Permanently Renting Instead of Owning

#286

Join Date: Jan 2014

Location: BOS

Programs: B6 Mosaic, Hyatt Plat, SPG/MAR Gold, Nat'l EEE

Posts: 128

Thanks for that --- I was shocked to see the quotes I received, $700-$880 for a 12-month policy. It seems like MA is just not a state that is financially conducive to this type of coverage, yikes.

#287

A FlyerTalk Posting Legend

Join Date: Sep 2002

Location: LAX/TPE

Programs: United 1K, JAL Sapphire, SPG Lifetime Platinum, National Executive Elite, Hertz PC, Avis PC

Posts: 42,228

That seems odd...maybe a MA thing, my Southern CA policy is $150 per year with 100/300/50 coverage.

#289

Join Date: Jul 2014

Location: JRF

Programs: AA Gold, Marriott Platinum, Hilton Diamond, National Executive Elite

Posts: 1,784

>Get to know all the Enterprise employees at you local location because you rent often (and credit days to National, of course)

>They all rotate out and/or get promoted and leave after a few months

Is this just an Enterprise thing or does it apply to the industry in general?

>They all rotate out and/or get promoted and leave after a few months

Is this just an Enterprise thing or does it apply to the industry in general?

#290

Join Date: Jul 2016

Location: Canada

Programs: National EE, Enterprise Platinum, Hertz President's Circle, NEXUS

Posts: 106

I looked into renting versus owning but wasn't worth it.

$700-800 p/m rental for a basic car from Enterprise. Insurance from credit card (would need to refresh the rental agreement every 45 days).

Car loan for a 2012 model: $265 per month at 6% interest. Can get lower at 4%.

Insurance: $150-250 per month

Even at the most expensive insurance (here in Canada), it's still not worth it. Car maintenance etc is not an additional $200 a month.

$700-800 p/m rental for a basic car from Enterprise. Insurance from credit card (would need to refresh the rental agreement every 45 days).

Car loan for a 2012 model: $265 per month at 6% interest. Can get lower at 4%.

Insurance: $150-250 per month

Even at the most expensive insurance (here in Canada), it's still not worth it. Car maintenance etc is not an additional $200 a month.

#291

Join Date: Nov 2014

Location: MCI

Posts: 698

Wow, this is a very interesting concept. One on the surface that doesn't seem worth it IMO.

The main thing you want to calculate is cents per mile/km driven to see if owning is better/worse than renting. Plus the hassle of exchanging cars. The clear upside is that you DEFINITELY want to do this where National has EA/ES rows and you can try out diff cars and even some premium/luxury models.

For my personal car, it only costs me about 30 cents/mile driven over the 3 years I've had it so far. (this includes purchase price and ALL costs associated with owning the car, not just gas)

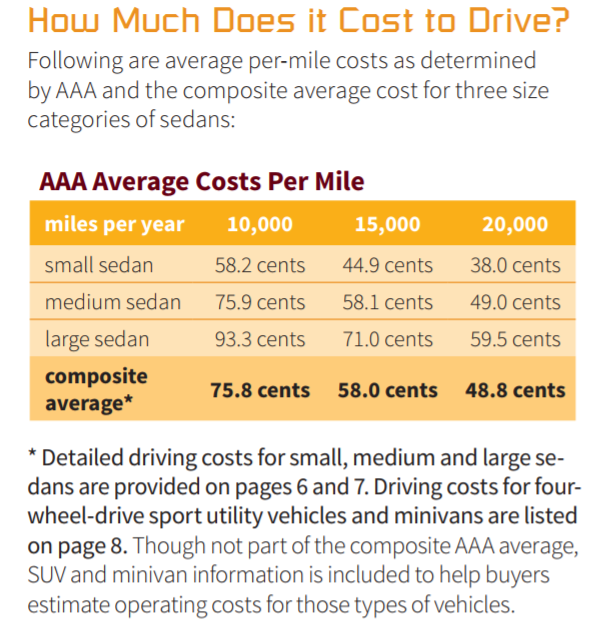

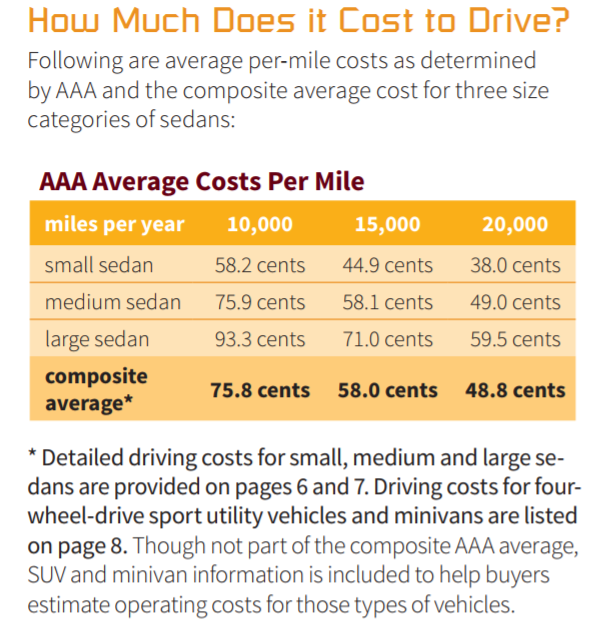

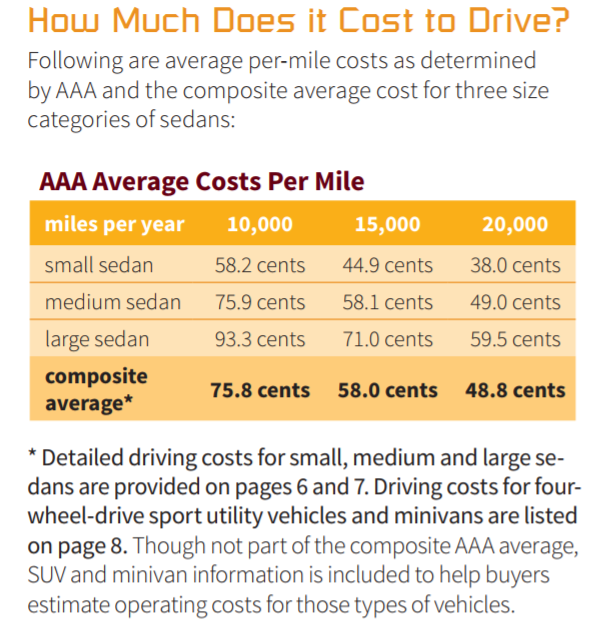

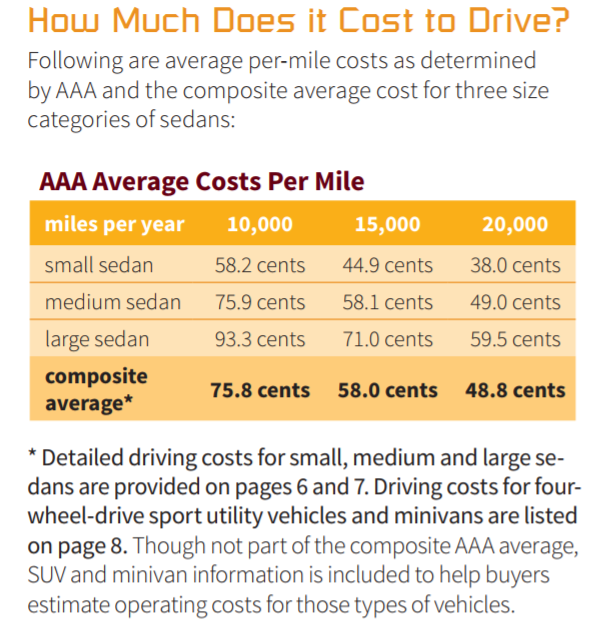

AAA's avg shows these numbers:

You'll need to calculate how many miles you drive each month/year with a rental vs a personal car and see if it's worth it.

For example, at an avg of 15,000 miles per year for a medium sedan that's about 60 cents/mile.....which comes out $9000/year or about $750/mo.

So using a very rough estimate, I would think that unless I can guarantee a monthly cost of less than 700, probably not worth it to rent perm vs owning...obviously each circumstances differ. But something else to consider when calculating the financial cost.

FYI: the number includes EVERYTHING, its not just gas..this includes avg insurance, tax, registration, maintenance, etc.

The main thing you want to calculate is cents per mile/km driven to see if owning is better/worse than renting. Plus the hassle of exchanging cars. The clear upside is that you DEFINITELY want to do this where National has EA/ES rows and you can try out diff cars and even some premium/luxury models.

For my personal car, it only costs me about 30 cents/mile driven over the 3 years I've had it so far. (this includes purchase price and ALL costs associated with owning the car, not just gas)

AAA's avg shows these numbers:

You'll need to calculate how many miles you drive each month/year with a rental vs a personal car and see if it's worth it.

For example, at an avg of 15,000 miles per year for a medium sedan that's about 60 cents/mile.....which comes out $9000/year or about $750/mo.

So using a very rough estimate, I would think that unless I can guarantee a monthly cost of less than 700, probably not worth it to rent perm vs owning...obviously each circumstances differ. But something else to consider when calculating the financial cost.

FYI: the number includes EVERYTHING, its not just gas..this includes avg insurance, tax, registration, maintenance, etc.

#292

Join Date: Jan 2017

Location: GEG/DEN/ATL

Programs: UA 1K, TK E+, AS MVPG, SPG&Marriott Plat, HHD, Hertz PC

Posts: 407

Iíve been doing this for the last 9 months and thereís more to the equation. If you drive anything newer, 2016+ the cost benefit ratio will skew towards renting. Plus if you travel, you get to save on airport parking and not pay on days you do not rent. Also you earn rental points Nd cc pointss. For me the best part is the feeling like a child at a candy store when i show up to the Emerald Exec Aisle or the Presidents Circle section. Thereís also the piece of mind that comes with it. Hit a pothole in your 100k+ car and itíll hurt. Believe me iíve had 3 flats last year. With a rental, not my car not my problem. Call roadside if it breaks down.

Wow, this is a very interesting concept. One on the surface that doesn't seem worth it IMO.

The main thing you want to calculate is cents per mile/km driven to see if owning is better/worse than renting. Plus the hassle of exchanging cars. The clear upside is that you DEFINITELY want to do this where National has EA/ES rows and you can try out diff cars and even some premium/luxury models.

For my personal car, it only costs me about 30 cents/mile driven over the 3 years I've had it so far. (this includes purchase price and ALL costs associated with owning the car, not just gas)

AAA's avg shows these numbers:

You'll need to calculate how many miles you drive each month/year with a rental vs a personal car and see if it's worth it.

For example, at an avg of 15,000 miles per year for a medium sedan that's about 60 cents/mile.....which comes out $9000/year or about $750/mo.

So using a very rough estimate, I would think that unless I can guarantee a monthly cost of less than 700, probably not worth it to rent perm vs owning...obviously each circumstances differ. But something else to consider when calculating the financial cost.

FYI: the number includes EVERYTHING, its not just gas..this includes avg insurance, tax, registration, maintenance, etc.

The main thing you want to calculate is cents per mile/km driven to see if owning is better/worse than renting. Plus the hassle of exchanging cars. The clear upside is that you DEFINITELY want to do this where National has EA/ES rows and you can try out diff cars and even some premium/luxury models.

For my personal car, it only costs me about 30 cents/mile driven over the 3 years I've had it so far. (this includes purchase price and ALL costs associated with owning the car, not just gas)

AAA's avg shows these numbers:

You'll need to calculate how many miles you drive each month/year with a rental vs a personal car and see if it's worth it.

For example, at an avg of 15,000 miles per year for a medium sedan that's about 60 cents/mile.....which comes out $9000/year or about $750/mo.

So using a very rough estimate, I would think that unless I can guarantee a monthly cost of less than 700, probably not worth it to rent perm vs owning...obviously each circumstances differ. But something else to consider when calculating the financial cost.

FYI: the number includes EVERYTHING, its not just gas..this includes avg insurance, tax, registration, maintenance, etc.

#293

Join Date: Mar 2012

Location: LGA

Programs: DL DM, UA Gold, Marriott Plat Prem., Hilton Gold, National Exec Elite.

Posts: 2,533

My wife and I are having this debate right now... I can rent a car for 31 days (i.e. from November 1 to December 1) for $609 including Taxes and LDW...

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

#294

A FlyerTalk Posting Legend

Join Date: Sep 2002

Location: LAX/TPE

Programs: United 1K, JAL Sapphire, SPG Lifetime Platinum, National Executive Elite, Hertz PC, Avis PC

Posts: 42,228

My wife and I are having this debate right now... I can rent a car for 31 days (i.e. from November 1 to December 1) for $609 including Taxes and LDW...

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

Now look at your monthly car rental rate (why not use a card like Amex that provides primary insurance for collision and by a non-owners policy for liability to get the cost down) over the same length of time - factor in some value for convenience and the benefit of a better/newer car on a regular basis - and then compare the two costs to see which is significantly cheaper.

If you travel often, don't forget to factor in adding (your car) or subtracting (rental car) things like airport parking charges, airport car service, etc

#296

Join Date: Nov 2014

Location: MCI

Posts: 698

My wife and I are having this debate right now... I can rent a car for 31 days (i.e. from November 1 to December 1) for $609 including Taxes and LDW...

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

My branch loves me and has amazing cars even for my mid-size rate - last rental was a 2019 Ford Explorer... I've had a bunch of Ford Edges - almost always gotten great cars with low mileage....

Even if we were to buy a simple car, like a Honda Civic, or Toyota Camry (which is what we would buy) - I can't believe it would be that much less... and renting, in my view, always ensures a clean car, no maintenance, no worries about scratches or spills, etc... - obviously, if we purchase, we would eventually own the car... but I always vowed never to purchase.

Who is right? Me or the Mrs?!?

But if you are planning to keep a single car for a long-time 10 years or more...then it's no-brainer to own a car as the costs will be significantly lower spread out over many years.

#297

Join Date: Oct 2016

Posts: 3,706

It seems like the only financially plausible way to permanently rent is if you live close to a major airport with relatively cheap rates that even out predictably over the course of a year, like Phoenix or Las Vegas or South Florida. Am I wrong?

#298

Join Date: Mar 2012

Location: LGA

Programs: DL DM, UA Gold, Marriott Plat Prem., Hilton Gold, National Exec Elite.

Posts: 2,533

so I like the idea of not having to worry about any of that. I used to have an Acura, and after 8 years it needed costly repairs - the drive side window got stuck down - $400 to fix. The trunk release cable snapped (?) - cost $300 -ish; the hood cable snapped another $300ish. - so all that ads up quickly!! - so I'd much rather spend $600/month and rent.

#299

Join Date: Feb 2012

Location: The place where it gets so hot in the summer some planes can't take off.

Programs: Marriott LT Titanium, WoH Globalist, National EE, United Platinum

Posts: 1,446

I had a monthly reoccuring rental from 2012-2014. I bought a Toyota Camry Hybrid LE in 2014 for $28k and hated life (had an issue with non-owner insurance and couldn't find another policy quickly). It was used to drive across Colorado and I ended up being reimbursed almost the entire purchase amount in mileage over 18 months. It served it's purpose. I took it to Carmax, got a check, and had my dad drive me to the National lot.

I've mostly had Jeep Grand Cherokee 4wd limited (I'm about to post and figure out why they seem to have disappeared form National) and if you look at the purchase price for one (~$50k) plus higher insurance and maintenance you're >=$900/month on a 5 year loan. Sure you get no car payment after that, and have some residual value, but I don't know if i'd keep a car longer than 6-7 years.

This only works if you get a great corporate rate (mine also includes LDW) and can find insurance company that will do the non-owner policy. I did have to go to a city with a smaller airport about 90 minutes away from my current area to get the original contract written (local airport taxes are $400/month more than at the other place).

All in I pay $680/month (currently in a Cadillac XT5) with ~$30/month non-owner insurance and LDW through credit card AND on the rental to make double sure I'm covered. I don't see myself buying a car again unless I break down and get a Tesla for the sheer novelty of it(I have an electric charger next to my spot).

I've mostly had Jeep Grand Cherokee 4wd limited (I'm about to post and figure out why they seem to have disappeared form National) and if you look at the purchase price for one (~$50k) plus higher insurance and maintenance you're >=$900/month on a 5 year loan. Sure you get no car payment after that, and have some residual value, but I don't know if i'd keep a car longer than 6-7 years.

This only works if you get a great corporate rate (mine also includes LDW) and can find insurance company that will do the non-owner policy. I did have to go to a city with a smaller airport about 90 minutes away from my current area to get the original contract written (local airport taxes are $400/month more than at the other place).

All in I pay $680/month (currently in a Cadillac XT5) with ~$30/month non-owner insurance and LDW through credit card AND on the rental to make double sure I'm covered. I don't see myself buying a car again unless I break down and get a Tesla for the sheer novelty of it(I have an electric charger next to my spot).

#300

Join Date: Nov 2014

Location: MCI

Posts: 698

I had a monthly reoccuring rental from 2012-2014. I bought a Toyota Camry Hybrid LE in 2014 for $28k and hated life (had an issue with non-owner insurance and couldn't find another policy quickly). It was used to drive across Colorado and I ended up being reimbursed almost the entire purchase amount in mileage over 18 months. It served it's purpose. I took it to Carmax, got a check, and had my dad drive me to the National lot.

I've mostly had Jeep Grand Cherokee 4wd limited (I'm about to post and figure out why they seem to have disappeared form National) and if you look at the purchase price for one (~$50k) plus higher insurance and maintenance you're >=$900/month on a 5 year loan. Sure you get no car payment after that, and have some residual value, but I don't know if i'd keep a car longer than 6-7 years.

This only works if you get a great corporate rate (mine also includes LDW) and can find insurance company that will do the non-owner policy. I did have to go to a city with a smaller airport about 90 minutes away from my current area to get the original contract written (local airport taxes are $400/month more than at the other place).

All in I pay $680/month (currently in a Cadillac XT5) with ~$30/month non-owner insurance and LDW through credit card AND on the rental to make double sure I'm covered. I don't see myself buying a car again unless I break down and get a Tesla for the sheer novelty of it(I have an electric charger next to my spot).

I've mostly had Jeep Grand Cherokee 4wd limited (I'm about to post and figure out why they seem to have disappeared form National) and if you look at the purchase price for one (~$50k) plus higher insurance and maintenance you're >=$900/month on a 5 year loan. Sure you get no car payment after that, and have some residual value, but I don't know if i'd keep a car longer than 6-7 years.

This only works if you get a great corporate rate (mine also includes LDW) and can find insurance company that will do the non-owner policy. I did have to go to a city with a smaller airport about 90 minutes away from my current area to get the original contract written (local airport taxes are $400/month more than at the other place).

All in I pay $680/month (currently in a Cadillac XT5) with ~$30/month non-owner insurance and LDW through credit card AND on the rental to make double sure I'm covered. I don't see myself buying a car again unless I break down and get a Tesla for the sheer novelty of it(I have an electric charger next to my spot).

Why not leasing a car? You can get economy cars for quite a bit less than 680 which also includes insurance and maintenance.

But one thing is that as a rental car you can swap it out anytime you want to try out diff vehicles. Though to me personally that's not worth the cost since I usually will buy used cars between 10-20k and use it for 10+ years.

If someone is resigned to be forever under a car payment then...well guess it can make sense.

Be careful about "double covering" for the LDW insurance. My CC says that if you take the rental company insurance then their own rental insurance is invalid