested in some of the issues in this area, look up court decisions, administrative rulings and regulatory announcements which touch upon the SCOTUS ruling on Morrison v. National Australia Bank. It provides a bit of a window into some of those issues.

Unsponsored ADRs took off like crazy in the US in 2008. And even with the Dodd-Frank Act era coming into play after the 2008-2009 financial crisis, there are these kind of ADRs around being traded today OTC. Caveat emptor is what I say about putting money into these kind of securities -- and I would say the same thing about sponsored ADRs too. These ADRs do have some use for retail investors; but, in this case, one use they don't have is to be easily useful toward getting the shareholder benefits from SAS that SAS markets to its registered individual investors resident in its home market countries.

Unsponsored ADRs took off like crazy in the US in 2008. And even with the Dodd-Frank Act era coming into play after the 2008-2009 financial crisis, there are these kind of ADRs around being traded today OTC. Caveat emptor is what I say about putting money into these kind of securities -- and I would say the same thing about sponsored ADRs too. These ADRs do have some use for retail investors; but, in this case, one use they don't have is to be easily useful toward getting the shareholder benefits from SAS that SAS markets to its registered individual investors resident in its home market countries.

#82

Join Date: Aug 2015

Location: SFO

Programs: AS 75K (OW), SK Silver (*A), UR, MR

Posts: 3,347

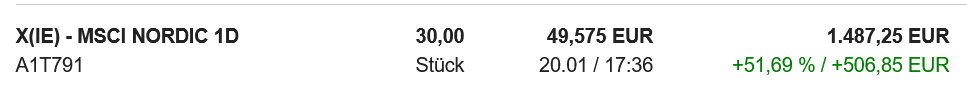

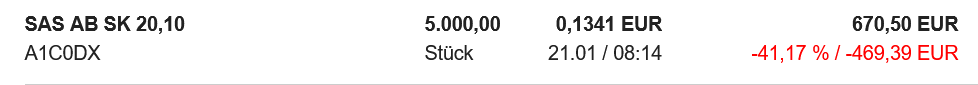

Am I reading it correctly that SAS shares have been doing okay so far this year, unlike the stock market in general which has experienced quite the blood bath?

https://borsen.dk/investor/aktie/S2529/SAS-DKK/SASAB

https://borsen.dk/investor/aktie/S2529/SAS-DKK/SASAB

#84

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

Am I reading it correctly that SAS shares have been doing okay so far this year, unlike the stock market in general which has experienced quite the blood bath?

https://borsen.dk/investor/aktie/S2529/SAS-DKK/SASAB

https://borsen.dk/investor/aktie/S2529/SAS-DKK/SASAB

Late December 2021 purchases of SAS share are also above water currently.

#85

Join Date: Nov 2013

Location: HEL

Programs: AY, SK, TK

Posts: 7,601

I wouldnt dare to buy any airline stock. Reason being overinvestments which needs no business high school to think out. If shares rise, they only rise for a speculative reasons. So the stocks can be good for speculators

#86

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

As the saying goes, a great way to become a millionaire is to be a billionaire who puts too much for too long into an airline.

#87

Join Date: Nov 2013

Location: HEL

Programs: AY, SK, TK

Posts: 7,601

#88

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

Maybe SAS can become an English football club and get some play money sent its way too. Given how the Norwegians have dropped out of pouring money into SAS shares, maybe Gulf Arab kingdom money can be the replacement for the Mid-West kingdom money that bailed out from bailing out SAS. From SAS AB to SAS FK?

I'm not going to be surprised if LH is going to eat SK one day. Or maybe it can be Aeroflot ---- if Finland and Sweden don't go into NATO sooner than later, and Germany doesn't try to stop it.

Last edited by GUWonder; Jan 21, 2022 at 7:33 am

#89

FlyerTalk Evangelist

Join Date: Aug 2010

Location: CPH

Programs: UAMP S, TK M&S E (*G), Marriott LTP, IHG P, SK EBG

Posts: 11,095

LH might eat it IF SK ditches all the expensive employees. Mr and I were talking about SK survival today and we think it will hang on life support for as long as it can because it is after all a flag carrier in Scandinavia. We don't think the Swedish government will let go of it, nor the Danish politicians. There are a lot of voters still enjoying the great benefit working at SAS. No matter what we will not buy their shares.

SAS is hiring CPH based cabin crew:

"We are excited to announce that SAS Link Crew Services A/S and SAS Connect Crew Services A/S are looking for Cabin Crew to operate out of Copenhagen. "

https://jobs.aapaviation.com/job/sas...ew-copenhagen/

I guess it's a separate company from SAS so that the contracts might not be as good as those who has been working there for a long time.

SAS is hiring CPH based cabin crew:

"We are excited to announce that SAS Link Crew Services A/S and SAS Connect Crew Services A/S are looking for Cabin Crew to operate out of Copenhagen. "

https://jobs.aapaviation.com/job/sas...ew-copenhagen/

I guess it's a separate company from SAS so that the contracts might not be as good as those who has been working there for a long time.

#90

Join Date: Aug 2015

Location: SFO

Programs: AS 75K (OW), SK Silver (*A), UR, MR

Posts: 3,347

SAS. No matter what we will not buy their shares.

Of course my dilemma is when to get back into stocks. We dropped from 80% of the portfolio to 10% a few weeks ago.